Happy Tuesday, Hospitalogists,

The Red River Rivalry never fails to disappoint, and unfortunately Texas was on the losing side this year. Hope to see a rematch in December – we’ll see!

I hope most of you are enjoying HLTH. Give me the inside scoop you’re hearing at the happy hours!!

SPONSORED BY WEAVER

Strong data privacy and cybersecurity are crucial not only for healthcare businesses, but also for patient well-being.

With in-depth knowledge of standards and control frameworks, Weaver expertly evaluates systems and practices against technical and regulatory requirements, including HIPAA, PCI, NIST CSF, NIST 800-53, Red Flags, Sarbanes-Oxley, FDICIA, and GLBA.

And now, they’re passing that knowledge onto you.

To stay in the know about all things compliance, subscribe to Weaver’s newsletter and get the upcoming 6-part series on HIPAA security rules, complete with a self-assessment checklist.

Healthcare Headlines

A VC-Backed Health System:

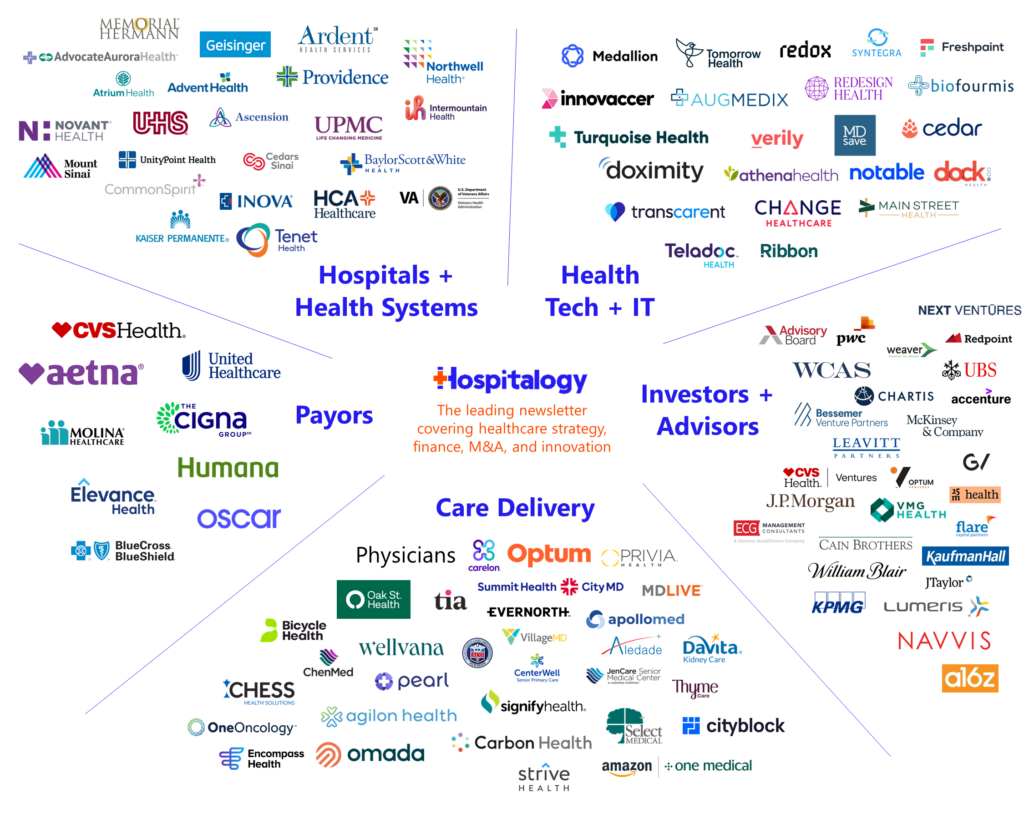

During HLTH (FOMO, by the way), General Catalyst (GC) announced the launch of Health Assurance Transformation Corp, or HATCo, a bold announcement similar in scope to the launch of Haven. From its blog on the launch, GC will focus HATCo on three strategic initiatives:

- working with our 20+ health system partners to help them develop and execute their transformation journey to health assurance;

- helping to catalyze the health assurance ecosystem, building an interoperability model with technology solutions including a subset of our health care portfolio companies to drive this transformation; and

- acquiring and operating a health system for the long term where we can demonstrate the blueprint of this transformation for the rest of the industry.

