We saw a big drop off in managed care names as a result of some utilization commentary from UnitedHealth Group, so I figured it was worth discussing current volume trends, and where things might be headed!

Join Hospitalogy along with 26,000 others from leading healthcare organizations by subscribing here.

SPONSORED BY DOCK HEALTH

Healthcare is complicated. We all know it.

And with the explosion and adoption of new value-based care programs, care coordination and team-based care is more important – but also more complex – than ever before.

Dock Health makes chronic disease management seamless across all dimensions:

- Better care coordination across PCPs, specialists, and caregivers;

- Proactive task management to facilitate patient engagement (reminders, medication adherence, and education);

- More efficient workflows for care teams dealing with multiple touchpoints; and

- More effective billing, auditing and documentation

Care delivery organizations face more hurdles than ever. Don’t overcomplicate this decision too.

Choose simple.

Choose Dock Health, and their thoughtful, client-focused team, today.

Key Takeaways

Shares in managed care players plummeted this week.

The drop related to UnitedHealth Group’s CFO commentary on higher than expected outpatient volumes in Q2.

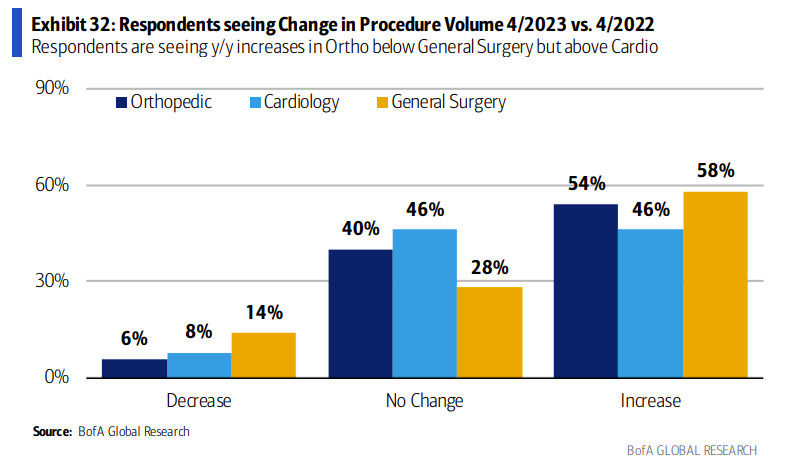

Survey data indicates that outpatient surgery demand is surging.

Volume is returning to healthcare as labor shortages alleviate and unlock OR capacity.

We are seeing a long-term, secular trend play out in the shift to outpatient services.

A Volume Paradigm Shift, or Small Blip?

A friend texted me earlier this week, asking “dude – look at what’s going on in managed care right now in the markets.”

