Welcome to the annual Hospitalogy year in review! This multi-part series is a culmination of a year’s worth of work. I’ve taken all of the stories I’ve written and analyzed and repackaged them into the themes that shaped 2023.

I hope you find this series valuable over the course of January. If you do, I’d appreciate it if you subscribed by submitting your email on this linked form. Hospitalogy is free, and subscriber growth and open rates are key reasons why that can continue!.

But first, please register for my upcoming webinars!

- Discussing the latest in AI-driven healthcare marketing trends and tactics: Register Here.

- Diving into 2024 population health strategies, including de-risking your behavioral health population: Register Here.

The multi-part 2023 year in review series will cover the following. Part 1 is today:

- Vertical integration shapes the payor landscape

- Emerging Medicare Advantage headwinds create ripple effects

- The rise of Retail Health and nontraditional players

- Health systems respond to labor and inflation struggles, and the return of Utilization a bright spot

- Fallout for high profile PE-backed and VC-backed organizations

- GLP-1s burst onto the scene, forming the new Wild West of healthcare

- AI in Healthcare – Evolution, or Revolution?

- Everything Policy – Inflation Reduction Act, Redeterminations, new risk models, and more

- Tactical tidbits – other notable partnerships, deals, and strategies

Hospitalogy Year in Review 2023: Vertical Integration Shapes the Payor Landscape

It’s 2011. Congress passed the Affordable Care Act the year prior, and a provision of the ACA included, among other sweeping changes, a cap on gross margins (MLRs) for health insurers. Thus, UnitedHealth Group (UHG) as an organization hits a major crossroad.

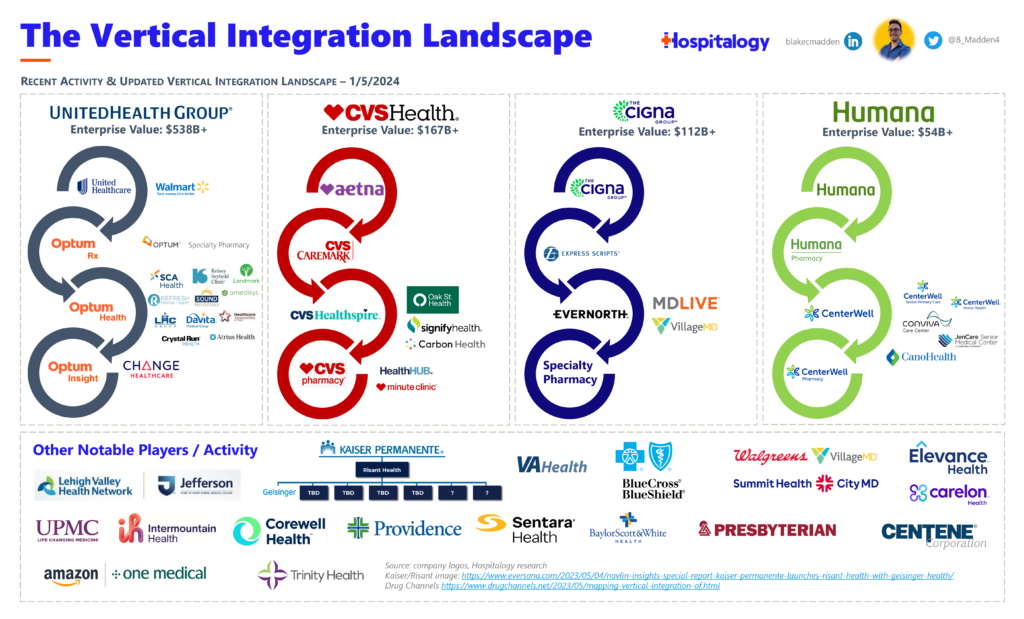

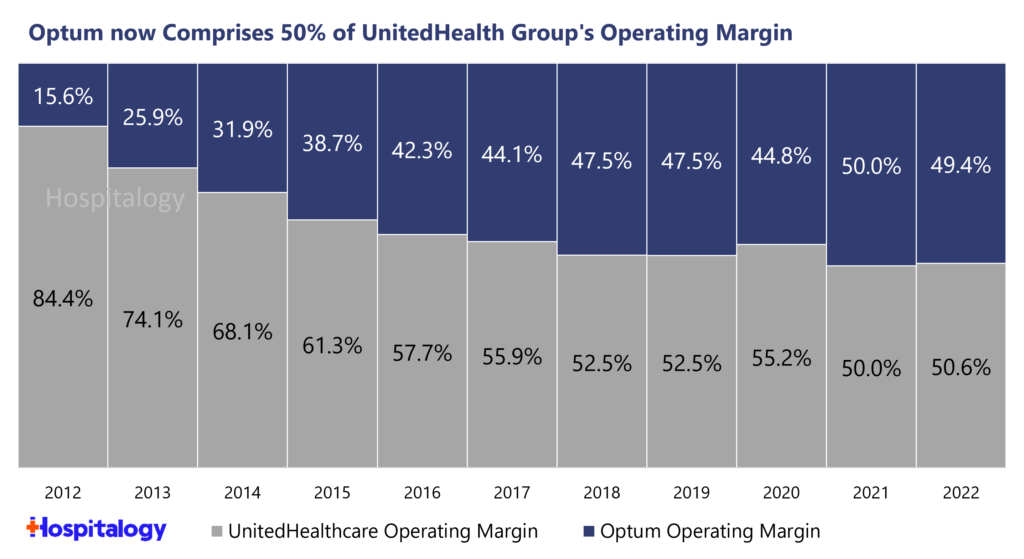

But UnitedHealth Group was at the right place at the right time. Stemming from that MLR policy, the fateful decision to form Optum that year may go down as one of the most shrewd business maneuvers of all time.

