09 October 2022 | Climate Tech

Capital and a cohesive narrative

By

Today, we want to track back in time a month plus to cover a fund announcement from August, though the fund itself was formed last year.

While not super ‘new,’ the fund concept is relatively novel, and as a result, it’s worth us spending five minutes on it. We often venture beyond the realm of venture capital in this newsletter; while critical to scale climate technologies, there are many more components in the climate tech capital stack. For instance, last week, we wrote about the critical role of project financing in building renewable energy. Previously, we’ve written about other forms of capital, like revenue-based financing.

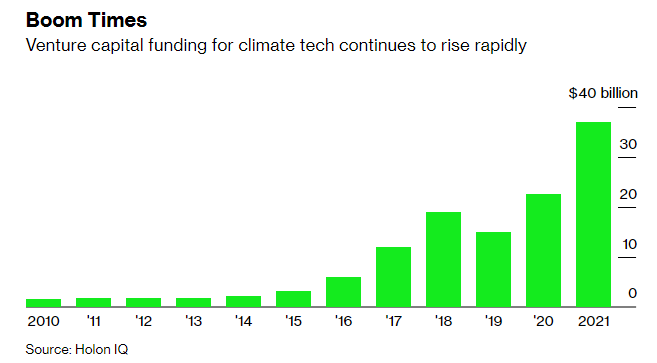

Still, today’s topic is back in the realm of venture, with a twist. After all, venture for climate tech has been booming:

While it does fit in the venture bucket most squarely, the $21M fund announced by VSC Ventures last month struck me as noteworthy because VSC is, first and foremost, a public relations firm. And while entities with significant media distribution are starting to raise funds more often – Packy McCormick’s Not Boring Capital and Harry Stebbing’s 20VC come to mind – this is the first PR venture fund with climate as an investment focus (to my knowledge, at least).

Again, investing alongside consulting services isn’t all that new. It’s just something that’s primarily happened individually, i.e., individual people consult and write angel checks, or at a considerable scale, e.g., Mercer is a large consulting firm that also invests.

That said, concerning PR, the model is relatively new. Why? Well, for one, 20 years ago, PR agencies didn’t work with start-ups. It was considered too risky – who pays your invoices when a young firm folds? But start-ups still need help with PR. And in the intervening two decades, firms like VSC have followed a wave of market growth in venture to provide PR services to start-ups.

Traditional venture firms are also building out their stacks in reverse. E.g., many of the established titans of venture are investing in media teams and companies. Still, there’s something to be said for investors with a storytelling-first focus.

How it works

Now, VSC is operating with investing in their quiver, too (officially VSC Ventures). Investing in clients for whom they also provide PR services has several benefits for both parties:

- For companies, they can source capital with PR help at the same time and can pay in equity rather than cash if that’s desirable.

- For VSC Ventures, the opportunity to invest should attract more clients and taking equity stakes could pay off handsomely (more than cash fees alone) if they invest well.

VSC Ventures established a proof of concept for their model by writing angel checks in the types of firms with whom they work. Jay Kapoor, the General Partner of VSC Ventures, noted that building a ‘real’ fund was a no-brainer based on the success of the angel portfolio. Now, the $21M fund will pair the company’s media wherewithal and deal flow and distribution to accelerate existing firms in its PR portfolio and new clients.

The agency works with 50-60 clients at a given time. Jay noted that perhaps 10%, or 5-6 firms, might fit the bill of what they’re looking for in investments. Their focus will be climate companies at the Seed and Series A stage. Here’s how Jay described the ultimate goal of this operation:

Our goal is for VSC to become the number one PR firm for climate companies.

Their portfolio already includes exciting climate techs like Sesame Solar, which focuses on decarbonizing disaster response (relevant post-Hurricane Ian), and Vibrant Planet, which builds a software solution for forestry management. The fund also invests in two other verticals: the future of work & wellness.

The first close on the fund was last summer, and the team has actively invested since. To be sure, VSC Ventures represents what is, as of yet, a tiny piece of the capital stack for climate technologies. But it’s growing, and I think the model is particularly exciting because the value add for companies beyond the capital is storytelling and marketing help.

Besides raising money and hiring the right people, one of the next most important gaps to growth I often see at early-stage climate companies is finding narrative fit and explaining the story to different stakeholders. Founders are often technical; while super-talented, their background is in engineering, chemistry, what have you. They know how to speak to their audience, but not always to all or many different types of audiences.

The net-net

Zooming out, Jay had a money quote on the future of venture fundraising:

Here’s where venture is heading in the next decade. Founders will assemble cap tables based on investors’ superpowers. The smartest founders are saying, ‘I want the best investor for recruiting, the best for PR, the best seed operator who’s going to get me ready for my series A.’

Those are wise words to heed if you’re an early-stage founder. If you’re raising venture funding and building out a cadre of investors, don’t just consider who will give you money and on what terms. Consider how else they augment your journey six months, 12 months, and 60 months into the future. And if you’re a climate tech company raising a Seed or Series A, that’s VSC Venture’s bread and butter. (As a note, they focus on co-investing rather than leading.)

For my part, VSC’s move is also inspiring because there’s still a world where I try my hand at combining Keep Cool’s coverage with capital, too. For now, I’m very much enjoying spreading my wings in climate tech media. In the future, perhaps I’ll be on the phone with Jay for more pointers on the investing front.