Happy Thursday, Hospitalogists!

Today was supposed to be the next part of my year in review series (it still is), but it kinda morphed into what’s going on with Humana, utilization and Medicare Advantage going back to Q2 2023. Spoiler alert: there are some pretty big implications. Let’s dive in!

Thanks so much to Nabla and Adonis for sponsoring today’s edition of Hospitalogy!

But first, please register for my upcoming webinars!

- Discussing the latest in AI-driven healthcare marketing trends and tactics: Register Here.

- Diving into 2024 risk strategy, including de-risking your behavioral health population: Register Here.

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 25,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)

SPONSORED BY NABLA

I’ve covered Nabla before when they announced their ambient documentation partnership with the Permanente Medical Group, and I’ll keep covering them as they gain traction with more and more physicians.

Nabla has a great team and has developed a provider-centric product that includes:

- Support for all specialties;

- Possibility to integrate into major EHRs – Epic, Cerner, NextGen;

- No data storage – Nabla is the only ambient AI solution that doesn’t leverage your data elsewhere;

- Plus, physicians love it. See for yourself what physicians are saying about Nabla Copilot!

Nabla is looking to bring back the joy of medicine to its growing user base of 20,000+ MDs. For physicians and CMOs who read Hospitalogy, check out Nabla Copilot – for free – below!

Utilization is Back, Baby

Patient volumes are BACK in a big way in 2024.

It’s an ongoing trend extending back to the second quarter of 2023. And everyone is watching, waiting, to see how volumes play out.

So, what happened in 2023? In what areas is volume returning? Finally, what are the downstream implications of this ‘New’ New post-post-Covid Utilization Normal ™ on payors, providers, and risk-bearing organizations?

First, let’s back up to the middle of last year, where we saw the first swing of the pendulum, and set the stage for the broader conversation.

2023: The One Where Seniors Finally Returned to Get that Delayed Surgery

(Sorry, the Friends reference in that title was unavoidable).

In June 2023, UnitedHealth Group set the investor world ablaze at the Goldman Sachs 44th Annual Global Healthcare Conference, ringing the alarm about a sudden, unexpected rise in senior outpatient procedures:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- “To illustrate, in the second quarter, outpatient care activity among seniors was a few hundred basis points above our expectations. As we’ve highlighted, specific orthopedic and cardiac procedures had increased far above that level of variation. And as we developed and filed our 2024 Medicare Advantage offerings, we assume that these levels of heightened care activity will persist throughout next year. Overall care activity among our Medicaid and commercial populations is consistent with our expectations.”

Humana followed suit with similar commentary, and subsequent utilization conversations dominated board rooms throughout 2023.

