Happy Tuesday, Hospitalogists!

Today’s newsletter is chock full of healthcare news & analysis for your viewing pleasure. If you enjoy Hospitalogy please do consider supporting me by sharing this with a colleague!

Or you could be selfish and keep it to yourself…I won’t say anything.

Onward!

SPONSORED BY BLAKEMORE CONSULTING

An adequate provider network isn’t just the backbone of health plan operations; it’s also the heart of quality access to patient care.

Few understand this better than Blakemore Consulting.

The leading turnkey network development firm, Blakemore Consulting boasts over 150 years of collective experience working with payors of all sizes, across a broad spectrum of products, and in multiple states.

With a focused approach to network development and adequacy Blakemore assists in:

- Provider network builds

- Network analysis and strategy

- Provider contracting and recruiting

- Adequacy reporting and modeling

Get started with Blakemore and start building adequate provider networks with ease.

Healthcare Headlines

Hospitals report Q3 earnings

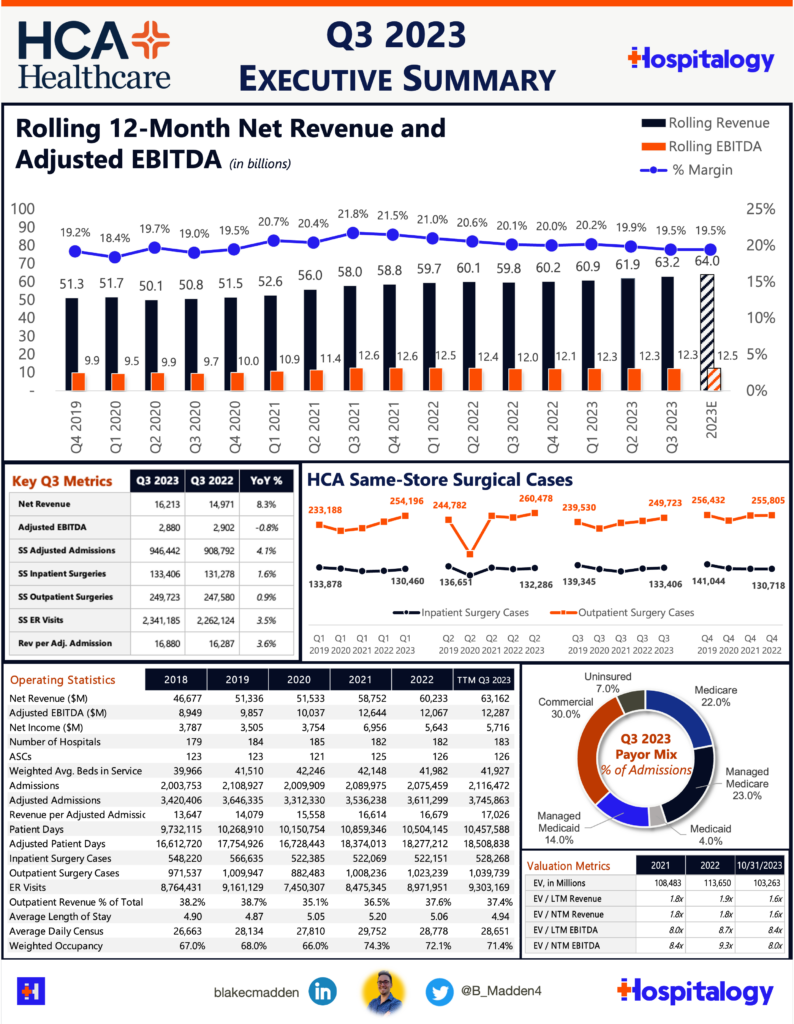

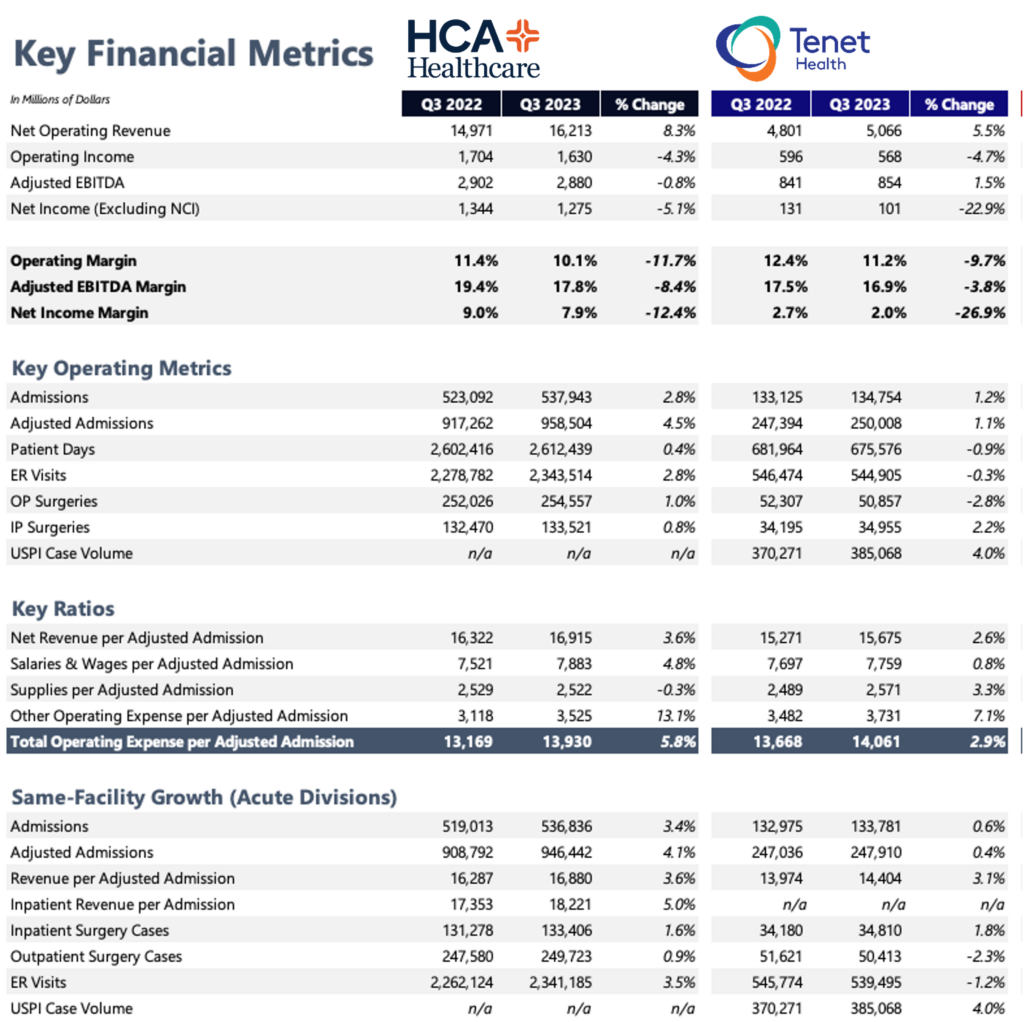

All publicly traded hospitals (HCA, Tenet, UHS, CHS) reported earnings this week with a slew of information for system execs and investors alike. Some quick highlights, analysis, and thoughts on the quarter:

HCA saw some EBITDA headwinds in Q3 most notably from its recently acquired Envision JV, Valesco (a 5,000 physician operation across 200 programs). The now wholly owned entity is bleeding cash for HCA to the tune of $50M a quarter, although they really had to bite the bullet rather than stomach ever-growing physician subsidies and keep the lights on:

- “It is important to understand that we believe the decision to consolidate Valesco was strategically imperative in maintaining the overall competitive positioning and capacity offerings of the company…As we have discussed previously, we have seen subsidy requests increase from contracted hospital-based providers.” HCA management

