This week’s send is a doozy and should catch up all you busy healthcare folks on what’s going on in our crazy world!

Here’s what happened in the business world of healthcare during Q3 2022.

P.S. If you want to check out my healthcare business 1st half 2022 in review, you can check it out here (warning: it’s LONG): The Top 20 Biggest Healthcare Business Healthcare Stories so far in 2022. Or you could just subscribe and get these stories each week 🙂

If you want to support me (Blake), please consider joining 10,100+ thoughtful healthcare professionals to stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Getcha popcorn ready.

Table of Contents – the Top 19 Healthcare Business Stories from Q3 2022

- CVS buys Signify Health

- Amazon acquires One Medical, shuts down Amazon Care

- Everything UnitedHealthcare

- Walmart and UnitedHealth team up on MA Plans

- UnitedHealth-Envision spat continues

- UnitedHealth wins again, will acquire Change Healthcare

- CMS payment updates for 2023

- Enhabit Home Health goes public

- Inflation Reduction Act: the biggest healthcare reform in 10 years?

- Turquoise Health partners with Ribbon, transparency era begins

- Physician Enablement platforms and Q2 earnings

- Public Hospital operators and Q2 earnings

- Nonprofit losses stack up in 2022 for CommonSpirit, Ascension, and Trinity

- Cano Health catches a Bid from CVS, Humana

- OneOncology dives headfirst into Value-Based Care, Enhanced Oncology Model

- Insurers plan major MA expansion for 2023

- Healthcare spinoffs from 3M and LabCorp

- BCBSA settles cartel antitrust lawsuit for $2.7B

- Tik Tok’s healthcare takeover?

- Notable Digital Health partnerships and announcements in Q3

- Notable Services and Hospital M&A, announcements in Q3

- Hospitalogy Deep Dives from Q3

CVS buys Signify Health

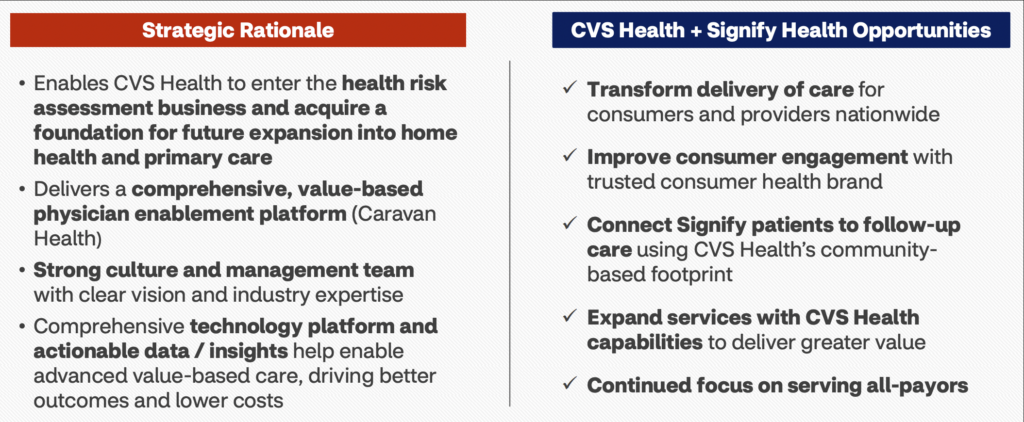

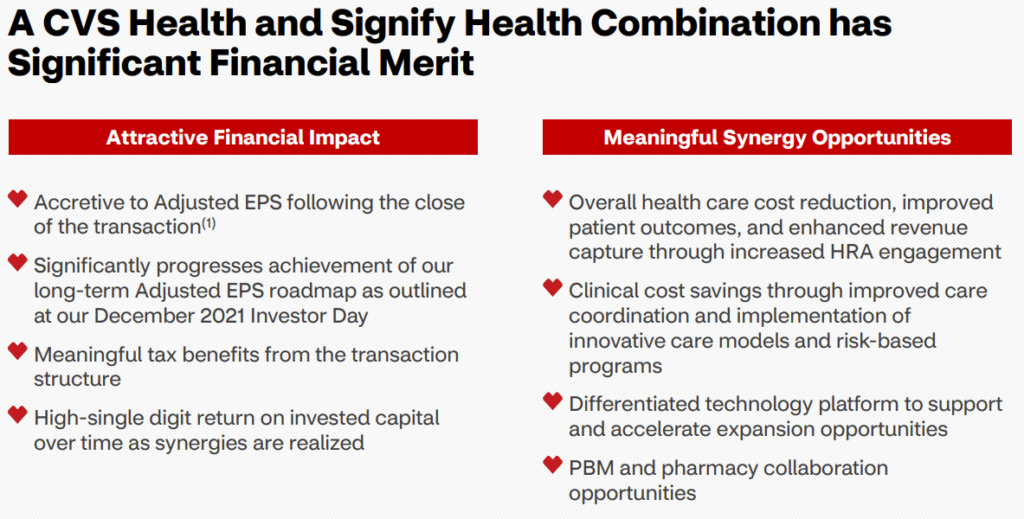

Signify Health’s bankers did NOT get Labor Day off in the Hamptons. News dropped on Labor Day that CVS successfully won the bid for Signify Health and is acquiring SGFY for $30.50 per share – a valuation right around $8 billion ($7.6B equity, $8B EV). With the acquisition, CVS managed to fend off the likes of Amazon and UnitedHealth.

Madden’s Musing: By acquiring Signify, CVS gets immediate access to 10,000-plus contracted clinicians that deliver comprehensive health screenings (Health Risk Assessments, 2.5M in-home visits) as well as Signify’s small but mighty care platform business, Caravan (700K+ Medicare beneficiaries, acquired in Q1 2022 for $250M).

Signify’s biz model is a key piece in the cog for an insurer that can immediately leverage its operations to enhance risk-scoring and add touch-points with patients, connecting patients with the rest of CVS’ and Aetna’s network. It’ll continue to function as an independent, payor-agnostic platform within the broader CVS umbrella similar to Optum, and I can’t imagine that CVS stops here with the acquisitions and buildout of its services platform.

This is a major win for CVS. I mean, just look at the rhetoric it put out in the deal presentation: “The transaction is expected to be accretive to Adjusted EPS and significantly increases our confidence in delivering on our 2024 financial targets”

The Signify acquisition is extremely synergistic to CVS as it’ll allow the healthcare behemoth to capitalize on risk scoring and assessments as well as provide it with a growth engine for the future of healthcare – a la, value-based care enablement platform.

Expect to see CVS continue to build out its services base and continues to vertically integrate ops – perhaps by snatching up regional primary care players or making an acquisition in the home health services business. Obviously Optum is well ahead in this terrain and you’re seeing similar activity from Humana with CenterWell heading down a similar vertically-integrated path.

I also have to wonder where this leaves Amazon. Its interest in Signify really signified (HA! you thought I couldn’t sneak that in!) its interest in the senior care and value-based care space especially with the potential synergy there with AWS. I can’t imagine that its ambitions with healthcare and acquisitions end here as it continues to be an active player.

Resources:

- CVS published a press release and the deal presentation, both of which you can access here

Amazon Acquires One Medical, shuts down Amazon Care

Amazon took over headlines for a bit during Q3 after buying One Medical (you can read my full analysis here) and then following that news, announcing the end of Amazon Care much to the excitement of the LinkedIn healthcare pundits. “AHA!” They exclaimed in unison from the rooftops. “Healthcare is hard. Amazon should know better.”

From the outside looking in, the headline appears as if Amazon is calling it quits on healthcare. It shut down Haven alongside JPM and Berkshire and now Amazon Care just 3 years later.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

In reality, Amazon is just getting started.

Let’s think about it this way. You run a business. You’ve got two analysts doing the exact same work. One analyst has been doing the job for 15 years. She’s already got specialized models for your company built out. Meanwhile, the other analyst, while ambitious and bright-eyed, sits basically where analyst 1 sat 12 years ago.

This is the ballgame that Amazon is playing today. Rather than pursue duplicative services, Amazon is leaning into its acquisition of One Medical and the capabilities that One Medical has painstakingly built out over 15 years. It’s a no-brainer and given the continued acquisition rumors, Amazon is developing a more sophisticated healthcare game plan.

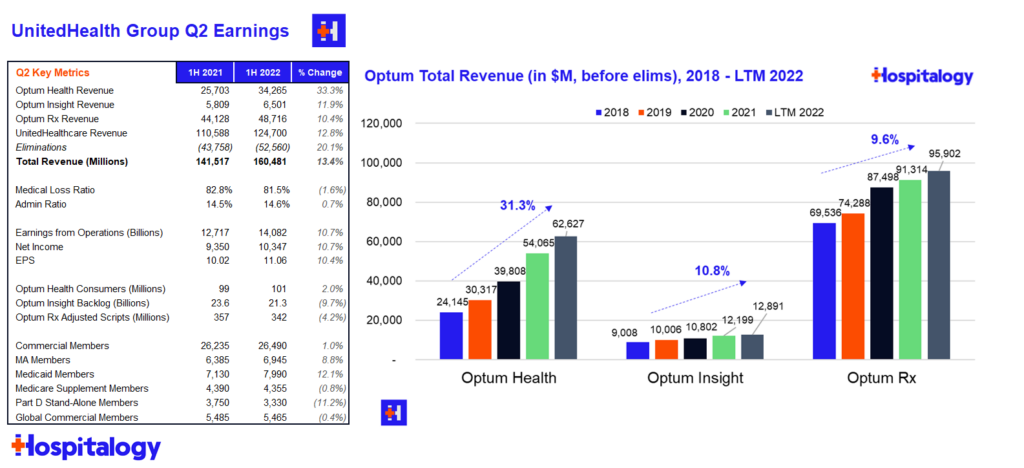

Everything UnitedHealth Group

Everyone’s favorite diversified healthcare behemoth UnitedHealth Group reported Q2 earnings on Friday. Surprise surprise, UNH jumped around 5% as its unstoppable train running through the heart of our healthcare system continues to chug along.

Major highlights from the earnings report and subsequent call:

Financials: UnitedHealthcare (insurance) revenue totaled $62.1B before elims and a 81.5 MLR for Q2. Optum’s (services) revenue totaled $45.1B before elims and revenue per consumer jumped 30% as it continues to tout its growth in value-based care arrangements.

Acquisitions: UNH spent $7.2B on net acquisitions in the first half of the year – I’m not sure if that includes the LHC acquisition but I would assume so. United spent $6 billion on acquisitions in the second quarter, which is what the entire firm spent annually each of the last 5 years. It’s clear that UNH is acquiring healthcare assets opportunistically as compelling valuations present themselves.

- As a part of its earlier deal to purchase Houston-based multi-specialty physician group Kelsey-Seybold, UnitedHealth Group also bought Kelsey-Seybold’s MA plan – KS Plan Administrators – a 41,000 member plan with $147 million in member premiums, closing the deal this month. Another interesting tidbit from the article: UnitedHealth bought KS for $2 billion. KS was/is a gargantuan practice with 600+ physicians and every ancillary service line under the sun.

- Late last year, Optum also quietly affiliated with another huge physician practice – CareMount, a 650 physician group, a few months ago. Someone help me point out the irony as Amy Klobuchar cries foul Amazon’s acquisition of One Medical. “In the Tri-State region of New York, New Jersey, and Southern Connecticut, Optum includes CareMount Medical, ProHEALTH Care Associates, and Riverside Medical Group. Together our more than 2,100 providers serve over 1.6 million patients annually across 630 practice sites.”

Utilization trends: Interesting tidbit for what we might see volume-wise on the hospital side – UNH noted that Covid-related inpatient admissions in Q2 dropped to 1/3 the volume of that seen during the Q1 Omicron wave. United management also noted lower pediatric and ER usage as compared to historical norms, but heightened utilization for senior preventative services (more wellness visits, specifically called out colonoscopies). Finally, United mentioned strong growth in its SCA segment as outpatient surgeries continue to see strong growth.

