Welcome to another edition of Hospitalogy, a newsletter focused on diving into the business of healthcare.

If you’re new here, please consider subscribing to join 20,000 other healthcare folks! (Subscribe here)

For experienced healthcare folks, I’m building an executive healthcare community. Check out the details here.

Onto this week’s news!

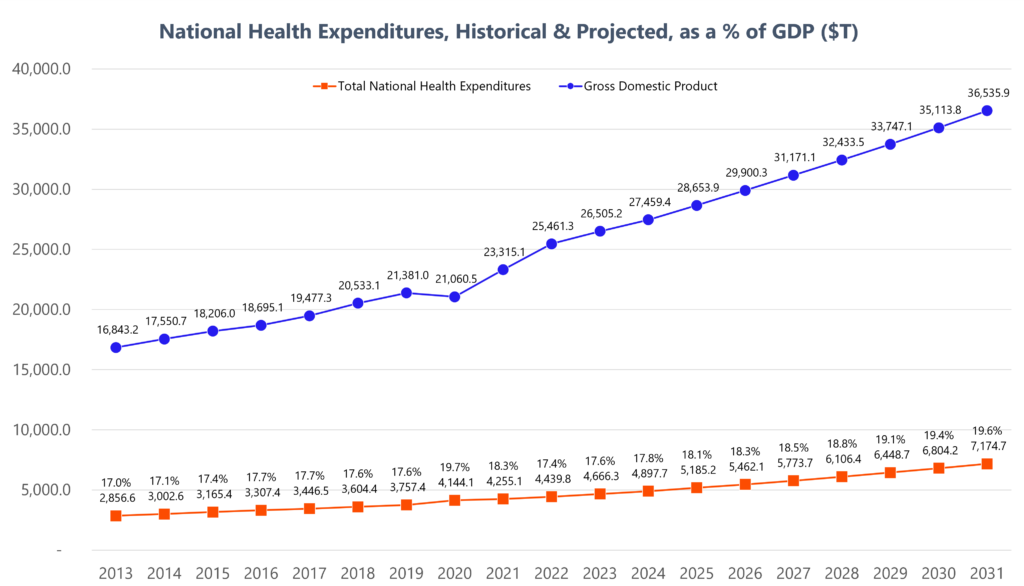

U.S. Health Expenditures Projected to hit 19.6% of GDP by 2031

Last week, CMS released its annual projection of national health expenditures, containing historical data through 2021. Driven by strong 65+ demographics growth, healthcare spending will outstrip broader GDP growth.

As a percentage, spending is projected to rise from 18.3% in 2021 to 19.6% by 2031.

Interestingly, the government agencies expect GDP to grow at a 4.6% compound annual growth rate from 2022-2031, though much of that is frontloaded in 2022 (9.2% growth expected). Annual growth in 2022 is expected to be 9.2% on the back of strong government spending and …ahem…inflation. After 2022, GDP will bounce around 4.0% growth thru 2031.

I will say, 4.0% growth seems pretty strong, although our GDP annual growth rate from 2013 to 2021 was 4.1% – which surprised me. That being said, current levels of government (and healthcare) spending are unsustainable, a core reason why CMS is pushing risk-bearing arrangements in healthcare to address total cost of care.

I’ll likely dive into healthcare costs given these projections and the recent June MedPAC report next week with key findings. Along with recent upticks in utilization that I touched on last week, we’re headed down a treacherous, unsustainable path when it comes to total healthcare costs and healthcare costs per capita. I could probably publish that last sentence every year for the past two decades.

Friday Health Plans Shuts Down

Several states have shut down Friday Health Plans, a VC-backed firm that has fallen the way of Clover and Bright Health – expanding too quickly with too many members and lacking the infrastructure on the back end to support responsible growth.

On its website, Friday leaves a somber note, disclosing that it had “grown incredibly quickly,” but had been “unable to scale our financial infrastructure to match the pace of our growth and secure the additional capital required to run our business.”

