Welcome back to another Tuesday edition of Hospitalogy, bringing you ALL of the latest healthcare news across business, finance, strategy, M&A, and digital health.

Join 10,500+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

VillageMD ties the $8.9B Knot with Summit Health

After swirling rumors of acquisition talks between the two, VillageMD announced that it’s buying Summit Health for $8.9B early Monday morning (can’t let a guy sleep in, can you healthcare?)

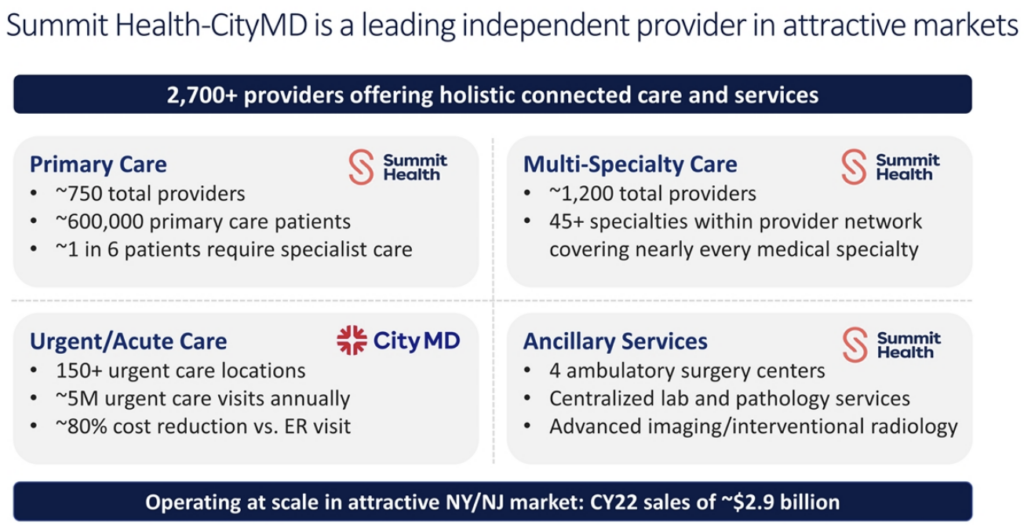

Combined, VillageMD NewCo will operate 4,100 providers (2,150 primary care physicians), 680 locations, 7 million patients, and 125,000 full-risk Medicare Advantage lives. That’s a pretty big deal (pun absolutely intended) as NewCo vaults itself into becoming one of the largest primary care providers in the country and geographically dense (an important feature in value-based care) in the Northeast.

Details: VillageMD will acquire Summit with investments alongside Walgreens and Evernorth (AKA, Cigna’s services arm). Through the acquisition, VillageMD will now have 680 locations (physician clinics and urgent care locations) in 26 markets. You can see the expansive Summit footprint above!

- Walgreens will invest $3.5B (50/50 debt + equity) into VillageMD but the transaction dilutes its ownership in VillageMD by 10% FROM 63% TO 53%

- Walgreens upped its 2025 (wow, that’s a bit of a ways out) U.S. healthcare sales revenue expectations by $3.5B to $4.5B, now expecting between $14.5B to $16.0B in 2025. Its adjusted EBITDA expectations for 2023 sit at around breakeven as it works to integrate the cluster of assets it just bought, and it’ll be slightly accretive to EPS.

- Evernorth will hold a minority stake in VillageMD-Summit NewCo

- Deal will close in Q1 2023

Madden’s Musing: Like I’ve mentioned before, this is a fantastic asset for VillageMD and a nice leeway for Walgreens to continue along with its healthcare strategy. Summit’s large physician base allows it to enter into risk-based arrangements with payors and CMS, a large avenue for growth. The CityMD footprint doesn’t hurt, while less important.

