This edition of Hospitalogy is sponsored by DOCK HEALTH.

Your clunky dashboards are failing you.

You need better processes, faster alignment across teams, and more access to data-driven insights to push your organization forward in 2023 and beyond.

And I know for a fact your innovation team is scrambling for a solution to simplify error-prone, complex processes costing real dollars and hurting patient care.

Dock Health is a future-proof, all-in-one solution to help you outperform growth targets.

Through Dock, healthcare enterprises can do better, and more than ever before:

- Manage market intelligence and strategy through unique concrete data sets

- Insights into organizational bottlenecks and inefficiencies to predict risk

- Opportunities for workforce optimization and/or growth

- Consolidation and integration of technologies for compounded learnings

All the while cutting significant admin time.

You can either fall behind with your legacy administrative structure, or optimize your organization for future success. Try out Dock’s demo risk-free today.

Introduction: The Oscar Odyssey

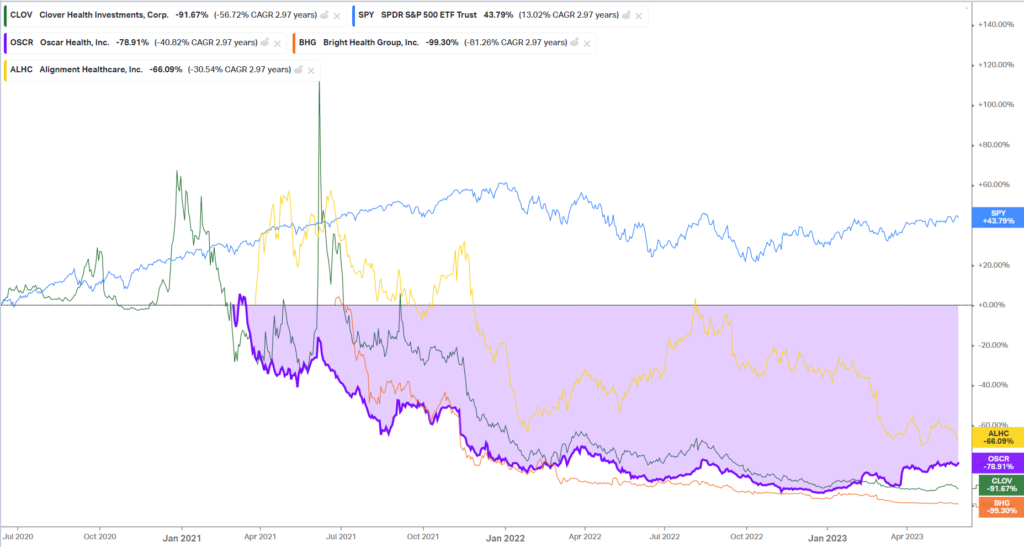

We all know that many health tech names have struggled since going public. Insurtechs have been no different, as an incredibly difficult industry to crack for a new entrant:

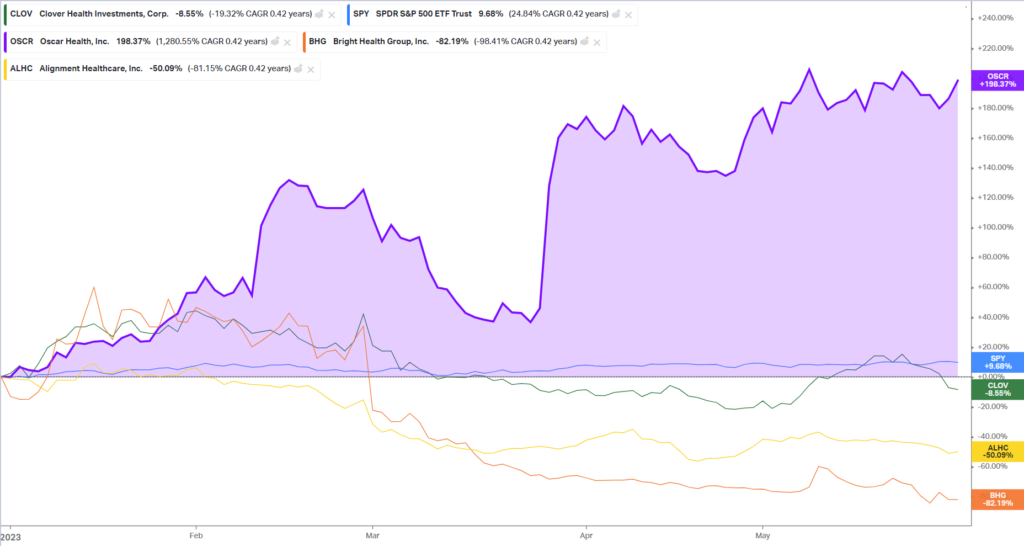

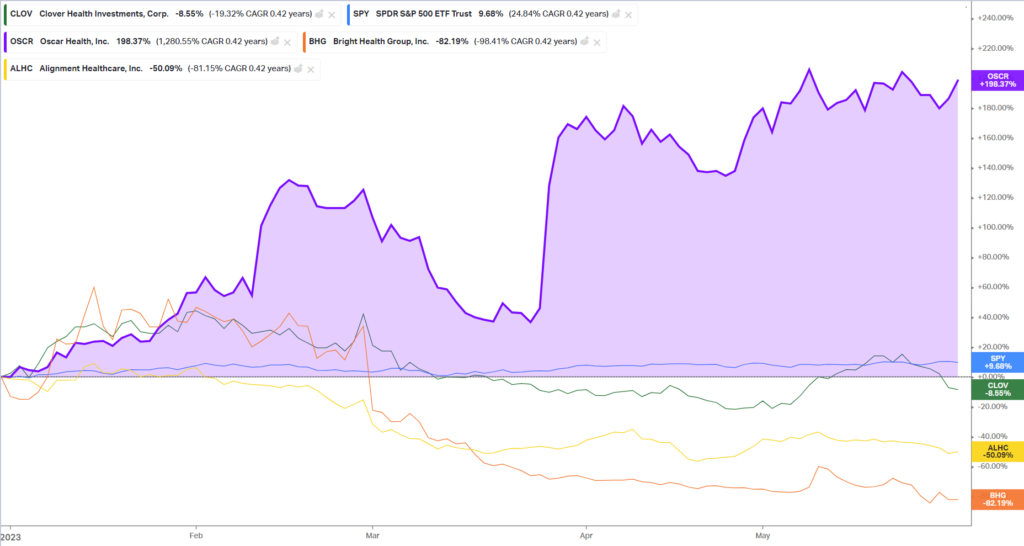

Yet I was perusing the inter-webs a few weeks ago as we content creators do when I noticed an interesting development. A resurgence. Oscar Health, stalwart of the healthcare insurtechs, outperforming its peers by a significant gap in 2023, up almost 200% year to date (albeit on a much smaller base):

