This first EVER edition of Hospitalogy dives into HCA’s worst Q1 ever and what their earnings report means for hospitals, Humana’s sale of Kindred’s hospice segment, the unraveling of MercyOne, and some major sell-offs in the public markets.

New here? Subscribe to Hospitalogy today.

HOSPITALS

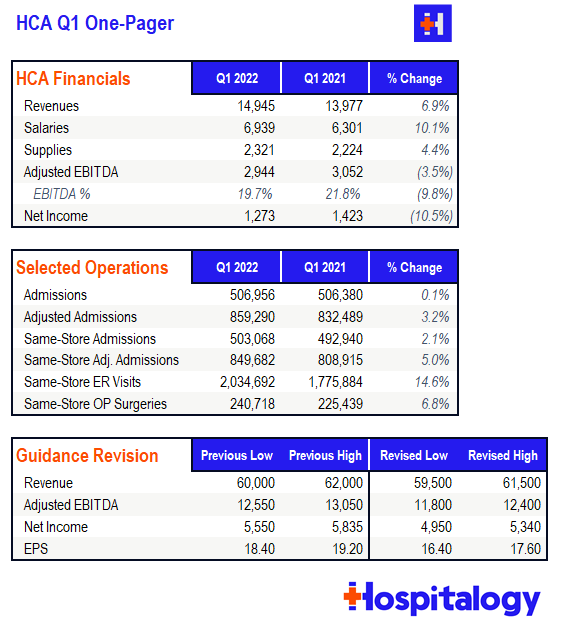

HCA’s Worst Q1 Ever

It’s only fitting that my first ever story writing Hospitalogy relates to … Hospitals.

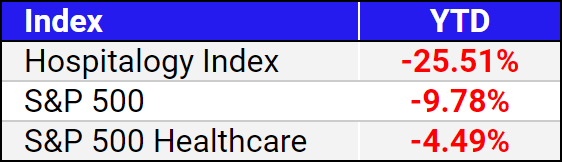

HCA, the largest of the public hospital operators by a wide margin, reported Q1 earnings this week and the market was NOT a fan of HCA’s results. The healthcare behemoth experienced its worst trading day EVER on Friday after reporting Q1 earnings, selling off 20+% in a day, leading to the demise of pretty much every other healthcare services stock – especially the other hospital operators.

Here’s what you need to know.

Despite experiencing some pretty nice rebound in volumes in same-facility admissions, ER visits, and outpatient surgeries, the volume bounce wasn’t enough to appease investors in the current volatile market environment.

Reach out to me for the downloadable excel

Based on comments from HCA’s earnings call transcript, HCA is dealing with multiple headwinds, most notably continued woes from labor market issues that refuse to go away for healthcare providers.

Although HCA had expected staffing issues to resolve themselves by this point, staffing shortages are still lingering throughout the organization but steadily improving.

HCA mentioned several initiatives to combat the challenging environment, including maximizing staff retention (bumping up salaries by 3-3.5%), aligning and consolidating operations, and improving KPI benchmarks across the organization.

One of the more insightful analyst questions came from Brian Tanquilut at Jefferies. He asked “why now?” for all of the staffing issues? Considering Covid and the Great Resignation have been going on for quite some time, I thought HCA’s Sam Hazen provided a decent answer:

The labor market was being tremendously impacted during the summer of 2021, and we had to use more contract labor at that time than we had in previous periods. Well, that’s continued into the fourth quarter and into the first quarter. Again, we think some of that is influenced significantly by the surges. So that’s part of what we occurred.

As Bill alluded to at the Delta variant was the most intense revenue per patient population that we had. So the third quarter covered a lot of that cost because the revenue intensity of the Delta patients was quite high. The fourth quarter had a blend of Delta and Omicron, and it still was higher than the first quarter. And so the labor costs really haven’t changed per FTE in the in three quarters. I’m considering that to be a good thing.

And I’m also considering it to be the opportunity because we’re using too much contract labor and it’s still at elevated outsized rates. And so our rate trend has continued in the quarter to be reduced. I think our contract labor cost per hour in the first quarter was down 5% from the fourth quarter.

Translation: Higher revenue from from higher COVID acuity cases covered up the pronounced staffing expenses for a while, but Omicron resulted in lower acuity, leading to lower revenues in Q1, compressing margin.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Madden’s Musing: Alright, this is totally not investment advice, but this selloff seems waaay overdone to me. Yes, HCA dropped guidance by 5-10%, but that doesn’t justify HCA losing a fifth of its value in a day. Doesn’t add up, now does it? I’m blaming the volatile market.