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

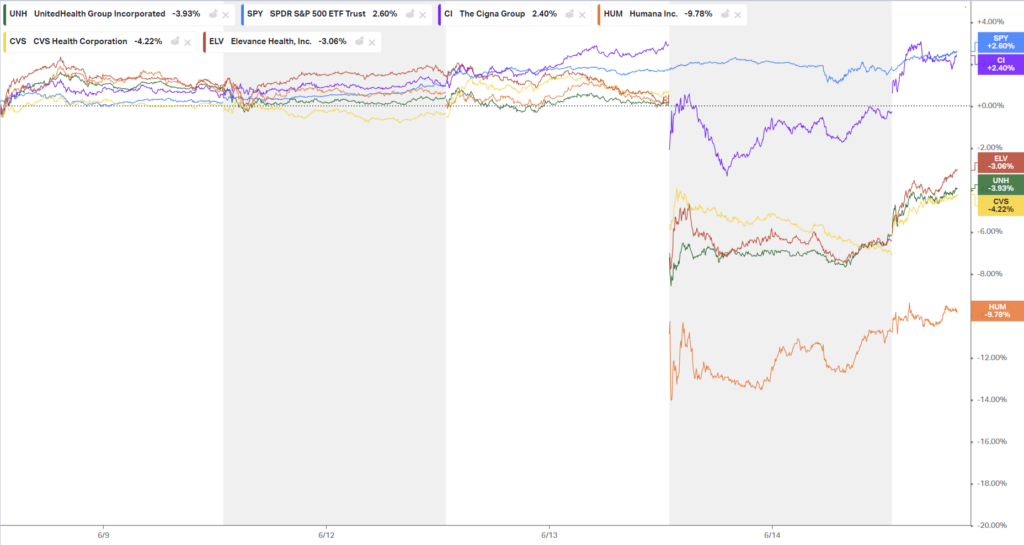

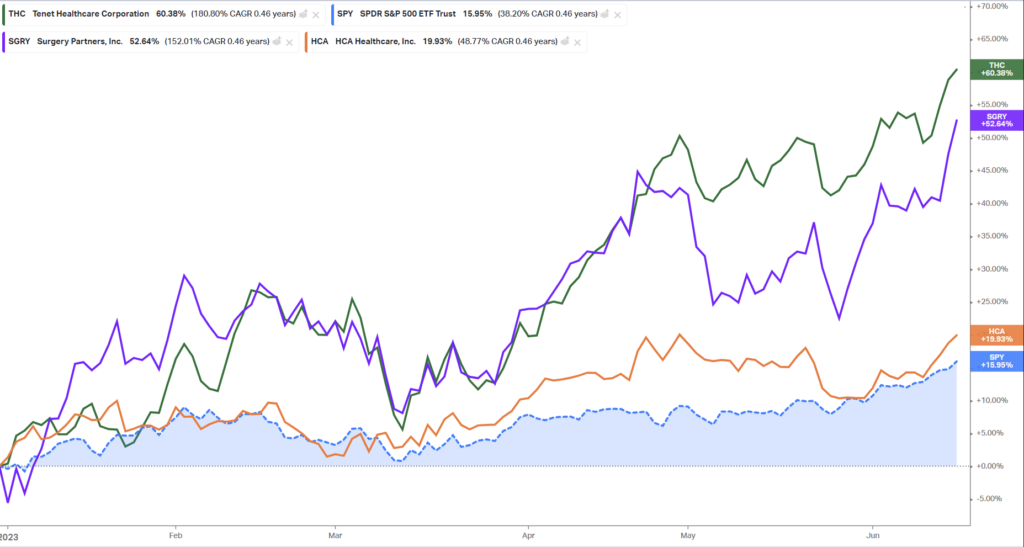

I took a quick peek. Managed care names were selling off in droves, with Humana down as much as 12%, and since then recovering a bit:

Originally I thought the selloff was related to this analysis discussing Medicare Advantage overpayments, but no – folks on Twitter quickly pointed me to the commentary at a conference made by UnitedHealth Group’s CFO discussing abnormal, heightened volume demand on the horizon:

- “…we saw higher levels inpatient continued pretty controlled. In fact, probably below 2022 levels…” = inpatient volumes are growing, but as expected.

- “but outpatient levels have continued to be an area that, we’ve really focused on most and where we see it really occurring.” = UHG worried about outpatient utilization.

- So much so, that they’re likely to see a spike in medical spend: “…you would expect Q2 medical care ratio to be somewhere in the in the zone of probably the upper bound or moderately above the upper bound of our full-year outlook…I would expect that the full-year would probably settle in the upper half of the existing range that we set up.”

The commentary aligns with findings from major healthcare analyst publications and surveys on utilization – TD Cowen’s nonprofit health system survey indicated continued, significant volume growth for hospitals in the second quarter.

And so this news, perhaps combined with some investor sector rotation, resulted in a selloff of managed care names scared of a resurgence in volume.

So – what’s the bigger trend at play here?

Utilization is coming back, and the outpatient book of business is surging for provider organizations.

Is the volume trend sustainable?

The question at hand now is whether the growth in outpatient volumes is a short-term release of backlogged surgeries – or, if a new paradigm is emerging in healthcare utilization with sustained, heightened surgical volumes unlocked as labor problems mitigate.

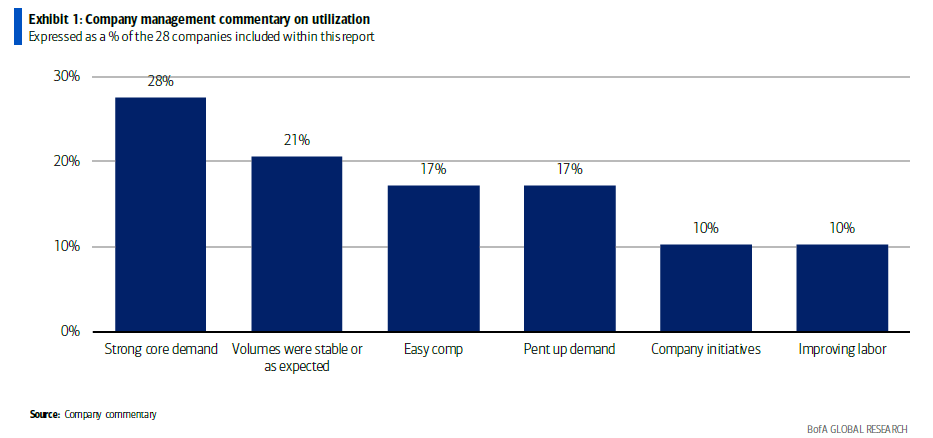

To that end, Bank of America published a great, recent note covering utilization trends. 50% of the care delivery organizations surveyed signaled that strong volumes are here to stay – at least in 2023 – with 10% of respondents also noting an improving labor environment:

In its note, BofA concludes: “In general, Q1 feels like peak growth, but strong demand should continue.” In my mind, volumes will continue to grow as provider organizations get their respective labor shortages in check – if ever.

