Welcome back to Hospitalogy!

Today’s post is a doozy, between all of the smaller announcements and Cigna-Humana on the horizon. Plus – executive jet stalking?? My kind of week in healthcare!

Upcoming content plans for Hospitalogy:

- HCA’s 2023 investor day & 2024 expectations

- UnitedHealth Group’s 2023 investor day & 2024 expectations

- 2024 predictions

- 2023 year in review

Have any content suggestions for 2024? Feel free to send em my way by replying anytime.

Thanks so much to Navina for sponsoring my first newsletter back from pat leave! Feeling fresh baby!

SPONSORED BY NAVINA

Clinicians are the heart of successful value-based programs.

But with rising administrative burdens, staff shortages, and burnout rates, how can risk-bearing groups keep clinicians engaged and aligned with value-based goals?

Navina is hosting a webinar on December 6 in partnership with the American Medical Group Association (AMGA): From Burden to Buy-In: Elevating Clinician Engagement in a Value-Based World

You’ll walk away with proven strategies for:

- Fostering trust and collaboration within a value-based framework

- Empowering care teams with effective training programs

- Enhancing clinician workflows with cutting-edge AI technology

Whether you’re just starting off with VBC or far along in your journey, there’s a lot to learn.

You don’t wanna miss it.

Cigna, Humana Rumored to be Eyeing $150B+ Merger

A mere 6 days removed from Thanksgiving and an impressive Cowboys victory, the Wall Street Journal reported that Cigna and Humana are in talks to create a health insurance behemoth with a current combined enterprise value of over $150 billion. The new enterprise would rival CVS’ scale, but still fall well short of UnitedHealth Group in value. Plus, if announced, it’d be the biggest deal of the year in the U.S.