Since restructuring its care delivery, pharmacy/PBM, and analytics/IT subsidiaries under Optum, UnitedHealth Group transformed its business into an unrelenting growth engine (you can read the full history of UnitedHealth Group here). From 2011 onward, UHG/Optum acquired at least $33B worth of companies over that decade, casting a wide investment net over healthcare services as well as assets involved in new administrative requirements mandated by the ACA. Fast forward 3 years into the 2020s and UHG has already disclosed $30B+ in material acquisitions, with billions more undisclosed tuck-ins across the landscape we hear of second hand months after the fact.

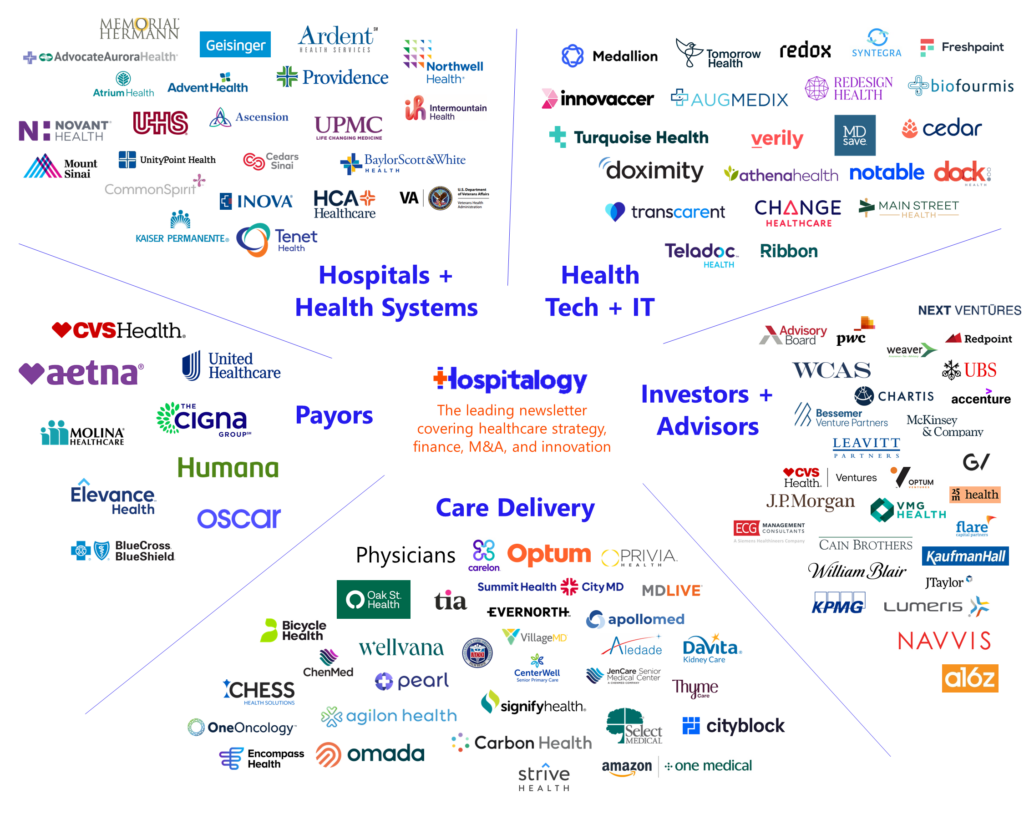

In 2023, Optum Health served 103 million individuals. Yes. A single company provided healthcare services for a third of America. But Optum is more than a care delivery titan – it’s a sprawling amoeba. OptumRx is the third largest pharmacy benefit manager behind Express Scripts and CVS CareMark with ~22% market share. Optum also has a financial services wing, acting as a bank – processing payments and other financial functions for providers, like working capital float. Oh, and don’t forget Optum Insight, which provides data, analytics, and other core IT functions as it quite literally absorbs thousands of health system employees in outsourcing deals.

Why am I telling you all of this?

