09 May 2022 | Media

What’s to come during hard times

By Adam Ryan

The odds are the following: something like, yes, they (the Fed) can engineer a soft landing, a third of a percent chance. Probably a third of a percent chance they can engineer a mild recession…and then there’s a chance this could be much harder than that.”

– Jamie Dimon, CEO of JP MorganChase on 5/4/22

Recession. I’ve heard it all week. From the grocery store to Mother’s Day dinner to all the newsletters I read, it’s just everywhere — and I’m not alone.

Google Trends shows “recession” is being searched for at the highest rate since March of 2020.

Will it happen? As Jamie Dimon said last week, there’s a good chance.

So, what do we do as media operators?

We have to be honest about what’s possible, learn from the past, and build to live another day. That’s what this deep dive is all about.

A look back and what’s different

The last sustained recession for more than a quarter was from 2007-2009. It lasted a total of 18 months. What can we learn?

Let’s first look at the NYT. In 2009, the NYT saw advertising revenue fall 27% from the previous year. When reading their annual report, they claimed, “with this recession we faced one of the most difficult advertising environments in recent history.”

There’s no doubt that advertising dollars will fall. If the NYT fell 27%, I wouldn’t be surprised if most publishers are closer to 40%.

In the same report, they announced they would launch a metered paywall in 2011 for their digital subscription (you know, the one all of us media folks love to admire). The word “digital” was used 44% more in their 2009 annual report compared to 2008 and 85% more than the 2006 report.

The NYT used this difficult moment to pivot their business model and, 10 years later, many believe that pivot solidified their position as one of the best media companies in the world.

Anything else different in 2009? Well, this little startup called Facebook drove $777M in advertising revenue in 2009. In 2021, they nearly hit $118B and own a massive part of the market share of digital advertising.

It’s impossible to predict how many ad dollars will go into the platforms compared to publishers if times get tough. Just this morning Uber’s CEO said in an email: “We’re only going to keep the most efficient marketing dollars.”

Are there a lot of lessons from 2009? Sure. But the reality is that the media industry has completely changed since 2009. There are more unknowns and than knowns at this point.

The industry now has digital subscriptions across the masses, platforms like Google, Meta, and Amazon dominate with ad spend, and we have this thing called the “creator economy”.

How will these changes hold up to a recession?

Some predictions about what’s to come

Creators on their own will have a hard time

Marketing budgets are some of the first to go in a recession. Even though this is statistically proven to be a dumb move, companies act irrationally during tough times.

And when those budgets get cut, two things will happen:

- People get cut from the team

- Those remaining will be asked to do more with less

When this happens, marketers will start to cut the programs that simply take too much of their time.

Even if the ROI is there, a marketer will have to make a decision about scale. Can they get 1.7X ROI and work with 1 media company or get a 2X and work with 5 creators? Without the additional staff support, marketers are going to start to lean on the media companies that make it easy to work with them.

The creator economy has largely been propped up by consumer subscriptions from their fans and companies flush with cash trying to diversify their spend as much as possible.

What happens when consumers don’t have the funds for a weekly newsletter and marketers can’t find the bandwidth to diversify their spend? Creators will start to suffer.

Takeaway: Most media companies have stayed away from embracing “the creator economy” play. With a recession, it could be an opportune time to build relationships with creators who need financial and operational support.

Performance and platforms will dominate

Between 2007 and 2010, the publishing industry was the 7th worst industry when it came to layoffs — more than 109,000 people lost their jobs.

Sure, some of that was in the newsrooms and editorial side, but a large portion was the business side. And that was before the digital advertising world became a duopoly. Content studios, brand campaigns, integrated marketing teams, and all the other top-of-funnel activity will come to a big screeching halt.

This has already been felt. One operator I recently spoke with told me, “We’re no longer getting the calls from our big partners saying hey we have $200K that we need to spend at the end of the quarter. Those days appear to be gone, for now.”

This next recession, platforms will absolutely dominate with ad spend due to their performance abilities. Marketers will be looking for performance and looking for ways to show off to their boss that they’re job is needed because they’re making money for the business.