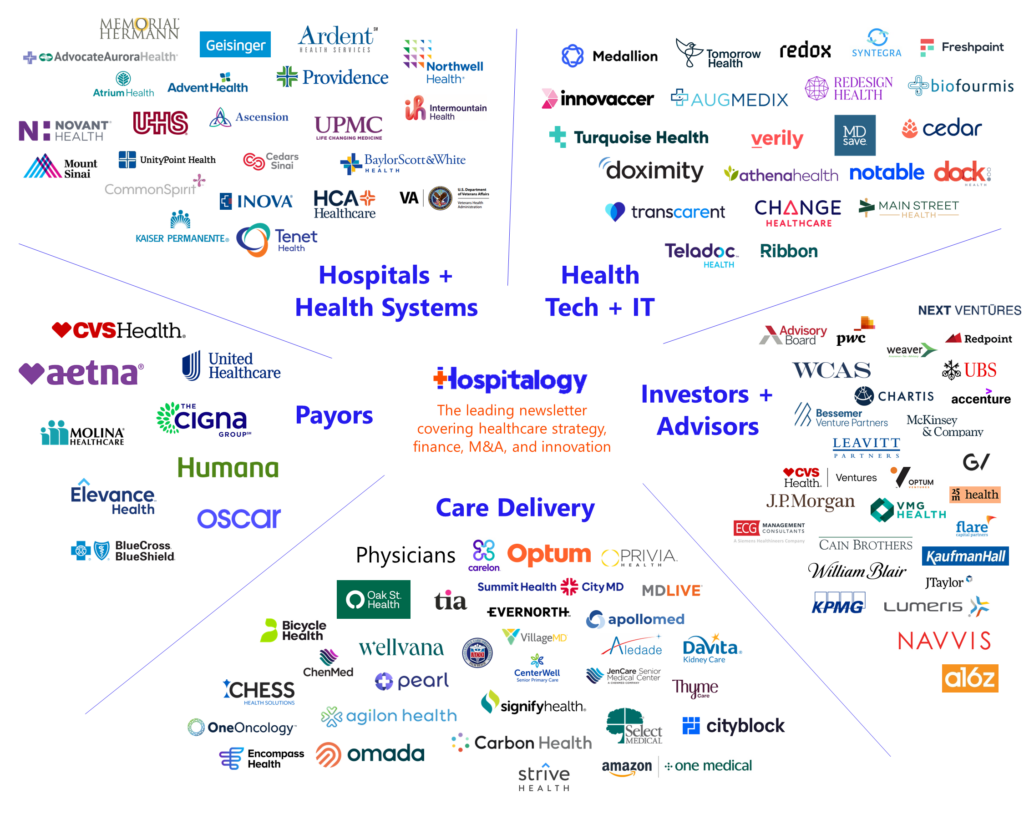

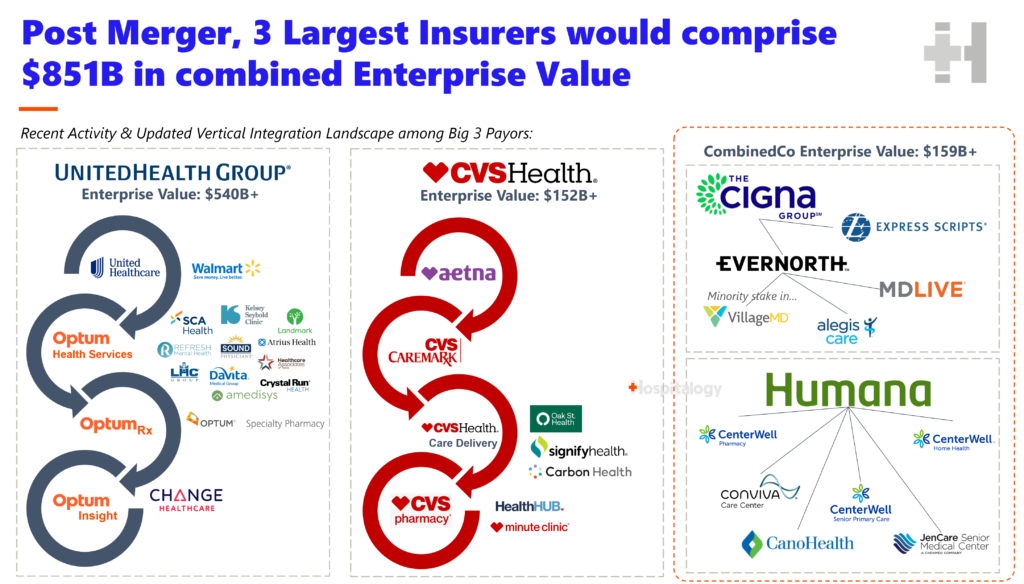

This move would create a Big 3 in healthcare to rival that of Lebron, Chris Bosh, and Dwyane Wade during the Miami Super Team years (that the Dallas Mavs beat, by the way), with 108 million members across the Big 3 and the below assets to boot:

By the way, what’s the best name for the potential NewCo? Cigmana? HumanaCig? I digress.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Cigmana would be formidable given that Cigna’s commercial book of business is strong, while Humana sports one of the best Medicare Advantage segments in the game between its MA plans and downstream CenterWell operations. The two don’t have much overlap, which is why the deal actually…makes a lot of sense. Tell that to the FTC, though.

Speaking of the FTC, the federal agency has been cracking down on healthcare M&A (and even Big Sandwich). The current regulatory dynamic presents a clear risk to Cigmana passing deal review. Not to mention that the review and merger process would probably take 2+ years.

Given the overlap in PBM operations (Humana with the fourth largest and Cigna with the second in Express Scripts) you’d probably expect to see some concession there at minimum.

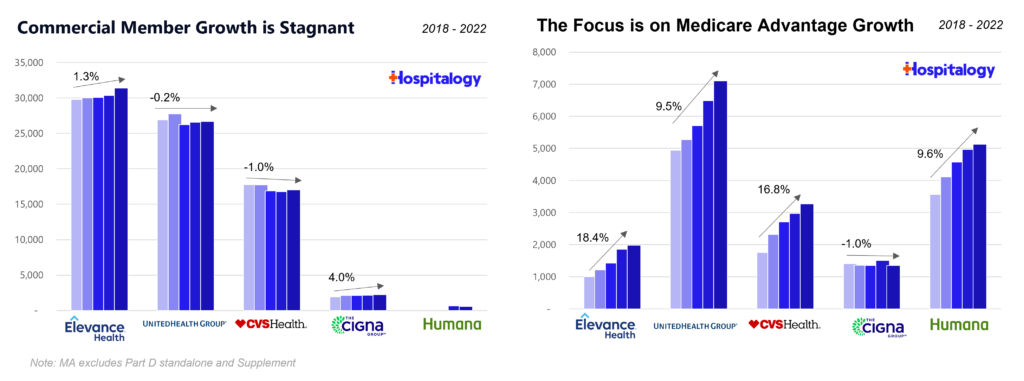

The two insurers appear to have been gearing up for this move for a while. Back in February, Humana announced plans to exit the commercial market, presumably to go all-in on Medicare Advantage at the time. Then more recently, Cigna was rumored to divest its Medicare Advantage segment focus (which Health Care Service Corp is interested in, by the way) on its better performing commercial book of business. Ah, how the puzzle pieces come together.

