28 January 2023 | Healthcare

The End of the Billion-Dollar Drug

By workweek

AbbVie’s Humira, the most financially successful drug in history, will be saying goodbye to its 20-year throne of U.S. market exclusivity.

That’s 20 years of zero competition in the U.S.

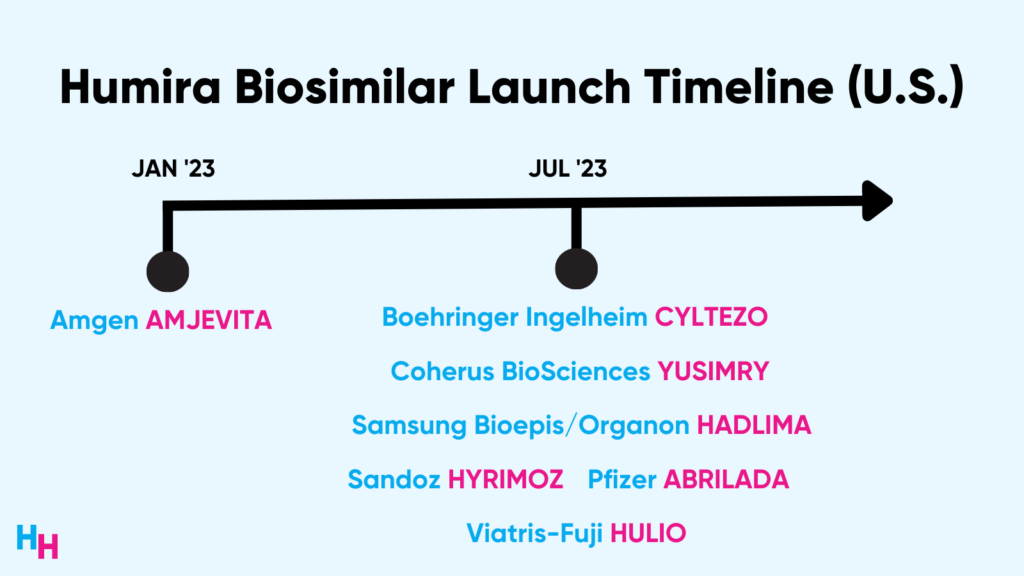

Following years of lawsuits and AbbVie’s patent tactics, several Humira biosimilars will hit the market throughout the year, with the first one by Amgen hitting the market this week.

So, it’s only timely to discuss Humira’s unique story. In this week’s Huddle, I’ll dive into Humira’s success, how it became so successful, and if it will remain successful in light of new competitors.

The Blockbuster Drug: Humira

AbbVie’s Humira—a monoclonal antibody used to treat autoimmune disease—is the most financially successful drug ever to hit the market, bringing in $200 billion in revenue over its 20-year market rein.

AbbVie is valued at around $270 billion, and Humira accounts for about 35% of AbbVie’s revenue. So do the math: Humira—alone—has a market cap of $95 billion. $95 billion! If Humira were its own company, it would be worth more than PayPal. (Thank you, Dr. Eric Bricker, for the breakdown).

Humira’s list price has grown more than 6x since its launch in 2003. The original list price was around $520 per syringe, skyrocketing to nearly $3,000 per syringe today. As its stranglehold on the market tightened, AbbVie could afford to increase the list price to what the market would tolerate. According to the latest estimates, insurers are paying at most $83,328 annually per patient on Humira—312,000 patients are taking Humira annually.

Through its monopoly on the adalimumab market, AbbVie’s Humira has reaped tremendous success—how did AbbVie pull it off?

The Patent Fortress

AbbVie’s success is credited to the patent fortress the company built around Humira, extending the drug’s patent from 2016 (expiration of the original patent) to 2034. Maybe “fortress” is an understatement. AbbVie filed over 130 patents during the past two decades. Here are some of them:

- 30 patents on the way the drug is administered.

- 25 patents on different formulations.

- 50 patents on the manufacturing process.

- 20 patents on delivery devices.

This patent fortress made it impossible for Humira’s competitors to enter the market. A competitor would have needed to challenge several of Humira’s 130+ patents in court—an egregiously expensive and time-consuming process. The easiest option for Humira’s competitors has been to not compete.

“Not compete” sounds like “antitrust” in some ways… so was this all legal?

Yes.

AbbVie was brought to court several times and won every time. According to the Seventh Circuit Court of Appeals ruling, filing patent after patent on a single product is not a violation of U.S. antitrust laws. There are no limits on the number of patents a company can hold.