Other Tidbits: Optum’s financial team (I guess it makes sense they’d have a payments or fintech team) has been piloting a consumer benefits card, which it expects to roll out to all members starting in 2023. As a savvy PR move and great benefit politics aside, United is planning to offer insulin and a few other notable drugs at no out of pocket cost to its members in 2023 as well.

Walmart and UnitedHealth team up on MA plans

Retail overlord Walmart announced a deal with fellow healthcare overlord UnitedHealth to collaborate on Medicare Advantage plans. Over the next 10 years, the two incumbent giants will target the fast-growing Medicare Advantage population on a number of healthcare initiatives.

High-Level details:

- Term: Initial 10 years, seems like a bit of a pilot in the grand scheme of healthcare starting in 2023

- Walmart gets access Optum’s platform, which appears to be analytics and decision support tools. Details are a bit hazy beyond that but I’m sure the partnership will expand over time. On top of the decision support platform, Walmart will conceivably look to build out its healthcare presence beyond the 15 Walmart Health locations mainly in Florida and Georgia

Madden’s Musing: From a bigger picture perspective, it’s extremely prudent for Walmart to continue to creep into the fast-growing MA space. In 2020, the retail giant partnered with Clover to launch MA plans in Georgia. On the other hand, its problems with its Walmart Health strategy and slowing rollout are well-documented.

Optum is the best positioned partner to enable the transition to value-based care and help Walmart continue to push its healthcare strategy forward. Walmart is also known for having an expansive database of high-quality providers and recently integrated a machine learning tool, Health at Scale, to personalize healthcare provider directory recommendations to Walmart Health plans. Of most healthcare providers, Walmart has a distinct opportunity to fill in the gaps in rural healthcare. My burning question is whether this is just a loosey-goosey partnership or a collaboration with real teeth for the future.

- I also have to wonder if the increased push for social determinants of health and Medicare Advantage supplemental payments for things like groceries is responsible for retail players’ continued pushes into healthcare (Amazon + Iora, Walgreens + VillageMD & CareCentrix, now Walmart + Optum). It’s truly a no-brainer and incredibly synergistic to your business model if you can use an MA plan to push business to the rest of your company via government subsidies/payment.

- Walmart’s push into MA health plans is somewhat damning for cash pay services as well – Initially, I thought Walmart Health was going to aggressively undercut insurers by offering competitive low prices and DTC cash pay, but it seems as if insurance wins again.

Resources:

- Link to Press Release

- Walmart, UNH ink 10yr collaboration deal on value-based care (Healthcare Dive)

- Walmart Launches Provider Recommendation Tool for Health Plan Members (HPI)

UnitedHealth-Envision spat continues

UnitedHealth Group continues to push Envision physicians out of network and denying claims. As a result, Envision is dropping lawsuit after lawsuit on UHG, this time in the state of Tennessee, stating that “United puts profits above all else.” Ironic.

Backstory: Envision and other physician staffing firms have long feuded with payors. Most recently in May, Envision sued UHG in Florida, calling it an ‘evil empire’ in the lawsuit’s language and accusing the payor of underpaying its contracted reimbursement rates.

It’s pretty clear what UHG’s strategy is here – using its negotiating leverage and the No Surprises Act to push high-cost providers out of network and try its luck in arbitration or other hospitalist groups. UHG continues to crowd Envision out of contracts, cutting emergency physicians from its network and claiming that Envision was asking for double to triple the median reimbursement rate of other ER/Anesthesia physicians.

What’s even more interesting is the discourse on social media surrounding high-cost physician staffing firms and payors. We’re really kind of dealing with 2 devils here. On one hand, physicians, tired of dealing with insurers, are more inclined to side with the physician / provider side and are tired of getting generally squeezed by payors on reimbursement.

On the cost side of the equation, folks have noted that insurers are actually doing their job in this instance by driving down high-cost providers (like PE-backed Envision), especially if they’re charging double to triple the going rate.

- Later in Q3, Moody’s downgraded KKR-backed Envision Healthcare to its lowest junk rating, or C. Factors included its ongoing spat (and out of network status) with United, No Surprises Act implementation, lower ER volumes, labor challenges, and social risk stemming from the negative publicity it received from pursuing an aggressive out of network billing practice in order to gouge patients and insurers. No love lost for Envision here.

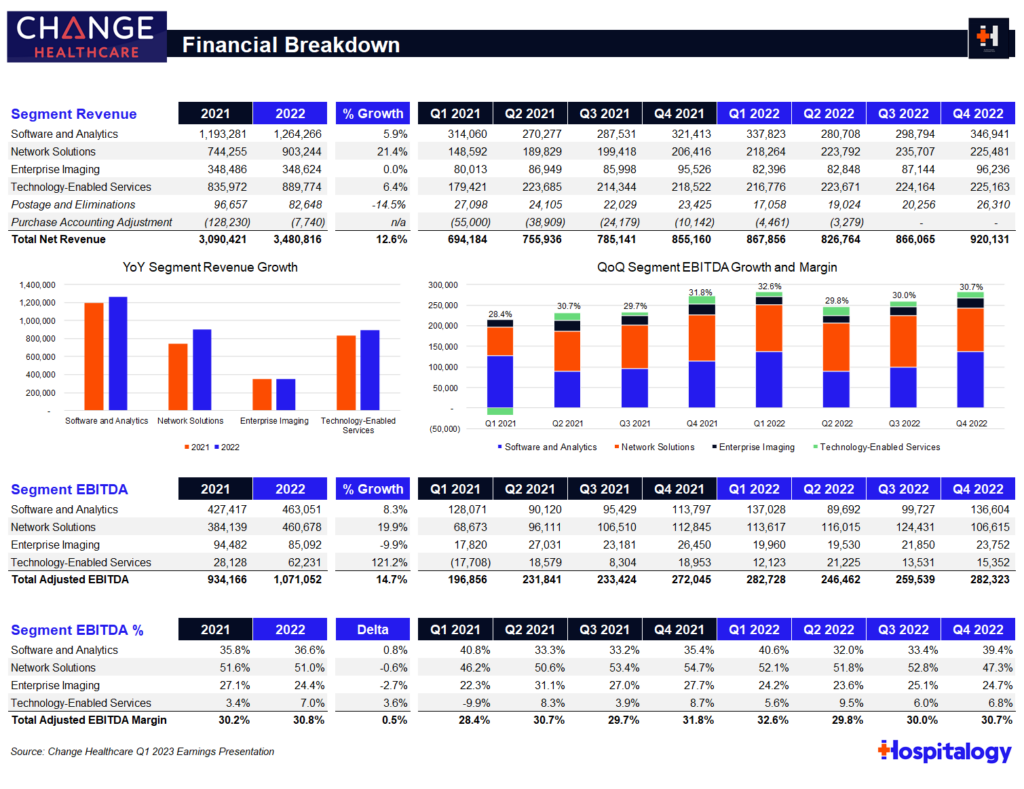

Judge blocks DOJ’s request to stop UnitedHealth Group – Change deal

A federal judge denied the DOJ’s request to stop UnitedHealthcare from buying Change Healthcare late yesterday, signifying the end of the antitrust trial and allowing UHG to move forward in acquiring Change Healthcare into Optum. UnitedHealth Group wins again! $CHNG closed up 6% in after hours trading.

Background: The transaction, announced in January 2021 and valued at $13 billion, was challenged by the DOJ after the big boi AHA and others voiced some concern over the deal.

Optum extended the merger agreement in April (with a $650M termination fee). The antitrust trial took place in early August and lasted two weeks, so healthcare reporters everywhere had been expecting a decision any day.

- Main arguments: The DOJ argued that since Change Healthcare works as a claims clearinghouse for rival health insurers, the Change acquisition would give UHG unfettered access to proprietary competitor info along with a near monopoly (75% market share) on the claims editing market. Opponents also claim that the forced divestitures aren’t enough and that the transaction is a significant consolidation in areas with very few players. Seems reasonable.

- UHG argued that the DOJ assertion is nonsense, stringent firewalls are in place between Optum and United, and that integrating Change into Optum would lower costs all around, including creating a more streamlined process for payors and providers that would ultimately benefit patients.

Madden’s Musing: I’m still wondering why the court briefs were sealed. But regardless, assuming no hiccups from this point, Optum will finally get to integrate Change Healthcare into its OptumInsight (analytics, rev cycle, & data platform) arm, which did $12.2B in revenue in 2021 and ~$12.9B in the last twelve months ended June 30, 2022.

Change Healthcare generated around $3.5B in revenue in its FYE March 2022 (seen above) but part of that will get divested as the judge ordered UHG to sell Change’s ClaimsXten biz to TPG Capital for around $2.2B.

It goes to show just how tough it is to prevent megamergers on this level by insurance giants. Change Healthcare processes $1.5T (yes, with a T) claims through 15B transactions with 6,000 hospitals and 1,000,000 physicians. Given that OptumInsight is one of the largest providers of healthcare IT services in hospitals nationwide, the Optum-Change combination creates a formidable, pretty much untouchable, entrenched incumbent. Every other health insurer would have to work through Change/Insight once the deal is closed.

United continues to successfully execute on its strategy to focus on Optum as its growth engine for decades to come as it quietly acquires physician groups across the country. It’s building an untouchable empire.

Resources:

- Original deal announcement press release

- AHA denounces deal

- Optum extends merger agreement thru December 2022

- United to divest ClaimsXten biz for $2.2B

- Federal judge denies DOJ request

CMS Payment Updates for 2023: Physician Cuts, Inpatient Bumps

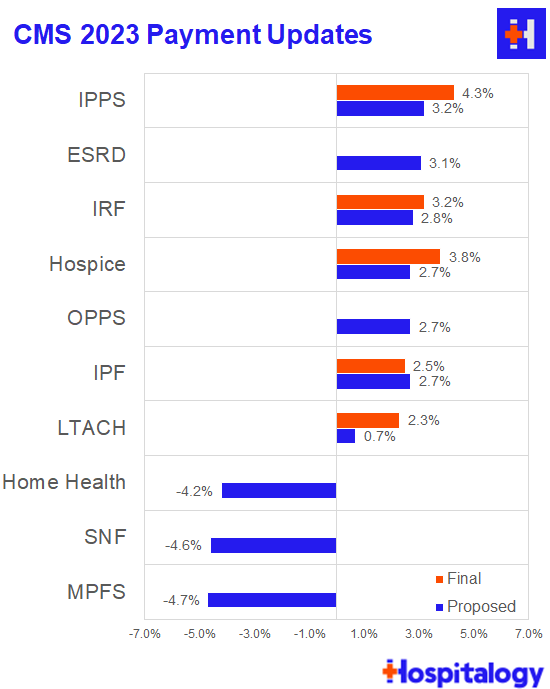

CMS released 4 finalized payment rules in Q3:

- IPPS and LTCH: 4.3% lift for IPPS and 2.3% for LTCHs (substantially higher than the IPPS proposed 3.2% after a ‘gentle’ nudge from Congress). CMS is also distributing ~ $6.8B in uncompensated care payments in 2023, a decrease of $318M from 2022.

- IRFs: 3.2% lift

- Hospice: 3.8% lift

- Inpatient Psych: 2.5% lift

- Skilled Nursing: 2.3% cut (up from a proposed 5% cut – CMS is phasing in the cuts required by the new PDPM payment model)

Make sure to check in here as CMS finalizes other verticals. All I can say that a lot of the physician crowd is going in on this announcement. I’m sure the post-acute players are feeling a similar way.