Resources:

- Check out the 8-k filing on 11/7/2022 for the press release and deal slides starting on page 10 (Read More)

- Deal announcement press release (Read More)

- Retail health updates from CVS, Walgreens, Amazon, and Walmart (Read More)

- About Summit Health (Read More)

Taking one final look at One Medical…

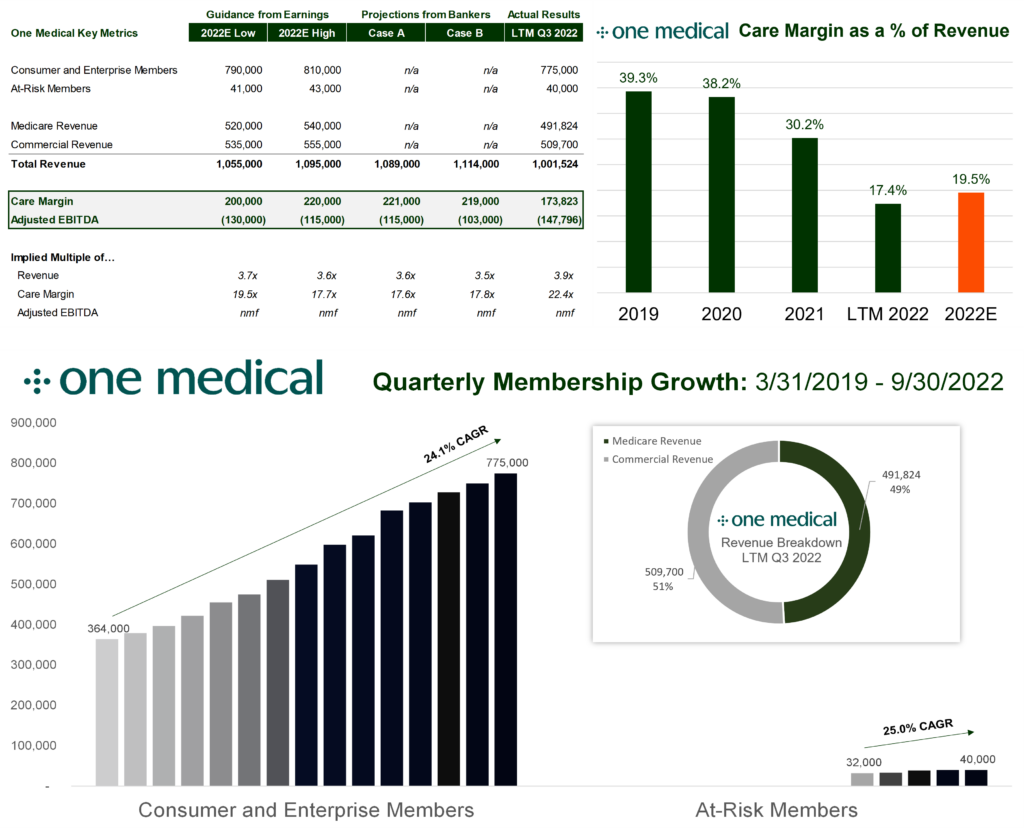

Final check in on One Medical (one less primary care comp…sigh) before Amazon closes the deal (expected Q4). Since I’m a freak, I was interested to see how the company performed in Q3 and was tracking as compared to both (1) their earnings guidance (which hadn’t been updated since the deal) and (2) the banker projections.

Based on its last-twelve months financials ended Q3 2022, One Medical’s care margin deteriorated a bit more, to 17.4% from 19.3% last quarter. (19.5% expected for full-year 2022)

Overall, One Medical’s consumer and enterprise members are in line with guidance that was issued prior to the Amazon takeover announcement, while Iora’s are (currently) slightly under the expected midpoint of 42k members. One Medical overall seems to be tracking slightly under its 2022E guidance, but Q4 is always a good, busy quarter for most healthcare providers. It’s hard to know for sure whether the Revenue, Adjusted EBITDA and Care Margin gaps would have closed in Q4, or if One Medical management would have updated its forecast during Q2 or Q3.

Based on its trailing, LTM care margin and revenue figures and the acquisition price of $3.9B, One Medical is trading at a 3.9x revenue and 22.4x Care Margin multiple.

This multiple compares to an expected 3.6x revenue and 17.7x Care Margin forward 2022E multiple on the acquisition projections (my breakdown here).

