Welcome to the Hospitalogy 1H 2022 year in review, where I’m diving into every major healthcare business news story from the first half of the year.

For those of you who aren’t familiar with Hospitalogy, I (Blake Madden) break down the business world of healthcare twice a week. You can subscribe here to support me!

If you read Hospitalogy content every week, you might recognize a lot of the stories. I’ve repurposed and touched up a lot of content I’ve written previously to combine it all into convenient trends for folks looking for a comprehensive review in one place!

If you’re getting a lot of value out of Hospitalogy, I would love for you to share it with a colleague or friend. This essay in particular took a ton of time to put together!

Also, if there’s anything big I missed, be sure to tell me how wrong I am on Twitter!

Let’s get after it.

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

Table of Contents – 20 healthcare stories to know

Here are the biggest stories and trends happening across healthcare provider organizations in the first half of 2022.

- Optum’s unlimited M&A budget and strategy updates

- The death of the private practice?

- Inflation Headwinds

- CMS payment updates leave nobody happy

- Staffing Shortages + Burnout hit healthcare hard

- Health System megamergers, including Intermountain-SCL and Advocate Aurora-Atrium

- The Rise, Fall, and …Rebirth? of Cerebral

- Teladoc’s $6.6 billion loss and virtual mental health CAC trends

- Take-Private deals begin in healthcare

- CareMax dives into MSO risk model with Steward Health Care

- A new era of price transparency, or the same old healthcare system?

- 5 Supreme Court rulings with big healthcare implications

- Enhabit Home Health spins off from Encompass

- Humana sells its Hospice segment

- Notable digital health partnerships with health systems

- Digital health layoffs begin

- Health system joint operating companies disband

- CMS revamps Direct Contracting to ACO REACH

- FTC ramps up antitrust in healthcare

- Primary care platforms attract takeover interest from payors

- Plus, my top 10 favorite reads this year!

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

Optum’s unlimited M&A budget and Strategy Updates

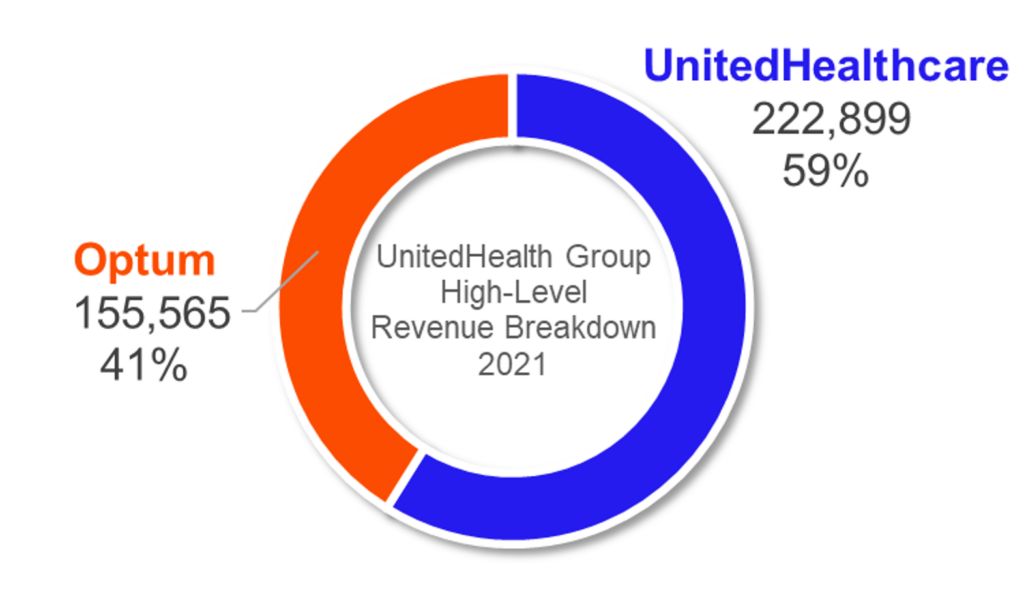

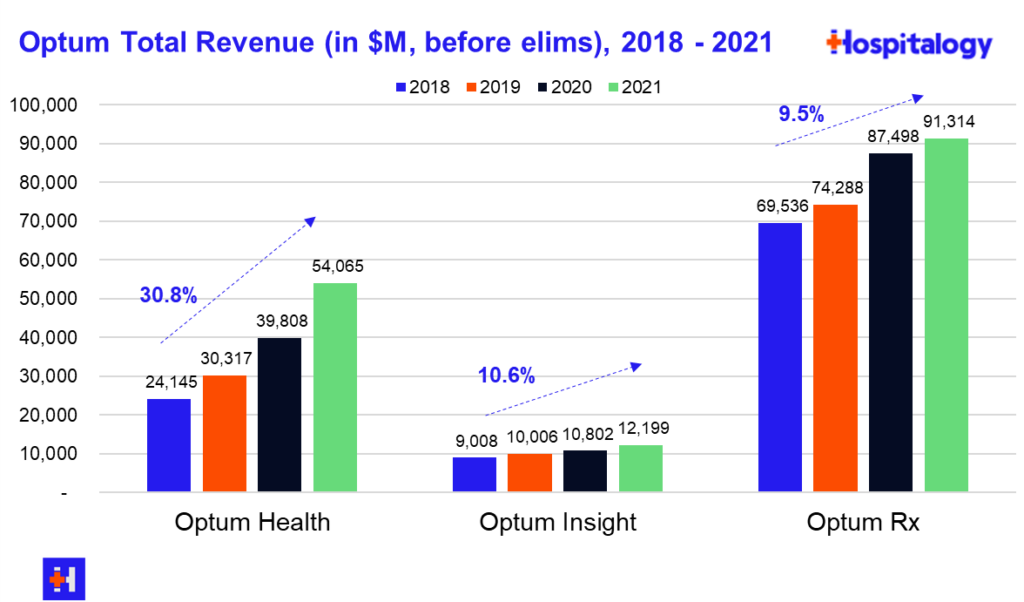

With revenues of $150,000,000,000 (I did all of the zero’s for extra attention given how GARGANTUAN Optum is), Optum kept busy during 1H ‘22. Here’s a list of most of Optum’s shenanigans this year:

Refresh Mental Health:

Optum bought Refresh Mental Health, an outpatient provider of behavioral health services, for an undisclosed sum. According to Axios, Refresh, founded in 2017, “operates a network of more than 300 outpatient mental health, substance abuse and eating disorder centers spanning 37 states.”

Refresh was rumored to be generating $40 million in EBITDA and was owned by private equity firm Kelso, which bought the mental health co back in 2020 for $700 million. At the time, Refresh operated in 28 states and 200ish facilities.

There’s also a real incentive for insurers to continue to build out mental health networks & coverage – Biden and lawmakers are starting to feel pressure to pass mental health legislation and address mental health insurance parity. In addition, CMS is looking to incentivize bundling mental health clinicians with primary care practices, another tailwind for the behavioral health space.

LHC Group:

On March 29, UnitedHealthcare’s Optum announced its acquisition of LHC Group for $170/share. The transaction values LHC at about $6.4 billion including debt. LHC Group is an important acquisition for Optum. Payors are continuing to morph into ‘payviders’ and UHG / Optum has a huge competitive advantage given its 60k aligned physician base. Acquiring LHC Group accelerates this payvider trend but also allows UHG to catch up to Humana, who now owns all of Kindred, in the post-acute sphere. I wrote about this in a long-form essay back in April!

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Software:

Optum acquired UK-based EMIS Group for $1.5 billion, about a 50% premium to EMIS’ closing price on Thursday. What the heck does EMIS do? The firm is a software-based health tech firm focused on integrating physicians, connecting PCPs with specialists to provide seamless care across sites of service. Looks like a pretty interesting strategic acquisition for Optum and add it to the laundry list of companies the services giant is snagging at supreme discounts.

Strategy with SCA:

With little fanfare, UnitedHealthcare’s Optum appears to have rebranded Surgical Care Affiliates into SCA Health. Under the new slick angular logo and rebranding that everyone seems to be copying, Optum’s strategy is now pretty clear for SCA – create a physician enablement platform to allow specialists in particular to transition to risk-based arrangements.

They’ll achieve this goal by aligning with health systems, local market health plans, and the practices themselves through the new SCA platform – a “physician-led, MSO-model of practice management that restores physician agency by aligning incentives to support growth and transition to value.”

Keep in mind that Optum purchased SCA back in 2017 for around $2.3 billion, and it looks like SCA is slated to grow like crazy given the platform creation and focus on physician enablement. I mean, who can step up to challenge this? Seriously.

Every time I think some org has a leg up on Optum in some aspect…they stay ahead of the game. They’re so far ahead of everyone else, it’s truly unreal. Creating a physician enablement platform focused on specialists and ASC revenue streams creates a ton of value for Optum/UHC. Not to mention that CMMI is trying to find ways to grow specialty providers’ role in value-based care arrangements.

ASCs are essentially untapped when it comes to risk-based relationships, and specialists control a large portion of the healthcare dollar.

Lab Benefit Management Tool Launched:

Optum launched a new lab-based benefit management tool aimed at reducing unnecessary testing. Kind of a quiet little announcement here, but this is something that could have an outsized effect on even routine testing for labs nationwide.

Massive Physician Platform Acquisitions:

- Kelsey-Seybold: Optum purchased Kelsey-Seybold (”KS”), a 500-physician, multispecialty practice with a huge footprint in the greater Houston area in April. Talk about another slam-dunk acquisition for Optum fresh off the LHC Group news. Not only does KS provide Optum with yet another huge physician base in a large market, KS also runs its own ~40k member, 5-star MA plan – KelseyCare Advantage – and operates a consortium of ancillaries, including two ASC’s, one of which is among the largest operating ASC’s in Texas, 19 pharmacies, after-hours clinics (urgent care), radiation therapy & infusion centers, and imaging centers

- Back in January 2020, private equity firm TPG purchased a minority stake in KS’s management company (not the medical group) at an alleged $1.3 billion valuation at the time. The injection helped fund KS’s expansion, and I’m sure TPG is making a nice chunk of change back from this acquisition. Just a casual 2-year flip.