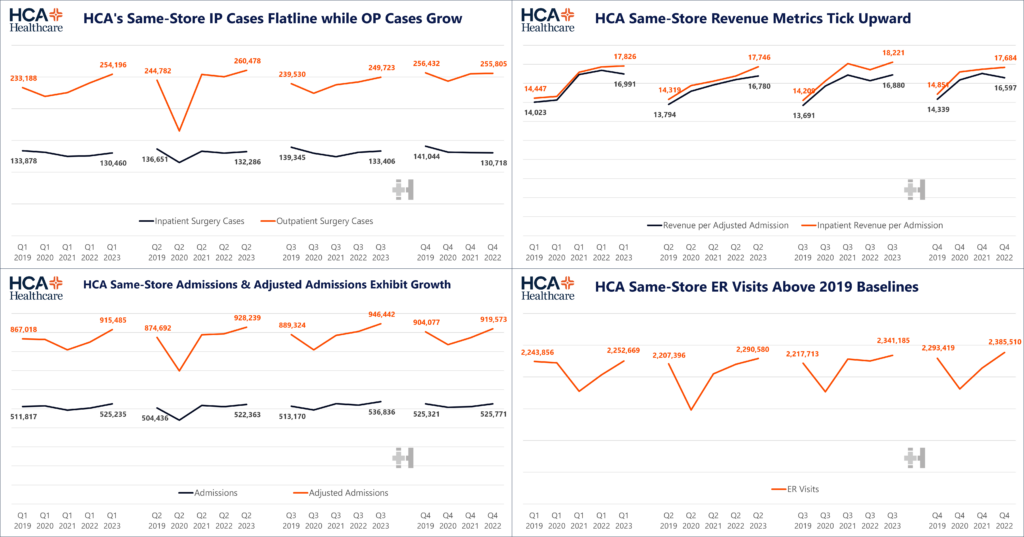

Other notable performance out of HCA includes continued strong same-store metrics (5% growth in OP cardiology procedures), continued alleviation of contract labor woes (down 18% or $300M year to date), and business as usual volumes-wise at HCA facilities.

- “…our volumes were broad-based. Every division in our company had admission growth had adjusted admission growth, every service category in our business offerings had growth, except for OV, our obstetrics volume. Mainly births were down slightly. Pediatric was down slightly, and our behavior was down because we made capacity adjustments, but not because demand is shrinking in behavioral just because we needed capacity that we felt might be more productive.”

Tenet exceeded expectations in Q3 and experienced strong same-store outpatient volumes in its core growth driver, USPI. Tenet continues to invest in the USPI platform. In Q3 Tenet added 6 ASCs focused on orthopedics while noting a pipeline of 30+ de-novo developments.

- “USPI had attractive volume growth in high-acuity service lines, including mid-teens growth in total joint replacements in the ASCs over third quarter 2022. We also delivered ongoing strength in GI, urology, and ENT procedures.”

Tenet also had some interesting intel for us on 2024 expectations:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- “Our starting point assumes that we will continue to produce organic volume growth in our key service lines, increase patient acuity, benefit from better than historical contract negotiations and effectively manage costs with a specific expectation for full year additional contract labor savings. And given the robust pipelines at USPI, we will have further contributions from M&A and de novo development center openings. These factors, in addition to an ongoing post-pandemic recovery for health care services provide tailwinds into next year.”

