Happy Tuesday!

First, everyone go follow Dr. Raihan Faroqui on LinkedIn because he’s the man.

Now, this newsletter will be a comprehensive summary of all of the major healthcare activity from October, for your viewing pleasure!

Thanks so much to Adonis and Blakemore Consulting for sponsoring today’s Hospitalogy. If you want to get your brand in front of 23,000 healthcare professionals click here.

October News Roundups:

- 10/9/23: A VC-Backed Health System?

- 10/16/23: GLP-1s vs. Healthcare Services

- 10/30/23: Breaking down Hospital Q3 earnings, Carbon’s bad 2023, and Direct Contracting results

October Essays:

- Bending the cost curve of healthcare inequities: investment in primary care, communities, and technology

- What’s top of mind for Healthcare Executives now?

- Where have all the Caregivers Gone?

- The Future of Value-Based Oncology Care: an Interview with Thyme Care

Past Month Recaps:

SPONSORED BY ADONIS

In today’s rapidly changing healthcare landscape, keeping up with the latest in legislation, revenue cycle management, prior authorization, and finding harmony with private equity partners can be challenging.

Luckily, Adonis’s Dan Murdoch is teaming up with Resident Physician at Mount Sinai and co-founder of Healthcare Huddle, Jared Dashevsky, on November 14th at 2PM EST for an exclusive 1:1 conversation diving deep into solutions in each of these areas.

If you’re a physician or private practice owner looking to stay in the loop, make sure to tune in.

Major October Healthcare Headlines

GLP-1 Kidney Study News takes down Dialysis Names

- Novo Nordisk’s GLP-1 trial was testing whether the widely used diabetes drug, which contains the active ingredient semaglutide, could delay progression of chronic kidney disease and lower the risk of death from kidney and heart problems.

- The clinical trial was halted early because it was clear that the treatment would work for the designated population

- Consequently, dialysis stocks – and other healthcare services names – tanked after news on Novo Nordisk’s kidney trial involving Semaglutide hit the wire. DaVita, Fresenius, and Outset Medical stocks were down double digits on the week. DaVita even issued a statement on the matter.

- The potential clinical indications for GLP-1s are insane, and they hold incredible long-term potential…but these selloffs are an overreaction to a market beholden to whimsical emotions rather than fundamental demand. Still, 2023 feels like an inflection point as payors and employers grapple with ways to cover the expensive drug amid an explosion in demand and clinical indications.

$11B UnityPoint-Presbyterian Healthcare Services Merger canceled

Announced last year, UnityPoint and Presbyterian Healthcare Services are calling off their merger with no known reason in mind. (Link)

Both health systems lost money on operations in 2022 in tough markets. The cross-market merger would have created a 50-hospital system across New Mexico and the Midwest. UnityPoint’s CEO is also stepping down.

Keep an eye on Presbyterian. The system could be an attractive partner for Risant or… HATCo (although the latter seems to want to target something in the $1B – $3B range per this Beckers interview)