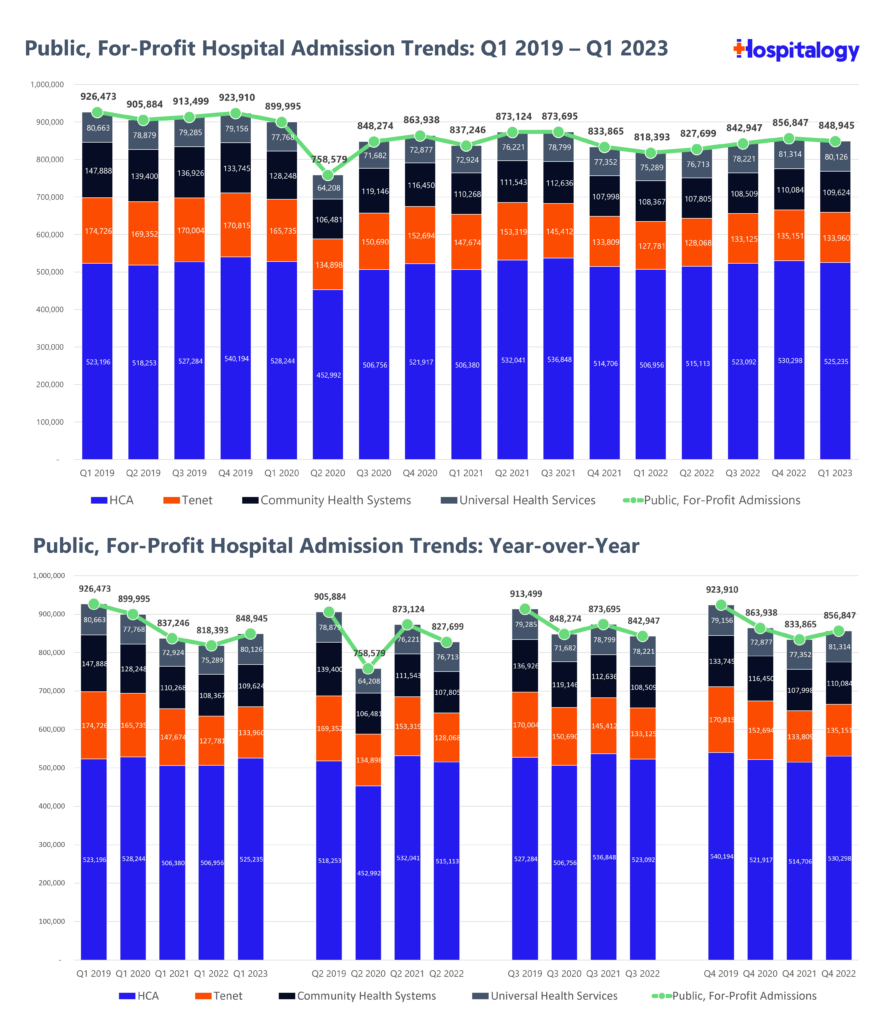

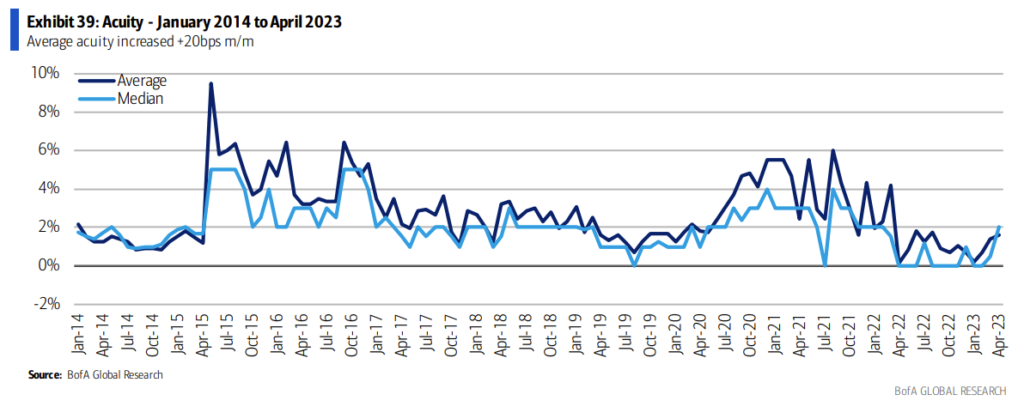

Meanwhile, inpatient growth has returned, but sits at, or below pre-pandemic levels. This is net positive for payors – in general, from a medical cost standpoint, they are much more concerned about inpatient utilization trends than outpatient growth:

All of this to say that the selloff is probably overblown. A few blips on the medical cost ratio from higher than normal outpatient utilization isn’t going to move the needle – yet. There are some headwinds on the horizon for payors, though – a dynamic I’ll dive into in Part 2 next week.

Who’s positioned to win?

The care delivery organizations with aligned physicians and the facilities to boot are poised to succeed long-term.

Consequently, look for names like Surgery Partners and Tenet’s USPI to enjoy nice volume growth while doubling down investment in orthopedic and cardiology service lines, two of the highest-margin, juggernaut specialties.

Notice the June spike in these operators:

And as the outmigration continues and surgical innovation moves complex cases into outpatient settings, acuity will continue to rise in the those settings, benefiting those with the facilities and highly specialized physician alignment to meet that growing demand:

The signal here is clear: those investing and operating in outpatient surgical growth will ride the secular tailwinds for the foreseeable future.

Nonprofit health systems are taking note, too. From a recent Modernhealthcare article:

- Other health systems are plotting their own expansions. Sacramento, California-based Sutter Health plans to add more than two dozen ambulatory care centers in the next four years, in addition to dozens of primary and multispecialty care sites. Henry Ford Health is investing $2.2 billion to expand its main campus in Detroit — the largest investment in its 108-year history. AdventHealth’s growth strategy includes expanding its outpatient operations, with plans to double its number of urgent care centers to more than 100, he said.

From a health system perspective, you have to ask yourself some tough questions. Where is utilization returning? To which markets? What service lines? Outpatient migration is driving the utilization train now. Inpatient beds are excessive and aren’t going to be full. If you don’t have that continuum of care from a system lens, things could prove difficult.

Finally, the next battleground between payors and providers will emerge over outpatient utilization. We’re already seeing that dynamic play out with UnitedHealth’s most recent attempt to rev up prior authorizations for GI procedures. GI and endo groups now have to collect and submit documentation in support of future endoscopy procedures. I wouldn’t be surprised to see more widespread ASC utilization management come to a head in the near future.

Part 2: Are Payor Headwinds on the Horizon?

As mentioned in part 1, payors are facing near-term utilization headwinds and blips on their medical loss ratio guidance, leading to selloffs in the managed care market. Consequently all managed care names are down year to date.

But folks I’ve talked to on the inside believe that there’s a potential larger cause for concern in risk-bearing healthcare names. So I wanted to present some thoughts on how healthcare MCOs might falter given a longer term trend of higher utilization:

Increased potential for mispricing: Given that organizations as large as Humana and United did not see the release of demand, we should expect insurers to price themselves more conservatively headed into 2024.

Increased scrutiny of outpatient utilization: If demand is continually harder to predict on the outpatient book of business, we’ll likely continue to see payor scrutiny of outpatient services and thus, an uptick in prior authorization. ASCs don’t report insightful utilization data, a point that MedPAC has bemoaned. This arena will be the next battleground as the goalposts shift. E.g., “Okay, now we’ve pushed more procedures out of the hospital inpatient setting and into outpatient. Now we need to check to make sure we’re appropriately paying for those procedures.”

Overutilization in healthcare is rampant. Like I mentioned in part 1, we’re already seeing that dynamic play out with UnitedHealth’s most recent attempt to rev up prior authorizations for GI procedures. GI and endo groups now have to collect and submit documentation in support of future endoscopy procedures. While UHG walked back the policy, providers need to prepare themselves for that reality.

If demand continues to normalize from a utilization perspective, we may see deeper payor penetration into areas including multispecialty groups, ASCs, and post-acute care to drive down medical spend.

The end of the Goldilocks Era for VBC?

While the pandemic was a horrible for…quite literally everyone else, it was a boon for both managed care players and value-based care firms. The segment of healthcare enjoyed operational outperformance in the era of historically low utilization, with the ability to drive cost savings through easy fee for service benchmark comparables. Not too hot…not too cold…but just the right environment for organizations taking on risk to succeed.