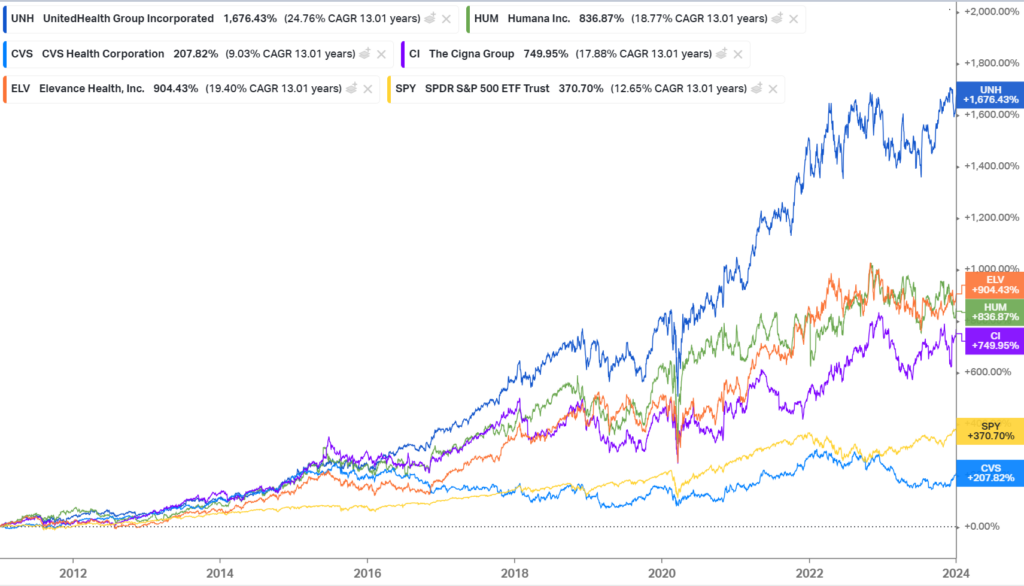

Because since going all in on Optum, UnitedHealth Group’s stock price has returned 1,676%, or 24.8% compounded annually, gob smacking its peers – and the S&P 500 – over that timeframe:

And vertical integration has been core to that outperformance, as UHG can unlock profits previously sealed away by those gross margin caps via intercompany eliminations with owned Optum subsidiaries, which makes Optum the primary growth engine for UHG, now comprising a majority of its operating margin:

Where we are in 2023:

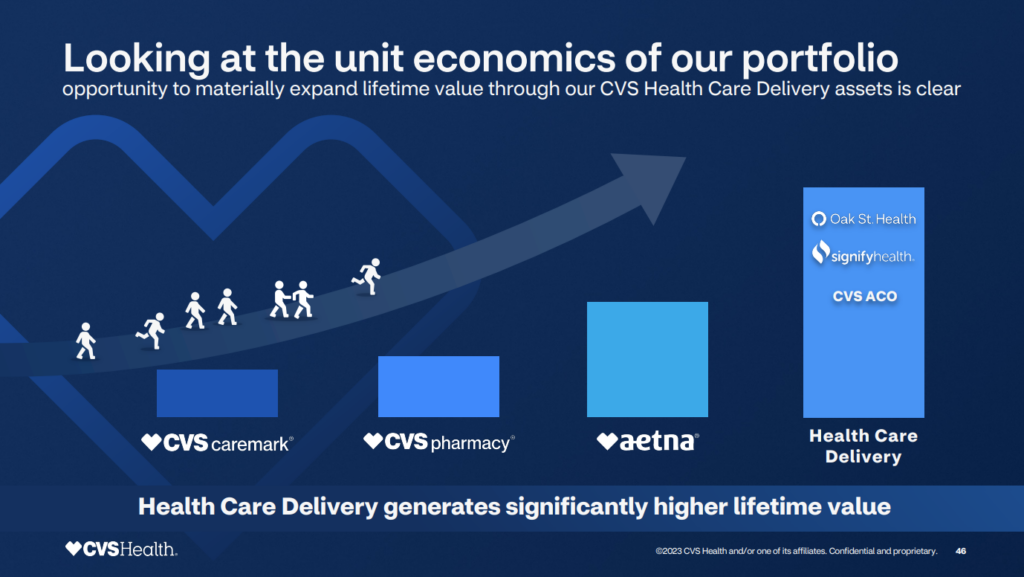

The history and strategy behind Optum – and UnitedHealth Group’s unreal outperformance – is important to know when you contextualize what happened in 2023. It’s why Optum continues to lay waste to the healthcare landscape by buying every company it wants. It’s why CVS started the year off with a bang by acquiring Oak Street Health for a hefty sum, then rebranding its services subsidiary to Healthspire. Payors everywhere are creating Optum-like subsidiaries to follow suit, and this activity accelerated in 2023. CVS even explicitly calls this out during its 2023 investor day:

Let’s review major vertical integration activity and M&A over the course of the year:

February 8, 2023: CVS announces $10.6B acquisition of Oak Street Health, eventually forms new subsidiary Healthspire

