Welcome back to another edition of Hospitalogy, a newsletter by yours truly that dives into the business of healthcare. First time reader? Subscribe here to support my newsletter and future content!

This edition of Hospitalogy is Sponsored by ADONIS

Over the past couple of weeks, I’ve been working closely with the Adonis team to provide Hospitalogy subscribers with a thoughtful, informative overview of revenue and compliance related trends.

On August 22, we’ll be releasing that conversation, diving into the key themes affecting physician practices, health systems, and digital health organizations. Billing, collections, price transparency, value-based care, and revenue cycle management are all on the table.

It’ll be a State of the Union, but for healthcare – and you don’t want to miss it. Even if you can’t attend, sign up and we’ll send you a recording after the fact. I’m looking forward to the discussion!

Cano Health’s Slow Demise

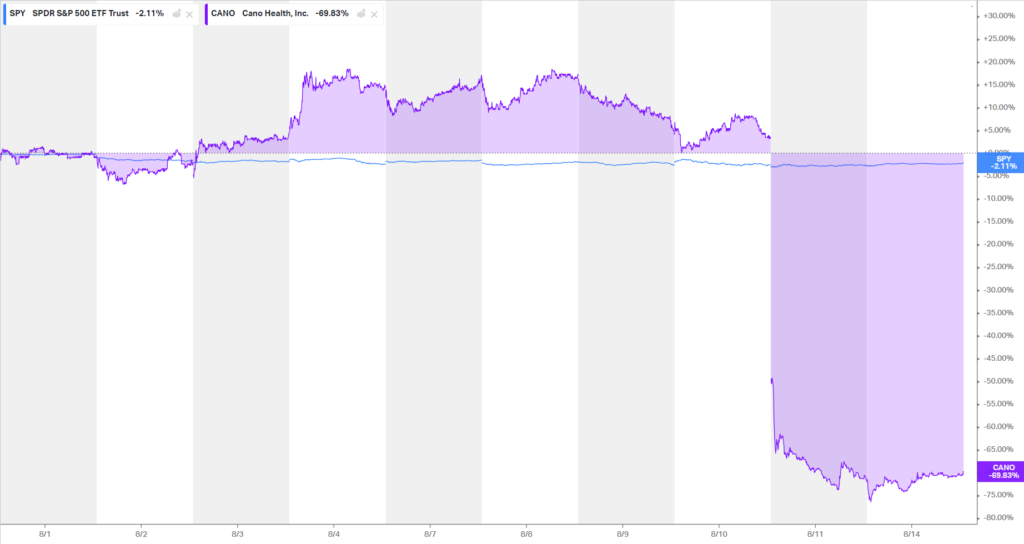

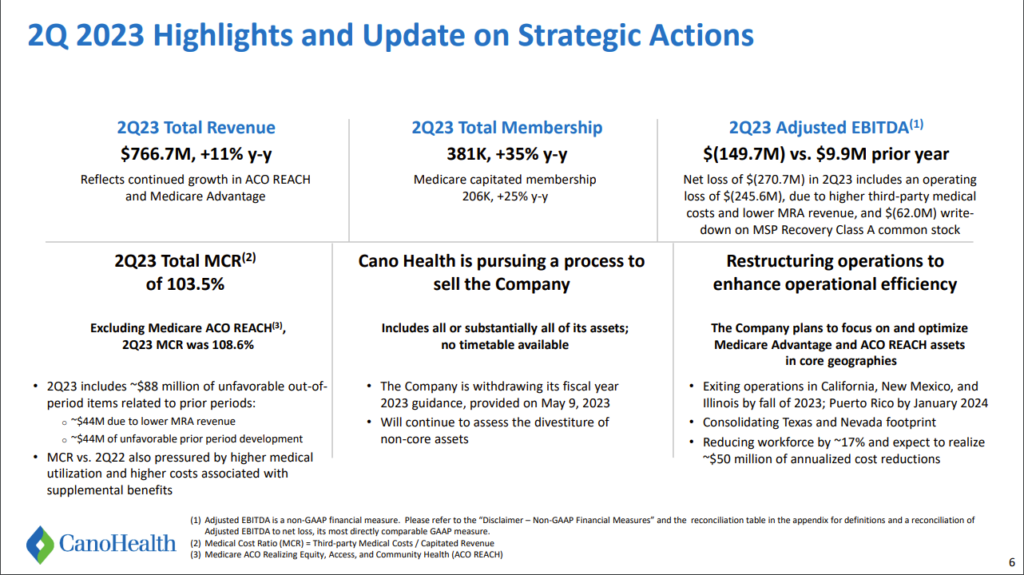

After a long and beleaguered journey to this point, including a lengthy board fight, going concern…concerns, a $150M loan at a 14% interest rate for a year-long lifeline, and a rescheduled Q2 earnings conference call, Cano Health posted dismal results on its Q2 earnings release. The Medicare Advantage-focused senior clinic care platform reported a 103.5% medical loss ratio, meaning that for every premium dollar earned, Cano paid out 103.5% in medical costs. Good on them for subsidizing needed patient care!

