Happy Tuesday, Hospitalogists.

I hope your February’s are off to a swimmingly wonderful start. Don’t forget that this February is a leap year!

For those of you who skip to the bottom first for Miscellaneous Maddenings, I have huge news: the first golf update is here. Hospitalogy Golf networking & conference when?

Thanks so much to NeuroFlow and Aha Media for sponsoring today’s newsletter. Partner with me here.

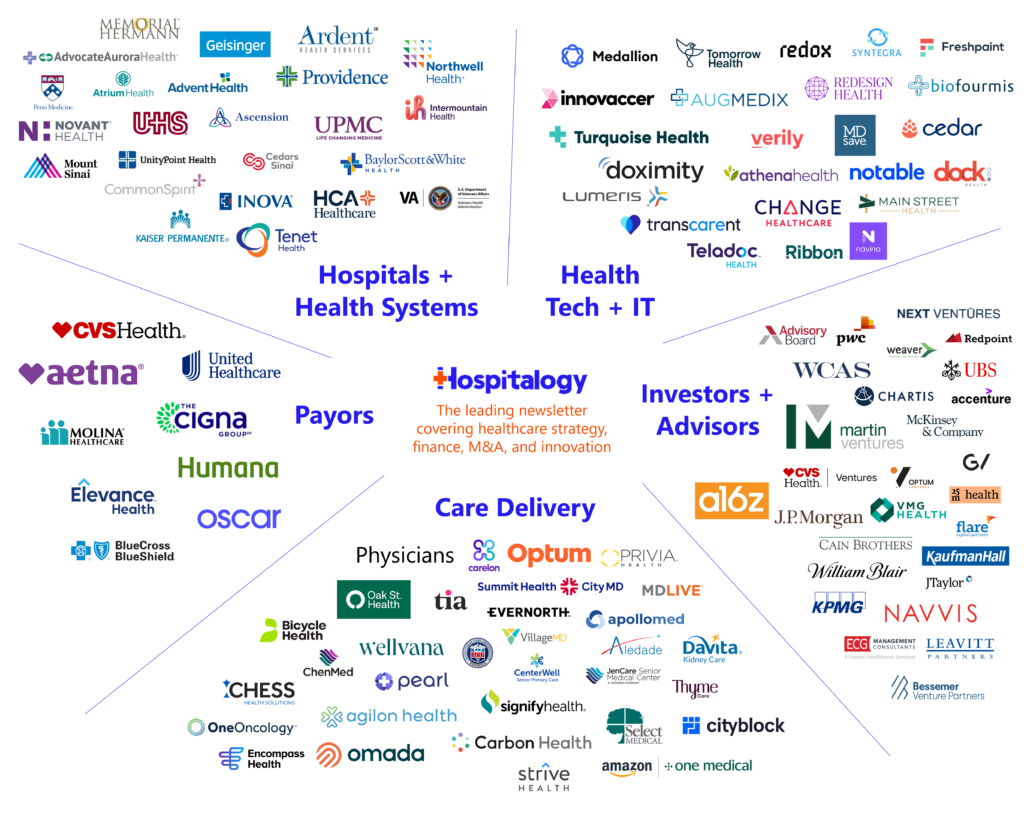

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 26.000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Privia, Oak Street Health, and Aledade by subscribing here!

SPONSORED BY NEUROFLOW

For risk-bearing organizations, it’s critical to recognize that behavioral health acuity is rising across your populations, and unfortunately, there’s no sign of this slowing down.

Research shows individuals with chronic diseases coupled with behavioral health conditions drive 2-6x higher healthcare costs. You need a cohesive strategy around this population.

On 2/15, join me, the NeuroFlow team, and a panel of experts in a virtual event.

We’ll have a much-needed conversation around how health systems, payors, and risk-bearing orgs can proactively measure and address the behavioral health of their complex patient populations.

Cigna sells MA business to HCSC for $3.7 billion

Announced on Jan. 31, Cigna is selling its 600,000 member Medicare Advantage business to Health Care Services Corp for a disclosed $3.7B. Jared Strock had a nice breakdown of the valuation implications and the segments included on LinkedIn here.

Cigna added some color on its earnings call as well, noting the plan generated $12 billion in revenue in 2023. Cigna also secured a 4-year deal for its pharmacy benefit manager Express Scripts to continue providing services for the plan, and Evernorth as a whole will have opportunities to sell other services like clinical care coordination into the newly secured HCSC asset. Overall, the deal is expected to close in early 2025.

Interestingly (maybe perplexing is a better word), Cigna still described the MA market as attractive despite the sale. What’s up with that?