- Atrius Health and Healthcare Associates of Texas: Keep in mind that in March 2021, Optum made a very similar acquisition in that of Atrius Health in Boston, a 715-physician, 30-clinic multispecialty group at the time. Finally, Optum bought Healthcare Associates of Texas – a 60+ clinician group – for a $300 million enterprise value and apparent 15x EBITDA multiple (in-line for a large physician org).

Based on the physician acquisitions and acquisitions in ambulatory assets like LHC Group and strategic alignment in SCA, you can see the strategy Optum is deploying in large markets. Optum is keenly focused on expanding its physician base and has said so on multiple earnings calls over the years. The segment is up to 60,000+ physicians in 2022.

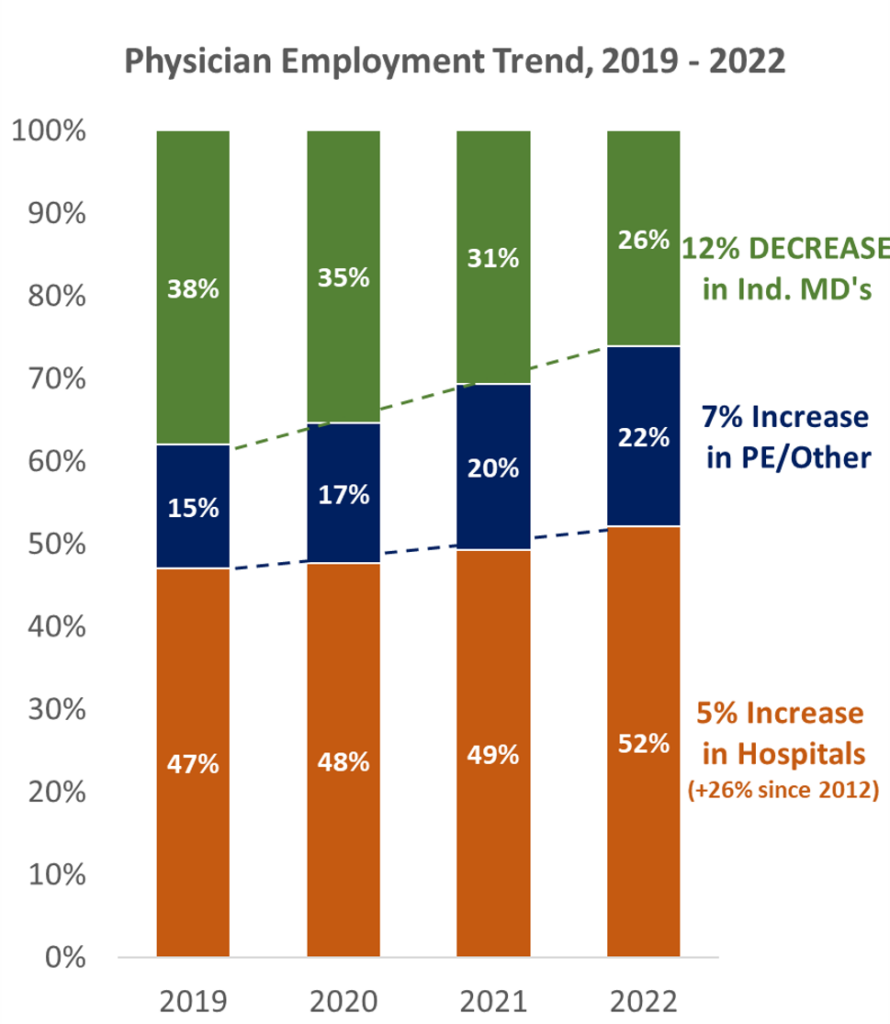

The Death of Independent Multispecialty Physician Practices?

Why are these large, financially successful independent practices cashing out now to the likes of Optum?

It points to the larger trend of consolidation in the physician space caused by a perfect storm of dynamics. Private equity players, strategic buyers (payors), and hospitals are prioritizing expanding their physician footprint as the front door to downstream opportunities.

- Couple this red-hot demand for physicians with current healthcare dynamics: the average physician (especially shareholder physicians) is nearing retirement. Selling the practice is a great way for them to monetize what they’ve built to achieve a succession plan.

- Along with the retirement trend, physicians are also facing margin pressures from supply inflation, labor shortages, and reimbursement headwinds from payors. Whether these headwinds are temporary or not, they’re probably not fun to deal with.

Jared and I have both discussed this and shared our opinions at length on the changing physician employment landscape (Jared’s Take) (My Take).

While the employment of physicians by payors, hospitals, and other corporate interests is nearing all-time high’s, we don’t think it lasts forever. In fact, I bet within the next 10 years we’ll see a shift back to the other side, especially given the rise of care platforms and other physician enablement companies yet to be named.

Bottom Line: UNH is creating an unprecedented vertically integrated TITAN in healthcare unmatched by other payors (yet) or service providers. I’d love to hear from my subscribers: at this point, beyond some sort of existential policy change to American healthcare, what is the bear case for UnitedHealthcare?

Inflation Headwinds

The day before I finished writing this, the latest inflation print came back at 9.1%. Even core CPI – which excludes more variable food and energy prices – rose 5.9%.

Still, prices for medical services rose at a rate considerably lower than the widespread inflation print.

For now, healthcare organizations are experiencing the effects of inflation on the expense side. Wage escalators stemming from labor shortages, increase in supplies costs that are in…ahem…short supply, utilities costs, rent escalators, and general & administrative expenses (consulting & legal fees, etc.) are likely the main culprits eating away at margin.

Even health systems, which have huge scale and purchasing power, should expect to see a 1.0% – 3.0% margin decline in 2022 stemming from expense headwinds according to McKinsey.

On the revenue and price side, we have yet to see the full ramifications of inflation in healthcare.

I’m worried about it.

In order to offset rising costs and CMS’ rate increase proposal of 3.2%, large hospital operators like HCA and UHS are asking for rate lifts of 10-15% from commercial payors.

On the payor side, and as ACA subsidies are set to expire, insurers are asking for significant rate hikes. CMS finalized an 8.5% rate hike for MA and Part D Plans. In Connecticut, insurers are asking for an average rate lift of over 20%.

Translation: Premiums are set to skyrocket in 2023.

On top of rising healthcare costs and compressed margins, inflation is also creating a tightening effect on capital. The Fed is forced to increase interest rates, and the end of easy money policy will place downward pressure on health system venture funds and endowment portfolios. I imagine these factors will affect the level of distribution and ability to invest in ecosystem innovations.

From a broad perspective, I have to question the sustainability of our current healthcare system given the margin pressures for provider organizations on BOTH expenses AND revenue. The biggest loser from inflation will continue, as always, to be the little guy in healthcare. The independent practitioner. Small & medium-sized provider orgs.

One thing is certain: For now and the foreseeable future, healthcare is a consolidation game. The bigger, the better.

CMS Payment Updates leave nobody happy

Given the dynamics in the economy today between inflation, shortages, and staffing woes, healthcare services organizations across the spectrum of verticals are sounding the alarm at CMS’ proposed payment updates.

I will say – which was pointed out to me on LinkedIn – CMS is a bit hamstrung by statutes already in place designated by Congress. If anything, Congress needs to act to expand funding for CMS. Otherwise, I really, really don’t know what’s going to happen in 2023 to provider organizations – especially small, independent agencies or physician practices.

Here’s everything notable about the main CMS proposed payment rulings:

Hospitals:

Given that the AHA is one of the most powerful lobbying groups in healthcare, hospitals collectively are calling Medicare’s proposed payment update of 3.2% ‘woefully inadequate.’ Cost inflation on expenses and payors playing hardball on increased commercial rate lifts are leaving hospitals in a tough spot from a margin perspective, as I mentioned in my analysis of the state of hospitals.

While players like HCA and UHS might have more negotiating leverage to get the 10-15% commercial rate lift they need to counteract CMS’ paltry 3.2%, lots of other less-concentrated players will continue to struggle. Health systems will need to continue to diversify revenues away from fee-for-service, find cost savings, and run more efficiently. The fact that so many hospitals operate at razor thin or negative margins gives me cause for concern for patient care.

Physicians:

Here’s the other big one. Physicians are pretty dang upset about the ~4% cut headed their way (as are most services verticals when their reimbursement is cut in a draconian fashion).

Numerous physician organizations cried foul about the proposed rule. Here’s a quote that sums up the sentiment quite tidily:

“The cost of running a medical practice has increased 39% in the past twenty years. When adjusted for inflation, the impact is a decline in value of Medicare physician payments of 28%. On top of jeopardizing patients’ access to care, the proposed cuts further exacerbate the difficult operating environment surgical practices already face and the people that are affected most are our patients.” – George Williams, MD, American Academy of Ophthalmology Senior Secretary for Advocacy

They’re right to be upset. We’re facing a bizarre dichotomy in healthcare today.

On one hand, expense inflation is vastly higher than historical norms. It’s hitting costs across the board (supplies, staff, utilities, G&A components).

No services vertical is immune to inflationary effects facing the U.S. this year and pricing power is more limited in healthcare in general as payors apply deflationary pressures on provider top lines.

At the same time, CMS is hamstrung by statutory requirements to keep Medicare budget neutral along with other measures in place aimed at keeping the trust fund afloat.

It IS ironic to me, though, that CMS touts expanding access throughout the fact sheet release despite the fact that it was just forced to cut reimbursement in physician services, quite literally the most integral vertical for patient access. I think CMS is well intentioned, but the statements struck me as contradictory.

If I’m a physician or any service provider, my main beef is with Congress right now and its lack of an answer to provide funding despite unprecedented levels of government spending over the past 2 years.

We’re witnessing a massive swing in physician employment to corporate entities & hospitals right in front of our very eyes mostly driven by legislation (or lack thereof) propagated by buffoons. Independent physician groups are struggling to survive. Meanwhile, continued consolidation will drive prices higher, ironically resulting in dire financial straits for the Medicare Trust Fund.

TL;DR: AHA > AMA, and healthcare continues as always to be a consolidation game. It’s already hard enough to be a provider. Let’s not make it harder.

Home Health & SNF:

Based on the various adjustments made in conjunction with PDGM planned adjustments, reimbursement to home health providers is expected to drop by 4.2%. That’s an $810 million decrease from 2022.

As you can imagine, the huge cut to home health reimbursement is controversial, especially considering CMS kind of…arbitrarily cut reimbursement based on the previously announced ‘behavioral assumption adjustment.’

