Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

CareMax and Steward Health Care Partner on Risk

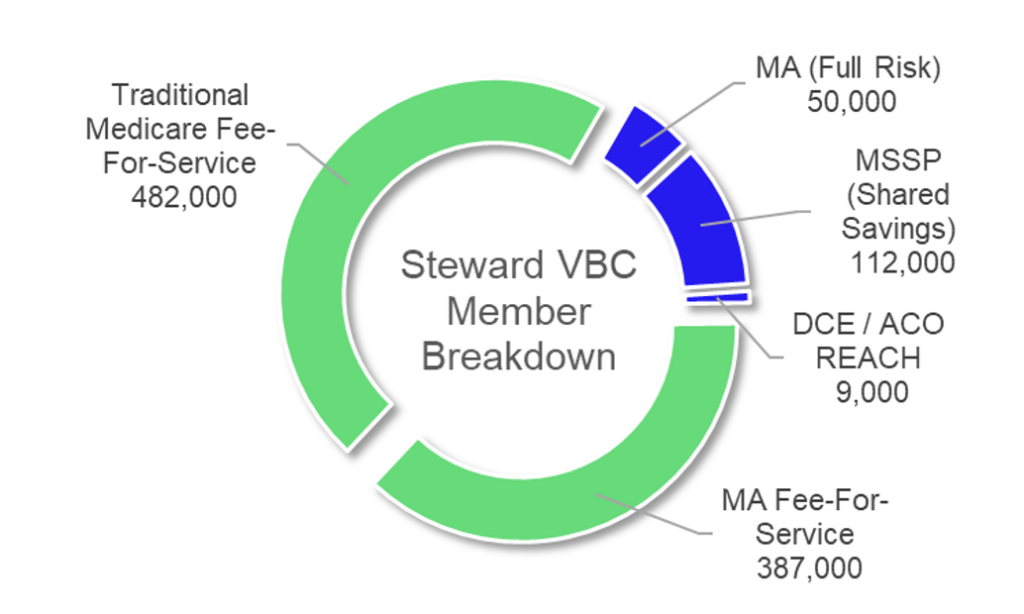

In one of the more significant value-based deals announced in 2022, CareMax announced the acquisition of Steward Health Care’s Medicare Advantage business, comprised of 171,000 lives across 8 states. The deal creates one of the largest independent MA-focused value-based platforms in the U.S. and will close sometime in the back half of 2022.

Deal structure: CareMax acquires Steward’s MA service line (Steward VBC) for $135 million in cash and stock. The value-based player will now serve as Steward’s exclusive management service organization (MSO) for Steward VBC.

As part of the deal structure’s earn-out provisions, CareMax will need to convert an additional 100,000 FFS lives to risk and will have to maintain an 85% MLR for two consecutive quarters to maximize the provisions.

Steward Gets: $25 million in cash, 21% CMAX ownership immediately, and up to 41% ownership in CareMax equity (if earnouts are achieved). Steward also offloads $72 million in VBC A/R offloaded to CareMax, a very non-significant working capital value that CareMax is now funding.