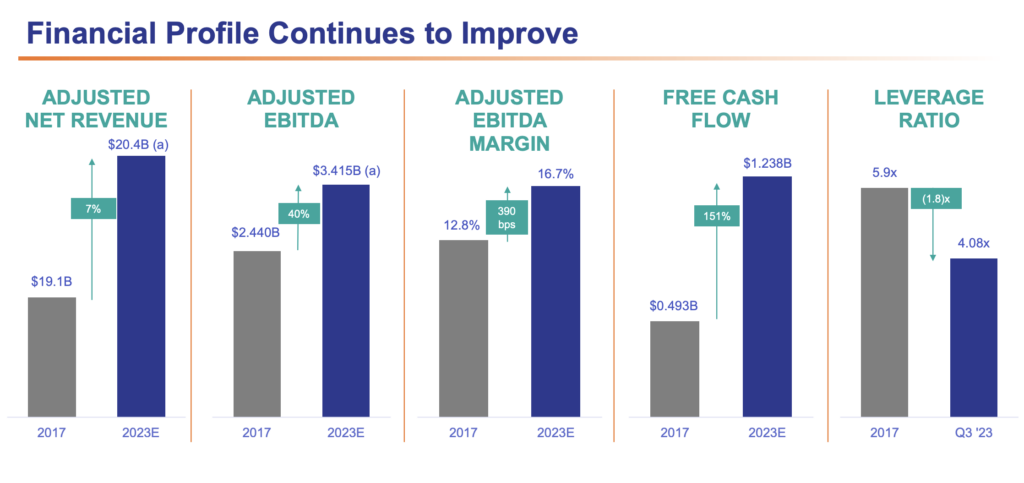

Notably, Tenet’s capital structure is favorable through 2026 with a fixed interest rate structure, giving the firm competitive capital advantages over other firms. Its leverage ratio has decreased to ~4x:

Finally, similarly to HCA, CHS is also bringing physicians in house to control physician subsidy cost inflation.

CMS Releases Direct contracting results

On October 20, CMS released results from the direct contracting (DCE) value-based care program. Overall, savings increased from performance year 2021 – “The model’s net savings to CMS was $371.5 million (1.6% of model benchmark), and the net savings to DCEs was $484.1 million (2.1% of model benchmark).

This is an absolute increase from the $70.4 million in net savings to CMS and the $46.5 million in net savings to DCEs in PY2021. Medicare beneficiaries aligned to DCEs participating in the GPDC Model retained all rights, coverage, and benefits that all beneficiaries with Traditional Medicare enjoy, including the freedom to see any Medicare clinicians.”

- Top 5 individual entities, total net savings:

- Iora Health NE DCE, LLC

- Castell Accountable Care, LLC

- American Choice Healthcare, LLC

- Oak Street Health Medicare Partners LLC

- agilon health Columbus Ohio DCE, Inc.

- Bottom 5 individual DCE participants, on total net savings:

- Clover Health Partners LLC

- Sutter Preferred Direct Contracting Entity, LLC.

- Iowa Health Accountable Care, L.C.

- Florence CIN II LLC

- AKOS MD IPA, LLC

- Read this nice summary from Healthcare Dive

- Check out the full 2022 DCE full results here and the CMS press release with summaries here

- Remember that direct contracting has transitioned into the ACO REACH program starting in 2023. Model overview here!

Henry Ford, Ascension form joint venture to create $10.5B health system in Michigan

Ascension continues to offload assets. In Michigan, Henry Ford, Ascension Michigan, and Genesys are forming a joint operating company to create a $10.5B health system with 13 hospitals.

- This news follows Ascension’s recent market exits, including unwinding Amita Health in Chicago, selling Network Health to Froedtert (who is now merging with ThedaCare), and exiting the Milwaukee market by selling 7 hospitals to Aspirus Health (who is now merging with St. Luke’s Duluth)

Akumin Inc taken private by Stonepeak

After some recent financial struggles and a heavy debt load, radiology and oncology imaging provider Akumin is going private. Stonepeak is restructuring its investment in Akumin, providing needed liquidity to the firm:

- The contemplated transaction will result in the existing Stonepeak Note, totaling approximately $470 million, being cancelled and converted into Common Shares of the Company. In addition, Stonepeak will invest $130 million in new money into the Company as a capital contribution.

