Hospitalogists,

We’re 1 month into 2024 already.

Isn’t that insane?

Before we get started, I wanted to bring another study to readers’ attention, as it’s an interesting one coming from the intersection of AI and primary care. The AAFP conducted an evaluation of Navina’s AI-enabled clinical intelligence platform and concluded that using a platform like Navina’s is essential (note: not just recommended) for primary care in 2024.

Find out why they reached this conclusion by downloading the full report here.

SPONSORED BY ADONIS

Hospitalogists! I need your help.

Adonis and I are launching a survey for our combined audiences asking healthcare organizations for their 2024 financial & strategic outlook.

It takes 5 minutes to fill out, and the results will help inform my content to help you better understand how your peers are discussing healthcare dynamics in 2024.

All answers are anonymous and I greatly appreciate you taking the time to fill it out! The link is here:

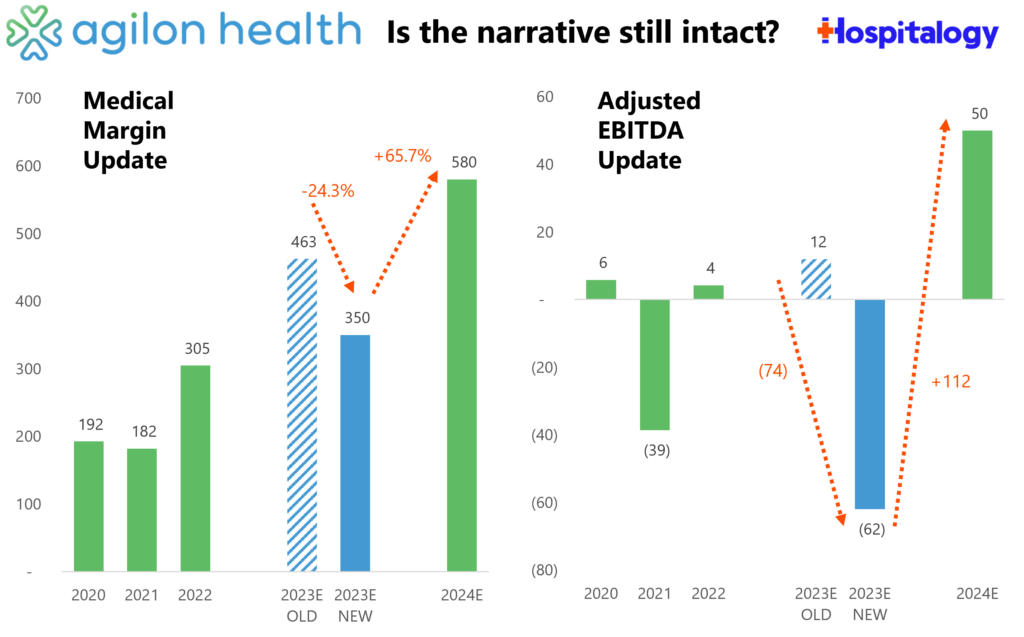

January’s Biggest Healthcare Stories

1. The theme of rising utilization was the biggest story from January. I covered it pretty robustly here, but the TL;DR is that many Medicare Advantage players are seeing a market uptick in seniors accessing care in the outpatient setting, causing major players like Humana and agilon to issue lower than expected forecasts for 2024. This dynamic – and headwinds facing Medicare Advantage in general – will be a huge talking point in board rooms across the country in 2024. On the MA side, we’re seeing an interesting dynamic play out given that CVS seems to have priced its plans for membership growth in 2024 – and succeeded, picking up 800,000+ new MA lives. Given these headwinds, how will the pricing strategy play out for CVS? Something to watch over the course of the year.

2. Even more MA scrutiny is on the horizon from CMS: Recommendations regarding MA data [collection and transparency] included calls for CMS to collect and release more MA data on key areas of concern, such as supplemental benefit costs and utilization, value-based payment arrangements between providers and plans, utilization management and prior authorization including denials and appeals and access to inpatient services and post-acute care, network adequacy and provider directory accuracy, competitive forces in the market such as the effects of market shifts and vertical integration and consolidation on consumers, care outcomes, and Medicare Loss Ratios (MLRs). Commenters also raised data considerations on topics such as MA marketing activity, especially predatory behavior, care outcomes and data available in MA compared to Traditional Medicare (Medicare Parts A and B), and geographic impacts including on rural areas, among other important topic areas.

