Healthcare is legitimately insane.

As I’m finishing up this post, Amazon just acquired One Medical for $3.9 billion and an 80% premium to its close price on Wednesday.

You already know I’m breaking down that transaction in depth next week. The implications are massive.

But for today, we’re diving into the world of healthcare valuation, a big part of my past life in healthcare consulting.

The other day I was daydreaming about healthcare (as I do, sue me) and thought to myself “hmm…it’d be interesting to take a look at how forward valuation multiples have shifted this year!”

Let’s get after it.

Join 5,400+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Healthcare Services Valuation Update – 2022

As a precursor for this essay, I’ll be looking at enterprise value (”EV”) to revenue and EBITDA multiples for publicly traded healthcare services firms (with some tech-enabled players mixed in).

The reason being that these two multiples are the most widely used from a valuation perspective, with EBITDA being the gold standard for profitable biz’s.

That being said, it’s not lost on me that certain healthcare sectors might benefit from more idiosyncratic multiples (e.g., EV / members or EV / practice collections or care margin for the Privias & One Medicals of the world).

There could be more nuance that these multiples capture to better interpret how the business is doing rather than a pure revenue or EBITDA multiple.

Don’t get me started on Adjusted EBITDA!

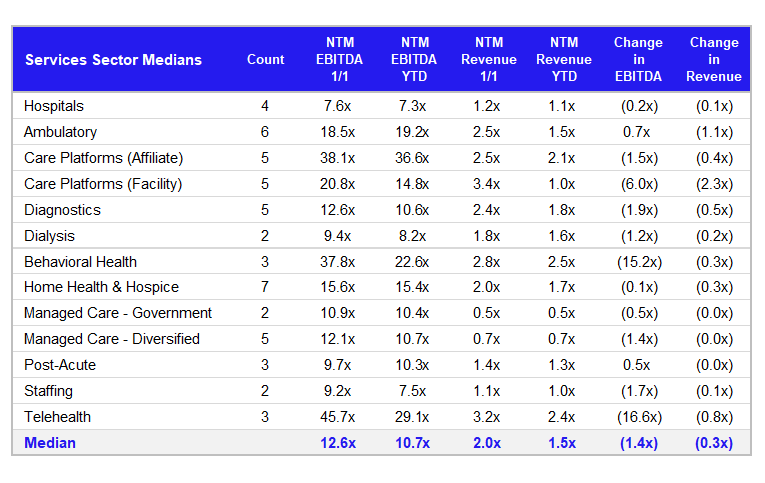

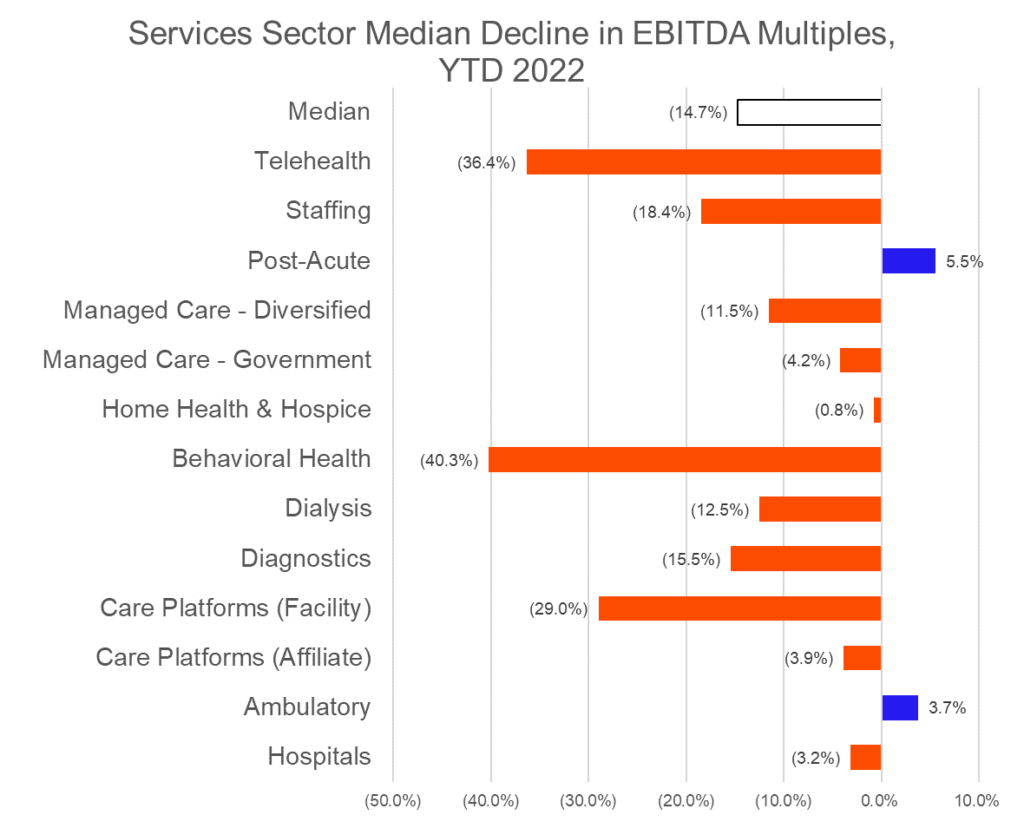

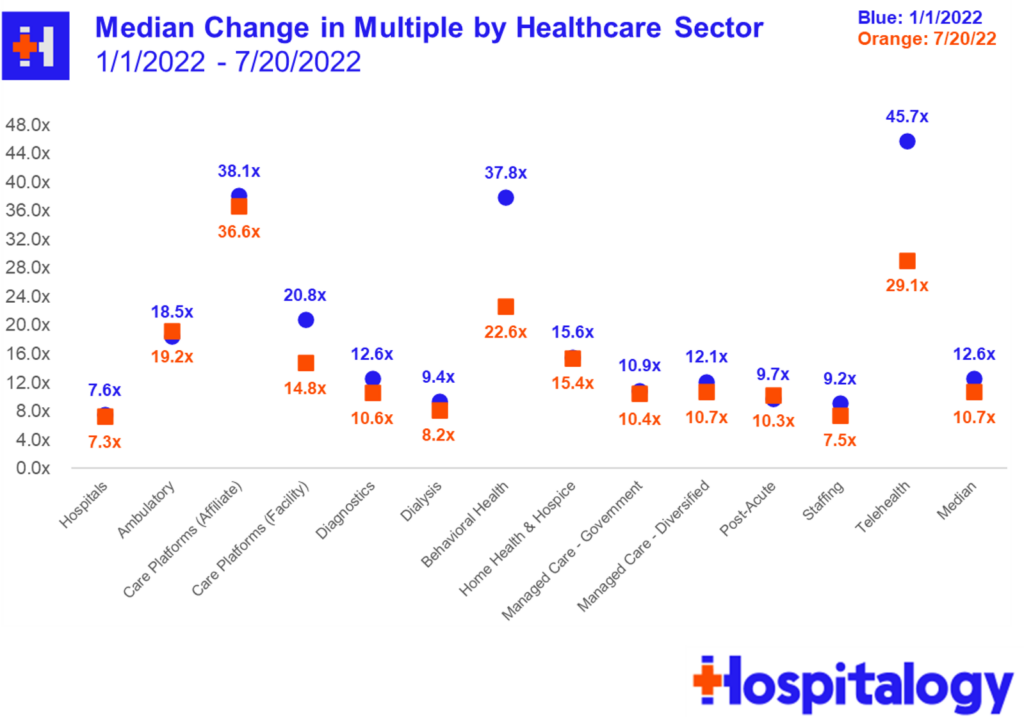

As far as median multiples across all services sectors that I actively track, 12 out of 14 healthcare services sectors saw a decline in next-twelve months (NTM) EBITDA multiples while ALL sectors saw a decline or no change in NTM revenue (data sourced from Koyfin):

Median multiple decline in healthcare services & managed care companies throughout the first half of 2022 was (1.4x) on the EBITDA side and (0.3x) on the revenue side, with wide variance depending on the sector.

As the only profitable telehealth player (apart from the $6.7B Livongo write-off), Teladoc’s multiple declined by almost 17 turns.

Meanwhile, hospitals and post-acute facility-based players, stalwarts of recession resistant defensive stocks, saw very little change in multiples despite share price declines and operational challenges facing these organizations in 2022.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Along with the macro headwinds facing healthcare stemming from tightened capital and inflation, there are some nuances causing multiple shifts in various sectors!

Let’s dive into a few of these sectors and I’ll explain what’s going on in a bit more detail.

