Happy Tuesday Hospitalogists,

I hope everyone is having a wonderful holiday season. If you haven’t already, go ahead and check out my new referral program. I put stuff on there that I think you guys would actually find valuable – like my Health Tech index resource you’ll get after referring just 1 person. I guarantee it’s worth your time to get access to it.

Onto this week’s news!

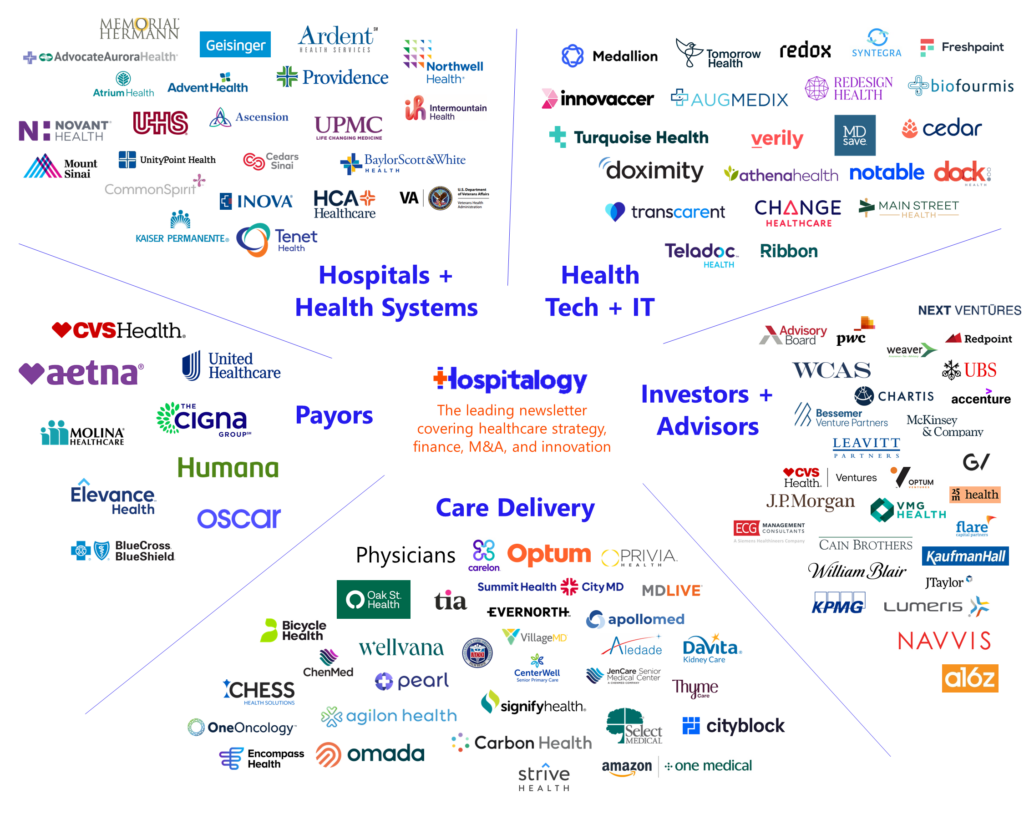

If you enjoy this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 23,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)

SAVE BIG ON BOARD ROOM

Picture this:

It’s 2024 and you’re killing it at work because you know exactly what your vision and goals for the year are.

All because in 2023 you joined the Board Room and connected with hundreds of top healthcare executives across the U.S.

And with $500 off your membership (using the code DEC500), there’s never been a better opportunity to join.

If you want to learn from some of the best healthcare leaders, investors, and executives in the industry, you can apply for a spot here.

HumanCig/Cigmana Merger talks end

Humana-Cigna merger talks ended as quick as they began.

After a couple weeks of post-Thanksgiving M&A rumor mill fun, the Wall Street Journal reported an end to what would have been the largest deal of 2023 between two health insurance giants Cigna and Humana. Or…HumanCig, as I’ve fondly been calling the grotesque amalgamation (I’m so proud of this word combo).