CMS imposed the behavioral adjustment – which is a negative 7.7% hit in 2023 – after arguing that home health agencies will change coding and documentation practices in order to maximize revenue under the new PDGM payment model. It’s notable considering that CMS didn’t appear to base the cut in much.

Along with similar adjustments to the proposed PDPM (SNF) payment structure, which is seeing a similar cut, the post-acute industry is almost certainly slated to continue to see consolidation. I mean, if your small business saw a 5% revenue cut while several input prices jumped 8% (most notably gas in home health for clinicians), you’d probably consider selling too. This quote from the HHCN article sums it up nicely:

“With significantly rising costs for staff, transportation, and more, home health agencies across the country cannot withstand the impact of the proposed rate cut,” Dombi added.

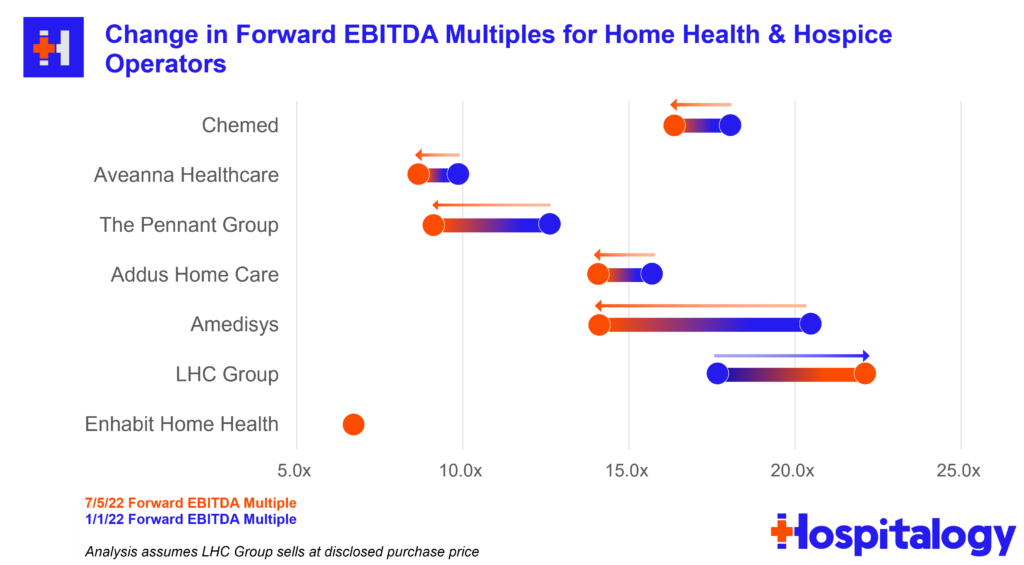

Home health operators tank the day after CMS drops its proposed rule expected to result in a 4.2% rate decrease in 2023. Amedisys (-10%), the Pennant Group (-11%), Aveanna (-17%) and Encompass (-4%) all suffered at the hands of daddy CMS.

Staffing Shortages + Burnout

Burnout was real prior to 2020 and has been further exacerbated by the pandemic. This is obviously a trend that extends beyond just 1H 2022!

Healthcare workers put themselves on the line during the pandemic and continued to do so despite immense shortages, sick leave, and poor coverage ratios.

Thousands of these individuals passed away from Covid while on the job. Over half of healthcare workers have reported symptoms of burnout. Mental health issues are rampant stemming from the aftereffects of long hours and overwhelming number of patients.

It’s no wonder why healthcare continues to face a labor shortage. Although jobs have steadily crept upward, overall employment still remains below February 2020 levels.

- 52% of nurses are planning to leave their clinnical practice

Along with the effects of ‘Rona, hospitals and post-acute service providers (nursing homes, home health, etc.) are increasingly competing with rising wage pressures from the likes of Target, Amazon, and others.

A recent Gist Healthcare analysis explained that “more than a quarter of hospital employees currently work in jobs with a lower median wage than Amazon warehouses.” It’s tough sledding for hospitals and providers who can’t compete with the top dollar and benefits that tech & retail companies might offer.

On the nursing side, hospitals were forced to pay top dollar for travel nursing in Q1 to contend with Omicron surge capacity. While demand for travel nursing has dropped since April and comments from top hospital operators agree that contract labor need will wind down, nurses and unions are striking and winning in negotiations with better pay and benefits.

In fact, most nurse strikes I’ve seen this year have ended rather quickly, which signals to me that labor has the upper hand at the moment.

While HCA and others are investing in the new nurse workforce, I’m concerned about the ability of our healthcare system to handle the coming expected utilization & demand needs of those aging into Medicare.

- The U.S. BLS projects a nursing shortage to the tune of around 1 million nurses by the end of 2022. 500k RNs will betire by 2022.

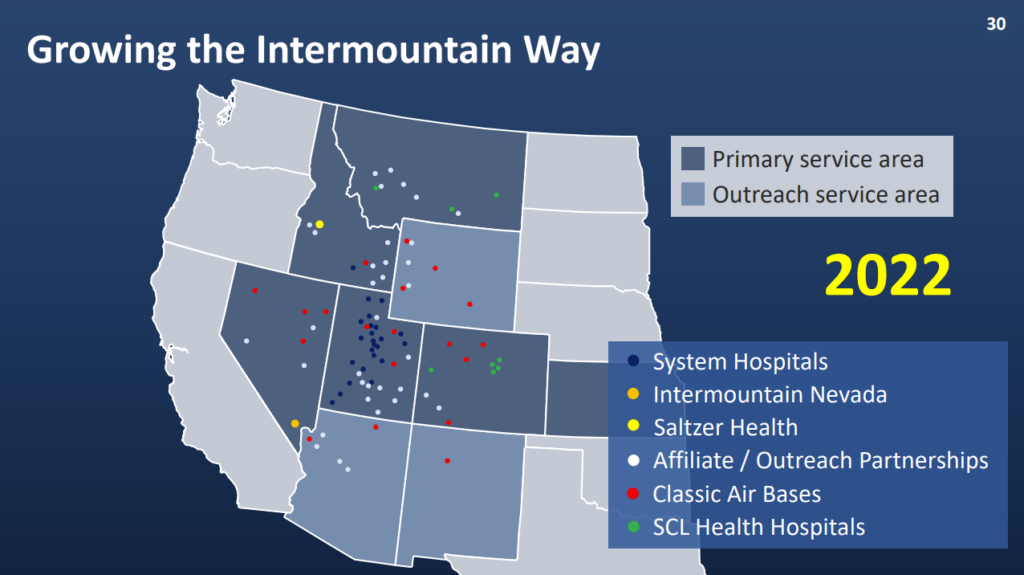

Intermountain completes merger with SCL

Intermountain and SCL Health finalized their merger on April 6, creating a $14 billion system in the Midwest / Mountain States region after announcing the merger late last year.

The combined system, to-be called Intermountain, will have an impressive footprint:

- 33 hospitals

- ~400 clinics

- 58,000 employees

- $14 billion in revenue

Intermountain is one of the savviest hospital operators around and has a huge 3,000+ physician base to bolster its value-based care initiatives. I love reading about the way they operate and how the health system is pushing the envelope forward when it comes to population health management. In fact, ~50% of IM’s ~$11.0 billion in 2021 revenue came from premiums & capitation, putting its money and strategy where its mouth is.

- This merger comes two years after Intermountain benefited from buying the HealthCare Partners Nevada operation as a part of the planned divestitures from the larger Optum – DaVita $4.3 billion deal.

Apart from physicians, legacy Intermountain’s footprint included 23 hospitals in 7 states, and around 1 million members on its insurance plan.

On the SCL side, the health system generated $3.0 billion in revenue across 10 hospitals and ancillary services in 3 states.

Although the Biden Administration loves to crack down on antitrust particularly in healthcare, this health system merger managed to pass through scrutiny.

Why?

- Insanely enough, the two health systems had minimal overlap in services & geographic footprint, creating a perfect storm for combining – there’s no local market power / monopoly argument to be made here.

- SCL Health will not materially change its charitable missions as a result. As a historically Catholic nonprofit, this would have created some problems had SCL changed anything related to charity care provisions or type of care.

- The combined org isn’t planning on laying any employees or or downsizing / combining clinic locations or other synergies you would expect from a for-profit entity (AKA, fire the excess personnel).

- When discussing merger motivations, Intermountain stressed the desire to advance value-based care and population health initiatives with the scale rather than JUST use that scale to negotiate favorable pricing. In a fee for service world, Intermountain would theoretically have much better pricing power with insurers post-merger.

In summary, this is a pretty impressive combination throughout the Midwest / mountain region if you ask me. I’ll be really excited to watch how Intermountain pioneers value-based care initiatives at scale within a health system strategy.

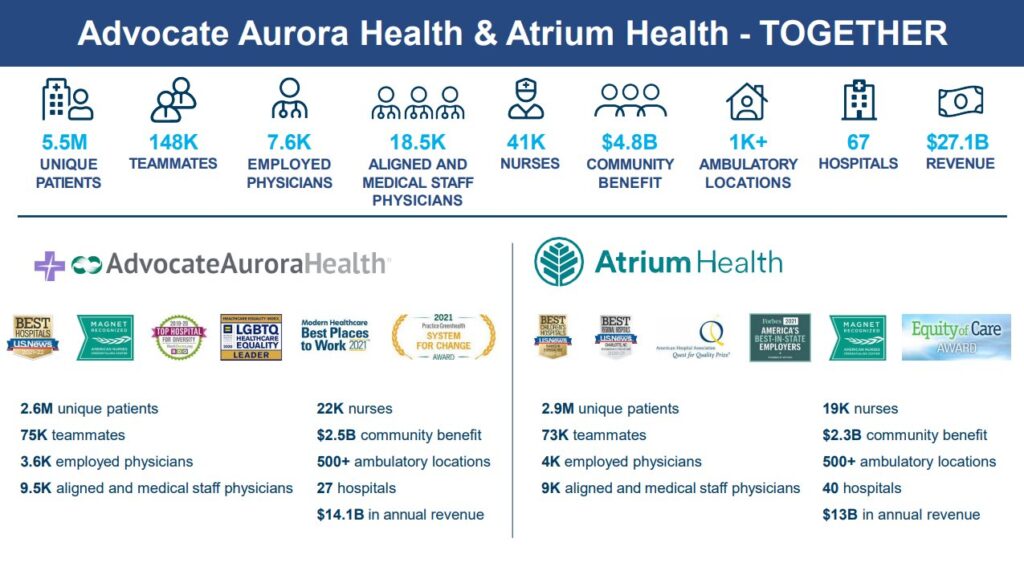

Advocate Aurora merges with Atrium to create $27 billion Health System

Advocate Aurora Health is merging with Atrium Health to create a $27 billion health system which will operate under a new name: Advocate Health.

