We’re back to our regularly scheduled programming this week after some fun interludes. In case you missed last week’s send, I recapped the first half of the year in healthcare, hitting on (most) of the major trends. You can find that piece here.

Onto this week’s stories!

Join Hospitalogy along with 20,000 others from leading healthcare organizations by subscribing here.

I’m grateful to partner with A.Team on this newsletter as the sponsor of this edition!

The role of AI in healthcare is just beginning, and there’s lots of chatter about where the real use cases lie. A.Team has put together some national experts to discuss the exciting world of Generative AI and where things sit today.

Join their webinar on July 27th for an eye-opening conversation: Demystifying AI in Healthcare.

It’s going to be a deep dive into the exciting world of Generative AI. The speakers? None other than some of the best minds in the field. We’ve got Mida Pezeshkian, founder of STEMA_cg, Ohad Zadok, a trailblazing healthtech CTO, and Ed Kopetsky, Stanford Children’s Hospital’s former CIO.

Together, they’ll help us explore how we can turn daunting challenges into opportunities. It’s all about confidently innovating in a field that’s traditionally risk-averse.

So, let’s break down those barriers and join a conversation that could change the healthcare game for clinicians and patients. Hope to see you there!

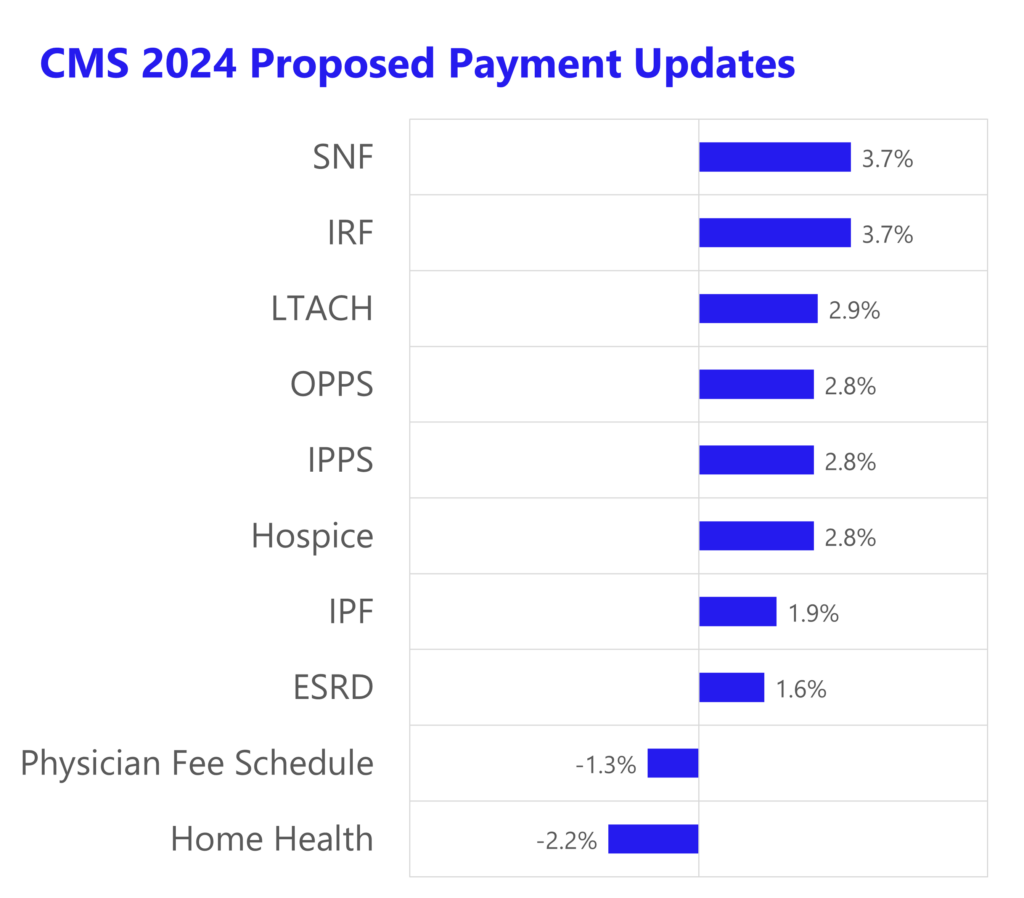

Graphic: CMS Proposed Rules round out with yet another Physician Paycut, inevitably spurring even more consolidation which will ironically result in higher prices