Following the financials down the line, Cano was wildly unprofitable in Q2, despite the relative success of its other peers in the space. For instance, compare the below results with CareMax’s Q2, which posted an MLR of 84.6% and positive adjusted EBITDA of $7 million despite some potential financial struggles on the Steward Health Care side given its previously announced partnership with the health system.

Jest aside, Cano has had some major questions to answer for quite some time. Consequently, the management of its business operations has crumbled. The once high-flying VBC organization is now laying off 17% of its workforce and announced that its ‘going concern’ status is in serious jeopardy:

- The Company currently believes that this amount of liquidity is not sufficient to cover the Company’s operating, investing and financing uses for the next 12 months. Management has concluded that there is substantial doubt about the Company’s ability to continue as a going concern within one year.

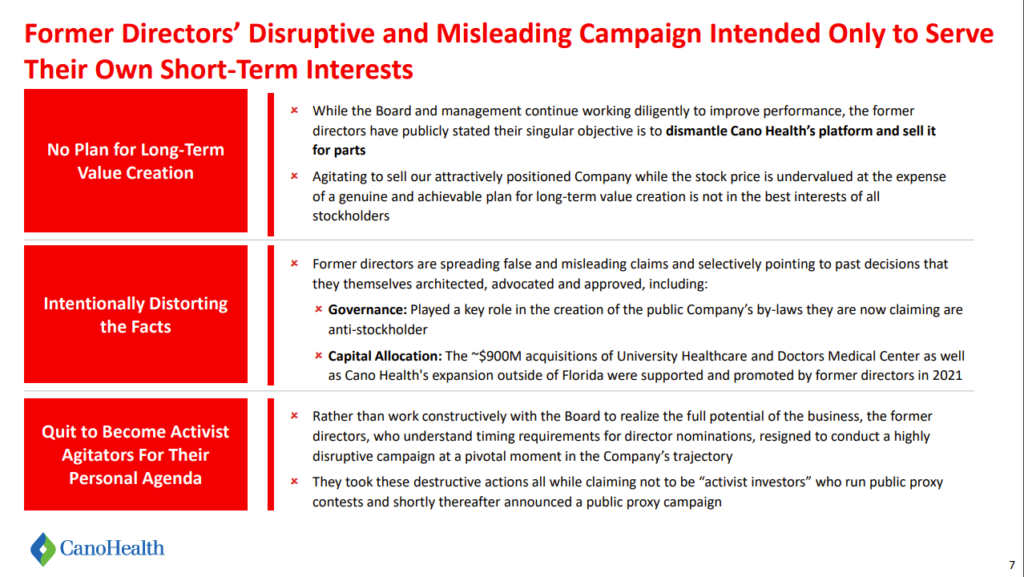

The narrative is familiar if you’ve heard my post-mortem of Babylon – Cano Health went public via SPAC at an over-exuberant valuation (I’ve heard anecdotally that the winning bid was several multiple turns above any other PE offer). The firm operated / expanded into bad markets, and facilitated extremely sketchy, borderline criminal related party transactions. So you can see why this mismanagement situation quickly devolved into a board fight over the course of 2023.

