Welcome to the annual Hospitalogy year in review! This multi-series post is a culmination of a year’s worth of work. I’ve taken all of the stories I’ve written and analyzed and repackaged them into the themes that shaped 2023.

I hope you find this series valuable over the course of January. If you do, I’d appreciate it if you subscribed or forwarded this email to your team (online version here). Hospitalogy is free, and subscriber growth and open rates are key reasons why that can continue!

But first, please register for my upcoming webinars!

- Discussing the latest in AI-driven healthcare marketing trends and tactics: Register Here.

- Diving into 2024 population health strategies, including de-risking your behavioral health population: Register Here.

Overview of the Hospitalogy 2023 Year in Review:

- Vertical integration shapes the payor landscape

- Big-Picture Trends in Medicare Advantage, ACA Marketplace, and Medicaid (Today’s Post)

- The rise of Retail Health and nontraditional players

- Health systems respond to labor and inflation struggles, and the return of Utilization a bright spot

- Fallout for high profile PE-backed and VC-backed organizations: a muted year for dealmaking and funding

- GLP-1s burst onto the scene, forming the new Wild West of healthcare

- AI in Healthcare – Evolution, or Revolution?

- Everything Policy – Inflation Reduction Act, Redeterminations, new risk models, and more

- Tactical tidbits – other notable partnerships, deals, and strategies

Big-Picture Trends in Medicare Advantage, ACA Marketplace, and Medicaid will drive the 2024 healthcare landscape forward

Following up my part 1 report on vertical integration dynamics, much of what’s occurring across government health insurance programs ties into the vertical integration trends, and ties into where investment dollars are headed in 2024. Here’s what happened, and where we’re headed across Medicare Advantage, ACA marketplace, and Medicaid.

Medicare Advantage: The Bigger Picture entering 2024

Medicare Advantage (MA) is both growing from a demographics perspective, but seeing headwinds from a policy and reimbursement lens. At a high level, here’s what’s going on with MA in 2023:

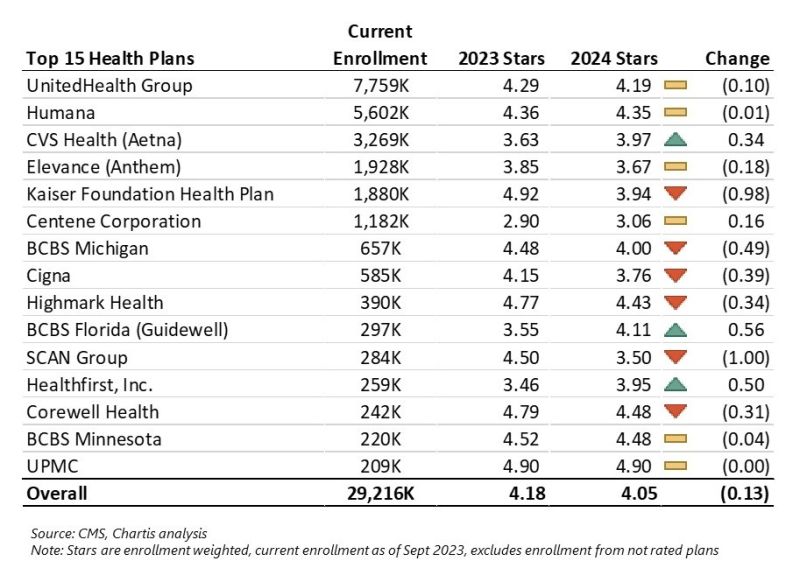

Star Ratings Decline for second straight year: After a decline in Medicare Advantage star ratings last year, many MA plans saw further star ratings declines. Here are some highlights and tidbits from the data published in late 2023:

- About 42% of Medicare Advantage plans that offer prescription drug coverage in 2024 earned four or more stars, compared with just over half this year. (Link)

- Many traditionally high-performing nonprofit plans performed poorly.

- “The market’s average star rating fell to 4.05 (4.04 per CMS) which is the lowest it’s been since 2017” – from Nick Herro’s excellent breakdown and table below (posted on LinkedIn).

- Full list of MA plans and star ratings here

Risk Adjustment Changes: Significant changes to risk adjustment by adopting Model V28 will leave some risk bearing organizations out to dry and lower overall risk scores in 2024 and beyond.