Helpful links related to CMS payment updates:

- MPFS (Press Release)

- OPPS (Press Release)

- ESRD (Press Release)

- IPPS and LTACH (Press Release)

- SNF (Press Release)

- IRF (Press Release)

- Hospice (Press Release)

- Home Health (Press Release)

- IPF (Press Release)

Partnerships and Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

Another PPM shutdown: In the rumor mill for the first part of the day, but I was told late yesterday that effective July 31, American Physician Partners is shutting down and / or declaring bankruptcy after an alleged deal with SCP Health fell through the cracks. The news comes on the heels of Envision Healthcare’s fateful collapse. Meanwhile, rumblings of Radiology Partners struggling to raise a new tranche of debt, and Blackstone’s TeamHealth struggling as well…lots of problems bubbling under the surface here folks.

FTC on a Bender: Yesterday the FTC announced its intention to withdraw two longstanding antitrust policy statements, stating that the documents were outdated based on today’s M&A environment. Now, the FTC plans to weigh healthcare mergers on a case-by-case basis. Expect to see some M&A tightening if the FTC has its way. (Link)

Hospitals’ $9 billion 340B Payday: After winning at the Supreme Court last year, CMS proposed a new rule for hospitals to recoup $9 billion in payments to eligible 340B participants. (Link)

Virginia Hospital Alliance: UVA Health and Riverside Health System announced a strategic hospital alliance to share various resources related to research and clinical program development. (Link)

Health Systems Buy Up Urgent Cares: Baylor struck a deal with NextCare to add 41 facilities to its footprint (Link). HCA ALSO bought 41 Texas-based urgent care centers from FastMed. (Link)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

FDA Warning: The FDA issued a warning to mobile dialysis maker Outset Medical for advertising the use of its Hemodialysis machine outside the scope of its current device indications. (Link)

Data Breach: An HCA Healthcare data theft exposed 11 million patient records in over 1,000 facilities. In total, 41.4 million people have been affected by healthcare data breaches. (Link)

Blitzkrieg: Fresenius Medical Care converted into a German stock corporation. I included this news just so I could use a German word. Takes me back to my Call of Duty days.

Alzheimer’s Updates: Medicare is proposing to expand patient access to Alzheimer’s scans, potentially opening up the door to new therapies & drugs. (Link)

Full Practice Authority Updates: A nice overview from Practical Pain Management on the full practice authority landscape. (Link)

Partnership Announcements:

- Novant and Ochsner announced a really interesting partnership in the senior care clinic space. Akin to Humana’s Centerwell, the two large health systems are partnering to create 65 Plus, combining shared clinical expertise to develop a footprint of 65+ Medicare Advantage clinics throughout the Midwest. Definitely something to keep an eye on especially considering the two hold no geographic overlap (Ochsner primarily in Louisiana, Novant in North Carolina). Do I smell another cross-market merger?! Kidding… (Link)

- Virginia Mason Franciscan Health announced a notable partnership with Optum, in which Optum’s Washington division gets full management reign of 25,000 MA patients while its 200-physician Polyclinic named Virginia Mason Medical Center as its ‘main acute-care referral center.’ The partnership is phrased very oddly and per the MH article…the partnership “does not include a financial component. Yeah okay sure – I believe you! (Link)

- Northwell Health adopted Prolucent Health’s workforce platform to manage its labor resources across its 21-hospital footprint. (Link)

