Welcome to the annual Hospitalogy year in review! This multi-series post is a culmination of a year’s worth of work. I’ve taken all of the stories I’ve written and analyzed and repackaged them into the themes that shaped 2023.

I hope you find this series valuable over the course of January. If you do, I’d appreciate it if you subscribed or forwarded this email to your team (online version here). Hospitalogy is free, and subscriber growth and open rates are key reasons why that can continue!

But first, please register for my upcoming webinars!

- Discussing the latest in AI-driven healthcare marketing trends and tactics: Register Here.

- Diving into 2024 population health strategies, including de-risking your behavioral health population: Register Here.

Overview of the Hospitalogy 2023 Year in Review:

- Vertical Integration Dominates the Payor Landscape

- Big-Picture Trends in Medicare Advantage, ACA Exchange, and Medicaid

- The rise of Retail Health and nontraditional players (Today’s Essay)

- Health systems respond to labor and inflation struggles, and the return of Utilization a bright spot

- Fallout for high profile PE-backed and VC-backed organizations: a muted year for dealmaking and funding

- GLP-1s burst onto the scene, forming the new Wild West of healthcare

- AI in Healthcare – Evolution, or Revolution?

- Everything Policy – Inflation Reduction Act, Redeterminations, new risk models, and more

- Tactical tidbits – other notable partnerships, deals, and strategies

This edition of Hospitalogy is sponsored by NAVINA

While AI was the biggest buzzword of 2023, 2024 will be the year that more and more healthcare organizations turn to AI to solve their greatest challenges.

As we go from hype to reality, tech companies like Navina are leading the charge in transforming primary care.

Join Navina and the American Academy of Family Physicians (AAFP) for a webinar on January 31st, where a panel of experts and physicians with firsthand perspectives will dive into how AI helps primary care organizations solve for tough realities in the space:

- VBC payment complexity;

- Physician engagement & burnout; and

- Integrating AI into clinical workflows

I highly recommend registering for any primary care leaders taking on risk to understand how the industry is evolving.

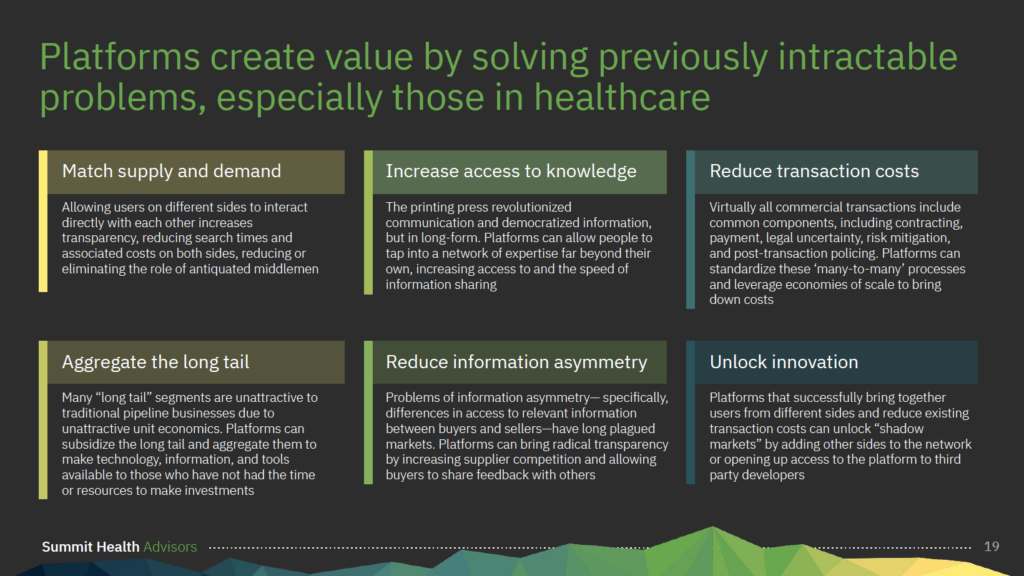

The rise of Retail Health and nontraditional players

One of the more trends that struck me as fascinating this year was watching the utter chaos happening among retail and nontraditional players trying to enter healthcare and figure out cohesive strategies. Bottom line: large retailers want a piece of the healthcare pie, and you should expect stepwise and incremental movement into healthcare from here for most of these (Amazon, Best Buy, various grocers, Walgreens, etc). The below is what I perceive to be close to a comprehensive review of what each player did in 2023, and what their core focus in healthcare is.

