Welcome to Hospitalogy, your best source for healthcare business news & analysis.

For those of you I met at SXSW Sunday, what a time. Lots of updates for subscribers in the Miscellaneous Maddenings!

Also, now that the March Madness bracket is out, join the Hospitalogy group with your bracket! If you choose Texas A&M to beat Texas in Round 2, I’m manually unsubscribing you from the list.

Join 19,500+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

Best Buy partners with major health systems on hospital-at-home initiatives

In the ever-advancing encroachment of retail players onto healthcare, Best Buy announced a 3-year deal with Advocate Health to partner on legacy Atrium Health’s hospital-at-home (HaH) program, one of the largest in the country having served 6,000+ patients since the program began. The Atrium HaH program will provide care coverage to a population of around 6 million people while serving around 100 patients at a time as an extension of the hospital. Along with Atrium, Best Buy’s Current Health now holds “‘relationships’ with 5 of the top 10 largest health systems in the US including Geisinger, Mount Sinai, NYU Langone Health, and others” according to comments from their Q4 earnings call on March 3.

So here’s the breakdown as I understand it:

- Atrium provides its established HaH program and clinical footprint while outsourcing the virtual functions and setup to Current Health. The program includes services such as virtual doctor visits, access to inpatient services, and remote patient monitoring.

- Atrium purchases the tech & other supplies needed for setting up virtual HaH from Best Buy in a vendor relationship; Geek Squad and/or Current sets up the tech (and while they’re at it, why not help grandma with her computer virus troubles?). Based on the comments on the press release, it looks like Best Buy will cross-train Geek Squad agents in certain aspects of health delivery to help stand up the program.

- The partnership in theory is a win-win: Best Buy gets the downstream tech & services sales while Atrium partners with Current, an operator with high quality patient outcomes:

Bigger Retail Health picture: Best Buy’s strategy in healthcare revolves around enabling – but not directly providing – care in the home, which is highly complementary to its existing Geek Squad operation further compounded by its $400M acquisition of Current Health. It has dabbled in the senior ‘AgeTech’ market for a while now, acquiring GreatCall in 2018 and Critical Signal Technologies in 2019.

At the time of acquisition in late 2021, Best Buy touted Current’s more sophisticated capabilities, which include an FDA approved remote patient monitoring wearable along with a network of connected devices. Now in 2023, Best Buy is expecting its Health division to grow faster than its base retail business in yet another example of a nontraditional healthcare player seeking out the $4.3T industry for some extra growth juice.

Given the acquisitions over the years and recent health system traction, Best Buy is developing a long-term play in the growing AgeTech space as an enabler of tech-enabled senior care delivery. The move is not too far off from Amazon’s foothold in the senior MA space with Iora Health. Still waiting for them to do something with Iora, though.

- Although Best Buy is leaning into Current to develop enterprise partnerships with health systems, let’s call this what it is – a way for Best Buy to retain and grow retail sales through sticky vendor relationships. Healthcare revenue amounts to nothing in the larger Best Buy organization. It’ll be a while until Best Buy Health is taken seriously. From the Q4 commentary: “We are essentially nurturing a startup within a large-scale organization and leveraging Best Buy’s core assets, including the Geek Squad to incubate a new business. The revenue contribution is currently very small and will take time to ramp as the Care at Home space matures and expands over the coming years.”

Bigger Hospital picture: Retail play aside, hospitals need help with HaH implementation and finding a good partner is a real need for hospitals right now. Health systems are very interested in expanding Hospital-at-Home programs. HaH reduces labor needs, shortens, length of stay, and keeps lower acuity, low margin observation patients out of the hospital. A quarter of the Advocate program’s patients are underserved or at-risk populations which bolsters access to hospital-level care in the home, a setting that patients prefer (HaH results in a 10% bump to patient saisfaction). Still, despite all of the positives, HaH enrollment and implementation has proven difficult based on conversations I’ve had. It’s an innovative program that deserves long term policy support.