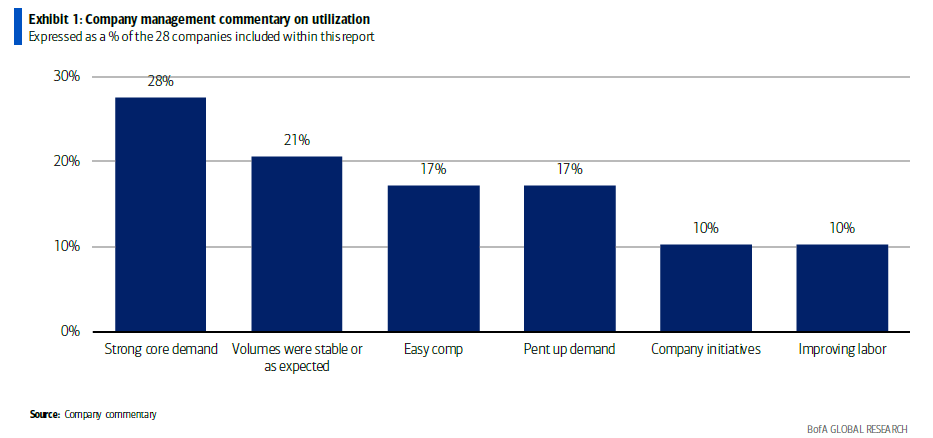

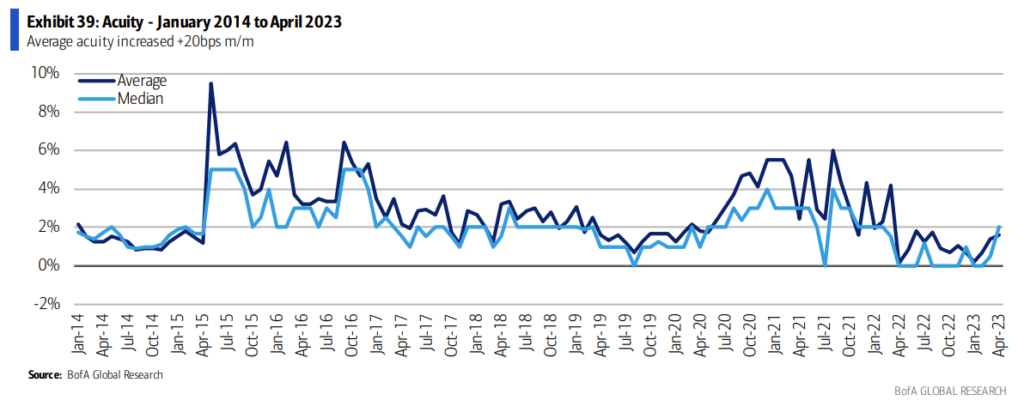

Adding to the hubbub, Bank of America published a bank note on the matter. In that note, B of A found 50% of the care delivery organizations expected strong volumes to stick around, while another 10% of respondents also noting an improving labor environment. Very bullish for the volume movement:

As it turns out, Bank of America and their surveyors were correct: this unwind wasn’t a one-off quarterly event. Utilization is still on the rise in 2024, got worse for payors with MA presence in Q4, and they’re limping so far in 2024. Like our Overlord UnitedHealth Group and others have mentioned, this elevated utilization dynamic sits in the Medicare and Medicare Advantage arena, meaning that seniors with delayed or backlogged surgeries are going back in to see the doctor and resuming normal healthcare-related behavior. Note that the rise in costs are not on the inpatient book of business (yet), or in commercial or Medicaid segments.

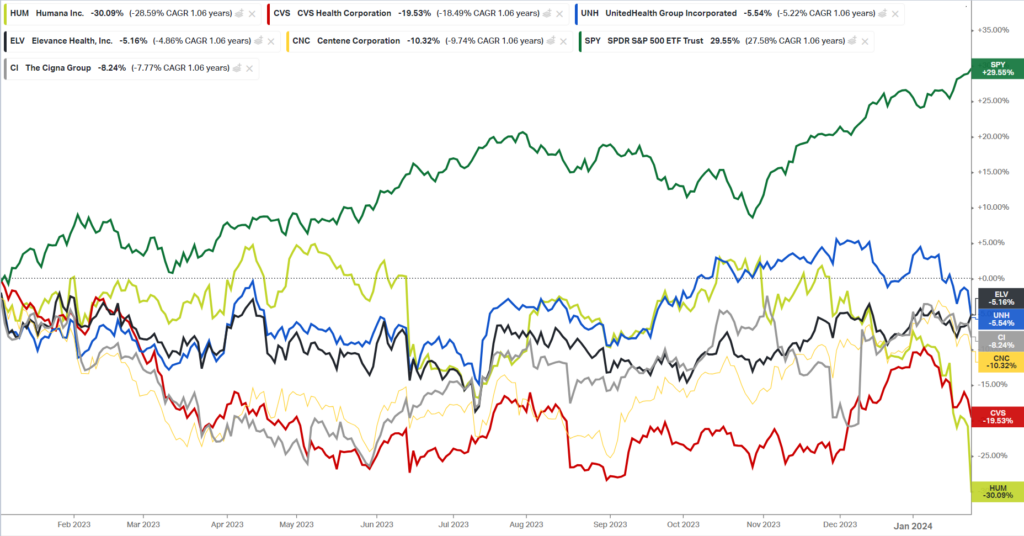

Look at how some of the biggest managed care players have fared since the start of 2023. During a time when the overall S&P 500 returned 30% (massive), health insurers are feeling the heat:

The New, New Utilization Normal

Once the pandemic ended, everyone wondered “is this the new normal for patient care? Suppressed utilization? Nobody going in for surgeries?” During this time of analysts and consultants spinning out a new narrative on a week-by-week basis, we also saw steady growth in the MA honeypot and an overall favorable paradigm for payors including but not limited to:

- Historically low utilization;

- Policy support for value-based care programs (and MA);

- The funding, rise, and outperformance of risk-bearing organizations; and

- Labor & therefore capacity constraints at provider organizations

Here’s the main thing you should learn from this post: the golden era of MA and value-based care 1.0 is at an end. The pendulum is now swinging back toward healthcare services in 2024, and VBC 2.0 has begun.