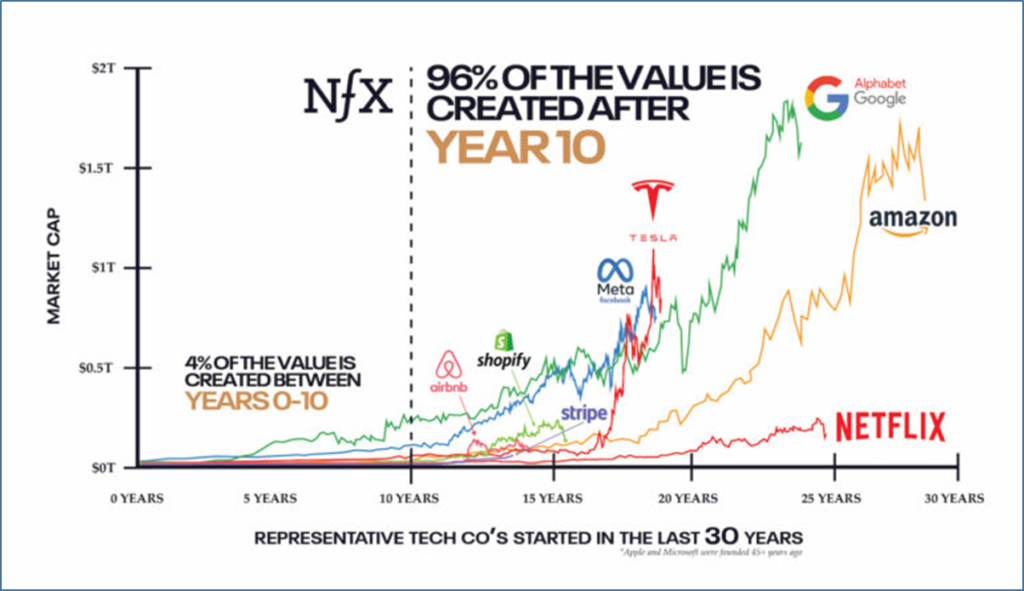

Amazon is building a consumer-focused healthcare platform

If they’re not already, Amazon is headed toward being a consumer-focused healthcare platform, making long-term investments and product launches into the space:

- Amazon Clinic as whitelabeled telehealth solution for low acuity services

- PillPack → Pharmacy for convenient at-home delivery

- One Medical for concierge level primary care

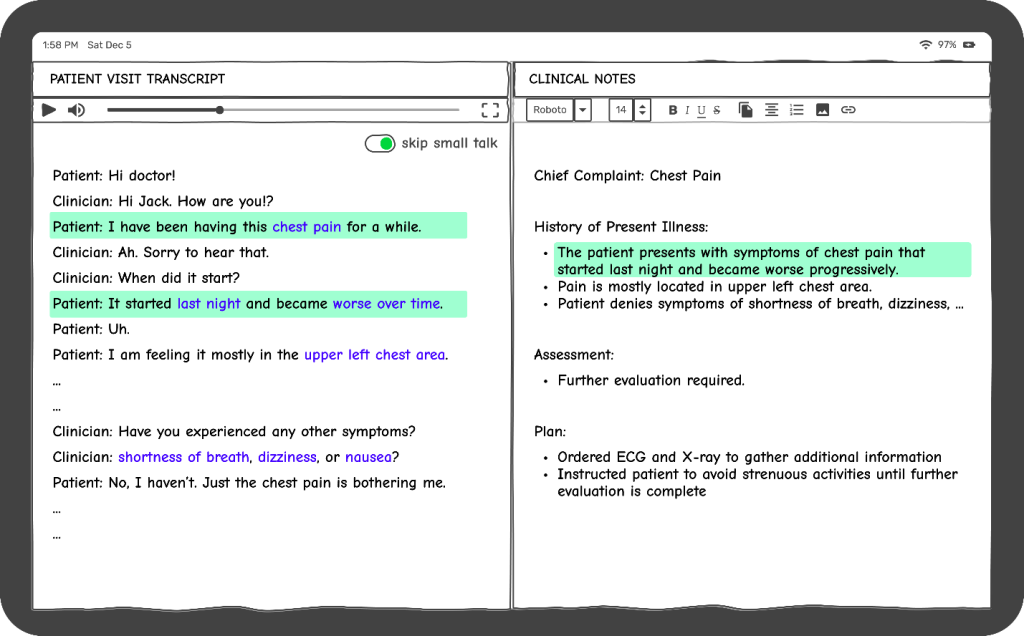

- On the other side of the coin, AWS for Health, Amazon’s enterprise cloud play, has been increasingly focused on providing the picks, shovels, and lego bricks for healthcare software developers to build new tools as of late which I wrote about on Tuesday (HealthScribe, HealthImaging) with the ultimate goal of creating a more compelling offering for its enterprise cloud healthcare customers.

