Happy Thursday, Hospitalogists,

Two things from me before we jump in:

- Fill out this survey. I’m launching a referral program soon and want to make sure the rewards are chock full of stuff that you guys actually want (not a mug…I mean unless you want a mug)

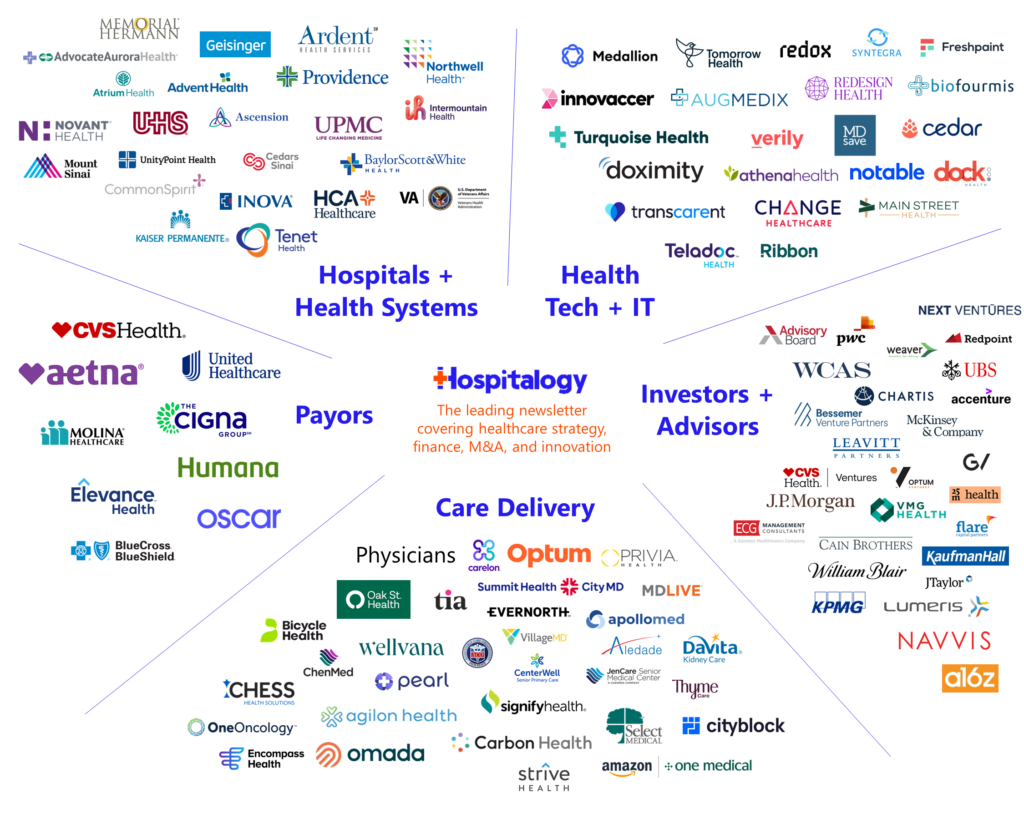

- Sign up for my virtual event with Freshpaint happening today at 2pm ET discussing how marketing leaders can survive a HIPAA world – current regulations & guidance happening in real time, how you can move the needle forward without shutting off digital marketing altogether, and more useful best practices. Register here, even if you can’t make it!

Onto today’s essay, which is a nice blend (pun intended) of sci-fi and healthcare, and a commentary style send this time around! If you’re new here, consider subscribing to Hospitalogy.

Who Controls the Healthcare Spice?

I’m an avid sci-fi fan (currently re-reading the Red Rising series), and if you’ve read the most popular sci-fi series Dune, you’ve heard of the spice – a scarce resource called melange. Among other powerful cognitive abilities, melange grants long life, and most importantly, it enables interstellar travel and therefore commerce between planets.

Spice in the Dune universe is an incredible economic commodity – so, whoever controlled the planet Arrakis, the only place it’s found in nature, held vast wealth potential. To put it simply, Spice represents an extremely valuable, unique resource with scarce distribution. A monopoly that even puts Surescripts to shame.

Melange holds several parallels to real-world ideals. The Spice represents control and dependency. As those in the Dune series learn, as you take Spice, you grow dependent on it – addicted to it, like a poison. And if someone controls what you need to survive, you’re completely and utterly at that person’s, or entity’s, disposal.

In healthcare, melange exists in a simple, abstract form: relationships. And relationships, while not as powerful as providing the ability to conduct interstellar commerce, are why a Medicaid care coordination and management company – CareBridge – came to be the highest growth private company in the U.S.

