To my fellow Hospitalogists,

I’ve been having a blast connecting with thoughtful healthcare folks over the past few months since launching Hospitalogy. If you want to hang out with a healthcare degenerate for a bit (especially if you’re in Dallas), feel free to reach out!

Next week we’ll be returning to regularly scheduled programming with Tuesday being the weekly news roundup and Thursday the deep dive.

Hospitalogy hits your inbox every Tuesday and Thursday. We’re closing in on 6,000 subscribers!

Join 5,900+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

HCA Healthcare and Tenet earnings breakdowns

You alreadyyyy know it’s that time of year once again for a dive into the hospital operators’ Q2 earnings! Here’s everything you need to know – please don’t read the transcripts like me.

Common themes for HCA and Tenet:

- HCA returns to business as usual, Tenet exceeds expectations, as I’m writing this, CHS is plummeting off the face of the earth (more to follow on Tuesday), UHS results in-line

- Contract labor winding down after Q1 high’s

- Inpatient admission softness, but more or less a return to ‘normal’ demand on the utilization front. It seems like hospitals are continually facing inpatient volume softness amid continued shift to outpatient and newer entrants targeting reducing hospitalizations

- Inflation pressures being managed and so far, payors seem to be playing ball with hospitals on commercial rate lifts for 2023.

- Hospitals are expecting a return to healthcare seasonal utilization patterns

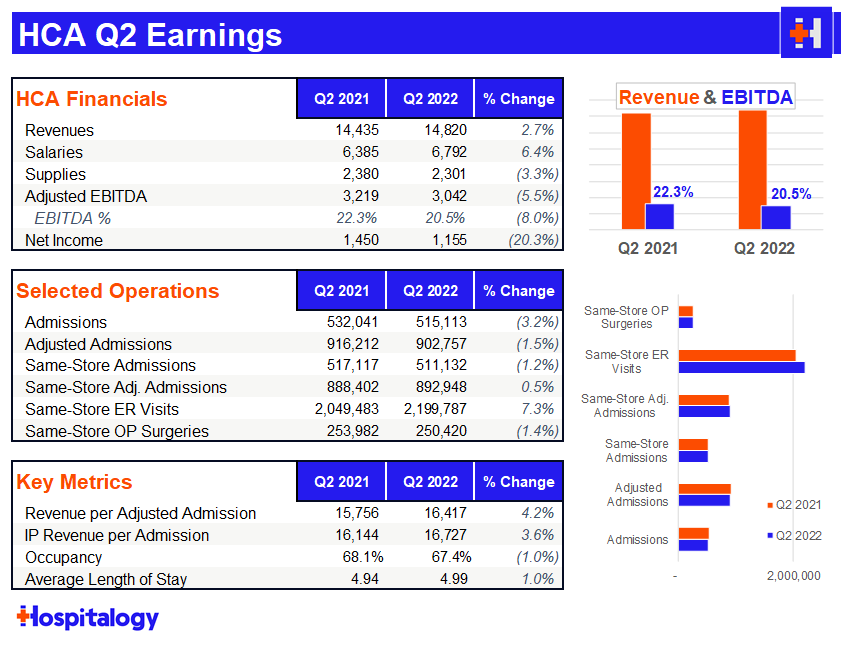

HCA: Back to business as usual

After a heavy selloff from HCA in Q1, it’s no surprise to me that the hospital giant bounced back in Q2. As far as Q2 major themes were concerned, I was keeping an eye on labor woes and HCA’s comments on ongoing payor contract negotiations.

HCA had an absolute slam dunk on the labor side, reducing costs 22% in June compared to April with additional management commentary that there’s still more room to fall there. HCA also mentioned it made a ‘fairly sizable’ wage adjustment to nursing salaries and expected another market adjustment in the mid-single digits for this year as well, so some pretty material wage increases there – a good sign for nurses.

As another interesting data point on labor, HCA is really leaning into its Galen nursing education partnership. HCA opened 3 Galen nursing colleges in Q2 with 2 more slated for 2H 2022.

Right now the Galen nursing footprint is up to 13 with 6-8 additional schools opening up over the next 12-18 months, with at least one in each major market HCA operates within. ~10,000 nurses graduate from Galen facilities each year, a huge pipeline for HCA (assuming the nurses choose to work at HCA facilities) along with other existing academic partnerships.

Analysts harped on commercial pricing quite a few times, trying to peg a concrete number on what HCA was expecting as far as average overall price escalators for 2023. HCA noted it normally sees between 2.5% – 4% on rate lift and expects ‘mid-single digits’ for 2023, so likely somewhere in the 4-6% arena.