The answer lies in Evernorth – its services segment – and bolstering the Evernorth footprint. Cigna was happy with the structure of the deal since it locked in Express Scripts for a number of years, while offloading an asset that wasn’t worth the trouble. From here, Cigna can prioritize Evernorth bolt-on acquisitions and find growth in working on the services side of MA, Medicaid – as a payor agnostic option.

- we’ve been quite deliberate now for several years, working to expand the service portfolio and the value proposition within Evernorth for health plan partners as it relates to their government services, be it Medicare, be it duals, be it Medicaid, et cetera. And we’re demonstrating a very attractive proven track record of growing our government reach but through the services franchise. And we will continue to fuel that on a go-forward basis and see that as an attractive trajectory for us.

- We see the Evernorth service portfolio as an attractive capital-light high visibility way to grow this portfolio.

Finally, with all of the hubbub happening around Medicare Advantage and utilization right now, it’s interesting to see a company as massive as Cigna go at the MA market without a vertically aligned strategy, but the puzzle pieces must not have been fitting well together. It wouldn’t surprise me to see Cigna make a big acquisition in a better-run MA plan down the line. While peak growth is up and profitability is declining in the segment, there’s still money to be made in all aspects of the entitlement program.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

A Fall from Grace for Cano Health and Steward Health Care

I’ve written about Cano’s troubles in the past (and covered Steward’s from afar), but I did want to highlight some important updates and great reporting on each of these.

As Steward Health Care struggles to stay afloat and deals with the repercussions of its poor operations in Massachusetts and elsewhere, its CEO Ralph De la Torre has plenty to answer for given the state of operations at his hospitals and their financial turmoil post-pandemic. Things have gotten even worse in 2024 as the Boston Globe found out – e.g., physicians buying their own surgical equipment, nurseries closed at birthing centers, and other egregious conditions these clinicians are dealing with.

There has never been a clearer microcosm for things gone wrong in healthcare than what we’re seeing unfold here.

A health system in financial and operational disarray.

Potential for patient harm rampant.

Private capital and real estate involvement in debt-fueled acquisitions, unusual, fraud-like loan structures, and sale-leasebacks causing hospitals to buckle in underserved communities.

And then the CEO spotted in the Galapagos – something I’ll probably never see beyond the Planet Earth documentary – on his $40M yacht.

THIS is how you sow mistrust in public institutions. I mean, it’s the easiest dunk session in history from the media’s perspective. The optics from the outside looking in are worse than bad with de la Torre and Medical Properties Trust shenanigans. This from the WSJ was back in 2022, and then we saw this follow-up from the WSJ paints the full picture of financial back alley deals happening for years. I mean, you’re just asking for it at this point. I hope you all can agree with me that we need to get this crap out of healthcare. And stories like these only equip members the media, public, and ultimately policymakers to crack down on hospitals.

- This Boston Globe essay (paywall) was so well done and worth the read.

- Massachusetts Wakes Up to a Hospital Nightmare

- This timeline of Steward Health Care was phenomenal as well: How Steward Health Care went from hospital savior to the precipice of failure

- Steward Health Care employees, patients grapple with turmoil (paywall – Boston Globe)

In similar fashion, Cano Health has left its physician equity holders out to dry. (If any of you are following this newsletter, feel free to reach out to me.) Earlier on Monday, Cano Health officially filed for bankruptcy after hemorrhaging cash for sometime from failing to appropriately manage risk or right-size the sinking ship. Cano’s stock will be delisted, wiping out common shareholders, and likely doing the same to its physician ‘partners,’ many of whose practice buyouts (and retirements) were funded via a combination of cash and equity.

Nobody should feel bad (other than for the patients and care teams, obviously) for this piece of junk getting taken out. At least the bankruptcy restructuring is assuring that staff gets paid and patients still get care, but the result here was a foregone conclusion after the history of mismanagement. There’s a reason why CVS backed out, and Humana – despite having a right of first refusal – STILL hasn’t touched it!! Cano Health put a sour taste on value-based care initiatives, and I’m glad I can move on from these guys in order to cover players actually trying to fix healthcare. By the way, CareMax is probably next.

Alright, that’s enough of that. You guys please send me some awesome folks, organizations, and health systems doing cool things the right way for their communities now.

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies to keep on your radar.