And now – this dismal Q2 print is the nail in the coffin. Cano Health’s days are numbered all the while other value-based care names are either flourishing (Privia, Agilon, Caremax), or being bought for hefty premiums by payors (Oak Street Health, One Medical).

Egregious mismanagement is an understatement here.

Bottom line: After almost selling to CVS back in October (I bet CVS knows exactly how bad things were once they started the diligence process), Cano is hoping to find a get out of jail free card through some form of garage sale with a major strategic or financial player.

Partnerships and Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

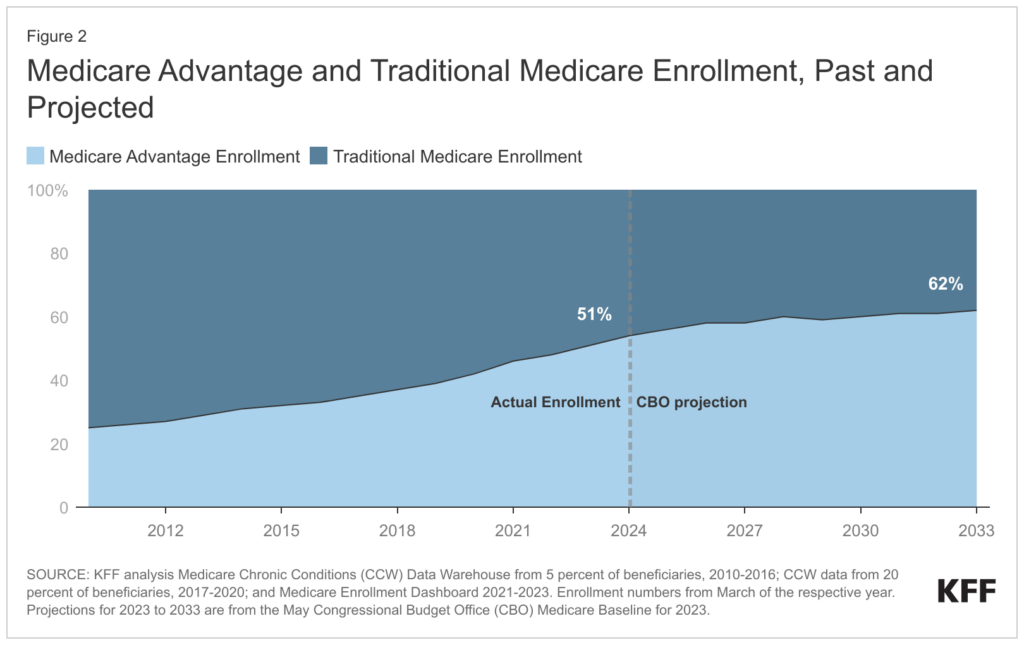

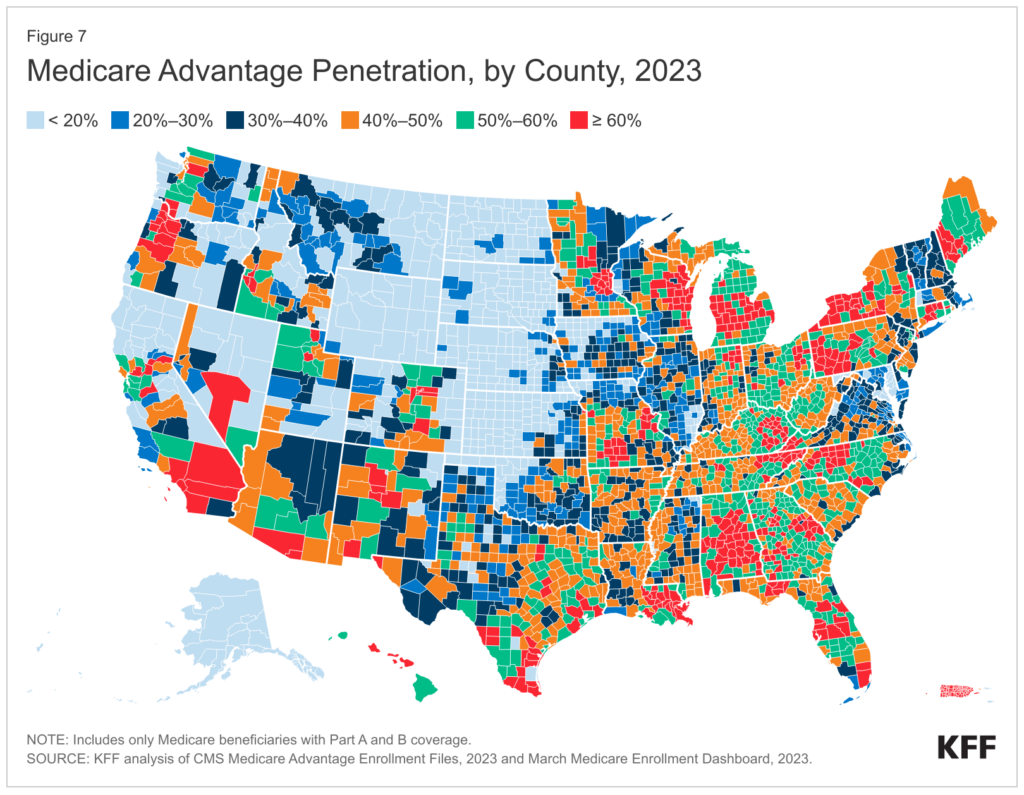

Medicare Advantage 2023: KFF highlighted several important trends in the Medicare Advantage space, including that 51% of enrollees are now on Medicare Advantage plans, and UnitedHealthcare and Humana nowcomprise about half of all MA enrollees. Very cool article and visualizations on trends throughout the Medicare Advantage landscape. (Link) Yubin Park from ApolloMed also shared some interesting insights on Medicare Advantage trends over the past two decades on LinkedIn here.

Health System Revamp: This was a good discussion from Beckers on thinking around how to redesign the health system, including: (Link)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Building outpatient surgery and care networks.

- Creating remote patient monitoring and hospital at home programs.

- Developing partnerships for telehealth, virtual care and digital front doors.

- Standing up virtual nursing programs.

- Embracing consumerism.

- Ken Kaufman also penned some good thoughts on current strategy and planning in the hospital c-suite here.

Obesity Breakthrough: A landmark trial found that Novo’s obesity drug Wegovy lowers cardiovascular risk by 20%. This has massive implications, mainly for senior populations, in gaining wider coverage access for patients. (Link)