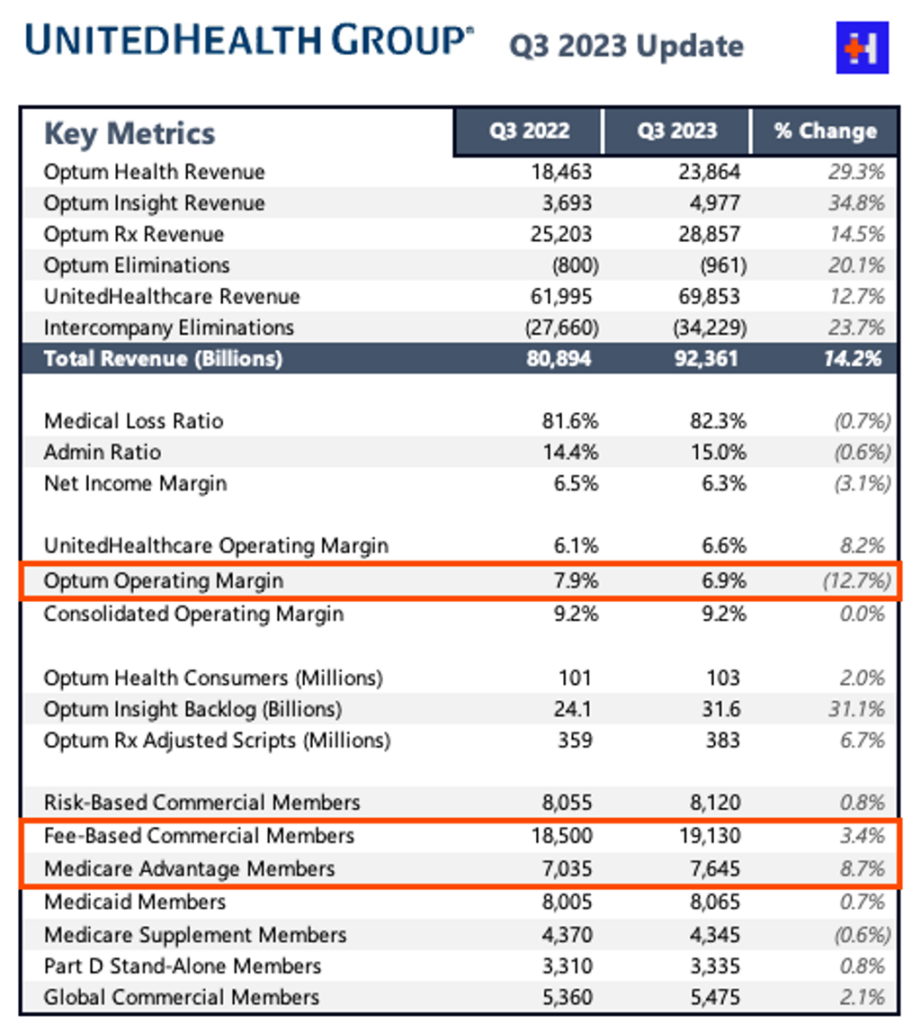

UnitedHealth Group’s Q3

UnitedHealth Group posted another business as usual quarter, but Optum’s notable underperformance from higher than expected utilization and long-term investments as noted in my Q2 earnings summary continues. It’s a situation worth monitoring, as UHG has invested significant resources and capital into Optum as its growth engine for the foreseeable future. (Link)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

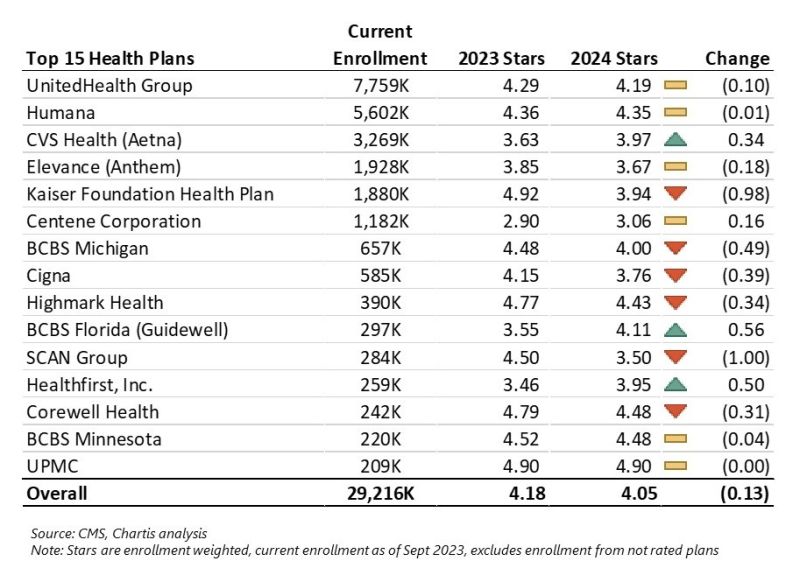

MA Star Ratings Decline for the second straight year

After a decline in Medicare Advantage star ratings last year, many MA plans saw further star ratings declines. Here are some highlights and tidbits from the data published this week:

- About 42% of Medicare Advantage plans that offer prescription drug coverage in 2024 earned four or more stars, compared with just over half this year. (Link)

- Many traditionally high-performing nonprofit plans performed poorly.

- “The market’s average star rating fell to 4.05 (4.04 per CMS) which is the lowest it’s been since 2017” – from Nick Herro’s excellent breakdown and table below.

- Full list of MA plans and star ratings here

General Catalyst launches HATCo, Looks to Acquire Literal Health System

During HLTH (FOMO, by the way), General Catalyst (GC) announced the launch of Health Assurance Transformation Corp, or HATCo, a bold announcement similar in scope to the launch of Haven. From its blog on the launch, GC will focus HATCo on three strategic initiatives:

- working with our 20+ health system partners to help them develop and execute their transformation journey to health assurance;

- helping to catalyze the health assurance ecosystem, building an interoperability model with technology solutions including a subset of our health care portfolio companies to drive this transformation; and

- acquiring and operating a health system for the long term where we can demonstrate the blueprint of this transformation for the rest of the industry.

In order to really move the needle in healthcare, we need to see convergence of the old guard health system with new-age digital health solutions. Given the seasoned leadership of Intermountain’s former CEO Marc Harrison and AdventHealth’s former CEO Daryl Tol, their existing network of health system partners, and the forward-thinking expertise available in GC’s Health Assurance portfolio, we’re seeing the beginning of a bold play to transform healthcare.

Ambient Documentation Wars Heat Up.

A slew of major announcements came across the wire within the sector that holds one of the best current applications for generative AI within healthcare:

- Augmedix: the publicly traded player launched Augmedix Go, its answer to new AI-powered entrants and products in the space and bringing its offerings complementary with Nuance’s DAX suite of offerings.