- Highmark BCBS partnered with Wellinks on virtual COPD care (Link)

- Velocity and Privia Health partnered to embed clinical research into practice sites

- CVS Caremark and GoodRx launched a drug discount program for Caremark client members. (Link)

- A couple of outsourced lab deals. Labcorp-Jefferson Health (Link) and Labcorp Legacy Health, as Legacy Health appears to be struggling heavily financially. (Link)

- Prominence Health Plan partnered with kidney care firm Strive Health to provide chronic kidney disease care to Prominence’s MA members. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

Kaufman Hall published its overview of Q2 2023 health system M&A activity, and health system transactions hit pre-pandemic levels at 20 total deals during Q2, up from 15 in Q1. (Link)

Beth Israel Lahey closed its merger with Exeter Health on July 1. (Link)

Phreesia bought health tech analytics and navigation firm MediFind. (Link)

ApolloMed acquired the assets of Texas Independent Providers, expanding its Care Partners business into the Houston market through a coordinated network of 120 clinicians and 4,500 MA patients. (Link)

This was a nice snapshot of the cardiology PPM market from Bailey & Co. (Link)

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Neuroflow notched a nice partnership with Novant. It’ll provide infrastructure support for Novant’s behavioral health programs to support 36,000 team members. (Link)

Spruce Point Capital Management published a bullish thesis on Hims and Hers. (Link)

Big Health acquired Limbix in a digital therapeutics deal. (Link)

Fundraising Announcements:

- Causaly raised $60 million in a Series B – it offers a generative AI platform for drug discovery. (Link)

- Augmedics (NOT Augmedix but…smh) raised $82.5 million to advance its augmented reality surgical navigation platform. (Link)

- Octave raised $52 million in a Series C to expand its therapy footprint nationwide. (Link)

The Healthcare Hype Cycle: Artificial Intelligence

This is the spot where I cover the buzzy, hot topics in healthcare. Currently the flavor of the month is AI in Healthcare.

Here’s an interesting piece on how Mount Sinai leveraged a new AI platform Theator to optimize care education in the OR – “It was the first time this capability had ever been shown at a surgical conference, and showcased the vendor’s ability to use AI to power the structuring of surgical videos in real time with high accuracy,” he continued.” (Link)

McKinsey has chimed in on the healthcare AI conversation, discussing how the tech can cut down on healthcare’s biggest burdens, identifying $1 trillion worth of ‘improvement potential’ in healthcare. (Link)

OSF Healthcare unveiled a machine learning model to more accurately predict cancer care navigator workloads. (Link)

MediView XR receives 510(k) clearance for AR surgical navigation platform (Link)

Health Care Service Corp. is finally using some semblance of technology, implementing prior authorization automation. (Link)

Notable Essays:

- The imperative for regulatory oversight of large language models (or generative AI) in healthcare (Link)

- Tackling healthcare’s biggest burdens with generative AI (Link)

- The 3 Hottest Areas for Healthcare Generative AI (Link)

- Eric Topol’s latest: Medical AI is on a tear (Part 1) (Part 2)

- UPMC Algorithm Predicts Post-Surgical Complications Better Than the Industry Standard, Study Shows (Link)

Hospitalogy Top Reads

My favorite healthcare essays from the week

- Join my webinar this week on 7/20 to chat everything healthcare and AI with some great panelists. (Register here)

- McKinsey published some fantastic intel on the Medicare Advantage space including how payors should navigate the rapidly changing environment. (Link)

- The Commonwealth Fund wrote up a nice piece on value-based payments and drug reimbursement models. (Link)

- Rock Health released its 1H 2023 fundraising report, which Jared Dashevsky covered here. Main takeaway: “Alongside lower funding totals, H1 2023 also saw a continued trend of fewer investors participating in digital health deals. 555 investors participated in digital health fundraises in H1 2023, down from 775 in H1 2022 and 832 in H1 2021.”