Carbon Health article reveals major trouble

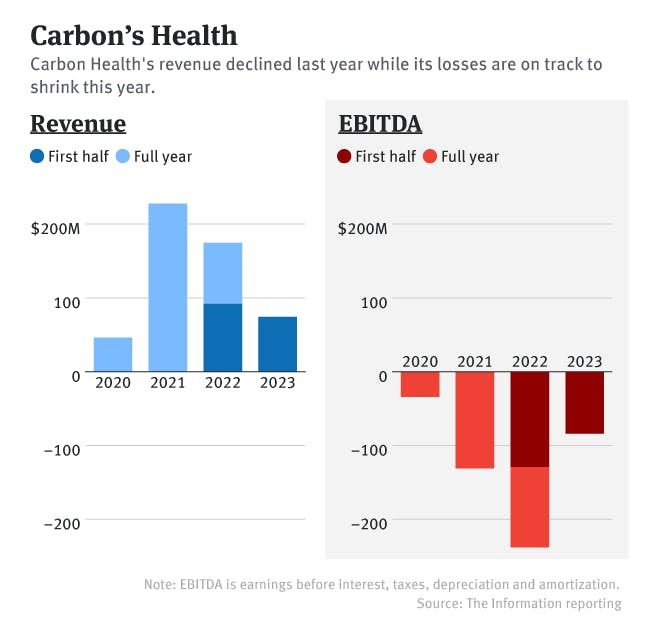

A fascinating report from the Information shed light on Carbon Health’s recent operating and financial struggles. Post-Covid, Carbon can’t seem to right the ship, as an alleged 60% of its revenues came from Covid testing and diagnostic services. Urgent care in general saw a boon during peak pandemic times as patients opted into the convenient care setting to get vaccines, boosters, and tests – all 100% covered by insurance during the public health emergency. But after the good times come the bad, and Carbon is experiencing a sharp decline in revenue.

The Information reported that Carbon’s company valuation dropped from $3B to $1.4B after its $100M funding round led by CVS, post-money. It went on to raise an un-reported additional $50M from its investors, per the article.

This chart below is particularly damning. I mean, now that Carbon shut off all of its shiny toys (public health, remote patient monitoring, hardware, and chronic care programs, etc.)…shouldn’t its results be better than what we’re seeing below? Urgent care is an OK business after all, with normal EBITDA margin in the 10-15% range, no? And isn’t Carbon just a glorified urgent care at this point? Shouldn’t a tech-enabled urgent care (and don’t get me wrong – its tech is COOL) and primary care platform be generating some superior margins, or so the thesis goes? It’s definitely not worth a billion-plus in this state.

No – in 2022, Carbon lost $105 per patient, which is…just under what a normal urgent care visit gets reimbursed for to begin with.

- “In 2022, Carbon lost a whopping $105 per patient visit on average, as issues with its tech platform stymied efforts to collect revenue and operational inefficiencies drove up costs, according to an internal company document viewed by The Information and interviews with current and former employees. As of January 2023, it was losing $64 per visit, according to that document.”

I personally cannot grasp the amount of money being shoveled into the furnace here. Carbon still holds 125+ locations nationwide, a pretty decent footprint. So it’s still a scaled primary care asset. But there are clearly massive issues under the hood. Hopefully Carbon can rightsize itself over the next 6 months, or we might see some more Twitter beef.

Abridge’s $30M fundraising round

AI-enabled documentation player Abridge announced a $30M fundraising round led by Spark Ventures with participation from several notable players including CVS, Mayo Clinic, Kaiser Permanente, and LifePoint Health. Per Forbes, the round brings Abridge’s valuation up to $200M after raising $62.5M to-date.

The round is further validation for AI in healthcare, but especially for AI scribes and documentation, one of the best, clearest near-term use cases for AI implementation in healthcare. Why? It addresses both clinician burnout and reduces administrative burden.

Abridge and other ambient documentation players (Nuance, Augmedix, notably) have gained considerable commercial traction. In particular, Abridge has notched partnerships with UPMC (where founder Shiv Rao has ties), University of Kansas, and Emory Healthcare. Don’t forget they’re one of the first participants in Epic’s Partners and Pals program as well.

Bottom line, this is great news for healthcare as I’m a huge fan of these companies entering a space with clear need. Read this for a full breakdown of what’s going on with AI in healthcare.

A Healthcare IPO on the Horizon – Waystar (no, not that Waystar)

Revenue cycle management player Waystar is has filed to go public at an $8B valuation – the first healthcare related IPO in quite a while.