The new system’s combined revenues puts it on par with that of Ascension & Providence at about $27 BILLION – good enough for the 6th largest health system in the U.S.

Advocate’s new footprint will include:

- 67 hospitals

- 1,000 sites of care

- 7,600 physicians

- 150k employees

- 5.5 million patients

- 2.2 million lives through 15 ACOs and 60 value-based contracts (whatever that means)

- $5 million in annual community benefit

- Operations across Illinois, Wisconsin, North Carolina, South Carolina, Georgia, and Alabama

The announcement creates one of the largest health system mergers since Providence / St. Joe’s & then CommonSpirit 5-6 years ago. It’s also right on the heels of the Intermountain-SCL merger, who consolidated in similar fashion into a $14 billion system across non-overlapping geographies. In late 2020, Atrium Health merged with Wake Forest Baptist Health into an $11.5 billion system. There’s absolutely no way that integration is done yet – right?

Here’s an interesting little tidbit – according to the press release, Advocate Health will be structured as a joint operating company (JOC). Instead of just contributing assets in a specific area, though, the two systems appear to be layering the JOC on top of 100% of their combined footprint. Which makes me wonder why they went the JOC route.

My guess is that the structure makes it easier to unravel if things go south since existing assets will remain in each of the health systems’ respective states.

The deal is pending regulatory review, in which the FTC is planning to check on insurer overlap in various markets.

In a 2-part series in May, I collaborated with fellow healthcare value-based care nerd Daran Gaus on where we think the future of health system megamergers is headed.

Spoiler alert: the days of horizontal hospital mergers are coming to a close. You can read the first part here and the second part here and I highly recommend doing so for context around health system mergers in 2022.

The Rise, Fall, and …Rebirth? of Cerebral

By now, most of us know what’s going on with Cerebral and its fall from grace. You can read the full story from Jared here.

Given that I’ve already addressed it and the story is receiving plenty of media attention with a new hit piece dropping every other week, I’m not going to dive into Cerebral further.

It’s already under investigation, everything that could be said or done from an operational perspective seems to be taking place from the outside looking in, and I’m rooting for a redemption arc for the embattled virtual mental health player.

I’m also rooting for continued support in the mental and behavioral health space – in the virtual arena, but also in the physical facility footprint arena. CMS and Congress both have signaled the need for increased mental health investment, so I’m optimistic for the future of the space given the dire and immediate need in our country.

Teladoc’s $6.6 billion loss and virtual mental health CAC trends

Teladoc posted the worst quarter that might ever happen for a digital health company.

In its 10-K filing for FYE 2021 back in February, Teladoc warned that if its stock continued to slide, it would be forced by auditors to recognize a goodwill impairment charge (AKA, an accounting term to basically say they overpaid on an acquisition) related to its $18.5 billion acquisition of Livongo. In that filing, Teladoc represented that the firm expected to recognize between about $800 million and $4 billion for that impairment charge.

- The good news is that the impairment charge is non-cash. Teladoc financed most of the acquisition with stock.

- The REALLY BAD news is that the recognized impairment charge came in at $6.6 billion. Which translates to a loss of ($41.11) per share for the quarter. Analysts trying to pull together comparable public multiples for the virtual care space are now cringing.

Based on the reported loss, Teladoc plummeted to $33 / share, sitting just $5 above its 2015 IPO price of $28, rebounding slightly Monday to $36. For those keeping score, Teladoc hit an all-time high in February 2021 at $294.54 and has since dropped almost 90% in a year.

Besides the Livongo write-off, I found CEOs Jason Gorevic’s comments about the direct-to-consumer mental health market VERY interesting. With the emergence of well-capitalized startups like Cerebral, Lyra, Talkspace, Ginger, and probably hundreds of smaller firms, competition is rampant in the space. As a result, Teladoc’s cost to acquire customers – especially in paid search and online ads – skyrocketed 20%. Here’s what Gorevic had to say:

Over the past several weeks, we’ve seen lower-than-expected yield on marketing spend for BetterHelp, which is a reversal of the trends we experienced exiting 2021 and in the early part of 2022.

One example of this is paid search advertising, where we’ve seen a notable increase in rates for keywords associated with online therapy. We believe the biggest driver of this dynamic is smaller private competitors pursuing what we think are low- or no-return customer acquisition strategies in an attempt to establish market share. Some of those same providers are also exploiting the temporary suspension of certain regulations associated with the national health emergency concerning the prescription of controlled substances.

We believe these strategies are unsustainable in the long term. This dynamic is likely to persist at least throughout the remainder of this year, however, resulting in growth and margin contribution from BetterHelp that is below our expectation in February.

Gorevic went on to say that Teladoc expects the trend to continue at least throughout the rest of the year. So…is Teladoc just throwing money at the wall, or is the entire virtual mental health market about to implode based on rising costs?

The more I read about DTC mental health, the more I either hear about (1) Cerebral’s irresponsible hyper growth and ‘pill-mill’ policies, or (2) Talkspace’s current failures in the DTC market and their frantic attempts to pivot to B2B. FYI, Talkspace, a pure-play virtual mental health provider, is down 85% all time.

Bigger question for Teladoc – based on current market activity , will we see some activist investors in Teladoc? Buy-out offers?

Finally, at the end of Q2, Teladoc announced an interesting expansion to its Primary360 offering this week. The whole-person virtual primary care platform is now integrated with fellow digital health players Capsule (digital pharmacy) and Scarlet Health (lab testing / diagnostic collection & delivery).

At a share price just above its IPO, Teladoc could be at compelling levels…unless you think the encroaching digital health players are too much to withstand.

Take-Private Deals begin in Healthcare

I’ve been predicting for a minute that healthcare assets at these valuation levels were pretty enticing for strategic and financial players alike. Healthcare players have stable demand and the market selloff is creating compelling opportunities for unlockable value.

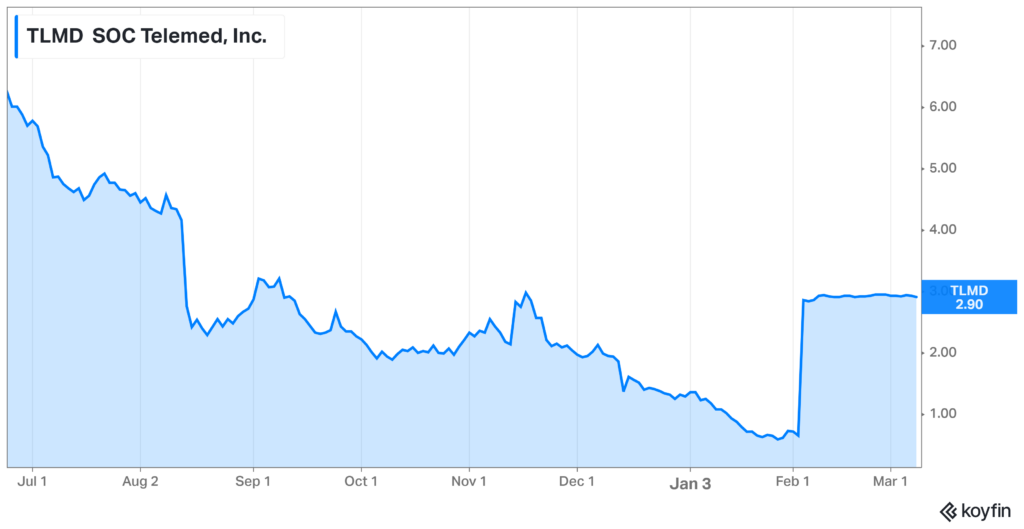

SOC Telemed Goes Private for $300 Million:

The first domino: After going public via SPAC at about a $720 valuation 15 months ago, SOC Telemed will be bought out and taken private by Patient Square Capital.

- Details: The healthcare investment firm announced its intention to purchase SOC Telemed at a 366% premium to its share price on February 3rd, or about a $300 million enterprise value at $3.00/share. For all you smart folks out there, that’s a 60% decay in value in one year.

- SOC’s stock price had tumbled from $8.33/share one year ago to $0.64/share prior to the announcement and is now trading just under the take-private price. It makes sense that the board unanimously jumped on the opportunity to go private in the market’s current state.

- SOC Telemed bought Access Physicians, a specialty telemedicine provider, for $194 million or 2/3rds of its take private price back in April 2021.

Bigger Picture: If you’ve been following the Health Tech Index for any period of time, SOC Telemed isn’t the only publicly traded digital health company suffering in the markets.

TPG takes Convey Health Solutions Private at $1.1B Valuation:

TPG Capital, a major private equity player, announced its intention to take Convey Health Solutions private at $10.50 per share. The value amounted to $1.1 billion, a 143% premium to Convey’s last close, and about a 100% premium to Convey’s VWAP, or volume-weighted average price per share as of a recent date to the transaction announcement. TPG previously invested in Convey, took them public at $14 per share and now is taking them private again at $10.50.

Take-privates and takeover acquisitions are happening at huge premiums. I wouldn’t be surprised to see some massive premiums in the back half of 2022.

Premier Inc. spikes on acquisition rumors:

Premier Inc spiked on reports of private takeover interest, although this flew under the radar quite a bit.