- Augmedix also announced interesting partnerships with Myndshft (prior auth automation), Ellipsis Health (mental health), and The Sullivan Group (medical error reduction) to create open networks of digital health solutions for enterprise clients. The suite of offerings is an interesting way to think about digital health and point solution consolidation and I imagine we’ll continue to see strategic collaborations and integrations like these.

- Nuance: The Microsoft-owned AI giant launched DAX Copilot for clinicians, a light, AI-enabled assistant for automated clinical documentation, which also seems to be a response to new entrants into the documentation space.

- Abridge announced a $30M fundraising round led by Spark Ventures with participation from several notable players including CVS, Mayo Clinic, Kaiser Permanente, and LifePoint Health. Per Forbes, the round brings Abridge’s valuation up to $200M after raising $62.5M to-date. Abridge has notched partnerships with UPMC (where founder Shiv Rao has ties), University of Kansas, and Emory Healthcare. Don’t forget they’re one of the first participants in Epic’s Partners and Pals program as well.

- Meanwhile, rumors have emerged around Robin, a fellow documentation player that launched in 2018. Robin appears to be shutting down after a 5 year run. Industry insiders I’ve chatted with seem to think that there will be further consolidation in the crowded documentation space.

- Finally, last but not least, Nabla notched a significant deal with Kaiser Permanente. In Northern California, Nabla’s Copilot will be made available to 10,000+ physicians. Nabla Copilot integrates with Epic, Kaiser Permanente’s EHR, enabling a seamless flow of information.

SmileDirectClub files for bankruptcy

- 4 years after raising over $1.3 billion in an IPO and valued publicly at $9B+, SmileDirectClub is filing for bankruptcy. (Link)