In 2024, the following is now true for payors:

- Material headwinds in Medicare Advantage stemming from star ratings declines, enrollment deceleration, rate notice opacity, competitive pricing, and risk adjustment changes.

- “The Medicare Advantage sector is navigating a complex and dynamic period of change as we are all working through significant regulatory changes while also absorbing unprecedented increases in medical cost trends.” – Humana Q4 2023 earnings call

- An ‘unexpected’ outsized rise in senior utilization for outpatient surgery, Part B drugs, supplemental benefits and downstream services (e.g., ortho/cardiology procedures → physical therapy, pain management), putting pressure on organizations exposed to downside risk

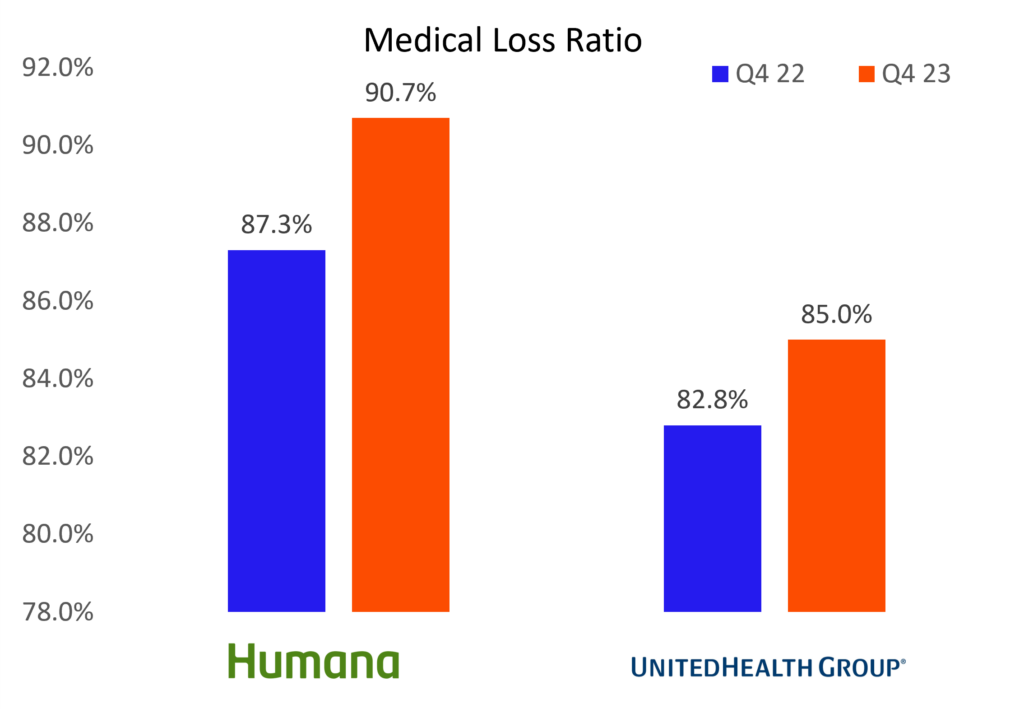

- No risk bearing organization is feeling the brunt of these headwinds more squarely than Humana, the payor with significant exposure to Medicare Advantage. There are 20+ mentions of “Utilization” in its Q4 earnings transcript: “The increase in utilization that emerged late in the fourth quarter was a significant deviation from an already elevated level impacting the industry.” – Humana Q4 2023 earnings call

- Some trickling utilization on short-stay hospitalizations (inpatient): “And what we’ve seen so far is an increase in short-stay inpatient authorizations, in particular. They are being upheld through our utilization management processes at a higher rate than you would typically expect as well.” – Humana Q4 2023 earnings call

- From a broader population perspective, seemingly unlimited demand for behavioral health utilization and GLP-1 weight loss drugs

Leading to noted underperformance in gross margins (Humana being the most picked on player here):

As a whole, payors & risk-bearing organizations in MA with material downside risk are…bracing. The situation is particularly dire for Humana. You should take time to read their earnings report. Management publicly commented on the state of MA, saying they don’t know how the industry as a whole can withstand “this kind of increase in utilization, along with regulatory changes that will continue to persist in 2025 and 2026.”

