ICYMI: Last week I dove into the Amazon – One Medical deal. It’s everything you need to know related to the transaction and you can find the write-up here!

We just crossed 6,000 subscribers and I’m thankful for every single one of you. Hospitalogy hits your inboxes every Tuesday and Thursday morning!

Join 6,100+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Humana does its best UnitedHealth Impression

Insurers continue to focus on building out clinical services assets.

The latest to do so is Humana, announcing during its Q2 earnings call its intentions to realign its business into two segments. By 2023, Humana will realign its existing divisions into an Insurance Services segment and its CenterWell (healthcare services) segment.

It’s a pretty notable pivot. Humana has invested significant dollars into its CenterWell division with legacy Kindred assets and joint ventures on senior clinics with Welsh Carson to build out a 100+ clinic national footprint.

The natural next step for these diversified insurance behemoths is expanding services capabilities to control the entire flow of the premium dollar. This move is just the latest in a string of activity for insurers to vertically integrate into untouchable titans of the healthcare industry.

We just saw Anthem rebrand to Elevance and its services segment into Carelon focusing on building out post-acute services. Optum continues to snatch up valuable services assets like LHC Group and large physician groups. CVS isn’t far behind, sniffing around for a primary care platform. Activity is heating up, and these titans of the healthcare industry aren’t going anywhere.

Resources:

- Humana Q2 earnings release

Healthcare Spinoffs from 3M and LabCorp

Two healthcare-related public spinoffs were announced in the past week.

Diagnostics and lab testing firm LabCorp is spinning off its clinical development business into a separate publicly traded firm. The yet-to-be-named spinoff (I hope they can do better than Anthem did but I have my doubts given that it’s coming from “Laboratory Corporation of America”) will instantly become one of the, if not the largest contract research organizations with $3 billion in revenue.

The CRO will provide Phase 1 to 4 clinical trials management and other support functions for pharmaceutical & biotech firms. Maybe they should team up with Martin Shkreli’s new Web3 drug discovery venture, Druglike!! (kidding, KIDDING)

Meanwhile, legacy Labcorp will continue its focus on the bread and butter $12.7B operation – diagnostics and testing. Management says the spinoff will allow each segment to focus on growth within their specific markets.

In a similar transaction, industrial conglomerate 3M announced its intention to spin off its legacy healthcare business into a separate publicly traded company. After the spinoff, 3M plans to own about 20% of the legacy healthcare segment.

According to the release, the spinoff will be a “leading global diversified healthcare technology company focused on wound care, oral care, healthcare IT, and biopharma filtration” that generates about $8.6 billion in revenue annually.

What exactly all of this comprises is pretty vague and from the outside looking in, it kinda looks like 3M cobbled a bunch of assets together and threw it into one company to get rid of some debt and refocus the business on other growth initiatives. I’m not an operator though.

Notably, part of the spinoff includes the Bair Hugger system which appears to have thousands of lawsuits against the product, something 3M vehemently disagrees with.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Resources:

- Labcorp unveils plans to spin out its clinical development business

- 3M will spin off its healthcare business into a new public company

CHS and UHS earnings highlights

If you missed it last week, I dove into HCA and Tenet Q2 earnings highlights. You can view the analysis here!

This week I’m covering the other two public hospital operators. TL;DR – Really quite the contrast here between UHS/CHS as opposed to HCA/THC. Here’s what you need to know:

