Happy Tuesday, Hospitalogists.

The Summa Health-HATCo breakdown is coming, I promise. It’s going to be…robust. Patience!!

In the meantime, please show some support and register for my upcoming virtual event! Come hang out with some incredible panelists, NeuroFlow, and…me.

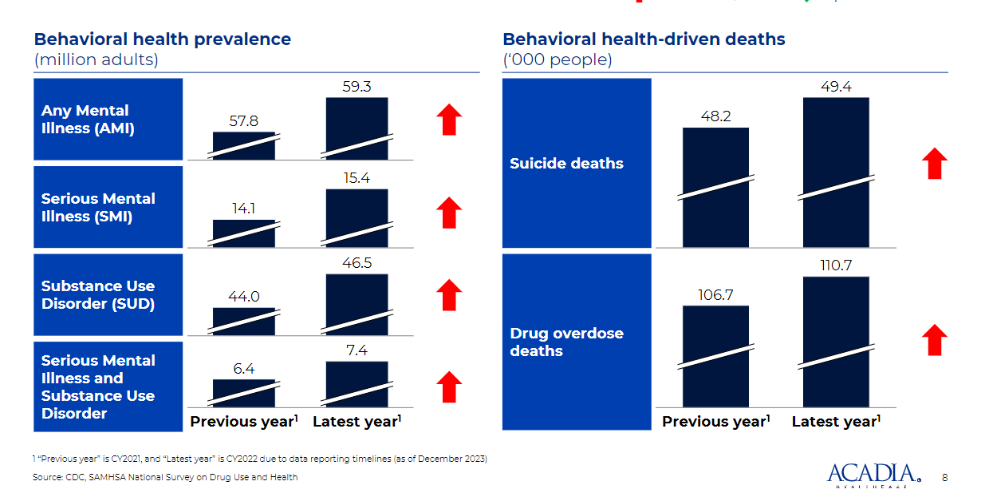

We’ll be discussing all things risk / population health in 2024 and from there, specifically dive into strategies around effectively managing behavioral health risk from experts in the space. If you’re not treating behavioral health with the delicacy it deserves, you might find yourself exposed – acuity is rising across the board.

Our virtual event will dive into everything you need to know to drive a cohesive risk strategy that includes mental health and drives better outcomes for the millions of Americans facing serious mental illness.

Thanks so much to Navina and Adonis for sponsoring today’s newsletter!

Here’s the rest of my roundup from JP Morgan, highlighting some of the more interesting stuff from around the public company presentations and notable commentary.

SPONSORED BY NAVINA

Primary care clinicians using Navina’s AI-powered clinical intelligence platform are mastering their workflow, succeeding in value-based care, and feeling less burnt out.

Don’t take my word for it: the American Academy of Family Physicians (AAFP) just released a report based on their evaluation of Navina’s AI Assistant and found:

- a 23% reduction in clinician burnout;

- 49% increase in identified diagnoses;

- 38% decrease in visit preparation time; and

- 45% increase in physician confidence & preparedness

Download the full study to learn why the AAFP called AI Assistants like Navina an essential innovation for primary care physicians. They’ll also be hosting a webinar on January 31st to share firsthand perspectives on the integration of AI to support clinical workflows. Register here if you haven’t done so already.

Privia’s All-Payor, All-Physician Model

The conversation between J.P. Morgan’s Lisa Gill and Privia Health’s Parth Mehrotra was one of the more in depth discussions from the conference. It’s worth a read to understand what Privia is trying to do, and where value-based care, utilization, and Medicare Advantage is headed in 2024.

Some of the more poignant highlights (yes, I just wanted to use the word ‘poignant’):