That being said, it’s a tough AF environment for hospitals right now and a bunch of small bad things are upcoming for hospitals.

- CMS is making changes to disproportionate share payments, while providing just a pay bump of just 3.2%. Wage index adjustments to Medicare payments will lag until CMS incorporates 2021 and 2022 into the formula

- Length of stay at hospitals is increasing – hospitals can’t discharge their patients to skilled nursing or other post-acute care settings because there’s nowhere for them to go. Staffing is affecting census and capacity everywhere, but especially post-acute care.

- Meanwhile, supplies and labor costs, and general input costs (shipping, etc.) are skyrocketing.

- Medicare sequestration will eventually cut reimbursement by 2%.

- Boosted reimbursement from ‘Rona and the public health emergency will likely fizzle out sometime in 2022.

- Finally, interest rates are rising, tightening capital just a bit more.

TL;DR: HCA = strong outpatient volume, strong same-store admissions. Labor = incredibly challenging environment but slowly trending downward. HCA is deploying other initiatives to combat inflationary pressures and is already in talks with payors for 2023 and 2024 contracts. HCA is a machine and will be just fine, but other less-scaled operators may suffer.

Resources

- HCA earnings call transcript. I highly recommend reading this to understand the current issues hospitals are facing.

- HCA Q1 press release

- CMS proposed 2023 IPPS rule

- CMS defends the IPPS proposed 3.2% bump for hospitals.

HOSPICE M&A

Humana sells its Hospice Segment

On April 21, Humana announced that it’s selling 60% of Kindred’s hospice business to Clayton Dubilier & Rice at an implied $3.4 billion enterprise value. According to the release, that’s 12x trailing normalized EBITDA. Humana will receive $2.8 billion in cash from the proceeds and will retain a minority stake in the red-hot hospice sector. At the same time, Humana gets a nice injection of cash to bolster its balance sheet.

For those following along at home (I know I am), Kindred Healthcare has been spliced every-which-way since 2017. Here’s a quick timeline:

December 2017: Humana, TPG, and Welsh, Carson, Anderson & Stowe purchased Kindred at a $4.1 billion enterprise value. Humana buys 40% of Kindred at Home with a call option to buy the remaining 60% later on. TPG / WCAS get their hands on Kindred’s facilities business (LTACH/IRF, etc).

April 2021: Humana buys remaining 60% stake of Kindred at Home for $5.7 billion. In case you missed that, Humana bought 60% of just ONE of Kindred’s segments for 40% more than the entire business was publicly valued at in 2017!

June 2021: Enter LifePoint Health. LifePoint, which was taken private by Apollo for $5.6 billion, acquired Kindred’s facilities business – 62 LTACHs, 25 IRFs, 100 acute rehab facilities, & more. The for-profit private hospital operator also agreed to invest $1.5 billion in the communities it serves over the following 3 years.

October 2021: LifePoint spins off Kindred’s 61 LTACHs and 18 of LifePoint’s community hospitals into ScionHealth, likely the least profitable segment of the business (given that LTACHs are typically low margin and community hospitals aren’t the mose efficient operation)

Finally, April 21: Humana sells 60% of Kindred’s hospice segment valued at $3.4 billion

Madden’s Musing: The timeline above has been a pretty wild ride for Kindred and it goes to show that there’s PLENTY of value to be unlocked in the private sector.

Although I don’t have any hard data on Kindred’s facility-based business and what it sold for, the enterprise values of JUST Kindred’s home health and hospice segments purchased this year implies a $13 billion standalone valuation for those segments ($3.4b for hospice and $9.5b for home health).

- Do the math and that’s a 215+% premium on what Kindred was trading at in 2017 – and that’s not even including its facilities business.

It is truly insane the poor attempts the public market makese at valuing healthcare assets, especially in the services world.

Or, maybe these private equity guys know what they’re doing…I’ll let the jury decide.

Resources:

- Announcement press release

- LifePoint spins off ScionHealth

HOSPITAL M&A

Trinity & CommonSpirit Unwind MercyOne

Trinity Health and CommonSpirit Health, two of the five largest health systems in the US, announced plans to unravel their joint operating company (JOC) in Iowa – MercyOne. As part of the deal, Trinity will acquire all of MercyOne’s assets throughout the state of Iowa.