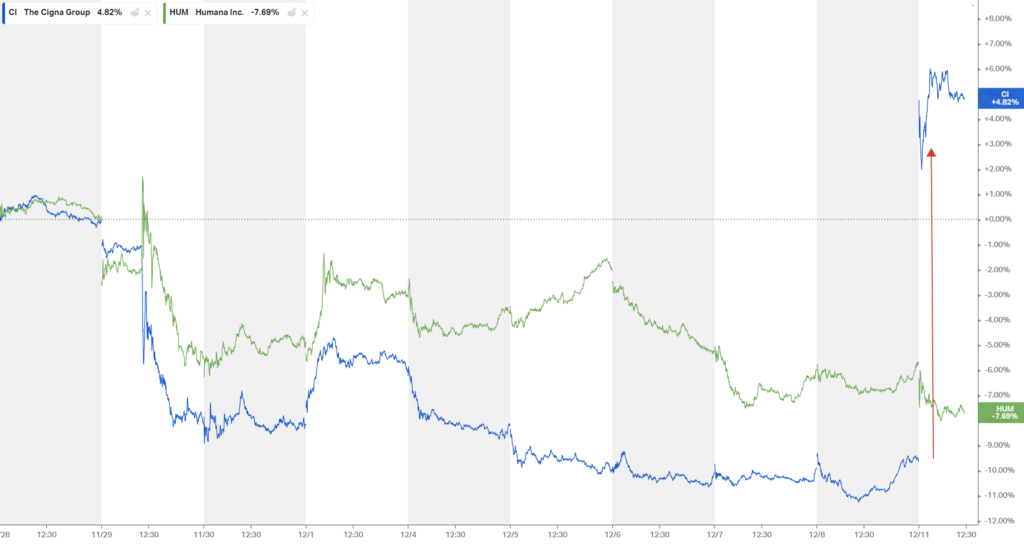

Despite analyst commentary ultimately speculating that this megamerger would survive antitrust scrutiny, and despite the deal kinda making sense for both sides, Cigna killed deal talks for good by announcing a massive share buyback. The commercial insurer boosted its buyback by $10B, bringing total approved buyback funds to $11.3B approved. Cigna also noted a new plan to pursue more bolt-on acquisitions rather than any sort of mega deal.

- “In light of the current environment, we will consider bolt-on acquisitions aligned with our strategy, as well as value-enhancing divestitures.”

Investors reacted well to the updates, sending Cigna’s stock price up 16% on the day:

From Wendell Potter’s latest on the deal, it sounds more and more like the merger rumor broke prior to the two sides being ready to discuss or address publicly, which may have contributed to the deal falling apart.

“The companies couldn’t come to agreement on price and other financial terms, according to people familiar with the matter.” Translation: Cigna shareholders probably couldn’t get on board with the NewCo valuation and subsequent share dilution.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

What are the implications of this merger falling through?

Humana: Humana – and anyone else not named UnitedHealth Group – is up for sale. For this reason, I wouldn’t be surprised to see a revival of Walmart-Humana acquisition talks given Walmart’s interest in the Medicare Advantage space. Maybe it’s already happening. Make it happen, Waltons. Side note – what ever happened to those Walmart-ChenMed rumors?

Cigna: Where does Cigna go from here? They’ll likely sell the MA business segment, fetching a few billion – but then they’re zoned out of MA altogether. Does that seem like the best path forward? Sticking to core competencies seems logical, but the commercial market is shrinking. No, I wouldn’t be surprised to see Cigna strike some sort of partnership or make another big move in 2024. Perhaps with someone in slight panic mode like say…Walgreens, which was downgraded to junk today by Moody’s amid its healthcare transformation.

M&A Environment: The break-up speaks to a tough M&A market in general and the high opportunity costs associated with higher interest rate environments. It’s very possible Cigna can drive just as good of a return by initiating buybacks and staying the course (at least for a while) than it can by engaging in a long-term, drawn out merger that might not close for 1-2 years.

Medicare Advantage: Is the Medicare Advantage gold rush over? As one of the market leaders in the MA space, what does it signal for us when Humana tries to sell itself like this? As the Baby Boomer demographics wind down, we should expect to see consolidation, more crackdown on M&A and risk adjustment, and finally the potential for increased regulation around reporting requirements for vertically integrated MA plans. Don’t get me wrong – Humana can continue to win as the 800 pound gorilla. But maybe the insurer thought it’s high time to diversity the book.

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies to keep on your radar.