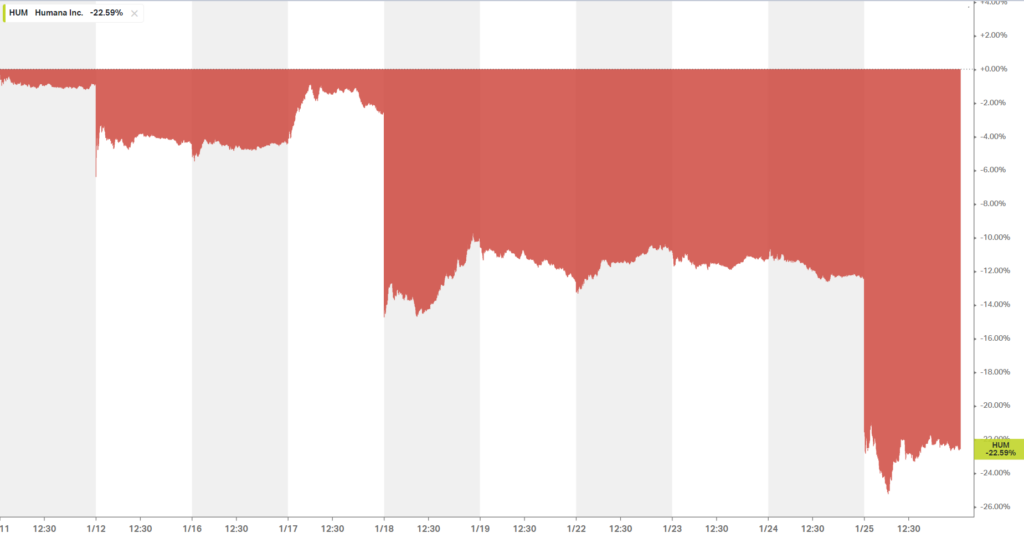

Sheesh. For a $50 billion enterprise, you can’t get much more existential than that. Its stock price has dropped 20+% in the span of 10 days and maybe in hindsight it’s no wonder why they were trying to merge with Cigna halfway thru Q4:

TL;DR: The tide is out on Medicare Advantage. Side note that Elevance is plodding along just fine with its commercial-heavy book.

The Pendulum Swings back to the Provider

On the other side of the see-saw, Health systems and surgical providers are ecstatic about the sudden rise in utilization. Importantly, labor problems are slowly mitigating, allowing health systems to bolster their outpatient facility footprints.