Between the two, NewCo would create a formidable, diversified health insurance behemoth. Humana holds the largest operation for senior-focused primary care services in the country, but MA regulation and headwinds are on the horizon. Cigna operates the second largest PBM in the country – Express Scripts – but there’s never been more scrutiny of their opaque rebate and DIR fee practices. So…bigger is better, as ever.

- Overall Evernorth holds a much larger presence in PBM and behavioral activities, while Humana maintains a sizable lead in MA, and pharmacy, home health, and senior clinics through CenterWell in partnership with Welsh Carson Anderson & Stowe.

Some other, final dynamics to consider in all of this hubbub:

- What about the local Blues? How do they feel about the weight of these ever-growing, nationally scaled behemoths against their carefully curated cartels?

- Walmart is also rumored to be interested in reviving its 2018 bid for Humana as we’ve seen increased retail interest and investment in healthcare, MA – “But on Friday morning, the research advisory company Gordon Haskett reported that a Humana corporate jet flew to Rogers, Arkansas Friday, which is near Walmart’s headquarters.” – incredible DD

- From an antitrust perspective – the FTC is sort of in a weird position. You have to think they’ll fight any sort of announced deal tooth and nail but…it’s really pretty unfair when you consider CVS purchased Aetna 5-6 short years ago, and UnitedHealth is so far ahead as it is with their 90,000 physicians. I would wager that an army of lawyers and strategists have studied this deal from every angle and are fairly confident that they’ll be able to push this through, perhaps with some concessions in certain markets and the aforementioned PBM dynamic.

- That being said, the DOJ has shut down past attempted mergers between Anthem-Cigna ($54B at the time) and Aetna-Humana ($37B at the time).

TL;DR: Health insurers want to merge to get bigger and mitigate upcoming regulatory headwinds. Humana = big in MA and senior care delivery services. Cigna = big in PBM and commercial. Biggest risks to this deal closing are FTC / state / DOJ review lasting forever and the potential dilution for Cigna shareholders.

Related reading:

- Humana’s CenterWell is focusing on aggressive growth and technological innovations in senior care. (Link)

- Bipartisan legislators express concerns over care denials in Medicare Advantage plans. (Link)

- Medicare beneficiaries will see an increase in Medicare Advantage plan options in 2024. (Link)

- Cigna is reportedly exploring the sale of its Medicare Advantage business. (Link)

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

North Carolina’s Medicaid Expansion goes live, Hospitals get funding: North Carolina is allocating $2.6 billion in funding to its hospitals as a part of its Medicaid expansion that went live on December 1st. (Link) North Carolina’s Medicaid expansion now allows nearly 600,000 additional residents to qualify for coverage. (Link)

$10B Midwest merger finalized: BJC and Saint Luke’s Health Systems finalized their merger agreement to create a $10B, 28-hospital system across Missouri, Illinois, and Kansas. (Link)

Clover’s ACO REACH departure: Clover is exiting the ACO REACH program after dismal results and no clear path to profitability. Makes sense after those 2021 DCE results, and then another scaled back, yet unprofitable year in 2022. (Link)

