Happy Tuesday, Hospitalogy fam,

Everyone wish a very happy birthday to my brother, who turns 32 today.

But first – I’m hosting the first Hospitalogy virtual event of 2024 on 1/31. We’ll be discussing AI-driven healthcare marketing strategies. Register here!

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Subscribe to my newsletter here!

SPONSORED BY AUGMEDIX

If you’ve followed Hospitalogy, you guys know I love solutions with the sweet spot of solving real problems while creating clear ROI for health systems.

I’ve talked about Augmedix in the past, including its innovative partnership with HCA and how its products solve real problems like clinician burnout.

In 2023, Augmedix took its suite of AI products to the next level by launching Augmedix Go.

The new mobile app, operated by clinicians, uses the latest technology (and genAI of course) to create medical notes instantly after each patient visit.

These notes empower clinicians in both acute and ambulatory care environments to swiftly review and approve them in the EHR. Augmedix Go drives efficiency and is easy for clinicians to use, resulting in higher satisfaction.

I highly recommend checking out Augmedix Go to help your organization do more with less in 2024.

agilon’s no-good, very bad start to 2024

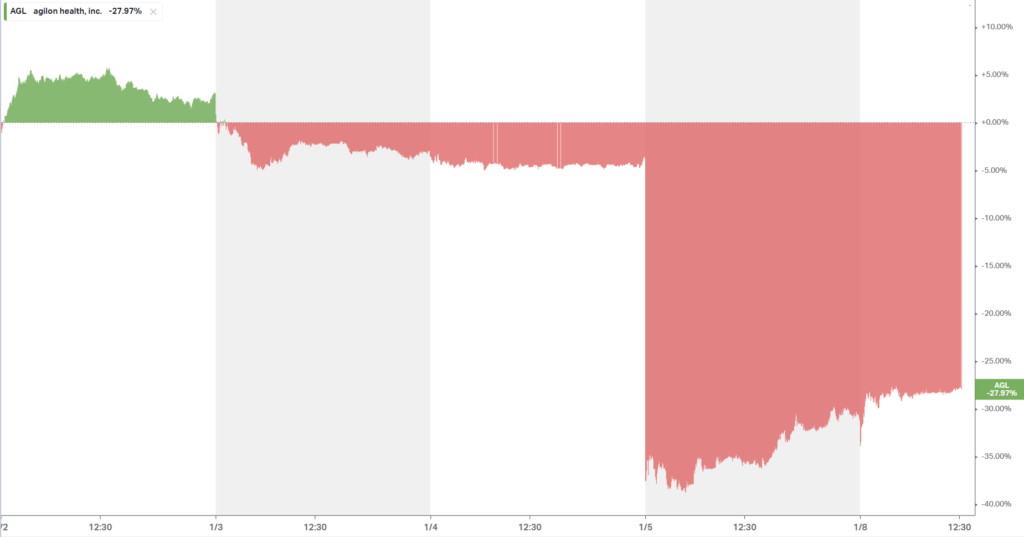

agilon kicked off the year in the worst possible way for the Medicare-focused enablement firm, announcing a huge cut to its expected financial results. Meanwhile, it also announced the retiring of its CFO on the same day. Goes without saying, but announcing a CFO transition the same day your company slashes your projected earnings is a recipe for disaster, as noted by the utter destruction of shareholder value, down 30% on the day:

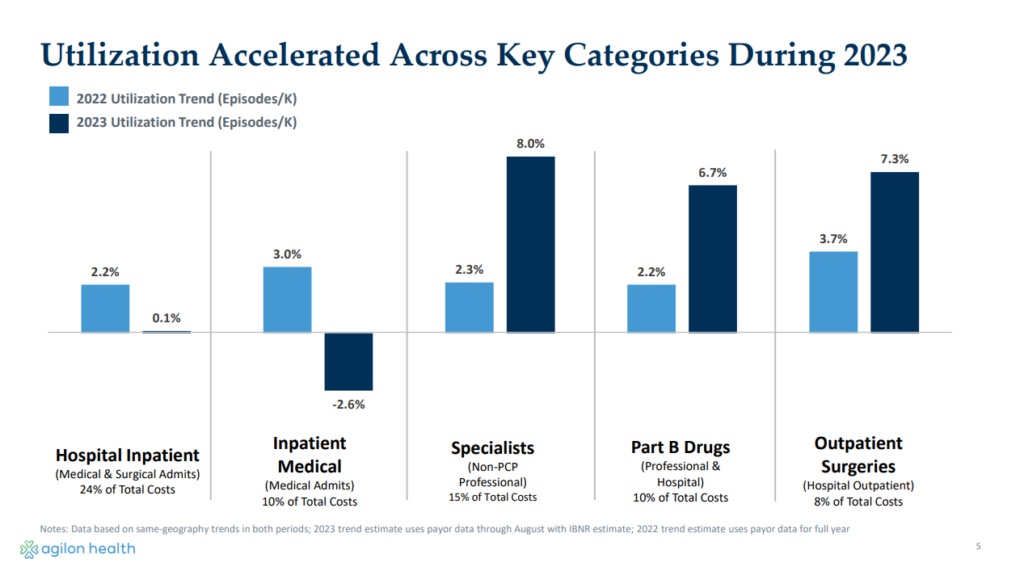

As it turns out, agilon – a ~$5B enterprise (well, now $3.2B) – was flying blind for much of 2023 with lagging claims data and a poor analytics infrastructure:

- ‘During 2023, agilon health experienced an increase in medical expenses attributable to higher-than-expected specialist visits, Part B drugs, outpatient surgeries, and supplemental benefits, partially offset by lower hospital medical admissions…

- …our 2023 underperformance was largely driven by 2 issues: a forecast that failed to recognize these elevated cost trends and a data and analytics gap that led to our being late in both recognizing the magnitude and source of the utilization shifts.

- (side note that agilon is about to be flooded with data analytics pitches)

- In fact, when we look at outpatient surgeries like hips and knees, we believe we are about 60% of the way through a backlog of pent-up demand from COVID.

- Higher cost trends became visible to us starting in mid-December, as we closed our November results. We recognized at that time that we were seeing cost trends that were 2 to 3x higher what we had seen in 2022

- Given the lower baseline and the elevated utilization assumption for 2024, we have made the decision to withdraw our 2026 outlook.

- …due to the much lower 2023 guidance that we just put out, our projection of getting to positive cash flow in 2024 is going to be pushed out to 2025.’ my emphasis added

So the TL;DR is that agilon had an above 5% medical cost trend in 2023 it wasn’t aware of since it received claims data a few months after the fact. agilon had no idea any of this utilization – 2 to 3 times higher than that of 2022 – was happening in its medical membership until December:

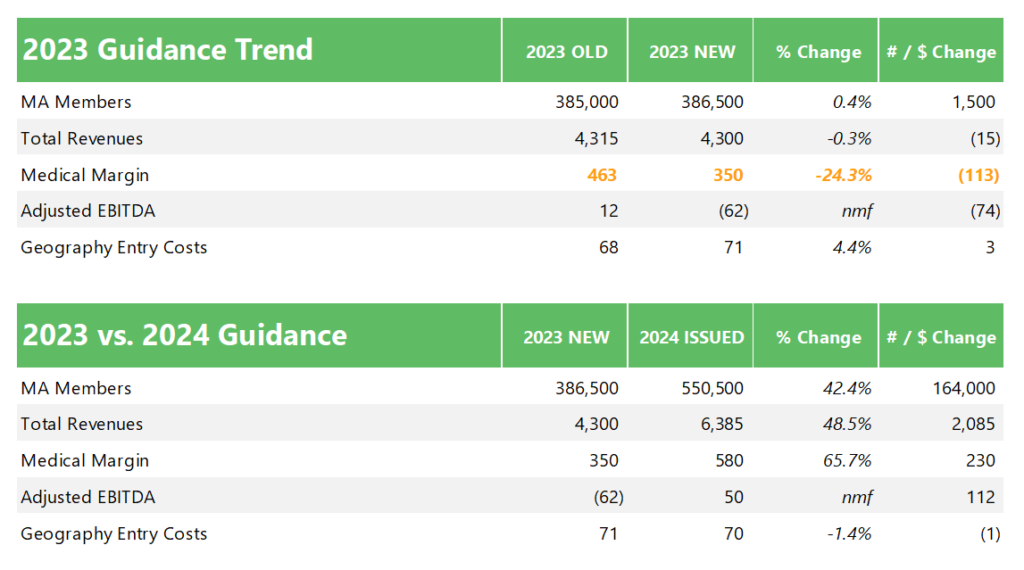

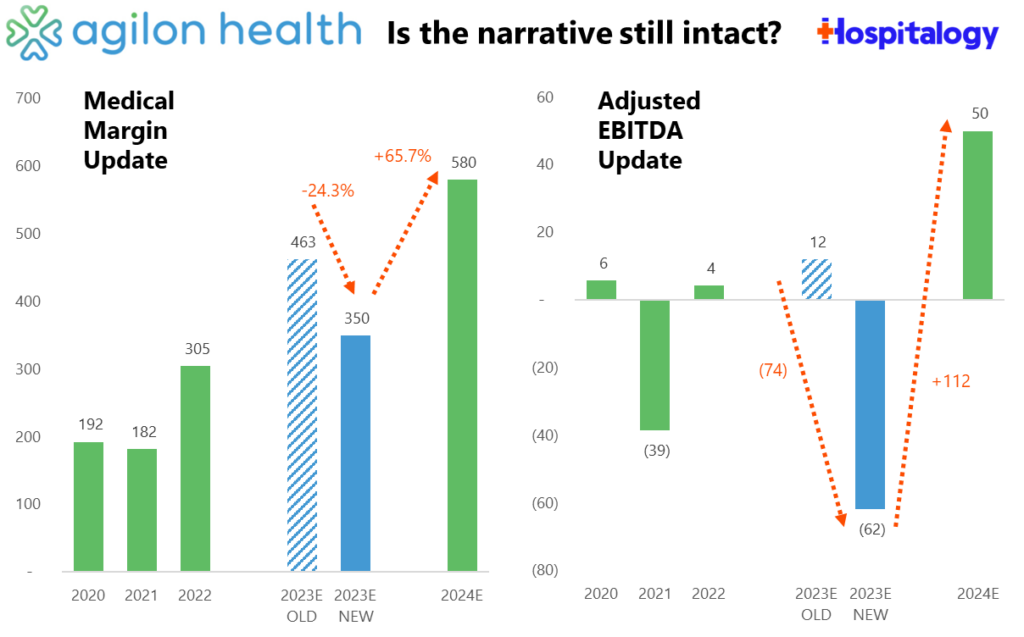

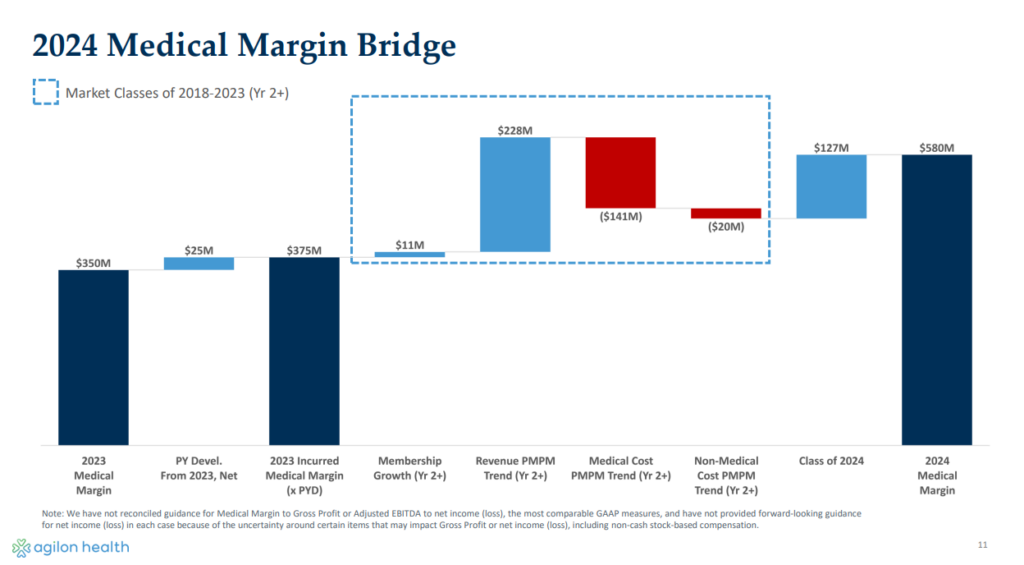

After disclosing the big miss 5 days into 2024, agilon lowered its 2023 guidance, cutting medical margin expectations by $113 million (24%) and adjusted EBITDA by $74M. It now has a steep hill to climb to hit 2024 numbers, a key year when many of agilon’s existing market cohorts reach maturity and profitability for the firm, and a year that it sorely needs to achieve cash flow positivity. The whole fiasco is a hit to agilon’s forecasting credibility:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Remember all of that public freak out around increased utilization (patient volume) in the middle of 2023? Turns out that stuff was a much more significant headwind for agilon than they thought.