Take a look at Amazon’s current healthcare footprint as of August 2023 and you can see the strategy slowly taking form:

The healthcare strategy is taking shape in a number of interesting platform plays:

- Amazon Clinic: Amazon Clinic acts as a supply and demand platform for low-acuity virtual care and rather than directly providing care themselves, Clinic aggregates existing supply of virtual care providers (Wheel, SteadyMD, Curai, HelloAlpha)

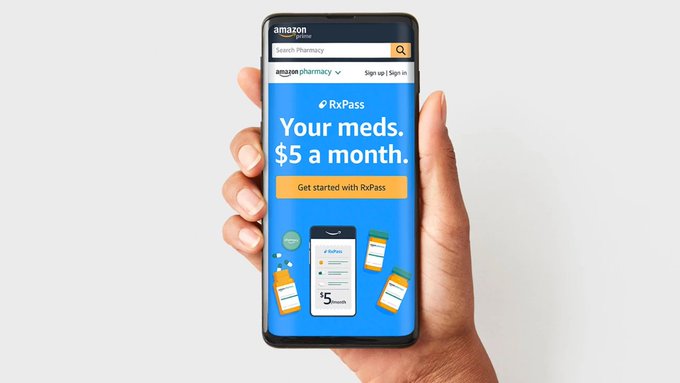

- Pharmacy ↔ Care Delivery Flywheel: Similarly to CVS-Caremark-Aetna-Oak Street or Walgreens-pharmacy-co-located VillageMD, patients are more likely to fill their prescriptions on-site, or in this case, on-platform with Amazon. The effect is probably compounded online given that Amazon’s RxPass is $5 and circumvents insurance (side by side with Clinic).

- RxPass: Amazon also set the healthcare world ablaze on January 24 by announcing its latest healthcare offering – RxPass. For $5 a month added on to an existing Prime membership, consumers can get as many generic medications eligible under RxPass as they need. Right now, RxPass covers around 53 generic medications. It’s a direct-to-consumer offering that doesn’t accept insurance.

What affords Amazon the ability to create these platforms in healthcare over time? First of all, they’re already giant, so stomaching losses on platform developing are a blip on the radar. Secondly, and more importantly, Amazon Prime is an incredibly sticky user base and allows Amazon to acquire customers for a long-term healthcare platform vision on the cheap. At the end of the day, it all boils down to CAC, and Prime is the CACiest of them all with 150 million active prime users in the US.

Source: Healthcare Platform Blog – Amazon is Uniquely Positioned to Deploy Platform Envelopment Strategies in Healthcare: 7 Leverage Points (Part I) (Part 2)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

The Healthcare Platform Blog had a great 2-part series on Amazon where they outlined the following competitive advantages and Amazon’s distinct ability to build platform businesses in healthcare:

- A Huge User Base

- A Loyal User Base

- Provision of Hybrid Clinical Care

- Deep Pockets

- A National and International Footprint

- One-Stop-Shopping for Employers

- Digital Front Door for Healthcare

To this end, Amazon can offer consumer-centric healthcare services to Prime members at scale and continues to push the healthcare needle forward from a consumerism standpoint. They’ve offered, for instance, a 28% discount on yearly One Medical memberships $144 / year during Amazon Prime Day, added estimated wait times along with telehealth messaging services thru Clinic, and of course the aforementioned RxPass for $5 / month no matter how many eligible generics you need filled.

In 2024, we’ve seen an extension of Amazon’s above platform strategy in announcing the launch of Amazon’s Health Services Division. Under that division, Amazon unveiled a new initiative called Health Condition Programs, with launch partner and virtual MSK provider Omada Health. Look for Amazon to make additional plays in this particular space – e.g., trying to grow engagement among employer health benefits – as it tries to get its own consumer base to change behaviors and use the Amazon Health Services platform for Clinic, Pharmacy, One Medical, and more under its growing umbrella. Meanwhile, assuming people actually use this thing, Omada likely benefits from better brand visibility, more enrollment, and lower acquisition costs as Amazon identifies potential Omada candidates via purchasing behaviors. Of course, with tracking purchasing behaviors and diving into insurance coverage & benefits checks, Amazon will have to continue to grapple with privacy concerns from patients, whether that’s fair or not.

