In today’s send I wanted to aggregate and describe a number of factors facing physicians and physician employment in 2023. While I don’t necessarily have a conclusion here, it seems as if a number of these variables are slowly coming to a head.

If you have any thoughts related to today’s post, send ‘em my way as always.

SPONSORED BY THE NASHVILLE ENTREPRENEUR CENTER

*Project Healthcare, a program of the Nashville Entrepreneur Center holds the best of the best in healthcare, and they’re hosting their annual event – the Telehealth Academy III – on September 21, 2023.*

Come to Nashville to network, meet, and learn alongside executives from incumbent provider organizations, industry influencers and disruptors, employers, associations, patients, consumers, and frontline providers – including experts from HCA Healthcare, Best Buy Health, Medstar, OSF, NTTData, eVisit, Baptist Health, and Ziegler – along with many others.

This isn’t some fluffy conference – the people at this event are attending to have real conversations to move the needle forward in healthcare and discuss how telehealth, virtual care, and digital health are addressing access to care and workforce optimization challenges.

The Telehealth Academy III’s theme this year is ‘Scaling Impact’ in virtual and hybrid care delivery, which includes some great topics:

- Reimagining Nursing: Unleashing the Power of Virtual Care to Empower Patients and Relieve Burden

- Revolutionizing Healthcare Delivery: Exploring Hospital-at-Home and Care-at-Home Capabilities

- Harnessing the Power of Generative AI: Revolutionizing Telehealth, Virtual Care, and Digital Health

- Venture Capital and Private Equity Perspectives: Navigating the Telehealth Investment Landscape

Don’t miss the opportunity to make valuable connections!

Key Takeaways

There are a whirlwind of dynamics facing the physician profession today:

- Older physicians are setting up their retirement plans and selling their practices to corporate interests.

- At the same time, several PE-backed practice management companies are struggling, and M&A is shrinking in 2023.

- Professional reimbursement and therefore physician compensation lags inflation.

- Nurse practitioner scope is increasing and it’s the fastest growing job in the country. Full Practice Authority will continue to expand.

These trends are slowly coming to a head. When? I don’t know. But physicians want more agency. Those who partner with physicians need to be aware of these dynamics, and the organizations poised to succeed long term will provide physicians with transparent communication…and compensation to boot.

Physicians are increasingly corporatized

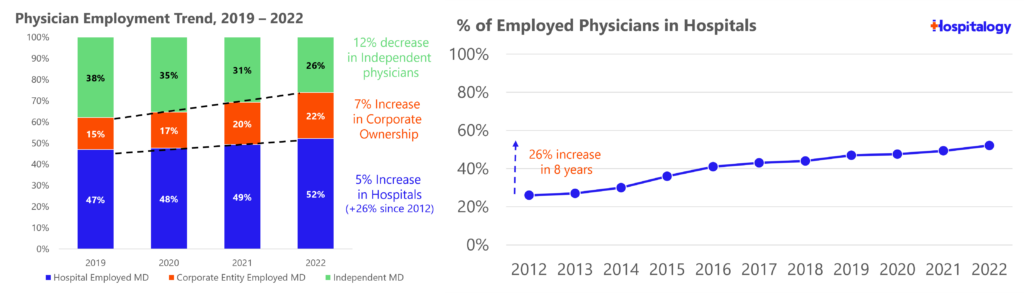

If you’ve followed my newsletter for any period of time, you have probably seen these charts once or twice (recreated by me) from the Physicians Advocacy Institute discussing trends in physician employment and the sharp decrease in independent physician practices.

Employment of physicians has increased 19% over the last 3 years, accelerated by the pandemic. Almost 75% of all physicians are now employed by a hospital or corporate interest, and over 83,000 physicians left their independent practices since 2020 to join a corporate or hospital entity. From a MedCity article summarizing a recent AMA report on physician practice dynamics:

- “Younger physicians experienced the biggest decrease in self-employment. From 2012 to 2022, the proportion of physicians under the age of 45 who were self-employed decreased by 13 percentage points, dropping from 44.3% to 31.7%. This indicates that a smaller portion of each subsequent group of physicians has begun their post-residency professional journey as independent owners.

- The main reason for the drop in practice ownership seems to be the retirement of older physicians, who are typically owners, and the decreasing proportion of new physicians, who mostly decide not to be owners or feel they don’t have the option to become owners, according to the report.