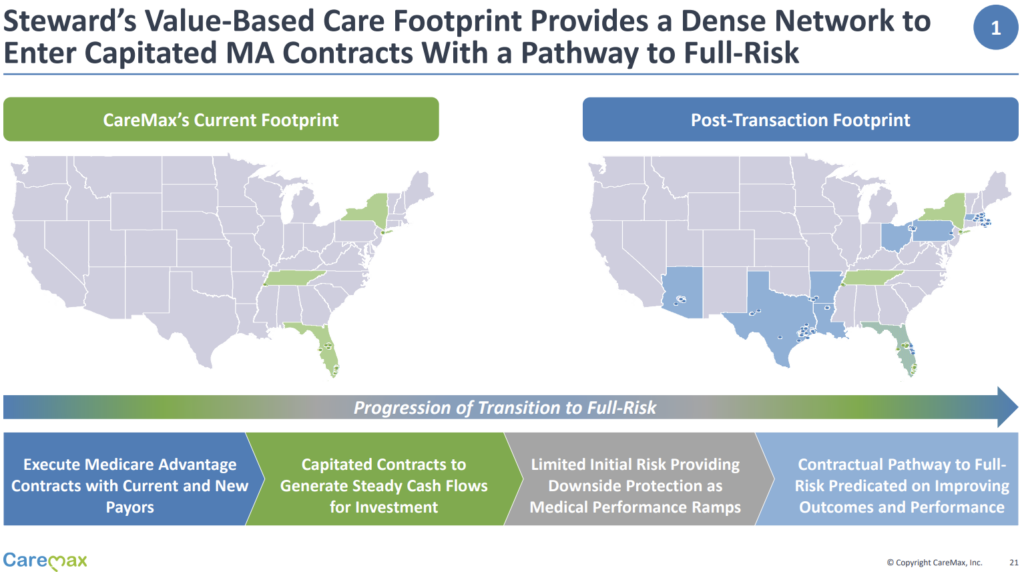

CareMax dives into MSO risk model with Steward Health Care

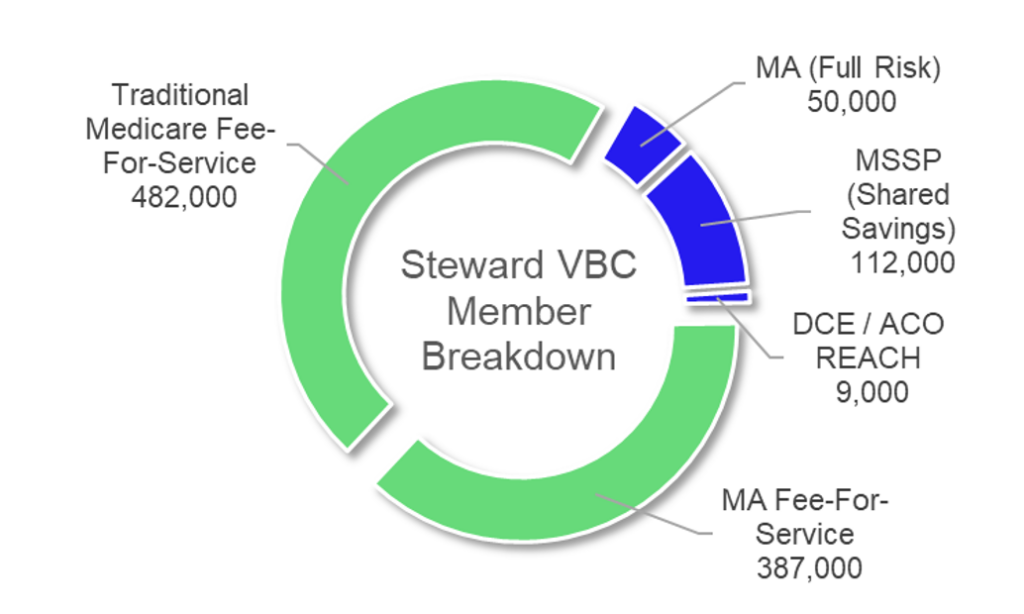

In one of the more significant value-based deals announced in 2022, CareMax announced the acquisition of Steward Health Care’s Medicare Advantage business, comprised of 171,000 lives across 8 states. The deal creates one of the largest independent MA-focused value-based platforms in the U.S. and will close sometime in the back half of 2022.

Deal structure: CareMax acquires Steward’s MA service line (Steward VBC) for $135 million in cash and stock. The value-based player will now serve as Steward’s exclusive management service organization (MSO) for Steward VBC.

As part of the deal structure’s earn-out provisions, CareMax will need to convert an additional 100,000 FFS lives to risk and will have to maintain an 85% MLR for two consecutive quarters to maximize the provisions.

Steward Gets: $25 million in cash, 21% CMAX ownership immediately, and up to 41% ownership in CareMax equity (if earnouts are achieved). Steward also offloads $72 million in VBC A/R offloaded to CareMax, a very non-significant working capital value that CareMax is now funding.

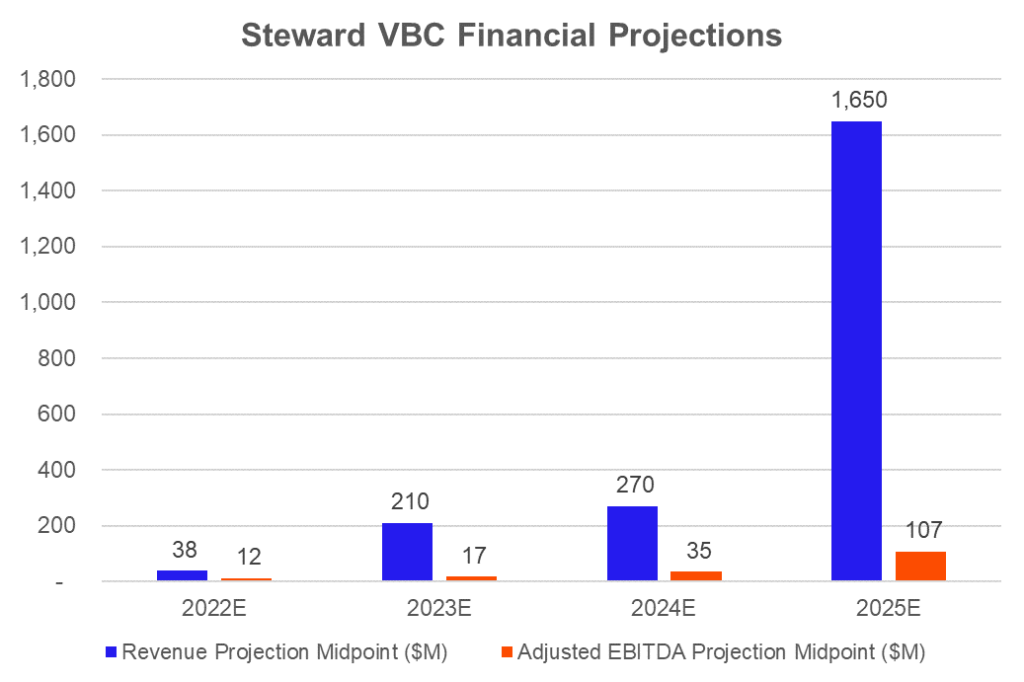

CareMax Gets: Access to 50,000 MA lives, 112,000 MSSP lives, and 9,000 direct contracting lives, along with the opportunity to convert 830k+ additional members to risk, along with some of the best ranking and performing ACOs nationally. CareMax identified the transaction as a $1.6B to $1.7B revenue and $100M to $110M EBITDA opportunity (implied 6-7% margin) by 2025, assuming pretty rosy projections I detailed more below. The firm’s total value-based footprint would jump to 2,000 providers across 200,000 senior lives in 30 markets.

This transaction is a huge win for CareMax.

For $135 million in cash and stock as well as funding A/R and working capital (which should be noted), CareMax gets immediate access to 170k+ risk-based lives and the potential to transition another 830k+ FFS Medicare members to risk. This base will only continue to increase, given the secular trend in Medicare beneficiary growth.

For this transaction, CareMax’s biggest execution risk lies in the following issues:

- Can CareMax transition FFS members to risk? Can CMAX transition MSSP members to full risk?

- Can CareMax efficiently manage Steward’s medical spend to an 85% max? In an MSO model, CareMax has fewer tools at its disposal to effectively manage risk. This transition will be a major challenge and will undoubtedly lead to a higher MLR than that of its fully-owned clinics.