Best Buy is building out an at-home empire, partnering with major health systems throughout 2023

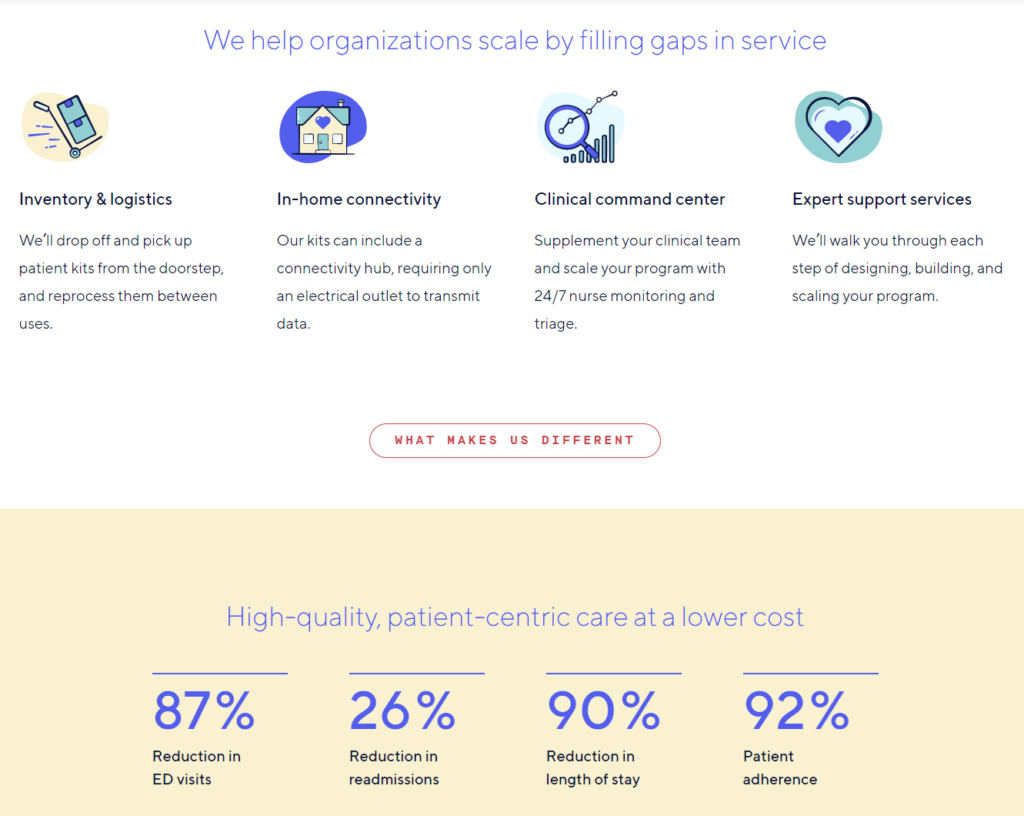

In the ever-advancing encroachment of retail players onto healthcare, Best Buy has been busy partnering with several notable health systems to work on Hospital-at-Home programs. These programs serve as an extension to a health system or hospitals existing bed count, and while traction has been muted, Best Buy & its acquired vendor in the space Current Health are positioning themselves to capture significant value in the space.

During 2023, Best Buy noted healthcare as a growth segment in its earnings calls and announced a 3-year deal with Advocate Health to partner on legacy Atrium Health’s hospital-at-home (HaH) program, one of the largest in the country having served 6,000+ patients since the program began. Diving into that partnership specifically, the Advocate Health ($27B+ in annual revenue system-wide) HaH program will provide care coverage to a population of around 6 million people while serving around 100 patients at a time as an extension of the hospital.

So here’s the breakdown of an existing partnership between Best Buy and a health system (using Advocate/Atrium as an example here) as I understand it:

- Atrium provides its established HaH program and clinical footprint while outsourcing the virtual functions and setup to Current Health. The program includes services such as virtual doctor visits, access to inpatient services, and remote patient monitoring.

- Atrium purchases the tech & other supplies needed for setting up virtual HaH from Best Buy in a vendor relationship; Geek Squad and/or Current sets up the tech (and while they’re at it, why not help grandma with her computer virus troubles?). Based on the comments on the press release, it looks like Best Buy will cross-train Geek Squad agents in certain aspects of health delivery to help stand up the program.

- The partnership in theory is a win-win: Best Buy gets the downstream tech & services sales while Atrium partners with Current, an operator with high quality patient outcomes:

Zooming out, along with Atrium, Best Buy’s Current Health now holds “relationships with 5 of the top 10 largest health systems in the US including Geisinger, Mount Sinai, NYU Langone Health, and others” according to comments from their Q4 earnings call on March 3.

Bigger Retail Health picture: Best Buy’s strategy in healthcare revolves around enabling – but not directly providing – care in the home, which is highly complementary to its existing Geek Squad operation further compounded by its $400M acquisition of Current Health. It has dabbled in the senior ‘AgeTech’ market for a while now, acquiring GreatCall in 2018 and Critical Signal Technologies in 2019.