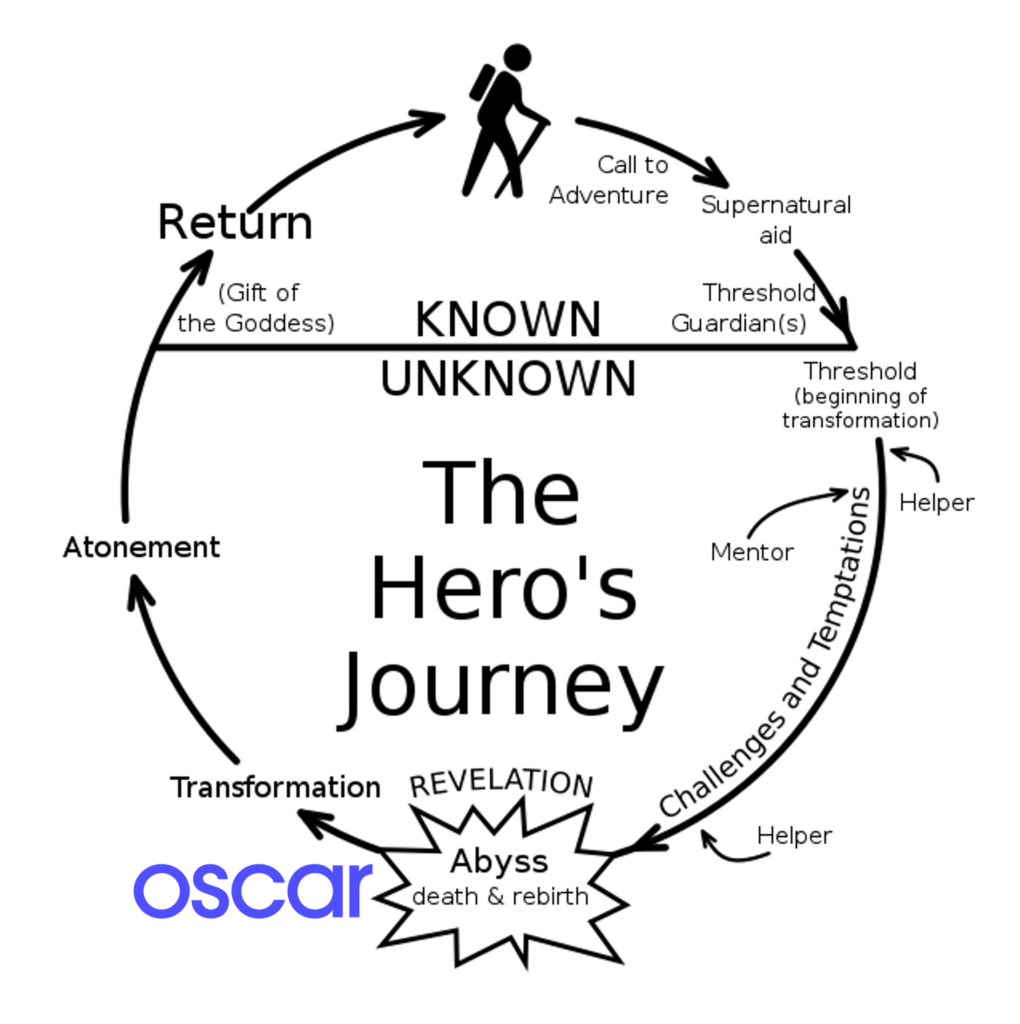

I’m a sucker for epic fantasy adventures. And so, for that reason, I wanted to dive into the Epic of Oscar Health over the coming weeks and how Oscar’s journey parallels that of the classic Hero’s Journey. When it’s all said and done, the Epic of Oscar may rival that of Homer’s The Odyssey.

Today we’re diving into Oscar’s beginnings, its rise to public company, and then its fall into the abyss.

Next week, I’ll be taking a look at Oscar’s transformation and atonement for past transgressions, what’s on the horizon for the insurtech, and why, despite past slip-ups, Oscar could be poised for a return.

Oscar Health’s Journey

In 2012, Oscar Health started as a response to a shared frustration. The frustration that health insurance…sucks.

Co-founders Mario Schlosser, Joshua Kushner, and Kevin Nazemi recognized a critical gap in the market—healthcare was (is) confusing, opaque, and unapproachable for consumers. They took it upon themselves to reinvent healthcare with a tech-driven, patient-focused approach.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

The idea was straightforward yet revolutionary: ‘Let’s use tech and consumer-friendly interfaces to simplify health insurance and improve patient care. From there, we’ll grow our membership, achieve scale efficiency, and create a compelling competitor to the health insurance incumbents that exist today.’ A tall, but ambitious task.

At the core of Oscar Health’s thesis was its use of virtual care, mobile applications, and a simple user interface set it apart from traditional healthcare providers. It enabled patients to easily connect with healthcare professionals, navigate their insurance plans, and manage their health more effectively.

The insurtech launched in-step with the Affordable Care Act (ACA), selling insurance through the ACA’s exchanges. Through growth in the individual markets and strategic partnerships with health systems and other payors, Oscar hit revenue and member milestones quickly.

By 2016, Oscar had hit 135,000 members. That number grew to almost 230,000 members in 2019 and total gross revenues (before reinsurance) of over $1 billion. Over its first 7 years of existence, Oscar expanded from New York into 9 states and 14 markets by 2019.

By 2019, Oscar had reached a $3.2 billion valuation on over $1.3 billion raised. CNBC named it as one of the world’s top 50 disruptors in 2018 alongside names like SpaceX, Uber, and AirBnB. It notched major partnerships with health system players including Montefiore and Cleveland Clinic as well as payors including Cigna and Health First.

For a time, and with easy money policies, losses and valuation were justifiable as a private name funded by private capital in growth mode. But there were chinks in the armor along the way. Its ability to hit profitability in a tough market came into question as early as 2016. From the NY Times:

- “But for every dollar of premium Oscar collects in New York, the company is losing 15 cents. It lost $92 million in the state last year and another $39 million in the first three months of 2016. ‘That’s not a sustainable position,’ said Mario Schlosser, chief executive at Oscar.