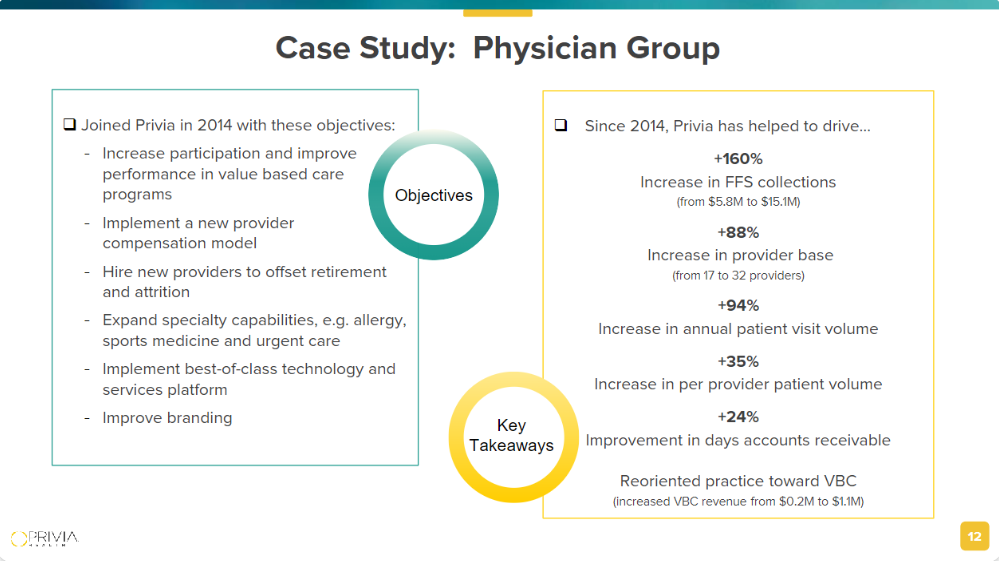

- Privia is building a differentiated, integrated medical group model in its markets with a focus on market density and getting physicians on-platform – partnering with all physicians in a practice across all specialties. Its value prop to those independent physicians is compelling, driving growth across the below practice’s fee-for-service, physician recruitment, visit volumes, collections, and value-based care transition:

- As the physician base grows, medical group integration and density allows Privia to transition patient panels to risk-based arrangements where appropriate, over time across all payor types – commercial, MA, MSSP, Managed Medicaid, etc. This diversification on Privia’s book is a relatively unique competitive advantage and acts as a hedge for the company as a whole. They want to maximize the physician practice’s economic potential in a clinically appropriate way. For instance, Privia isn’t going to bludgeon lives into full capitation if it doesn’t make sense to do that in a market, especially with headwinds facing MA in 2024. Through executing on all facets of a physician practice’s growth, Privia works to maximize gainshare for their physician partners, as docs keeping 60% of savings:

- “We want to move as many patients into value-based arrangements. We collect dollars on all of those patients, fee-for-service and value-based, that’s practice collections, and we charge a management fee that translates into care margin for this business. We charge about 11% to 12% on fee-for-service, 40% on value-based care, and we own a care management fee on top of most of our value-based lives.”

- “*And we have a very flexible value-based strategy where we can **move these providers across the risk spectrum over time as they get ready, the payers get ready, we have enough density…*And then we follow whatever the local geographic limitations might be and we work best around that.”

Bottom line: Privia is working to create an all-payor, all-physician, all-risk model across its growing book of business. Incredibly complex, but they’re pulling it off.

- “If you just go backwards from there in our diversified business model, all lines of business, integrated medical groups, everything we talked about in the last 30, 40 minutes here, I think people will realize this is a very unique model. It doesn’t exist. Nobody else is doing what we do. The diversification of the business leads to very less volatility in earnings, and with a lot of predictability, and we can play the value-based them in the most broadest possible manner.”

- So I don’t think there’s any competitor that we come across that is doing exactly what we do in the way we do it. If you find it, let us know, we’ve got $400 million of cash, and we want to buy it.”