Strong Tenet Results Bolster Utilization Outlook: As Tenet makes divestitures in the acute care space, its USPI portfolio is outperforming. In a pre-announced earnings release, Tenet noted that strong surgical growth in USPI resulted in higher than expected profitability – above the high end of its adjusted EBITDA guidance for ‘23. Will cover this in more detail once the full release is out. (Link)

2025 MA Rates Disappoint: Although CMS’ advanced MA rate notice increases the base rate by 3.7% (if that’s characterized incorrectly don’t sue me), changes to overall MA risk score trends will result in a net 0.2% decline to MA rates in 2025. More info here → (Link)

First Healthcare IPO disappoints: BrightSpring Health Services debuted on the public markets to an unfortunately muted response, which disappointed me. We need more upbeat energy around healthcare IPOs. I’m hoping the up and coming firms inject some positivity – and working business models – into the public markets.

Scathing LifeStance Short Report: Famous short-selling shop Hindenburg Research put out an infamous short report on hybrid behavioral health player LifeStance Health this week, noting a number of perceived issues at the firm, including issues around retention rate, compensation numbers, CFO turnover, ease of prescription access for controlled substances, and more. (Link)

- Overall, we think LifeStance is a classic example of what happens when private equity meets a ‘hot’ healthcare sector: Massive debt fueling a grinding, metric-focused corporate culture resulting in worse quality of care for patients, a worse environment for clinicians and long-term losses for the average investor.

- Which reminds me of the short report Citron Research put together on agilon. Guess they were vindicated after all, huh?

Partnership, Products, and Pilot Announcements:

- Allina Health is offloading 2,000 admin employees to Optum in an outsourcing deal we’ve seen a few times over the past couple of years. Interestingly, though SSM Health ended its contract with Optum after outsourcing 2,100 employees to them. I guess that’s one way to conduct layoffs at a nonprofit health system huh?

- Acadia Healthcare enters into a joint venture partnership with Ascension Seton to expand behavioral health services in Austin, Texas. (Link)

- Noom partners with Liviniti on Noom’s newest offering: Noom GLP-1 Companion. (Link)

- TruLite Health announces collaboration with Mayo Clinic to address clinical bias and improve health equity. (Link)

- Mark Cuban Cost Plus Drug Company and Sidecar Health team up to tackle rising healthcare costs. (Link)

- Instacart and DispatchHealth partner to tackle food insecurity. (Link)

- US Acute Care Solutions expands partnership with Inova Health System to include comprehensive emergency medicine services at Inova Fairfax Medical Campus. (Link)

- Calibrate sets a new benchmark in obesity treatment, demonstrating a remarkable 18% sustained weight loss for members at 24 months, outperforming GLP-1 medication trials. (Link)

- Everly Health and the National Kidney Foundation partnership aims to save lives through early detection of chronic kidney disease. (Link)

- Florida Blue partners with Sanitas to run a value-based primary care center in Jacksonville. (Link)

- WellSky partners with Google Cloud to accelerate data-driven innovation and integrate cutting-edge AI technology into solutions. (Link)

- Trinity Health and Anthem have established an interesting value-based partnership utilizing the Epic platform. (Link)

- Saint Agnes Medical Center and Anthem Blue Cross also entered into a similar deal – a new multi-year contract emphasizing enhanced value-based health care and improved data connectivity. (Link)

- Cigna plans to launch a weight loss management program through its health services organization, Evernorth. (Link)

- The Mayo Clinic Diet introduces a medical weight loss Rx program, offering a specialized approach to weight management. (Link)

- Midi Health collaborates with Ambience Healthcare to enhance women’s health specialty services with the use of generative AI. (Link)

- Navina integrates its AI-powered diagnosis insights directly into the Epic EHR system, enhancing clinical decision-making. (Link)

- Hims & Hers partners with Hartford HealthCare to provide access to in-person care services. (Link)

- CVS Health collaborates with Wexner Medical Center to work on an Accountable Care Organization (ACO) initiative. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

Optum Oregon is acquiring large multispecialty group The Corvallis Clinic. With more than 100 providers across the clinic, and more than 500 additional support staff, according to the same public notice, Optum Oregon would employ the current physicians and other providers currently employed at their 11 clinic locations in Albany, Corvallis, Lebanon, Lincoln City, Newport, and Philomath areas. Read Optum’s petition to the Oregon State Health Authority here. Un-redact the purchase price, you cowards!!

Atlantic Health System and Saint Peter’s Healthcare System plan to merge:

- “Under the terms of the LOI, Atlantic Health System would make significant investments in Saint Peter’s and the service area, helping Saint Peter’s to continue to evolve as a high-quality, resourceful, and comprehensive healthcare system serving communities throughout central New Jersey. The two systems would work collaboratively to create significant synergies between the two organizations including transitioning Saint Peter’s onto Atlantic Health System’s electronic medical record system.