Behind enormous topline growth, media attention, and capital investment (around $1.4B pre IPO), Oscar filed its S-1 and IPO’d on March 3, 2021 during the post-Covid peak of irrational market exuberance.

Hitting a peak of $39 / share good enough for a market cap of $7 billion+, Oscar was a hot commodity and held a powerful brand within healthcare and health tech (still does). A month after IPO, the firm launched its tech platform, +Oscar, to much fanfare, announcing that its partnerships with Cigna and Health First would use the tech platform to improve patient outcomes, care coordination, and administrative workflows. Oscar’s thesis as both a tech-enabled insurance company and tech platform seemed to be blossoming.

Falling into the Abyss

But as Oscar entered the public arena, the market turned on Oscar and other speculative growth names. With increased scrutiny, a desire for a path to quicker profitability, and the quarterly demands of a publicly traded healthcare company, Oscar hit major operating speedbumps.

Throughout 2021 and 2022, it became quickly apparent that Oscar and other insurtech names had been going the route of the prodigal son, chewing up capital by entering new markets and growing membership with reckless abandon. Macroeconomic conditions exacerbated the losses piling up, and Oscar wasn’t helping its image with investors.

Its growth strategy teetered like a whipsaw between touting +Oscar, entering Medicare Advantage, and achieving profitability in its core ACA business. Oscar presented odd, idiosyncratic operating metrics and spun everything – even dismal operating results – in a positive light, much to the chagrin of investors.

During one investor day, Oscar seemed to go all-in on its +Oscar platform as the next phase of the growth for the company, only to pause new implementations of the platform shortly thereafter. It lost a major contract with Health First, an MA plan with 60,000 members, over implementation struggles of +Oscar. From anecdotal, inside sources, I heard this implementation was a disaster to the point that +Oscar was unable to process claims or perform basic functions for the plan. Finally, Oscar’s MA presence, a massive avenue for growth for major incumbent players, is next to nonexistent.

On unsure footing, investors caught on to Oscar’s challenges. All of a sudden, they collectively understood they were throwing money at a health insurance company, an industry with capped profit margins and nuanced regulatory requirements, at multiples many turns above anything rational.

To put Oscar’s fall into the Abyss into perspective, Oscar lost 85%+ of its value in less than 2 years. After raising $2.7 billion +, it sat at a sub-billion dollar market cap as recently as December 2022. Peak disillusionment. Peak bearishness in health tech. And deep into the Abyss goes the hero of our story.

Can Oscar Reinvent Itself?

In October 2022 I wrote about why the health insurance space is a tough market to enter as a startup given major disadvantages to entrenched, well-capitalized incumbents in a game of regulatory capture. TL;DR, you need scale in the risk game. It’s not impossible, just very, very difficult, and a long journey (an epic, if you will).

Bright, Clover, and yes, Oscar, all faced a difficult operating environment further exacerbated by their own bad operating decisions. There’s no way around it – health insurance is a hard, nuanced business. I’m not going to pretend like I know the half of what goes on in the industry.

With billions of dollars raised, a rocky start to its public debut, and a seasoned exec in charge, Oscar the Hero is at a defining moment in its history. There’s still a long runway left for the organization as it works to entrench itself as a tech-forward health insurer fighting a scrappy battle against the Titans of healthcare (United, Humana, et al), large enough to rival their Greek mythology counterparts.

Still, there is reason for optimism on the horizon. Political and policy support for the ACA (subsidies and popularity of the program) are at an all-time high as new avenues for growth like ICHRAs increase in popularity. Growth in the ACA is high. And Oscar seems to be gaining its footing under new leadership and a more narrow, defined focus.

Plus, out of that initial Oscar crew sprang the Oscar Mafia, the little brother to the PayPal Mafia – some of the most talented folks across health tech today.

To its credit, Oscar quickly realized its issues and has since started to streamline its operation. Oscar presented a road to profitability for its core insurance segment, exiting both the Arkansas and Colorado markets in 2022, with plans to exit California in 2023. Oscar also shrank its footprint in Florida and noted that partnerships seem to be the best path forward in Medicare Advantage. The changes have seen positive results and a push in the right direction under the leadership of Mark Bertolini while still holding the technical expertise of Mario Schlosser.

In part 2, I’ll dive into what’s next for Oscar in 2023 and beyond. Don’t call it a comeback…yet. But, I’m cautiously optimistic.

