17 July 2022 | Healthcare

H1 Digital Health Funding Breakdown

By workweek

Rock Health’s H1 digital health report showed a continued slowdown in funding this year compared to an explosive funding year in 2021. What’s the reason for the slow down and what digital health areas are on the come-up?

The Deets

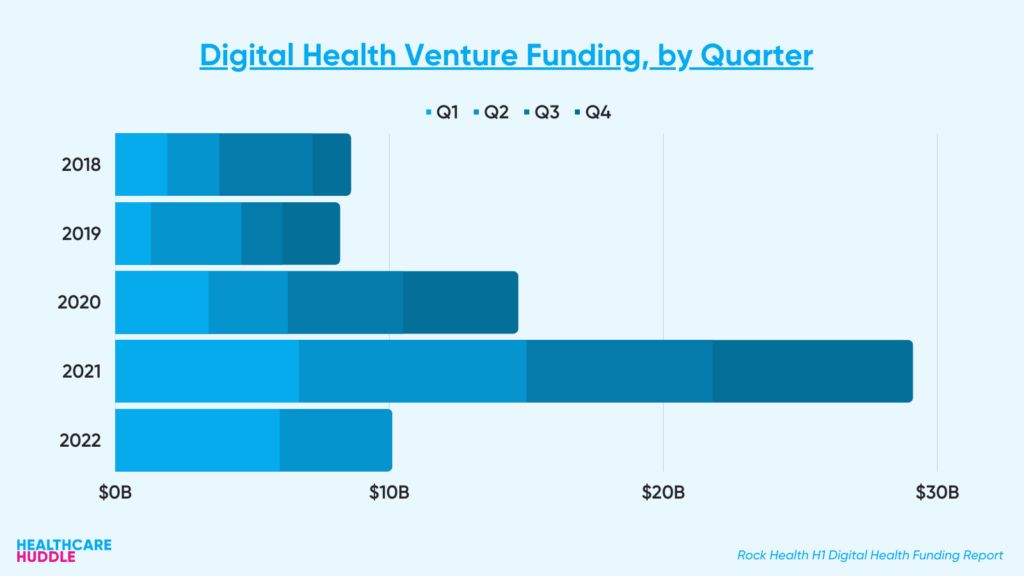

H1 funding totaled $10.3B in 2022 compared to $15.0B in 2021.

There are a couple of reasons why digital health raised 1.5x less funding in the first half of 2022 vs. 2021:

- Economic turmoil with Covid-19 variants, war and massive inflation (9.1%).

- Decreased confidence in companies with high valuations to turn a profit.

- Fewer new investors (30% in 2022 vs 45% in 2021).

Additionally, no companies went public in the first half of 2022 while 23 companies went public last year. Startups are essentially at a standstill, where funding activity has stalled and costs have spiked. Companies are therefore responding by reconsidering their 2021 valuations (perhaps overvalued), trimming costs through massive layoffs and decreased hiring, and refining go-to-market strategies.