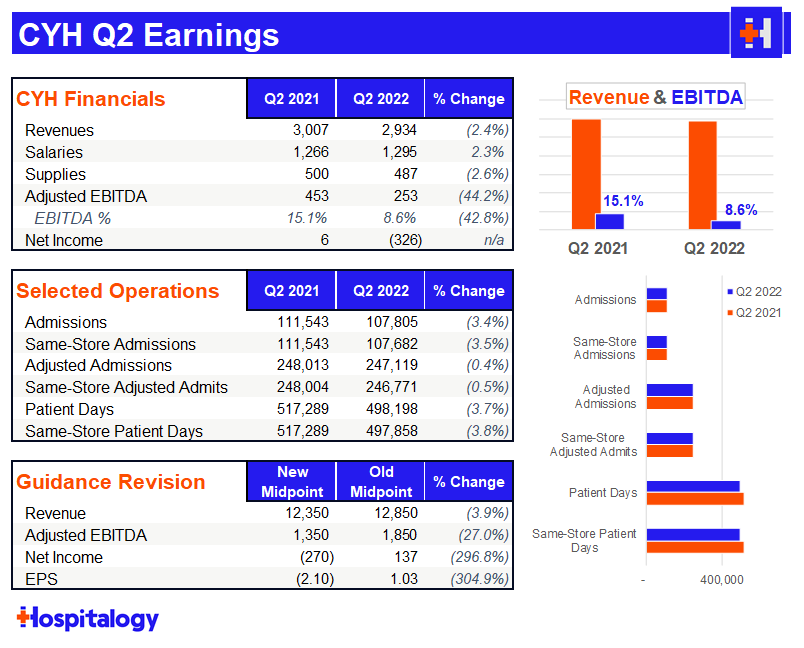

Community Health Systems declined almost 40% after some shocking misses on earnings amidst a tough operating environment for the embattled health system. The tone was pretty somber on the Q2 earnings call with CEO Tim Hingtgen outright beginning the call by saying CHS didn’t achieve the results they had expected.

Although CHS mirrored comments by its peers HCA and Tenet that contract labor was sequentially improving, the hospital operator still identified contract labor challenges as its number one priority and opportunity to improve its performance. For context, CHS total contract labor was 10% of SWB (13% in Q1) compared to HCA’s 8% and Tenet’s 6%. As far as other expenses were concerned, CHS managed them well and did a good job of maintaining or lowering its G&A and supply costs despite the inflationary environment.

Reduced capacity, lower acuity cases, and short-stay surgical patients put a ton of pressure on Community’s admissions, dropping 3.4% quarter-over-quarter. Translation: ASCs seem to be eating CHS’ lunch.

As a result, net income plummeted to -$326 million and adjusted EBITDA margins dropped to single digits. According to CHS management, just 2 of its 48 markets accounted for 20% of the total decline in EBITDA for the quarter. That’s some kind of 2 & 20.

“We do not view 2022 as the new baseline. Rather, it is a period of disruption and unusual events. Looking out longer term, we believe the stronger return of deferred care, the execution of our growth and strategic initiatives, our successful expense management, and continued focus on cash flow and capital structure management will allow the company to achieve its medium-term financial goals, which includes targets for 16%-plus EBITDA margin, positive annual free cash flow generation, and reducing our leverage below 5x.” – Kevin Hammons

CHS dropped its guidance further (after a Q1 chop) and you can see the outsized effect that labor and reduced volumes are having on its financial performance. Tough sledding ahead for CHS in the back half of the year.

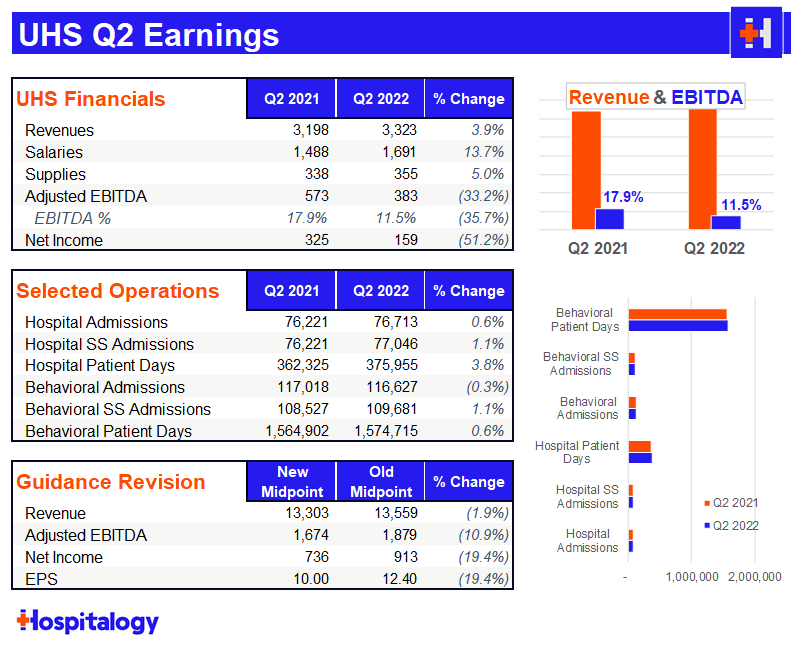

Universal Health Services dropped 7% (and since seems to have recovered) on a pretty even quarter, all things considered. The hospital and behavioral health facility operator noted similar trends to its peers in that contract labor dropped sequentially from April to June as did COVID cases as a percentage of admissions.