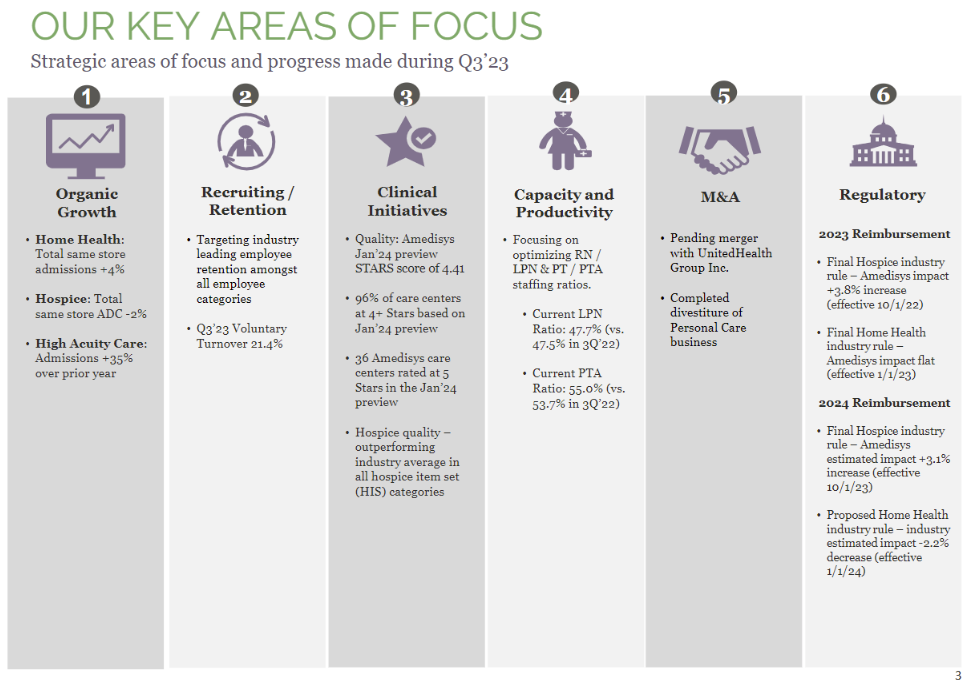

Amedisys’ Q3: Home health focused Amedisys dropped a nice slide on ongoing dynamics for home health players in Q3, including final & proposed rule expected reimbursement impact, same store growth, and more:

Amazon Prime & One Medical: Amazon Prime members now have access to a One Medical subscription for $9 a month. (Link)

Medicare Advantage Shifts: Hospitals moving away from Medicare Advantage may face unintended future consequences. (Link)

Growth in Hospital-at-Home: This was a good interview with Medically Home’ CEO Rami Karjian discussing the expansion and future of hospital-at-home programs. (Link)

Healthcare Organizational Strain: A great report by Syntellis dove into the problems health systems are facing due to care delivery shifts and rising expenses, particularly in orthopedic cases and associated margins. (Link)

340B Program Expansion: A monumental court ruling in the ever-ongoing 340B saga expanded the “patient” definition under the 340B program, allowing broader use for 340B. “The decision has the potential to upend 340B program operations, allow broader use of 340B drugs, raise questions about HRSA’s ability to oversee the program and invite further calls for Congress to provide HRSA with authority to limit 340B use.” Yikes. (Link)

Hospital Strategy Outlook: Paul Keckley published a great piece on Health System Chief Strategy Officers and the reality they’re facing entering 2024, including near-term challenges and an uncertain long-term future, with perceived disadvantages for hospitals. (Link)

ASC Equity Stakes: Health systems are increasingly seeking larger equity stakes in ambulatory surgery centers as system strategy evolves. The Avanza Intelligence 2023 survey is chock full of information folks in the ASC space need to know. (Link)

Retail Health Model: Health systems are adopting strategies to create a ‘retail health’ environment for patients including partnerships with nontraditional players. (Link)

Women’s Health Research: The White House launched an initiative focusing on investment in women’s health research. (Link)

Eli Lilly’s FDA Approval: The FDA approved Eli Lilly’s weight-loss drug Zepbound for chronic weight management, set to compete with Novo Nordisk’s Wegovy in the category. (Link)

Medicare Advantage 2025 Rule: Melissa Newton Smith provided some nice fodder on the proposed 2025 Medicare Advantage rule and its implications. (Link)

Medicaid Enrollment Trends: The KFF Medicaid Enrollment and Unwinding Tracker published some great updated data on Medicaid enrollment patterns. (Link)

Amazon’s Healthcare Challenges: Internal hubris and strategy disputes have reportedly hindered Amazon’s advancements in healthcare. (Link)

Cyber attack: Ardent Health Services experienced a huge ransomware attack affecting operations in multiple states. (Link)

Partnership & Product Announcements:

Aledade-Anthem Medicaid Collaboration: Aledade and Anthem have announced a new partnership to expand value-based care in Medicaid services in Virginia. (Link)

Lifepoint-Ascension Partnership: Lifepoint Health and Ascension Saint Thomas have partnered to enhance healthcare in Middle Tennessee. (Link)

Lee Health System partnered with telehealth player KeyCare’s Epic-based platform. (Link)