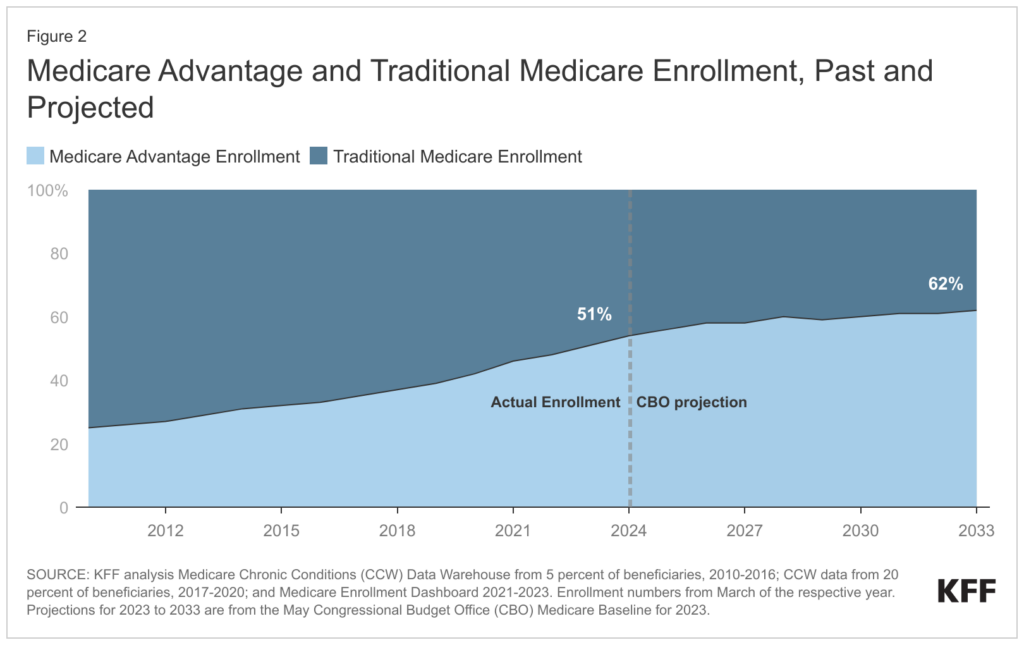

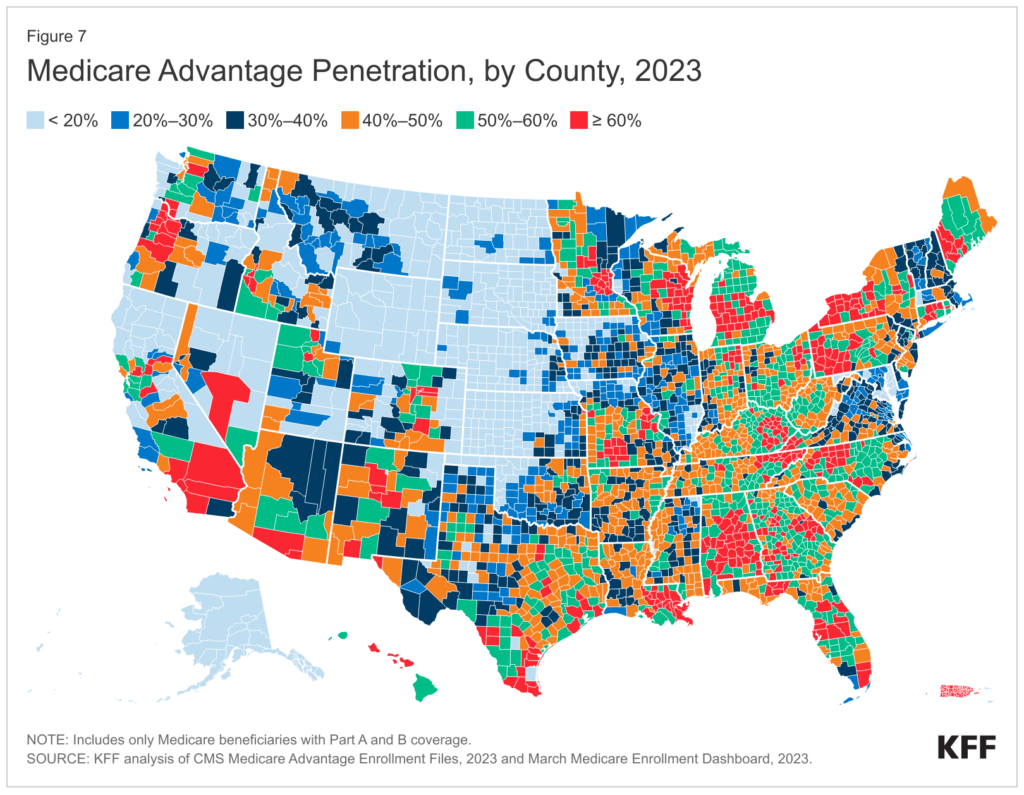

Medicare Advantage Penetration: MA plans as a % of all Medicare beneficiaries is greater than 50% – depending on the source you look at, around 51%, meaning an increasing number of folks reaching age 65 are picking the privatized version of Medicare.