Resources:

- One Medical Q3 earnings release (Read More)

ApolloMed Q3 Results

ApolloMed (note and disclaimer – I am invested in ApolloMed – this is not investment advice) dropped its Q3 earnings this week. Here’s a quick one-pager on their financials!

Resources:

- ApolloMed Q3 earnings release (Read More)

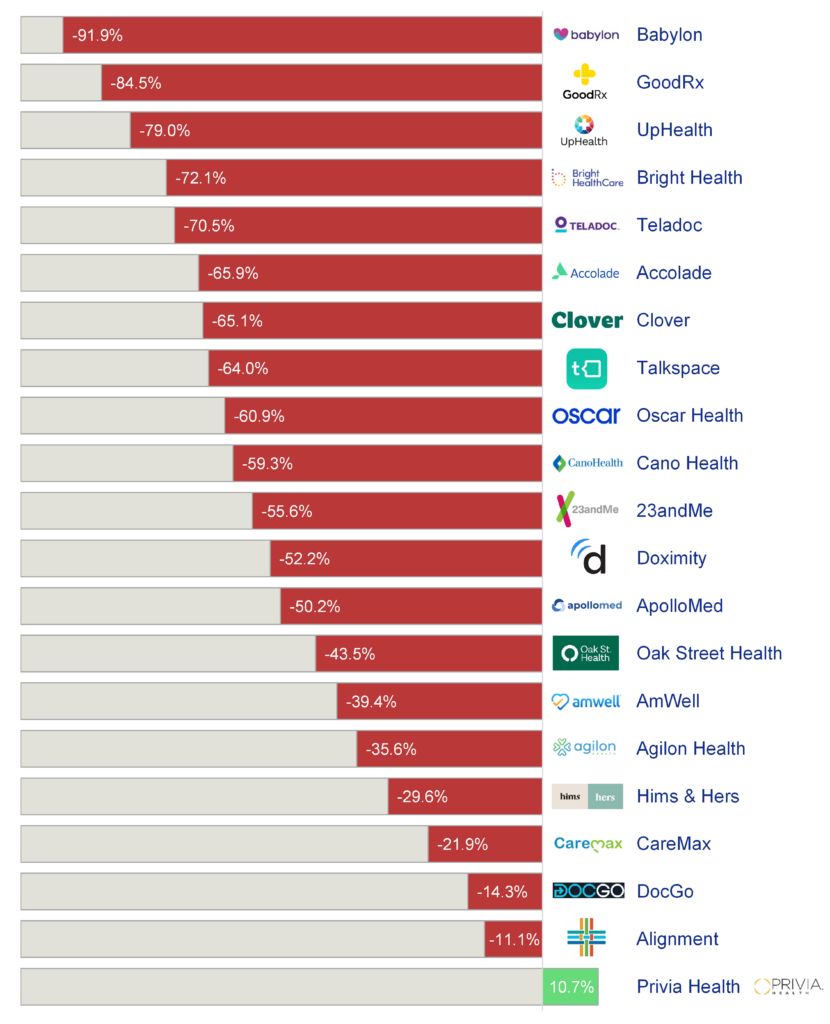

Market Movers

Here’s a question I posed on Twitter – out of these 20 or so companies, which 3 would you choose to increase in value the most over the next 5 years? Answer here!

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Partnerships and Strategy Updates:

- Enablement firm Privia Health announced its latest partnership with Novant Health, in which it’ll create a clinically integrated network, launch Privia Medical Group – North Carolina, and joint venture with Novant Health’s professional corporation. Privia will manage the JV and assist with the transition to value-based arrangements. (Read More)

- Kaufman Hall’s October hospital flash report showed another slight rebound in financials for hospitals, but a slow recovery continues. (Read More)

- CVS seemed to officially launch its CVS Health Ventures arm this week. (Read More)

- UnityPoint spun off 3 Illinois hospitals to Carle Health. (Read More)

Finance and M&A Updates:

- Johnson & Johnson is buying heart pump maker Abiomed for $16.6B. (Read More)