For my Holes fans out there:

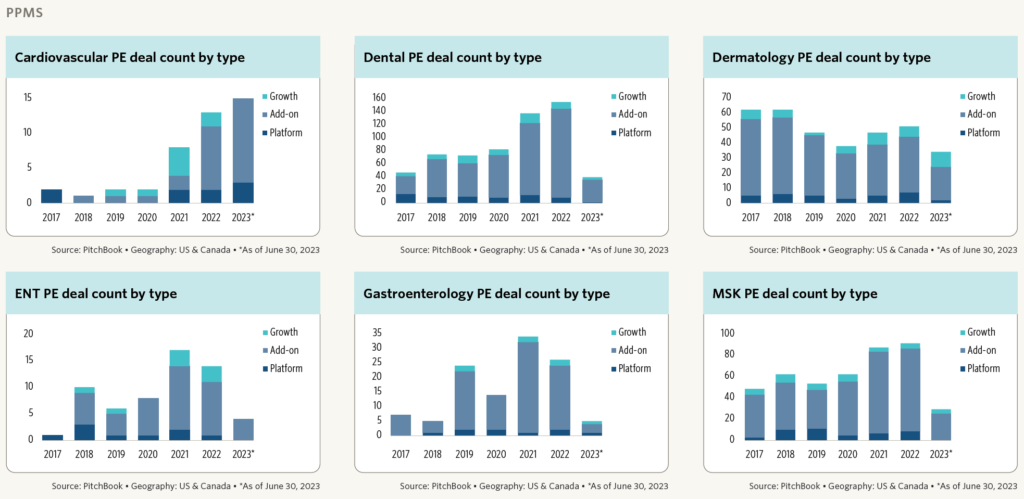

Private equity rollup activity, existing giants including Optum, Kaiser, and VillageMD, and now new entrants like CVS all have joined the fray to compete for physicians in local markets alongside health systems. As the study notes, corporate employment of physicians has increased faster than overall employment across all specialties.

But – the business cycle has turned, and activity has slowed down as interest rates have risen. Debt-saddled players are hitting a financing wall, leading to the decay of several high-profile failures. Which begs the question: have we hit peak physician employment? Activity has slowed down in 2023.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Image credit: Pitchbook Q2 2023 Healthcare Services Report

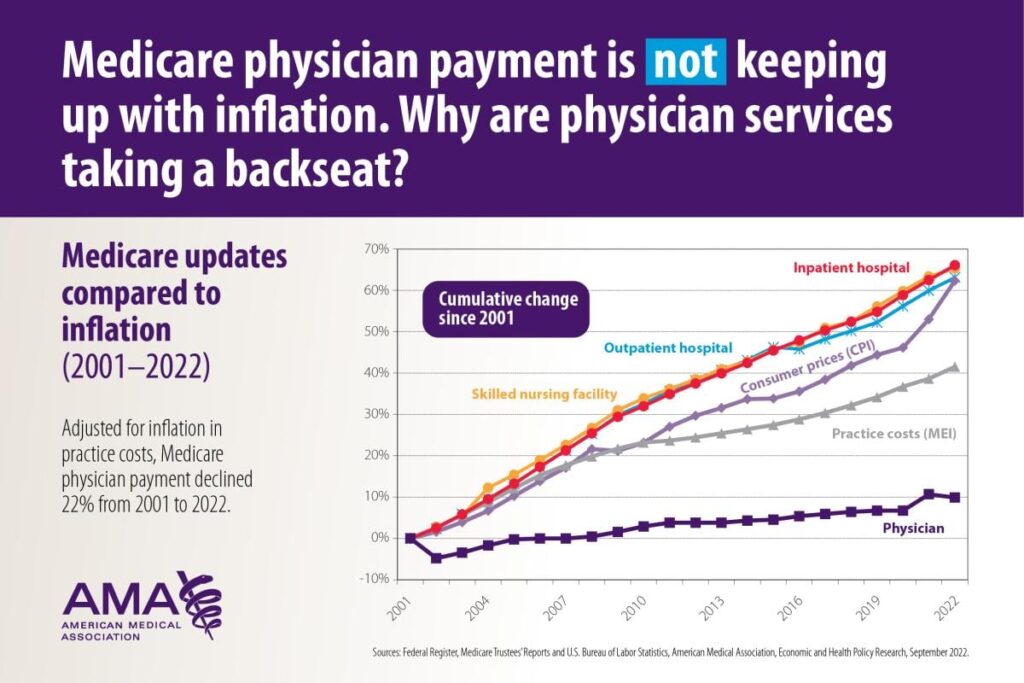

Physician compensation lags inflation

You’ve probably seen some version of this chart shared on social media or elsewhere:

As corporate interests move in with deep pockets for both acquisitions and for lobbying, physicians feel like the little guy. The cog in the machine fitted to optimize for and churn out RVUs for ‘The Man.’ And…well…that’s basically what’s happening. As these dynamics and feelings play out, physician distrust and resentment of corporate interests will grow. Anger toward PE-backed rollups may lead to recruitment challenges in those settings. Managed care ownership of physicians along with health insurance paperwork barriers leads to frustration as they feel (rightfully so, in most instances) that a corporation is practicing medicine and deciding what’s right or wrong for their patient rather than the highly skilled individual.

All of these issues play a role in physician employment dynamics. But I’d argue at its core is the fact that physician compensation is stagnant while they feel as if everyone around them is profiting much more off the work that they accomplish.

Bottom line: many physicians are jaded to the realities facing the profession today.

The AMA summarizes the sentiment well here: “…the shift away from independent practices is emblematic of the fiscal uncertainty and economic stress many physicians face due to statutory payment cuts in Medicare, rising practice costs, and intrusive administrative burdens,” said AMA President Jesse M. Ehrenfeld, M.D., M.P.H.”

Growth in the role of the APP and Full Practice Authority

Finally, as the fastest growing healthcare profession, the role of the nurse practitioner is an ever-growing threat to physicians who feel as if the encroachment and scope of services that an advanced practice provider (APP) can provide has gone too far. Much to the chagrin of physicians, the role of nurse practitioners will continue to grow for a number of reasons:

- Economically, they cost less and there’s a greater (and growing) supply of them

- Value-based care is all about team-based care and care coordination, of which the NP is a vital component

- NPs will increasingly be used to address shortages as the role is the fastest growing job in the country.

As a result, states are continuing to expand the scope of nurse practitioners – so called Full Practice Authority. And while there’s much discourse around whether this expansion is harmful to patients or FPA results in increased utilization and downstream higher costs, the reality is is that this is a trend that will continue whether physicians or patients like it or not. APPs serve an important role in healthcare and their scope will continue to increase in staffing models across healthcare delivery organizations. Physicians just simply disagree on what that role ought to be, which I get.

What might define a successful physician alignment strategy in the future?

All of these dynamics (and more, I’m sure) are affecting physicians, and have been for a number of years. Where do we go from here?

Here’s a few ideas for what might set up an organization for long-term success:

- Physician-involved governance or agency within governance structure – Alignment on management objectives; more transparency between physicians and management; patience

- For PE-backed PPMs, a path to partnership and equity participation for junior physicians (younger physician recruitment may present an issue in the near future)

- Reasonable valuations and prudent M&A – no M&A just for the sake of growth at all costs; reasonable compensation scrapes for acquired physicians, and transparent communication for what post-transaction realistic expectations look like; better technical and cultural integration post-M&A

- Aggregating physicians into multispecialty practices to break down silos of patient care, commanding higher reimbursement rates, having access to capital for more sophisticated resources

- Physicians will continue to seek arrangements to lock in or increase compensation – entering new opportunities in value-based care, clamor for physician owned hospitals, ask for leadership positions within healthcare organizations

SPONSORED BY ADONIS

Over the past couple of weeks, I’ve been working closely with the Adonis team to provide Hospitalogy subscribers with a thoughtful, informative overview of revenue and compliance related trends.

On August 22, we’ll be releasing that conversation, diving into the key themes affecting physician practices, health systems, and digital health organizations. Billing, collections, price transparency, value-based care, and revenue cycle management are all on the table.

It’ll be a State of the Union, but for healthcare – and you don’t want to miss it. Even if you can’t attend, sign up and we’ll send you a recording after the fact. I’m looking forward to the discussion!