RADV Audits are a $4.7B headwind: After finalizing its controversial RADV audit rule, CMS plans to claw back a total of $4.7B between 2023 and 2032. CMS is estimating that RADV payments will hit $468M per year, ramping up to $702M by 2032 and baking in the RADV adjustment into overall reimbursement to Medicare Advantage plans. Moving forward, CMS will look to audit ~5% of MA plans, or 30 contracts per year. That could reach a more significant percentage if consolidation happens in the MA space. Naturally, Humana thinks this methodology is unfair and is suing HHS over this development.

Spotlight on Humana for Medicare Advantage Activity in 2023

As a mostly pure-play Medicare Advantage player, Humana was one to watch in 2023. So what kind of signals did the $50B+ payor put out for the rest of us to consider?

In February, Humana called it quits on the employer group insurance business altogether. The segment includes all fully insured, self funded, and Federal Employee Health Benefit Medical plans.

Humana also holds an existing joint venture with well-known primary care player ChenMed called JenCare. In August 2022, this JV was rumored to be up for sale by ChenMed. More recently in 2023, Humana extended existing network agreements with ChenMed through 2028 which included JenCare.

A year prior, in 2022, Humana really dug in on the MA front. Starting in January, Humana announced expansion of CenterWell’s senior primary care footprint into several new markets and 26 new centers. Following that, Humana doubled down on CenterWell with WCAS by forming a second joint venture with double the capital contribution. The new JV is deploying $1.2B in capital to develop 100 new CenterWell centers between 2023 and 2025. Humana also developed senior clinics with Cano Health as well and was rumored to be interested in buying the senior clinic operator late in 2022.

Humana now holds the largest operation for senior-focused primary care services in the country – at a time when Medicare Advantage plans require patient engagement and satisfaction more than ever to move the needle financially.

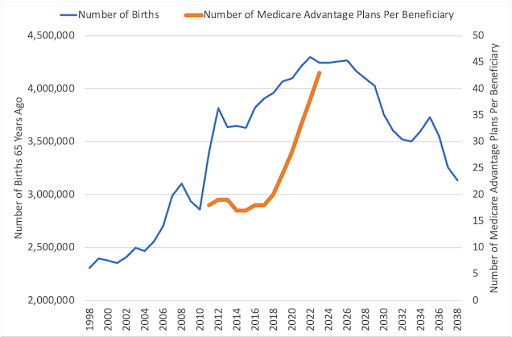

So while these clinics are breakeven to losing money today in their initial cohorts, Humana has a fantastic capital partner in WCAS and is well ahead of the curve for the future of healthcare services demand (AKA, senior-focused Medicare clinics) by 2030 – which, if you recall, is when a fifth of the country will be 65+. At that point, the 300+ clinics will have reached financial and operational maturity with nice platform contribution.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Long term, Humana is poised to win – and win big – in Medicare Advantage. The problem is…Medicare Advantage is facilitated by the government, and Humana lacks diversification. So what’d it try to do? Merge with Cigna near the end of 2023. Like I mentioned in Part 1 of the year in review, HumanCig was called off within 2 weeks of the rumor mill starting, but it’ll be interesting to see what, if anything, Humana tries next.

Broader implications in Medicare Advantage:

Like I mentioned in the predictions piece I wrote with Parth, it’s worth considering whether the Medicare Advantage gold rush is over. As the Baby Boomer demographics wind down, we should expect to see consolidation, more crackdown on M&A and risk adjustment, and finally the potential for increased regulation around reporting requirements for vertically integrated MA plans. Not to mention insurers are shooting themselves in the foot by doing the aforementioned shenanigans – wrongful plan denials, algorithmic case decision-making, ProPublica’s investigative series into insurers. These dynamics combined lead me to believe a crackdown is coming. Maybe not in an election year, but soon

Plans will tighten up after rate notices shrivel (the Medicare funding cliff and all that) while the demographic tailwind decelerates. The inevitable narrow networks will form leading to patient and provider frustration, and health systems will tighten their reins. Not only will we continue to see evergreen payor-provider contract dispute headlines increase, the health systems with the means to do so will offer their own plans within their populations, you have to think that patients start taking a look at their MA plan – offering less and less over the years – and feeling trapped. The slowdown of MA penetration may be closer than we think – or is set to shift in some material way.