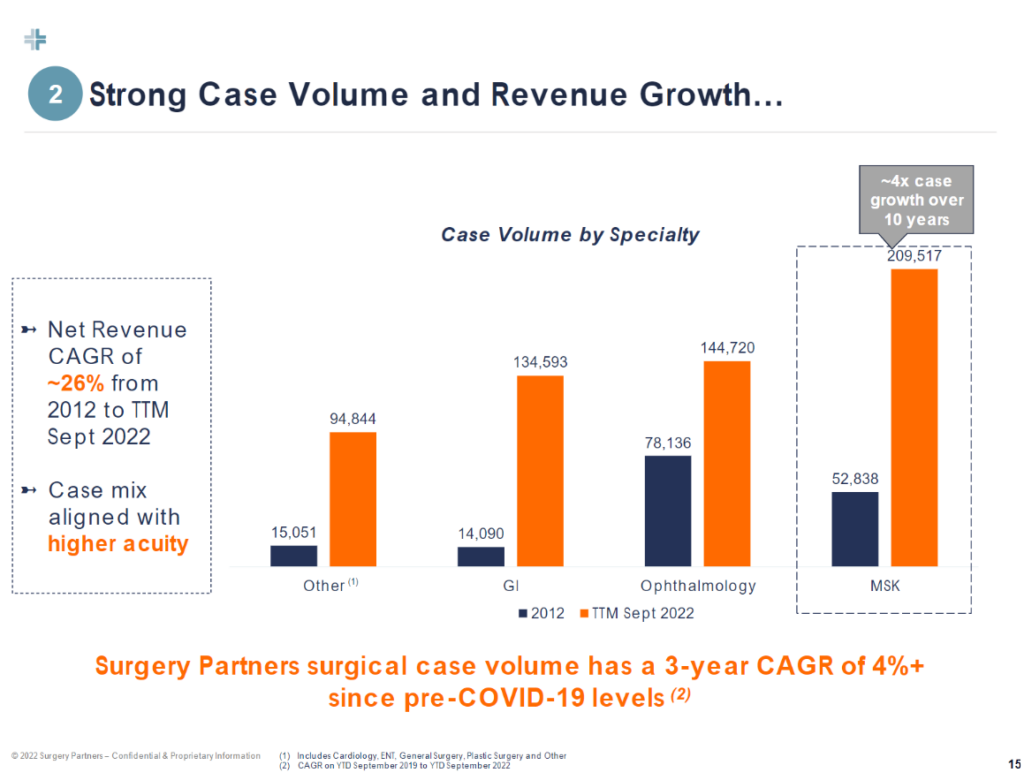

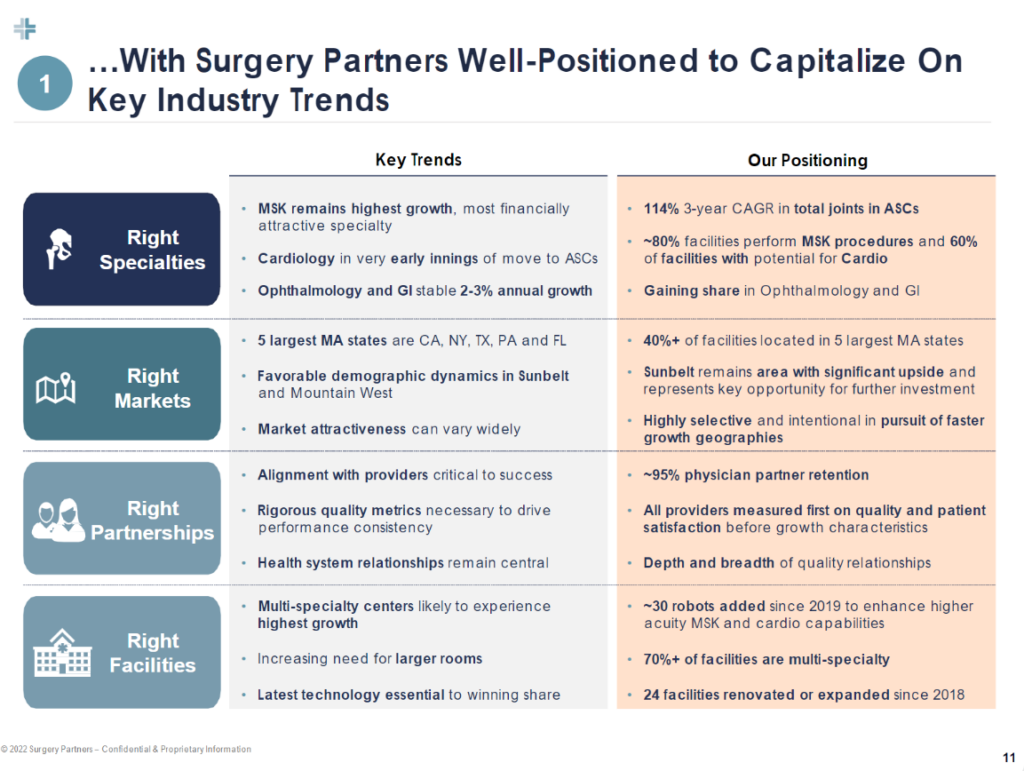

Diving deeper into where we’ll see utilization go in 2024, two specialties continue to dominate outpatient growth: orthopedics, and cardiology. Orthopedics leads the way as CMS continues to add eligible ortho cases (total shoulders & ankles this year), while cardiology presents a compelling growth opportunity for outpatient migration for the same reason.

Here were some of the more notable quotes related to 2024 utilization trends:

- The New Utilization Normal: “We’ve seen very good utilization trends on the same-store basis. Now we have only 4,000 providers in select geographies. That’s mainly primary care plus select specialty, so it doesn’t represent the country or nation. But everything we see, we think utilization on a same-store basis is trending up…We don’t think there’s going to be a big place where utilization drops. We think actually it’s going to be elevated, and this is a new normal.” – Privia Health

- Cardiology cases are just getting started as ASCs build out infrastructure, cath labs: “*On the **cardiac side, we’re in the early innings…*we’re starting with things like AICDs, lead extractions, EP procedures. But we do, in our de novo pipeline, have cath lab-based ASCs being built…So we see that as a big future growth play for us.” Surgery Partners