Emphasizing Physician Agency

In summary, when thinking about partnerships, healthcare organizations need to form genuine relationships with physicians. While administrators in the public discourse often receive a ‘iron curtain’ label for their communication with doctors, managing physician practices also presents its challenges as physicians are notoriously fickle (you know it’s true, guys). The balance between these dynamics can quickly destabilize when business results falter or dissatisfaction arises on either side. True partnerships require collaboration, focusing on better patient care, physician satisfaction, and robust financial performance.

What’s the root issue, given the undercurrents of tension? While I’m neither a health system executive nor a physician, my interactions with both groups indicate a desire among physicians to focus on patient care. They yearn for agency within organizations, seeking recognition as esteemed professionals. They want a say in decision-making and governance.

Yet, physicians also need the tools and investments to thrive. Despite their expertise in medical fields, they might lack business acumen. Perhaps the dialogue should shift from advocating for physician independence to emphasizing ‘physician agency’. Regardless of their affiliation with hospitals, insurers, or management companies, the involvement of physicians is critical to an organization’s long-term success. However, this collaboration requires physicians to engage constructively.

The future of physician employment and the broader impact of corporatization remains uncertain. But 2023 promises to be a pivotal year, worthy of our close attention

Where we go from here with physician employment and the ultimate result of corporatization, I don’t know – but there’s plenty to pay attention to in 2023.

Open-ended Questions to Consider:

- If some or all of these trends continue to play out, how will the physician employment environment shift, if at all?

- What’s the long-term fallout from physician mistrust of capital partners, if any?

- What happens if the FTC bans non-competes?

- What happens to physician compensation if hospitals can no longer stomach physician practice subsidies?

- Why are 70,000 physicians and APPs still aligned with Optum if they’re constantly being villainized publicly?

- Will the physician-owned hospital movement pick up steam?

- As rollups like Envision, American Physician Partners, Cano, and future candidates like Radiology Partners fall apart, where do these physicians go, and what happens to staffing – and subsequent patient care – at those hospitals or clinics?

Resources and Further Reading Material:

- American Medical Association. Medicare physician payment reform: Long overdue. https://www.ama-assn.org/about/leadership/medicare-physician-payment-reform-long-overdue

- Adler, L. [@LorenAdler] https://twitter.com/LorenAdler/status/1681694408817758211?s=20

- PitchBook. UK private equity & healthcare: What’s the future for the NHS? https://pitchbook.com/news/articles/UK-private-equity-healthcare-NHS

- Radiology Business. Radiology Partners seeking new investors to help repay more than $2B debt: report. https://radiologybusiness.com/topics/healthcare-management/healthcare-economics/radiology-partners-seeking-new-investors-help-repay-more-2b-debt-report

- Hospitalogy. The rise and fall of Envision Healthcare. https://workweek.com/2023/05/11/the-rise-and-fall-of-envision-healthcare/

- Becker’s Hospital Review. Private equity, payers acquire far more physicians than hospitals: AHA. https://www.beckershospitalreview.com/finance/private-equity-payers-acquire-far-more-physicians-than-hospitals-aha.html

- Lever News. Private equity gloats over a doctor glut. https://www.levernews.com/private-equity-gloats-over-a-doctor-glut/

- Lexology. https://www.lexology.com/library/detail.aspx?g=38da0310-84ee-48aa-94b4-4262f92d5286

- MedCity News. AMA: Physician employment and the future of Medicare. https://medcitynews.com/2023/07/ama-physician-employment-healthcare-medicare/

- Becker’s Hospital Review. American Physician Partners’ looming closure leaves hospitals scrambling. https://www.beckershospitalreview.com/hospital-physician-relationships/american-physician-partners-looming-closure-leaves-hospitals-scrambling.html

- American Antitrust Institute. https://www.antitrustinstitute.org/wp-content/uploads/2023/07/AAI-UCB-EG_Private-Equity-I-Physician-Practice-Report_FINAL.pdf

- American Medical Association. https://www.ama-assn.org/system/files/2022-prp-practice-arrangement.pdf

- Becker’s Hospital Review. (n.d.). “Almost biblical in its impact”: Physicians balk at CMS’ proposed 3.34% pay cut. https://www.beckershospitalreview.com/finance/almost-biblical-in-its-impact-physicians-balk-at-cms-proposed-3-34-pay-cut.html

- BMJ. (2023). https://www.bmj.com/content/382/bmj-2023-075244