As states wind down Friday’s operations and members hop onto new plans, it’s yet another valuable lesson learned from a well-intentioned firm working in a cutthroat segment of healthcare – health insurance.

Join Ari Gottlieb and me on Thursday to discuss everything insurtech, including what happened to these once high-flying names, what we might expect moving forward, and lessons learned from those who flew too close to the sun.

- Register here for the virtual event. This Thursday at 11am CT.

- Have any questions for us to discuss on the webinar? Submit them through this form! Or, respond to this e-mail with your question.

Partnerships and Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

Aetna & New York Retirees: Interesting little tidbit about the ongoing battle between NYC retirees and Aetna. In the court case, Aetna noted that 3.4% of its 82 million claims were subject to prior authorization, and of those 3.4%, Aetna rejected 14.4% of claims requiring prior auth. Aetna apparently has the highest denial rate of any insurer as Medicare and Medicare Advantage continues to head toward a narrow network future, one that we’ll all bemoan before it’s too late. (Link)

MA Overpayments: A recent study conducted by the USC Schaeffer Center found that because of beneficial selection of healthier members, overpayments to Medicare Advantage plans exceed $75 billion. (Link)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Cano’s CEO Out: Amid internal board fighting, shady related party transactions, and a poorly run value-based care enterprise, Cano Health’s CEO has stepped down. I imagine the next step for Cano will be to conduct a sales process to save the sinking ship. (Link)

Medicaid Redetermination Latest: The Biden Admin is alarmed by the rate of folks getting booted off Medicaid, although most individuals should be able to find insurance again. States are scrambling to reach patients as patient visits get canceled amid administrative slowdowns. “About 4 in 5 people dropped so far either never returned the paperwork or omitted required documents, federal and state data show.” (Link)

Utilization Headwinds for Managed Care: Humana became the second major payer to flag higher outpatient volumes in Q2, filing an 8-k echoing UnitedHealth Group’s utilization sentiments. Medical loss ratios elevated outpatient trends are expected to push its medical loss ratio, a marker of how much payers spend on patient care, toward the high end of its outlook for both the second quarter and the full year. Humana’s stock performance is down 11% year to date while the S&P as a whole is up more than 15%. (Link)

Trusted Health’s Nursing Survey: After surveying more than 1,900 nurses, Trusted Health’s survey found an improvement in self-rated nurse mental health scores, to 6.6 in 2023 up from 5.8 (rated on a 10 point scale) in 2022. It’s a positive market signal, perhaps pointing toward better treatment of healthcare’s key employees and a normalizing labor market. (Link)

Partnership Announcements:

- Pearl Health partnered with virtual cardiology firm Story Health to provide Pearl PCPs with access to Story’s specialty care model. (Link)

- Concert Health partnered with Wisconsin provider for behavioral health (Link)

- Panoramic Health partnered with Southwest Nephrology Associates (Link)

- Simple HealthKit partnered with Walmart to bring at-home diagnostic tests, including diabetes, respiratory wellness and sexual wellness labs, to the retail player. (Link)

- KeyCare notched another partnership, this time with Captive Health (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare, along with M&A that caught my attention.

Home Health Bids: Amid LHC Group getting acquired by Optum and Amedisys either merging with Option Health Care or ALSO getting bought by Optum, activist investors in Enhabit Inc. think that the home health player should consider selling as well. Recall that Encompass Healthcare spun off Enhabit in mid 2022 after announcing plans to do so in early 2022. Enhabit spun off after drama ensnared the former home health and hospice division’s key executive April Anthony. She has since started a new company VitalCaring. (Link)

More ER Staffing Debt Issues: After Envision’s bankruptcy declaration, Blackstone’s TeamHealth is currently negotiating over $1 billion in debt with lenders, due in 2024. Lenders are likely to negotiate more aggressive terms given the rise in rates and recent bankruptcy of a major competitor. (Link) (paywall)