Resources:

- CMS fact sheet

- AHA response to the OPPS ruling

- HFMA write-up of the OPPS ruling

- BH Business write-up of the OPPS behavioral proposed provision

Enhabit Goes Public

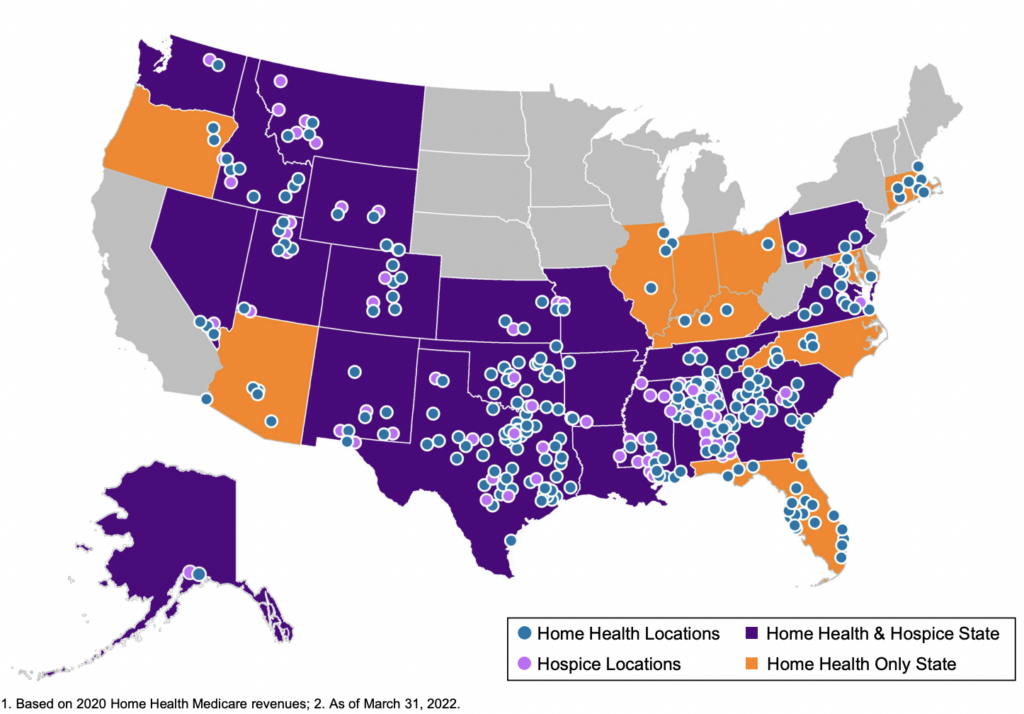

After announcing spin-off plans in January, Encompass’ home health arm, Enhabit Home Health & Hospice, successfully debuted on the public markets this quarter under the ticker ‘EHAB.’

About Enhabit: The home health and hospice operator holds a nationwide footprint and generated just north of $1.1B in revenue as of CY 2021. Enhabit is solidly profitable as well, operating at around a 17% EBITDA margin, or $184M on 200,000 admissions.

As part of the spin-off announcement, Encompass issued guidance for Enhabit for full-year 2022. Financials are expected to decrease slightly, with a revenue midpoint of $1.1B and EBITDA midpoint of $175M. Some of this is likely related to corporate overhead allocations while the rest is attributable to the headwinds I’ll mention below. Its hospice segment comprises about 19% of total revenue with an ADC of around 3,800.

Enhabit is the 4th largest home health player and the 12th largest hospice player sitting alongside the likes of other national operators like Amedisys, LHC Group, AccentCare, and Kindred. The operator boasts 351 HH&H locations across 34 states with 10k employees.

Madden’s Musing: Although home health – and post acute in general – is poised for growth given the aging Medicare population and continued shift to the home, Enhabit and other home health orgs are facing major short-term headwinds, including staffing woes and reimbursement hits from CMS given that 80% of its book of business is Medicare. Here’s an interesting tidbit on Enhabit’s home health → hospice pipeline:

“Many home health patients will ultimately require hospice services. By offering hospice services in many markets where we operate our home health business, we minimize disruption and gaps in care to patients who transition to hospice. We believe this co-location strategy between our home health and hospice businesses creates a growth opportunity for our hospice business, especially in geographies where we operate home health but not hospice.” Enhabit 8-K filing

One of the major reasons why Encompass decided to spin Enhabit off seemed to be related to Encompass’ desire to fully focus on the IRF biz while Enhabit could do the same for home health.

Enhabit still has a major opportunity ahead of it both from a consolidation standpoint (home health is STILL highly fragmented along with a growing need for hospice) and a value-based care standpoint (payors are incentivizing shifts to value-based models).

Since Enhabit operates at a lower cost per visit than Amedisys and LHC Group as of CY 2021 and holds solid readmission percentages, the firm believes it’s in good shape to serve the Medicare Advantage population as it continues to grow to above 50% by 2030.

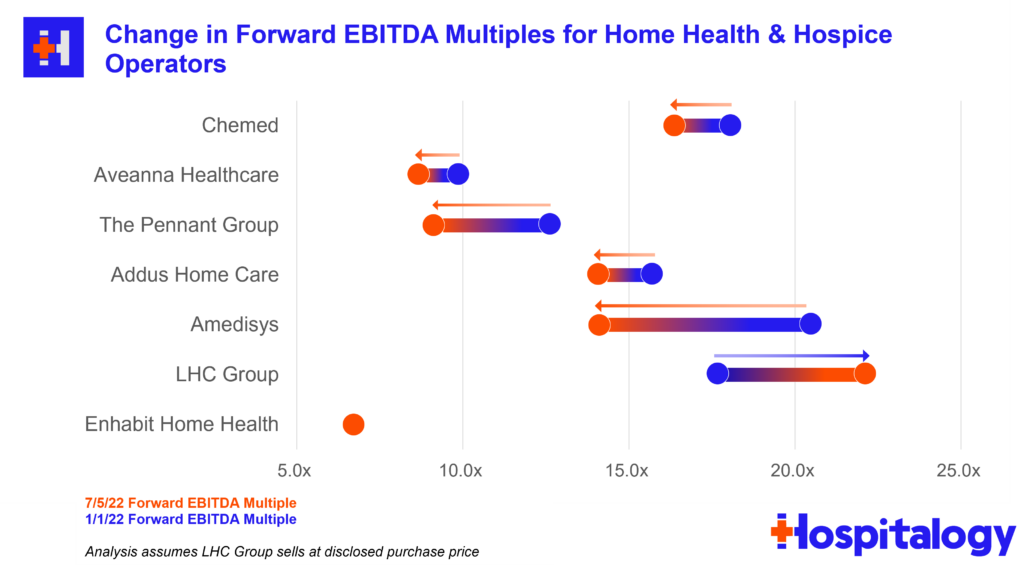

Final point – Timing for the spin-off wasn’t exactly ideal given what’s going on in the broader economy as well as the idiosyncratic struggles home health operators are facing. These issues are probably one of the major reasons why LHC decided to sell to Optum for 22x EBITDA back in late March. Really timing the top there!

Home health multiples continue to be hammered given the current macro outlook for these operators. During the quarter, Aveanna was downgraded by equity analysts and dropped another 7%. Meanwhile, Enhabit (Encompass spinoff) continues to get hammered and dropped under a $1B market cap while trading at a sub-7x EBITDA multiple. Check out the graphic below and make sure to share Hospitalogy with as many friends as you possibly can so that I can keep making fire analyses (and afford electricity).

Disclosure: I received Enhabit shares as part of the Encompass spin-off.

Resources:

- Here’s the Enhabit investor presentation

- Press release on completed spin-off

- Enhabit SEC filings – the recent 8-k is a great overview

- Encompass issued guidance for consolidated, IRF segment, and Enhabit

- CMS comes after home health

Inflation Reduction Act: The biggest healthcare reform in 10 years?

In a 51-50 vote, Democrats passed the Inflation Reduction Act (IRA), which is a pared down version of the Build Back Better Act. Among other climate and tax-related provisions, I, as a healthcare freak, was obviously focused on the healthcare stuff. Lots of health policy experts are calling the IRA a huge breakthrough when it comes to drug pricing regulation.

Healthcare Stuff in the Inflation Reduction Act

Direct Price Negotiation for Drugs: When Medicare Part D passed in 2003, lawmakers banned Medicare from being able to negotiate drug prices since it would be too similar to every other developed country in the world.

- With the IRA, Medicare can now negotiate drug prices on the oldest, largest drugs that still don’t have any competition starting in 2026. Negotiation is limited to the 10 largest drugs and will expand from there each year (20 total drugs by 2029, from both Medicare Part B and D).

- To be eligible for negotiation, a drug must (1) comprise a high proportion of Medicare spend, (2) not have any competition (e.g., biosimilars or generics, and (3) be 9+ years post-approval (depending on type of drug).

- The IRA mandates minimum discounts (which the IRA refers to as the ‘maximum fair price’) of these eligible drugs.

- Years 9-11 = 25% min discount

- Years 12-15 = 35% min discount

- Year 16+ = 60%

List Price Inflation: Drug list prices cannot increase faster than inflation for drugs that Medicare buys; otherwise they’ll have to pay a rebate starting in 2023.

Out-of-Pocket Spending: Out of pocket drug costs for Part D will be capped at $2,000 for beneficiaries starting in 2025, which creates huge savings for beneficiaries but likely will result in much steeper costs for Medicare’s share. This also seems advantageous to drugs priced in the previous out-of-pocket range ($10,000). Along with capping OOP spend, Part D premium growth would be capped at 6% starting in 2024.

ACA Subsidies: The IRA will extend ACA subsidies currently in place thru 2025, a $64B provision.

And finally…what’s notably missing from the final bill:

- Private Equity Escapes Unscathed: While the original bill removed the carried interest loophole, the final bill will let carried interest survive, which is a major win for private equity players. If the loophole had been eliminated, it MIGHT have incentivized longer hold periods for PE players in healthcare.

- Insulin Caps: A $35 cap on insulin prices for private insurers (note – Medicare beneficiaries still receive this perk) didn’t make it through to the final IRA bill, as it was considered out of scope for the reconciliation package.

Big Pharma’s Big Beef.

As with most things (even when I’m wrong or off-base) I want to bring both sides of this bill to your attention. PhRMA isn’t a fan of the sweeping changes to the industry. According to STAT, the pharma lobby spent 7+ figures – more in 2022 than any other industry – in an attempt to stifle the drug pricing changes in the IRA.

PhRMA CEO Stephen J. Ubl called the drug pricing plan a ‘tragic loss’ for patients:

“Today’s vote may feel like a political win for Democrats, but it’s really a tragic loss for patients. This drug pricing plan is based on a litany of false promises. They say they’re fighting inflation, but the Biden administration’s own data show that prescription medicines are not fueling inflation. They say this is “negotiation,” but the bill gives the government unchecked authority to set the price of medicines. And they say the bill won’t harm innovation, but various experts, biotech investors and patient advocates agree that this bill will lead to fewer new cures and treatments for patients battling cancer, Alzheimer’s and other diseases.

So in short, the main arguments seem to be stringent government price control (since it’s less of a negotiation and more of a “you get what we decide.”) leading to less innovation. PhRMA is also arguing that net drug prices are decreasing when factoring in rebates and discounts/refunds and are therefore deflationary, therefore not contributing to inflation.

On the plus side, Big Pharma will have 3 years to digest the legislation, continue to lobby, and plan for the IRA’s implementation. That’s a hell of a lot of Drug Channels content, too.

Madden’s Musing.

Drug price negotiation/control isn’t a new concept, even in the U.S. The Veterans Affairs has been able to negotiate drug prices for a while and has its own formulary. Plus pretty much every other developed country in the world negotiates drug pricing. So it’s not like this policy is coming out of left field or anything. Medicare/Gov spending is about 20% of Big Pharma’s revenue mix, so while it’s significant, it’s not insurmountable.

