03 August 2022 | FinTech

Will A Decline In Corporate VC’s Affect M&A?

By

I was doing my weekly perusal of random research reports earlier this week and came across this CBInsights report on corporate venture capital investing. I never really paid much attention to this but over the past few years, there have been some fascinating CVC trends that have been affecting fintech and crypto:

- Banks Are Investing More: Over the last few years, regulation has eased up on banks supporting venture capital firms as LP’s. That, combined with the rise in leveraging fintech infrastructure for internal operations and banks getting flush with cash a lot over the past 3 years created a ripe environment for banks to become significantly more active in the venture capital space, particularly in fintech and crypto. A great example is Canapi Ventures—a VC firm backed by 35 banks and financial institutions that’s invested in some 🔥 fintech startups that I’m super jealous I didn’t invest in—like Alloy, Middesk, Greenlight, and Codat.

- Later Stage Fintech & Crypto Companies Are Investing More: Some of the most active CVC funds are fintech and crypto companies. FTX, Stripe, Coinbase, Binance, Circle are just a few of some really active CVC funds in the ecosystem, and more will probably be popping up over the next few years. 6 out of the top 10 most active CVC investors in fintech this past quarter were from late stage or publicly traded fintech companies.

- CVC’s Are Going Earlier: This is a much more recent trend but noteworthy nonetheless: these corporate VC funds are going earlier and earlier too. 60% of the deals this past quarter are considered “early stage,” according to CB Insights. In my opinion, going earlier for CVC’s is significantly harder but the payoff could be great—you not only get access to a company’s product earlier but are more involved in their fundraising process; which gives CVC’s a chance to pursue M&A on companies they like too.

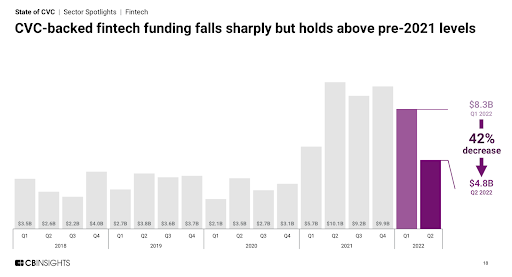

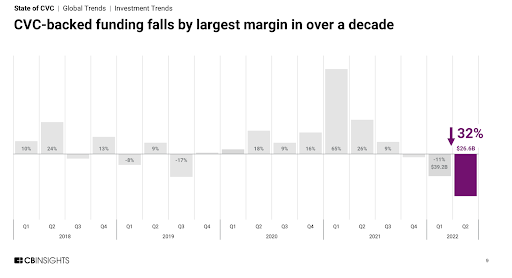

Q2 2022 was the beginning of what I suspect will be a brutal few quarters for corporate venture—while this past quarter was still the 6th highest quarter on record according to CB Insights, funding rounds with CVC’s involved fell 32%, and fintech fell even more precipitously. Geographically, fintech CVC deals only grew in LatAm and Africa—two critical regions for growth for financial services in general (hence, the interest in CVC deals.) And, like we mentioned, a lot of these CVC dollars are going to early stage companies too.

My big question for all this is: will we see a slowdown in M&A because of the lack of CVC activity? It’s fair to assume that, like most venture capital, CVC investing will be easing up from the 2021 highs. If that’s the case, then M&A should slow down too—these companies now won’t have the insight into how startups are doing nor will they have any equity ownership to build on top of. Combined with the general purse-tightening that companies are going through right now, it’s easy to think that M&A may take a hit too.

The one bright note, however, is the fact that more and more of these CVC deals are focused on early stage deals. Like I mentioned before, it’s much harder to find winners in early stage companies—there are way less metrics to analyze and a lot of it is dependent on understanding the problem, market, and opportunity very deeply. But I think we’ll start seeing more innovative partnerships and deal structures where early stage funds and corporate VC’s work together. In theory, it makes sense—funds can leverage the gravitas and expertise of a corporation while firms that invest can still get access to top early stage deal flow without having to aggressively hire a venture team. So, while M&A might dip for a bit as the market normalizes, I think as long as CVC firms focus more on early stage, there’s still a ripe opportunity for companies to be acquisitive in the long run.