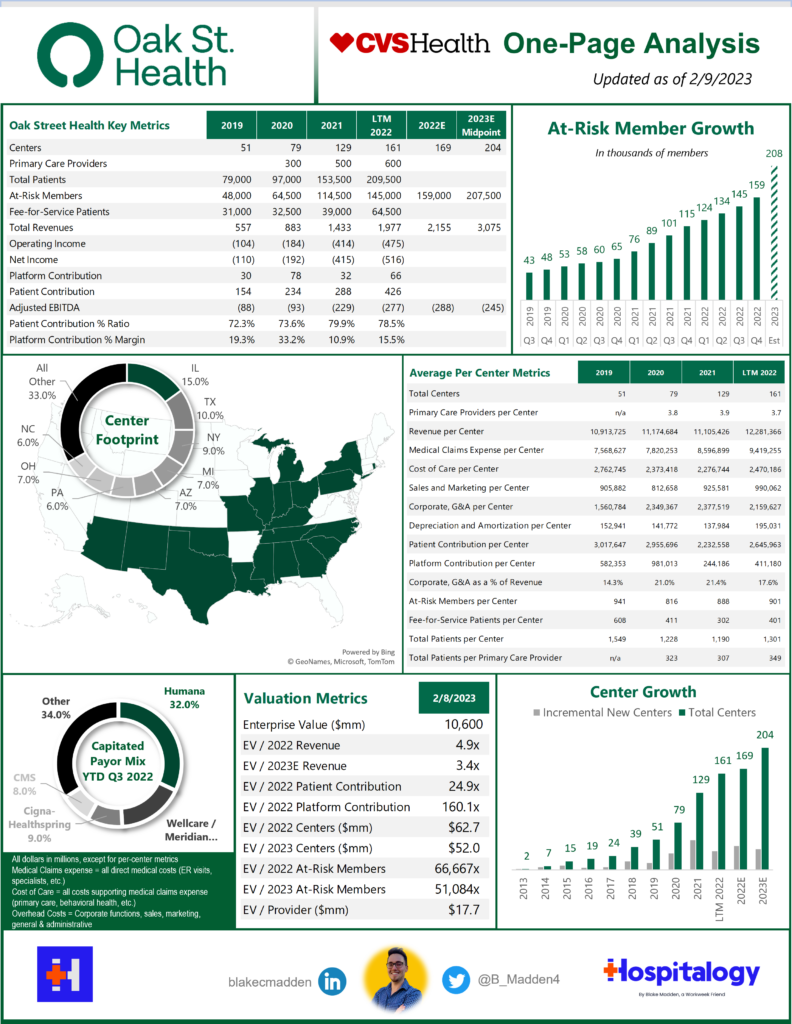

On February 8, 2023, CVS Health announced its intention to acquire Oak Street Health (”OSH”) for $10.6 billion in an all-cash deal, or $39 per share and a robust 3.4x revenue multiple on 2023 estimated revenues north of $3 billion.

As of 2022, Oak Street Health operated through a footprint of:

- 169 well-placed clinics in 21 states (I use centers and clinics interchangeably);

- 600 primary care providers (delineation between physicians and APPs not noted);

- Interdisciplinary care teams (behavioral health, specialty care, home health, telehealth, social workers, call center, etc.) including its 2021 acquisition of specialist telehealth platform Rubicon MD – providing it access to a key lever in managing total cost of care through specialist referral; and

- Its proprietary, custom-built tech platform and electronic medical records system, Canopy (for which it has won multiple awards). Canopy is key to OSH’s operation, collecting longitudinal patient data, providing population health analytics, and creating comprehensive reviews of OSH target demographics based on the populations it wants to serve.

From the acquisition, Oak Street (OSH) received an injection of growth capital to accelerate clinic openings. From 2013 to 2022, Oak Street opened 169 clinics in total. After going public, OSH accelerated those openings to around 40-50 a year but most recently ran out of steam, leading to the CVS acquisition. With the backing of CVS resources, Oak Street will open 50 to 60 clinics in 2023 and expand into 25 states. As of mid year 2023, OSH was at around 177 clinics.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

As a standalone entity prior to CVS acquisition, Oak Street had expected to hit 204 centers by the end of 2023 and 300+ by 2026. Do the math here and CVS is pumping enough resources to open an incremental ~15 to ~25 clinic locations beyond what OSH could have managed on its own.

What’s in it for CVS? Opening more OSH clinics helps with a few different financially motivated initiatives:

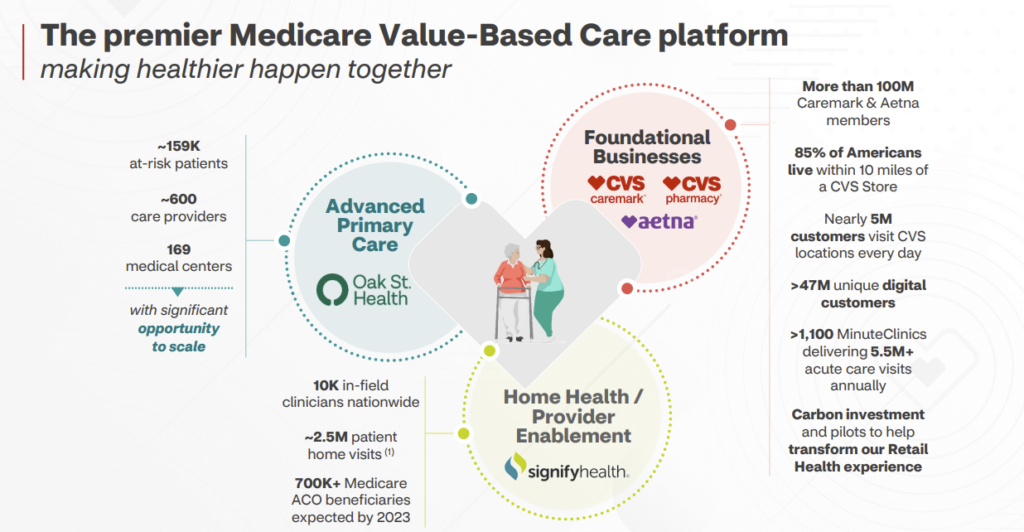

- Accelerating patient acquisition from CVS Pharmacy and Aetna channels – “Today, there are approximately 1 million Medicare eligible seniors, who visit CVS pharmacies each week that are located near an Oak Street Clinic.”

- These initiatives will drive Oak Street patient growth and accelerate the path to mature clinic profitability, while broadly serving the needs of Medicare members…We will also open new Oak Street clinics co-located with CVS pharmacies this year, and have already identified additional locations for 2024. We now expect to build 50 to 60 clinics next year.

- Our analysis has consistently shown that accelerated clinic growth is the right thing to do in terms of optimizing the long-term returns on this investment and expanding access for at-risk populations.

- Boosted patient engagement, which should in theory boost MA star ratings and $$$ – “We launched new member engagement initiatives focused on creating connections between Medicare-eligible CVS customers, both in-store and digitally, and Oak Street Health provider.”

- Helping Aetna members find primary care providers – “We are also connecting Aetna Medicare members who are currently without a primary care physician with their local Oak Street provider to reengage them in their care.”

Ultimately, CVS is following in the footsteps of Humana and UnitedHealth group, matching up against Humana’s CenterWell (and Conviva) activity and of course, Optum’s buying sprees. Through the CenterWell JV with WCAS, Humana is opening 30 – 35 clinics annually. CenterWell /Conviva together also delivers care to 240,000 patients across the nation while Oak Street Health is responsible for 181,000 at-risk patients (and 224k patients in total, which may be more comparable).

“The [Primary Care Organization], including CenterWell and Conviva, is the largest provider of senior-focused primary care in the country. Between the two brands, the PCO operates more than 220 centers across 11 states and expects to continue to grow by 30-50 centers per year through 2025.”

In late March, Oak Street Health also announced a JV with chronic kidney disease player InterWell Health, officially launching OakWell. The partnership plans to integrate primary care to end-stage renal disease patients directly in the dialysis clinic. This deal makes a lot of sense when you consider that dialysis patients on average spend around 12 hours in the clinic and very often have other chronic, complex conditions that Oak Street can leverage to improve patient care while boosting the bottom line. Looks like InterWell has contributed centers in Chicago, DFW, and Houston. (Press Release)

During its 2023 investor day later in the year, CVS also gave us some commentary on creating an MSO, saying that it formed from culmination of assets from Signify’s Caravan Health, CVS’ own internally developed ACO, and likely some influence from Oak Street Health. Ultimately the newly formed ACO has allowed CVS to partner with the likes of RUSH Health in Chicago, and Ardent Health Services nationally, reaching 1 million covered lives (presumably 700k of which are under Caravan).

Finally, CVS’ care delivery segment is now called…Healthspire, announcing the new subsidiary on December 5.

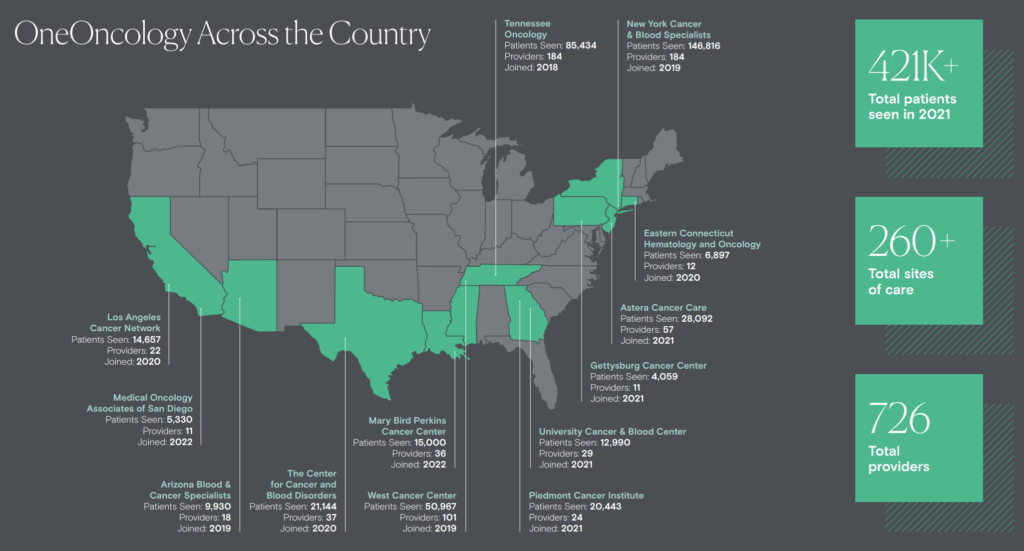

April 20, 2023: TPG, AmerisourceBergen acquire OneOncology for $2.1B

In mid April, TPG and AmerisourceBergen (ABC) announced the acquisition of OneOncology from General Atlantic for $2.1B. ABC purchased a 35% minority stake ($685M) in OneOncology while TPG holds the remaining 65% in a joint venture. 4 years from now, ABC will buy the remaining 65% of OneOncology at a 19x multiple. What a payday for TPG. And using 19x as a ballpark multiple for the transaction today, that roughly implies around ~$110M in EBITDA for OneOncology today.