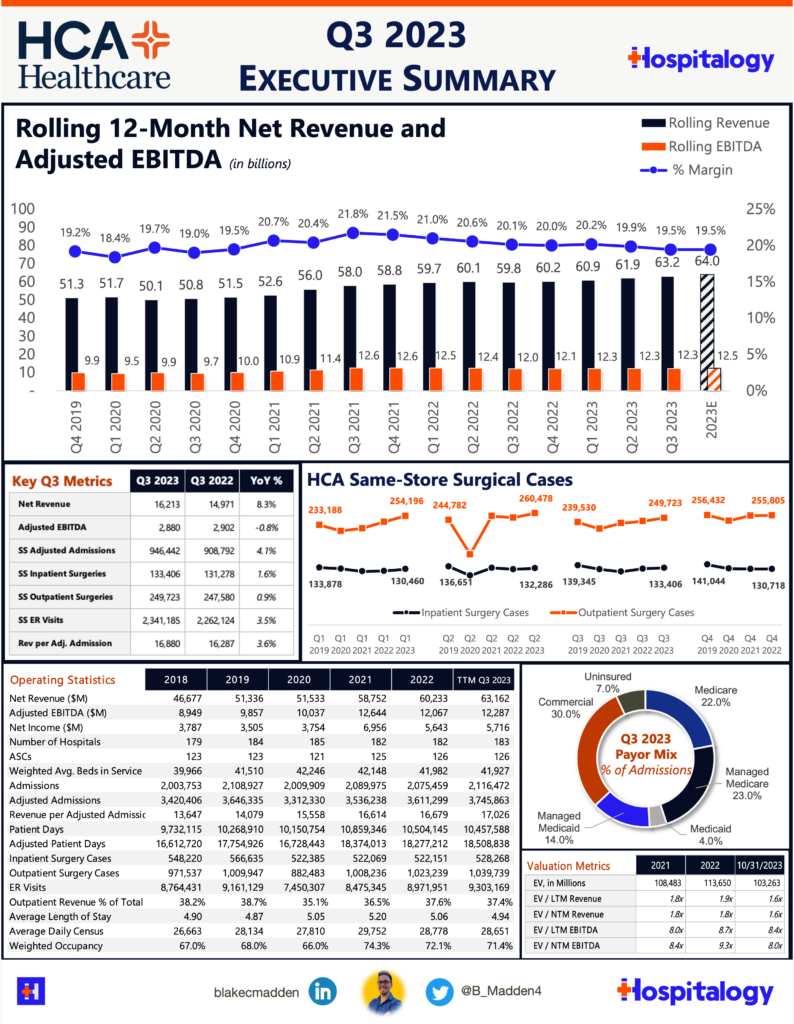

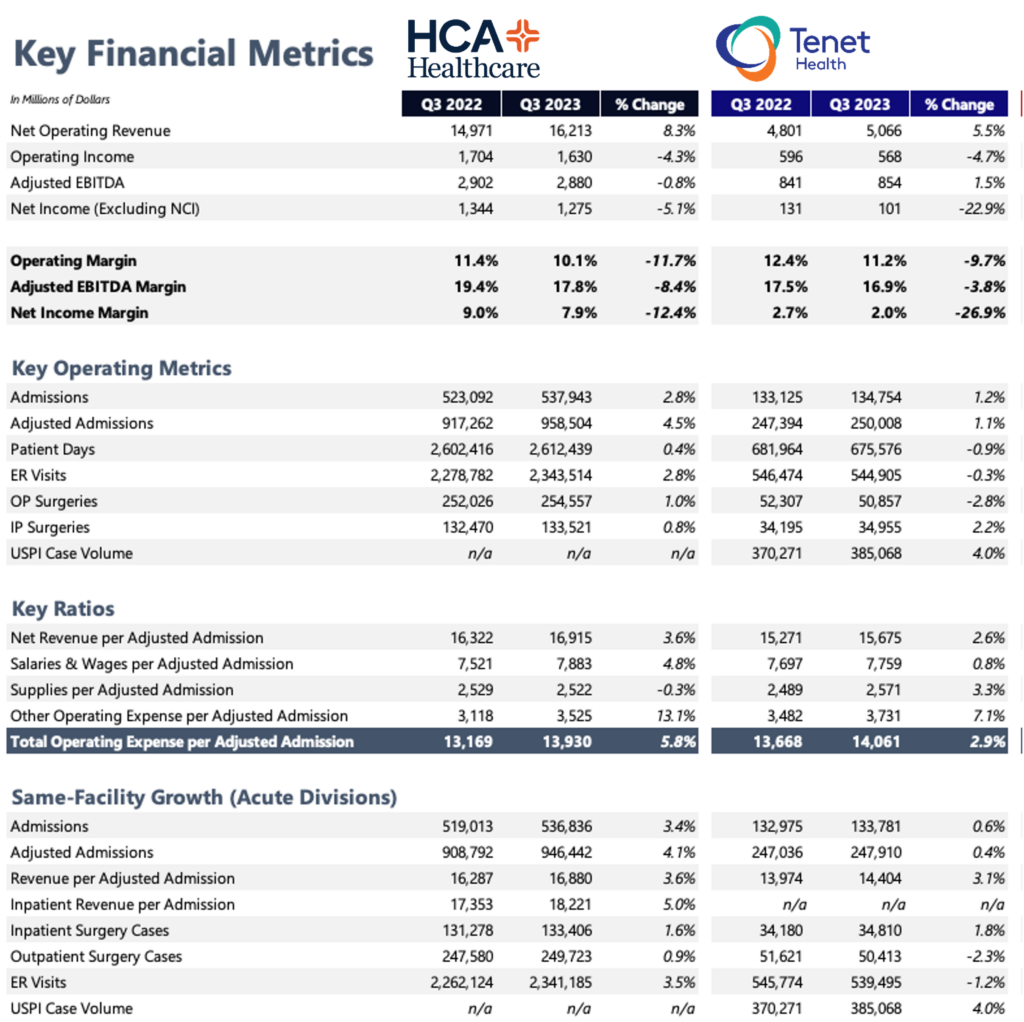

Hospitals report Q3 earnings

All publicly traded hospitals (HCA, Tenet, UHS, CHS) reported earnings this week with a slew of information for system execs and investors alike. Some quick highlights, analysis, and thoughts on the quarter:

HCA saw some EBITDA headwinds in Q3 most notably from its recently acquired Envision JV, Valesco (a 5,000 physician operation across 200 programs). The now wholly owned entity is bleeding cash for HCA to the tune of $50M a quarter, although they really had to bite the bullet rather than stomach ever-growing physician subsidies and keep the lights on:

- “It is important to understand that we believe the decision to consolidate Valesco was strategically imperative in maintaining the overall competitive positioning and capacity offerings of the company…As we have discussed previously, we have seen subsidy requests increase from contracted hospital-based providers.” HCA management

