Before I dive more broadly into key themes from Q2, I wanted to specifically jump into the CVS earnings report, as it was chock full of lots of info covering a lot of big things happening right now. Definitely take the time to read the CVS transcript!

Also – I’d really appreciate your support in 2 arenas:

- Fill out this survey. I’m launching a referral program soon and want to make sure the rewards are chock full of stuff that you guys actually want (not a mug…I mean unless you want a mug)

- Sign up for my virtual event with Freshpaint discussing major marketing trends in healthcare that healthcare marketing leaders need to know. Register here (even if you can’t make it)

- If you enjoy this post, join 20,300 others and subscribe to Hospitalogy here.

This edition of Hospitalogy is SPONSORED BY MEDALLION

*Elevate, Medallion’s annual virtual conference featuring forward-thinking industry veterans across the healthcare delivery ecosystem, is returning on September 20.*

The curated agenda is chock full of valuable information designed to equip and empower healthcare leaders with insights to take on the operating challenges you’re facing in 2023.

Hospitalogists should sign up to get the latest insights across a number of interesting topics including:

- M&A in Healthcare: Transformational Tools of the Trade;

- Looking Ahead: What Does the Next Year in Healthcare Look Like?; and

- Rising Costs, Strategic Transformation: Tackling the Healthcare Tidal Wave

*Register for Elevate and explore the transformative landscape of healthcare, including how we can turn industry challenges into operational excellence opportunities.*

Executive Summary for CVS Health’s Q2 2023

The TL;DR on CVS:

- Major medical loss pressure from outpatient utilization in Medicare Advantage. Earnings expected to be flat in 2024.

- Integration of Signify, investment in Oak Street Health signals that CVS is betting the house on the long-term bets.

- Other tidbits include no current impact from rising GLP-1 utilization, and entrance into the ACA exchanges.