How the Spice Created the Fastest Growing Company in the U.S. – in Medicaid

On August 15, Inc.com released its list of the fastest growing companies in America, and something unique caught my eye.

Topping the list – at the numero uno apex, was a healthcare company. One of healthcare’s latest unicorns also happens to be the fastest growing private company in the U.S. – CareBridge.

And not only is that company in healthcare – it operates in Medicaid! The company realized that the current state of administration and management for those who receive long-term care in the home (Managed Long Term Services and Supports, or MLTSS) was…dismal. And so they set out to fix that. CareBridge emerged from stealth in 2019 with $40M in funding, setting up advanced analytics and support for high acuity patients.

4 years later, it’s on pace to hit $2.5B in revenue.

- In 2019, the two men co-founded CareBridge, a value-based health care management company whose revenue expanded a feverish 157,144 percent last year, to nearly $873 million, putting it atop the 2023 Inc. 5000. With revenue likely to surpass $2.5 billion this year, CareBridge may have a chance to defend its title. That’s because some of the country’s largest health insurance companies are hiring CareBridge to care for Medicaid patients who receive home and community-based services.

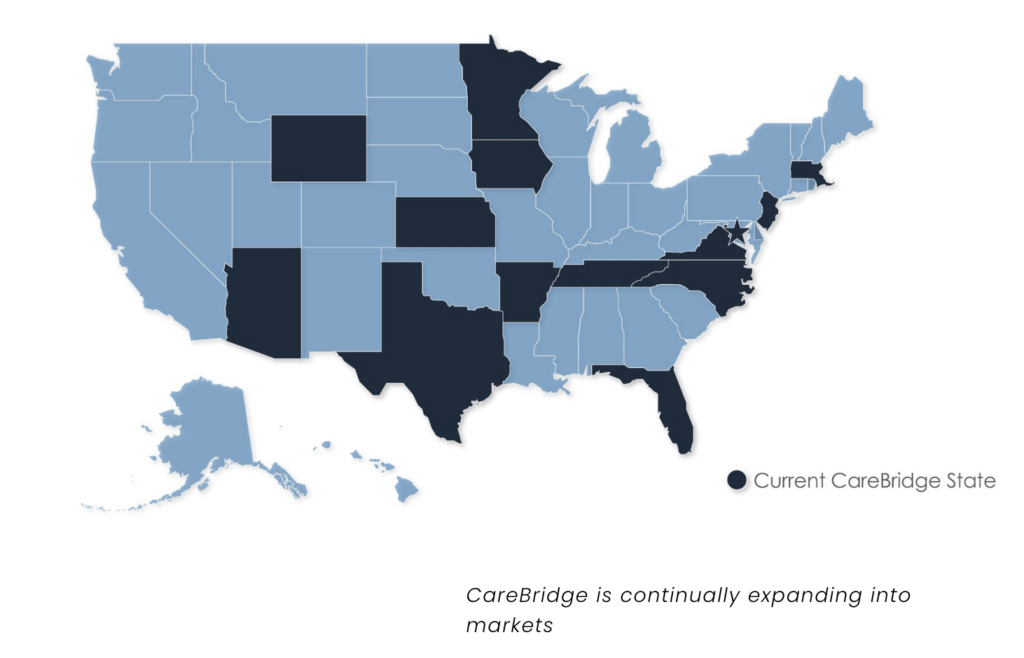

You might ask yourself: “How could a company operating in Medicaid expand so drastically, to the point that it hit $873M in revenue last year and is on pace for $2.5B this year?” The answer lies in the fact that CareBridge holds the Spice, and incumbents have already chosen a winner in MLTSS. CareBridge executed a brilliant growth strategy and one you could argue was ..slanted in their favor. They identified a rising tide – highly fragmented Medicaid markets, and care coordination within those markets – and then simultaneously grasped control of the Moon directing the tides of MLTSS, which is a capitated Medicaid managed care program for home health & community services. An increasing number of states are picking up the MLTSS program, and CareBridge caught the wave at the exact right timing.

Then CareBridge seized the entire market.

In June 2022, CareBridge raised a $140M Series C and the firm’s prescient strategy – riddled with Spice – laid bare for us all to see. From the Fierce article:

- “Existing investor Oak HC/FT led the financing round. The company also has gained the backing of four of the nation’s five largest managed Medicaid plans: Optum Ventures, CVS Ventures, Anthem Inc. and HLM Venture Partners. Together those organizations serve nearly 60% of all Americans receiving home and community-based services.”

In one fell swoop, CareBridge secured financing from the 5 most influential organizations in its arena. That’s a hell of a close.