- Translation: Required disclosure of data like CMS indicates above could hold major implications for proving harm in vertical merger activity within healthcare.

3. The ACA Exchange enrollment hit 21.3 million members, a record total, as people move off Medicaid (redeterminations will end later this year) and driven by growth in states including Texas and Florida. Multiple payors noted the exchange as a tailwind for 2024 (CVS, but more particularly Centene and Oscar). I also noted several comments regarding ICHRA, and how the time seems to be right for certain employers to slowly and steadily adopt this program. (Link)

4. Probably the biggest news from the land of health tech and venture in January, General Catalyst announced that its recently formed Health Assurance Transformation Co. is acquiring Summa Health, an integrated health system in Akron. Folks outside of the transaction (me included) will be watching in fascination as HATCo tries to turn Summa Health into a premier destination for innovation in health systems. Meanwhile, we’ve finally figured out what GC has been up to this whole time with its health system thinktank partnerships. The move holds just as much value for the venture firm from a branding perspective, as it’s now known as a firm that wants to take on big bets in healthcare. Deep dive on this transaction coming from yours truly soon.

5. During the JP Morgan Healthcare conference, outside of chatter around AI, emerging biotech & medtech stories and GLP-1s, Health systems unveiled a heavy strategic focus on building out their outpatient footprints. This story and theme goes hand in hand with a recent investment TPG announced as part of its Growth fund – Compass Surgical Partners – an independent ASC management company holding joint ventures with a number of health systems. TPG’s latest Growth fund continues to focus on companies helping health systems build out their ambulatory care networks.

6. Large scale M&A has never been in a worse state. Apart from healthcare, we’ve seen several high profile deals fall through in recent months (Amazon-iRobot, Adobe-Figma, JetBlue-Spirit, etc). While the M&A headaches are multi-industry, hospitals are also feeling M&A pressures. Missouri’s AG is looking to block a merger between Liberty Hospital and KU Health. Meanwhile, the FTC sued to block Novant’s $320M takeover of two North Carolina hospitals from Community Health Systems. Marshfield Clinic Health System and Essentia Health called off what would have been a 25 hospital megamerger. Finally, given the local market disaster HCA has on its hands with Mission Health, I’d expect to see some concessions or a divestiture there as well. Big picture: the M&A market has been de facto dismantled by the current administration. But don’t worry fam, Optum Health is here to save the day as it scoops up 20,000 physicians per year.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

7. ApolloMed announced a new strategic partnership with California based 400+ physician group BASS Medical Group. From the release, ApolloMed will serve as BASS Medical Group’s exclusive partner for all new value-based arrangements, which is interesting considering Privia partnered with BASS Medical Group as its anchor group for California back in late 2021. So what does ApolloMed’s partnership say about Privia – were they unwilling to take on risk with BASS in the Cali market?

- Back in October, this was the quote issued by BASS. I mean, I know it’s PR boilerplate, but still: “We look forward to a highly collaborative partnership with Privia Health to support our current and future provider partners in enhancing patient engagement, reducing administrative burdens, strengthening practice vitality, and successfully transitioning to value-based care.”

- Pretty interesting dynamic here to say the least!

8. Walgreens, cash-strapped to all heck, is rumored to be selling one of its best performing assets at the crest of what appears to be a major boon in specialty pharmacy – Shields Health Solutions – for a rumored $4B price tag. Word on the street is several health systems are rethinking their relationships with Shields, but that’s just a rumor. You have to wonder where selling Shields leaves Walgreens’ other healthcare assets given it has been selling investors on this integrated healthcare transformation story over the course of ‘23. How is VillageMD faring? Will we see an asset impairment? Walgreens has plenty to answer for in ‘24.

9. Elevance’s big plans for Carelon: After a pretty successful quarter, a scaleback from certain MA markets, and an uptick in commercial member growth, Elevance noted its desire to expand Carelon’s capabilities in 2024. To that end, it acquired Paragon Healthcare, a provider of ambulatory and at-home infusion services. (Link)

10. Epic launched its connected ecosystem platform called Epic Showroom replacing the Partners and Pals program – Brendan Keeler had a nice breakdown of the various components on his LinkedIn post here.