CareAbout selected Innovaccer for data and analytics solutions in scaling value-based care. (Link)

Tufts Medicine chose Premier, Inc. as a strategic partner to optimize its supply chain over the next 10 years. (Link)

Tuva Health partnered with Metriport, providing analytics and AI-ready data on over 300 million patients in the US. (Link)

One Medical announced several health system and employer partnerships in recent memory:

The pediatric telehealth startup Summer Health is broadening its text-based service into primary care for children. (Link)

Memorial Hermann Health System partnered with AI-enabled Laudio for frontline leaders. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

Novant Health agreed to buy three Tenet hospitals in South Carolina for $2.4 billion. (Link)

The FTC sued to block the Tenet and John Muir deal. (Link)

HCA Houston Healthcare completed the purchase of 11 Houston area SignatureCare Emergency Centers. (Link)

HCA’s Medical City Healthcare acquired Wise Health System, expanding its network in greater DFW. (Link)

CHS completed the sale of three Florida hospitals for $294 million. (Link)

Kaufman Hall released its National Hospital Flash Report for November, noting incremental improvement and stabilization in margins. (Link)

U.S. Anesthesia Partners filed a motion to dismiss the FTC’s complaint alleging its monopolistic practices in an ongoing saga with major implications. (Link)

CMS finalized a $140 million increase in home health payments. (Link)

Memorial Hermann-GoHealth Urgent Care is significantly expanding its presence in Houston. (Link)

ApolloMed announced a definitive agreement to acquire assets of Community Family Care Medical Group IPA, Inc. (Link)

About a year after merging in a $1.35B deal to go public via SPAC, UpHealth entered a definitive agreement to sell its Cloudbreak Health business to GTCR for $180 million. (Link)

- UpHealth also wants to assure everyone that everything’s totally fine. Totally. (Link)

LifeStance announced the closure of 70 centers by year’s end and a $50 million lawsuit settlement. (Link)

Oscar Health announced that Mark Bertolini’s Foundation and Deerfield Management agreed to purchase shares of Oscar Health. (Link)

Great Lakes Gastroenterology joined Corewell Health in Southwest Michigan. (Link)

Bain agreed to a $5 billion acquisition of consulting firm Guidehouse. (Link)

American Shared Hospital Services entered an agreement to acquire a majority interest in three Rhode Island radiation therapy cancer centers. (Link)

Vincere Health was acquired by RVO Health, a collaboration between Optum and Red Ventures. (Link)

Mayo Clinic revealed a $5 billion, six-year renovation plan for its Rochester campus. (Link)

Attorney General Bonta conditionally approved a change in control of seven ProMedica-owned skilled nursing facilities. (Link)

A deal by Optum’s SCA Health involving purchasing a controlling ASC stake faces regulatory scrutiny in Connecticut. (Link)

Optum closed seven clinics in Florida and Minnesota. (Link)

IKS Health acquired AQuity for $200 million to extend its hospital reach. (Link)

Season Health announced a strategic asset acquisition from Wellory to expand its clinical network and insurance coverage. (Link)

Health Catalyst acquired ERS, enhancing its tech-enabled managed services with data abstraction and oncology registry management. (Link)

BehaVR and Fern Health merged to form RealizedCare. (Link)

Surescripts acquired ActiveRADAR to expand therapeutic alternatives to prescription drugs. (Link)

UpLift acquired Minded, expanding its virtual behavioral health offerings. (Link)

3M Healthcare named its spinoff ‘Solventum’. Nice. (Link)

Two Colorado mental health centers merged to form the state’s largest center. (Link)

Earnings roundups – Nonprofit Health Systems:

- CommonSpirit began its 2024 fiscal year with a $738 million loss. (Link)

- UPMC faced a $177 million downturn in operations over nine months due to increasing care delivery costs and claims payouts. (Link)

- Intermountain Health reported a profitable third quarter, albeit lower than 2022’s figures. (Link)

- Advocate Health saw a decrease in its operating margin and net income in the third quarter of 2023. (Link)

- Northwell’s operating income declined by $104 million in the third quarter. (Link)

- Trinity Health reduced its operating loss to $58.6 million in the first quarter of the fiscal year. (Link)

- Corewell Health reported a 1.4% operating margin as its revenue surpassed $11 billion. (Link)

- Providence Health & Services reported a $310 million operating loss in the third quarter. (Link)