On ABC’s front, the strategic acquisition gives the drug distributor a major asset in the oncology space after watching McKesson dominate the market with its own practice management company, the U.S. Oncology Network, over the past 13 or so years. Since acquiring the USON in 2010, McKesson has expanded the practice into 2,300 total clinicians. From a vertical standpoint, ABC’s move helps to protect its market share in distribution.

As for General Atlantic, the growth equity investment firm exits its ~5-year investment in OneOncology. It made the initial $200M investment in 2018 and formed the oncology practice management company alongside Tennessee Oncology.

Since that initial investment, One Oncology has grown into a sizable footprint:

- 15 practices

- 300 sites of care

- 560+ oncologists

- 940+ total clinicians

In 2022, its latest update, OneOncology tacked on another 86 physicians and holds an impressive retention rate with docs (an important metric in practice management).

Remember that OneOncology’s model is focused on oncologist enablement – e.g., physicians retain their independence when agreeing to affiliate. In addition, all 14 of OneOncology’s practices applied to participate in the Enhanced Oncology model – the next phase of value-based care in oncology, and the successor to CMMI’s Oncology Care Model (which failed to generate meaningful savings for CMS but made meaningful progress toward value-based oncology care). That means for certain cancer treatment plans under EOM, OneOncology will help oncologists transition to risk-based arrangements and allow them to take on some level of two-sided risk.

April 26, 2023: Hospitals Respond: the Rise of Risant Health

Also in April, Kaiser Permanente formed a new nonprofit health system called Risant Health, which will have significant financial backing as a subsidiary of Kaiser.

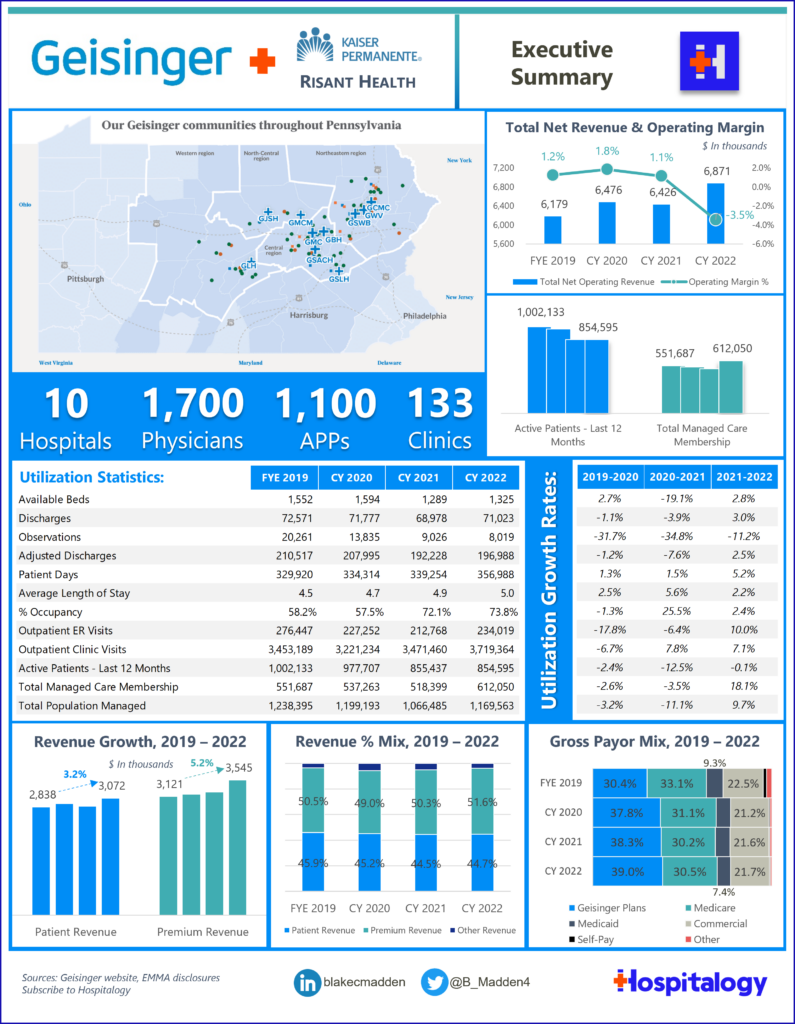

The system’s inaugural member is Geisinger, based in Pennsylvania – a health system with an impressive footprint including $6.9 billion in revenue, a risk chassis (600,000+ managed care members), 10 hospitals, 1,700 physicians across 133 clinics, and has even been referred to as the ‘Kaiser of the East.’