In order to really move the needle in healthcare, we need to see convergence of the old guard health system with new-age digital health solutions. Given the seasoned leadership of Intermountain’s former CEO Marc Harrison and AdventHealth’s former CEO Daryl Tol, their existing network of health system partners, and the forward-thinking expertise available in GC’s Health Assurance portfolio, we’re seeing the beginning of a bold play to transform healthcare.

Ambient Documentation Wars Heat Up.

A slew of major announcements came across the wire within the sector that holds one of the best current applications for generative AI within healthcare:

- Augmedix: the publicly traded player launched Augmedix Go, its answer to new AI-powered entrants and products in the space and bringing its offerings complementary with Nuance’s DAX suite of offerings.

- Augmedix also announced interesting partnerships with Myndshft (prior auth automation), Ellipsis Health (mental health), and The Sullivan Group (medical error reduction) to create open networks of digital health solutions for enterprise clients. The suite of offerings is an interesting way to think about digital health and point solution consolidation and I imagine we’ll continue to see strategic collaborations and integrations like these.

- Nuance: The Microsoft-owned AI giant launched DAX Copilot for clinicians, a light, AI-enabled assistant for automated clinical documentation, which also seems to be a response to new entrants into the documentation space.

- Meanwhile, rumors have emerged around Robin, a fellow documentation player that launched in 2018. Robin appears to be shutting down after a 5 year run. Industry insiders I’ve chatted with seem to think that there will be further consolidation in the crowded documentation space.

- Finally, last but not least, Nabla notched a significant deal with Kaiser Permanente. In Northern California, Nabla’s Copilot will be made available to 10,000+ physicians. Nabla Copilot integrates with Epic, Kaiser Permanente’s EHR, enabling a seamless flow of information.

SmileDirectClub files for bankruptcy

- 4 years after raising over $1.3 billion in an IPO and valued publicly at $9B+, SmileDirectClub is filing for bankruptcy. (Link)

CMMI is a Net Loss – So Far

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

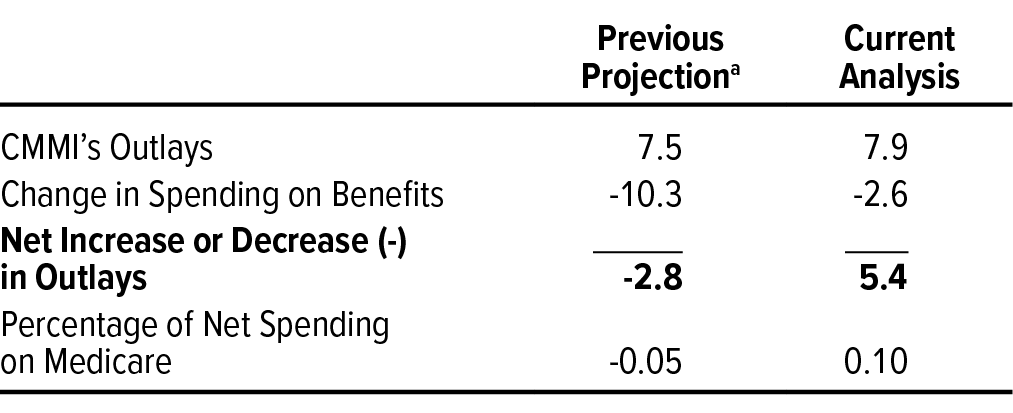

- On September 28, the CBO released a report disclosing that the Center for Medicare & Medicaid Innovation’s (CMMI’s) activities increased federal spending between 2011 and 2020 and will also increase it from 2021 to 2030. In 2010, CBO projected that CMMI would produce savings. Critics of CMMI’s policies will probably use this report as a damning datapoint for alternative payment models, but you really have to consider that the agency is up against the healthcare industrial complex. (Link)

NC Medicaid Expansion

- North Carolina’s Medicaid expansion will take effect December 1, making health insurance available to up to 600k individuals. (Link)