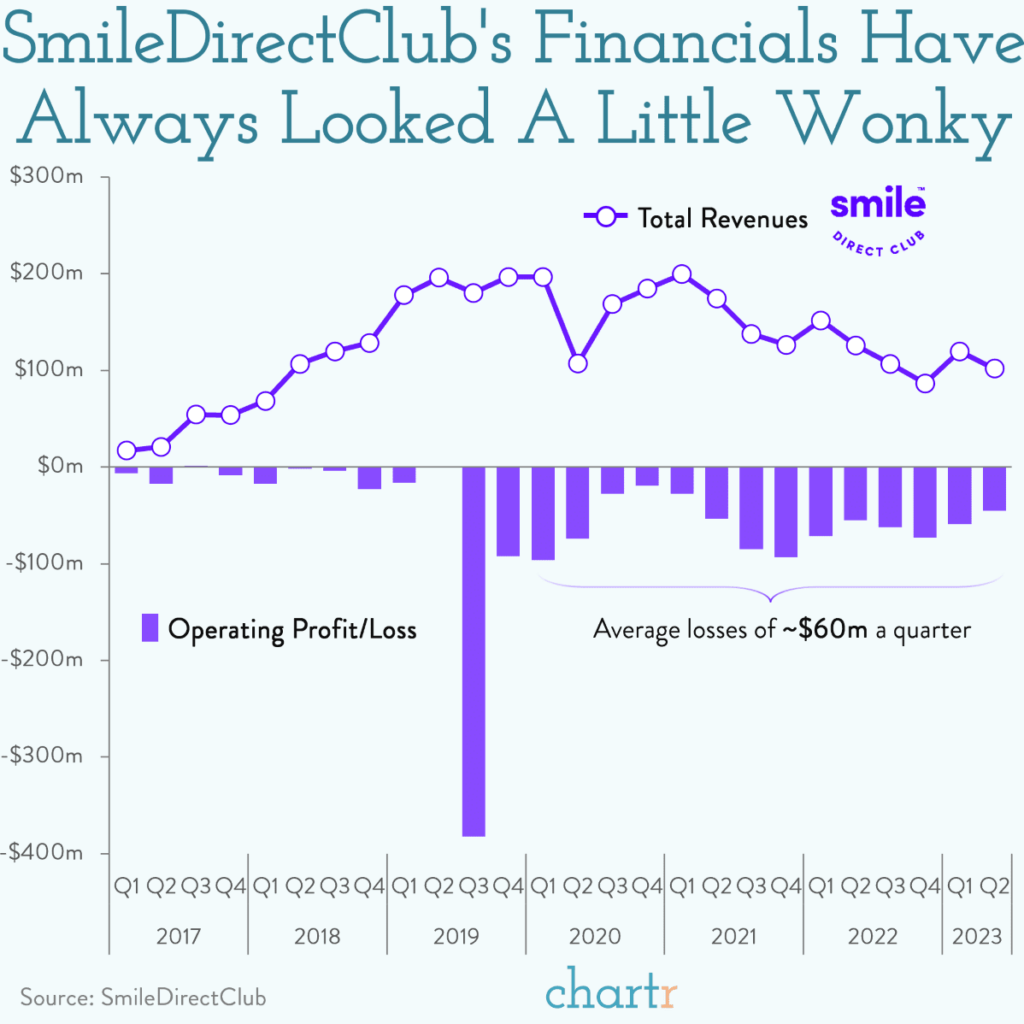

SmileDirectClub Shutdown: the direct-to-consumer dental service filed for Ch. 11 bankruptcy in September and couldn’t find a buyer. It’ll shut down…effective immediately after debuting on the public markets at an $8.9B valuation. I’m sure current customers are thrilled about the fact that they still need to be making financing payments despite a lack of customer / product support and the removal of its ‘lifetime guarantee.’ In the end, based on Chartr’s analysis above, we can attribute SmileDirectClub as investor-subsidized dental care for its customer base. (Link)

Source: Chartr

Healthcare Network Effects: Summit Health Advisors released a new guidebook on building network effects in healthcare. (Link)

Top Health Systems Ranked: Fortune and Premier have ranked the top 15 health systems for 2023 based on clinical outcomes, operational efficiency and patient experience. Shout out to Dallas’ own Baylor Scott & White! (Link)