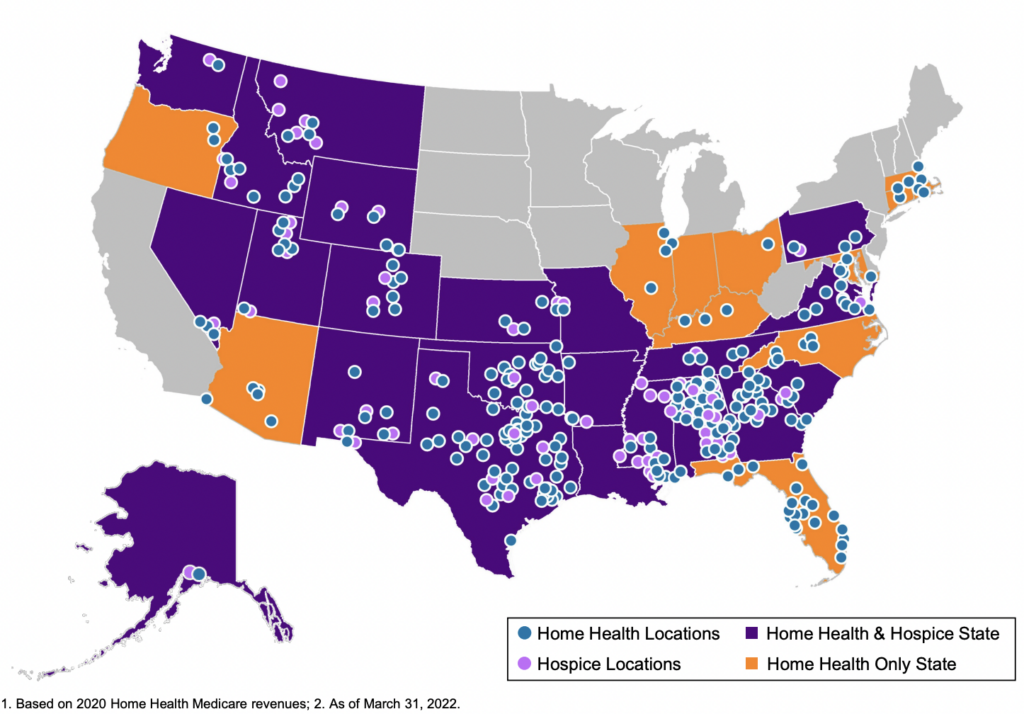

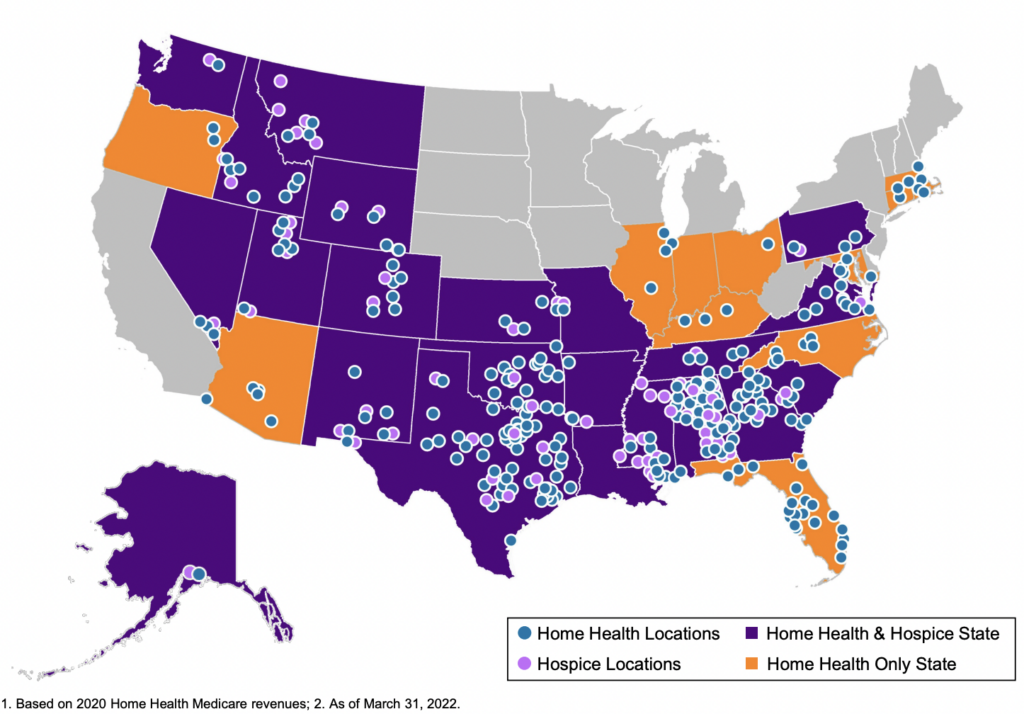

The deal immediately diversifies CareMax’s revenue streams from primarily Florida to a footprint across 8 more states. Just look at this immediate geographic diversification below!

CareMax expects its MSO, a very capital-light business, to contribute 10% of its overall platform contribution margin:

Meanwhile, Steward outsources its risk business to a specialized operator, assuming CareMax indeed has the secret sauce. In a way, since Steward could receive up to 41% of CareMax’s outstanding equity, you could think of this transaction as a pseudo-IPO of Steward’s risk business.

Don’t forget – back in September, Steward announced the sale of 5 of its Utah-based hospital operations to HCA Healthcare. Very notably, Steward expected to use the proceeds from that sale to fund ACO expansion into Florida and Texas in particular outlined in this Beckers article. As it turns out, this sale might not go through as expected. The FTC is suing to block the transaction between HCA and Steward.

I have to wonder if Steward saw the writing on the wall here at all. Is the transaction between CareMax and Steward unrelated to the FTC announcement? Considering that Steward wanted to expand into Florida anyway, I would guess that the health system operator planned to do this anyway. The CareMax deal synergizes well with Steward’s strategy given CareMax’s expansive clinical footprint in Florida. CareMax previously bought Unlimited Medical Services of Florida for $110 million in the Orlando area and operates several other clinics there.

Final interesting financial tidbits! Do these projections seem a bit…rosy to anyone else? It appears as if Steward internally was expecting some major risk transitions to occur between 2024 and 2025:

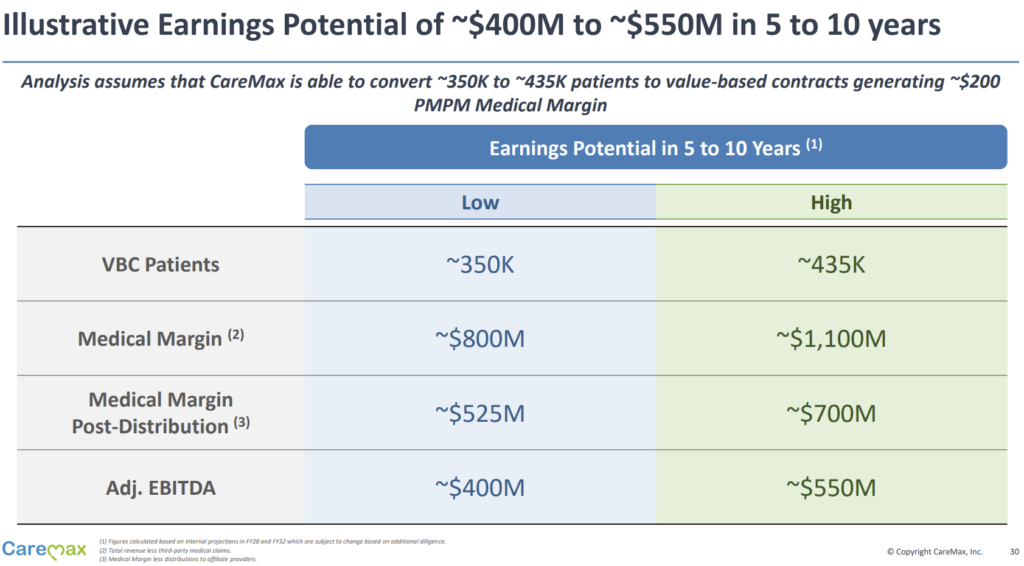

CareMax also provided an illustrative profitability example if the firm can convert 350k to 435k existing Medicare beneficiaries to VBC contracts, which would generate a $200 per-member-per-month medical margin. Note: full MA risk? It’s unclear, but I assume so.

I would highly recommend giving the presentation overview linked here a read through. It’s a very innovative, interesting deal structure and immediately escalates CareMax into an Agilon type player on the MSO side.

A new era of price transparency, or the same old healthcare system?

CMS issued the first EVER price transparency fines to two Georgia hospitals in Q2:

- $883k to Northside Hospital Atlanta, and

- $214k to Northside Hospital Cherokee.

Those are actually significant fines – over $1M to the same health system – Northside Health – in Georgia. According to 2021 disclosures (or actually, 2019 disclosures considering that the link on Northside’s website to 2021 audited financial statements redirects me to FYE 2019 statements – what gives there?), the fine amounts to just under 1% of Northside’s operating income from 2019.

1% is enough to pay attention to considering every dollar counts in 2022.

Back up: As a quick refresher, don’t forget that the Trump Administration’s CMS imposed a price transparency rule on hospitals back in 2019 requiring service providers to provide machine-readable prices (including, most importantly, prices negotiated for commercial insurer contracts, which are closely held trade secrets) for the 300 most common procedures.

That ruling took effect starting in 2021. Since the fine was so low initially (a total of $110k in annual fees), CMS upped the fine to around $2 million annually for the largest hospitals. It’s JUST big enough to be an annoying fine for systems.

On the payor transparency side, price transparency digital health firm Turquoise Health announced a partnership with healthcare-focused API data platform Ribbon Health to integrate Turquoise’s price transparency data into Ribbon’s platform.

Through the partnership, Turquoise and Ribbon aim to continue to empower patients and consumers within the healthcare system. Imagine that you’re googling various in network providers and their prices for common procedures (including other pertinent information) pop up next to the practice. This use-case is just one example of what Ribbon, Turquoise, and others in the space hope to achieve.

Price transparency in the midst of the increasing consumerization of healthcare is a great thing – don’t get me wrong. But from the conversations I’ve been having, we still have a decent ways to go for it to mean anything cost-wise within the broader healthcare system.

How much will partnerships like these, and actually knowing the costs of things move the needle? With so many other factors to consider – doctor referrals, networks, and structure of health insurance – it’s hard to know. Despite the unclear effects of price transparency, I’m excited by the fact that we’re still in the early innings of data collection & insights driven by that data.

Regardless, Turquoise has a compelling market opportunity in front of itself, especially as payors begin to submit their pricing data after the very-under-the-radar CMS price transparency rule compelled them to do so on July 1.

5 Supreme Court Rulings with Big Healthcare Implications

As we all know, SCOTUS was plenty busy in the back half of Q2 issuing opinions. Here were most of the big ones you need to know that affect healthcare from a high level:

340B Program:

The Case: The 340B program allows certain eligible and critical access hospitals access to outpatient drugs at favorable rates they can make a decent amount of $$ on. Big Pharma hates it, hospitals love it, Feds are trying to fix it. Previously, HHS changed the reimbursement formula for hospitals from cost-plus-6% to average sales price-less 22.5%. Hospitals argued that HHS broke statutes when doing so, saying that certain protocol needed to be followed first.

The Decision: On the 15th, SCOTUS decided that HHS broke the law when it changed the payment formula for hospitals to get reimbursed on drugs from cost-plus-6% to average sales price-less 22.5%. SCOTUS said that in order for HHS to have authority to make that change, the regulatory body would first have to conduct a drug cost survey at the targeted hospitals.

Madden’s Musing: The 340B Program now accounts for 15% of all pharmaceutical sales in what will continue to be a hot battleground between hospitals, big pharma, and the government.

Abortion:

The Case: Mississippi wrote a law criminalizing abortion after 15 weeks in direct contradiction to the legal precedent set by Roe. Jackson Women’s Health sued the state as a result.

The Decision: SCOTUS overturns Roe v. Wade, ending the constitutional right to abortion and leaving the decision up to the states in lieu of federal codified law.

Madden’s Musing: I took a deep dive into the potential ramifications for our healthcare system – for both physicians, clinicians, and health systems alike. You can read it here.

PBMs:

The Case: If a PBM has the ability to lower drug prices, does it have a fiduciary duty under ERISA to do so? (Keep in mind that PBMs benefit from higher drug prices by scraping a piece of the drug price for their own benefit in the form of a rebate)

The Decision: SCOTUS decided NOT to take up a lawsuit related to whether PBMs had a fiduciary duty to provide lower drug prices under the Employee Retirement Income Security Act (ERISA).