ACA Exchange Market has Reached Maturity, Companies Focused in Space will Outperform

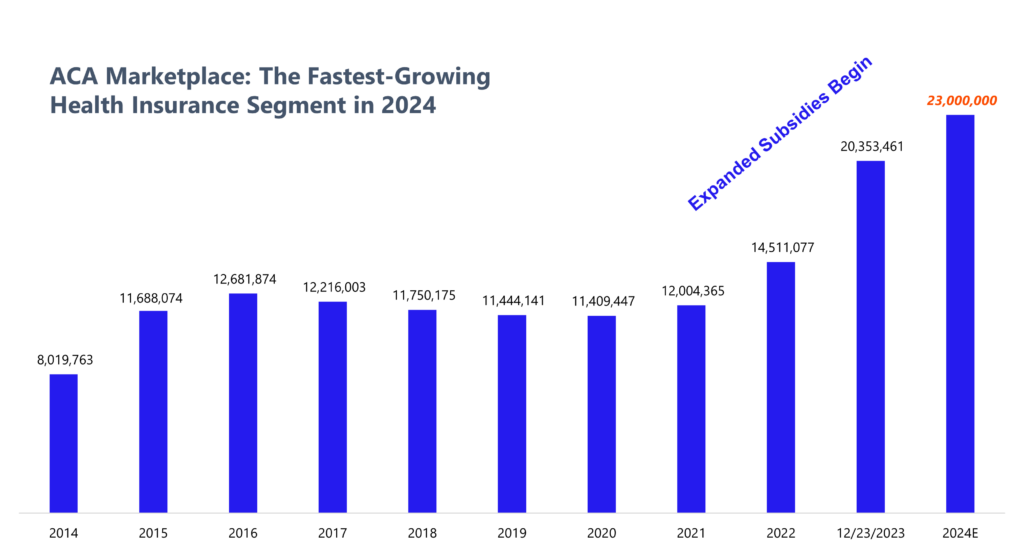

Moving on to the Marketplace, this is the most interesting segment of health insurance to me entering 2024. As of December 23, ACA marketplace enrollment sits at 20+ million individuals, and is expected to approach 23 to 24 million individuals for 2024 once enrollment ends in mid January. That’s a huge leap in overall enrollees (nice breakdown here from a month ago of growth drivers).

In 2024, the ACA Marketplace is the fastest growing segment in health insurance.

Main drivers of growth in the ACA Marketplace from 2023 into 2024 include:

- Expanded subsidies from the American Rescue Plan, extended by the Inflation Reduction Act thru 2025 (75%+ of ACA enrollees benefit from the government footing at least part of the bill);

- Medicaid Redeterminations boosting ‘off-season’ and current enrollments as things wind out; and

- Non-Expansion states driving outsized enrollment growth (Texas, Florida)

Assuming things hold to the trend, overall marketplace enrollment in 2024 is going to see upwards of 20-25%+ growth from 2023. And that growth holds significant implications for players betting on the exchange (Centene, Oscar, others), and associated downstream trends (ICHRA).

When looking at trends in the ACA, two of the more interesting players to look at are Centene (with a massive existing market share) and Oscar (on an NCAA March-Madness style Cinderella comeback bolstered by marketplace growth). CVS also had some footnotes for Marketplace presence in 2024 and beyond, and even health systems can get in on the action. The bottom line here is that the ACA Marketplace has major federal support, and there are 20,000,000+ people on it in 2024. It ain’t going anywhere.

Multiple payors pointed to the exchange as a growth driver for their overall portfolio:

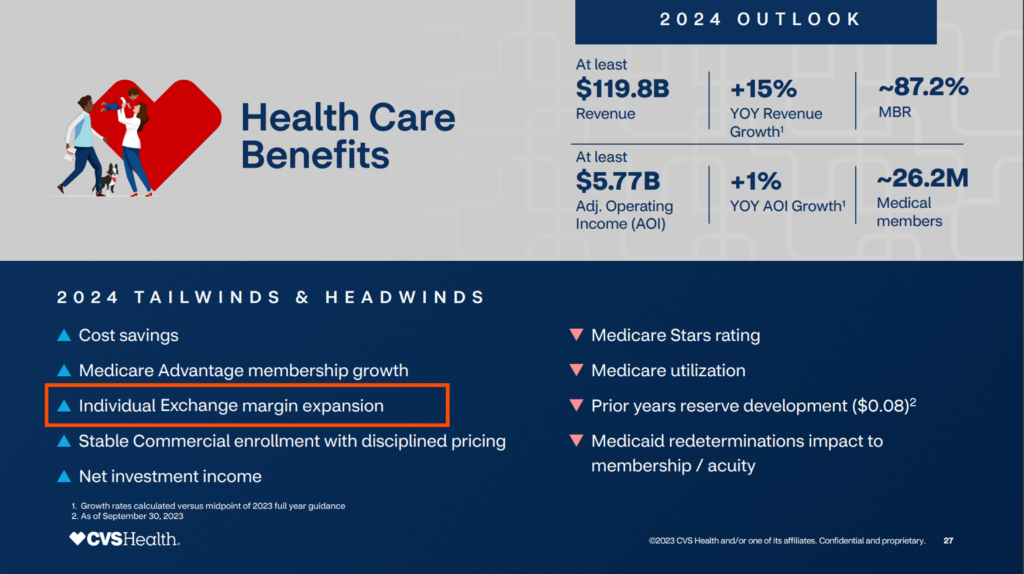

CVS noted the individual exchange as a 2024 tailwind during its investor day:

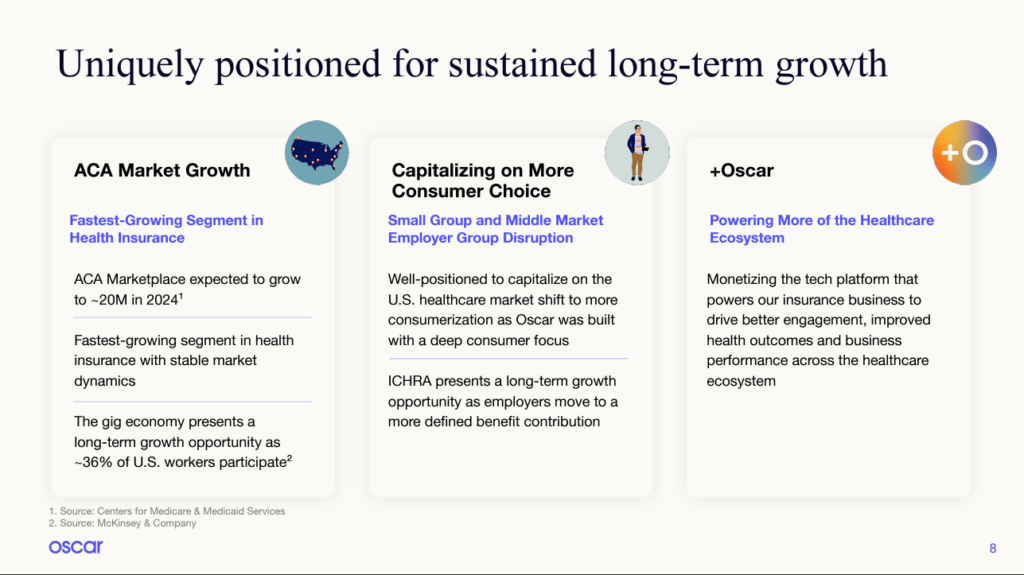

Oscar Health is expecting profitability in 2024 amid Marketplace growth and a high interest rate environment as a buoy to support cash flow (e.g., interest rate float). Oscar’s CEO Mark Bertolini also had some fascinating comments during JP Morgan about Oscar’s turnaround and opportunities for the insur-tech in 2024:

“We expect that we will have 1.3 million members when open enrollment is done. That is a 31% increase in membership and if you exclude the California exit, it’s a 38% increase overall year-over-year. So double the market.”

“Our first market opportunity will be in ICHRA. We believe ICHRA’s time has come. We believe we have a different approach than most other people in that marketplace, but that will give us an advantage in growth in 2024 and 2025.”

“So this ICHRA product is a huge hedge for employees, and we were trying to control the inflation on their costs. So it’s a macroeconomic opportunity. So we think that makes the individual market larger”

“So if you go back to 2007, when we were worried about the next election and what would happen to Medicare Advantage, all of us in the industry said, if we can get to 20 million lives, they can’t shoot it. It’s just too big to kill. And we’re going to get close to that this year. So I think it’s here to stay. I think the individual market is going to continue to grow.”

Spotlight on Centene as a major Marketplace Player

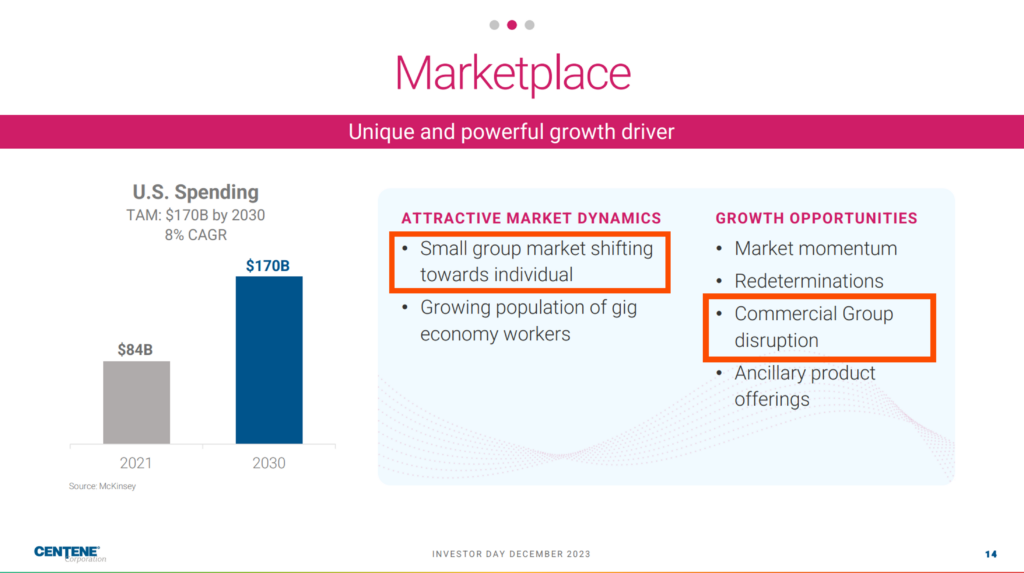

Turning to Centene, as the biggest player on the exchange, Centene’s commentary during its 2023 investor day was particularly notable, diving into ICHRA, market presence, and fundamental growth of the Marketplace.