From what I’ve heard, Waystar is seems to hold the gold standard in RCM

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

Hinge Health IPO: Physical therapy startup, Hinge Health, is targeting profitability in 2024 as it gears up for an IPO. (Link)

Healthcare Performance 2023: Kaufman Hall published its 2023 State of Healthcare Performance Improvement Report, suggesting signs of stabilization in the healthcare sector. (Link)

Rite Aid’s Strategy: Following Rite Aid’s bankruptcy, questions arise regarding a potential new healthcare strategy. Sounds Walgreens-esque (Link)

FTC & Private Equity: The FTC is seeking feedback from physicians on their experiences with private equity ventures. (Link)

Health Systems & Population: This was a good look into how health systems are adjusting their strategies for the coming decade. (Link)

Charity Care Law Dispute: Hospitals in Washington have filed a lawsuit against the state over an expanded interpretation of a charity care law. (Link)

Physician-Owned Hospitals: The AHA is challenging the rising trend of physician-owned facilities, a growing rhetoric on Capitol Hill. (Link)

Nursing Home Staffing: Bipartisan lawmakers have voiced their opposition to the White House’s nursing home staffing proposal. (Link)

Billing Dispute Overhaul: The Biden administration has proposed changes to the heavily criticized out-of-network billing dispute resolution process. (Link)

ACA Risk Adjustment: Insurers have been underpaid by $1.1B in ACA risk adjustment payments, with Bright and Friday failing to meet obligations. (Link)

Partnerships and Product Announcements:

- Greater Good Health partnered with Humana to open up senior primary care clinics at 3 sites in Montana – fresh off Greater Good’s fundraising announcement. (Link)

- Midi Health expanded women’s care access across all 50 states. (Link)

- Alignment Healthcare and Walgreens introduced co-branded Medicare Advantage plans. (Link)

- Mass General Brigham is working on integrating behavioral care into its primary care model. (Link)

- HCA Healthcare is collaborating with Grail to advance comprehensive cancer care with multi-cancer early detection screening. (Link)

- Bicycle Health and Override Health are teaming up for chronic pain and OUD care referrals. (Link)

- Amazon Pharmacy has initiated a drone delivery service in Texas. (Link)

- Memorial Hermann partnered with Midi Health for a new menopause care initiative. (Link)

- Amwell and Leidos secured a defense contract potentially worth up to $180 million. (Link)

- Folx Health announced national and regional payer partnerships to enhance LGBTQ+ care access. (Link)

- DaVita is collaborating with Google Cloud to create a tailored clinical operating system aimed at transforming kidney care. (Link)

- Ayble Health introduced a mind-gut program utilizing behavioral therapy techniques to alleviate GI symptoms. (Link)

- Helpful, a caregiver support platform, has partnered with VNS Health. (Link)

- Walmart expanded its doula services benefit across the nation after a pilot in four states. (Link)

- Luna unveiled value-based products to diminish the cost of musculoskeletal care and boost outcomes. (Link)

- Vivlio Health joined athenahealth’s Marketplace Program, offering a comprehensive medical record workflow solution for healthcare practitioners and staff. (Link)

- Noom declared Navitus Health Solutions as its latest partner for the Noom for Work program. (Link)

- Hartford HealthCare will be opening clinics at Walgreens locations. (Link)

- Galileo and Wellcare have established a new partnership in Maine that will extend to 23k+ potential Medicare Advantage members. (Link)

- Amazon’s One Medical has decided to rebrand Iora senior centers to One Medical Seniors. (Link). ONEM also partnered with Mount Sinai Health System to expand primary care in New York. (Link)

- Cleveland Clinic partnered with TikTok on a search initiative. (Link).

- The State of Delaware chose Bamboo Health’s Behavioral Health Care Coordination Suite to improve connections and information sharing among providers. (Link).

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

- Healthpeak Properties and Physicians Realty Trust are merging to create a $21B enterprise serving the healthcare REIT market with a portfolio across outpatient care and health systems alike. (Link)

- Baptist Memorial and Anderson entered into a shared mission agreement – AKA, a merger – to form a 24 hospital system throughout Mississippi and Tennessee. (Link)

- UPMC and Washington have signed a definitive merger agreement. (Link)

- Business Insider is reporting that weight loss startup Calibrate is selling to a private equity firm. (Link)

- Blue Cross Blue Shield North Carolina acquired 55 FastMed urgent care clinics. (Link)

- AMN Healthcare is acquiring healthcare staffing peer MSDR for $300M. MSDR has a reported YTD annualized revenue run rate of ~$155M. (Link)

