01 February 2022 | FinTech

Fintech Index Tracks Performance Against S&P

By

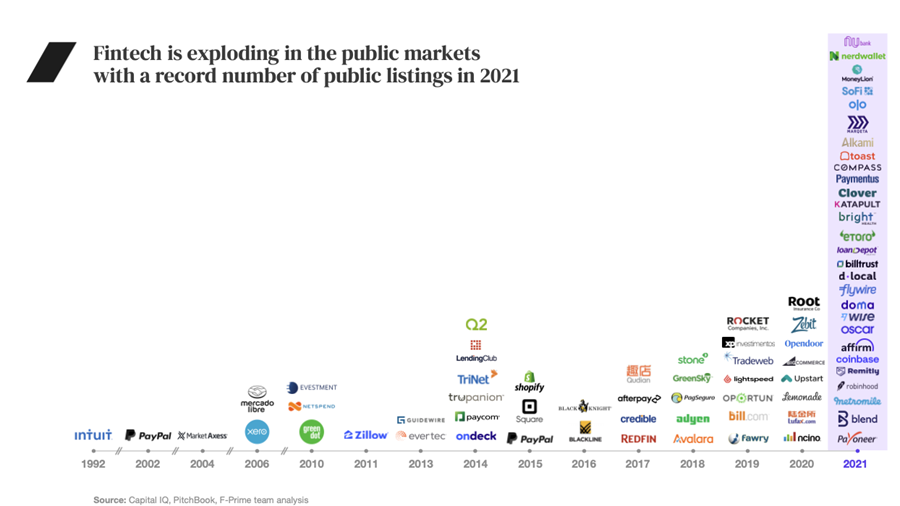

TL;DR: F-Prime wanted to publish a Fintech Index, designed to track the performance of emerging, publicly-traded financial technology companies, years ago. But it wasn’t until 2021 that there was a large enough sample size of fintech companies slated to go public to actually track.

Fintech performance is just heating up. Can you feel it?

What’s Up

These findings can help us understand that we’re just in the early innings of the Fintech boom. A lot of these companies are just starting to gain market share and, over time, there’s a lot of potential for growth as more Fintech companies go public.

Fintech now makes up 34% of all tech investing, which is a 3x increase compared with the percentage is was 10 years ago (11%). Plus:

- Fintech Index has outperformed S&P 500 by 1,000 percentage points.

- Disruptors have raised significant capital in private markets ($119B+ in 2021) with mega rounds in Fintech becoming common (300 $100M+rounds in 2021).

- Companies in the Fintech Index generated $120B+ in revenue over the LTM with average revenue of $2.2B per company.

- Performance by listing type from Fintech Index (as of Dec. 31st):

- All exits: +1,132%

- Without SPACs: +1,170%

- SPACs alone: -19%

- S&P 500: 132%

Also, 8 of the top 10 IPOs of all time happened within the last year:

Key Takeaways

I met up with authors of the index John Lin and Abdul Abdirahman to break it down:

- After a decade of funding into fintech startups, over $342 billion has gone into fintech, and we’re just starting to see exits and M&A ramp up. In 2021 alone, there were $415 billion in valuation: $393 billion of that was from public listings, IPOs, SPACS, and $22 billion was from M&A.

- There’s over 200 Fintech companies tracked in the Index, which will add another $500 billion in exit value to the Fintech F-Prime Index over the coming years.

- Despite this remarkable rise in Fintech, venture-backed startups have captured less than 10% of the U.S. industry value in their categories. There’s still tremendous room for growth in areas like wealth tech and insurance tech.