Why Risant, and why now? For one, Kaiser has struggled with growth initiatives and entering markets in other states. But Kaiser thinks the time is ripe for health system transformation. Risant provides a potential lifeline for health systems struggling in the 2023 operating environment to provide population health expertise, capital needs, and capability-based scale.

The Risant development in April picked up perfectly where we left off in 2022 with cross-market megamergers (Advocate-Atrium in particular) and the evolution of hospital M&A. And it’s a perfect, natural response to current health system headwinds as a response to local market competition (when it comes to Geisinger), labor and inflation pressure, and finally, a move to counter payor vertical integration activity.

Over the next 5 years, Risant will target smaller integrated care delivery organizations (e.g., nonprofit health systems with a health insurance offering) with the goal of hitting $35 billion in system revenue. The nonprofit health system members will operate independently but hold affiliation with Risant. And I know for a fact they’re actively having conversations. Expect to hear more from Risant in the coming years – if they can close deals.

Read my full write-up on Risant Health, including my take on the deal, the broader trends at play, and the hospital value proposition that likely enticed Geisinger to join. (Read More)

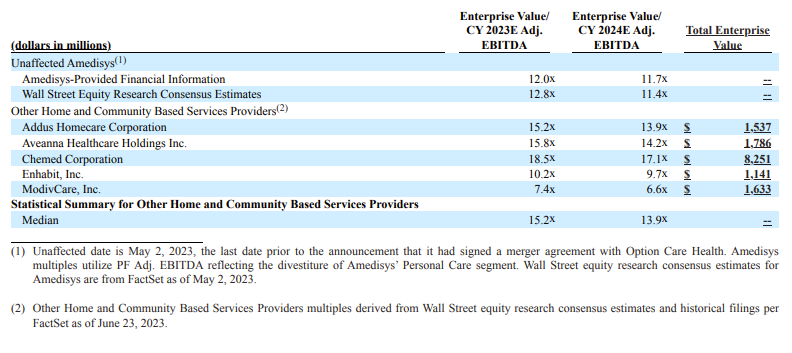

June 26, 2023: Optum announces $3.3B Amedisys acquisition

On June 26, national home health and hospice player Amedisys announced plans for Optum to acquire the firm at $101 per share, or over $3.3 billion. If you recall, Amedisys had previously announced its intention to merge with Option Health Care to create a $10 billion enterprise at the time. I broke that merger down here – and the TL;DR is that both analysts and those on the outside looking in felt dubious about the deal prospects. Smelling a weakness, the Optum empire stepped in, offering Amedisys a much more shareholder friendly all-cash deal in the following weeks. Between closing its LHC Group deal in February 2023 and now Amedisys (with the assumption that the deal goes through), Optum holds around 10% market share in home health and tacks on another potential growth funnel in high acuity at home programs, Contessa, on its growing list of post acute services. Meanwhile Optum can leverage its newfound home health footprint to facilitate better care coordination and drive down costs in VBC arrangements.

Optum also continued its tuck-in streak, acquiring Crystal Run – a multispecialty (40+ specialties), 15+ clinic locations, 5+ urgent care centers, multi-specialty ambulatory surgery center, and 400+ provider practice – among other acquisitions. UHG hit the immense milestone of a 90,000 physician and 40,000 APP footprint in 2023. That’s an accelerated addition of 20,000 MDs in 2023 versus their previously stated goal of 10,000 per year, and the embedded economics of adding these physicians and APPs will play out for years to come.

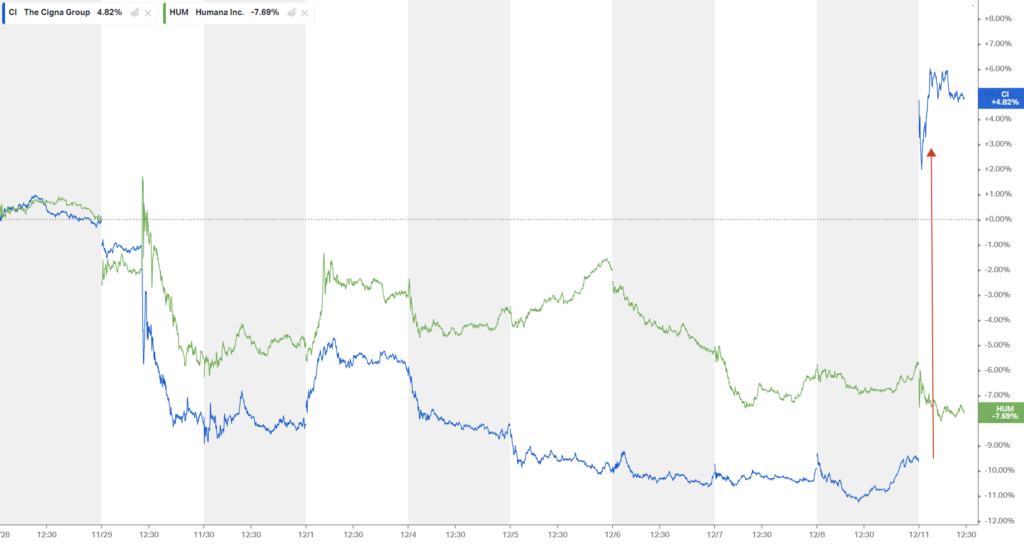

December 10, 2023: Humana/Cigna Merger talks end, but signal desire for diversification

As fun as they were, after the Wall Street Journal broke the megamerger news, Humana-Cigna deal talks ended as fast as they began.