Part 2: Oscar’s Transformation?

In Part 1, I left you on an epic cliffhanger in the story of the Oscar Odyssey.

Can our hero emerge from the abyss as a transformed champion?!

…that sounded like the start to a terrible epic fantasy novel.

But let’s pick up with where I left Hospitalogists in part 1 with regard to Oscar.

By the way, on Thursday, June 22, Ari Gottlieb and I are having a discussion around all of the latest insurtech happenings, including Friday’s shutdown, and what future companies can learn from the failures of the past. It’ll be a lively conversation filled with audience Q&A and interaction. Join us by signing up here!

Oscar’s current state of affairs

Checking back in with where we left off with Oscar in Part 1, the insurtech hit peak bearishness in 2023 after a long road:

- It had burned through billions of dollars in capital after raising money in an era of peak financial exuberance;

- It priced premiums to gain market share in new markets, but got toasted on the back end under the ACA’s zero sum risk adjustment transfer program;

- Its rollout of + Oscar implementation failed miserably, burning HealthFirst in the process;

- It operates in health insurance, an incredibly tough segment of healthcare with capped gross margins due to medical loss ratio minimums; and

- It wasn’t (isn’t) profitable.

And now Oscar is at an inflection point in 2023. It can continue its odyssey – its hero’s journey – to make health insurance a more consumer friendly experience profitably, or the firm might wither away under the pressures of the current economy.

I’ve outlined some of the bull and bear cases for Oscar below.

The Return of Oscar: Bull Case

Some reasons to be optimistic about a return to glory for Oscar.

Management Experience.

Perhaps one of the biggest reasons for the turnaround in Oscar share performance was its decision to transition its Co-Founder Mario Schlosser to the CTO role and bring in seasoned industry vet Mark Bertolini to lead the enterprise. In healthcare, Bertolini most recently led at the helm of Aetna prior to its sale to CVS in late 2017. So not only does the move bring in someone with major ties to the industry, to my investor mind, it also signals a sale as a down-the-line possibility for Oscar. And most interestingly, his pay is almost entirely performance-based:

- “And so we put together the comp structure, which I and Josh and Mario talked about was I don’t get paid until the internal people get paid. So my gets are above their strike prices. And then there’s a little bonus at the top if we get back to IPO. And I thought it’s a good way to do it. I’m getting less salary than I have in probably 20 years, but that doesn’t matter.” – Mark Bertolini, Bank of America Securities 2023 Healthcare Conference

To both of the points above, on the day of that announcement, Oscar shares jumped 50%+ and haven’t looked back since.

ACA Growth, and BUCAs Re-Entrance as a Signal.

The BUCAs are re-entering the ACA exchanges en masse, a market signal that sustainable, profitable growth is there for the taking in the space. United, Aetna, Cigna, et al expanding in the market, with UnitedHealth entering 22 state marketplace exchanges this year. Why, after rapidly exiting the ACA and getting their collective lunches eaten in 2016, would the BUCAs ratchet up growth in 2022 and 2023? Growing enrollment, Medicaid redeterminations, and subsidies.

Policy and Political Support for the ACA.

All policies and bipartisan support for the ACA signal that it’s here to stay. Congress extended ACA subsidies through 2025 as a part of the Inflation Reduction Act.

To add to this, the ACA is gaining bipartisan momentum, even in Republican states. Take Georgia as an example. When the ACA originally passed over a decade ago, Georgia lawmakers vehemently opposed it, going so far as to pass legislation to prevent the state from setting up its own health insurance exchange – EVER.

Welp, about a month ago, Georgia did a full 180 and is now setting up a state-run ACA exchange beginning in 2024. And this sort of arrangement is gaining steam in red states according to industry insiders I spoke with. As I understand it, you should expect other red states to follow this path under an emerging ‘states’ rights’ movement – i.e., states want more control over policy rather than letting the federal government run things for them.

Up to this point, we’ve only seen blue states follow this path under the ACA and ironically, states setting up their own exchanges fell under the original intent of the healthcare reform.

Big picture – seeing states like Georgia pass bills like these, or even Texas introducing exchange bills in both chambers of Congress is the clearest signal that the ACA will receive continued political support.

Finally, the growth of ICHRA, while a much more minor point on this list, is another data point in favor of the ACA sticking around.

Oscar’s Demise: Bear Case

Oscar’s bear case really revolves around a couple of key points.