Health Tech Crisis Averted after Silicon Valley Bank Failure

Surprise – this is a finance newsletter today. On Friday, Silicon Valley Bank became the largest bank to fail since the 2008 financial crisis. It’s the second largest bank failure in American history. I’m writing about it because 50% of all venture capital-backed tech and life sciences companies banked with SVB.

Since I’m not a fintech writer, my colleague Alex Johnson was hard at work this weekend. He gave a great breakdown of what happened to Silicon Valley Bank and then wrote a follow-up piece today on the latest updates and social discourse. TL;DR – Silicon Valley Bank had exposure to rising interest rates. Valuations fell, and startups continued to burn cash leading to sizable (but controllable) losses, people freaked out anyway, and thus ensued a venture-capital led run on the bank.

The ongoing story holds significant weight to startups and health tech given that SVB banked 50% of all VC-backed tech and healthcare IPOs over the past 2 years. Startups like Pair Team held their collective breath as they hoped to recoup funds deposited at SVB. Over the weekend, regulators finally sorted the deposit situation out, announcing that all deposits at SVB and a regional bank Signature would be guaranteed.

Some high-level healthcare thoughts based on the SVB nonsense:

- Effect on trust in health tech startups: venture-backed healthcare companies held significant exposure to SVB. If the panic had continued (which, as of this writing, we seem to be through the worst of it), what would’ve been secondary effects? Extreme human capital flight? How might’ve physicians and clinicians – traditionally very risk averse folks – working at startups reacted? Would they flee to the shelter of larger organizations? Seek stable employment deals? An event like this could have very easily shut down a large portion of innovation in healthcare.

- Total focus on macro: The public markets are completely focused on macro-level events right now. Big picture is in, individual company performance is out. Assuming we’re through the worst of the panic, what’s the long-term fallout? How severely will banking regulations change once we emerge from the other side? Expect the Federal Reserve to ease up on interest rates at least in the short-term, which will ease some borrowing pressures on capital-intensive healthcare businesses and debt-saddled players. But VC-backed health tech players may find it harder to raise capital in the future.

- The SVB crisis is a lesson for all organizations: Lastly, patient trust in healthcare organizations remains paramount, and this is a good lesson for healthcare organizations to hope for the best, but prepare for the worst: “In healthcare, we’ve made a promise to our patients – that we will deliver them high-quality, highly accessible, and well-coordinated care. Those who take risk – whether in healthcare, finance, or otherwise – would do well to take a global view of possible future states of the world, how they might affect the risk you are taking, what happens if multiple possible future states occur at the same time, and if your organization is prepared in all of those scenarios to make good on that promise made. I definitely will.” – Brandon Sim

So, should I try out writing about fintech or nah?

…I’ll stick to healthcare.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Partnerships and Strategy Updates:

RIGHT after my Humana analysis dropped on MA, Aledade and Humana announced a 10-year partnership for Aledade physicians to provide risk-based primary care to Humana members. Aledade manages risk for 100,000 Humana members. From this point, Aledade will work to transition these individuals and new members to full risk – AKA, capitation. As of this latest release, Aledade is up to 1,500 partnered physicians in 45 states, sharing in risk arrangements with 150 payor contracts covering 2 million lives under management. Aledade also announced a partnership with CareFirst BlueCross BlueShield.