Eligible drugs are limited, which makes me think that the actual impact of the law is overstated – for now. The big thing happening here is the government putting its foot in the door and setting the precedent for continued and expanded scope of negotiation in 2030 and beyond.

While I understand the argument related to innovation, drug makers will still have plenty of flexibility on initial price and will undoubtedly find other ways around the regulations in the classic cat and mouse game.

Open-Ended questions I have:

- Will these changes trickle out to the commercial market? To what degree?

- How will the IRA affect physician oncology compensation (drug dispensing / infusion ancillaries) and the 340B program?

- Will the IRA and Medicare drug negotiation push drug makers into more creative, value-based arrangements? How will drug pricing models shift as a result of the legislation? I would assume that the structure would incentivize higher upfront list prices that the government would then try to negotiate down.

Resources:

- KFF provided a great overview of the provisions and timeline of the IRA

- A detailed analysis from JP Morgan on the IRA’s financial and operational impact to pharma, including key provisions

- Evan Brociner had a really nice contextual overview of the IRA reform that I really enjoyed.

- Endpoint News did a good deep dive on the issues at hand as well.

Turquoise Health partners with Ribbon

Price transparency digital health firm Turquoise Health announced a partnership with healthcare-focused API data platform Ribbon Health to integrate Turquoise’s price transparency data into Ribbon’s platform.

Through the partnership, Turquoise and Ribbon aim to continue to empower patients and consumers within the healthcare system. Imagine that you’re googling various in network providers and their prices for common procedures (including other pertinent information) pop up next to the practice. This use-case is just one example of what Ribbon, Turquoise, and others in the space hope to achieve.

Madden’s Musing: Price transparency in the midst of the increasing consumerization of healthcare is a great thing – don’t get me wrong. But from the conversations I’ve been having, we still have a decent ways to go for it to mean anything cost-wise within the broader healthcare system.

How much will partnerships like these, and actually knowing the costs of things move the needle? With so many other factors to consider – doctor referrals, networks, and structure of health insurance – it’s hard to know. Despite the unclear effects of price transparency, I’m excited by the fact that we’re still in the early innings of data collection & insights driven by that data.

Regardless, Turquoise has a compelling market opportunity in front of itself, especially as payors begin to submit their pricing data after the very-under-the-radar CMS price transparency rule compelled them to do so on July 1.

Turquoise Health also announced a partnership with Komodo Health to continue to build out transparency tools and leverage each others’ data to build out a compelling data platform. It’s a fascinating time for digital health firms focused on analytics to drive insights and associations with the ultimate goal of better patient care. Even more notable was that Komodo Health was expected to IPO this summer but that obviously has been put on hold given the macro environment unfolding!

Physician Enablement Platforms in Q2

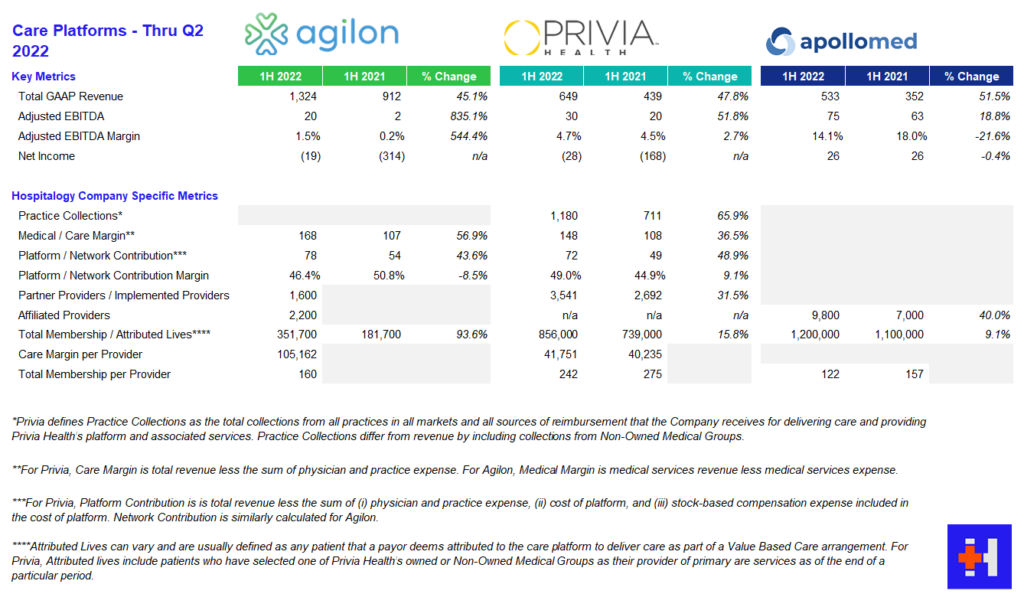

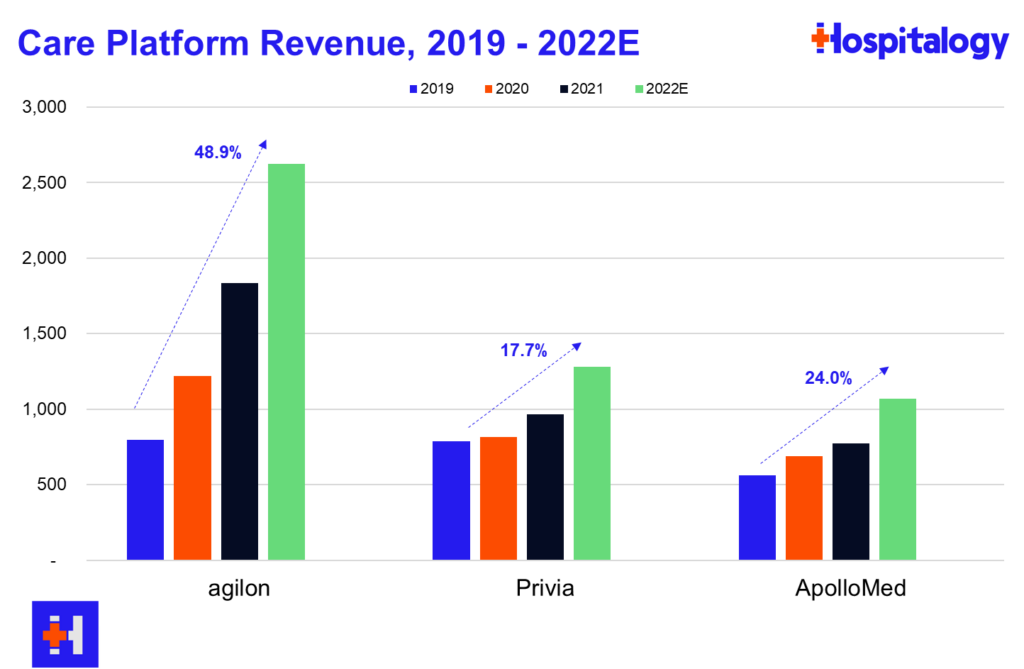

You all know that I love diving into the care platforms, particularly the affiliate based models (agilon, Privia, ApolloMed). Here’s what you need to know about how they’re doing thru Q2 earnings:

agilon: AGL reported strong growth across membership, revenue, and adjusted EBITDA stemming from better than expected membership numbers in year 1 geographies. To date, agilon operates in 16 markets with 2,200 affiliated providers. As far as same-store markets are concerned, agilon experienced a favorable PMPM boost of $136, a 26% increase year over year from $108. agilon attributes the boost to its care model and its ability to engage with high-risk seniors. On the direct contracting side, AGL management noted strong growth and margin expansion and included that the model is nice for its primary care physicians since they can maintain a single full-risk model across all of their Medicare patients. For 2023, agilon is focused on onboarding for its 7 new physician partners to establish a smooth transition to its platform. Management is also prioritizing payor contracts with health systems. As is similar to Privia and ApolloMed, the pipeline for new physician partners is strong and will continue to be as physicians seek these platforms for independence and their ability to focus on patient care. agilon has already signed a few providers for 2024 onboarding and continues to be a strong value prop for primary care physicians.

Some other interesting tidbits from the AGL call:

- 25% of its membership, or 90k members, are direct contracting members. On average, AGL partner physicians have 400 members across DCE and MA. AGL has generated over $500 million in DCE revenue over the first half of the year, which comprises almost 40% of its revenue if my math checks out.

- When discussing utilization, AGL management noted that acute (hospital) utilization is below 2019 baselines but is getting offset by outpatient volumes, confirming the trends happening in healthcare as the shift to outpatient continues.

- agilon touched on its partnership strategy with health systems (it recently partnered with MaineHealth) including the changing mindset within those organizations that primary care could shift from a subsidy model to an integrated economically sustainable model. AGL noted they’re holding ‘robust’ conversations with potential health system partners, but these conversations take longer since health systems move notoriously slowly.

- Medicare sequestration will have a 2% knock on PMPM reimbursement in the back half of the year.

- AGL noted that its ability to take risk on PPO products gives it a competitive advantage and is a key differentiator.

- “The inflection in demand we are seeing reflects macro drivers, namely payer demands for value and the growing senior population and the level of success that our partners are seeing on the platform.” – Steven Cell, CEO, Agilon

- “We’ve never had groups signed up this early. When we talk about an inflection in demand, when we talk about group’s understanding the value that they have and what they can achieve through a partnership with Agilon, that’s accelerating this. And so the 2 that we’ve signed last year at this point, we had 0 and every year prior to that, we’ve had 0. So these will have 16-, 18-month implementations, which should give us just a tremendous leap forward. And — the rest of the funnel for 2024 looks extremely strong, basically at every step down on that process from qualifying all the way down to signing letters of intent, like we talked about.” – Steven Cell, CEO, Agilon

Privia: PRVA continues to execute on its strategy, notching wins in increased implemented providers on its platform and raising its guidance across revenue and profitability. Privia continues to shine as a care platform, touting strong provider retention and a strong pipeline to enter new markets. Interestingly, Privia management noted a big tailwind in CMS’ plans to prioritize the Medicare Shared Savings Program (MSSP), using the program as the basis for ‘growth and care transformation.’ PRVA saw 31.5% growth in implemented providers and 15.8% growth in total membership.

Other notable tidbits:

- Privia thinks it’s uniquely positioned to continue to capitalize on CMS’ investment into the MSSP program as it operates one of the largest, most successful ACOs in the country.

- Privia continues to see a solid pipeline of providers to add to its platform given its value prop (similarly to other care platforms, it seems to be an easy sell for physicians, at least for now).

- Main drivers of growth for Privia continue to be (1) transitioning physician partners downstream to take on more risk (management noted a lot of TAM left here as the transition is slow) and (2) entering new markets.

- As far as utilization trends, Privia echoed similar sentiment to agilon – outpatient and ambulatory volumes are strong, but inpatient utilization is highly variable and hard to predict. The biggest unknown for PRVA’s model would likely be inpatient utilization in the back half of the year.

- Geographically, Privia operates in 8 states and has “42 more to go” if that gives you an idea of its growth ambitions. Privia is uniquely positioned to benefit from both fee for service arrangements (higher utilization) and risk-based arrangements (MSSP & MA growth, about 30% of total revenue)

- Similarly to agilon, Privia sees major potential and appears to be in talks with health systems about partnerships and enabling risk in those arrangements. On top of health system conversations, Privia has seen initial success and appears to be chugging along just fine in its 3 markets (Texas, Montana, and California, most notably)

- One of the more interesting analyst questions revolved around Privia’s moat (AKA, ability to retain its physician practices) and if there were any existential risk involved from someone coming in and outbidding Privia for its existing partners. Privia management noted that its doctors are ‘vehemently independent,’ it has enough practices not to worry about concentration risk with any single group, physicians at Privia-affiliated practices are making more comp, attrition is at all-time low’s, and it’s not going to worry about M&A buying out its groups or chase anyone coming in with a big checkbook.