Chicago-Area Health Rebranding: Post-merger, NorthShore – Edward-Elmhurst in the Chicago area rebranded as Endeavor Health. (Link)

R1 RCM’s Acquisition: R1 RCM announced its plans to acquire Providence-owned revenue cycle management platform Acclara, expanding its healthcare financial management services. Providence is also migrating from Acclara to R1 RCM…obviously…as part of this transaction. (Link)

- As part of the partnership, R1 has entered into a definitive agreement to acquire the Acclara business for $675 million in cash and warrants to purchase 12.2 million shares of R1 stock. At the closing of the acquisition, Acclara and Providence will enter into a 10-year agreement. The selection of R1…represents the first major cross-sell of a strategic partnership from the Cloudmed customer base, which includes 95 of the top 100 U.S. health systems.

- The proposed 10-year agreement…is expected to contribute more than $625 million in revenue and approximately $185 million to Adjusted EBITDA by year five of the partnership, not including potential revenue synergies.

- Significant Cost Synergy Opportunities: As a result of the acquisition, R1 estimates that it could realize approximately $30 million in run-rate cost synergies by the third year following the closing and run-rate cost synergies of approximately $50 million by year five.

Senate Inquiry into Private Equity: U.S. Senators are investigating the impact of private equity investments on hospital operations. (Link)

Reimbursement Savior: “A bipartisan group of representatives has introduced a bill into the House that would undo a 2024 physician pay cut finalized last month by the Biden administration.” (Link)

Generative AI in Healthcare: A survey revealed that healthcare executives plan to implement generative AI in the coming year. (Link)

ACA Voter Poll: A KFF poll found that Democratic voters are now more concerned about the Affordable Care Act than Republican voters, and trust Democrats more to manage its future. (Link)

Healthcare Jobs Growth is GOATED: Continuing its trend as a federal jobs subsidy program, the healthcare sector made up 38% (77,000) of the 199,000 jobs added in November (Link):

- Ambulatory services (+36,000)

- Hospitals (+24,000)

- Nursing / residential care facilities (+17,000)

Partnership, Products, and Pilot Announcements:

Best Buy continues to tap into healthcare and the at-home care delivery sector for some growth. Most recently, Best Buy announced a partnership with remote patient monitoring firm Biobeat. It’ll integrate Biobeat with Current Health to bolster its at-home care offering for health systems and others playing in the home health, SNF@Home, and Hospital@Home markets.

- Biobeat offers several products including a wrist, chest, and web monitoring along with a proprietary patient acuity / warning scoring system called Early Warning Score. Best Buy has existing partnerships with some formidable health systems including Advocate Health and Risant’s Geisinger. (Link) more from me on BBY’s strategy – (Inside Best Buy’s Big Bet on the Home)

HealthStream announced a major expansion of its nursing program, aiming to extend its market to over 1,000 nursing schools and more than 1 million nursing students. (Link)

Vxtra Health selects the HELIOS® Platform to deliver value-based care for self-insured, middle-market employers. (Link)

Elevance Health’s CarelonRx is rolling out a new digital pharmacy with text chat or phone support between pharmacists and patients, comparison of prices in-app, and a Dominos’ delivery style tracking update on the status of prescriptions. (Link)

RadNet signs a pilot deal to open diagnostic imaging centers – its MammogramNow offering – in multiple Walmart locations. (Link)

Hims & Hers introduces a holistic weight loss program to address the cycle of weight gain and loss. (Link)

LeanTaaS announces serving over 1,000 hospitals and centers across the U.S., highlighting the growing demand for AI-powered hospital operations management solutions. (Link)

CarelonRx plans to launch the CarelonRx Pharmacy. (Link)

athenahealth expands the use of artificial intelligence to simplify processes for practices, providers, and patients. (Link)

Jefferson Health announces a new primary care program for older LGBTQ+ adults. (Link)

Privia Health’s Texas medical group launched an OB/GYN initiative and virtual care wraparound in partnership with Iron Health. (Link)

Talkspace partners with Evernow to enhance women’s health services. (Link)

CLEAR offers verified solutions tailored for the healthcare sector. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

In the behavioral health arena, Integrative Life Network and Integrative Health Centers are merging to form a new mental health firm called Peregrine Health. Peregrine Health also announced the closing of its $7M Series A in the press release linked here. (Link)

- ILN = a network of residential, partial-hospitalization, and intensive outpatient programs in four states providing high-acuity treatment options

- IHC = nationwide telemedicine platform that connects clinics, hospitals, and health systems in underserved communities with specialized mental and behavioral health providers.