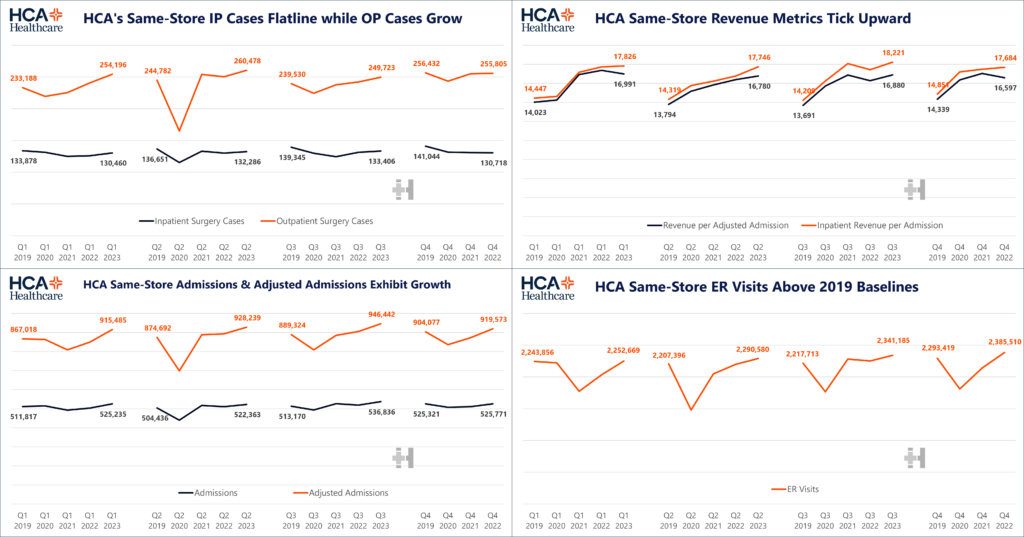

Other notable performance out of HCA includes continued strong same-store metrics (5% growth in OP cardiology procedures), continued alleviation of contract labor woes (down 18% or $300M year to date), and business as usual volumes-wise at HCA facilities.

- “…our volumes were broad-based. Every division in our company had admission growth had adjusted admission growth, every service category in our business offerings had growth, except for OV, our obstetrics volume. Mainly births were down slightly. Pediatric was down slightly, and our behavior was down because we made capacity adjustments, but not because demand is shrinking in behavioral just because we needed capacity that we felt might be more productive.”

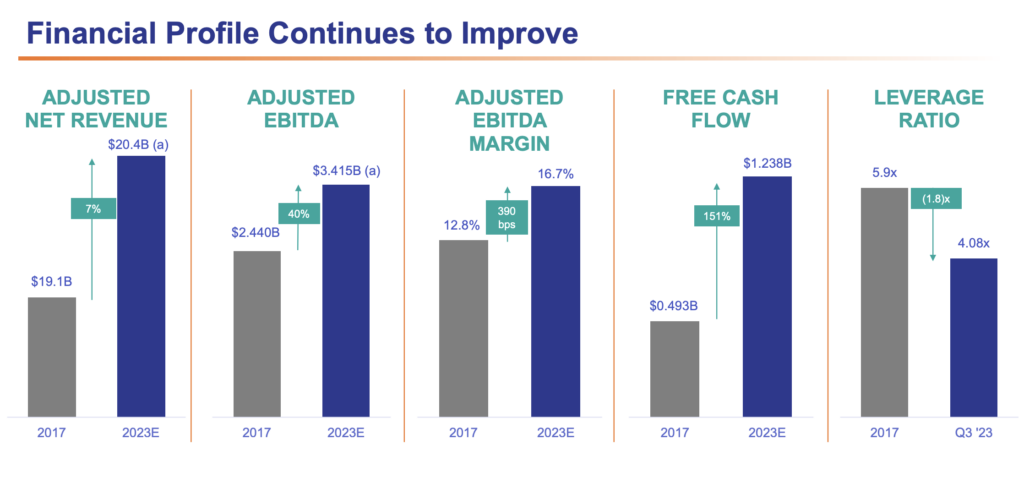

Tenet exceeded expectations in Q3 and experienced strong same-store outpatient volumes in its core growth driver, USPI. Tenet continues to invest in the USPI platform. In Q3 Tenet added 6 ASCs focused on orthopedics while noting a pipeline of 30+ de-novo developments.

- “USPI had attractive volume growth in high-acuity service lines, including mid-teens growth in total joint replacements in the ASCs over third quarter 2022. We also delivered ongoing strength in GI, urology, and ENT procedures.”

Tenet also had some interesting intel for us on 2024 expectations:

- “Our starting point assumes that we will continue to produce organic volume growth in our key service lines, increase patient acuity, benefit from better than historical contract negotiations and effectively manage costs with a specific expectation for full year additional contract labor savings. And given the robust pipelines at USPI, we will have further contributions from M&A and de novo development center openings. These factors, in addition to an ongoing post-pandemic recovery for health care services provide tailwinds into next year.”

Notably, Tenet’s capital structure is favorable through 2026 with a fixed interest rate structure, giving the firm competitive capital advantages over other firms. Its leverage ratio has decreased to ~4x:

Finally, similarly to HCA, CHS is also bringing physicians in house to control physician subsidy cost inflation.

CMS Releases Direct contracting results

On October 20, CMS released results from the direct contracting (DCE) value-based care program. Overall, savings increased from performance year 2021 – “The model’s net savings to CMS was $371.5 million (1.6% of model benchmark), and the net savings to DCEs was $484.1 million (2.1% of model benchmark).

This is an absolute increase from the $70.4 million in net savings to CMS and the $46.5 million in net savings to DCEs in PY2021. Medicare beneficiaries aligned to DCEs participating in the GPDC Model retained all rights, coverage, and benefits that all beneficiaries with Traditional Medicare enjoy, including the freedom to see any Medicare clinicians.”

- Top 5 individual entities, total net savings:

- Iora Health NE DCE, LLC

- Castell Accountable Care, LLC

- American Choice Healthcare, LLC

- Oak Street Health Medicare Partners LLC

- agilon health Columbus Ohio DCE, Inc.