Here’s my next question for these players, though: what happens if the larger managed care titans start to face headwinds?

Let’s say policymakers tighten up risk adjustment around the belt. Then outpatient demand stays hot, and the managed care names struggle with pricing and MLR for a year. Maybe operating margin slips from 5-6% down to 3-4% or lower.

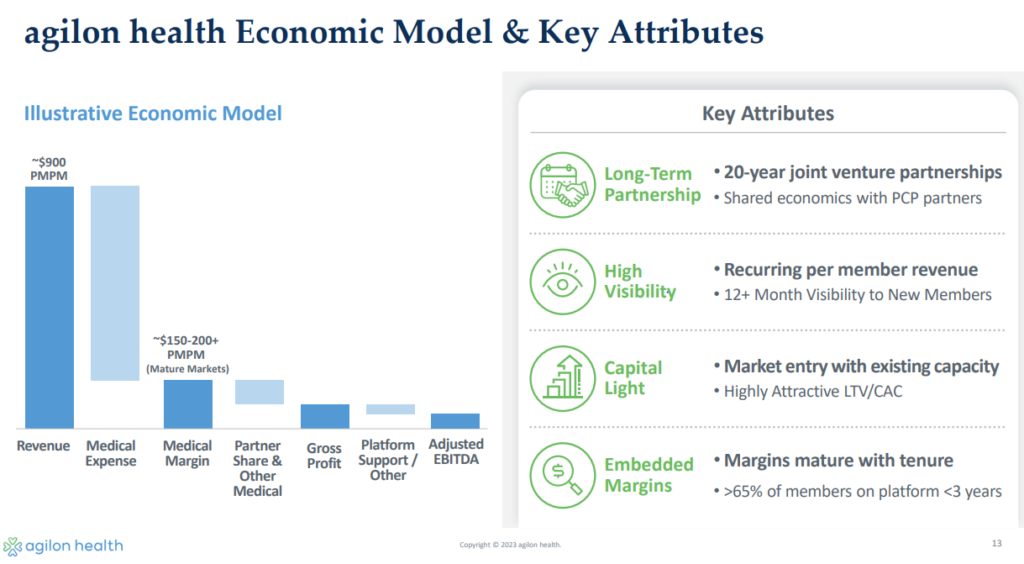

I would speculate that payor struggles would hold downstream ripple effects on the subcapped provider names – perhaps getting push back on risk pricing. Names that are farther down the risk spectrum – full capitation – would conceivably have substantial price exposure in the event that these dominos fall in line.

Stated differently, if there are structural cost changes occurring in healthcare, then the providers who are primarily in charge of managing that risk and utilization are more exposed. And while nothing is conclusive at this point regarding volume and utilization, things are trending that direction. At least in the short term. The end of the VBC Goldilocks era is nigh.

If margins erode from ~5% to ~3%, this financial dynamic could have bad downstream consequences for the value-based care platforms. This is a bear case for these players. More and more, it seems as if the sweet spot (at least currently) for operating a similar value-based care is exposure to both fee-for-service and risk-based revenue streams.

A recent William Blair note reiterated thoughts on a couple of MA-focused players:

- “AGL is 100% MA risk-based, so any uptick in MBR would impact margins here too. That said, management has consistently indicated that the company was more active in ensuring that care for its population was managed during the pandemic, thus creating less pent-up care relative to the broader market. Still, a broad uptick could modestly impact margins.”

- PIII is also 100% MA risk based, and would thus see a similar impact. It is surprising, thus, that PIII shares are up 3% while the managed care providers and AGL are all off 10%-15% today.”

I’d like to reiterate that I’m still optimistic about the companies in this space, but the above conditions present a real, and considerable headwind. What I’m outlining above could mark the beginning of a bear case in these names.

What levers can a VBC player pull if the topline PMPM gets pressured in the face of heightened utilization? Some speculation from me:

- More aggressive patient steering and narrow networks to preferred providers?

- Decreased shared savings splits with provider partners?

- A bigger focus on ACO REACH to work around managed care contracting?

- A broader move away from Medicare Advantage as MA penetration fizzles out?

There are plenty of variables to consider, and the bearish folks I talk to in the space mention that it’s possible for things to spiral into a competitive ‘race to the bottom.’ For now, expect these utilization challenges to be short-term with moderate impact.

Obviously these effects and dynamics are very open ended, with lots of factors to consider. If you have a perspective to share here, particularly in this arena, I would love to hear how you’ve thought about what I’ve presented above!

That’s it for this week! Join 26,000 others from leading healthcare organizations by subscribing here.