- The surge in health-insurance costs presented challenges for finance chiefs. (Link)

- Hallmark Health Care Solutions announced a major growth investment spearheaded by Summit Partners. (Link)

- Sharecare confirmed receiving an unsolicited proposal from Claritas Capital. (Link)

- Elevance Health reported a Q3 profit of $1.3B and increased its guidance. (Link). Elevance also might experience a $500M revenue reduction in 2025 due to a decrease in MA star ratings. (Link)

- Acara merged five entities to innovate home healthcare in Central and South Texas. (Link)

- KKR-supported BlueSprig acquired Trumpet Behavioral Health, adding about 40 new locations. (Link)

- Cone Health doubled its investment to $72M to expand its cancer center plans. (Link)

- Prospect Medical Holdings was given permission to find a buyer for Crozer Health. (Link)

- Express Scripts faced a lawsuit from independent pharmacies over alleged price manipulation. (Link)

- TT Capital Partners made an investment in Cantata Health Solutions. (Link)

- UCI Health acquired GenesisCare radiation oncology centers in Orange County, while GenesisCare filed for Chapter 11 bankruptcy. (Link)

- The FTC sought further review of the merger plans between Atrium and Harbin. (Link)

- agilon health reported its ACOs achieved $107 million in gross savings during the 2022 ACO REACH model performance year. (Link)

- PicnicHealth acquired AllStripes, reinforcing its position as a leader in patient-centered healthcare evidence generation. (Link)

SPONSORED BY VERIFIABLE

If you are looking for a way to revolutionize your credentialing process, it’s your lucky day.

By automating over 3200 primary source verifications, Verifiable slashes credentialing packet completion time by a staggering 78%.

The Verifiable API is a breeze to work with, letting your organization customize to your needs and seamlessly integrating with existing systems and workflows. It’s the key to quickly and efficiently scaling provider networks.

Say goodbye to traditional CVOs.

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Andreessen Horowitz wrote a piece discussing the commercialization of AI in healthcare from an enterprise buyer’s perspective. (Link).

Teladoc revealed AI, M&A, and MSK as the company’s strategic focal points. (Link).

Northwell, New York’s largest health system, introduced the Northwell Cardiovascular Institute to innovate cardiac care. (Link).

Highmark Health aimed to revamp both its payer and provider segments by partnering with Google’s generative AI. (Link).

Amazon Pharmacy began its drone delivery service in College Station, Texas. (Link).

Satya Nadella penned his annual letter focusing on leading in a new era. Adjacent to healthcare but still relevant! (Link).

WebMD engaged Freshpaint to enhance data privacy compliance related to web tracking tech. (Link).

Harmonic Health, an initiative of Redesign Health, was launched to address dementia care delivery. (Link).

GSR Ventures released a survey indicating that generative AI is reshaping digital health investors’ strategies and outlooks. (Link).

eClinicalWorks and healow announced their projected revenue for 2023 at $900 million, up from $800 million in 2022, along with an increase in providers to over 180,000. (Link)

Multiple states initiated legal actions against Instagram and Meta due to alleged negative impacts on youth mental health. (Link).

Fundraising Announcements:

- Waymark secured an additional $42M (Link)

- Evident Vascular raised $35M for AI-enabled intravascular ultrasound (Link)

- Abridge raised an aforementioned $30M (Link)

- Signos raised $20 Million (Link)

- Sage secured $15M (Link)

- Allara raised $10 Million (Link)

- Pair Team raised $9 Million (Link)

- The Next Ventures team penned some great thoughts on the thesis behind their Pair Team investment: (Link)

- Ventricle Health raised $8M (Link)

- Ilant Health launched with $3M in funding (Link)

- Reimagine Care received an investment from Memorial Hermann in Houston. (Link)

Hospitalogy Top Reads

My favorite healthcare essays from the week

- Setting the revenue cycle up for success in automation and AI

- A look into where all of the healthcare spending is going, from the Commonwealth Fund

- How US healthcare leaders are scaling innovation and transformation

- A study of the cost of care provided in physician-owned hospitals.

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 20,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)