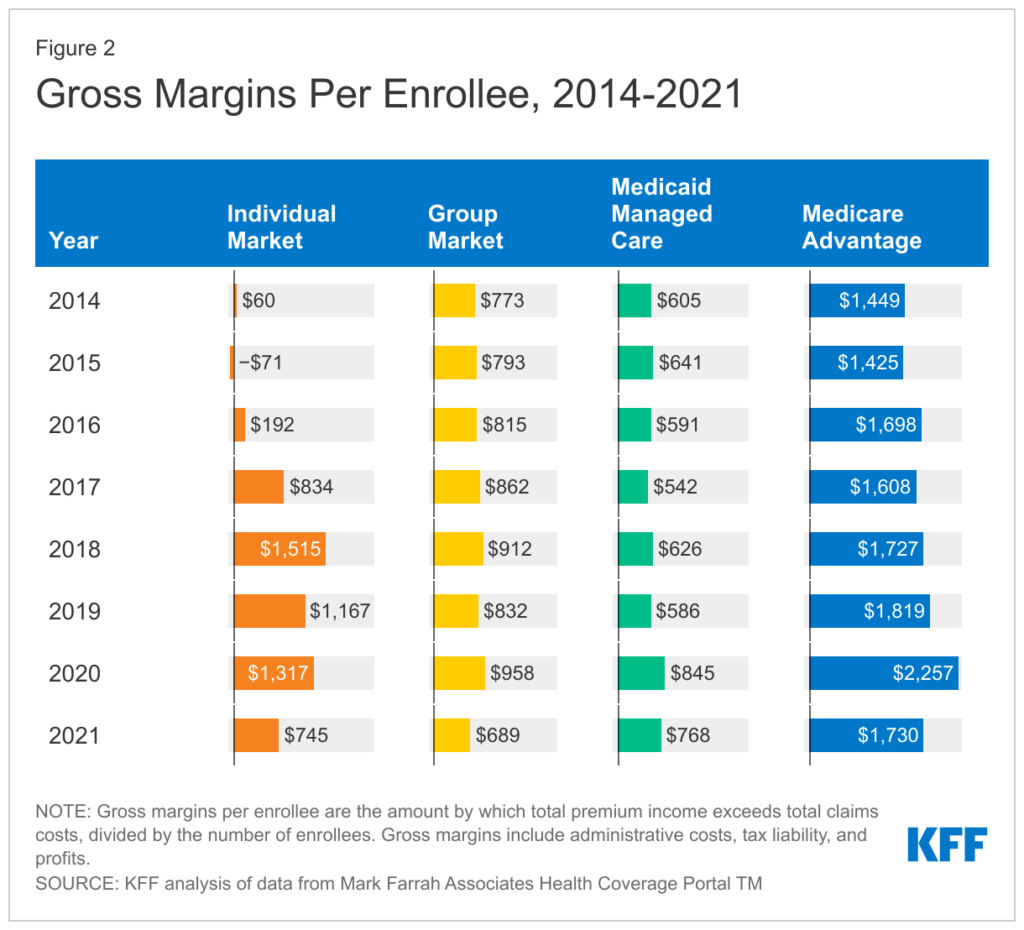

With charts like these from KFF, it’s clear to see why Medicare Advantage is getting so much attention:

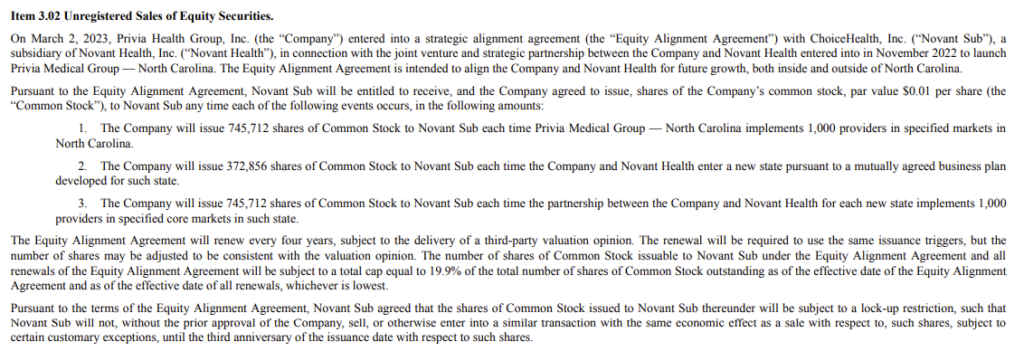

Privia Health officially solidified its partnership with OhioHealth, formally launching Privia Medical Group – Ohio. Privia also disclosed some interesting joint venture agreement terms related to its joint venture with Novant Health in a recent 8-k filed on March 7. For every 1,000 providers that Novant brings onto the Privia platform, they will be awarded 745,712 shares of Privia’s stock.