1. CVS Faces Short-Term Utilization, Integration Headwinds

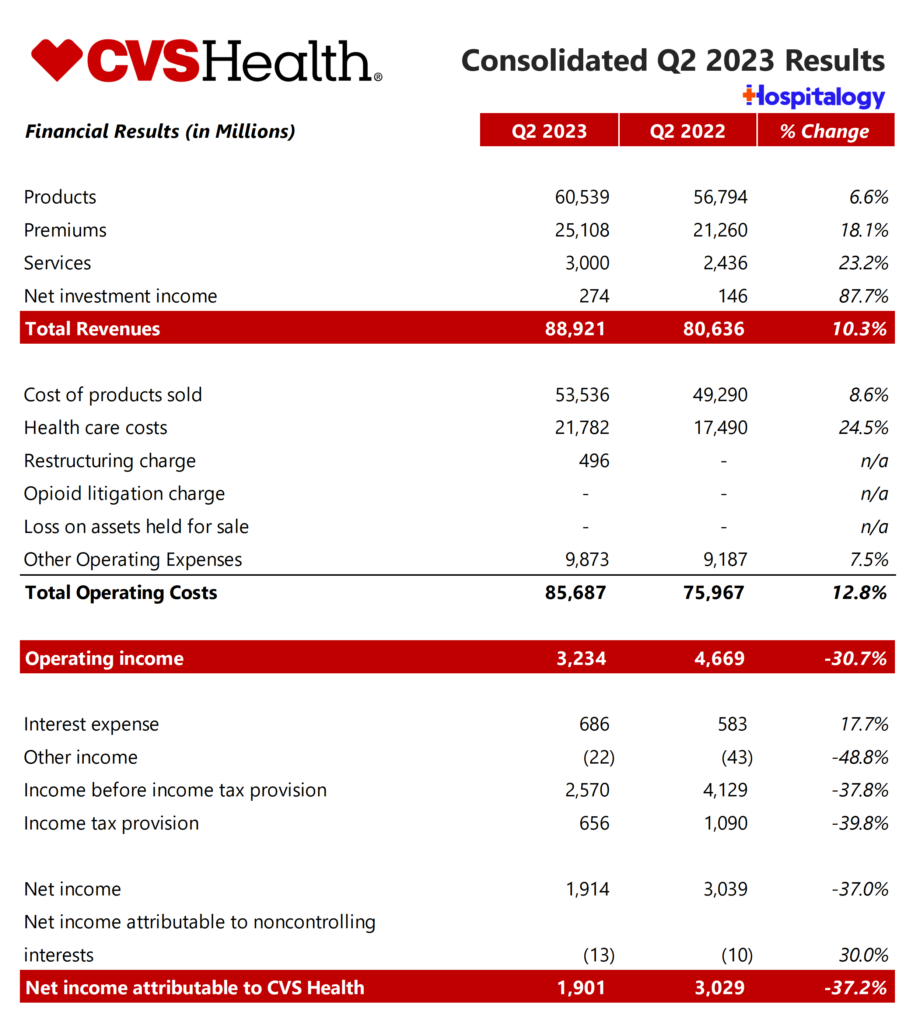

What to know: CVS struggled this quarter with higher than expected utilization as it sets up its long-term vision after purchasing Signify Health and Oak Street Health. Consequently, while the managed care behemoth reiterated earnings guidance for 2023, its guidance for 2024 is flat (includes Oak Street Health losses) and pulled 2025 guidance altogether.

Short term headwinds for CVS include:

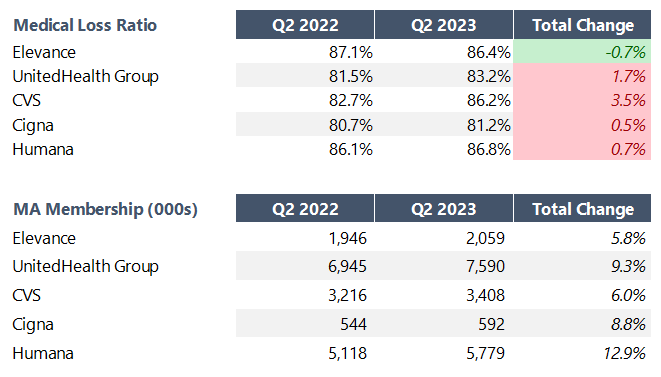

- Utilization concerns: CVS holds exposure as outpatient utilization picks up major steam in the MA population. Consequently, its medical loss ratio slid 3.5% from 82.7% a year ago to 86.2% in Q2 2023.

- “Our medical benefit ratio of 86.2% increased 350 basis points year-over-year, reflecting higher-than-expected Medicare Advantage utilization in the second quarter. These trends were primarily driven by higher utilization in the outpatient setting as well as dental and behavioral health. We also recognized higher utilization levels in the first quarter and prior year, resulting in lower year-over-year prior period development in the quarter.”

- …We now expect our 2023 medical benefit ratio to fall at the high end of our previous range of 84.7% …reflecting the impact of higher Medicare Advantage utilization…our 2023 guidance now prudently assumes that these medical cost trends will remain elevated for the rest of 2023.

- Our 2024 MA bid did contemplate a degree of higher utilization…If a higher level of medical cost trend then persist again in ’24 or, said differently, if we don’t see an abatement in medical cost trend, we would then be pressured on our bid assumptions.