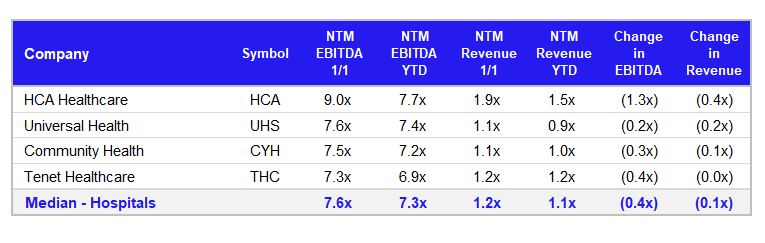

Hospitals

The pressures facing hospitals are well documented at this point. Along with macro headwinds, hospitals are in a tough position right now:

- Constant influx of coronavirus patients and sick leave for clinical staff creates pressure on census and outpatient volumes, impacting health system revenue & profitability

- Staffing shortages creates a challenging environment for patient care and financially speaking forces hospitals into unfavorable travel nursing contracts and higher starting base pay for nursing.

- Payors and CMS are applying pressure on reimbursement and rate lifts to reimbursement. The full extent of this impact isn’t fully known yet since renegotiated rates will take place in 2023. I expect we’ll hear more on this during hospital Q2 earnings calls slated for the next couple of weeks

Of the publicly traded hospitals, HCA experienced the biggest decline in multiple, dropping from a premium (9x) down to almost in-line with fellow hospital peers.

While I’m of the mindset that the drop is pretty overblown, I’m also cognizant of the fact that it’s tough to be a hospital right now and further pain may be ahead in the short-term as new variants ravage healthcare organizations.

I’ve mentioned this before, but I wouldn’t be surprised if traditional health systems took a long hard look at population health & risk based models to diversify revenues.

Care Platforms

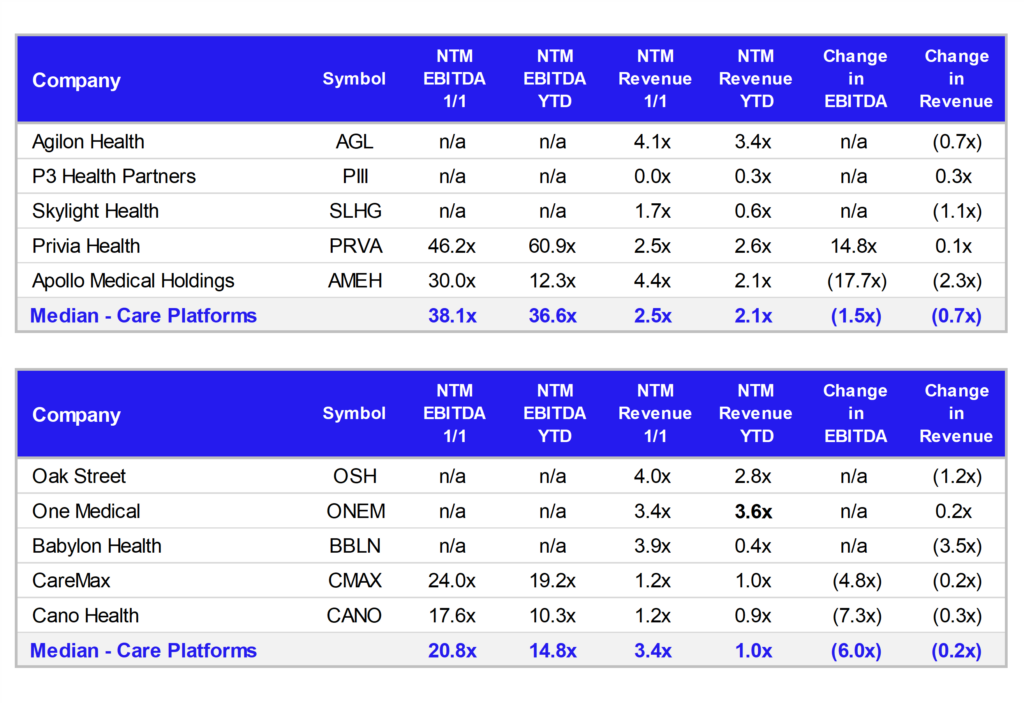

Both facility and non-facility (affiliate) based care platforms saw a precipitous decline in multiples in the post-COVID era.

As hype and easy money policy died out and a focus on profitability emerged, these firms were left out to dry by public investors despite the fact that many of these care platforms have compelling, promising business models and are growing at a 20-30% clip.