Enhabit’s Strategic Shift: Enhabit declared its aim to initiate a strategic alternatives process following some talk of this happening earlier in 2023. Given that we’ve seen major takeovers of home health players of late and the fact that Encompass orphaned its home health and hospice spinoff, I wouldn’t be surprised to see yet another sale in the space. (Link)

Microsoft & Epic Collaboration: We’re getting some glimpses into Microsoft’s previously announced collaboration with Epic, starting with Mount Sinai (shout out Jared) and working on an EHR cloud database solution leveraging Azure’s Large Instances. (Link)

HHS’s Nursing Investment: HHS pledged over $100M to boost the nursing workforce. (Link)

DOJ Investigates latest Optum $3.3B Deal: The DOJ sent a second request concerning the $3.3B deal between UnitedHealth and Amedisys. They’ll try to prove some antitrust case out and then ultimately let Optum acquire its second nationally scaled home health asset in as many years. (Link)

Private Equity in Healthcare: This is a good overview of niche investment areas within healthcare-related private equity from McGuireWoods. (Link)

Physician-Owned Hospital Restrictions: Keep an eye on the physician-owned hospital space. While most rhetoric is on social media, there is some lobbying effort and real legislative movement toward this end, including from the AMA itself. I wrote about the physician owned hospital debate here. (Link)

Optum Layoffs: Similarly to CVS, Optum has quietly administered layoffs within its workforce. If you’re affected by recent layoffs, (Link)

One Medical plots Expansion: Amazon’s subsidiary primary care platform One Medical has plotted out new clinic openings: 2 in CT just opened, 1 in SF, and 3 more in CT coming in the near future. (Link)

MultiPlan Antitrust Lawsuit: AdventHealth accused MultiPlan of acting “like a mafia enforcer for insurers” in an antitrust lawsuit. (Link)