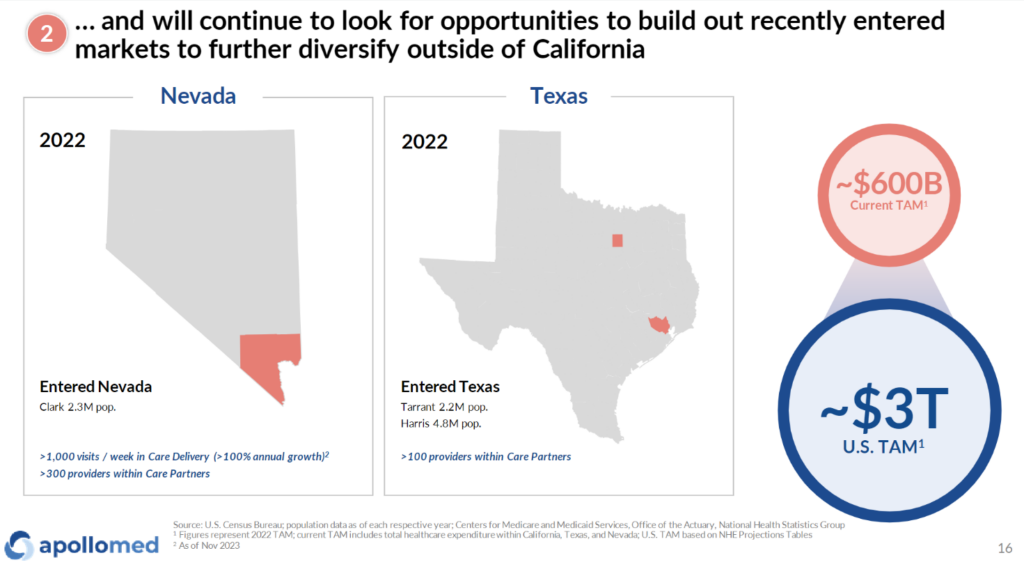

ApolloMed’s New Identity – Astrana Health

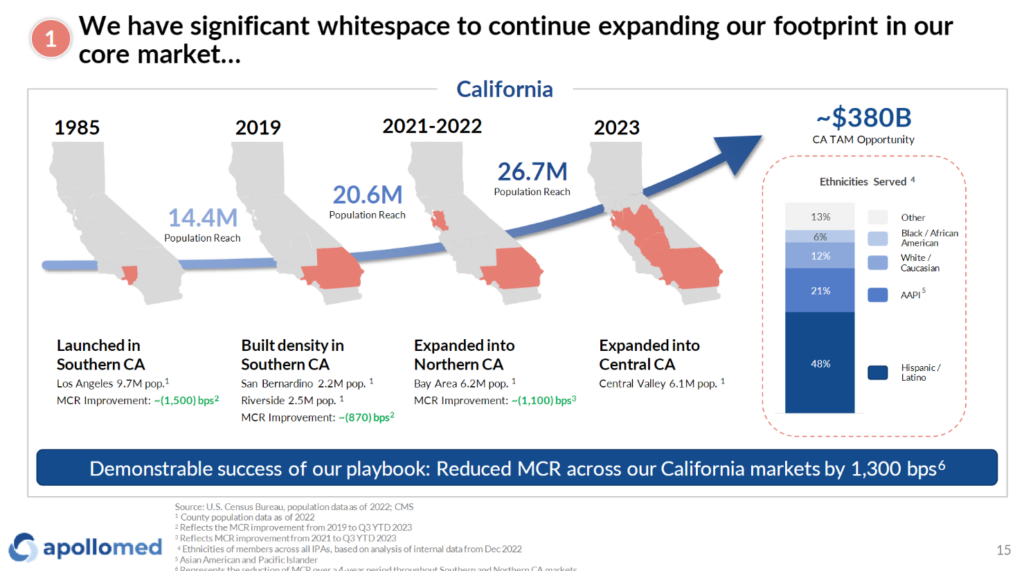

Apollo Medical Holdings – soon to be known as Astrana Health!! (gonna be honest, I’ll really miss the ApolloMed shorthand) – has had a bit of a revamp to its business and segments over the past year or so. Much of its JPM was spent on defining its growth strategy as a traditional California regional player shifting into an emerging national value-based care player, entering markets like Texas and Nevada and planning to enter 1-2 new markets per year, while hitting critical mass in those markets. Of course, there’s execution risk involved in wedging its way into new markets, but ApolloMed management noted their payor partners were working with them to make moves into these markets, an interesting dynamic.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

How successful ApolloMed’s M&A and market entrance execution goes will determine its ability to sustainably grow beyond its big California book of business in the future:

ApolloMed also restructured its company reporting into 3 clear segments to help us understand what’s going on under the hood, which I can appreciate: Care Partners (affiliate provider network), Care Delivery (owned provider assets), and Care Enablement (tech & data platform). More on these in its presentation:

Finally, ApolloMed-now-Astrana – in a not too different fashion from Privia – noted its strong data capabilities (and high data fidelity) as a differentiator to drive insights along with higher quality care for its partnered physician network. Seems like there’s some clear posturing here from other players in the enablement space given what happened to agilon.