However, AbbVie settled with several U.S. drugmakers to allow Humira biosimilars’ entry into the U.S. market in 2023. The catch? These drugmakers will pay AbbVie royalties on the net sales of their Humira biosimilar based on the individually held patents.

Seven Humira biosimilars are set to hit the market this year, ending Humira’s 20-year monopoly. Amgen’s biosimilar will hit the market first, followed by six others throughout the year.

Dash’s Dissection

With the advent of Humira biosimilars, there are three questions I’m pondering:

- Will the list price of the new biosimilars be lower than Humira’s?

- Will pharmacy benefit managers (PBMs) add the new biosimilars to their formularies?

- Will the increased competition affect Humira’s market share?

Lower List Prices

If we think of biosimilars like “generic drugs,” there’s little doubt Humira biosimilars’ list price will be less than Humira’s. But I don’t expect it to be significantly less—maybe 15%. The reason has to do with rebates and royalties.

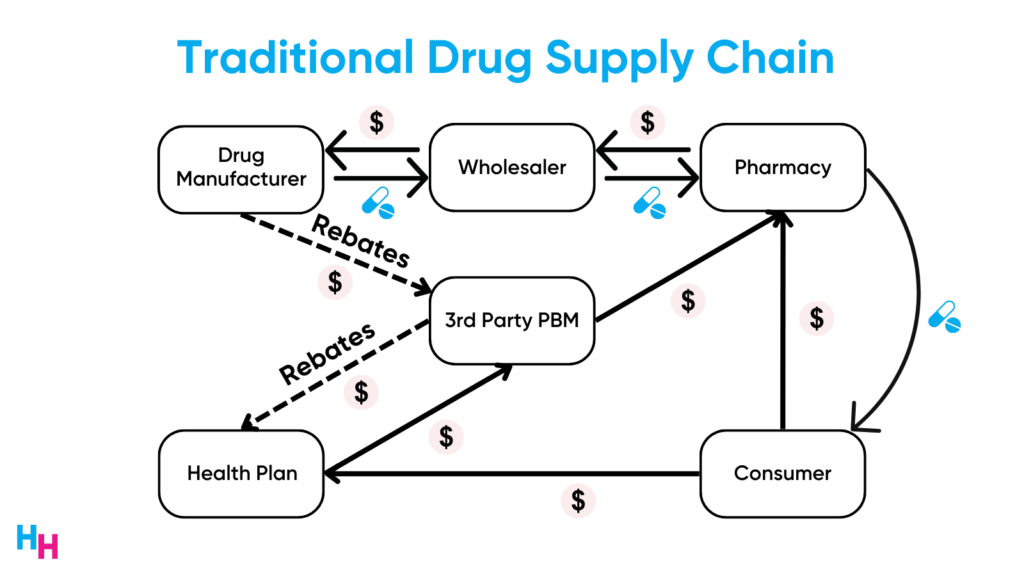

Drug manufacturers pass rebates—a dollar amount that’s a percentage of the drug’s list price— to pharmacy benefit managers. PBMs give a portion of these rebates to the insurer, who then passes a bit to employers. Rebates are the “shady” area of the drug supply chain, and PBMs make a lot of money from rebates. So, for the first biosimilar to remain competitive with Humira, its list price may have to be close to Humira’s so PBMs can receive high rebates.

Drug manufacturers of Humira biosimilars also need to pay royalties to AbbVie based on the Humira biosimilar net sales. These drug manufacturers will therefore hit a floor limit on their Humira biosimilar list price to remain profitable. But as more biosimilars enter the market throughout the year, the increased competition may allow list prices to become lower and lower.

PMBs and Formularies

Even if a Humira biosimilar’s list price is lower than Humira’s, it doesn’t mean PBMs will jump to include it on their formularies. To explain why I’ll tell a quick story about Lantus (insulin) biosimilars.

Drugmaker Viatris released two Lantus biosimilars: Semglee and Insulin Glargine. Both drugs are interchangeable with Lantus, meaning pharmacists can exchange a Lantus prescription with Semglee or Insulin Glargine. Semglee’s list price is 5% less than Lantus’s list price, while Insulin Glargine’s is 65% less.

Again, Lantus, Semglee, and Insulin Glargine are all structurally and functionally identical (for simplicity, we’ll say identical). On paper, Insulin Glargine is cheaper. So, PBMs should opt to include Insulin Glargine on their formularies instead of Semglee, right?