- Bottom 5 individual DCE participants, on total net savings:

- Clover Health Partners LLC

- Sutter Preferred Direct Contracting Entity, LLC.

- Iowa Health Accountable Care, L.C.

- Florence CIN II LLC

- AKOS MD IPA, LLC

- Read this nice summary from Healthcare Dive

- Check out the full 2022 DCE full results here and the CMS press release with summaries here

- Remember that direct contracting has transitioned into the ACO REACH program starting in 2023. Model overview here!

Henry Ford, Ascension form joint venture to create $10.5B health system in Michigan

Ascension continues to offload assets. In Michigan, Henry Ford, Ascension Michigan, and Genesys are forming a joint operating company to create a $10.5B health system with 13 hospitals.

- This news follows Ascension’s recent market exits, including unwinding Amita Health in Chicago, selling Network Health to Froedtert (who is now merging with ThedaCare), and exiting the Milwaukee market by selling 7 hospitals to Aspirus Health (who is now merging with St. Luke’s Duluth)

Akumin Inc taken private by Stonepeak

After some recent financial struggles and a heavy debt load, radiology and oncology imaging provider Akumin is going private. Stonepeak is restructuring its investment in Akumin, providing needed liquidity to the firm:

- The contemplated transaction will result in the existing Stonepeak Note, totaling approximately $470 million, being cancelled and converted into Common Shares of the Company. In addition, Stonepeak will invest $130 million in new money into the Company as a capital contribution.

Carbon Health article reveals major trouble

A fascinating report from the Information shed light on Carbon Health’s recent operating and financial struggles. Post-Covid, Carbon can’t seem to right the ship, as an alleged 60% of its revenues came from Covid testing and diagnostic services. Urgent care in general saw a boon during peak pandemic times as patients opted into the convenient care setting to get vaccines, boosters, and tests – all 100% covered by insurance during the public health emergency. But after the good times come the bad, and Carbon is experiencing a sharp decline in revenue.

The Information reported that Carbon’s company valuation dropped from $3B to $1.4B after its $100M funding round led by CVS, post-money. It went on to raise an un-reported additional $50M from its investors, per the article.

A Healthcare IPO on the Horizon – Waystar (no, not that Waystar)

Revenue cycle management player Waystar is has filed to go public at an $8B valuation – the first healthcare related IPO in quite a while, although it has been delayed temporarily

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

Hospitals & Services:

Walgreens continues to try and transform operations into a profitable, sustainable healthcare player. The struggling retail pharmacy chain plans to cut up to $1B in costs, drop CAPEX by $600M, close struggling stores, and, interestingly, close 60 VillageMD locations to focus on VMD’s density in existing markets. Walgreens also announced the hiring of Tim Wentworth as CEO, who holds substantial experience in healthcare at both Evernorth and Express Scripts. Finally, Walgreens launched a DTC telehealth offering. (Link)

A consortium of investment partners is funding SurgNet Health Partners, a new ASC management company that launched on October 10 and is looking to use fresh funding to partner with existing ASCs and physician practices. (Link)

St. Luke’s and Aspirus Health based in Minnesota and Wisconsin respectively, formalized their previous merger LOI announcement by signing a definitive merger agreement this week. It’ll create a 19-hospital system in the region. (Link)

Transcarent launched a new network for its direct to employer model in partnership with a number of leading regional health systems nationwide including Advocate Health, Baylor Scott & White, Intermountain Healthcare, and others. (Link)

Envision is splitting into 2 entities post-bankruptcy and cutting $7B in debt:

- The low margin physician staffing business – Envision Physician Services, and

- AMSURG, the more desirable outpatient surgery center biz

- Ironically, Envision bought AMSURG in 2016, so we’ve really come full circle here. (Link)

AdventHealth’s Primary Care Network in Florida partnered with Wellvana to help the health system transition its primary care services into value-based care arrangements. (Link)

Blue Cross Blue Shield North Carolina acquired 55 FastMed urgent care clinics. (Link)

Carbon Health made a deal with UHC for at-risk primary care in the commercial PPO market in California starting in 2024. (Link)

Cano Health sold the majority of its Primary Care Centers in Texas and Nevada to Humana’s CenterWell. Makes a lot of sense considering that Humana had the right of first refusal over the sale of any assets, so I have to imagine that Humana cherrypicked the good ones for itself and growth of its CenterWell platform for seniors, along with ensuring continuity of care for seniors at the clinic. (Link)

Duly Health and Care, one of the remaining large, independent multispecialty physician practices, faces layoffs and cutbacks following executive shakeup amidst heavy debts. (Link – paywall)

Ascend Capital Partners acquires a majority stake in Seoul Medical Group. Founded in 1993, SMG is the largest Korean-American-focused IPA serving over 70,000 patients and 4,800 providers, including nearly 400 primary care physicians and more than 4,400 specialists in seven markets across the United States: California, Georgia, Hawaii, New Jersey, New York, Virginia and Washington. (Link)