- Cleveland Clinic managed to cut its operating loss to $14.9 million in the third quarter. (Link)

- Highmark reported revenues exceeding $20 billion in the first three quarters. (Link)

Publicly Traded Healthcare:

- Humana reported growth in medical costs due to increased MA utilization. (Link)

- CVS Health reported a $2.3 billion profit in Q3. (Link)

- Cigna raised its 2023 membership outlook amid a healthier economy. (Link)

- Oscar Health announced third-quarter 2023 results and raised its full-year 2023 adjusted EBITDA outlook. (Link)

- Surgery Partners, Inc. announced its third-quarter 2023 financial results. (Link)

- RadNet reported third-quarter financial results and revised its 2023 financial guidance upwards for adjusted EBITDA. (Link)

- Apollo Medical Holdings, Inc. reported its third-quarter 2023 results. (Link)

- Hims & Hers reported a 57% revenue increase and the launch of an AI offering. (Link)

- Amwell disclosed a widening net loss, including a $79 million impairment charge. (Link)

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Healthcare providers are reporting significant IT budget increases for 2024. “Based on a survey of 144 provider executives conducted by the Healthcare Financial Management Association, chief financial officers and other healthcare executives reported they saw digital and IT budgets increase by an average of 18.3% from 2019 to 2023.” (Link)

The White House launched an initiative focused on women’s health research. “The initiative will then find areas for additional investments, like in research around heart attacks in women and menopause, according to the White House, which also plans to engage the private sector and philanthropic leaders.” (Link)

AstraZeneca formed a digital health unit called Evinova with significant partnerships to advance certain initiatives like unified trial solutions, study design and planning, and portfolio management. (Link)

AWS and Hoppr created a model to accelerate generative AI tools in medical imaging. (Link)

GE HealthCare launched a new AI suite to detect breast cancer earlier. (Link)

RadNet unveiled DeepHealth, an AI-powered health informatics portfolio. (Link)

The first Teladoc virtual ER opened in New-Wes-Valley. (Link)

Stanford Health uses AI to reduce clinical deterioration events. (Link)

Toku’s AI platform predicts heart conditions through eye scans. (Link)

Hims & Hers discusses its proprietary EMR and new AI-enabled MedMatch. (Link)

The New England Journal of Medicine announced NEJM AI, a new AI-focused journal. (Link)

Arbital Health launched in December, which aims to be a neutral umpire for value-based and outcome-based contracts. (Link)

Jona, an AI-enabled gut startup, launched from stealth. (Link)

Fundraising Announcements since mid November:

Note: based on feedback received, I will be expanding upon these bullets in future sends. Unless you guys really like the quick hit format:

- Better Health Group secured a $175M capital infusion (Link)

- EndoQuest raised $42M (Link)

- RepeatMD raised $40M (Link)

- PayGround raised $19.7M (Link)

- Intermountain’s Culmination Bio raised $10M (Link)

- Forum raised $5.3M (Link)

- Maia Oncology raised $4.25M (Link)

- Fortuna Health raised $4M (Link)

- Morf Health raised $3M (Link)

- Bright Uro raised $23M. (Link)

- BeMe Health raised $1.5M (Link)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

- Related to the college football playoff: coming from a Texas fan, Florida State got absolutely hosed. I feel for that fanbase, and I would be absolutely livid with the committee’s decision. That being said, I do think the 4 best teams at the moment are in (sorry Georgia, ya lost the conference championship). Bama’s win over Georgia really benefited Texas, because Texas gets to ride the coattails of anything that Bama does, so the committee had to include both in the playoffs. The bigger question to me is … if Georgia wins on Saturday does the committee put in Texas over FSU? I lean no.

- Aaron Rodgers is coming back from an Achilles injury already? That is insane. I need some doctors to weigh in here.

Hospitalogy Top Reads

My favorite healthcare essays from the week

- Register for this panel discussing 2024 health tech predictions with some friends of Hospitalogy! (Link)

- Less about healthcare, more of a cool general discussion on AI as a coming revolution. (Link)

- Healthcare Appraisers wrote up another industry deep dive, this time highlighting women’s health in focus. (Link)

- A discussion on a user-centric approach to working with AI. (Link)

- Aledade’s CEO Farzad Mostashari discusses how early failures helped shape the company’s growth. (Link)

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 20,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)