Carbon Health gets into commercial risk with UnitedHealthcare

- In a Twitter post on 9/28, Carbon announced its first commercial at-risk deal with UnitedHealthcare in California, slated to go live in 2024. Makes sense to start this in a state with a history of capitated payment models. (Link)(Carbon + UHC Panel)

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

SCAN announced a decade-long partnership with ApolloMed and launched a female-focused Medicare Advantage Plan. (Link)

Transcarent launched a new network for its direct to employer model in partnership with a number of leading regional health systems nationwide including Advocate Health, Baylor Scott & White, Intermountain Healthcare, and others. (Link)

Carbon Health made a deal with UHC for at-risk primary care in the commercial PPO market in California starting in 2024. (Link)

“And one of the important differentiators for Privia, compared to organizations with just ACOs, or Medicare Advantage, is we help them with every aspect of their practices, including commercial, Medicare, Medicare Advantage, and specialty programs. In fact, we’re about to launch a downside risk program in the OB/gyn area. Our line of business is the whole practice of the medical group.” Dr. Keith Fernandez, CCO Privia Health

Instacart’s Supplemental MA Benefit Push: Instacart will add Medicare Advantage, Medicaid, and other health benefits for grocery deliveries next year. This follows the company’s recent acceptance of food stamps as payment.

- Kaiser Permanente joined hands with Instacart to study expanded nutritious food access. (Link)

- Alignment Health and Instacart launched co-branded Medicare Advantage plans. (Link)

- Instacart partnered with Mount Sinai Solutions to launch a post-hospital care offering. (Link)

CMMI’s Spending Spike: CMMI’s initiatives led to a $5.4B increase in federal spending over a decade. (Link)

Health Plan Acquisition: Froedtert finalized a deal with Ascension Wisconsin to acquire full ownership of a health plan. Keep in mind that while Ascension is exiting the Wisconsin market ASAP, players like Froedtert are expanding through positions of strength by acquiring assets like these and merging with ThedaCare. (Link)

DEA’s Telehealth Extension: The DEA extended telehealth prescribing flexibilities through 2024 while considering new policies. (Link)

CVS Lawsuit: An independent pharmacy filed a lawsuit against CVS Caremark over exorbitant fees, adding to the pile of regulation piling up against PBM market-dominating practices along with pharmacist walkouts nationwide. (Link)

- PBM Business Shift: Related, PBMs have shifted their business model towards revenue from fees and specialty pharmacies. (Link)

Gastroenterology Outlook 2023: Healthcare Appraisers published another nice report, this time an overview and outlook for gastroenterology practices and ancillary services. (Link)

Insurance Options Expansion: UCHealth’s third party administrator (TPA) combined with Select Health’s TPA. This announcement comes on the heels of the UCHealth and Intermountain’s 700-physician CIN formation (Link)

Dollar General & Rural Health Access: A nice write-up from KFF on Dollar General’s mobile clinic pilot was a great update on its healthcare strategy and emerging models – both good and bad – of healthcare in rural America. (Link)

Hospital Financial Strain: Hospitals are expected to continue facing labor shortages and weak financial margins past 2024. (Link)

HCA Hospital Denied: The Virginia health department denied HCA’s CON bid to establish a hospital in Hanover amid opposition from local health systems. (Link)

AMCs’ Strategy Shift: Academic medical centers are resetting traditional strategies amid growth and evolving roles. (Link)

Hospitals Reject Medicare: A rising number of hospitals are opting out of Medicare Advantage plans. (Link)

Walgreens’ CEO Hunt: Walgreens is considering Tim Wentworth, a former Cigna executive, for its CEO position – looking for an experienced healthcare vet as its next CEO. (Link)

Pharmacists Fill Gaps: With the primary care shortage, pharmacists are emerging as a key resource for patient care. (Link)

Anthem Layoffs: Anthem/Elevance employees are facing layoffs, as shared on a Reddit discussion – up to 20% of the workforce. (Link)

23andMe Data Leak: A scraping incident exposed data of 1.3 million 23andMe users of Ashkenazi and Chinese descent. (Link)

Hybrid Care Efficiency: Group practice increased patient appointments by 6-8 daily due to hybrid virtual care implementation. (Link)

Products & Partnership Announcements:

- ProHealth Care tapped into a strategic technology partnership with Optum, offloading 800+ administrative employees to Optum in areas including revenue cycle management, IT, analytics, and more. (Link)

- Amazon Clinic is working on a physical, in-person referral network for downstream, higher acuity care. (Link)

- Enablement platform Alo added Davidson Family Medicine to its Avance Care Platform. (Link)

- Gastroenterology Associates of New Jersey joined forces with Oshi Health to initiate hybrid virtual and in-person care for enhanced digestive health outcomes. (Link)

- Best Buy will sell continuous glucose monitors to worried well customers in partnership with Wheel and pharmacy HealthDyne – everything handled online. It’s the first expansion into a consumer device that requires physician approval. (Link)

- Virtual opioid use disorder provider Bicycle Health will partner with chronic pain management provider Override Health to connect their patients to pain management or opioid use specialists. (Link)

- Concert Health and Mass General Brigham integrated behavioral health services for all insurance types. (Link)

- Solis Mammography partnered with Jefferson Health to operate around a dozen imaging centers. (Link)

- LabCorp announced a strategic relationship with Baystate Health for diagnostic laboratory services. (Link)

- Memora Health partnered with Eisenhower Health to support over 1,000 patients receiving cancer treatment. (Link)

- Brightside Health began providing services to Medicare and Medicaid beneficiaries through several national payor contracts. (Link)

- The telehealth company’s coverage network now spans more than 100 million people. Its Lucet partnership will serve Florida Blue members, while its Optum partnership will serve UnitedHealthcare Medicare Advantage members.

- Mark Cuban Cost Plus Drug Company collaborated with elderly care coordination company Avanlee Care to provide affordable medication for seniors. (Link)

- Uber and Optum partnered to streamline access to supplemental benefits. (Link)

- KeyCare teamed up with Remission Medical to increase access to virtual rheumatology care nationwide. (Link)

- Samsung joined b.well to provide longitudinal health data to Galaxy smartphone users. (Link)

- Kindbody partnered with Rightway to expand fertility care offerings to employers. (Link)

- Verily was selected by the U.S. Centers for Disease Control and Prevention to support national wastewater monitoring. (Link)

- CareSource and Spark Pediatrics launched ImagineCare to serve Florida Medicaid enrollees. (Link)

- DocGo allied with Main Line Health in Philadelphia to provide medical transportation and agreed to collaborate on remote patient monitoring initiatives. (Link)

- UnitedHealthcare published a report on its Surest product, noting improved preventive care, member satisfaction, and cost reduction. (Link)

- Humana and Denver Health signed an agreement to expand Humana’s Medicare Advantage Provider Network in the Denver area. (Link)

- Kaiser Permanente and UPMC were among the 13 major health systems that signed an interoperability pact with the VA. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

Trinity Health’s contract labor costs grew 50% in fiscal year ended June 2023, from 5.6% of total salaries and wages to 7.8%. (Link)

- On that note, here’s a summary of how 23 other health system labor costs are trending. (Link)

Elevance Health and BCBSLA have temporarily halted their $2.5 billion merger due to increased scrutiny from regulators. (Link)