- “The remarkable expansion we’re seeing in this market is exciting, and we believe it is just getting started. ACA marketplace spend is expected to grow to $170 billion by 2030, representing an 8% CAGR.”

- “As the commercial insurance market continues to evolve, disruption of the small group market via individual coverage health reimbursement arrangements, or ICHRA’s, present Centene with the potential to widen the aperture. Over the long term, we believe that consumers’ desire for individual choice, customized products and flexibility. In addition to employers’ desire for budget predictability will drive increasing momentum into the individual market. What does this mean for Centene? Put simply, it means that 45% of the health insurance market currently under an employer group model is a long-term disruption opportunity.”

- “the Marketplace is no longer a little brother or sister of Medicaid.”

To that end regarding its bullishness on ICHRA, Centene touted its partnership with ICHRA specialist & leader in the space Take Command (which recently closed a $25M Series B) and also thinks ICHRA’s setup makes the individual market more palatable for brokers:

- Centene’s Marketplace business currently covers roughly 13,000 ICHRA lives. To further grow this business in a planful way, we entered into an alliance agreement with Take Command Health, the nation’s most experienced and successful ICHRA administrator. We plan to enter the Indiana market in 2024 with a new ICHRA product targeting both small and large employers.

- As carriers abandon the small group market, a legion of brokers are looking more seriously at the individual market, and they’re bringing their installed books of business with them.

- there is an emerging disruption opportunity through ICHRA for the large group market or an accelerated group migration that could further goose the total addressable market and therefore, the growth rate of Marketplace.

Centene is also expecting the government to expand ACA subsidies in 2025 given the extreme reliance on them for Marketplace affordability (side note that this dynamic is also a potential existential headwind):

- “Next year, we hope to see solidifying support and demonstrate the tremendous impact these [ACA tax] credits have had in helping connect lower-income people with affordable quality coverage. 2024 open enrollment is off to a strong start, and CMS is reporting almost 1 million sign-ups from people new to the Marketplace. This success makes a strong case for expansion before they expire — for extension before they expire at the end of 2025, given that around 90% of enrollees rely on the tax credits for affordability. Now we do not expect an extension to pass in 2024 as the federal government tends to usually wait until expiration dates are imminent before major action. To that end, eAPTCs expire at the same time as the Trump Tax Cuts, creating an opportunity for both parties to work together on an end-of-year package in 2025.”

Finally, I also wanted to include some UnitedHealth Group commentary on the Marketplace as well as our resident Healthcare Overlords: “Our individual exchange offerings continued to grow in 2023, driven by strong retention of our existing membership and expanded growth among consumers across the country…In 2024, we are expanding the availability of our individual exchange plans to more than 400 new counties and four more states, such that we will serve people across 26 states, and expect to add more geographies in the coming years.”

Now of course, the biggest question facing the Marketplace is whether this enhanced governmental support will continue. Say, if Republicans win the election, will they support future ACA subsidies? Given that enrollment is above 20 million (a magic number according to Oscar’s Bertolini) and that individuals on marketplace plans are also in Republican constituencies, odds are that lawmakers will continue to throw cash in the ACA’s direction.

Translation: Despite it all, the ACA is here to stay.

Medicaid: Redeterminations Dominate Headlines, but Significant Investment Dollars and Opportunities Emerge in the Space