The MercyOne operation is impressive and includes:

- 16 medical centers seeing 3.3 million patients

- 420 care sites

- 20,000 employees

- 2,000 doctors

And a host of other clinical assets to consolidate into Trinity’s larger 80+ hospital operation.

Trinity plans to finalize the transaction in summer of this year. The deal will expand Trinity’s presence individually into the Iowa market to compete with the likes of UnityPoint, which has a large presence in the state and a formidable player there.

Meanwhile, CommonSpirit gets an infusion of cash to bolster their balance sheet for other strategic initiatives.

My thoughts:

I’ve had the privileged opportunity of working with both Trinity and MercyOne representatives and have nothing but good things to say about their respective organizations.

From a bigger picture perspective, this unraveled JOC marks the second such transaction in the past year or so. Smaller systems not part of a larger conglomerate will continue to struggle in the current healthcare environment. Labor shortages, inflationary pressures, and payor dynamics that I touched on in my analysis of HCA’s earnings call all likely contributed to MercyOne shutting down.

To add to my thesis, just last fall, Ascension and AdventHealth unwound their JOC, Amita Health, a 7 hospital JOC in the Chicago area. The moves signal that health systems are prioritizing scaled, consolidated operations over JOC structures where control over assets may be confusing and not fit with the organization’s overall objectives.

If you have any perspective to add, I’m all ears – feel free to reply to the e-mail anytime.

Resources.

- Announcement press release

Market Movers.

Big Winners: The Pennant Group (16%), Cano Health (+14%), The Oncology Institute (+11%)

Big Losers: Babylon (-51% SHEEEEESH bro), Community Health Systems (-19%), HCA (-19%)

Full List: (Link)

Tenet posted its Q1 earnings this week as well. Despite reporting in-line expectations, Tenet also experienced the Wrath of HCA by selling off 18% on Friday, but has since recovered a bit. I should note that Tenet did NOT revise its guidance lower but mentioned similar headwinds offset by very strong outpatient surgery growth.

Teladoc announced a partnership with Northwell Health, the largest health system in New York state, to expand Northwell’s virtual care platform. Northwell will leverage Teladoc’s existing partnership with Microsoft to deploy Teams and improve clinical workflows, including scheduling and other virtual care requirements. Even though the collab is scant on details and financials, Northwell’s NY footprint is no joke. They also did about $13 billion in revenue as a system last year.

Babylon tanked 50% on Friday for legitimately no reason – actually, one reason. The value-based care player’s lock-up period for insider stock selling expired. Probably not that great of a signal for Babylon shareholders if insiders are selling stock in droves. I mean sheesh, what a selloff. Healthcare had a baaaaad week. Babylon is the second worst performer in the Health Tech index, narrowly beating out GoHealth, which we won’t even talk about.

To get the deal to the finish line and appease DOJ’ers, UnitedHealth is selling Change Healthcare’s claims adjustments biz for $2.2 billion to TPG Capital, who knows their stuff when it comes to healthcare. You have to imagine that TPG is making off like a bandit in this deal considering UHG HAD to divest this asset to get the deal past regulators. There’s plenty of private rev cycle M&A going on

Welsh Carson sold Hospice Select to Bristol Hospice for an undisclosed sum, marking the second massive hospice transaction in as many weeks. According to Hospice News, Hospice Select generated about $70 million in EBITDA and has a 45-state footprint. Doing the math, I’d guess the biz sold for around $840 million assuming they get around the Humana multiple, no?

Madden’s Musings

- Elon Musk bought Twitter. He also had some interesting things to say about Bill Gates’ Tesla Short

- Dustin Johnson tied the knot this week with Paulina Gretzky…But there’s no way this is his handwriting…right???

- This was such a cool feature on Mr. Beast. The dude is just a marketing genius and an incredibly entertaining Youtuber.

- PLEASE stay AWAY from health sharing ministries!!!

Hospitalogy Top Picks

- I really enjoyed this overview from Advisory Board on the current labor dynamics (not to beat a dead horse lol) and specifically how nursing employment is being affected.

- Jan-Felix Schneider wrote a great breakdown of physician independence, employment trends and the dynamics at play.

- Jared also touched on the death of the private practice – as well as a fair criticism of Levels – in the latest Healthcare Huddle.

- Nikhil Krishnan wrote on current mental health and employer dynamics. The memes are absolutely next-level this time around.