- “…over half our additions come from doctors referring colleagues to Privia. And I mean, if you think about it, and somebody asked the question in the last quarter about how does — how the inflation factors, is it kind of different? Will it — what do you think from a driving business perspective? And anytime there’s, I guess, tough things going on in the economy, people are looking for partners and solutions to help, and we believe that. I mean we saw it through COVID, and we believe that’s going to continue to play out in the next few years as we — as the economy kind of gets back on its feet.” – Shawn Morris, CEO, Privia Health

- “The one thing I would say is our criteria, as we’ve been very clear, to take on more risk is always to ensure that at a minimum we’re not economically and from an EBITDA standpoint worse off. And ideally we’re doing it to enhance the level of EBITDA and earnings and shared savings. So that’s a fundamental criteria. We’re not going to do it just to recognize top line practice collections or revenue. We’ll do it when it makes sense and when we think it’s a good financial decision for our physicians as well as the payers in Privia.” – Parth Mehrotra, President & COO, Privia Health

ApolloMed: AMEH saw strong growth in capitated revenues, increasing 57% year over year. ApolloMed management noted higher expenses on both the medical expense side given a return to pre-COVID utilization, something that both HCA and Tenet noted in their earnings calls as well – a return to normal. G&A costs rose as well as ApolloMed continues to invest in geographic expansion and an increase in stock based comp. Management continues to execute and pursue strategies to enable independent physicians throughout its geographic footprint and noted the benefit of its recent acquisition of Orma Health.

- AMEH continues to fly under the radar as its business model chugs along and it actually walks the talk in transforming primary care and risk-based relationships in reaching and caring for underserved communities. It serves 1.2 million members, about half of which in capitated arrangements, and has massive staying power in its core regions stemming from longstanding relationships. The mind-blowing thing to me is that ApolloMed has no analyst coverage despite its fascinating and compelling, economically sustainable business model in an area with fast-growing secular tailwinds.

- “ApolloMed has a long history of operating successfully and profitably in our core regions, and we believe we can replicate our success in other local communities across the country by partnering with like-minded physicians. We remain incredibly excited and energized in our mission to enable providers to excel in value-based care and deliver higher quality outcomes to their communities.” Brandon Sim, CEO, ApolloMed

Note that I would include P3 Health Partners here, but it looks like they’ve decided not to report earnings so far in 2022 (It’s August btw). Hmm.

Resources:

Q2 Performance for HCA, Tenet, CHS, and UHS

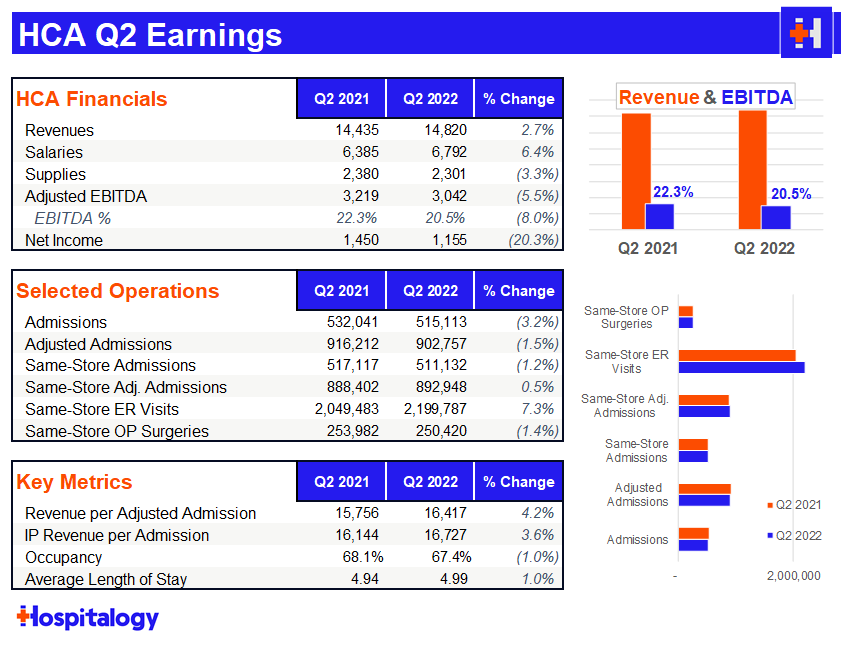

HCA: After a heavy selloff from HCA in Q1, it’s no surprise to me that the hospital giant bounced back in Q2. As far as Q2 major themes were concerned, I was keeping an eye on labor woes and HCA’s comments on ongoing payor contract negotiations.

HCA had an absolute slam dunk on the labor side, reducing costs 22% in June compared to April with additional management commentary that there’s still more room to fall there. HCA also mentioned it made a ‘fairly sizable’ wage adjustment to nursing salaries and expected another market adjustment in the mid-single digits for this year as well, so some pretty material wage increases there – a good sign for nurses.

As another interesting data point on labor, HCA is really leaning into its Galen nursing education partnership. HCA opened 3 Galen nursing colleges in Q2 with 2 more slated for 2H 2022.

Right now the Galen nursing footprint is up to 13 with 6-8 additional schools opening up over the next 12-18 months, with at least one in each major market HCA operates within. ~10,000 nurses graduate from Galen facilities each year, a huge pipeline for HCA (assuming the nurses choose to work at HCA facilities) along with other existing academic partnerships.

Analysts harped on commercial pricing quite a few times, trying to peg a concrete number on what HCA was expecting as far as average overall price escalators for 2023. HCA noted it normally sees between 2.5% – 4% on rate lift and expects ‘mid-single digits’ for 2023, so likely somewhere in the 4-6% arena.

While asked about inflation at 8 or 9%, HCA mentioned that this big of a hike was unrealistic. HCA also has inflationary provisions in place in many of its contracts with payors. Here’s a relevant quote from CEO Sam Hazen:

- “We are seeing some early success recognition by the payers, and we expect the payers to appreciate the overall inflationary environment that the providers are in. But we’re seeing some early recognition of that and some renegotiated contracts have reflected more escalation in pricing than what we had seen in our past trends. As I mentioned on the last call, we’re pretty much contracted for 2022, obviously. But as we look to 2023, we’ll start to see some uplift in our contracting pricing, reflecting the new contracts. And then on ’24, we fully anticipate having a different trend on our pricing as a result of these renegotiations.”

HCA brushed off any thoughts on Amazon’s purchase of One Medical, calling primary care multi-faceted and no expectations of any sort of paradigm shift in the space.

Regarding utilization trends, overall demand for services was not as strong as expected, but overall, demand has largely normalized for HCA – a return to healthcare normalcy, if you will. HCA expects volume softness on the inpatient side (1-2% growth) and a bit more growth in-line in the outpatient setting. ‘Rona admissions comprised about 3% of total admissions, down 70% from Q1.

Although HCA lowered guidance in Q1, HCA retained that 2022 outlook during the Q2 discussion.

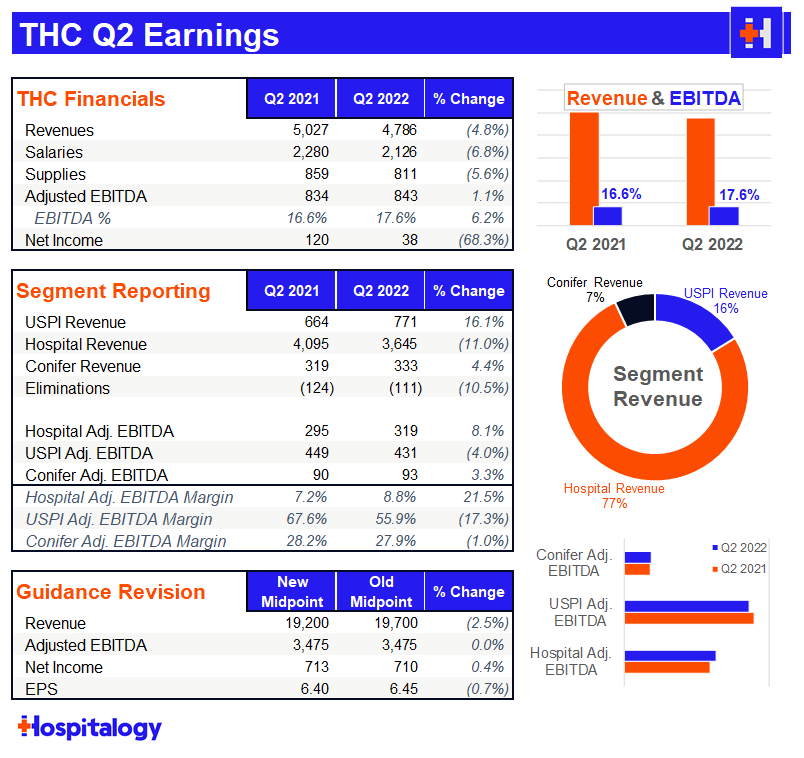

Tenet: The most notable part of Tenet’s earnings discussion was the fact that it estimated its Q2 cyber attack cost $100 million in Adjusted EBITDA!! $100 million!! Tenet expects a payout from insurance to make up for the lost $$ from the cyber crime. In spite of the lost revenue, Tenet reiterated its full year 2022 guidance which means they expect major operating strength during the back half of the year.

I have to give a lot of credit to Tenet. Despite it all, the continues to execute well on its plan to scale USPI through announced acquisitions with the likes of United Urology and buying out long time JV partner Baylor from its equity stake (remaining 5% at a $406 million equity valuation). The buyout provides Tenet with another $25M incremental increase in earnings. USPI continues to be the growth engine for the company, achieving 7% market share in the ASC industry while Tenet invests $200+ million into the segment annually.

Tenet continues to harp on the fact that it deserves a higher multiple given its focus on outpatient & higher margin ops and I tend to agree with their thesis given the strategic pivot.

Tenet is more insulated from contract labor given its structure and continues to fully capitalize on the migration to outpatient. Nothing personifies this better than Tenet’s contract labor as a % of SWB sitting at 6.2%, significantly lower than HCA’s of 8+%.

USPI’s EBITDA grew 15% and achieved 2019 levels of utilization while Conifer continued to chug along just fine.

Tenet extended its national contract with UnitedHealthcare thru 2025, covering all facilities and terms Tenet was happy about. As far as rate lifts, Tenet echoed HCA’s sentiments and expects to see 3-5% increases for 2023.

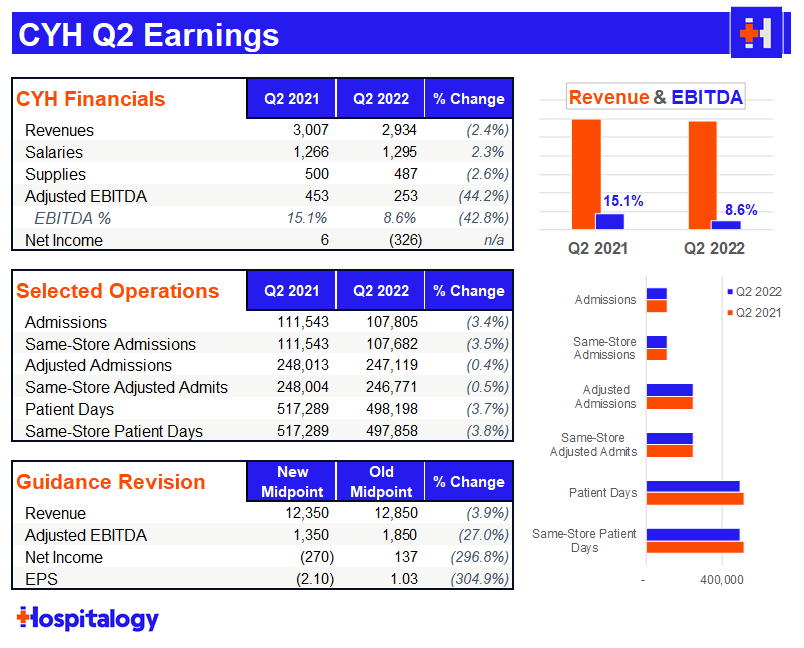

Community Health Systems: declined almost 40% after some shocking misses on earnings amidst a tough operating environment for the embattled health system. The tone was pretty somber on the Q2 earnings call with CEO Tim Hingtgen outright beginning the call by saying CHS didn’t achieve the results they had expected.