Hinge Health IPO: Physical therapy startup, Hinge Health, is targeting profitability in 2024 as it gears up for an IPO. (Link)

Galileo and Wellcare have established a new partnership in Maine that will extend to 23k+ potential Medicare Advantage members. (Link)

Baptist Memorial and Anderson entered into a shared mission agreement – AKA, a merger – to form a 24 hospital system throughout Mississippi and Tennessee. (Link)

Retail Health:

Walmart is rolling out Included Health’s telehealth services to its employees nationwide. (Link)

- Walmart also expanded its doula services benefit across the nation after a pilot in four states. (Link)

Dollar General & Rural Health Access: A nice write-up from KFF on Dollar General’s mobile clinic pilot was a great update on its healthcare strategy and emerging models – both good and bad – of healthcare in rural America. (Link)

Best Buy will sell continuous glucose monitors to worried well customers in partnership with Wheel and pharmacy HealthDyne – everything handled online. It’s the first expansion into a consumer device that requires physician approval. (Link)

Rite Aid filed for Chapter 11 bankruptcy protection. The struggling retail pharmacy player managed to secure $3.45B from existing lenders while it figures out how to right-size a sinking ship to the tune of $680M in losses and $8.6B in total debts. (Link)

Alignment Healthcare and Walgreens introduced co-branded Medicare Advantage plans. (Link)

Amazon’s One Medical has decided to rebrand Iora senior centers to One Medical Seniors. (Link). ONEM also partnered with Mount Sinai Health System to expand primary care in New York. (Link)

Policy:

The Minnesota AG is reviewing 2 health system megamergers – Essentia Health and Marshfield Clinic Health System and St. Luke’s Duluth and Aspirus Health. (Link)

LCMC Health’s $150 million hospital purchase from HCA Healthcare received regulatory approval after some community backlash and antitrust concerns. (Link)

Kaiser Permanente and UPMC were among the 13 major health systems that signed an interoperability pact with the VA. (Link)

DEA’s Telehealth Extension: The DEA extended telehealth prescribing flexibilities through 2024 while considering new policies. (Link)

CVS Lawsuit: An independent pharmacy filed a lawsuit against CVS Caremark over exorbitant fees, adding to the pile of regulation piling up against PBM market-dominating practices along with pharmacist walkouts nationwide. (Link)

Charity Care Law Dispute: Hospitals in Washington have filed a lawsuit against the state over an expanded interpretation of a charity care law. (Link)

Physician-Owned Hospitals: The AHA is challenging the rising trend of physician-owned facilities, a growing rhetoric on Capitol Hill. (Link)

Nursing Home Staffing: Bipartisan lawmakers have voiced their opposition to the White House’s nursing home staffing proposal. (Link)

Billing Dispute Overhaul: The Biden administration has proposed changes to the heavily criticized out-of-network billing dispute resolution process. (Link)

ACA Risk Adjustment: Insurers have been underpaid by $1.1B in ACA risk adjustment payments, with Bright and Friday failing to meet obligations. (Link)

On September 28, the CBO released a report disclosing that the Center for Medicare & Medicaid Innovation’s (CMMI’s) activities increased federal spending between 2011 and 2020 and will also increase it from 2021 to 2030. In 2010, CBO projected that CMMI would produce savings. Critics of CMMI’s policies will probably use this report as a damning datapoint for alternative payment models, but you really have to consider that the agency is up against the healthcare industrial complex. (Link)

North Carolina’s Medicaid expansion will take effect December 1, making health insurance available to up to 600k individuals. (Link)

Everything Else:

Epic Systems generated $3.8B in 2022 revenue according to Forbes…which begs the question – if one of the most successful software firms ever to date, with overwhelming market share in the large health system market, ~35% market share in the acute care hospital market, and 48% of beds – makes $3.8B a year, what does that say for the entire healthcare vertical SaaS VC-backed market? (Link)

Instacart’s Supplemental MA Benefit Push: Instacart will add Medicare Advantage, Medicaid, and other health benefits for grocery deliveries next year. This follows the company’s recent acceptance of food stamps as payment.

- Kaiser Permanente joined hands with Instacart to study expanded nutritious food access. (Link)

- Alignment Health and Instacart launched co-branded Medicare Advantage plans. (Link)

- Instacart partnered with Mount Sinai Solutions to launch a post-hospital care offering. (Link)

Healthpeak Properties and Physicians Realty Trust are merging to create a $21B enterprise serving the healthcare REIT market with a portfolio across outpatient care and health systems alike. (Link)

Business Insider is reporting that weight loss startup Calibrate is selling to a private equity firm. (Link)

Sharecare confirmed receiving an unsolicited proposal from Claritas Capital. (Link)

Partnership & Product Announcements:

Microsoft and Mercy announced a deal to explore over four dozen healthcare AI applications. (Link)

DaVita is collaborating with Google Cloud to create a tailored clinical operating system aimed at transforming kidney care. (Link)