With digital advertising expected to hit $700B by 2025, I see Google 2Xing their revenue in another 3-4 years — putting their business close to $400B in advertising revenue annually across search, Youtube, and their network.

Having a hard time understanding how big that is? The NYT doesn’t even make $500M a year in advertising revenue.

Takeaway: If you’re a media business that doesn’t have scale or a low churn audience, I’d be focused on finding new paths of monetization that can help make marketers look really good with performance outcomes.

Consumption will increase

One of the positives of a recession or any economic downturn for media companies is that consumption goes up among consumers.

And it’s not just news. Sports, entertainment, politics, and just about every other category see an increase when it comes to tough times.

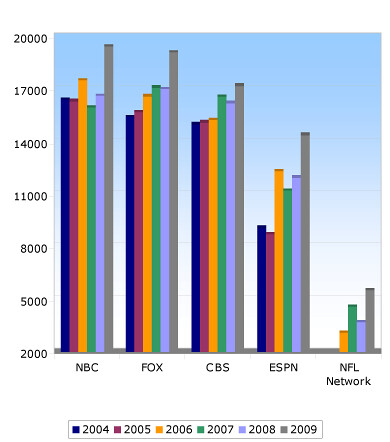

Sports viewership

Why? Because consumers are paying for it with their attention instead of their dollars.

But this consumption rarely turns out to be super beneficial from a financial standpoint. When consumer and business spending is down, then, in the end, advertising performance is down — which then brings rates down. With lower rates, there is a lower MRPU.

During COVID, this happened in a big way. For most publishers, eyeballs were up between 15-30%, yet revenue per user fell up to 50%. This means more work for less money.

Though the revenue may not be there, there can be habits built during moments like this. Substack has shown there are plenty of writers, like Packy McCormick or Mario Gabriele, who started writing during COVID have been able to sustain their audience 2 years later.

The media companies that can capture market share and build a habit while still keeping their doors open with lower revenue will be the media companies who come out stronger.

Takeaway: Recognize that you’ll have more eyeballs on your content during this time. If you can capitalize and survive, you’ll walk out of this recession a stronger business than you entered.

Diversification of revenue could mean lack of focus

Barstool announced the launch of their newest brand this morning, Would — a men’s grooming brand. It’s a move that looks like to diversify Barstool away from advertising and affiliate.

But will it serve well?

When things get tough, there are few stronger moves than to have absolute focus. With so many media companies diversifying their portfolio, will it cause distraction? Will it make them average at a lot of things vs. great at one thing?

In order to have success with a new channel during a recession, you can’t be in the “payback” period. You either need to be in absolute build mode where you’re okay losing money OR focused on what brings cash in the door.

These days, most media companies are trying to not be one trick ponies — they’re diversifying across education, commerce, events, and other lines of revenue.

But that’s a lot easier when the ad dollars are covering all of your costs to build.

Takeaway: Diversification of revenue can be the saving grace of any company during a recession, but there better be enough cash flow and people to have absolute focus.

Final thought

Recessions aren’t fast.

In 2007, unemployment was at 5%. By 2009, it hit 10%. It wasn’t until 2015 that unemployment got back to 5% levels — meaning it took 6 years to recover.

The Dow Jones index took a similar amount of time to recover. From its peak in 2007, it fell 50% and didn’t start to make a recovery until 2010. It wasn’t until 2013, and a lot of stimulus later, that it broke its 2007 highs — 6 years to recover.

NYT stock fell 80% during The Great Recession. It’s share price didn’t return to its 2008 highs until 2017 — 9 years to recover.

With record inflation, the government won’t have a huge amount of stimulus to lean on to bail out businesses, unlike COVID’s mini-recession.

This potential recession is somewhat similar to the 1981 recession that lasted two years through rising interest rates and large inflation. Unemployment hit 11%. It was rough.

But things did get better. By 1984, the GDP rose by 7.2% — the fastest in 24 years.

And that’s what happens. Things get better.

It’s not easy to run a media company in good times, let alone in a recession. But through these hard times, the best operators will manage their downside because they know, one day, their ability to survive allowed them to thrive.