Suicides in 2022: The CDC reported an all-time high in suicides for 2022, truly a crisis of catastrophic proportions. (Link)

Healthcare Data Breach Costs: For the 13th consecutive year, healthcare experienced the highest data breach expenses. (Link)

Partnership Announcements:

- Ambience Healthcare and The Oncology Institute partnered to bring an AI-enabled operating system for oncology care. (Link)

- Kakao Healthcare partnered with Novo Nordisk to offer a digital diabetes service. (Link)

- Suvida Healthcare collaborated with Elation Health to aid Hispanic seniors. (Link)

- Charlie Health and Mantra Health joined forces to enhance behavioral healthcare for college students. (Link)

- Blues plan and 12 major healthcare systems united to eradicate racial bias from 15 clinical decision-making tools. (Link)

- Mae and Molina Healthcare of Virginia formed a partnership to support Black expectant mothers. (Link)

- Beth Israel Lahey Health planned to implement a ‘hospital at home’ program across 10 hospitals. (Link)

- Guideway Care and Vizient initiated a strategic alliance, introducing Care Guidance to Vizient’s High Value Network and connecting employers to top-tier health institutions across the country. (Link)

- Optum and Capella University unveiled a new Nurse Practitioner Program to meet the increasing national demand for proficient clinicians. (Link)

- CareFirst BlueCross BlueShield joined with Ryse Health to tackle uncontrolled Type 2 diabetes. (Link)

- Maven Clinic partnered with Amazon to provide women’s healthcare to Amazon employees. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

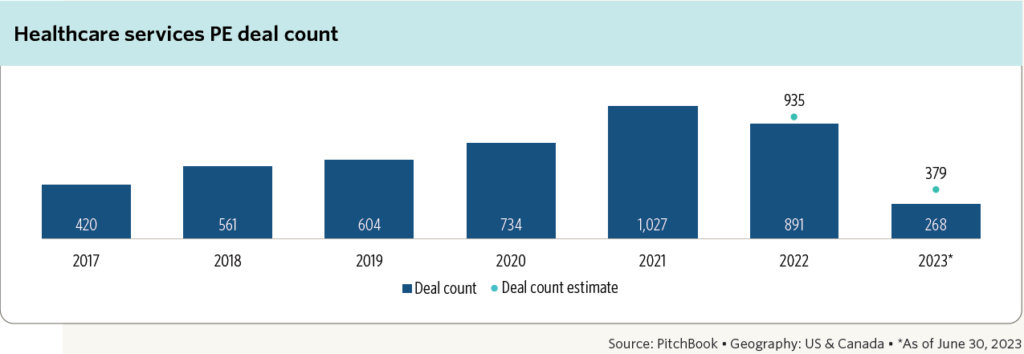

- Pitchbook’s Q2 healthcare services report published on 8/11 noted a 3-year low in M&A activity on the heels of heavy leverage from private equity. That being said, both Pitchbook (Linked Here) and KPMG (Linked here) are expecting a rebound in activity in the second half of 2023. Image credit: Pitchbook Q2 2023 Healthcare Services Report

- Thoma Bravo and Madison Dearborn Partners sold Syntellis Performance Solutions to Roper Technologies for a reported $1.4B EV. (Link)

- Phreesia acquired Access, expanding its services for acute-care hospitals and emphasizing patient experience improvement. (Link)

- Definitive Healthcare acquired provider data and analytics firm Populi. (Link)

- Doximity laid off 10% of its workforce and downgraded its revenue guidance as the stock declined. (Link)

- Insurers are projected to receive $12.8B in MA bonus payments in 2023 which will likely be the high for some time as payments and star ratings come back down to earth after 2023. (Link)

- Despite several high profile failures in the autism space, KKR and Altamont launched a new autism platform Gracent. (Link)

- Interesting commentary from the Pennant Group’s COO, John Gochnour, that valuations in the hospice sector are becoming more aligned with reality and coming down from a peak of 29x during Covid!! (Link)

- California introduced proposed regulations concerning notification requirements for healthcare transactions. (Link)

Q2 earnings roundups continue:

- RadNet Q2. (Link)

- Bright Health Group Q2. (Link)

- GoodRx Q2. (Link)

- DocGo Q2. (Link)

- Clover Health Q2. (Link)

- Lifestance Q2. (Link)

- Oscar Health Q2. (Link)

- CareMax Q2. (Link)

- Cano Health Q2. (Link)

- Definitive Q2. (Link)

SPONSORED BY OPILIO

I’ve spoken to several healthcare executives who are worried about losing control of their organization’s data when thinking about implementing AI and machine learning solutions. But there’s a path forward, and Opilio has the product and expertise you need.