- “because we are the ones actually processing claims, processing prior authorization approvals and denials, we have a great amount of visibility into the data even faster, frankly, than our payer partners do.”

- “We are a risk manager. And we have the ability to drill down because of the data fidelity we talked about earlier and the real-time nature of our data to look at on a per provider, per ZIP code, per geography, per specialty basis, what everything is looking like in terms of utilization, in terms of claims trend, alert the appropriate medical director for that region whenever anything is out of bounds and then have the medical director go and figure out what’s wrong, talk to the providers, whether it’s primary care or specialty and do something about it.”

In 2024 and beyond, I’ll be watching Astrana to see if it can continue to execute profitably on its payor agnostic growth, M&A, and integrated primary care – specialist care model to drive down total cost of care and meet patients where they’re at. These are two players doing the healthcare dance well.

SPONSORED BY ADONIS

Hospitalogists – Blake here!

I’m asking for a quick favor from the finance and revenue leaders in my audience.

I’m putting together a survey on what’s top of mind for you all in the world of revenue cycle management, given the pressures facing provider organizations in 2024. Could you please take a couple of minutes and help inform my content by filling out this survey?

Please note that these survey responses are entirely confidential and your identity will remain anonymous. If you have 5 minutes to complete the short survey, your expert insight would be truly valued!

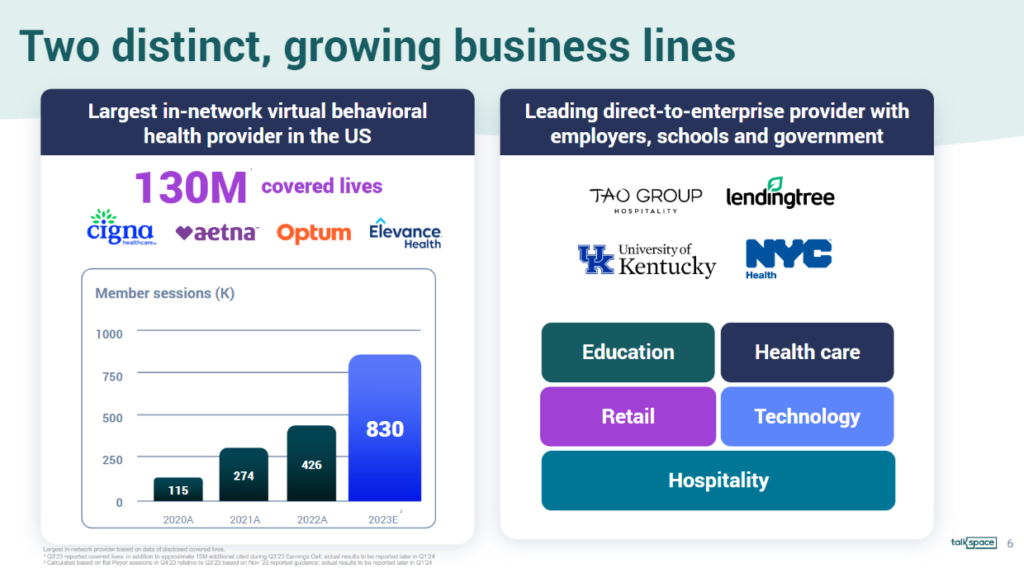

Talkspace to hit breakeven EBITDA in Q1 2024

First off this quarter, after 12-plus years of Talkspace’s existence, this quarter, end of Q1, we will be breakeven and then profitable. We will also maintain our very strong cash position with greater than $120 million of cash on the books.” Jon Cohen, CEO & Director, Talkspace

The Talkspace thesis goes something like this:

- Demand for mental health services is skyrocketing (and we’ll talk about the implications of this dynamic in my 2/15 virtual event, sign up!)

- We’re a national tele-mental health provider in all 50 states with 5k providers on-platform

- Our B2B pivot (payors & employers) is working out. We’re growing revenue and covered lives, engaging more lives, and cutting costs

Along with the two segments, Talkspace also announced its official entrance into the Medicare and MA space during the JPM conference, rolling out services there in all 50 states by the end of 2024. Given its national virtual footprint, this move seems like a natural progression and the next phase of growth.

- “We might be — we’re not sure, but we might be the first and possibly the only telehealth mental health provider to be in network with Medicare across the country…Currently, it’s increased 2.5x since 2020, the number of people that have said they have mental health challenges…60 to 70-year-olds, 80% have [cell phones].”