Here’s the weird thing, though – throughout Q2 and Q3 2023, analysts posed utilization questions to agilon given its massive Medicare presence in both MA and ACO REACH and its connection to several large national payors. The management team downplayed those trends, instead touting its operating model as differentiated, stating they had plenty of leading indicators and visibility into utilization trends. Here are some examples of those quotes:

- “One theme I would like to drive home, given all of the speculation on utilization trends is that different models will yield different outcomes.” – agilon Q2 2023 earnings call

Yes. Yes they will.

- “Third, our model has natural advantages in terms of leading indicators and visibility.” – agilon Q2 2023 earnings call

- “Additionally, while MA claims data has some lag, our REACH claims data is very current through May, which is more than 90% complete.” – agilon Q2 2023 earnings call

- “We have not seen any meaningful change in our expected cost trend, including outpatient procedures. Lastly, our 50-50 surplus sharing not only creates strong alignment in driving long-term positive patient outcomes, but it also buffers our financial results up and down. As a result, we are able to guide to relatively tight ranges on medical margin and adjusted EBITDA and absorb puts and takes that may arise during a given period.” – agilon Q2 2023 earnings call

- “For MA, we did observe an increase in utilization during May and early June…This was contemplated in our guidance, and trends moderated back towards normalized levels during the third quarter.” agilon Q3 2023 earnings call

- “So the fact that we saw a spike up [in utilization] and some moderation down is probably just a factor also of the strength of our model.” agilon Q3 2023 earnings call

- Analyst question in Q3: “Like one of your payor partners, Humana, talked about recently — about having higher MLR from their PPO book of business, which I believe is like almost more than half of your membership, curious what you are seeing in terms of utilization trends among PPO members versus HMO members.”

- agilon response: “our PPO business is — performance is in line with our HMO business. And I think the reason for that is the differences in our model. a large payer with a broad network versus our high-touch PCP patient model, which has the ability to guide that patient on where they’re going to go for specialty care. At our Investor Day, we shared over 90% of specialty referrals come through that primary care physician even in a PPO model, that is allowing us to really deliver cost-effective care. And so our PPO experience is very strong.”

Translation: agilon essentially lied to investors’ faces for half a year. Throughout the commentary and responses, there’s a tone of confidence and superiority, when in reality, the curtains hadn’t yet been pulled back.

Now, with its back against the wall, agilon’s reputation is on the line. With significant embedded EBITDA (and profitability) expected to come online for the MA enablement firm in 2024, It’s now or never for agilon.

Not to mention the competitive pressure agilon is likely to face in acquiring new physicians to its platform. There are more payors, PPMs, well-capitalized enablement players in MA and ACO REACH than ever before, and even health systems looking to bolster physician alignment. You have to think this affects their ability to recruit or onboard MDs, but agilon was firm in its value prop for PCPs.

At the end of the day, we’ll look back at 2024 as a make or break year for agilon. agilon still thinks there’s plenty of opportunity for its model, pivoting the conversation back to its ability to onboard new primary care physicians and the associated downstream economics for its org by doing so throughout the conference call. But trust is hard to earn back.

The big question is whether investors believe what agilon is telling them about the long-term thesis of the firm given the 2026 guidance pullback and potential for sustained utilization:

- …the thesis remains intact. I mean what I said is I think this is a timing issue, and our cohort maturation is off. The decision to pull the ’26 guide is really based on this utilization being elevated. It’s a pretty material change in ’23, north of 5%, projecting 5% again in 2024. And given that uncertainty, that was kind of that key driver around that. And so I think that becomes the key part of us as we look at this maturation. We believe we can drive them up. The question is, will it be at that same slope that we had looked at historically? And that utilization piece is a critical element around that.

To other value-based care players, the message is clear. Do your blocking and tackling. The Goldilocks era of value-based care is at its end, and utilization is here.

Resources:

- Agilon’s late 2023 guidance update press release (Link)

- Agilon’s late 2023 guidance update (PDF Presentation)

- Agilon’s CFO retires (Link)

Devoted Health Raises a $175M Series E at a … WHAT valuation??

On December 29, Devoted Health announced it raised a Series E at a reported $12.87 billion. A bit over 2 years prior, Devoted last raised $1.2B in a Series D in at a $12.7B post-money valuation.