Montefiore physicians have voted to unionize, with 82% in favor of the move. “The National Labor Relations board must certify the results, at which point bargaining can begin for about 1,200 residents and fellows.” (Beckers)

Finance and M&A Updates:

Ascension, Trinity and Providence all reported quarterly financial and operating updates recently:

- “St. Louis-based Ascension saw its operating margin fall to -2.9 percent in the six months ending Dec. 31, 2022, down from 0.2 percent for the same period in 2021 and 5.7 percent in 2020” (Beckers)

- “Renton, Wash.-based Providence, a 51-hospital system, has reported a $1.7 billion operating loss for fiscal 2022 amid labor and inflationary pressures as well as delayed reimbursements. Investment losses also further dragged the system’s performance down.” (Beckers)

- “Trinity Health reported a six-month operating loss of $298 million, a stark reversal of the prior year’s $295.8 million operating gain the nonprofit largely attributed to expenses that grew faster than revenues.” (Fierce)

Due to rising medical supply costs as well as the cost of drugs and labor, total expenses for Connecticut hospitals in 2022 were $3.5 billion higher than they were before the pandemic – a more dire predicament than that seen by hospitals nationwide, according to new findings from the Connecticut Hospital Association. (HCSIN)

Almost all relevant value-based care players (enablement + clinic models) performed well on full year 2022 earnings and set 2023 expectations high. The group includes Agilon, Privia, ApolloMed, Oak Street Health, and Evolent. From a William Blair research note: “We believe this was another solid quarter for the advanced primary care (APC) providers in our coverage universe, and we continue to view the space as having significant greenfield opportunity and long-term growth potential. We also believe the sector remains well positioned for strong organic growth in 2023 and 2024 regardless of the broader macroeconomic environment. More specific, the bulk of our APC coverage universe generates sales from highly visible, recurring per-member, per-month (PMPM) fees, and we believe the outlook for new-partner/membership growth for 2023, and increasingly 2024, is highly visible at this point. Thus, we continue to view the space as one of the best-positioned subsectors in the healthcare industry at present.”

Pfizer is considering buying Seagen for a rumored $30B+. (WSJ)

Amid the Fairview / Sanford proposed megamerger, the University of Minnesota is requesting funding from the state to acquire its academic health facilities to “prevent out-of-state control of Minnesota’s academic health system.” (TCUMN)

Digital Health and Innovation:

Masimo and Temple Health formed a strategic innovation collaboration, which sounds as wide in breadth as it appears to be. (Press Release)

Tech-enabled Fertility & Family clinic Kindbody raised $100M, bringing its valuation to $1.8B and total $ raised to $290M. Kindbody is currently the largest women-owned fertility company serving 112 employers through direct contracts and covering 2.4 million lives through 31 clinics. (Kindbody)

Elemy is apparently pivoting from autism treatment to SaaS sales. It’s been in the news for all the wrong reasons related to abruptly dropping patient care and expanding too quickly. Perhaps they’ll find better luck on the software side of things. (BI)

Koko, a mental health nonprofit, found at-risk teens on platforms like Facebook and Tumblr, then tested an unproven intervention on them without obtaining informed consent. (Vice)

Somatus Expands Partnership with Inova to Further Enhance Care and Improve Outcomes for Patients (Press Release)

Overview of telehealth trends in 2023. (HITN)

Abridge announced a sizable partnership with the University of Kansas Health System to deploy its clinical ambient documentation tech to 1500 physicians and 140 locations. (MedCity)

Policy and Payment Updates:

Healthcare takeaways from Biden’s proposed budget for 2024 (Beckers) – per Beckers, includes some interesting highlights:

- Funding Medicare for another 25 years through a wealth tax

- Require to adopt 12-month postpartum Medicaid coverage

- $150B allocated to Medicaid home healthcare over 10 years

- $144B toward HHS in 2024

- Solidify and make permanent the ACA tax credit subsidies currently in place from the Inflation Reduction Act (probably not reducing premiums tho)

- $2.8B toward the Cancer Moonshot initiative

- Double the FQHC program in size

- $471M allocated toward maternal health crisis planning

- $512M allocated toward Title X Family Planning Program

- & plenty more in the article linked above!