Bigger picture: Talkspace is quietly mounting a comeback after a dismal start to its public company journey.

Talkspace also had a fascinating discussion around an AI play involving its massive behavioral health dataset to flag patients at risk for self harm, detect language patterns for high risk behaviors, and provide additional tooling for therapists in workflows and documentation.

I do wonder though, whether it’ll eventually need some sort of hybrid presence over time or lose out to more comprehensive offerings.

Other Notable Tidbits and Announcements

Alignment Healthcare grew MA membership an impressive 44% year over year:

- “Alignment Health’s membership is up 44%…And, as you know, the company has signed new agreements with Instacart and Walgreens to offer more coverage and convenience for seniors in select markets.”

Walgreens is focused on accelerating VillageMD profitability, exiting markets without proper density: “we want to really concentrate on accelerating the profitability within Village. And that team has taken that task and is working through it. We talked about we’re going to exit roughly around 5 markets, 60 clinics. I think we’re halfway there at this point. Their growth that we talked about, both on the risk-based book and fee-for-service panel in markets where they are dense, we continue to see that.”

Centene had an interesting session:

- They still think there’s plenty of runway as far as Medicare Advantage penetration is concerned

- Improving star ratings are the biggest lever from a margin recovery perspective

- Risk model changes and rate updates are small and unknown headwinds, respectively: “I don’t know what the rates are going to be for the next few years. Obviously, we have the risk model. I said at Investor Day, it’s about a 1.3% headwind for each of the next 2 years, amortized in over a 3-year period.”

- Medicaid utilization is back to normal, and the conversation around value-based care in Medicaid is advancing – FQHC networks, etc.

- The marketplace is here to stay, given that it holds bipartisan support at this point.

- “the market growth that we’re seeing right now is one of the best defense mechanisms because it means we’re adding millions of Americans and providing access to care and coverage. It also, as we’ve talked about before, the timing was not by accident. It was designed to coincide with the expiration of the Trump tax cuts, which is a mechanism by which to bring both sides to the table to have this conversation…”

- “The idea that the marketplace chassis is a very interesting infrastructure for the individual market and sort of principles for coverage, but I think, align with a Republican view and obviously resonates with access to care and coverage that is sort of principal to the current Democratic platform. There’s just a lot there to like regardless of what’s side of the aisle you sit on.”

- They think ICHRA is in the initial innings of growth and will see it take off similar to HSA adoption for employers. Need more broker support and education for employers thinking about defined contributions

- “We’re going to learn a lot this year through the pilots that we’re doing in Indiana and some other kind of experimentation that we’re doing to really understand what we think the rate and pace will be in terms of adoption in specific kind of subsegments of the market.”

RadNet’s AI play: “And so last quarter in November, we introduced at the big radiology meeting RSNA, a new operating system, again, based on DeepHealth. DeepHealth was now not just going to be our Pixel AI or our clinical AI, but our full portfolio of cloud-native AI-enabled operating system for the entire kind of medical operations we’re doing, radiology and beyond. And this, we brought in a new team. We’re investing seriously in it, and it will allow us to capture the benefits both of the clinical AI that we either build or in-source, but also the substantial improvements that are happening, especially in the cloud due to the Generative AI and large language models.”

- “we spend about $2 million a year on interpretation services. We believe we could eliminate or will eliminate all of that when we fully implement our generative AI, which will be able to answer the patient probably better and faster than interpretation can.”

Multiple public health tech players are expecting to hit breakeven profitability in 2024. We’ll see which pan out:

- Talkspace

- Oscar

- Alignment

- Clover

- Agilon

- Accolade

Wrapping up with a few more notable happenings over the past couple of weeks:

- Inovaccer launched an AI documentation product called Sara Scribe for ambulatory settings.

- Cityblock hit $1B in revenue while notching a partnership with Buckeye Health Plan

- Somatus (kidney value-based care) and Kindbody (fertility care) could go public in 2024, leading me to believe there are several other late-stage players considering dipping their toes in this direction. My only hope is that they spread out the S-1 filings so they don’t kill me.

- Harbor Health announced a $95.5M fundraising round led by General Catalyst

- And then, of course, the Amazon-Omada announcement.