- Pennsylvania’s Department of Health is suspending operations at Delaware County Memorial Hospital after Prospect Medical Holdings failed to adequately staff the hospital. The move comes after Prospect failed to (1) convert DCMH into a behavioral facility, then (2) sell Crozer Health, a Prospect subsidiary, to ChristianaCare. This news also comes on the heels of the Atlanta Medical Center closure. (Read More)

- Kaiser Permanente reported a $1.5B loss for Q3. (Read More)

- U.S. Physical Therapy acquired 60% of a 14-clinic physical therapy practice in the Houston area for $19.3 million, a 2.1x revenue multiple. (Read More)

Digital Health and Startup Updates:

- Two instances of venture capital groups partnering with health systems this week: General Catalyst partnered with Hackensack Meridian Health – a 17-hospital system based in Edison, NJ. Then, a16z’s Bio + Health fund partnered with Bassett Healthcare, a 5-hospital system based on upstate NY. Details are fuzzy, but both of these partnerships will work together as “think tanks” to leverage the VC firms’ portfolio companies, incubate, & strategize on where to invest next.

- Also remember that General Catalyst launched a $670M fund in July 2022 and holds partnerships with 33-hospital system Intermountain (and also snagged Intermountain’s former President and CEO Marc Harrison along with AdventHealth’s former CEO Daryl Tol in July 2022), UK-based Guy’s and St. Thomas’ NHS Foundation Trust, 8-hospital system Wellspan Health, 182-hospital system HCA Healthcare (AKA the largest health system in the U.S.), and 18-hospital system Jefferson Health in late October 2021. Its Health Assurance portfolio contains some of the biggest names in digital health including Olive, Cadence, Capital Rx, Cityblock, Circulo, Color, Commure, and more.

- One year after its $3 billion merger with Ginger, Headspace Health has rolled out a new, unified product experience that brings together meditation and mindfulness services with Ginger’s on-demand coaching, therapy and psychiatry services. (Read More)

- Transcarent partnered with Prescryptive Health to help build out Transcarent’s new pharmacy program for self funded employers and health systems. (Read More)

- Hint Health acquired AeroDPC, an EMR and software company also tailored to direct primary care providers. (Read More)

Policy and Payment Updates:

- CVS, Walgreens, and Walmart collectively will pay a $13.8B settlement related to opioid claims. (Read More)

- A new AMA study seems to indicate that Medicare Advantage markets are anti-competitive. “Nearly 4 out of 5 MSAs had MA markets with low levels of competition as these local-level markets ranked ‘highly concentrated’ according to federal guidelines.” Some interesting tidbits on national payor MA market shares too. (Read More)

- A WSJ report indicated that a United-AARP-branded Medicare drug plan is pretty expensive compared to other plans in the market. Goes to show how sticky MA plans are over time. (Read More – paywall)

- A few pro-price-transparency stakeholders have come together to form Project Clarify. (Read More)

- RCM provider and startup Cedar is now providing its integrated billing platform to Highmark and Allegheny Health Network customers. (Read More)

Costs, Data, and Other Updates:

- In 2021, an average of 1.95 healthcare data breaches of 500 or more were reported EACH day!! (Read More)

- RSV is a real concern for children’s hospitals across the country. (Read More)

- Some interesting stats on contract labor during 2022 from Beckers (Read More)

Hospitalogy Top Reads

- Rik Renard and I are hosting an ‘analyzing healthcare stocks 101’ crash course, which will be a high-level webinar diving into some stocks, resources you can use to understand what’s going on, and more! Register here.

- Rock Health put out a must-read on digital health M&A trends, including archetypes for different kinds of M&A, and deals conducted thru Q3 2022. (Read More)

- Sam Sirell over at Woodside Capital Partners published his quarterly review of health tech in Q3 2022 – lots of great insights this time around. (Read More)

- Ann Sommers Hogg at the Christensen Institute published a nice report on health system strategy and decision making related to fee for service and value-based business models. (Read More)

- Finally, Sachin Jain came out guns ablazing in his healthcare predictions for 2023. In November no less! I need to step up my game. (Read More)

Join 10,500+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!