Hospitals are once again fighting against Congress to prevent $8B in looming disproportionate share payment cuts. (Fierce)

Costs, Data, and Other Updates:

ChatGPT And Healthcare Privacy Risks (NatLaw)

Marketing budgets across pharma, biotech, and device companies dropped 8%, from $8.3M in 2022 to $7.6M in 2023. (MMM)

A Mass General Brigham study across 3 hospitals found that a virtual care team implemented to help guide cardiovascular treatment strategies seems to result in improved quality outcomes. (MGB)

- “The study included 198 unique patients and 252 clinical encounters (contact between the patient and care providers). Of these, 145 encounters received usual care and 107 received the virtual care team-guided intervention. The virtual care team consisted of a centralized physician, study staff and local pharmacist at each site.

- Based on the recommendations of the virtual care team, significantly more patients initiated new treatment or received a more appropriate dosing of GDMT. Length of stay and safety events were comparable between the groups.

- Quote: “To see that a virtual care team could help improve guideline-concordant care across three diverse system hospitals and do so in a manner that was both safe and did not prolong hospitalization was a very encouraging finding.”

Nurses are seeking more flexibility and work life balance from employers. Vivian Health is also reporting that more nurses are seeking full-time, permanent staffing than in previous years, a potential signal that labor woes may alleviate somewhat. (Press Release)

Whitepapers and Resources

Trilliant Health published a comprehensive, detailed overview of behavioral health (Trilliant). Highlights include behavioral health utilization, investment trends, clinical needs, and trends among youths. Two of the more notable points from the report:

- While prescriptions for Adderall and its generic to ADHD patients under 21 and over 45 remained relatively consistent with pre-pandemic levels, prescriptions skyrocketed by 58.2% in the 22-44 age cohort from Q1 2018 to Q2 2022.

- Private equity investments in the behavioral health sector, including virtual care and digital health platforms, totaled $2.6B across 289 deals in 2022, declining 52.9% and 15.8%, respectively, from 2021.

Miscellaneous Maddenings

- For anyone who was at the Hospitalogy x Next Ventures SXSW happy hour, thanks for coming out. It was an awesome time meeting a lot of great healthcare folks.

- So as mentioned we were in Austin this weekend and played the good ole Butler Pitch & Putt. A guy from the group in front of us lines up his shot on the #1 tee, which is a ~55 yard downhill approach. He hits a low liner. The ball hits the fringe, ricochets, off a rock and then rolls…straight into the hole as if in slow motion. It was incredible to witness, but honestly I’d be pretty bummed if my first hole in one came at a par 3 course. Beggars can’t be choosers!

- Speaking of Austin, we were enjoying some incredible ice cream at Amy’s (the Oreo Mexican Vanilla combo is unmatched) when I looked up and spotted no fewer than 20 Nuns crossing the street and proceed to get into the Amy’s line on South Congress. Little did I know that this was a show promotional and I could’ve snapped a picture of them to enter a contest! Maybe next time nuns; maybe next time.

- Shout out to Scottie with the win at the Players. The man has been accused of playing boring golf (not reacting to surroundings) but what an absolute stone cold killer to win the event cruising by 5 shots. Wouldn’t surprise me if he went back to back at Augusta.

- My Texas Longhorns had a great weekend with the win at the Big 12 tourney to take home the post-season Big 12 trophy. Not as important, but I’ll take the Horns trending in the right direction for March Madness.

- Ole Miss announced the hiring of Chris Beard today with a video, which would have been great apart from the fact that the school didn’t include a single highlight from his stint at Texas. Hmm. Wonder why?

Hospitalogy Top Reads

- Macro trends in contraception (Fertility Rules)

- Denied by AI: How Medicare Advantage plans use algorithms to cut off care for seniors in need. (Stat)

- Is vision insurance a scam? (Out of Pocket)

- ‘Indentured servitude’: Nurses hit with hefty debt when trying to leave hospitals (NBC)

- Is there an emergency for Emergency Medicine? (Sheriff of Sodium)

Join 19,500+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!