We are so back.

At the time in 2021, per this Fierce article, Devoted served 40k members and generated $247.3M in the first half of 2021 (though this stat tells us nothing in insurance land).

Today, Devoted serves 140k members (assuming 70% year over year growth that implies it served around 82k members in December 2022), expanding to almost 300 counties in 13 states according to its press release. That same press release also makes note of key points of purported differentiation for Devoted, namely the following :

- ‘comprehensive, tech-enabled preventive care services from Devoted Medical, the first virtual-first and in-home medical group built from the ground up to serve the specific needs of the Medicare population.’

- Full service guides, who help Devoted members with patient navigation

- A proprietary tech platform – Orinoco – powering everything behind the scenes – ‘the first modern software platform that can support the entirety of payor and healthcare provider operations, end to end, in a highly integrated way.’

- Its family-oriented company culture, treating every Devoted member like family.

Based on the above & plenty more, Devoted noted it achieves better health outcomes, and noted superior results for its diabetic and hypertension programs along with medication adherence. It also notched a 4.6 star rating across all of its MA plans in 2023.

The large round – and valuation to boot – leads me to believe that Devoted is gearing up to go public in the near future. Maybe…just maybe…it can prove it’s not like the other insur-techs. But I cannot lie; I’m getting big Oscar-like vibes here. For instance, Alignment Healthcare has 155k members (~40% growth) and is worth ~$1.5B. I’m not exactly an expert in payor valuation, but doesn’t that seem like a pretty massive delta?

What else is trending?

The JP Morgan Healthcare Conference is coming in hot with lots of interesting presentations and insights across healthcare. I’ll be keeping an eye out on what’s notable across the JPM landscape. Keep in mind that the conference is investor-focused, so you should expect to see lots of language around growth strategy, market share, physician alignment, population health strategy, and more as these health systems and other players vie for investors to raise bonds (nonprofit health systems), equity, and potential M&A dealmaking to kick off 2024.

CommonSpirit, one of the largest nonprofit health systems in the U.S., is doubling down on an outpatient-focused strategy. (Link – MH Paywall)

Elevance’s subsidiary CarelonRx – a segment of its newly rebranded Optum-like services segment – is acquiring Paragon Healthcare, a provider of ambulatory and at-home infusion services. (Link)

Eli Lilly launched its own telehealth service LillyDirect for patients to receive its GLP-1 drug Zepbound via telehealth vendor Form Health. Although there’s plenty of fanfare around this move, folks I’ve talked to are skeptical about how much volume LillyDirect will actually manage to produce for the drugs in question. (Link)

Omada Health announced a partnership with Amazon’s Amazon Health Services division, which seems to have just launched a new initiative called Health Condition Programs. To me it sounds like Amazon is trying to act as a platform for virtual care delivery companies to join, and Omada is one of the first to make the leap. Look for Amazon to make additional plays in the space as it tries to get its consumer base to change its behavior and get on the Amazon site for provision of healthcare delivery. Meanwhile, assuming people actually use this thing, I imagine Omada benefits from better brand visibility, more enrollment, and lower acquisition costs as Amazon identifies potential Omada candidates via purchasing behaviors. (Link)

Steward Health Care is way behind on its rent payments and struggling financially big-time. Given that Medical Properties Trust, a healthcare focused real estate investment trust, has a vested interest in Steward, MPT disclosed that Steward is behind to the tune of $50M in unpaid rent. Makes me wonder how that whole CareMax-Steward relationship is going. (Link)

Marshfield Clinic Health System and Essentia Health called off what would have been a 25 hospital megamerger. (Link)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

- I’m writing this late Monday, so congratulations to those of you who support the

cheatingnational champion Michigan Wolverines. It made me sick to see Penix miss all those wide open throws…All kidding aside, hope you guys enjoy the win. See you week 2!!

Hospitalogy Top Reads

My favorite healthcare essays from the week

- The Information’s Paris Martineau had a pretty scathing report of Athelas, which in October, merged with Commure in a $6B deal. “In the weeks after Palmetto began using Athelas’ software, his practice stopped receiving payments from insurers for the counseling services it had provided patients, even though the daily patient load for his team of counselors hadn’t changed. “No billing went out for almost two months,” said Schlauch. “I’ve never seen anything like this in all my career.” (Link)

- The New Yorker’s Dhruv Khullar had a great write-up on the Year of Ozempic. (Link)

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 24,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)