BrainChild Bio spun out of Seattle Children’s to develop CAR-T and other therapies to address central nervous system tumors, the first target being pediatric brain tumors. I can get on board with that. (Link)

InnovAge acquired a couple of ConcertoCare PACE Programs. (Link)

Steward Health Care will close a hospital in Massachusetts due to financial challenges. (Link)

Moody’s predicts that many healthcare companies will have no options but to default in 2024. (Link)

- In general, strategies implemented by private equity firms have left some companies – including physician practices, emergency medicine and anesthesiology – with high debt loads, which has limited their ability to adapt to economic and industry changes, the report said.

Fruit Street Health sues Sharecare for $25M, as reported by MedCity News. (Link)

Mass General Brigham posts profit in FY 2023, boosted by federal funds, after a -$432 operating loss in 2022. (Link)

Moody’s downgraded Radiology Partners, citing high financial leverage. The next ticking time bomb after Envision, GenesisCare, American Physician Partners? (Link)

Fitch Ratings also downgraded Community Health Systems amid margin and free cash flow pressures. Yikes. (Link)

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Rock Health wrote a nice level-set on 7 ongoing trends in health tech innovation and where they stand along the market maturity scale including:

- AI

- Caregiver solutions

- Interoperability

- Obesity care & Food-as-medicine

- Retail health

- Enablement

Nuance Communications unveiled advanced PowerScribe AI features at the Radiological Society of North America (RSNA) annual meeting. (Link)

Merck KGaA, Darmstadt, Germany announced its new AIDDISON™ drug discovery software, aimed at enhancing pharmaceutical research and development. (Link)

Maven Clinic demonstrated how virtual doulas are assisting pregnant individuals in reducing the rate of C-sections through remote support and guidance. (Link)

A Google led study revealed that its Large Language Model (LLM) significantly aids in the accurate diagnosis of complex medical cases. (Link)

Fundraising Announcements:

SCAN Group announced an investment in ambient documentation player Abridge, continuing its longstanding relationship extending back to 2021. Dr. Shiv Rao & team continue to make major moves. (Link)

Ketryx, provider of the first and only connected application lifecycle management software for the life sciences industry, raised $14 Million in Series A funding (Link)

Medefy Health secured a $10 million Series A funding to assist employees in navigating the complexities of health benefits. (Link)

Maia Oncology raised $4.25 million to develop a virtual primary care clinic specifically tailored for cancer patients. (Link)

Doctor Anywhere secured $41 million in funding, aiming to expand into the generative AI (genAI) sector. (Link)

Digital Health Strategies completed a Series A funding round, planning to extend its Health™ Patient Loyalty Platform. (Link)

Canopy emerged from stealth mode, introducing a wearable panic button designed to enhance safety for healthcare workers. (Link)

Events I’m Attending:

12/12: What Comes Next? 2024 HealthTech Predictions (Register)

12/15: Ann Somers Hogg’s (Board Room member) webinar on Business Model Innovation & Disruption in Healthcare: Why It Matters. (Register)

12/18: AI in Healthcare: The Explainability Dilemma (Register)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

Here’s your daily reminder NOT to enter an MRI machine with a loaded firearm.

How bout them Cowboys? Dak for MVP? Gotta say, I can’t see them beating the 49ers with the way they’re playing, but Dak has a good argument.

For my golfers in the audience (you know who you are) what are your thoughts on the golf ball rollback? Personally I’m against it. I want to play the same golf balls and equipment as the pros. What other sport can you do that and compare yourself on a direct basis? To me that’s such a cool aspect of golf. Plus I want to keep hitting bombs. Not bombs minus 8% distance of what I know I’m capable of.

Hospitalogy Top Reads

My favorite, recent healthcare essays

How health-tech founders can survive a brutal 2024

Health systems must accelerate their ability to transform

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 23,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)