At the time of acquisition in late 2021, Best Buy touted Current’s more sophisticated capabilities, which include an FDA approved remote patient monitoring wearable along with a network of connected devices. Now in 2023, Best Buy is expecting its Health division to grow faster than its base retail business in yet another example of a nontraditional healthcare player seeking out the $4.3T industry for some extra growth juice.

Given the acquisitions over the years and recent health system traction, Best Buy is developing a long-term play in the growing AgeTech space as an enabler of tech-enabled senior care delivery. Although Best Buy is leaning into Current to develop enterprise partnerships with health systems, let’s look at this from the Best Buy enterprise lens – these partnerships are a way for Best Buy to retain and grow retail sales through sticky vendor relationships. Healthcare specific revenue amounts to nothing in the larger Best Buy organization, but downstream services for Geek Squad tech support and associated device sales will boost Best Buy in 2024 and beyond. From the Q4 commentary: “We are essentially nurturing a startup within a large-scale organization and leveraging Best Buy’s core assets, including the Geek Squad to incubate a new business. The revenue contribution is currently very small and will take time to ramp as the Care at Home space matures and expands over the coming years.”

Bigger Hospital picture: Retail play aside, hospitals need help with HaH implementation and finding a good partner is a real need for hospitals right now. Health systems are very interested in expanding Hospital-at-Home programs. HaH reduces labor needs, shortens, length of stay, and keeps lower acuity, low margin observation patients out of the hospital. A quarter of the Advocate program’s patients are underserved or at-risk populations which bolsters access to hospital-level care in the home, a setting that patients prefer (HaH results in a 10% bump to patient saisfaction). Still, despite all of the positives, HaH enrollment and implementation has proven difficult based on conversations I’ve had. It’s an innovative program that deserves long term policy support.

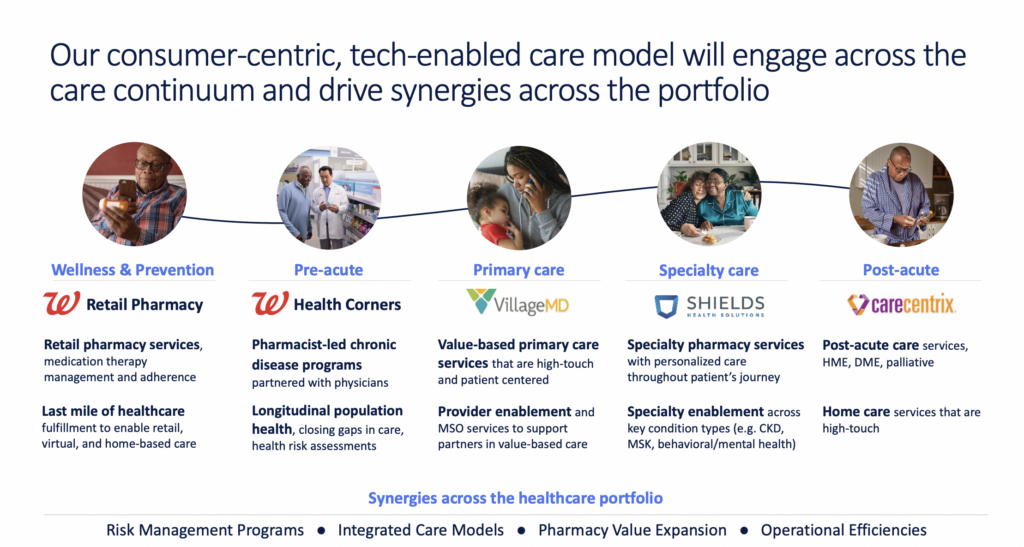

Walgreens is trying to sell the healthcare transformation story

Walgreens is an interesting one.

For one, they have massive national presence through their retail pharmacy footprint, but growth in that segment is stagnant to declining. Two, they own around 53% of VillageMD, a massive payor agnostic healthcare player in both urgent care, senior clinics, and multispecialty physician services. Three, they’ve cobbled together some other non-VillageMD assets around population health, specialty pharmacy, post-acute care coordination, and at-home services.

But here’s the big picture – Walgreens is floundering entering 2024. Hard.

As it turns out, selling a turnaround transformation by leaning into healthcare is pretty difficult. A transformation like one Walgreens is undertaking doesn’t happen overnight, and there’s a healthy amount of skepticism. After a massive decline in stock price, along with announcing a CEO transition right after a dismal quarter, the writing is on the wall, and leading to unfortunate headlines like this:

So…what in the world happened to Walgreens to get us to this point?

Major VillageMD Scaleback to focus on market density: After a long period of clinic expansion including an $8.9B purchase of Summit Health (where integration efforts are likely taking their toll), VillageMD is exiting certain markets including Indiana as part of its announced cost cutting plan from October 2023 in an attempt to create a profitable, sustainable healthcare player. The struggling retail pharmacy chain plans to cut up to $1B in costs enterprise-wide, drop CAPEX by $600M, close 200+ stores, and also close 60 VillageMD locations across 5 markets to focus on VMD’s density in existing markets.