Still, the drop hasn’t happened as fast or as impactful as expected, and you can see below the huge increase in salaries quarter-over-quarter. Both salaries and supplies growth outpaced revenue over the QoQ period. UHS similarly experienced inflationary pressures on the labor side but in G&A or other expenses. They also seem to be having some issues with retaining nurses.

Utilization demand didn’t rebound as strongly as expected for UHS either, leading management to suspect that patients are deferring care. The deferring of care has been a major talking point since COVID began. Most believe that this trend will inevitably end up in higher acuity issues down the road for patients, which is troubling. UHS expects some recovery in Q3 and major volume recovery in Q4 as things return to a more normal environment.S

UHS gives zero F’s about payor contracting:

“I’ve mentioned in previous calls that we’ve been aggressively giving notice of termination on contracts in both the acute and the behavioral business at a pace faster than quite frankly, I can really remember ever historically because as we identify contracts that simply in our minds, are not even remotely keeping up with inflationary pressures and labor pressures.” – Steve Filton

Madden’s Musing: After a strong 2021 and a perceived resurgence in the vitality of Community’s hospital offering, they’re back to square one. It seems as if CHS was caught off guard by seeing certain short stay inpatient cases shift to outpatient classifications, which affected reimbursement significantly. The one bright spot for CHS seems to be its lack of debt covenants in the near-term as it tries to de-lever.

Hospital operators and other services based biz’s have seen declines to profitability in the challenging operating environment.

As far as overall hospital activity is concerned, it looks as if all 4 hospital operators are optimistic about the continued wind-down of contract labor and expect better operating performance in the back half of 2022.

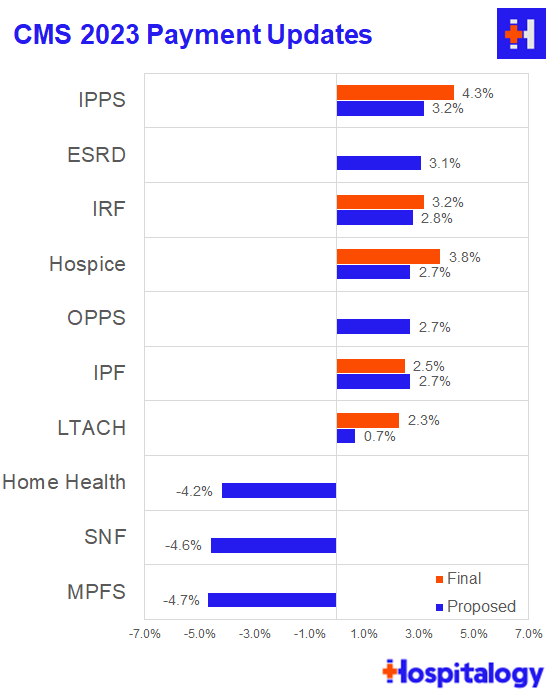

As I’m writing this, CMS just dropped its final IPPS rule (more below), lifting rates by 4.3%, so things seem to already be perking up for hospitals

Resources:

- Community Health Systems Q2 earnings release

- Universal Health Services Q2 earnings release

Market Movers

The Inflation Reduction Act has ironically turned into a healthcare heavy bill and has some very notable provisions. Although it’s not in final form, the legislation would let Medicare directly negotiate 10 prescription drugs starting in 2026, extend ACA subsidies thru 2025, and cap Part D out of pocket spending at $2,000 beginning in 2025. In total, savings for drug negotiation are expected to reach $288 billion while subsidies will cost the feds $64B. I’d love to see that other $220B devoted to some better healthcare initiatives.

CMS released 4 finalized payment rules over the past week:

- IPPS and LTCH: 4.3% lift for IPPS and 2.3% for LTCHs (substantially higher than the IPPS proposed 3.2% after a ‘gentle’ nudge from Congress). CMS is also distributing ~ $6.8B in uncompensated care payments in 2023, a decrease of $318M from 2022.