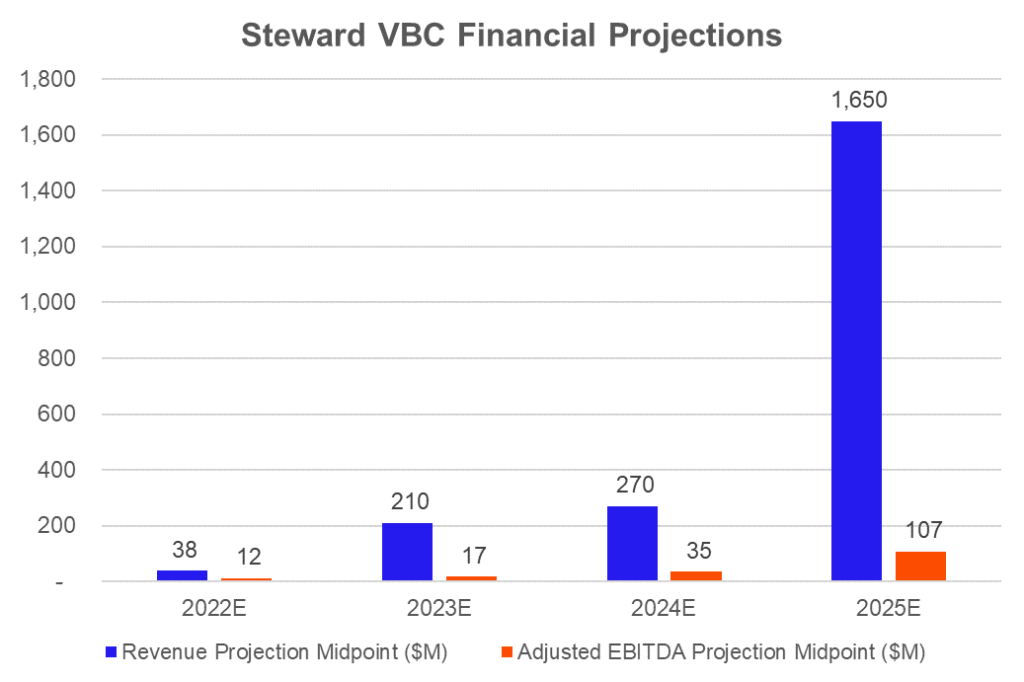

CareMax Gets: Access to 50,000 MA lives, 112,000 MSSP lives, and 9,000 direct contracting lives, along with the opportunity to convert 830k+ additional members to risk, along with some of the best ranking and performing ACOs nationally. CareMax identified the transaction as a $1.6B to $1.7B revenue and $100M to $110M EBITDA opportunity (implied 6-7% margin) by 2025, assuming pretty rosy projections I detailed more below. The firm’s total value-based footprint would jump to 2,000 providers across 200,000 senior lives in 30 markets.

Madden’s Musing: This transaction is a huge win for CareMax.

For $135 million in cash and stock as well as funding A/R and working capital (which should be noted), CareMax gets immediate access to 170k+ risk-based lives and the potential to transition another 830k+ FFS Medicare members to risk. This base will only continue to increase, given the secular trend in Medicare beneficiary growth.

For this transaction, CareMax’s biggest execution risk lies in the following issues:

- Can CareMax transition FFS members to risk? Can CMAX transition MSSP members to full risk?

- Can CareMax efficiently manage Steward’s medical spend to an 85% max? In an MSO model, CareMax has fewer tools at its disposal to effectively manage risk. This transition will be a major challenge and will undoubtedly lead to a higher MLR than that of its fully-owned clinics.

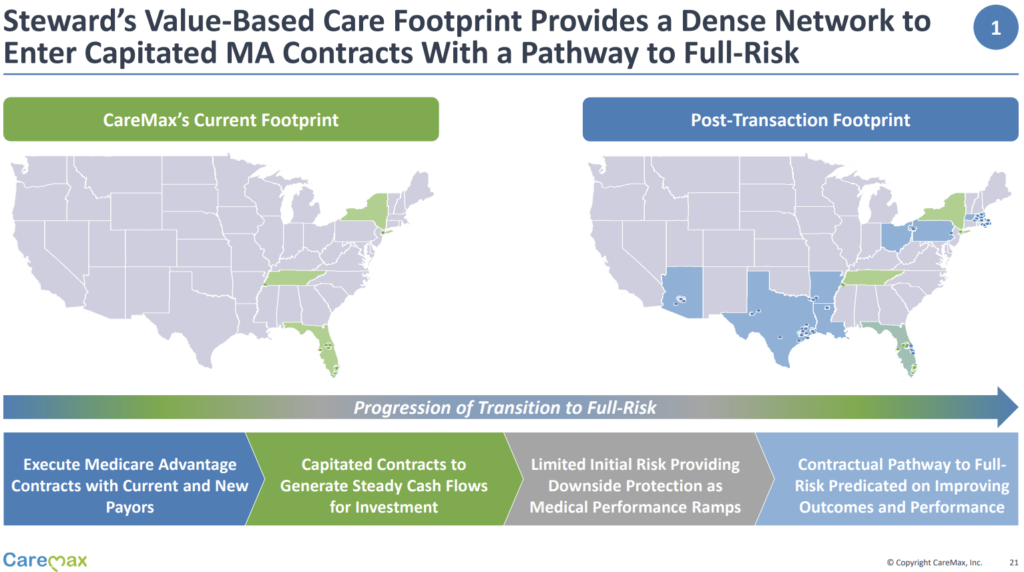

The deal immediately diversifies CareMax’s revenue streams from primarily Florida to a footprint across 8 more states. Just look at this immediate geographic diversification below!

CareMax expects its MSO, a very capital-light business, to contribute 10% of its overall platform contribution margin:

Meanwhile, Steward outsources its risk business to a specialized operator, assuming CareMax indeed has the secret sauce. In a way, since Steward could receive up to 41% of CareMax’s outstanding equity, you could think of this transaction as a pseudo-IPO of Steward’s risk business.