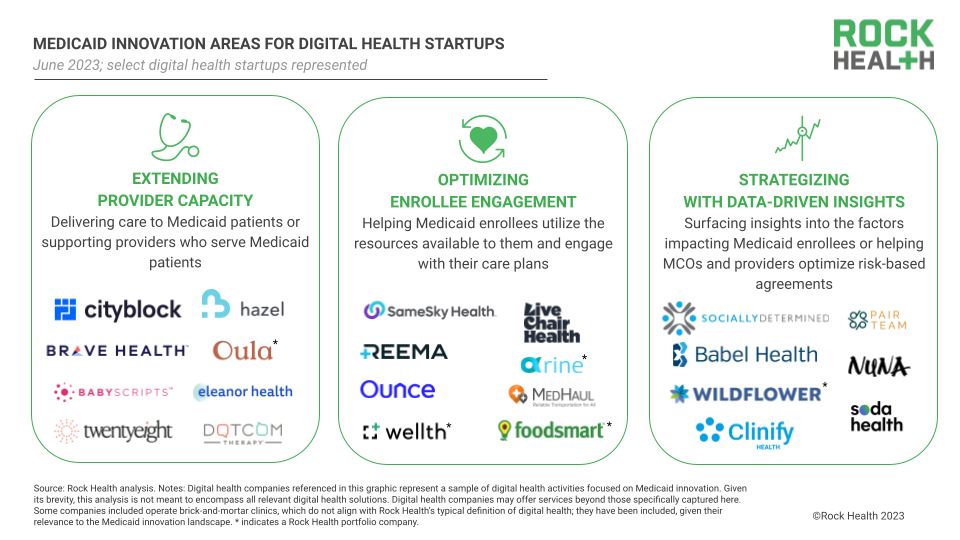

2023 was a year of accelerating interest in Medicaid. This Rock Health piece encapsulates the movement well, characterizing Medicaid as “one of the most promising arenas for digital health activity…”

But let’s recap what happened to Medicaid from a policy perspective throughout 2023 to set the stage.

- In 2022, Congress signed the Inflation Reduction Act which included extended subsidies for the exchange;

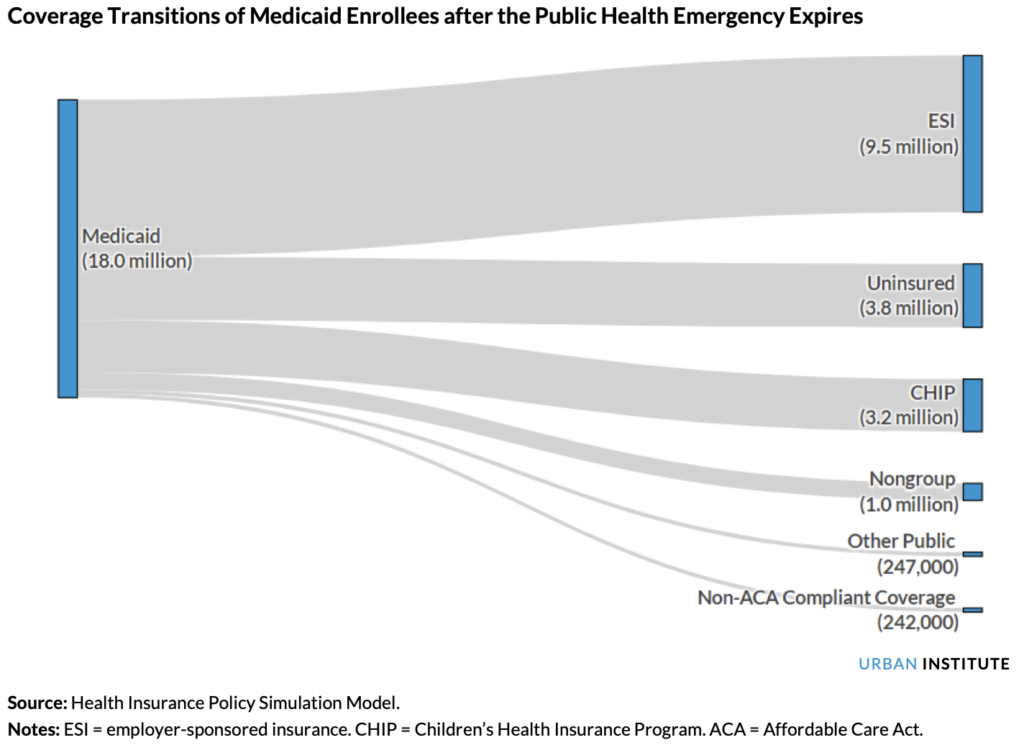

- In May 2023, Health and Human Services ended the Public Health Emergency, triggering a cascading state-by-state unwinding effect and putting coverage for 18M+ Americans up in the air;

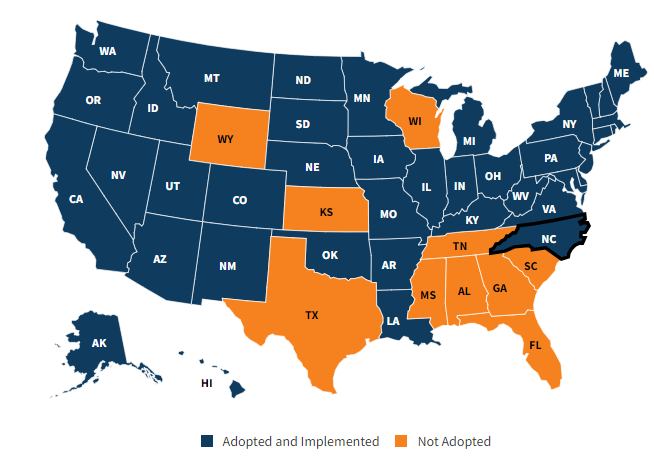

- Throughout 2023, we saw a few states expand Medicaid, meaning individuals with income up to 138% of the poverty line can gain Medicaid coverage. Medicaid coverage began in December in North Carolina, providing Medicaid to 600,000 new individuals, while South Dakota extended coverage in July to 52,000 South Dakotans (who knew they were called that?).