ProHealth Care tapped into a strategic technology partnership with Optum, offloading 800+ administrative employees to Optum in areas including revenue cycle management, IT, analytics, and more. (Link)

Insurance Options Expansion: UCHealth’s third party administrator (TPA) combined with Select Health’s TPA. This announcement comes on the heels of the UCHealth and Intermountain’s 700-physician CIN formation (Link)

Amazon Clinic is working on a physical, in-person referral network for downstream, higher acuity care. (Link)

Enablement platform Alo added Davidson Family Medicine to its Avance Care Platform. (Link)

Gastroenterology Associates of New Jersey joined forces with Oshi Health to initiate hybrid virtual and in-person care for enhanced digestive health outcomes. (Link)

Solis Mammography partnered with Jefferson Health to operate around a dozen imaging centers. (Link)

Alto Pharmacy and Mark Cuban Cost Plus Drug Company collaborated to deliver hundreds of low-cost medications to patients across the U.S. (Link

Greater Good Health partnered with Humana to open up senior primary care clinics at 3 sites in Montana – fresh off Greater Good’s fundraising announcement. (Link)

HCA Healthcare is collaborating with Grail to advance comprehensive cancer care with multi-cancer early detection screening. (Link)

Amwell and Leidos secured a defense contract potentially worth up to $180 million. (Link)

SPONSORED BY BLAKEMORE CONSULTING

Effective access to care relies on building an adequate provider network.

That’s why Blakemore Consulting empowers payors of all sizes with high-quality turnkey network development and adequacy solutions.

From provider network builds and network analysis to provider contracting and adequacy reporting, Blakemore Consulting offers a specialized approach to network development and adequacy.

Want to streamline network operations and enhance patient access to care?

Fundraising Updates:

First, read this analysis from Dr. Raihan Faroqui on what he’s seeing in early Q4 digital health fundraising. Also, note that the below is a non-exhaustive list:

- Main Street Health raised a whopping $315M. The Spice. (Link)

- Structure raised $300M (Link)

- Harbinger Health raised $140M (Link)

- Headway raised $125M (Link)

- Iambic raised $100M (Link)

- Evozyne raised $81M (Link)

- Capital Rx raised $50M (Link)

- Adela raised $48M (Link)

- Waymark secured $42M (Link)

- Cortica raised $40M (Link)

- Evident Vascular raised $35M (Link)

- Doceree raised $35M (Link)

- Diana Health raised $34M (Link)

- “Fundamentally, what we’re trying to do is to build Centers of Excellence for maternity care in partnership with hospitals,” Condliffe said. “We are starting in the South and southeast because, in part, because we believe there is a great need there. We’re also focused on partnering with health systems who are really looking to make the kinds of changes that we think are needed.”

- Health Data Analytics Institute (HDAI) raised $31M (Link)

- Abridge raised an aforementioned $30M (Link)

- Connections Health Solutions raised $28M (Link)

- Midi Health raised $25M (Link)

- Cartwheel raised $20M (Link)

- Signos raised $20M (Link)

- Commons Clinic raised $19.5M (Link)

- Optimize Health raised $18M (Link)

- Sage secured $15M (Link)

- Evvy raised $14M (Link)

- Allara raised $10M (Link)

- Good Doctor raised $10M (Link)

- Plenful raised $9M (Link)

- Pair Team raised $9M (Link)

- The Next Ventures team penned some great thoughts on the thesis behind their Pair Team investment: (Link)

- Ventricle Health raised $8M (Link)

- Prevounce Health raised $7M (Link)

- Ounce raised $5.2M (Link)

- Partum Health raised $3.1M (Link)

- Ilant Health launched with $3M in funding (Link)

- MDisrupt raised $3M (Link)

- Clinikally raised $2.6M (Link)

- FlexifyMe raised $1M (Link)

Hospitalogy Top October Reads

My favorite healthcare reads from the Month

- Bessemer’s 2023 State of Health Tech report

- Kaufman Hall’s 2023 State of Healthcare Performance Improvement Report (Link)

- GSR Ventures’ generative AI survey indicating that generative AI is reshaping digital health investors’ strategies and outlooks. (Link).

- Healthcare Appraisers’ overview and outlook for gastroenterology practices and ancillary services. (Link)

- Yuvo Health’s update on the state of FQHC’s.

- Silicon Valley Bank’s Future of Health Tech report.

- Reconceptualizing Primary Care: From Cost Center to Value Center

- The Emergence of Alternative Network Models

- How Palantir Pushed Toward the Heart of U.K. Health Care

- Food For Thought: The Potential Ripple Effect of GLP1s

- Betty Chang’s Digital Health Vendor Library

- Setting the revenue cycle up for success in automation and AI

- A look into where all of the healthcare spending is going, from the Commonwealth Fund

- How US healthcare leaders are scaling innovation and transformation

- A study of the cost of care provided in physician-owned hospitals.

That’s it for this week! If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 23,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)