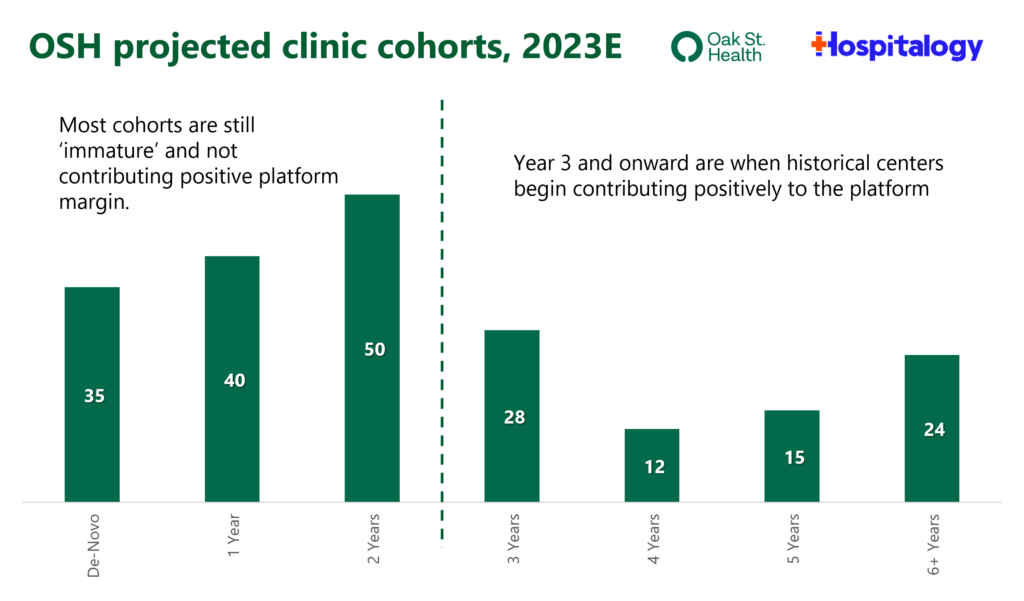

- Setting up for the Long-Term includes short-term pain: CVS is focused on integration and investment in long-term strategies, including Signify and Oak Street Health clinic buildout. Similarly to UnitedHealth group commentary with Optum on short-term headwinds and risk-based cohort maturities, CVS is betting on these acquisitions long-term. And given the fact that CVS is too big to fail in the short-term (and despite the fact that the firm shelled out top dollar for Oak Street), we should see these investments play out successfully over the next 5-10 years.

- Retail Segment is Stagnant: CVS’ Consumer Wellness division, in-step with Walgreens’ suffering here as well, is deteriorating.

Based on the problems outlined above and the associated operating struggles, CVS’ financial results are in a deteriorating state. The firm conducted a small (relatively speaking) reduction in force, cutting around 5,000 corporate jobs. CVS also mentioned the selective use of AI to improve efficiencies and is more broadly targeting up to $800 million in cost cutting initiatives across the organization.

Key Quotes:

- However, given the emergence of multiple potential headwinds across our diverse set of assets, including uncertainty in Medicare Advantage, the potential for a weakening consumer environment and reduced retail contributions from COVID, combined with our plans to accelerate Oak Street clinic growth, our 2024 adjusted EPS target of $9 is no longer a reasonable starting point for our guidance range. Given the more challenging outlook for 2024 and our desire to set guidance that is achievable with opportunities to outperform, we now believe investors should anchor their initial expectations for our 2024 adjusted EPS to $8.50 to $8.70, essentially flat to our existing 2023 guidance range.

2. CVS’ Focused on Vertical Integration Flywheel with Signify, Oak Street Acquisitions

A theme of my content lately across Amazon, CVS, UnitedHealth Group, and others is…long-term thinking. Their ventures, investments, and acquisitions won’t translate into success overnight. And this fact couldn’t be more apparent than it is with CVS.

CVS has drawn criticism for the premium it paid to acquire recent businesses. But the leverage gained in operating as both payor and provider needs time for integration and development, which is why CVS as a broader company will see flat growth in earnings in 2024. Investors and industry onlookers will be looking for progress and results over the coming years.

To that end, CVS spent quite a bit of time unlocking what the various services all mean for long-term growth:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- We are unlocking opportunities by connecting Signify and Oak Street to CVS Health assets, such as Aetna, MinuteClinic and CVS Pharmacy, and driving patient engagement and growth. As we scale our health care delivery assets and realize synergy opportunities, we will accelerate our long-term growth trajectory.

- We launched new member engagement initiatives at select CVS pharmacies to drive In-Home Evaluation conversion of Aetna Medicare members and CVS Pharmacy customers to Signify. Early results are promising with higher engagement across the CVS Health channels utilized.

- Survey results show that members who are highly satisfied with their Signify in-home evaluations are 26x more likely to recommend their health plan and 74% more likely to consider additional health services. Signify’s customers recognize the power of this trusted relationship and the value of these home services.

- From an Oak Street perspective, we’ve seen similar trends on medical costs with outpatient and being up across our payer partners. Specifically though, we’ve had a really strong start to the year on Caremark execution at Oak Street. And so we’ve been able to largely offset the increased outpatient costs through a roughly 4% reduction year-over-year in admissions per thousand. So we’re able to offset the increase in outpatient with continued strong performance in keeping our patients out of the hospital and decreasing inpatients.

3. CVS plans to accelerate Oak Street Health Clinic Buildouts

“Turning to Oak Street Health. We are accelerating patient growth through our broad community presence and ability to engage consumers across multiple channels.”

Oak Street (OSH) is getting an injection of growth capital to accelerate clinic openings. From 2013 to 2022, Oak Street opened 169 clinics in total. In recent years after going public, OSH accelerated those openings to around 40-50 a year but most recently ran out of steam, leading to the CVS acquisition. With the backing of CVS resources, Oak Street will open 50 to 60 clinics in 2023 and expand into 25 states. As of mid year 2023 per the earnings call, OSH is up to 177 clinics.