Madden’s Musing: “Your silence is deafening” – me to SCOTUS on PBMs. PBMs exist in this insane space where everyone knows they suck, yet they’re untouchable. Plz, FTC, do something.

Disproportionate Share Payments:

The Case: Disproportionate share payments are extra payments that CMS makes to hospitals that serve a ‘disproportionate share’ (ha, get it?) of low-income patients. I’ll spare you the highly fascinating details, but the hospital in this case was arguing that HHS was underpaying their DSH payments

The Decision: SCOTUS decided that HHS’ DSH payments were ultimately consistent with the written statute and adequately accounted for the hospital’s entire low-income patient population.

Madden’s Musing: Not gonna lie, this case is highly confusing, and what’s even more confusing is trying to understand what the heck is going on with hospital supplemental payments. Even the dang Supreme Court was confused about the statute’s language if it gives you any indication as to why healthcare is sometimes really stupid when it comes to highly technical, nuanced subjects like DSH. Still, DSH revenue represents a significant chunk of change for hospitals and health systems.

Dialysis:

The Case: centered on whether a health plan followed Medicare statute when it purposefully offered extremely low reimbursement rates for outpatient dialysis – AKA “Medicare shouldn’t pay for a service that this health plan should cover.” DaVita argued that the low rates effectively caused all providers to be out of network and alleged that the plan discriminated against chronic kidney disease patients

The Decision: SCOTUS decided that the plan didn’t discriminate against ESRD patients since it cut rates for all plan members…wtf? As a result, a private health insurance plan can cut or limit dialysis coverage uniformly… DaVita

Madden’s Musing: On the same week that CMS proposed a 3.1% lift to dialysis providers, DaVita dropped 11% after SCOTUS ruled against the dialysis maker. This ruling has implications beyond just dialysis. The precedent set here could trickle down to other benefits and services. At the end of the day, this decision does nothing good for chronic kidney disease patients across the country, a continual spurned group of individuals.

“It’s not like anyone is dying in the emergency room waiting for coverage. Medicare will pay,” said Jen Jordan, an attorney who specializes in Medicare Secondary Payer Act cases. “The only fear I would have is that plans may be more inclined to write more bare-bones benefits now that they know that the Supreme Court supports such an outcome.”

Sick!!

Enhabit Home Health spins off from Encompass Healthcare

After announcing spin-off plans in January, Encompass’ home health arm, Enhabit Home Health & Hospice, successfully debuted on the public markets this week under the ticker ‘EHAB.’

About Enhabit: The home health and hospice operator holds a nationwide footprint and generated just north of $1.1B in revenue as of CY 2021. Enhabit is solidly profitable as well, operating at around a 17% EBITDA margin, or $184M on 200,000 admissions.

As part of the spin-off announcement, Encompass issued guidance for Enhabit for full-year 2022. Financials are expected to decrease slightly, with a revenue midpoint of $1.1B and EBITDA midpoint of $175M. Some of this is likely related to corporate overhead allocations while the rest is attributable to the headwinds I’ll mention below. Its hospice segment comprises about 19% of total revenue with an ADC of around 3,800.

Enhabit is the 4th largest home health player and the 12th largest hospice player sitting alongside the likes of other national operators like Amedisys, LHC Group, AccentCare, and Kindred. The operator boasts 351 HH&H locations across 34 states with 10k employees.

Madden’s Musing: Although home health – and post acute in general – is poised for growth given the aging Medicare population and continued shift to the home, Enhabit and other home health orgs are facing major short-term headwinds, including staffing woes and reimbursement hits from CMS given that 80% of its book of business is Medicare. Here’s an interesting tidbit on Enhabit’s home health → hospice pipeline:

“Many home health patients will ultimately require hospice services. By offering hospice services in many markets where we operate our home health business, we minimize disruption and gaps in care to patients who transition to hospice. We believe this co-location strategy between our home health and hospice businesses creates a growth opportunity for our hospice business, especially in geographies where we operate home health but not hospice.” Enhabit 8-K filing

One of the major reasons why Encompass decided to spin Enhabit off seemed to be related to Encompass’ desire to fully focus on the IRF biz while Enhabit could do the same for home health.

Enhabit still has a major opportunity ahead of it both from a consolidation standpoint (home health is STILL highly fragmented along with a growing need for hospice) and a value-based care standpoint (payors are incentivizing shifts to value-based models).

Since Enhabit operates at a lower cost per visit than Amedisys and LHC Group as of CY 2021 and holds solid readmission percentages, the firm believes it’s in good shape to serve the Medicare Advantage population as it continues to grow to above 50% by 2030.

Final point – Timing for the spin-off wasn’t exactly ideal given what’s going on in the broader economy as well as the idiosyncratic struggles home health operators are facing. These issues are probably one of the major reasons why LHC decided to sell to Optum for 22x EBITDA back in late March. Really timing the top there!

Home health multiples continue to be hammered given the current macro outlook for these operators. This week, Aveanna was downgraded by equity analysts and dropped another 7%. Meanwhile, Enhabit (Encompass spinoff) continues to get hammered and dropped under a $1B market cap while trading at a sub-7x EBITDA multiple.

Disclosure: I received Enhabit shares as part of the Encompass spin-off.

Humana sells its Hospice Segment

On April 21, Humana announced that it’s selling 60% of Kindred’s hospice business to Clayton Dubilier & Rice at an implied $3.4 billion enterprise value. According to the release, that’s 12x trailing normalized EBITDA. Humana will receive $2.8 billion in cash from the proceeds and will retain a minority stake in the red-hot hospice sector.

For those following along at home (I know I am), Kindred Healthcare has been spliced every-which-way since 2017. Here’s a quick timeline:

December 2017: Humana, TPG, and Welsh, Carson, Anderson & Stowe purchased Kindred at a $4.1 billion enterprise value. Humana buys 40% of Kindred at Home with a call option to buy the remaining 60% later on. TPG / WCAS get their hands on Kindred’s facilities business (LTACH/IRF, etc).

April 2021: Humana buys remaining 60% stake of Kindred at Home for $5.7 billion. In case you missed that, Humana bought 60% of just ONE of Kindred’s segments for 40% more than the entire business was publicly valued at in 2017!

June 2021: Enter LifePoint Health. LifePoint, which was taken private by Apollo for $5.6 billion, acquired Kindred’s facilities business – 62 LTACHs, 25 IRFs, 100 acute rehab facilities, & more. The for-profit private hospital operator also agreed to invest $1.5 billion in the communities it serves over the following 3 years.

October 2021: LifePoint spins off Kindred’s 61 LTACHs and 18 of LifePoint’s community hospitals into ScionHealth, likely the least profitable segment of the business (given that LTACHs are typically low margin and community hospitals aren’t the mose efficient operation)

Finally, April 21: Humana sells 60% of Kindred’s hospice segment valued at $3.4 billion

Although I don’t have any hard data on Kindred’s facility-based business and what it sold for, the enterprise values of JUST Kindred’s home health and hospice segments purchased this year implies a $13 billion standalone valuation for those segments ($3.4b for hospice and $9.5b for home health). Do the math and that’s a 215+% premium on what Kindred was trading at in 2017 – and that’s not even including its facilities business.

Digital Health Partnerships with Health Systems

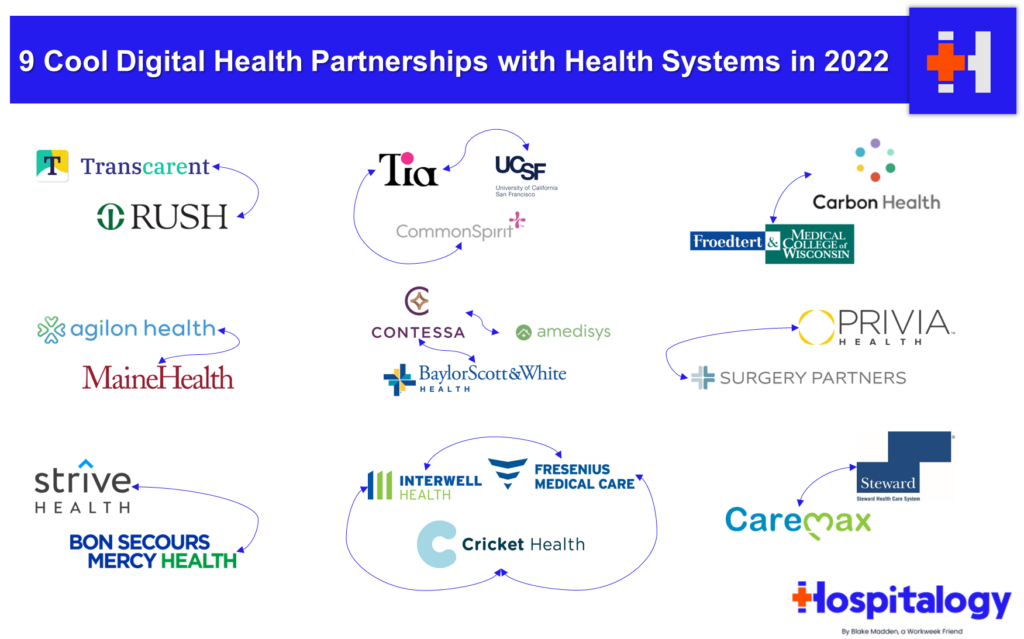

In a Hospitalogy deep dive, I wrote about digital health’s continued push into collaborations with health systems and traditional provider organizations. Here’s a summary of the 9 that I touched on:

Tia: Women’s Health-focused startup Tia has notched two major health system partner under its belt. After raising about $132 million and announcing its first partnership with CommonSpirit Health in April 2021, Tia announced a second partnership with UCSF Health in the Bay Area and will open at least 10 de-novo clinics in the area.

Carbon: Carbon Health announced a partnership with Milwaukee-based Froedert Health in April 2022. Froedert Health will join Carbon Health’s management platform called Carbon Health Connect. Carbon Health will manage new and existing primary care and urgent care clinics while expanding into other markets in Froedert’s footprint in the greater Milwaukee area. Carbon has announced a host of other partnerships with health systems and has been quietly expandingng its footprint.

agilon: In March 2022, agilon announced a notable partnership with MaineHealth, an integrated nonprofit health system with at least 9 hospitals and plenty of other outpatient care settings, to transition MaineHealth’s primary care delivery system to agilon’s platform.