With Opilio, you can leverage the power of AI and machine learning technology within your organization while maintaining ownership and control of your data. No need to compromise on compliance with HIPAA either.

Discover how Opilio makes it all possible and more.

Learn more about Opilio’s offering now to unlock the true potential of AI without sacrificing data ownership. Let’s navigate the future together.

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Hims & Hers plans to launch weight loss business by year-end as revenue growth streak continues in Q2 (Link)

The Board Room’s own Ross Armstrong, Chief Commercialization Officer at Biofourmis, was interviewed by Home Healthcare News on recent trends across home healthcare, and how Biofourmis has laid out its home care enablement platform. (Link)

Circulo Health is in a state of disarray after its $50M Series A in 2021, terminating 2 of its 3 segments. Healthcare is hard. (Link)

Fundraising Announcements:

- Daybreak Health, a provider of free school-based mental health services for youth, raised $13M. (Link)

- HerMD, a women’s health clinic network, secured an additional $18M in funding. (Link)

- FIGUR8, a startup focused on measuring musculoskeletal health and injury recovery, closed a $25M Series A-1 round. (Link)

- Better Life Partners, a virtual SUD and mental health platform, raised $26.5M. (Link)

- Memorial Hermann Health System made a strategic investment in the Capital Rx customer solutions platform, though the specific amount wasn’t mentioned. Memorial Hermann joins Capital Rx’s existing investors in supporting the development of JUDI®, the new standard for backend claims processing platforms in the pharmacy benefit management (PBM) industry, and the overall growth of Capital Rx’s full-service PBM and pharmacy benefit administration (PBA) platform as a service (PaaS) solution. (Link)

The Healthcare Hype Cycle:

This is the spot where I cover the buzzy, hot topics in healthcare. Currently the flavor of the month is AI in Healthcare.

Google is being questioned by a senator regarding the accuracy and ethics of its generative AI tool. (Link)

Ramsay Health Care is amplifying its AI adoption through a partnership with Google Cloud. (Link)

Lupin Digital Health launched an e-clinic focused on heart failure treatment. (Link)

Healthcare executives express optimism about generative AI, yet many lack a comprehensive strategy. (Link)

A focus on M&A exits and the potential applications of generative AI are emerging trends in healthcare AI. (Link)

Bain offers insights on leveraging generative AI in the healthcare sector beyond mere industry buzz: (Link)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

- If you haven’t read the latest ESPN report on Michael Oher and his faux-adoption conservatorship, you should. It’s pretty crazy. (Link)

- Another crazy story – my favorite lefty golfer Phil apparently has lost $100M in gambling. No wonder he needed the LIV money!! Forever a Phil fan here, though. We all know he’s a weird dude with some struggles, but you gotta love him. (Link)

- I’m pleased to announce 2 things – 1) Blake’s bets, for the upcoming college football season, is coming soon! 2) I’m getting back out on the links this Sunday, so for all of you on the edge of your seats waiting for my next golf round, you won’t have to wait much longer.

- I’m becoming an full-fledged influencer with some apparel getting sent my way (kidding). But one of my wife’s friends hooked me up with some sick golf shirts from Criquet. Not an ad & no financial arrangement but I’m a huge fan of the linked shirt there. Great fabric.

Hospitalogy Top Reads

My favorite healthcare essays from the week

- The hidden fee costing doctors millions every year. This piece by ProPublica is actually insane and personifies the structural disadvantages for smaller providers. (Link)

- This long, well written overview of UnitedHealth Group was a fascinating read into the giant’s beginnings. Quite biased, though; lots of spin about how apparently every decision ever made at the organization was a cruel twist of fate toward an evil end. (Link)