Don’t forget – back in September, Steward announced the sale of 5 of its Utah-based hospital operations to HCA Healthcare. Very notably, Steward expected to use the proceeds from that sale to fund ACO expansion into Florida and Texas in particular outlined in this Beckers article. As it turns out, this sale might not go through as expected. The FTC is suing to block the transaction between HCA and Steward.

I have to wonder if Steward saw the writing on the wall here at all. Is the transaction between CareMax and Steward unrelated to the FTC announcement? Considering that Steward wanted to expand into Florida anyway, I would guess that the health system operator planned to do this anyway. The CareMax deal synergizes well with Steward’s strategy given CareMax’s expansive clinical footprint in Florida. CareMax previously bought Unlimited Medical Services of Florida for $110 million in the Orlando area and operates several other clinics there.

Final interesting financial tidbits! Do these projections seem a bit…rosy to anyone else? It appears as if Steward internally was expecting some major risk transitions to occur between 2024 and 2025:

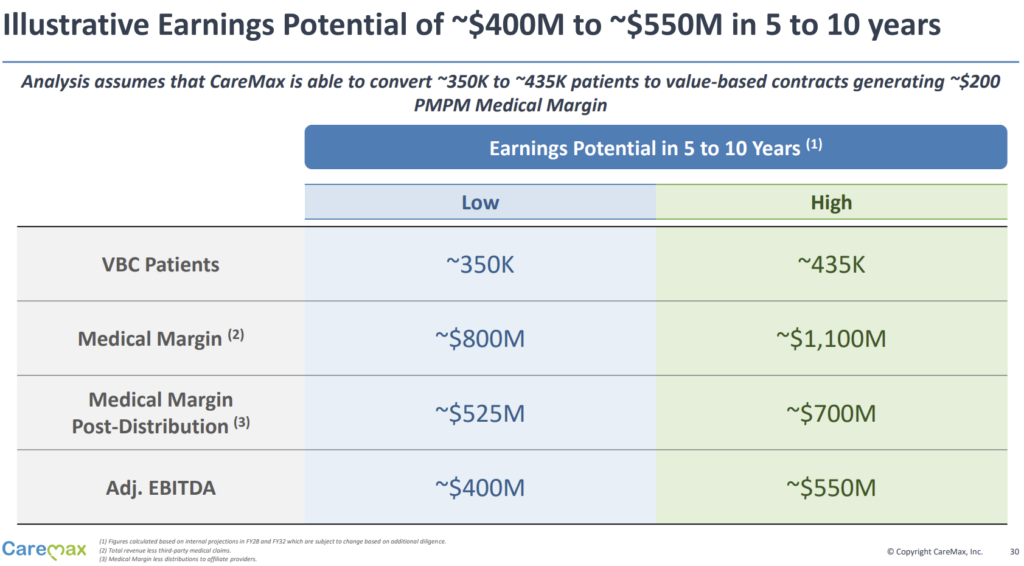

CareMax also provided an illustrative profitability example if the firm can convert 350k to 435k existing Medicare beneficiaries to VBC contracts, which would generate a $200 per-member-per-month medical margin. Note: full MA risk? It’s unclear, but I assume so.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

I would highly recommend giving the presentation overview linked below a read through. It’s a very innovative, interesting deal structure and immediately escalates CareMax into an Agilon type player on the MSO side.

Resources:

- CareMax – Steward press release announcement

- CareMax – Steward transaction overview – acquisition presentation

Digital Health Layoffs Begin

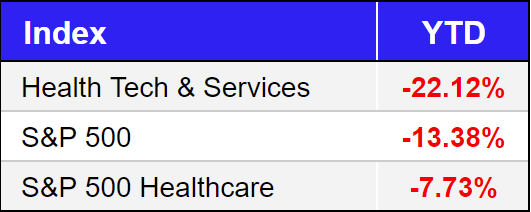

News hit the wire this week related to several health tech layoffs.

Carbon Health (valued at $3.3 billion) laid off about 250 employees in its corporate workforce, representing about 8% of its total base. In the press release, the tech-enabled services biz noted that most of these layoffs were related to COVID-based service lines, which leads me to wonder if similar urgent care businesses are seeing a similar drop-off in COVID testing and related service lines. My hunch says yes and that we’ll see a decline in revenue & profitability for other urgent care businesses.

Cerebral (valued at $4.8 billion) also laid off members of its workforce amid an ‘organizational review’ of the embattled mental health firm. Cerebral hasn’t had the best track record with labor relations at its company.