11. In the background, value-based care facility players are hemorrhaging capital. CareMax announced a 1-for-30 reverse share split (absolutely never, ever a good sign) and is likely dealing with the fallout from Steward Health Care’s financial woes including its impending sales and hospital closures that will materially impact patient care in Massachusetts. Cano Health’s struggles are well documented. VillageMD is shuttering locations. Finally, anyone check in on the Walmart-ChenMed sale rumors? Makes you wonder why we haven’t gotten an update on that since…September ‘23. I can wager a guess: RAF scores.

12. Eli Lilly launched its own telehealth service LillyDirect for patients to receive its GLP-1 drug Zepbound via telehealth vendor Form Health. Although there’s plenty of fanfare around this move, folks I’ve talked to are skeptical about how much volume LillyDirect will actually manage to produce for the drugs in question. Still, the obesity market is expanding via digital health partnerships as noted by Rock Health in this LinkedIn post. Meanwhile, states like North Carolina are shutting down coverage of GLP-1s after costing the plan $102 million, or 10% of its entire prescription drug cost!

13. Fundraising: some of the most notable fundraising rounds in January included Harbor Health ($95M raised and one to watch – I know for a fact payors and health systems are interested in their model), Devoted Health ($175M raised at a $12.8B valuation), Employer Direct Healthcare ($92M raised at a $1B+ valuation) and Turquoise Health ($30M raised)

14. Omada Health announced a partnership with Amazon’s Amazon Health Services division, which launched a new initiative called Health Condition Programs. Look for Amazon to make additional plays in the space as it tries to get its consumer base to change its behavior and get on the Amazon site for provision of healthcare delivery. Meanwhile, I imagine Omada benefits from better brand visibility, more enrollment, and lower acquisition costs as Amazon identifies potential Omada candidates via purchasing behaviors. (Link)

15. BrightSpring Health Services is planning to go public, filing an S-1 on January 2.

16. Commons Clinic launched an orthopedic center of excellence in California, committing to investing $100M over the next decade to transform ambulatory spinal care delivery.

17. 130 Allina Health physicians unionized in an accelerating trend highlighting some pretty tough dynamics between physicians and hospital admin.

18. UnitedHealth Group’s Q4 results: the Optum margin slowdown continues while utilization headwinds dominate investor anxiety. Spoiler alert – they’re fine.

SPONSORED BY NEUROFLOW

For risk-bearing organizations, it’s critical to recognize that behavioral health acuity is rising across your populations, and unfortunately, there’s no sign of this slowing down.

Data has shown individuals with chronic diseases coupled with behavioral health conditions drive 2-6x higher healthcare costs. You need a cohesive strategy around this population.

On 2/15, join me, the NeuroFlow team, and a panel of experts in a virtual event.

We’ll have a much-needed conversation around how health systems, payors, and risk-bearing orgs can proactively measure and address the behavioral health of their complex patient populations.

Hospitalogy Top Reads and Resources

My favorite healthcare essays and published resources from January

- Health Management Associates and Leavitt Partners produced a fantastic report covering the value-based care landscape across the entire continuum. It’s exceedingly thorough, and free to download, so do so here. Also, give one of the lead researchers, Kate de Lisle, a follow on LinkedIn for this wonderful report.

- Navina’s excellent report in partnership with the AAFP diving into why primary care physicians need an AI-enabled clinical intelligence tool.

- Dana Farber Cancer Institute’s data manipulation scandal

- Gene-therapy breakthrough allows congenitally deaf children to hear. Just amazing.

- Kaufman Hall’s 2023 hospital and health system M&A year in review

- McKinsey: what to expect in US Healthcare in 2024 and beyond (a nice look at growth expectations for various sections of healthcare).

- What to Watch in 2024: The Latest Health Cost and Affordability Issues and Trends

- The WSJ’s coverage of an alarming trend – that cancer is more prevalent in young people than ever before. Diagnosis rates in the U.S. rose in 2019 to 107.8 cases per 100,000 people under 50, up 12.8% from 95.6 in 2000

- The Year of Ozempic, by the New Yorker’s Dhruv Khullar

- AcquiredFM’s overview of Novo Nordisk, Eli Lilly, and GLP-1s. Well researched, entertaining, and learned a lot!

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 25,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)