As a standalone entity prior to CVS acquisition, Oak Street had expected to hit 204 centers by the end of 2023 and 300+ by 2026. Do the math here and CVS is pumping enough resources to open an incremental ~15 to ~25 clinic locations beyond what OSH could have managed on its own.

What’s in it for CVS? Opening more OSH clinics helps with a few different financially motivated initiatives:

- Accelerating patient acquisition from CVS Pharmacy and Aetna channels – “Today, there are approximately 1 million Medicare eligible seniors, who visit CVS pharmacies each week that are located near an Oak Street Clinic.”

- These initiatives will drive Oak Street patient growth and accelerate the path to mature clinic profitability, while broadly serving the needs of Medicare members…We will also open new Oak Street clinics co-located with CVS pharmacies this year, and have already identified additional locations for 2024. We now expect to build 50 to 60 clinics next year.

- Our analysis has consistently shown that accelerated clinic growth is the right thing to do in terms of optimizing the long-term returns on this investment and expanding access for at-risk populations.

- Boosted patient engagement, which should in theory boost MA star ratings and $$$ – “We launched new member engagement initiatives focused on creating connections between Medicare-eligible CVS customers, both in-store and digitally, and Oak Street Health provider.”

- Helping Aetna members find primary care providers – “We are also connecting Aetna Medicare members who are currently without a primary care physician with their local Oak Street provider to reengage them in their care.”

Ultimately, CVS is following in the footsteps of Humana and UnitedHealth group, matching up against Humana’s CenterWell (and Conviva) activity and of course, Optum’s buying sprees. Through the CenterWell JV with WCAS, Humana is opening 30 – 35 clinics annually. CenterWell /Conviva together also delivers care to 240,000 patients across the nation while Oak Street Health is responsible for 181,000 at-risk patients (and 224k patients in total, which may be more comparable).

- “The [Primary Care Organization], including CenterWell and Conviva, is the largest provider of senior-focused primary care in the country. Between the two brands, the PCO operates more than 220 centers across 11 states and expects to continue to grow by 30-50 centers per year through 2025.”

Side note – there’s a CenterWell clinic opening up in Dallas not 5 minutes from my house and I have to be the person paying the most attention to this.

4. Aetna is now Running the Show

Take a peek at year over year performance for CVS by its reporting segments, specifically that middle column focused on Pharmacy & Consumer Wellness. Bottom line: Retail sales and retail pharmacy is low on the totem poll at CVS right now given slowing growth and eroding operating margin. The same dynamic is happening at Walgreens. CVS is after predictable demand, which is healthcare. You can see why both Walgreens (with VillageMD and Summit Health acquisition) and CVS are going all-in on the healthcare strategy. And as a result, Aetna is front and center for CVS as the $69B acquisition in 2018 works to acquire members, boost growth in healthcare services, and preserve market share for the coveted CVS Caremark PBM.

Is the CVS Narrative Believable?

Given the facts and circumstances outlined above, would you invest in CVS today? The turnaround depends on quite a few levers:

- Ability to scale and achieve profitability in acquired assets (e.g., cohort maturity of Oak Street Health patient panels); success of co-located OSH clinics to drive retail pharmacy sales

- Preservation of Caremark market share

- Continued growth in both membership and MA plan QUALITY for Aetna

Based on continued operating struggles and despite the boon that was Covid for managed care players, CVS has underperformed the S&P 500 (not dividend adjusted):

CVS is too big to fail. But can CVS attract investors back with the healthcare growth story? I’ll leave you with this, from Karen Lynch:

While emerging headwinds have created uncertainty for our 2024 and 2025 outlook, make no mistake, we are more convinced than ever in our long-term strategy. The power of our integrated model and care delivery assets will change how consumers and patients engage with the health system and how they receive care. We believe this will benefit customers, patients, payers and ultimately, our shareholders.

Resources and Reading Material

- CVS Q2 earnings call transcript from the Motley Fool (Link)

- CVS Q2 results (press release, earnings presentation, prepared remarks, and 10-Q) (Link)

- CVS Q2 databook will be shared exclusively with the Board Room community.

- CVS, Oak Street Health, and the great payor vertical integration war. (Link)

- The Rise of Retail Health (Link)