- IRFs: 3.2% lift

- Hospice: 3.8% lift

- Inpatient Psych: 2.5% lift

- Skilled Nursing: 2.3% cut (up from a proposed 5% cut – CMS is phasing in the cuts required by the new PDPM payment model)

Make sure to check in here as CMS finalizes other verticals. All I can say that a lot of the physician crowd is going in on this announcement. I’m sure the post-acute players are feeling a similar way.

Inova Health announced a partnership with prevalent urgent care player GoHealth. As part of the JV, Inova will contribute 7 of its urgent care centers to GoHealth’s existing footprint across Northern Virginia. GoHealth is forging major relationships in the health system department across several big players, including Henry Ford and Memorial Hermann.

Direct primary care startup Everside Health withdrew its IPO plans and raised $164 million privately to continue building out its clinical capabilities (behavioral health) and pursue potential M&A strategies.

Mercy Health and the Mayo Clinic announced a 10-year partnership to share clinical data. Algorithms! Machine learning! Patient outcomes! It’s all there.

After pausing the shipments of its Tablo Hemodialysis System during Q2, Outset Medical announced that its device received clearance to continue shipments of its device for home use.

New York City has sued CVS over its 340B practices, asserting that CVS engaged in anti-competitive practices related to the 340B program and forcing safety net hospitals to use CVS’ Wellpartner 340B administrator in order to collect savings.

In other suing news, HCA has been sued by Asheville for alleged antitrust practices after its acquisition of Mission Health, which appeared to already have antitrust complaints prior to the transaction. In addition, a union-backed investment group submitted an SEC complaint purporting that HCA’s corporate strategy includes targeting higher than normal Medicare ED admissions in order to boost its hospital ops’ bottom line. Although I get the logic, it’s hard to imagine that HCA is forcing people to visit their ERs and then compelling physicians to admit them.

In your final legal healthcare news update for today, keep an eye on the United – Change Healthcare case. TL;DR – the Justice Department is arguing that OptumInsight would essentially get a monopoly on data clearinghouse operations exacerbated by the fact that United’s competitors literally use Change for that purpose. United/Optum says these allegations are far-fetched and represent a fundamental misunderstanding of the insurance industry. Coming up next: we’ll see just how well the DOJ fundamentally understands health insurance! Read more here.

I lied, one more: Meta, UCSF, and Dignity Health Medical Foundation are facing a class action lawsuit related to data collection practices. Specifically the lawsuit alleges that the organizations collected sensitive healthcare data through Meta’s (Facebook’s) pixel and subsequently were targeted with ads based on that data.

Revenue cycle AI management startup Olive laid off about 450 folks in mid July.

Q2 Earnings Roundup (I may get to some of these next week):

- Chemed earnings

- Amedisys earnings

- Acadia Healthcare earnings

- Molina Healthcare earnings

- Encompass earnings (and insights into Enhabit’s growth – looks like both its home health and hospice segments saw revenue declines in Q2)

- DaVita earnings

- Outset Medical earnings

Miscellaneous Maddenings

- So I shot an 80 at Pecan Hollow on Sunday and am actually kind of disappointed with the result…I drove the ball better than I ever have (capped off by a 358 yard drive and subsequent birdie on hole 10 – maybe one of my best holes ever) but couldn’t get the rest of the game together. Putting was miserable with several 3-putts and my irons were all over the place. Someday I’ll piece it all together!

- The wife and I saw Where the Crawdads Sing in a matinee. Solid 8 out of 10 but I hope she didn’t murder anyone in Zambia.

- This curious river otter made my morning.

- So fantasy football is right around the corner (as is college football, Hook ‘em) and I’ve realized I’ve done next to no research on the offseason. Who are the top picks? Sleepers? Man I gotta get on that grind ASAP.

Hospitalogy Top Reads

- VMG Health released its flagship report on Healthcare M&A and valuation trends in 2022. It’s a great look across the healthcare services industry at partnerships and activities among the various verticals especially looking at multiple trends before and after COVID.

- Politico wrote a great deep dive into the caregiver crisis and the coming shortage of workers needed to care for the elderly.

- I enjoyed this write-up of Hinge Health and the MSK market (if albeit it was a little sales-y toward Hinge, which I don’t mind)

- Tech-enabled primary care has been top of mind for me lately and I wanted to reshare an essay from a couple of months ago that I really enjoyed from Next Ventures.

Join 6,100+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!