A new leader at the helm: Walgreens also announced the hiring of Tim Wentworth as CEO, who holds substantial experience in healthcare at both Evernorth and Express Scripts, and knows the PBM space intimately.

New telehealth service: Finally, Walgreens launched a DTC telehealth offering in 9 states in an almost exact replica of Amazon Clinic – cash pay, no insurance, etc.

Pearl Health Partnership: The most interesting announcement by far to me was Walgreen’s decision to partner with Pearl Health, a physician enablement player primarily focused on ACO REACH to this point. On September 12, Pearl announced a strategic collaboration with Walgreens. While the details surrounding the partnership itself were a bit high level, Pearl just set itself up for potentially a huge win with a national player that owns one of the largest healthcare delivery organizations in the country in VillageMD.

Here’s the initial scope of the capital-light joint venture:

- Pearl: will provide its tech and analytics to identify patients that can benefit from Walgreens-led healthcare programs

- Walgreens: will provide prescription fulfillment, medication adherence, immunizations, care gap closure, diagnostic testing, and discharge transition management to the JV

Per Axios, it seems like Walgreens will look to provide MSO services to health systems and physician practices. “The idea is to marry Pearl’s operating system and capabilities to Walgreens’ care delivery assets. Walgreens will act as a management services organization for doctors and hospitals, he said.”

Bigger picture: Walgreens is way behind. As Advisory Board pointed out, CVS’ market cap has doubled since its acquisition of Aetna while Walgreen’s has dropped by 60%+ (notably, both have significantly underperformed the S&P. Diversification for the win).

Despite being a $140B+ in annual revenue company, Walgreens is losing money, and has plenty to prove in 2024. Walgreens will lean hard into its trusted brand and existing sprawling infrastructure to evolve the overall business model, with the stated goal of being the independent partner of choice among healthcare service providers, and lean into enabling the pharmacist as a core provider. To that end, look for Walgreens to make more capital-efficient, capital light moves in the coming years like the Pearl partnership. Finally, Walgreens holds a significant opportunity in 340B and leveraging Shields Pharmacy to support health systems in the program. There’s a long road ahead, but still plenty of value for Walgreens to capture in the healthcare landscape.

- “Because actually, we’ve got several of the major, major health plans in the country that want to sit down with us. We just sat down with a large health system where we’re doing some additional things for. And six of their Senior and Executive Vice Presidents spent a day in Chicago with our team sort of brainstorming what are other things you can do, leveraging this engagement platform that creates high trust, touches 10 million people a day and is in every community and neighborhood pretty much that you would want to be in, in order to affect your strategy as a payer. So more to follow, but I think you’re going to see there’s a tremendous amount we’re going to be able to do.” Tim Wentworth, CEO & Director Walgreens – JPM Healthcare Conference

- “But we’re open for business as it relates to looking at small- to mid-sized ideas. We are not cash-rich right now. We are not in a position where we can do large acquisitions. And I believe we’re not in a position where we need to, to grow the company in a meaningfully responsible way on an earnings basis for the longer term. So we’re out there looking, but we don’t need it.” Tim Wentworth, CEO & Director Walgreens – JPM Healthcare Conference

The Walmart Health Growth Story

What might alignment with Walmart look like? To help inform that question, let’s look at what Walmart has done in healthcare in recent memory. From my retail health update in October 2022, some history you need to know:

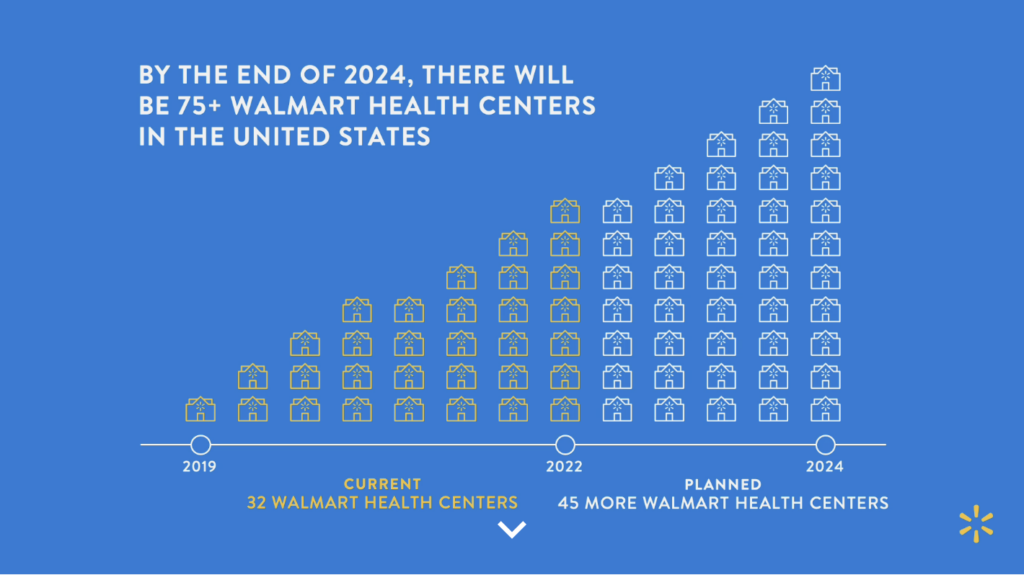

Originally, Walmart had an ambitious vision to open up consumer-friendly Walmart Health clinics very quickly across a number of regions, announcing the plan to do so back in 2019. Since then, Walmart lost some key healthcare executives and faced other rumored operating challenges, which caused a slowdown in healthcare.

Walmart then came out of the woodworks and acquired little-known virtual care provider MeMD, which has since been renamed Walmart Health Virtual Care.

It then partnered with UnitedHealthcare and Optum on a 10-year collaboration focused on Florida and Georgia, including a co-branded Medicare Advantage plan in Georgia to include Walmart Health locations with Optum’s guidance.

Then later in 2022, Walmart unveiled significant expansion plans. On October 26, Walmart announced plans to open 16 new clinics over the course of 2023 in Florida around Jacksonville, Orlando, and Tampa.

Since that announcement, Walmart found its footing and plans to double the number of Walmart Health centers in size by the end of 2024 to 75+ clinic locations. As of this writing, Walmart has 48 Health Center locations across 5 states, with 23 of those in Florida.

Since then, Walmart deepened its interest in healthcare.

Bloomberg reported on September 8 that Walmart was rumored to be eyeing an acquisition of ChenMed, a longstanding family-owned senior, Medicare Advantage (MA) primary care platform. While the deal value was alleged to be in the billions of dollars, talks seem to have fizzled out since. Still, the message is clear: Walmart wants to be a major healthcare player. Their desire to acquire Humana years back tells you as much.

Through the rest of this year, we witnessed Walmart launching a virtual primary care clinic via Included Health for its employees. Then in the back half of the year, Walmart brought in 2 former health system leaders (and continues to actively hire in senior management roles).

In one of the more notable moves, in November, Walmart notched care coordination and referral management partnerships with Ambetter Health (Centene owned exchange plan) and Orlando Health, a system with a sizable in Florida. Given that most retail health clinics provide lower acuity, urgent care like services, I’d expect to see more alignment and referral management between players like Walmart and health systems & health plans for greater care coordination / referrals among shared patient populations.

Dollar General: The Rural Healthcare Savior, or a Fraud?

In late January, Dollar General announced it’s partnering with non-emergency medical transportation provider DocGo under its DG Wellbeing brand to begin providing care outside its stores in mobile clinics. The pilot started with 3 stores at Dollar General locations outside of Nashville, Tennessee and will mostly care for low-acuity, urgent care level conditions, but since this announcement, Dollar General has already closed one of those sites, citing ‘low volume.’ Sigh. The mobile clinic will rotate between each site every two days – closed Tuesdays – with hours from 10am – 8pm.

While pretty limited in scope, the pilot holds major potential to fill in gaps in rural primary care. Dollar General execs have long noted that 65% of its almost 19,000 stores are located in areas with little to no access healthcare and pharmacy deserts. At the same time, 75% of Americans reside within 5 miles of a DG store. With these data points combined, DG wants to gut rural America address healthcare shortages in rural communities. So far since 2021, here’s what they’ve done in healthcare and related areas to that end:

- Launched DG Fresh in 2019, a program to distribute fresh groceries into stores, aimed to counter criticisms over what DG historically offered in food deserts;

- Hired a CMO in 2021 and expanded in-store options to include health and wellness offerings like cold medicine;

- Partnered with Babylon (I wonder if this still exists?) on telehealth services and Higi on blood pressure machines;

- Worked with GeniusRx on prescription delivery and online pharmacy services; and now,

- Piloted this mobile clinic partnership with DocGo (the company formerly known as Ambulnz, the realest name ever)