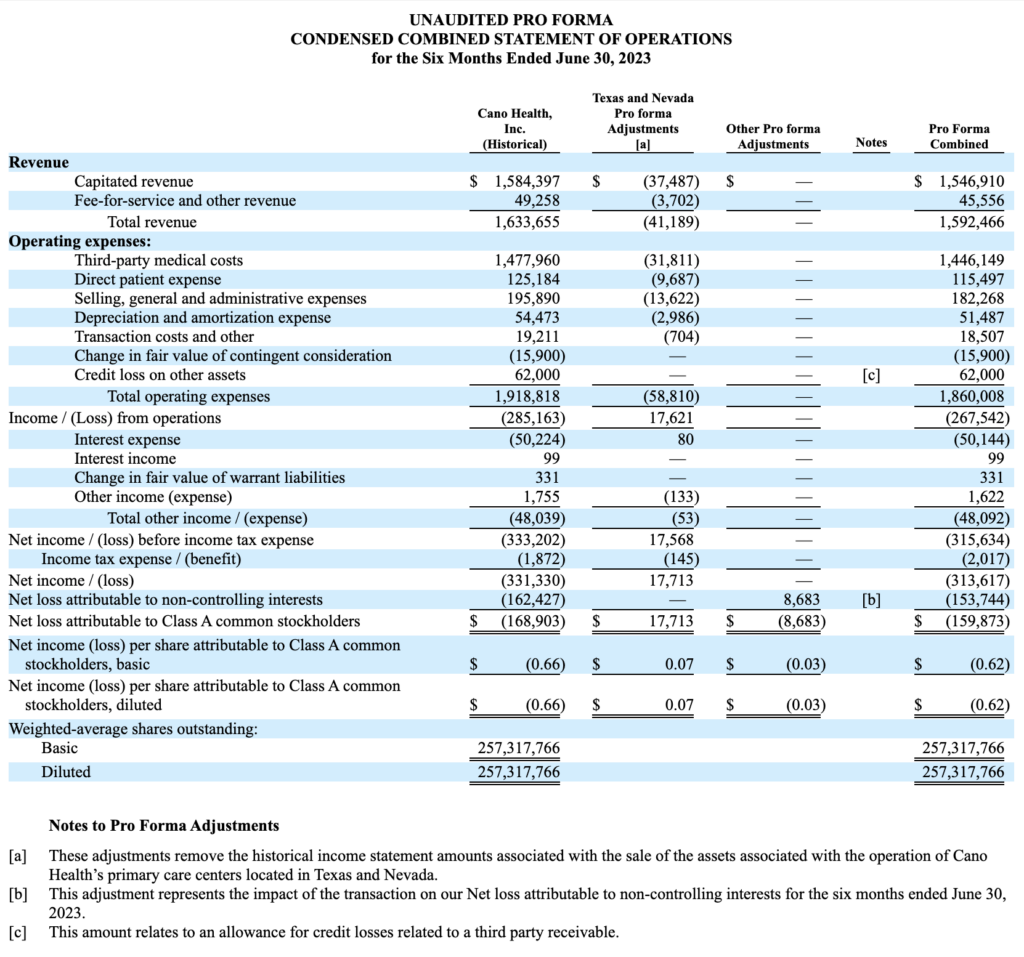

Cano Health sold the majority of its Primary Care Centers in Texas and Nevada to Humana’s CenterWell. Makes a lot of sense considering that Humana had the right of first refusal over the sale of any assets, so I have to imagine that Humana cherrypicked the good ones for itself and growth of its CenterWell platform for seniors, along with ensuring continuity of care for seniors at the clinic. (Link)

- You can see the 8-k filing here along with pro forma adjustments for the assets here: (Link)

Hospital personnel are urging Governor Lamont and lawmakers to approve the Yale-Prospect deal, stating that the financial situation is ‘dire.’ (Link)

Virgin Pulse and HealthComp plan to merge to establish a $3B comprehensive employer health platform. It’ll get financial backing from the likes of New Mountain Capital, Blackstone and Morgan Health. (Link)

LCMC Health’s $150 million hospital purchase from HCA Healthcare received regulatory approval after some community backlash and antitrust concerns. (Link)

UMass Memorial and Milford Regional are considering a merger. (Link)

The Minnesota AG is reviewing 2 health system megamergers – Essentia Health and Marshfield Clinic Health System and St. Luke’s Duluth and Aspirus Health. (Link)

Baptist Health is set to acquire Drew Memorial Health System. (Link)

Duly Health and Care, one of the remaining large, independent multispecialty physician practices, faces layoffs and cutbacks following executive shakeup amidst heavy debts. (Link – paywall)

Carlyle is in exclusive talks for a $7 billion-plus Medtronic units deal. (Link)

Clark Memorial Health and Scott Memorial Health join Norton Healthcare. (Link)

Marshall Health and Mountain Health Network merge to form an integrated academic health system. (Link)

Health IQ filed for Chapter 7 bankruptcy. (Link)

Rite Aid is closing up to 500 stores. (Link)

Ascend Capital Partners acquires a majority stake in Seoul Medical Group. Founded in 1993, SMG is the largest Korean-American-focused IPA serving over 70,000 patients and 4,800 providers, including nearly 400 primary care physicians and more than 4,400 specialists in seven markets across the United States: California, Georgia, Hawaii, New Jersey, New York, Virginia and Washington. (Link)

SPONSORED BY BLAKEMORE CONSULTING

Building an adequate provider network is no easy feat.