Although CHS mirrored comments by its peers HCA and Tenet that contract labor was sequentially improving, the hospital operator still identified contract labor challenges as its number one priority and opportunity to improve its performance. For context, CHS total contract labor was 10% of SWB (13% in Q1) compared to HCA’s 8% and Tenet’s 6%. As far as other expenses were concerned, CHS managed them well and did a good job of maintaining or lowering its G&A and supply costs despite the inflationary environment.

Reduced capacity, lower acuity cases, and short-stay surgical patients put a ton of pressure on Community’s admissions, dropping 3.4% quarter-over-quarter. Translation: ASCs seem to be eating CHS’ lunch.

As a result, net income plummeted to -$326 million and adjusted EBITDA margins dropped to single digits. According to CHS management, just 2 of its 48 markets accounted for 20% of the total decline in EBITDA for the quarter. That’s some kind of 2 & 20.

“We do not view 2022 as the new baseline. Rather, it is a period of disruption and unusual events. Looking out longer term, we believe the stronger return of deferred care, the execution of our growth and strategic initiatives, our successful expense management, and continued focus on cash flow and capital structure management will allow the company to achieve its medium-term financial goals, which includes targets for 16%-plus EBITDA margin, positive annual free cash flow generation, and reducing our leverage below 5x.” – Kevin Hammons

CHS dropped its guidance further (after a Q1 chop) and you can see the outsized effect that labor and reduced volumes are having on its financial performance. Tough sledding ahead for CHS in the back half of the year.

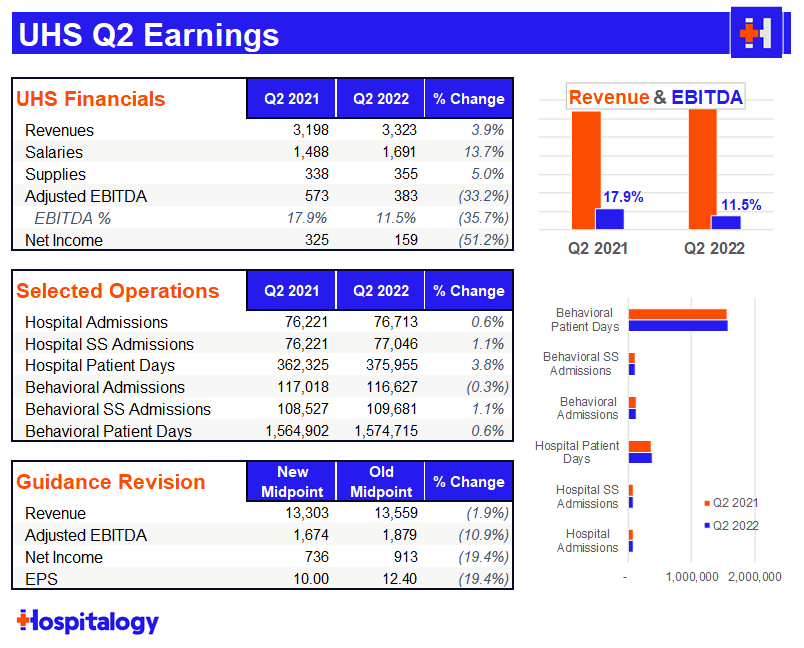

Universal Health Services: dropped 7% (and since seems to have recovered) on a pretty even quarter, all things considered. The hospital and behavioral health facility operator noted similar trends to its peers in that contract labor dropped sequentially from April to June as did COVID cases as a percentage of admissions.

Still, the drop hasn’t happened as fast or as impactful as expected, and you can see below the huge increase in salaries quarter-over-quarter. Both salaries and supplies growth outpaced revenue over the QoQ period. UHS similarly experienced inflationary pressures on the labor side but in G&A or other expenses. They also seem to be having some issues with retaining nurses.

Utilization demand didn’t rebound as strongly as expected for UHS either, leading management to suspect that patients are deferring care. The deferring of care has been a major talking point since COVID began. Most believe that this trend will inevitably end up in higher acuity issues down the road for patients, which is troubling. UHS expects some recovery in Q3 and major volume recovery in Q4 as things return to a more normal environment.S

UHS gives zero F’s about payor contracting:

“I’ve mentioned in previous calls that we’ve been aggressively giving notice of termination on contracts in both the acute and the behavioral business at a pace faster than quite frankly, I can really remember ever historically because as we identify contracts that simply in our minds, are not even remotely keeping up with inflationary pressures and labor pressures.” – Steve Filton

Madden’s Musing: After a strong 2021 and a perceived resurgence in the vitality of Community’s hospital offering, they’re back to square one. It seems as if CHS was caught off guard by seeing certain short stay inpatient cases shift to outpatient classifications, which affected reimbursement significantly. The one bright spot for CHS seems to be its lack of debt covenants in the near-term as it tries to de-lever.

Hospital operators and other services based biz’s have seen declines to profitability in the challenging operating environment.

As far as overall hospital activity is concerned, it looks as if all 4 hospital operators are optimistic about the continued wind-down of contract labor and expect better operating performance in the back half of 2022.

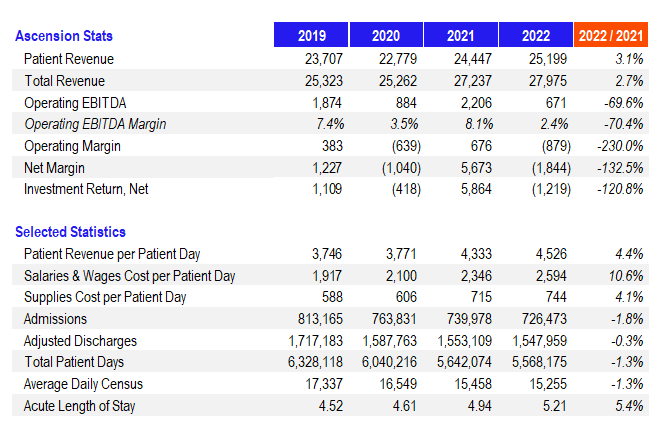

Nonprofit Hospital Losses Stack up in 2022

Top-5 nonprofit health system Ascension released its full year (MH paywall) 2022 financial and operating results on September 14th, and the trend of hospital losses marches on. Common themes continue to plague even the largest operator financial and operating performance.

Investment losses aside, Ascension’s operating margin totaled ($879M) while its total net margin dropped to ($1.84B). Operating EBITDA dropped to $671M, or 2.4%.

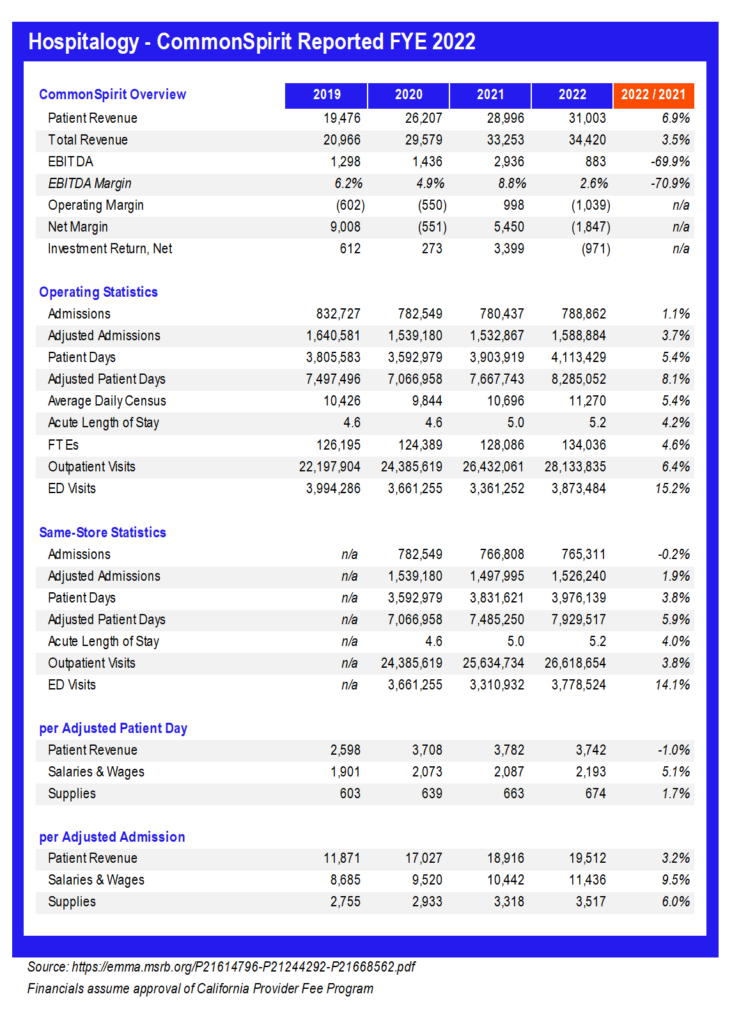

CommonSpirit Health, the largest nonprofit health system in the U.S. after its merger with Dignity Health 4-5 years ago, posted its full year 2022 (fiscal year end June 30) financial results in Q3.

Madden’s Musing: In summary, CommonSpirit faced similar issues to Ascension and hospitals in general. Revenue gains on the topline were offset by expense inflation. Salaries & wages and supplies grew 9.5% and 6.0% per adjusted admission respectively while same-store admissions stagnated. It’s pretty amazing to see length of stay jump across the board even at these gigantic health systems. The widespread trend signals higher patient acuity and more observation days stemming from a lack of post-acute discharge support.

Of course, investment losses didn’t help CommonSpirit, but given the sheer size of this organization and its pretty favorable payor mix, the health system will be just fine. In fact, Fitch even upgraded some of its debt recently, expecting the org to trend back to an 8% EBITDA margin over time by 2025. CommonSpirit operates among a number of diverse, growing markets which alleviates a lot of concern when it comes to factors affecting smaller hospitals and health systems. It’s nice to be big.