- “But health care produces data–measurable outcomes. And the initial data on CareBridge’s performance was so compelling that the owners of four of the largest managed Medicaid plans–Elevance Health (formerly Anthem), UnitedHealthcare, Centene, and Aetna CVS–took a piece of CareBridge’s $140 million Series B funding round last year, helping push CareBridge’s valuation past $2 billion. These payers, as the big health insurers are known, are also CareBridge’s biggest customers, and they are moving the company into 30 states where they have won Medicaid contracts.”

Dang, that must have been some incredible data.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

The final question you might ask is “Does CareBridge deserve this success?” In no way am I discrediting the hard work or actions of internal management in identifying key healthcare problems, developing interesting analytics and solutions to address those problems. And on top of that fact, it’s very plausible that CareBridge has a secret sauce we don’t know about, allowing it to outperform other competitors in its arena and leading to the managed care giants selecting CareBridge over other solutions in MLTSS.

But there’s a simpler truth, too – and these truths can coexist. The bigger picture lesson for investors and founders: in many instances, winners have already been selected by insiders who influence the puck’s movement in various corners of healthcare. It’s the Spice’s secret. At all levels, the business of healthcare – and to be sure, business in general – is driven by relationships, and CareBridge’s relationships were key to the growth of its operation along with won contracts in the MLTSS space. To its credit, CareBridge leveraged the Spice efficiently: identify the market, the policies with tailwinds, build for that segment, influence the direction from the inside, and then win the space. It’s not some grand conspiracy – it’s reality for healthcare startups, especially when you’re going up against industry juggernauts and former influential government officials.

- “Smith, the former director of the Center for Medicare and Medicaid Innovation (CMMI), moved over to CareBridge last year as he feels the company is filling critical gaps in care delivery.”

This write-up isn’t meant to be some hit piece on CareBridge, although I know it seems as if I have some agenda to pick on them. I do not. I want CareBridge to succeed in its mission and innovation in Medicaid along with better care coordination and patient communication is sorely needed. It’s not all about topline growth, especially in capitation (even though that percentage growth seems appealing). Medicaid is a slog across states, member churn, and vastly differing markets. Even when you succeed, you grind out a tough, low-margin business, even at scale. Kudos to them for recognizing this problem and working to address it. But time will tell as to whether the CareBridge data truly was that compelling – or, whether it’s simply a vehicle to funnel dollars from Medicaid into managed care giants. Finally, once CareBridge has scaled across 60% (assuming that this is the case), we have another natural monopoly on our hands, dictated by the BUCAs. An incredible business model, but perhaps not the best path forward long-term.

Remember that the best product does not always win. In any industry, to be sure – but definitely not in healthcare.

SPONSORED BY MEDALLION

Mark your calendars for September 20th!

Medallion, the all-in-one provider network management platform, is back with their annual virtual conference, Elevate. Tune in for a curated agenda full of insights for healthcare leaders to better understand the latest happenings across the industry is waiting for you.

Join experienced veteran panelists from Optum, Oak Street Health, and more as they tackle operating challenges head-on. You’ll receive strategic insights on topics like reimagining provider retention, revenue protection in the midst of uncertainty, and the future of the industry.

Don’t miss this opportunity to explore the ever-changing healthcare environment and turn challenges into operational excellence opportunities alongside fellow healthcare executives.

Sign up now and elevate (ha) your healthcare expertise!

Is the Spice a Problem?

The problem with melange on Arrakis was its highly addictive qualities. Those native to Arrakis couldn’t survive without the Spice for long – and neither could the Spacing Guild. Ironically, the Spice that grants amazing prescience and other superhuman qualities…is also poison. the spice is “[a] poison—so subtle, so insidious… so irreversible. It won’t even kill you unless you stop taking it.” In Dune, melange is responsible for creating genetic abominations, and civil and interplanetary war. As the Spice gives, so it takes away.

CareBridge’s growth is an incredible feat. Again, as I’ve pointed out, I don’t want to discredit that fact, nor take away anything from the firm recognizing a real, pressing problem in Medicaid and serving patients across states that had previously existed in a fragmented, broken state. I just want to point out that the numbers and the meteoric rise simply raise yellow flags for me. CareBridge has taken the spice: but the larger problem here is a person (or people’s) outsized ability to influence healthcare markets, or pick the winners in an eerily predetermined way.

As government officials ping pong between public agencies and private companies, the Spice in healthcare spreads. Policy and decision-making gets influenced. Many times this influence gets exerted over the tiniest corners of healthcare without notice. And in this sits the true power of the spice in healthcare.

“It’s the systems themselves that I see as dangerous. Systematic is a deadly word. Systems originate with human creators, with people who employ them. Systems take over and grind on and on. They are like a flood tide that picks up everything in its path.” – Frank Herbert

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 20,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)