But few organizations have the experience and knowledge as Blakemore Consulting.

A leading turnkey network development firm, Blakemore Consulting brings a specialized approach to network development and adequacy, with services like:

- Provider network builds

- Network analysis and strategy

- Provider contracting and recruiting

- Adequacy reporting and modeling

With focused project planning capabilities, targeted provider prospecting skills, and experience with state-specific adequacy requirements, Blakemore helps you navigate building provider networks with ease.

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Microsoft and Mercy announced a deal to explore over four dozen healthcare AI applications. (Link)

Regard, an AI-powered copilot for clinicians, has expanded its strategic partnership with Sentara Health. This expansion will give clinicians access to Regard’s AI technology in all 12 hospitals of Sentara. It will automate note taking, enhance diagnostic accuracy, improve patient care, and optimize financial outcomes in healthcare. (Link)

HealthTap and Health Gorilla united to make medical records seamlessly available to doctors and consumers on HealthTap. (Link)

Hospitals lobbied Congress to counteract HHS’s restrictions on third-party web trackers. (Link)

Wheel announced the rollout of an improved platform aimed at payers, retailers, and the pharmaceutical industry. (Link)

Solera Health introduced an integrated platform designed to simplify employer benefit management. (Link)

Komodo Health launched Maplab, a new full-stack solution to aid clients in data analysis streamlining. (Link)

Providence announced the unveiling of Praia Health, marking its fourth technology incubation. (Link)

mRNA vaccine developers were celebrated as they received the Nobel Prize for their groundbreaking work in healthcare. (Link)

Baptist Health’s pilot study found that generative AI significantly reduces clinical documentation time. (Link)

Employers are showing increased interest in ICHRAs, though a lack of knowledge remains a challenge. (Link)

Tia revealed data indicating that a comprehensive primary care model enhances health outcomes for women. (Link)

Mount Sinai initiated the Discovery and Innovation Center in Midtown West to foster healthcare innovations. (Link)

DUOS launched an AI-informed platform designed to connect older adults with essential resources. (Link)

Fundraising Announcements:

- Main Street Health raised a whopping $315M (Link)

- 7wireVentures closed a $217M+ fund (Link)

- Structure raised $300M (Link)

- Headway raised $125M (Link)

- Harbinger Health raised $140M (Link)

- Iambic raised $100M (Link)

- Evozyne raised $81m (Link)

- FemHealth Ventures closed a $32 Million fund (Link)

- Health Data Analytics Institute (HDAI) raised $31 Million (Link)

- Doceree raised $35M (Link)

- Diana Health raised $34M (Link)

- “Fundamentally, what we’re trying to do is to build Centers of Excellence for maternity care in partnership with hospitals,” Condliffe said. “We are starting in the South and southeast because, in part, because we believe there is a great need there. We’re also focused on partnering with health systems who are really looking to make the kinds of changes that we think are needed.”

- Cortica raised $40M (Link)

- Midi Health raised $25M (Link)

- Cartwheel raised $20 Million (Link)

- Commons Clinic raised $19.5M (Link)

- Connections Health Solutions raised $28M (Link)

- Evvy raised $14M (Link)

- Plenful raised $9M (Link)

- Ounce raised $5.2M (Link)

- Adela raised $48M (Link)

- Partum Health raised $3.1 million (Link)

- Clinikally raised $2.6M (Link)

- FlexifyMe raised $1M (Link)

Hospitalogy Top Reads

My favorite healthcare essays from the week

- Rock Health’s Q3 funding environment update

- Yuvo Health’s update on the state of FQHC’s.

- Silicon Valley Bank’s Future of Health Tech report.

- Reconceptualizing Primary Care: From Cost Center to Value Center

- Breaking Up Is Hard to Do — More Heartbreak from Corporate Decisions in Medicine

- The Emergence of Alternative Network Models

- How Palantir Pushed Toward the Heart of U.K. Health Care

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 20,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)