08 July 2022 | Media

The opportunity with audio

By Adam Ryan

Bloomberg put out a hell of a piece on Spotify and audio. It was one of the most in-depth pieces I’ve read about the audio space. Here is the TLDR:Spotify pivoted to podcasting 3 years ago because music comes with bad margins due to royalties. If they can own podcasts, the margins are expansive. They’ve built a multi-billion dollar subscription business, without turning a profit. Their stock is now down more than 70% since all time highsThey’ve invested heavily in big names like Joe Rogan and Call Her Daddy. They hoped Rogan would be the “House of Cards” moment Netflix had. An internal report says it didn’t happen. Folks like Rogan have said things on their podcast that Spotify CEO has said he disagrees with. They’ve asked Rogan to not publish a few controversial episodes. He did it anyway. Their relationships with talent/creators is straining. Only 14% of podcasts on the platform currently earn the company money. They could potentially add a $100B in sales by going deeper into advertising.

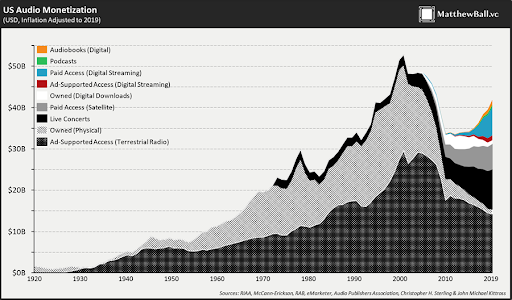

Even though podcast growth is consistently going up, it hasn’t had explosive growth. What’s holding it back? One huge issue: growth. Anyone that dabbles in podcasts knows it’s one of the hardest mediums to grow. It’s at this odd point where it can serve as a top of funnel with mass reach (think Rogan and him selling protein powder), yet the best way to grow a podcast is by promoting it to a current audience via bottom of the funnel (think using large newsletter audiences to grow a podcast). It causes podcast hosts and operators to be stuck in a rock and a hard place. As of today, there are no great paid advertising opportunities with podcasts. Why? Because there’s no good data to show ROI of advertising spend. It’s nearly impossible to have data on a user level on who listens to your podcast, which makes it incredibly difficult to build out a paid growth strategy. Want to know why newsletters grew so much? Because consumers liked the format AND companies could easily measure return of ad spend . The issue is that platforms like Spotify are the only ones with access to this data on a 1st party level. How does this get solved? For those who have read this newsletter every week, you may be surprised by this answer: Substack. Yes, I hate on Substack a lot. Yes, they laid off 14% of their staff this week. With that, they have created a closed loop system where their podcasting platform could be the most successful part of their entire business. Imagine this as a media business: Your ESP is now a ASP (made this term up, but let’s call it an Audio Service Platform). It allows 1st party data to be collected by the media company/production studio on who is listening to the podcasts, how long, and, most importantly, how they discovered the podcast. Can Spotify do this? Maybe, but their north star needs to change from building the Netflix of Audio to building the Facebook of Audio. If they do that, they can keep their subscription because people will always pay for music, while building an ad network with enough data that allows marketers to not only grow their own podcasts but other products/services. Similar to YouTube, this strategy would allow Spotify to pay creators a cut – which will then increase the amount of content created in the audio format. A move like this would increase the total addressable market for audio by 10 fold and Spotify would become a $250B+ company (at $18B today). The impact this would have on media companies would be profound. They could start to diversify their revenue and start to own the ears of their audience, like media companies in the 1960s and 1970s did so well.

Daniel Elk, the CEO of Spotify, is all about creating a company that can have a huge impact on the world. Well, Daniel, now you know how you do it.