Contessa: Amedisys’ Contessa Health, its hospital-at-home segment announced a partnership with Dallas health system Baylor Scott & White on June 9, 2022. The joint venture will extend new at-home care models, including hospital-at-home, SNF-at-home, and other care to eligible patients starting in 2023. More recently, Contessa notched another partnership with Houston-based Memorial Hermann as it makes its way down I-45.

Privia: Surgery Partners announced a strategic partnership with Privia Health on February 3rd, 2022.

As part of the deal, Privia gets its foot in the door into the Montana market by buying into Great Falls Clinic, a physician practice wholly owned by SGRY. The buy-in will give Privia the ability to expand in the Montana market, acting as Privia’s ‘anchor practice’ in the state (65 providers, 24 specialties). The two companies will also establish a management company, of which Privia will be the majority owner.

Strive: announced a notable partnership with Bon Secours Mercy Health in May 2022. Under the arrangement, Strive will manage BSMH’s chronic kidney disease patients through its platform and has been deploying its model through several health systems. CKD is in chronic need of change and needs innovation to make up for its lack of funding, so I’m excited to see how these partnerships develop.

Cricket: A big kidney care announcement happened on March 21, 2022 related to a new value-based care kidney merger. Fresenius Health Partners (a value-based subsidiary of the larger Fresenius), InterWell Health (a nephrology network), and privately held startup Cricket Health are merging to form a $2.4 billion VBC kidney care company.

Transcarent: Its partnership (announced Feb 2022) will allow 9k RUSH employees and associated family members to get access to Transcarent’s care team, which includes services across a number of verticals and robust healthcare offerings, most of which looks to be running through RUSH’s Centers of Excellence.

Hue Health: Hue Health and Banner Health partnered to launch 39North, which is a new performance based primary care plan engined by Flume Health. The word ‘health’ was like 20% of that sentence, sorry fam.

Digital Health Layoffs Begin

News hit the wire in the second quarter especially related to several health tech layoffs.

Carbon Health (valued at $3.3 billion) laid off about 250 employees in its corporate workforce, representing about 8% of its total base.

Cerebral (valued at $4.8 billion) also laid off members of its workforce amid an ‘organizational review’ of the embattled mental health firm. Cerebral hasn’t had the best track record with labor relations at its company.

Olive (valued at $4 billion) laid off (paywall) around 20+ employees.

Cue Health shed 10% of its staff

Circulo Health laid off a quarter of its workforce last week.

& plenty more made unfortunate headcount reductions.

It’s not just digital health. Market conditions are rough right now, and startups / unicorns across industries are tightening up on cash and prioritizing reducing burn.

In my mind, as tough as it is for these individuals, fundraising dollars drying up a bit in health tech will turn out to be a good thing for the industry. Valuations were frothy. Hopefully we can continue to allocate capital more efficiently to the savvy operators actually making a difference.

“Difficult market conditions can create exceptional opportunities for strong businesses to get stronger and that is our plan,” – Farzad Mostashari, MD – CEO & Co-Founder, Aledade

Health System Joint Operating Companies Disband

Ascension and AdventHealth completed their JOA breakup in Chicago, formally disbanding Amita Health. AdventHealth will continue to operate the four legacy Amita Health hospitals under its brand.

To add to the JOC unraveling trend, Trinity Health and CommonSpirit Health, two of the five largest health systems in the US, announced plans to unravel their joint operating company (JOC) in Iowa – MercyOne. As part of the deal, Trinity will acquire all of MercyOne’s assets throughout the state of Iowa.

The MercyOne operation is impressive and includes:

- 16 medical centers seeing 3.3 million patients

- 420 care sites

- 20,000 employees

- 2,000 doctors

And a host of other clinical assets to consolidate into Trinity’s larger 80+ hospital operation.

Trinity plans to finalize the transaction in summer of this year. The deal will expand Trinity’s presence individually into the Iowa market to compete with the likes of UnityPoint, which has a large presence in the state and a formidable player there.

Meanwhile, CommonSpirit gets an infusion of cash to bolster their balance sheet for other strategic initiatives.

CMS Revamps Direct Contracting to ACO REACH

CMS dropped a next-gen program slated to replace the current Direct Contracting starting in 2023.

Details: CMS is replacing all direct contracting programs (Global/Professional/Geo) with a re-skinned model called ACO REACH. The new program is essentially DC with some extra bells & whistles.

ACO REACH aims to continue to move traditional Medicare toward risk-based and capitation payment models through…

- Allowing mainly provider-controlled groups into the program. 75% of applicant boards have to be provider-controlled. Non-provider groups have to demonstrate a certain level of direct patient care to be included in REACH.

- Addressing health equity (SDOH) – Every entity has to identify & determine ways to address health disparities in specific markets & geographies – dope

- Preventing the abuse of risk score adjustments. CMS is capping adjustments based on population trends & traditional Medicare risk score trends among other more specific items.

- Maintaining a similar PMPM payment structure to DC by keeping the professional and global payment tracks, but ditching the controversial geographical track.

- Alleviating Progressive concerns about ‘corporate profiteering’ and ‘getting rid of Medicare’ – Beneficiaries will keep all provider choice freedom that traditional Medicare provides. This is in contrast to Medicare Advantage programs that typically create narrower networks.

- Providing greater transparency into the program. AKA, more reporting on how entities are doing, how health equity is being addressed regionally, etc.

ACO REACH will start accepting new applicants in Jan. 2023. It’ll run thru 2026 and by that point I’m sure we’ll have some new acronym and the next iteration of VBC payments.

FTC ramps up Antitrust in Healthcare

The hospital market is growing more and more concentrated. Hospital consolidation has developed an insane amount of notoriety for increasing prices. As a result, proposed mergers are increasingly failing state antitrust review due to hospital market concentration concerns.

And the FTC is on the attack.

This trend isn’t just limited to hospitals – Optum and others are struggling with the FTC as it ramps up scrutiny on healthcare consolidation, including Optum’s recent bids for Change Healthcare as well as LHC Group. The FTC is even looking into PBM business practices (once again), so we’ll see if anything comes from it.

For health systems specifically, there have been a number of health system mergers canceled or struck down in very recent memory for a number of reasons:

- Hackensack Meridian Health and Englewood Health called off their planned merger after an appeals court blocked the consolidation.

- Sentara Health and Cone Health canceled their merger in what would have created a $11.5 billion system with 17 hospitals.

- Baylor & Memorial Hermann chalked their plans after some strategic differences in what would have created a $14 billion Texas powerhouse.

- Dartmouth Health and GraniteOne Health canceled their merger after antitrust review raised similar market concentration concerns

- Lifespan and Care New England announced an intent to merge into a 7-hospital system, but shut down talks again in February 2022 after an anticipated challenge by the FTC.

- Finally, most recently, HCA cancelled its acquisition of Steward’s 5-hospital footprint in Utah after the FTC played hardball on the transaction.

Any hospital acquisition or merger that might result in increased market concentration over a certain threshold is very likely to be blocked in this transaction environment.

Primary Care Platforms Attract Takeover Interest from CVS, Humana

Several news stories dropped at the end of Q2 related to payors holding talks with publicly traded facility-based primary care platforms.

Shares of One Medical skyrocketed 22% immediately after sources reported that CVS, which has been on the hunt for a primary care deal for some time, was in talks to acquire (paywall – Bloomberg) the embattled primary care player. Apparently One Medical is still weighing potential acquisition offers to this day!

Just a day or two later, Humana was rumored to be eyeing a takeover of Cano Health, somewhat of a peer to One Medical focused on the Medicare Advantage space and primarily located in Florida. I should note that Humana also has the right of first refusal to any potential acquisition of more than 20% of Cano Health, so it makes sense that Humana would look into buying Cano after a steep drop-off in share price and valuation in the primary care facility-based players.

Along with these two players, the entire primary care platform industry saw a boost in stock price on the heels of the news:

- One Medical jumped 26%

- CareMax climbed 25%

- Cano rose 22%

- Oak Street increased 19% (I’m out of synonyms for ‘increased’)

- agilon and ApolloMed spiked (aha! fooled you) 16%

- Privia swelled 12% along with Teladoc

It’s an interesting juxtaposition – these facility-based players seem to have a vast amount of untapped potential and value to be unlocked by being acquired strategically by a payor, yet at the same time, are heavily discounted in the public markets.

In a standalone business, the economics of value-based primary care platforms are tough. It seems to a long time to breakeven while transitioning patient panels. But assimilated into a payor? Lots of value to unlock there. Literally.

Facility-based VBC platforms are a FANTASTIC strategic asset for payors who can manage medical spend. For instance, Cano’s guided medical loss ratio in 2022 is around 76%! That’s insane savings to acquire for payors.

Keep in mind that Humana also has a MA-facility joint venture with Welsh Carson thru CenterWell to develop 150+ MA clinics by 2025.

Hospitalogy’s top 10 reads from 1H 2022

- Nikhil Krishnan’s overview of the main problems facing healthcare today and his deep dive on the mental health employer market

- Morgan Cheatham’s analysis of payor contracting best practices for virtual care companies and a16z’s founders playbook for risk-based contracting

- Jan-Felix Schneider’s and Brendan Keeler’s joint post on problems with direct patient scheduling in healthcare and JFS’ post on building the Shopify for digital health

- Christina Farr and Second Opinion’s dives into the current state of fundraising for health tech founders and thoughts on diagnostics-as-a-service

- Jacob Effron’s piece on the parallel journeys of Fintech and Health Tech and a16z’s corroborating piece on the intersections of healthcare and fintech

- Jared Dashevsky’s piece on unwarranted clinical variation and mental health care in 2032

- Robert Longyear’s analysis on the evolution of telemedicine

- Tejas Inamdar’s 3-part breakdown of pharmacy benefit managers

- 7wire Ventures’ dive into health equity and increasing access for underserved healthcare consumers

- Woodside Capital Partners’ Health Tech Q1 2022 update

If you made it this far, thanks so much for reading. If I missed anything you think I need to know, please hit me up on twitter or LinkedIn (my name is Blake Madden)!

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!