After a couple weeks of post-Thanksgiving M&A rumor mill fun, the Wall Street Journal reported an end to what would have been the largest deal of 2023 between two health insurance giants Cigna and Humana.

Despite analyst commentary ultimately speculating that this megamerger would survive antitrust scrutiny, and despite the deal kinda making sense for both sides, Cigna killed deal talks for good by announcing a massive share buyback. The commercial insurer boosted its buyback by $10B, bringing total approved buyback funds to $11.3B approved. Cigna also noted a new plan to pursue more bolt-on acquisitions rather than any sort of mega deal.

- “In light of the current environment, we will consider bolt-on acquisitions aligned with our strategy, as well as value-enhancing divestitures.”

Investors reacted well to the updates, sending Cigna’s stock price up 16% on the day:

What are the implications of this merger falling through for the two sides?

Humana: Humana – and anyone else not named UnitedHealth Group – is up for sale, and to me, the desire to move or combine from Humana’s end signals to me that they’re looking to diversify quickly away from pure play MA. Are we done chatting about Humana as a merger or acquisition target? Not yet.

Cigna: Where does Cigna go from here? They’re likely to sell their MA book of business to Health Care Services Corp, fetching a few billion – but then they’re zoned out of MA altogether. Does that seem like the best path forward? Sticking to core competencies seems logical, but the commercial market is shrinking. I’ll be interested to see what kind of tuck-in acquisitions Evernorth engages in, with the most notable recent investment of recent being involved in the Summit-VillageMD deal.

- Reuters had reported in November that the company was exploring a sale of the business. Cigna, which got into the Medicare Advantage business with an $3.8-billion acquisition of HealthSpring in 2011, would be backing away at a time when the U.S. government is tightening its purse strings – it cut the reimbursement rate for health insurers in early 2023.

M&A Environment: The break-up overall speaks to a tough M&A market in general and the high opportunity costs associated with higher interest rate environments. It’s very possible Cigna can drive just as good of a return by initiating buybacks and staying the course (at least for a while) than it can by engaging in a long-term, drawn out merger that might not close for 1-2 years.

The dark side of vertical integration

Here’s something to continue to watch as these business amoebas grow and integrate. In theory, a vertically integrated player should be able to provide the best, most coordinated level of care, with the least amount of friction, at the lowest price – right? Finally, a healthcare business model with aligned incentives!!

But as we’ve seen play out, there are hundreds of levers to pull within a vertically integrated healthcare colossus that still incentivize financial performance over optimal patient care.

We’ve seen unfortunate algorithmic driven clinical decisions uncovered via the naviHealth controversy, or anticompetitive patient steerage with other players in-market, and finally, growing market presence with the ability to squeeze out independent practitioners (pharmacists, physicians) on starved reimbursement.

These dynamics are something I’m watching closely entering 2024. Will politicians & regulatory eventually find enough weaponized rhetoric to bring these players down a peg.

In 2024, expect heightened animosity toward these players from all angles.

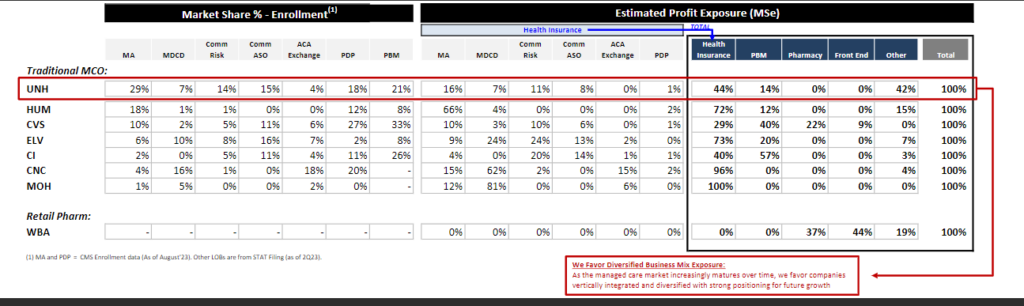

Why vertical integration won the day in 2023

Until there’s a federal crackdown or a forced breakup, payvidors will exploit an extreme scale advantage for financial gain. It’s simple capitalism.

“As the managed care market matures over time, we favor companies vertically integrated and diversified with strong positioning for future growth.”

As they stand today, scaled payvidors boast better financial performance, a more diverse book of business to weather headwinds across its asset base, attractive embedded economics from integrating care delivery or other assets, and therefore easier levers to pull for growth.

That’s it for part 1!

If you enjoyed this, consider subscribing to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 24,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)