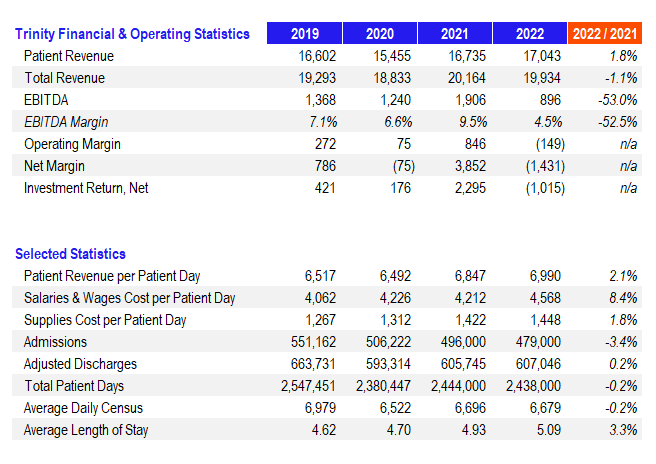

Finally, Trinity Health posted its full-year 2022 results to a similar tune. While patient revenues increased 1.8%, overall revenues decreased due to the end of provider relief funds. EBITDA was cut in half while net margin dropped to ($1.4B) as a result of dismal investment returns. Length of stay crept up

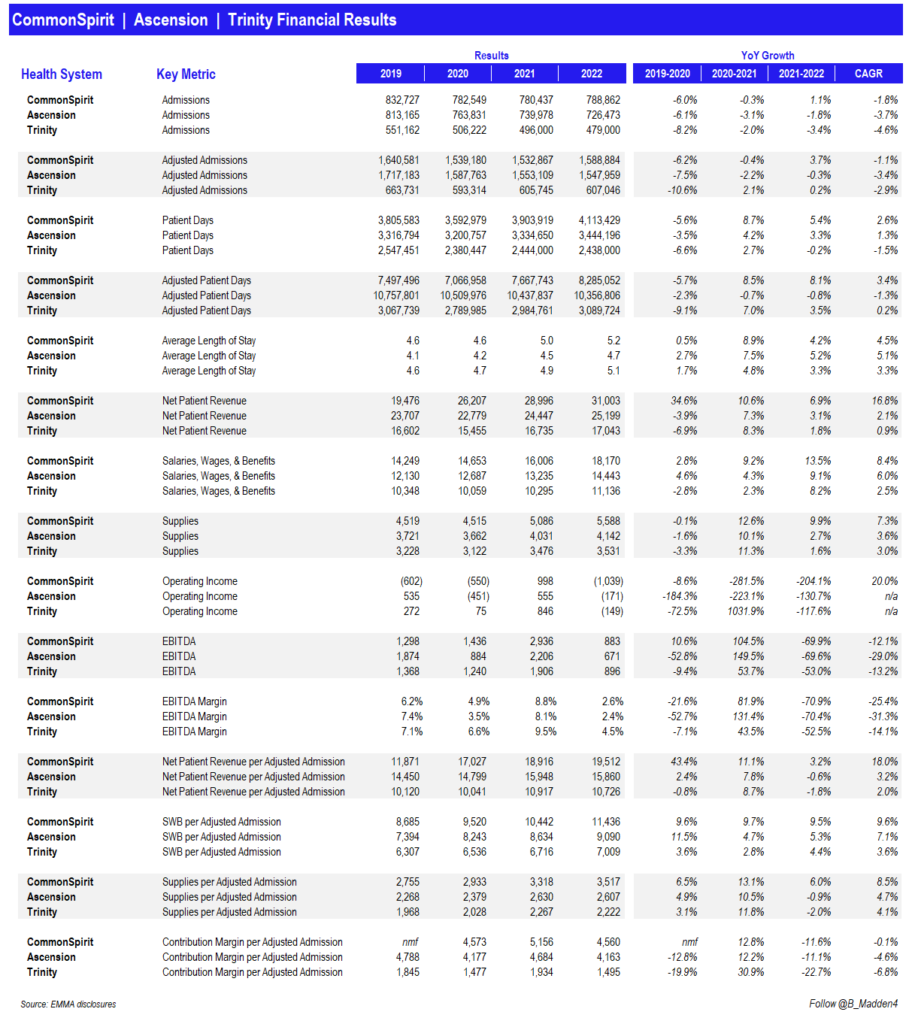

Here are key operating and financial results for 3 of the top 5 biggest nonprofits stacked up side-by-side:

Cano Health Catches a Bid

Cano Health is the latest name to get thrown into the acquisition ring. Rumors are swirling around the risk-based care MA clinic operator. Among the potential suitors are at least CVS, which just bought Signify Health for $8B, and Humana, which has a right of first refusal for any sale of Cano over a certain ownership threshold.

Madden’s Musing: Cano spiked 30+% on the acquisition rumors to around a $3.3B enterprise value and I feel like a broken record writing about these takeovers being perfect targets for payors.

- Background: the MA player SPAC’d at a $4.4B valuation in early 2021 amongst the value-based care and ‘Rona trade. Then, in March 2022, activist investor group Third Point bought 6.4% of the company and allegedly pushed Cano to consider a sale which ultimately didn’t materialize. In July, Humana was briefly rumored to be holding acquisition talks with Cano, which again, ultimately didn’t materialize.

So now here we are again with some more substantial weight to the discussions, considering that the Wall Street Journal reported on the news after previously scooping the Signify talks. Cano would be an attractive strategic asset for any payor – particularly CVS – as these giants continue to build out clinical assets and vertically integrate. The MA player provides for 282,000 members across 143 clinics located mainly in Florida but also in Texas, Nevada, and a few other states.

For 2022, Cano guided for revenues just south of $3B, a medical cost ratio in the high 70%’s, total membership around 300k, and 184+ opened medical centers. All of that acquired growth and continued capex comes with a cost, though – similarly to One Medical, Cano needs capital. I’m expecting to see a sale here and likely a substantial premium, but the valuation window for primary care assets is closing as most other names have been bid up as a result of the flurry of activity.

Resources:

- Activist investor group pushes Cano Health to explore a sale – Reuters

- Cano Health reportedly exploring a sale – Reuters

OneOncology Dives Head First into Value-Based Specialty Care

OneOncology is going full risk-on! On Monday, October 3rd, the oncology practice care platform announced that all 14 of its practices applied to participate in the new CMMI Enhanced Oncology Model (EOM). EOM is a 5-year voluntary alternative payment model that will start next year on July 1. Under the model, OneOncology will take on 2-sided risk (AKA, can lose money to the downside) for episodes of care that involve chemo administration to patients with common cancer types.

Madden’s Musing: OneOncology is a significant player in the cancer care space with an expansive footprint – 850+ providers, 175+ sites of care, and 485k+ patients (backed by General Atlantic and partnered with Flatiron Health in 2018). There’s a ton of momentum in oncology care between EOM and Biden’s Cancer Moonshot program. But the biggest part of this news to me is the fact that specialty care is the next frontier for value-based care. In my mind, this is a significant jump into risk-based payments for specialists, an untapped – and huge – market.

Just look at what Optum is doing – it quietly rebranded Surgical Care Affiliates, its specialty care segment, into SCA Health to ‘support growth into many aspects of specialty care’ like transitioning specialist practices to primary care and even pursuing risk-based contracting in the ASC setting. Meanwhile, UnitedHealth execs are touting the growth of value-based care arrangements in Optum. Optum leads the way and everyone else follows.

Resources:

- OneOncology press release

- Surgical Care Affiliates rebrands to SCA Health

Insurers expand MA plans for 2023

The biggest managed care players all have announced their Medicare Advantage plans for 2023:

- Aetna is expanding into 141 new counties

- Clover is expanding into 13 new counties

- Alignment is expanding into 14 new counties

- Cigna is expanding into 106 new counties

- UnitedHealthcare is expanding into 314 new counties

- Humana is expanding into 260 new counties

- Wellcare (Centene) is expanding into 209 new counties

Along with all the expansion announcements above during enrollment, MA premiums are set to decrease on average by 8% in 2023.

Healthcare Spinoffs from 3M and LabCorp

Diagnostics and lab testing firm LabCorp is spinning off its clinical development business into a separate publicly traded firm. The yet-to-be-named spinoff (I hope they can do better than Anthem did but I have my doubts given that it’s coming from “Laboratory Corporation of America”) will instantly become one of the, if not the largest contract research organizations with $3 billion in revenue.

The CRO will provide Phase 1 to 4 clinical trials management and other support functions for pharmaceutical & biotech firms. Maybe they should team up with Martin Shkreli’s new Web3 drug discovery venture, Druglike!! (kidding, KIDDING)

Meanwhile, legacy Labcorp will continue its focus on the bread and butter $12.7B operation – diagnostics and testing. Management says the spinoff will allow each segment to focus on growth within their specific markets.

In a similar transaction, industrial conglomerate 3M announced its intention to spin off its legacy healthcare business into a separate publicly traded company. After the spinoff, 3M plans to own about 20% of the legacy healthcare segment.

According to the release, the spinoff will be a “leading global diversified healthcare technology company focused on wound care, oral care, healthcare IT, and biopharma filtration” that generates about $8.6 billion in revenue annually.

What exactly all of this comprises is pretty vague and from the outside looking in, it kinda looks like 3M cobbled a bunch of assets together and threw it into one company to get rid of some debt and refocus the business on other growth initiatives. I’m not an operator though.

Notably, part of the spinoff includes the Bair Hugger system which appears to have thousands of lawsuits against the product, something 3M vehemently disagrees with.

BCBSA Settles Antitrust Lawsuit for $2.7B

A decade long legal battle accusing the Blue Cross Blue Shield Association of anticompetitive behavior (paywall – WSJ) (non-paywall – Beckers) has come to a close. BCBS settled the lawsuit for $2.67 billion. The lawsuit had alleged that BCBS acts like a cartel and purposefully retains geographic exclusivity (AKA, prevents competition among members) to collude on pricing to the detriment of providers.

BCBS, of course, denied the allegations. The final settlement requires some concessions to existing BCBS rules and would let employers choose another Blue plan to compete against its current Blue insurance bid, but ultimately geographic exclusivity stays the same. Sick. Employers like Home Depot complained about the settlement, saying it doesn’t do enough to spark competition. Elevance’s portion of the settlement totals $594 million since it operates Blues plans in 14 states.

Also, have I mentioned that lawyers stay winning in healthcare? As part of the settlement, they’ll get $627 million and another $41 million to boot in covering 10 years of legal fees. Can you imagine? Nuts.

Tik Tok’s Takeover?

“I’ll take news I didn’t expect to hear for $200, Alex” (RIP legend).

What is…Tik Tok buys a health system? ByteDance, the owner and operator of Tik Tok and valued privately around $300 billion, just bought AmCare Healthcare (paywall – Bloomberg), a Chinese health system that specializes in women and children’s hospitals. According to Bloomberg, ByteDance bought Amcare’s footprint for $1.5 billion in Freedom dollars.

It’s a pretty wild step for a social media company. Prior to the announcement, ByteDance’s only real foray into healthcare (that I’m aware of) was some sort of scheduling app for clinics and hospitals. So jumping right in to facilities seems…odd…and…forced.

I’m not too well versed on health data practices but I would prefer for ByteDance NOT to own mine. It also doesn’t seem likely that ByteDance would independently pursue M&A in a low margin, highly capital intensive, low IRR business like healthcare facilities.

Side note – can you imagine the outrage if Meta tried to buy a health system?

Notable Digital Health Partnerships and Announcements in Q3

Elevance announced a partnership with Aledade. As part of the transaction, independent primary care docs aligned with Anthem plans will get the option to access to the Aledade platform, including Aledade’s tech stack and other services as a physician enablement company like Privia, Agilon, or ApolloMed. The announcement is a significant win for Aledade. Anthem’s plans serve 47 million + members and Aledade is quickly becoming (is already) a major player in the care platform space after raising another $123 million in June. The partnership will allow physicians to transition to value-based care arrangements, which is a major driver of growth in both primary care and managed care.

Rock Health’s Q3 digital health funding report noted a significant, expected slowdown in activity. Q3 is the “lowest quarter by dollars raised in digital health since Q4 2019.”

According to reports, primary care platform ChenMed is exploring a possible sale of its joint venture with Humana, JenCare. The JV operates in 5 states and cares for about 50,000 patients. ChenMed is seeking around $4 billion for its JenCare spinoff, or about 3x its revenue. Humana currently owns 35% of the joint venture. Now I have to speculate…Might ChenMed be spinning off its JV ops with Humana to ultimately sell to CVS?.

- JenCare also recently appointed former Co-CEO and UnitedHealthcare exec Steve Nelson as its new CEO.

Prime Healthcare, a 14-state, 45-hospital for-profit system, announced a partnership with Robotics Outpatient Center LA to offer certain robotic procedures. Another relevant tidbit from the presser: “Over the next year, Prime intends to joint venture with more ambulatory surgery centers to ensure more efficiency, appropriate care for patients, and significantly reduce healthcare costs as a nation.” In other news, grass is green.