Movano Health, medical and consumer device company and maker of the Evie Ring, announced an initial public offering. (Link)

Premier Inc divested its non-healthcare GPO ops for $800M. (Link)

BGL published a report on urology, specifically noting expectations for consolidation to accelerate in the space. (Link)

RadNet raised $225M in a recent stock offering. (Link)

Labcorp is prepping the media for its spinoff of Fortrea, set to commence on 6/20. Fortrea holds legacy Labcorp commercialization services and clinical development segments. (Link)

Digital Health and Startup Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Oshi Health received investments from American College of GI and American GI Association. In April 2023, Oshi Health announced the close of $30M in Series B funding. **(Link)

A recent Redox survey found that clinical integration challenges affect 97% of provider organizations in cloud adoption. (Link)

Andor Health is now connected to Oracle Health’s EHR. (Link)

Hyro, an AI-enabled call center for care delivery orgs, raised $20M (Link)

Baptist Health consolidates legacy EHRs to Epic, adds AI-powered Rx tech (Link)

Hackensack Meridien Health partners with AI-driven speech analysis start-up (Link)

Octave raised $52M to continue to scale its hybrid behavioral health model. (Link)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

- After a dismal showing at the worst muni in Dallas (Duck Creek if you recall), we played Texas Rangers Golf Club in Arlington with the old man for Father’s Day. Since it was a lighthearted round, we played from 6,000 yards and I managed to shoot a 73 with some solid ball striking and mediocre at best putting effort. The game is coming together!

- Hole of the round: The 9th hole at TRGC is a sharp dogleg right. I pull-drew my drive a bit and thought it was gone for sure, but somehow found it in the right rough – AND I had a tiny gap into the green with a halfway decent lie. I mean these are the hero shots you dream of. I didn’t come to a nice course to lay up. So I pulled my 8 iron out, 174 yards away to an uphill pin, focused on making solid contact through impact and…spawned a golf ball laser beam, sizzling right through the gap in the trees with a tidy draw, right on line with the pin. Once I pulled up the golf cart to the green, my ball was about 12 feet for eagle. Unfortunately I patty-caked the putt, but we take a tap-in birdie any day of the week.

- U.S. Open thoughts from yours truly:

- Where the hell were the fans and the atmosphere?! Apparently LA Country Club hogged all the ticket sales and nobody was there. A far cry from the atmosphere when Phil won in Kiawah. Shout out to my fellow lefty.

- Congrats to Wyndham – he had some wicked par saves and short game to carry himself to victory. That being said, No 18th hole at the U.S. Open should have a 50 yard wide fairway!!

- Rory’s game is top tier, and he’s fun to watch when he’s on

- I was pulling for Rickie and was disappointed in his round Sunday, but still a great result for him.

- Scottie Scheffler is world class. To look like he’s struggling and to pull off 3rd place effortlessly is unreal.

- How the heck did Fleetwood manage a 63 on Sunday?

- I would struggle to break 100 in those conditions

Hospitalogy Top Reads

My favorite healthcare essays from the week

- While at ViVE I joined the Friends of Project Healthcare for a podcast about my background, growing a healthcare newsletter, and current trends in healthcare. It was a great discussion and I’d love to hear readers’ thoughts on the discussion! (Link)

- This essay was a solid note on value-based care in Health Affairs, defending its ‘value’ proposition from recent criticisms. (Link)

- A recent piece from the WSJ (paywall) dives into concerns when AI meddles in patient care, even going so far as to overrule nurses. Although AI holds vast potential in clinical settings, we need to acknowledge its current shortcomings and develop guardrails for patients and clinicians. (Link)

- ProPublica published an investigative piece on outpatient vascular care and the bad actors that developed in the space after the implementation of financial incentives in the space. (Link)

- A pair of nice essays in healthcare came from the NY Times this week – the first discussing five other countries’ healthcare systems and what the US can take from them, and the second discussing the ongoing corporatization of healthcare and physicians’ emerging moral crisis from the trend.