In total, per that linked KFF analysis, 41 states have expanded Medicaid with much of the Southeast still opting out:

Meanwhile, while states expanded Medicaid, we also saw fallout from the end of the Public Health Emergency in May. The freeze on Medicaid insurance coverage thawed out. As a result, millions of Americans lost Medicaid coverage over the course of 2023 during each state’s so-called Medicaid Redeterminations. While there were (are) plenty of ongoing clerical and administrative issues involved with figuring out their current eligibility, folks are finding their ways back to either Medicaid, the ACA exchange through aforementioned subsidies, or employer sponsored plans. Overall, redeterminations affected 18 million individuals and naturally resulted in net enrollment losses to the program overall despite ACA subsidies. We should expect to see the uninsured rate creep up once those numbers go public in 2023.

In 2024 and beyond, we’ll see more attention on the Medicaid space as the Medicare Advantage arena crowds out.

As of September 2023, 88,414,771 individuals are enrolled in Medicaid/CHIP nationwide, comprising a ~$730B market split up into 52 state Medicaid agencies, 7 national Medicaid health plans, and 451+ state managed care organizations.

Medicaid is tricky, to put it mildly – while MA has some uniformity from a national perspective, states use their Medicaid dollars in different ways. For instance, maybe favoring more mammograms in one state or whatever the programs and initiatives might be, or providing one-off block grants for certain programs that may not sustain. This dynamic makes contracting opaque and hard to understand from state to state. But it also creates regulatory capture – a barrier to entry – that players with the right niche can capitalize on, and even become the fastest growing company in the US.

Players like CareBridge (the aforementioned fastest growing company in America), Cityblock (generates $1B+ in revenue), and Main Street Health (raised $315M in 2023) all have reached unicorn status in Medicaid. Meanwhile, there are plenty of interesting players to follow across the landscape, including Equality Health, Yuvo Health, newly-minted Fortuna Health, and more. The margins might be low, but the opportunities for success and innovation for the sake of patients are still there – and sorely needed.

Source: Unwinding the opportunity: Medicaid’s digital health moment: Rock Health by Leigh Kinney, Marnie Wallach, and Adriana Krasniansky

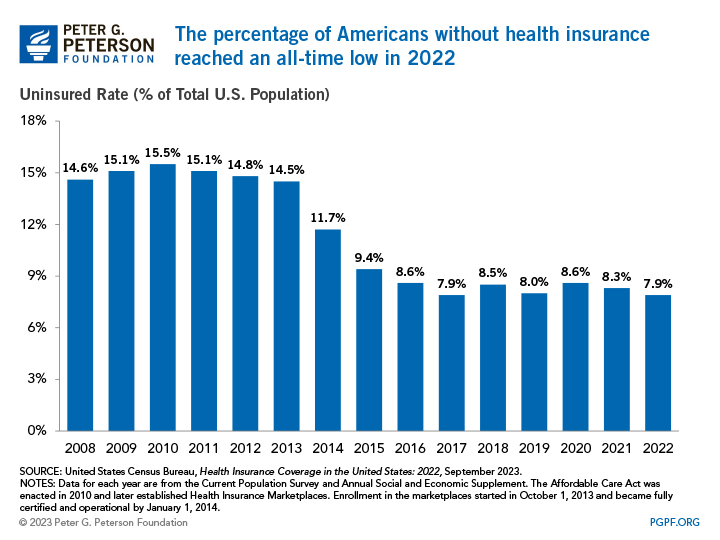

Uninsured Population sits at Record Low 8%

The Uninsured population hit a record low of 26 million people, or ~8% of the total U.S. population. It’s the lowest % number ever, and I imagine that number will continue to trickle downward given the trend over the past decade.

If you’re uninsured at this point it’s pretty much because of affordability (64% say they can’t afford insurance) or undocumented status, but the 26 million is still a significant part of the population. I wonder what the demographic makeup is of these folks and if there’s a compelling business opportunity to serve them direct care given that the uninsured figure is expected to rise in 2023 from Medicaid redeterminations.

Source: THE SHARE OF AMERICANS WITHOUT HEALTH INSURANCE IN 2022 MATCHED A RECORD LOW

The Shifting plan landscape creates compelling opportunities in new segments

With all of the above activity unfolding in 2024, it’ll be interesting to watch various company bets play out. Will ICHRA get off the ground? How will Humana fare as pure-play MA? Who will dominate the fractured Medicaid landscape, and is domination even a possibility? Will Oscar and Centene find material success on the exchange? These are the spaces I’m watching this year.