Dispatch Health is partnering with rural health system Marshfield Clinic to create a hospital-at-home program. The partnership will deploy Dispatch’s model across Marshfield’s 11-hospital footprint across Wisconsin and Michigan. At this point, HaH has massive traction and likely isn’t going anywhere, even after the waiver expires. Still don’t believe me? Mass General Brigham is ramping up its HaH program too.

New York-based Northwell Health invested $10 million into pediatric specialty mental health provider Brightline. Northwell also struck a deal with Google Cloud to partner on automating administrative workflows and identify patient risk factors.

Amazon is partnering with the Fred Hutchinson Cancer Center in Seattle to work on a clinical trial for a cancer vaccine, which appears to be a personalized vaccine for patients with skin and breast cancers.

Amazon is also prepping a partnership with mental health firm Headspace Health as Amazon continues to build out its healthcare footprint. Keep in mind that Ginger merged with Headspace in a deal valued privately at $3B to create the new mental health conglomerate now known as Headspace Health with both direct to consumer and B2B segments.

- Amazon is parting ways with the two founders of PillPack, which was acquired by Amazon back in 2018.

7wireVentures and OMERS Ventures announced the launch of Caraway, a new startup focused on college-aged integrated primary care for women, with $10.5 million in initial funding.

Health Catalyst announced a couple of partnerships this quarter. The data analytics and patient engagement firm partnered with LifePoint Health, one of the largest for-profit health systems in the country, to offer quite a few of its platform’s services for the goal of reducing clinical variation at LifePoint facilities. Additionally, the firm announced a smaller partnership with MemorialCare to offer its Twistle communication service to pediatric cardiology patients.

Mount Sinai expanded its existing JV with Contessa Health to build out its post-acute spectrum of care, now expected to include Mount Sinai South Nassau’s home health assets along with its hospital at home program and other post-acute services.

Pear Therapeutics announced that its prescription digital therapy for opioid use disorder treatment will now be covered by SelectHealth. Sound familiar? That’s Intermountain Healthcare’s insurance arm!

Augmedix expanded its existing partnership with Adventist Health after an initial successful pilot that had been running since April 2019.

Homeward raised $50 million and partnered with Priority Health, a plan under BHSH Health to provide primary and specialty care through value-based care arrangements in rural Michigan.

Vori Health announced a strategic affiliation with Physical Rehabilitation Network to create a huge hybrid care model for MSK services.

CareFirst partnered with Headway to expand access to in-network mental health services.

Intermountain CEO Marc Harrison is departing his role as CEO to work in venture capital in conjunction with General Catalyst. Keep in mind that General Catalyst just raised (paywall – Forbes) a $670 million fund and had a pre-existing partnership with Intermountain announced in May. General Catalyst has similar partnerships with several health systems across the U.S. most recently with WellSpan Health.

According to reports, VBC player Babylon is considering a take-private transaction (paywall – Seeking Alpha). After some trading volatility, Babylon refuted the claims so I guess they’ll just continue to bleed cash to the dismay of shareholders. Kidding aside, Babylon is down 90+% since SPACing last year.

Oscar is losing up to $60M in revenue this year after Florida-based insurer Health First Shared Services terminated the contract for its +Oscar platform implementation (administrative services agreement). Given that HFSS seemed to be Oscar’s only major customer for the segment, it seems as if the Oscar technology platform has lost a ton of steam after once being touted as a high-growth potential engine for the organization. As others have noted, I have to wonder how Oscar gets to profitability from here and the insurtechs have their work cut out for them.

After announcing a deal to go public via a Chamath Palihapitiya SPAC earlier this year, digital therapeutics company Akili ($AKLI) debuted on the markets and raised $163 million in cash in the process to launch EndeavorRx, a prescription video game to treat ADHD in kids. Naturally, Akili dropped 49% today as there’s not the best appetite for a pre-revenue digital therapeutic right now. Pear Therapeutics (SPAC’d on 12/6/21) is down 82.3%.

Incredible Health raised $80 million at a $1.65 billion valuation, joining a few other private and public names benefiting majorly from the nursing shortage trend while also providing real value to allocate nurse staffing at hospitals.

ScionHealth, the Kindred and LifePoint Health spinoff, is partnering with Cadence on a remote patient monitoring program for chronic disease management.

Acceptance rate for CMS’ new ACO REACH (direct contracting 2.0 program) was 47%. 142 organizations applied to the program and were not accepted. While 128 organizations were accepted, 18 applicants have withdrawn. Here’s a nice breakdown.

SOC Telemed significantly expanded its behavioral health telehealth biz by purchasing Forefront Telecare. In addition to the acquisition, SOC is also rebranding!! Going forward, SOC Telemed will now be known as…Access TeleCare. No comment.

Prime Healthcare partnered with Steer Health to launch its platform PrimeHealthNow, which will invest in better care coordination and other care delivery tools (patient scheduling, intake, etc).

Transcarent launched a new pharmacy benefit offering for its self-insured employers and health systems with an emphasis on drug pricing transparency. It’ll face an uphill battle against the likes of CVS, OptumRx, and Express Scripts. If you’re interested, I also wrote a thread on PBMs here.

Frontier Direct Care partnered with Flume Health to launch a new health plan in South Texas.

Oak Street Health launched a 12-month Nurse Practitioner fellowship for adult primary care in collaboration with the Michigan school of Nursing. The NP model is growing increasingly prevalent in urgent care and primary care settings and will fill a major shortage gap in primary care during the coming decade.

9 months since launch, Mark Cuban is expecting his Cost Plus Drugs pharmacy to be profitable in 2023. Cuban said that the company already has over a million customers and a 10% week over week growth rate, which makes me wonder how this model, which seems pretty easy to replicate, hadn’t been done at this level of success before. Was it the personal branding and marketing touch with the Mark Cuban name that did it? Either way, I constantly see patients saving tons of money at MCCPD versus pharmacy formulary prices for various drugs.

BCBS of Massachusetts will offer both Carbon Health and Firefly Health in most of its commercial plans in 2023, two hybrid primary care platforms and what I imagine to be a nice win for both digital health organizations.

ApolloMed acquired All American Medical Group, a 250-physician practice and For Your Benefit, a licensed health plan, for an undisclosed sum. The acquisition will bring ApolloMed’s total membership to 30k+ in the Bay Area and allow the care platform to take on more risk through 250 additional physician partners. The deal will close by Q1 2023. Coincidentally, ApolloMed also picked up some analyst coverage from William Blair. Finally!

Independence Blue Cross sold a minority stake in Tandigm Health to Penn Medicine. Penn and Independence will partner by using Tandigm as the primary care platform of choice moving forward. Tandigm was founded in 2014 and serves the 5 Philadelphia counties through 400+ primary care physicians.

Cigna is launching a care platform called Pathwell which seems to be a suite of products offered by Evernorth to help providers manage high-cost patients (with rare and complex diseases).

Services, Hospital and Health System M&A, and Notable Announcements

Privia Health partnered with OhioHealth Health System – under the collab, Privia will help OHHS launch a medical group for independent physicians throughout the state of Ohio within OHHS’ clinically integrated network and ACO. The partnership adds to Privia’s growing list of affiliated health systems.

Premier Health made an interesting, very under the radar move during the quarter. For $177.5M, Its subsidiary Contigo acquired the rights to contracts that gives it access to 900,000 providers across 4.1 million diverse service locations (hospitals, ASCs, labs, imaging, etc.). Contigo seems to be making a very clear bet on the future of self-funded employer health plans to offer an extremely competitive product on an out-of-network coverage/wrap for these players looking to shake up at least a portion of the employer-sponsored, lucrative commercial market.

In the upper Midwest, Bellin Health and Gundersen Health are expecting to complete a potential merger in what would create an 11-hospital and 100 clinic system across Wisconsin, Upper Michigan, southeastern Minnesota, and northeast Iowa. The two systems would generate $2.4B in annual revenue across 14k FTEs assuming it gets past FTC approval, which is sure to check for market concentration, impact on wages and employment, and everything in between. Here’s some more background on the deets.

Inova Health announced a partnership with prevalent urgent care player GoHealth. As part of the JV, Inova will contribute 7 of its urgent care centers to GoHealth’s existing footprint across Northern Virginia. GoHealth is forging major relationships in the health system department across several big players, including Henry Ford and Memorial Hermann.

UChicago Medicine is acquiring 4 hospitals from AdventHealth that used to be part of the JOA – Amita Health – between AdventHealth and Ascension until very recently. The acquisition is part of a larger affiliation between UChicago and AdventHealth in which the two Chicago operators will enable consumers to seamlessly access primary, specialty and subspecialty medical care across both organizations. UChicago has been aggressively expanding lately.

Tenet and Steward Health Care, two large for-profit health systems, are in litigation after Tenet sold 5 hospitals to Steward for $1.1B and apparently ended its IT & data services to those hospitals, something Steward isn’t OK with.

In conjunction with its joint venture with Welsh Carson, Humana is purchasing MA-focused senior primary care clinics from the PE firm for between $450M – $550M, continuing the trend of payors building out robust primary care services. Humana expects to have around 250 clinics by the end of 2022. Check out its full investor day press release here.

Providence is planning a $712M expansion across a multitude of services in Southern California, including primary care, imaging, specialty care, an ASC, and 100 more beds on one of its fast-growing campuses.

GI Alliance, a private-equity backed roll-up in the gastroenterology space, is getting bought out by its physician owners, valuing the biz at $2.2B. Apollo helped the physicians buy out Waud Capital’s remaining minority stake and will hold a similar position in the GI practice.

Virginia Mason and Confluence Health announced the formation of Madrona Health, a joint venture to expand its specialty pharmacy operation to more of the Pacific Northwest.

Labcorp bought RWJBarnabas Health’s outreach laboratory biz.

CenterWell announced that it’s opening 9 senior primary care clinics in and around Phoenix and is on its way to opening 100+ more MA centers by 2025. Don’t sleep on the WCAS-Humana backed venture.

In one of the weirder investment announcements, Pure Health, the largest health system in the UAE, invested $500M in Ardent Health Services, the fourth largest private for-profit health system in the U.S.

CAMC Health and Mon Health System have merged to create an integrated health system now known as Vandalia Health.

Trinity Health finalized its acquisition of the previous JOA MercyOne in Iowa.

- MercyOne, the once-JOA now owned by Trinity, is pursuing a strategic partnership with Genesis Health, the details of which sounds eerily similar to a merger. If it looks like a duck…

The Advocate-Aurora and Atrium $27B hospital mega-merger (which I wrote about here alongside fellow healthcare compatriot Daran Gaus) is somewhat in jeopardy after the Illinois health board voted to delay the approval of the merger after some confusion over corporate governance structure.

Axios reported (paywall) that PE firm Webster is planning to sell its ophthalmology portfolio company Retina Consultants of America in 2023 after forming the company in March 2020. That’s an…extremely short hold. Notable.

Novant Health bought a minority stake in MA plan HealthTeam Advantage, currently majority-owned by Cone Health, solidifying the joint venture.

Hospitalogy Deep Dives from Q3

Finally, in case you missed any of them or are a recent subscriber, here were the pieces I wrote in Q3:

- Is the Hospital Dying? (Link)

- Breaking down the Amazon-One Medical Deal (Deal Analysis) (Valuation Analysis)

- The Hospital Needs to Evolve (Link)

- Syntegra and Synthetic Data: Solving Healthcare’s Data Problem (Link)

- Healthcare Services Valuation Update (Link)

- The 22 Best Healthcare Business Follows (Link)

- The Battle Between CMS and Home Health over the 2023 Proposed Rule (Link)

- Why Private Equity Invests in Healthcare (Link)

That’s it for this quarter!

Join 10,100+ thoughtful healthcare professionals and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!