Wrong.

PBMs, pharmacies, payers, and wholesalers benefit from high-list price medications since drugmakers pay these stakeholders rebates (a percentage of the list price). The higher the list price, the great the rebates. For this reason, Express Scripts only included Semglee on its National Preferred Formulary, the PBM’s largest commercial formulary.

This is how the system works, which is why PBMs may resist including Humira biosimilars with lower list prices on their formularies. This should now make sense. In fact, it’s estimated AbbVie paid over $5 billion in rebates to PBMs in 2021.

However, we know that PBMs Express Scripts, Optum Rx, and Prime Therapeutics will add some Humira biosimilars to their formularies.

Market Share

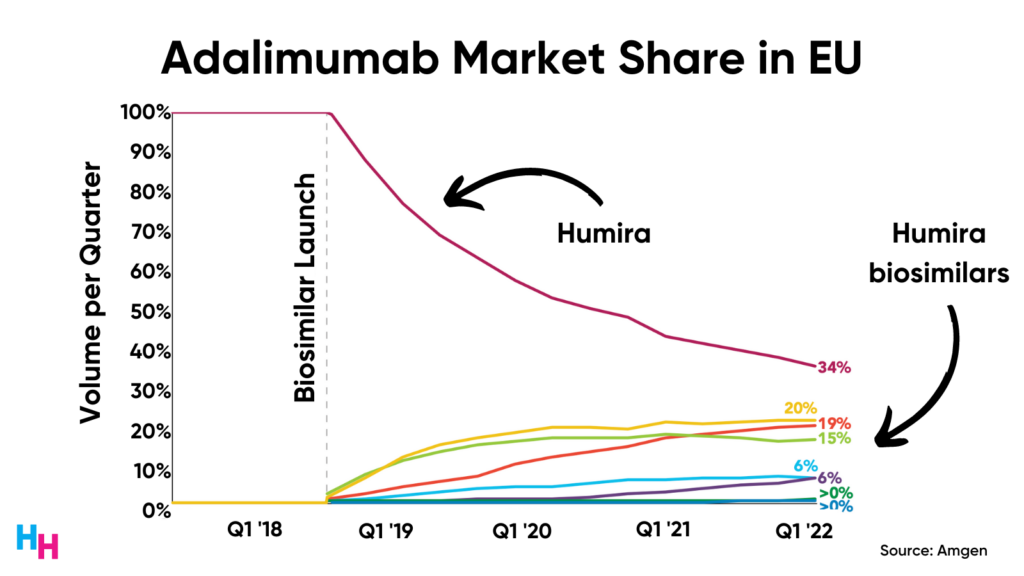

The advent of Humira biosimilars will certainly decrease Humira’s market share, but not as much as you’d think.

First, Humira biosimilars have been on the market in the EU since 2019, making up 66% of the adalimumab market share.

As we know, healthcare in Europe is a different ball game than healthcare in the U.S., so Humira’s future may be slightly different from its EU experience.

AbbVie (strategic or not) launched Humira’s updated, high-concentration and citrate-free formulation in 2016. Since then, all Humira on the market is this updated formulation. There will be no interchangeable Humira biosimilars of the latest formulation hitting the market this year, and there likely won’t be until 2025. Will physicians prescribe Humira biosimilars, even if they aren’t high-concentration and citrate-free?

Additionally, Boehringer Ingelheim’s Cyltezo is the only Humira biosimilar the FDA has designated interchangeable with Humira. While Cyltezo can be used to fill Humira prescriptions, other biosimilars can’t. This friction will make it challenging for other biosimilars to gain market traction. Unlike Humira, though, Cyltezo can’t be self-injected. This is inconvenient for physicians and patients, again increasing market friction.

Lastly, AbbVie may remain competitive with drugmakers producing Humira biosimilars by increasing its rebate. This incentivizes PBMs to keep Humira as a preferred drug on formularies.

Time will tell how the market reacts to Humira biosimilars.

In summary, AbbVie’s Humira is the most financially successful drug in history, bringing in over $200 billion during its 20 years of market exclusivity. AbbVie’s patent fortress gave Humira a monopoly on the adalimumab market and extended Humira’s market exclusivity until 2034. However, AbbVie settled with drugmakers of Humira biosimilars to allow them to enter the market in 2023—but they’ll pay AbbVie royalties. It’s unlikely the advent of Humira biosimilars will “take down” Humira simply because the U.S. drug market acts in weird, shady ways. Only time will tell.

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.