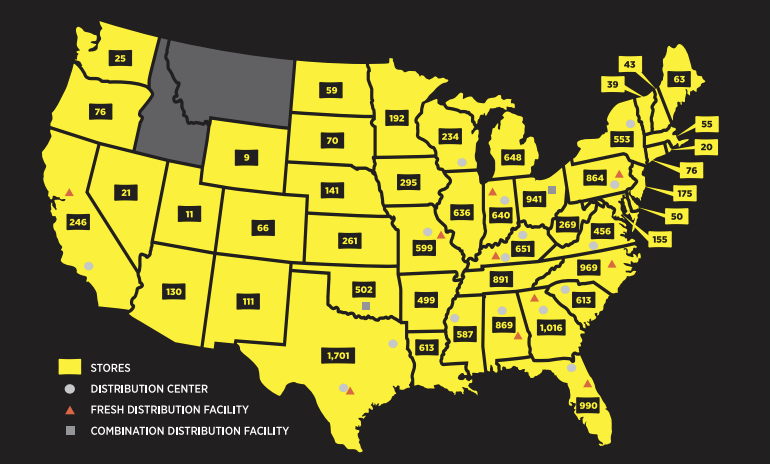

Dollar General footprint from January 2022

As CVS and Walgreens decrease their stagnant retail footprints but double down on healthcare, Dollar General is doing both by taking over rural retail markets – an area where even Walmart seems to have struggled. DG is opening stores throughout rural America, downturn or not, with 1,000+ new store openings planned in 2023. It can enter and win in these markets like other retail chains can’t. And the markets are quite literally too small for other players to enter profitably, which gives DG a sustainable moat.

The Dollar General playbook is well documented and startlingly efficient. DG enters rural towns with low populations. Then, it leverages its national scale to operate at razor-thin margins, taking out local businesses like independent grocery stores or local shops that simply can’t sustain on such a low price competitor down the street. “Dollar General sells some items at a lower price than he can get them for wholesale.”

As far as healthcare is concerned, so far, Dollar General isn’t planning to repurpose physical space in its stores. Rather, DG is focused on care delivery segments that fill in gaps in rural care (telehealth, mail order pharmacy, mobile clinics). It’s the perfect business model. Sell sodas and cigs to your community of 500 people, then treat them for chronic conditions like high blood pressure and diabetes. Talk about a flywheel!

Dollar General holds vast potential to serve rural communities well, but it’s not even close to moving the needle on healthcare – yet. Jokes about junk food and tobacco aside, there’s a huge, obvious need here. I’m glad something is being done. But at the same time, everything DG has done so far has been quite limited in scope. If health initiatives aren’t yet a priority for the ~$36 billion in sales, $68 billion company – and likely never will be. And we shouldn’t expect a retail player to be a healthcare savior in rural markets to begin with. We should expand the conversation to see what actually needs to be done from an access perspective.

What’s everyone else up to?

Kroger: Kroger and Intermountain’s Select Health introduced a co-branded Medicare Advantage plan in August. The co-branded plan will be offered in Colorado, Idaho, Nevada, and Utah. Kroger has previously partnered with Elevance and Priority Health and there are several other co-branded plans out there in the wild.

Kroger is boosting its healthcare presence by jumping onto the senior primary care clinic train. The grocery chain full of seniors is partnering with Better Health Group and their MSO offering to transform Kroger’s existing Little Clinic footprint into value-based primary care for Medicare & MA enrollees. According to Fierce, there are 225 Little Clinic locations and Better Health Group operates 162 of its own but we all know that this sort of play is a keeping up with the Joneses maneuver to drive downstream grocery and pharmacy sales.

Still, more access is better than less, and if Kroger succeeds in offering longitudinal primary care services, especially in underserved areas, it’s not a problem for me. Call me dubious, but I it’ll be interesting to see how Kroger plans to transform a more “Minute Clinic” urgent care-like offering into advanced comprehensive primary care services. Kroger is also likely looking to jump into the ‘Food as Medicine’ movement as those programs emerge.

HEB: After launching its HEB Wellness Primary Care in 2022, HEB is slowly expanding its Texas primary care presence.

Costco: Adding to its hot dog value deal, Costco also launched a cash pay telehealth offering to its members similarly to offerings launched by Walgreens and Amazon Clinic.

- Side note: When are we gonna see the Kirkland care delivery brand? Kidding.

Bigger Picture: What’s the end game for Retail Health?

Most of us are familiar with the retail health playbook. Provide care for people in-store, and they’ll end up buying other stuff from you. So while you might not necessarily make money on the primary care or urgent care book of business, you’ll definitely make money on the supplement they bought, or the groceries they purchase afterwards.

But what about the deeper care coordination and need for downstream services? In 2024, retail health 2.0 will see more follow Walmart’s lead. Players increasingly involved in care delivery forging deeper relationships between themselves and traditional healthcare players.

What else are you seeing across the retail health landscape? Respond with your thoughts.