Cardinal Health is acquiring Specialty Networks for $1.2B – “Specialty Networks is an integrated platform focused on independent physician practices across urology, gastroenterology and rheumatology as well as life sciences organizations. It lists 11,500 specialty providers across 1,200 independent practices” (Link)

Providence settled its lawsuit over improper patient billing and charity care (Link)

The RadNet-Dignity Health joint venture acquires 7 imaging centers from a Cigna company, expanding its imaging services footprint. (Link)

Novo Holdings agrees to purchase drug manufacturer Catalent for $16.5 billion, potentially expanding production of the weight-loss drug Wegovy. (Link)

Premier, Inc. announced the completion of its strategic review process. (Link)

98point6 Technologies announces the acquisition of Bright.md to fast-track the launch of its asynchronous care module. (Link)

Johnson & Johnson faces accusations of mismanaging its employees’ drug benefits. (Link)

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

The NEJM published a study on ambient clinical documentation using the recently announced partnership between the Permanente Medical Group and Nabla, noting what appears to be some pretty strong adoption numbers by TPMG’s physicians. In total, 3,442 physicians have used Nabla to help with documentation, and 968 of those have used it during 100+ encounters.

- TL;DR – ambient documentation is great, letting physicians have more meaningful patient interactions and spending less time on admin work. Patients were also generally fine with MDs using Nabla’s tool

- It’s also crazy accurate!! a review of 35 AI-generated transcripts resulted in an average score of 48 of 50 in 10 key domains

- The study also listed next steps for AI ambient players: “Ongoing enhancements of the technology are needed and are focused on direct EHR integration, improved capabilities for incorporating medical interpretation, and enhanced workflow personalization options for individual users…ongoing attention must be paid to ensure that the technology supports clinicians while also optimizing ambient AI scribe output for accuracy, relevance, and alignment in the physician–patient relationship.”

Interesting applications of Apple’s new mixed reality headset Vision Pro are surfacing – like in diagnostic imaging; pretty dang cool. I’m incredibly excited to see potential new use cases for mixed reality from the surprisingly well-polished product. I mean, radiologists are pretty used to staring at screens in dark rooms so maybe this means they can actually get some sunlight!

The first Neuralink implant called Telepathy was implanted into a willing recipient. Wild times we live in, fam. (Link)

Fundraising Announcements:

AI-generated funding roundup for your viewing pleasure

- Accompany Health raised $56M to work on a hybrid offering aimed at complex, low-income populations. Personally I think it’s pretty awesome to see efforts like these supported with a huge swath of capital, and I hope dollars continue to go where they’re most sorely needed. (Link)

- Cohere Health, working on prior auth and products for utilization management purposes, raised $50M. (Link) (More Context)

- Isaac Health nabbed $5.7M in a seed round to scale its virtual brain health and dementia care services, aiming to make comprehensive brain health services more accessible and effective. (Link)

- Avante raised $10M to do vague things but planning to tackle big problems in healthcare. (Link)

- Care Continuity secured $10M to turbocharge patient navigation, focusing on improving patient outcomes and healthcare efficiencies through enhanced navigation solutions. (Link)

- Vektor Medical, a pioneer in non-invasive, AI-based arrhythmia analysis technology, raised $16M (Link)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

Alright fam, here it is…the first golf update from yours truly in 2024. We shot an 82 at the home course and the game felt…alright. I’ve played a few times since baby Madden, but I’m definitely rusty, and rust is noticeable in the feel of the hands on shorter wedge shots and putting. The swing is surprisingly coherent though, which is good considering I have a big golf trip coming up in early April at Pine Dunes in east Texas, if any of you have ever played out there. One of my favorites.

Another fun little anecdote. My wife and I were at the mall ordering coffee, and you know how they ask for your name? Well I told the barista my name, but either I didn’t speak clearly or she was having some fun with me. When I got my coffee the name on it was “Spleck.” Spleck?! So…now I have a new nickname!

SPONSORED BY AHA MEDIA GROUP

You guys heard from Aha Media Group during our virtual event on 1/31. From that, they’ve taken the time to put together a really handy guide on Do’s, Don’ts, and Pauses for healthcare marketers using AI in their day-to-day. For instance:

- Do: Use AI to save time on monotonous tasks

- Don’t: Rely on AI for fact-checking

- Pause: Take time to understand potential legal risks

Download the useful cheat sheet today!

Hospitalogy Top Reads

My favorite healthcare essays from the week

- The WSJ’s profile of 23andMe’s rapid descent from a $6B company to almost nothing – At the center of 23andMe’s DNA-testing business are two fundamental challenges. Customers only need to take the test once, and few test-takers get life-altering health results. Really fascinating read for those with a WSJ subscription. I respect Anne Wojcicki for sticking to her guns though.

- Matthew Holt – The Money’s in the Wrong Place. How to Fund Primary Care

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 26,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)