Finally, Axios reported that Olive (valued at $4 billion) laid off (paywall) around 20+ employees.

Madden’s Musing: It’s not just digital health. Market conditions are rough right now, and startups / unicorns across industries are tightening up on cash and prioritizing reducing burn.

I want to give a lot of credit to Carbon here – the tech-enabled urgent care co. was very transparent about the layoffs and gave these employees favorable severance as well as help in finding their next opportunity elsewhere.

In my mind, as tough as it is for these individuals, fundraising dollars drying up a bit in health tech will turn out to be a good thing for the industry. Valuations were frothy. Now, hopefully we can allocate capital more efficiently to the savvy operators actually making a difference.

“Difficult market conditions can create exceptional opportunities for strong businesses to get stronger and that is our plan,” – Farzad Mostashari, MD – CEO & Co-Founder, Aledade

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!

Market Movers

Top 3: Babylon (+33%); ATI Physical Therapy (+15%); CareMax (+14%)

Bottom 3: Nutex Health (-37%); 23andMe (-17%); Convey Health Solutions (-16%)

Optum continues to snatch up large independent provider groups, this time acquiring Healthcare Associates of Texas for an alleged $300 million enterprise value and a 15x-plus EBITDA multiple. This acquisition is Optum’s third splash play in recent memory – it also acquired Kelsey-Seybold and Atrius Health, two other huge multi-specialty, many-ancillary physician groups.

Value-based physician enablement firm Aledade raised $123 million in a Series E led by OMERS Growth Equity, bringing its valuation to $3.1 billion. According to the release, Aledade is EBITDA positive and makes at least $300 million in revenue. It makes sense – this business model in general is extremely capital-light with high free cash flow conversion, like I talked about in my deep dive of the enablement space.

Regulators approved Oracle’s purchase of Cerner for $28.3 billion to create a massive zombie corporation slowly approaching death.

Humana’s CenterWell health continue to build out its footprint. In 14 states, Humana is planning to transition Kindred at Home to the CenterWell brand. Keep in mind that CenterWell also completed a second joint venture with Welsh Carson to expand senior-focused primary care clinics. A name to watch!

The DOJ is joining a whistleblower lawsuit against Fresenius Medical Care, claiming that Fresenius performed thousands of unnecessary vascular procedures and then fraudulently billed Medicare for those procedures.

In what I can only describe as fantastic timing given the Hospitalogy deep dive on health system mergers, the FTC is suing to block 2 separate hospital mergers. One of which I’ve already touched on – the Steward-HCA deal, while the other relates to the horizontal merger between RWJBarnabas and Saint Peter’s Healthcare in New Jersey. As I’ve said before and I’ll repeat: the days of the horizontal health system merger in local markets are coming to an end.

Miscellaneous Maddenings

- Here’s the power of Netflix & social media – Kate Bush’s song, Running Up That Hill – is one of the most streamed songs this month after Stranger Things heavily featured it throughout season 4. By the way, for those who have watched, what do you think of the season so far? I thought it got off to a slow start and has a creepier, more horror-esque vibe, but I was bought back in by the end of volume 1. I’m looking forward to the final 2 episodes!

- I want to give a shout-out to Packy McCormick, paving the way for us newsletter creators. He had a tough week outlined in this thread. This is the toughest side of the creator life – it’s incredibly easy to dunk on someone when they slip up, no matter how many fantastic, thoughtful pieces of content they’ve created prior to the mistake. Luckily for all of us, the internet has the attention span of a toddler.

- I like following the latest tech news, and Apple just released its plans for iOS 16 along with other device plans at its annual WWDC. Widgets on the home screen!! The tech giant also debuted its M2 chip, which has an insane amount of processing power. 16% CPU gains, and 25% GPU gains over M1!!

Hospitalogy Top Reads

- From the Pear Health Playbook, this overview of Eleanor Health with co-founder Corbin Petro gave some great insights into the value-based mental health care co.

- This read on Australia’s My Health Record was fascinating. After the country dropped $2 billion and 12 years developing the service, patients still can’t access their medical information online. We have a long way to go, folks.

- I enjoyed these insights from McKinsey on the employer health benefits market – looking to expand benefits while managing costs will be no easy feat given the inflationary environment we’re facing in 2022.

- A16z broke down the the opportunities present for fintech companies unbundling the ‘payvidor’

Want to get these in your inbox to never miss an edition? Subscribe to Hospitalogy today!