- Cardiologists are ready for the outpatient migration movement: “…there’s a couple of barriers to cardiology, moving quicker. One is it’s a highly employed specialty. So physicians, even if they want to be independent, they often have a 3-year employment agreement. So there’s some delay there. There are about 20 states that still have not followed CMS in making PCIs and higher-acuity ASC procedures available based on CON laws in the state. But all of that stuff will go away over time with the numbers. It’s been proven to be safe and efficacious. Cardiologists are reaching out to us on a regular basis saying, hey, we want to do this. We’re not happy employed. We want to have a seat at the table. This is one that over the next several years, we expect to be one of our leading growth engines and over time will be just as big, if not bigger, than the orthopedic opportunity we’re in the middle of today.” – Surgery Partners

ASCs bolstered by total joint and cardiovascular cases will outperform over the long-term, with GI and other specialties contributing stable growth. Surgery Partners pegs the ASC industry as a whole as a $40B market growing at 6% annually. Hospital outpatient departments (HOPDs, or surgery centers acting as hospitals as satellites) hold another ~$60B. Meanwhile, $60B in annual costs have the potential to migrate from inpatient settings to outpatient surgery centers. These trends will continue to play out:

And as these specialty trends play out, outmigration continues, and surgical innovation moves more and more once-complex cases into outpatient settings, acuity will continue to rise in the those settings, benefiting those with the facilities and highly specialized physician alignment to meet that growing demand:

As we talked about before, nonprofit health systems are taking note, too. From a recent Modernhealthcare article:

- Other health systems are plotting their own expansions. Sacramento, California-based Sutter Health plans to add more than two dozen ambulatory care centers in the next four years, in addition to dozens of primary and multispecialty care sites. Henry Ford Health is investing $2.2 billion to expand its main campus in Detroit — the largest investment in its 108-year history. AdventHealth’s growth strategy includes expanding its outpatient operations, with plans to double its number of urgent care centers to more than 100, he said.

Also remember the health system commentary at JP Morgan earlier in January around the aforementioned outpatient growth strategy and prioritizing for density in existing markets. It’s all coming together now right?? The musical chairs!

Implications of Rising Utilization

How does Humana, and VBC players respond? Honestly, if you’re in Medicare and facing these headwinds, I would love to hear from you and how you’re thinking about this environment, but here’s how I think things might play out:

- We’ll see a rise in denials and stiffer utilization management

- Payors will try to push / delegate risk for unmanageable populations onto overexuberant enablement players

- Payors will exit noncore MA markets or where pricing is unsustainable

- Payors will double down on their services-based strategies (CenterWell) in an attempt to find synergies for the mothership, drive patient engagement and acquisition, more effectively manage medical costs, and boost plan star ratings.

- Bigger picture though, if an organization like Humana is telling us that the current dynamic is unsustainable, and the primary way to make MA financially sustainable is to keep people from accessing healthcare, what does that tell us about the future state of Medicare? I think the answer probably lies in the middle; i.e., – make sure people are accessing care appropriately – but this is a conversation for another day.

On the health system and provider side, expect to see hospitals scramble to set up broader outpatient footprints, plugging in ASCs and other facilities to capture outpatient volumes, aligning with physicians in the process. 340B, specialty pharmacy, oncology all are along for the ride, while it goes without saying that ASC management companies should benefit in the current environment too.

The Medicare Advantage environment is challenging in 2024 for risk bearing orgs – there’s no doubt about it. And there are plenty of moving chess pieces involved here. If there’s any nuance you’d like to add to this conversation and the constant push-pull between payors and providers, please reach out! Your content and knowledge informs my content more than anything else.

2024 is shaping up to be an interesting one.

SPONSORED BY ADONIS

For my Finance and Revenue folks,

I have a brief request for you.

I’m putting together a survey to understand your most pressing concerns across revenue cycle management given how pressing it is for most provider organizations.

I’d really appreciate it if you could spare a few moments to complete this survey and help shape some upcoming content with the Adonis team!

Please note that these survey responses are entirely confidential and your identity will remain anonymous. If you have 5 minutes to complete the short survey, your expert insight would be truly valued!

Thanks so much for reading. If you enjoyed this post, please consider subscribing along with 25,000 others to Hospitalogy, where I break down healthcare strategy, M&A, finance, and innovation 2x / week.