#Trending

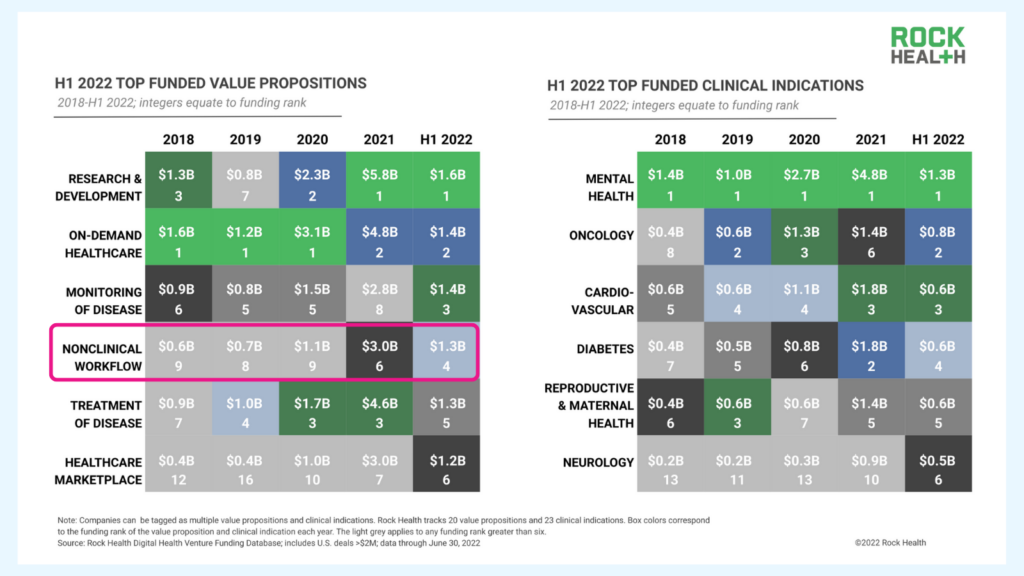

The top funded areas are shown below.

It’s no surprise digital mental health still holds the number 1 position for top funded clinical indication. What may or may not be surprising is the rise in funding for clinical and non-clinical (administrative) workflow companies. In the year’s first quarter, clinical workflow companies jumped from 11th place to 3rd place for top-funded value propositions (read my take here). Now, non-clinical workflow companies have broken into the top 5 funded areas, raising $1.3B in H1.

Dash’s Dissection

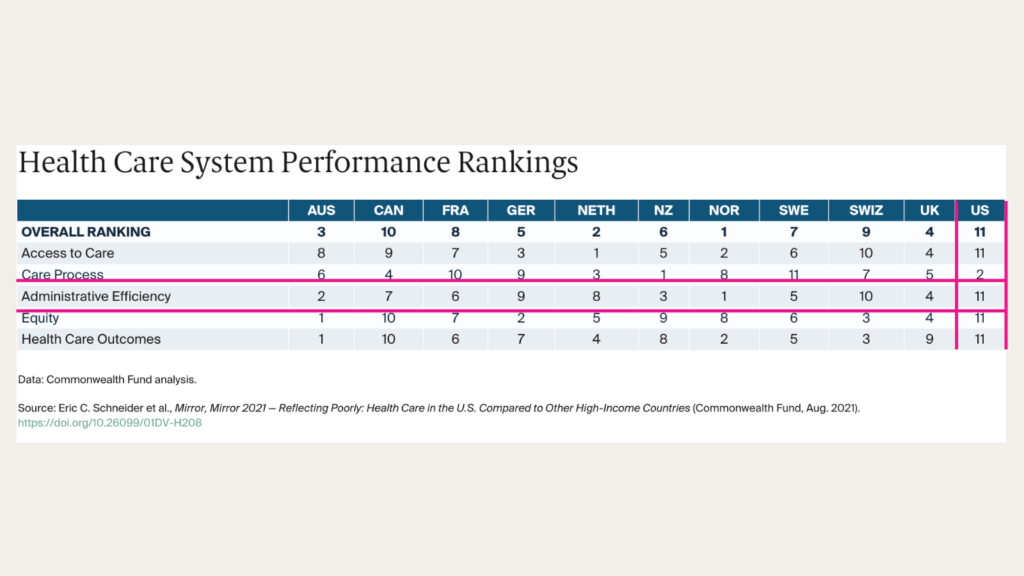

Companies tackling clinical and nonclinical workflow will continue to receive increased attention. Recall, U.S. healthcare is burdened by inefficiencies. Compared to peer nations, the U.S. ranks dead last in administrative efficiency, which refers to health systems’ ability to reduce bureaucratic paperwork patients and clinicians encounter.

Such bureaucracy contributes to clinician burnout, leading to the great resignation in healthcare. Therefore, any startup that can improve workflows by streamlining “trivial” tasks for the clinician will allow the clinician to spend more time focusing on patient care—the reason they originally went into medicine.

Improvements in workflows may also expedite a potential shift from hospital-employed physician back to the independent physician. One of the main reasons independent physicians join health systems is the energy-draining bureaucratic tasks they must upkeep daily. The choice is to either succumb to the bureaucracy, snowballing burnout, or join a health system that will take care of it for you. Physician-focused companies like ApolloMed, DeepScribe, Memora Health and Decisio Health are tackling the inefficient workflows embedded in the healthcare system, making it easier for physicians and practices to focus on what they do best—caring for patients.

Overall, I predict digital health’s clinical and nonclinical workflow areas will become top-funded areas within a decade.