With the One Medical news dropping today, the $3.9 billion all-cash deal values the traditional concierge care primary care platform at 3.6x forward guided revenue of about $1.1 billion. One Medical bought Iora Health in mid 2021 in an all-stock deal valued at $2.1B, so you can really see how much valuations have plummeted over that horizon.

That multiple is largely in-line with how One Medical was valued at the start of the year and is a major premium to current valuations in the space.

Oak Street is the next closest peer trading at 2.8x while Cano and CareMax, geographically constrained players, sit at a discounted 1.0x.

It makes perfect sense why we’re seeing an upward correction in multiples for these players as takeover interest ramps up. CVS is still out in the wild looking to make a similar play to Amazon, and all of these care platforms present compelling strategic opportunities for large integrated players.

Home Health

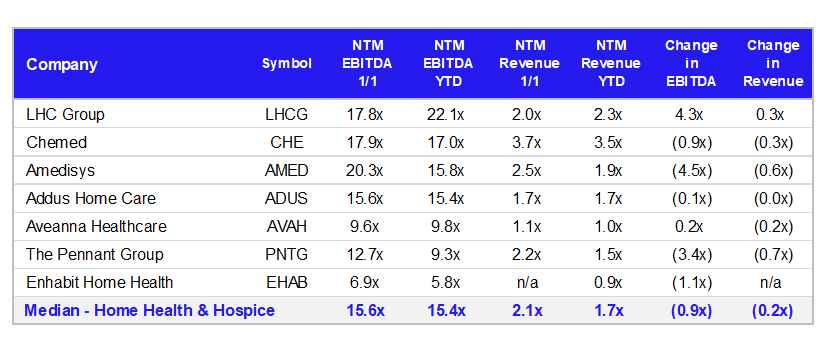

Take out Optum’s $5.4B acquisition of LHC and the multiple compression facing home health and hospice operators gets real very quickly.

Pure-play home health and hospice players like Amedisys and the Pennant Group are getting hammered in the current operating environment as CMS proposes draconian rate cuts and staffing shortages, burnout are rampant.

More recently, Aveanna released preliminary Q2 results, reducing 2022 guidance by around 6% on the revenue side and cutting EBITDA profitability expectations by $50 million to $150 million (from a previous expected range of $190M – $205M) – a 25% haircut to EBITDA!

Home health is facing a similar dynamic to hospitals and other provider organizations in that workforce shortages and inflationary wage pressures haven’t slowed down like most expected after Q1. Since staffing is such a significant portion of expense structure for home health and other provider orgs, as long as these factors continue to play out, these operators will struggle.

Behavioral Health

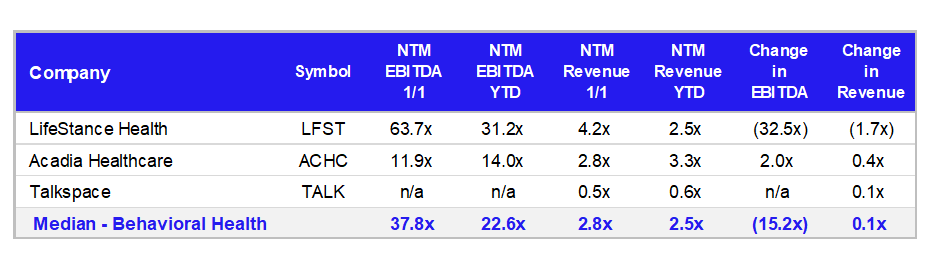

Although LifeStance reiterated guidance during Q1, the market has not been kind to its multiple. Despite 42% growth in top-line year over year in Q1, LifeStance’s multiple declined by 50% which appears to indicate that LifeStance isn’t doing enough to grow its clinician base and boost productivity throughout its footprint.

It’s pretty surprising to me given the secular tailwinds in the behavioral space and coming funding for mental health across a wide array of initiatives, but time will tell as always.

Meanwhile, longstanding facility-based behavioral player Acadia has been plodding along just fine. Acadia has announced several joint ventures and continues to crush.

Conclusion

Although I can’t speak for broader market conditions, continued inflation, and shortages nationwide, the fact that multiples have compressed so heavily across the board in healthcare makes me think that the market has priced in a doomsday scenario for healthcare services companies.

Given how inelastic demand is in healthcare, I wouldn’t be surprised to see a bounceback on the multiple front.

For now, we’re in a relatively low valuation environment for healthcare services players in the public markets.

Join 5,400+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!