Can Oscar hit its profitability goals?

The biggest question facing Oscar today on its odyssey is whether it can continue to hit singles and doubles, grow responsibly, and optimize its existing, leaned-up footprint. Can Oscar get the core direct insurance business to breakeven?

Oscar’s most significant bear case rests on this narrative. If, for whatever reason, Oscar can’t get the numbers to work right (e.g., continues to get risk corridors and adjustment wrong, prices poorly), Oscar will follow the path of other struggling insurtechs. I guess Bertolini could always sell to BUCA at that point.

Will investors believe the growth story?

Of course Oscar can skinny up and achieve profitability in core markets. But is it investable from that point? Is there a compelling growth story moving forward, and is that narrative believable after investors getting burned by both initial insurance growth objectives but also the + Oscar rollout?

To add to that point, is there a wider market appetite for insurtech investment in general given recent, high-profile failures and scalebacks from the likes of Bright and Friday Health Plans?

Conclusion: Hit the singles and doubles, not the home run

What can we learn from Oscar’s hero’s journey?

In healthcare, especially in an arena like health insurance or healthcare services, it’s much more important to focus on hitting the singles and doubles rather than pulling your back swinging for the fences.

Instead of pulling out your driver on the tight, narrow golf hole, aim for the wide part of the fairway with your fairway finder.

Focus on the day to day operations. Understand your core competencies, and have a thorough, comprehensive understanding of your market – like understanding how premium prices affect the type of member you’re attracting to your platform. For Oscar and others in health tech, at certain times, tech hubris gets in the way of good business decisions (e.g., “let’s rip out this insurance company’s entire tech stack since we know we can do it better”).

Sometimes the simplest solution is the right answer rather than doing it your own way and reinventing the wheel. In many arenas, we’re trying to reinvent the wheel.

In healthcare, patience is key. These executives and health plans don’t get to the top by taking massive risk. They get there by following the rules. And yes, some rules need to change, but we need to find a balance between attempting major disruption and status quo.

The singles, doubles, and even walks add up to a significant number of runs over time. And the keyword is time in healthcare. Execute today!

Will Oscar return to glory? Respond with your thoughts, and I’ll include them in the online version with Akiff’s response below (with any attribution as desired, can also be anonymous!)

Subscriber Commentary

Just read your Oscar series part 1! Good stuff and liked it. As someone who was there relatively early (2016-2018) I’ve definitely seen the bumps and obstacles. Always was concerned it was over hyped and market seems to agree. I think ACA is a tough game to play and the real game becomes risk adjustment. Navigating care within a narrow network sounds cool but very very hard to do (esp in geo outside of nyc) – Akiff Premjee

That’s it for this week! Subscribe to Hospitalogy to dive deep into the business of healthcare along with 25,000+ seasoned healthcare professionals from leading organizations.

Resources + Field Notes

Oscar beginnings, recent happenings prior to IPO https://www.beckerspayer.com/payer/10-things-to-know-about-oscar-health-a-view-of-the-company-6-years-after-its-founding.html

INSURTECHS VS INCUMBENTS: WHY BRIGHT, OSCAR, AND CLOVER STRUGGLE TO COMPETE WITH THE HEALTH INSURANCE TITANS https://workweek.com/2022/10/13/insurtechs-vs-incumbents-why-bright-oscar-clover-struggle/

Oscar S-1 analysis Kevin O Leary https://kevinoleary.substack.com/p/kevins-weekly-health-tech-reads-27

Oscar’s S-1: why it matters https://caseload.substack.com/p/oscars-s-1-why-it-matters

Oscar launches + Oscar, tries to reinvent itself https://www.hioscar.com/press/oscar-health-inc-launches-+oscar-to-power-the-healthcare-ecosystem-through-platform-based-partnerships

Oscar loses Health First Health Plans, citing the complexity of an integration at such a massive scale. https://www.beckerspayer.com/payer/oscar-health-first-health-plans-terminate-60m-partnership.html

Oscar pauses + Oscar https://www.healthcaredive.com/news/oscar-health-stops-full-service-tech-deals/629566/

Oscar Health – The Health Insurance Startup That Wants To Revolutionise Healthcare https://www.the-digital-insurer.com/dia/oscar-health-health-insurance-startup-wants-revolutionise-healthcare/

Not Boring – the Oscar Puzzle https://www.notboring.co/p/the-oscar-puzzle