While asked about inflation at 8 or 9%, HCA mentioned that this big of a hike was unrealistic. HCA also has inflationary provisions in place in many of its contracts with payors. Here’s a relevant quote from CEO Sam Hazen:

- “We are seeing some early success recognition by the payers, and we expect the payers to appreciate the overall inflationary environment that the providers are in. But we’re seeing some early recognition of that and some renegotiated contracts have reflected more escalation in pricing than what we had seen in our past trends. As I mentioned on the last call, we’re pretty much contracted for 2022, obviously. But as we look to 2023, we’ll start to see some uplift in our contracting pricing, reflecting the new contracts. And then on ’24, we fully anticipate having a different trend on our pricing as a result of these renegotiations.”

HCA brushed off any thoughts on Amazon’s purchase of One Medical, calling primary care multi-faceted and no expectations of any sort of paradigm shift in the space.

Regarding utilization trends, overall demand for services was not as strong as expected, but overall, demand has largely normalized for HCA – a return to healthcare normalcy, if you will. HCA expects volume softness on the inpatient side (1-2% growth) and a bit more growth in-line in the outpatient setting. ‘Rona admissions comprised about 3% of total admissions, down 70% from Q1.

Although HCA lowered guidance in Q1, HCA retained that 2022 outlook during the Q2 discussion.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

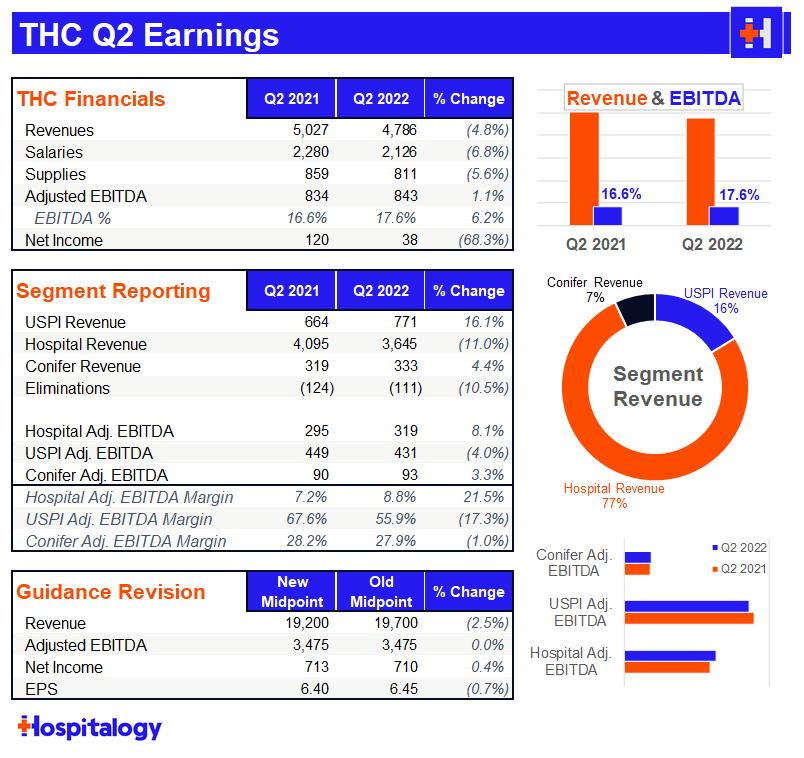

Tenet: Resilient

The most notable part of Tenet’s earnings discussion was the fact that it estimated its Q2 cyber attack cost $100 million in Adjusted EBITDA!! $100 million!! Tenet expects a payout from insurance to make up for the lost $$ from the cyber crime. In spite of the lost revenue, Tenet reiterated its full year 2022 guidance which means they expect major operating strength during the back half of the year.

I have to give a lot of credit to Tenet. Despite it all, the continues to execute well on its plan to scale USPI through announced acquisitions with the likes of United Urology and buying out long time JV partner Baylor from its equity stake (remaining 5% at a $406 million equity valuation). The buyout provides Tenet with another $25M incremental increase in earnings. USPI continues to be the growth engine for the company, achieving 7% market share in the ASC industry while Tenet invests $200+ million into the segment annually.

Tenet continues to harp on the fact that it deserves a higher multiple given its focus on outpatient & higher margin ops and I tend to agree with their thesis given the strategic pivot.

Tenet is more insulated from contract labor given its structure and continues to fully capitalize on the migration to outpatient. Nothing personifies this better than Tenet’s contract labor as a % of SWB sitting at 6.2%, significantly lower than HCA’s of 8+%.

USPI’s EBITDA grew 15% and achieved 2019 levels of utilization while Conifer continued to chug along just fine.

Tenet extended its national contract with UnitedHealthcare thru 2025, covering all facilities and terms Tenet was happy about. As far as rate lifts, Tenet echoed HCA’s sentiments and expects to see 3-5% increases for 2023.

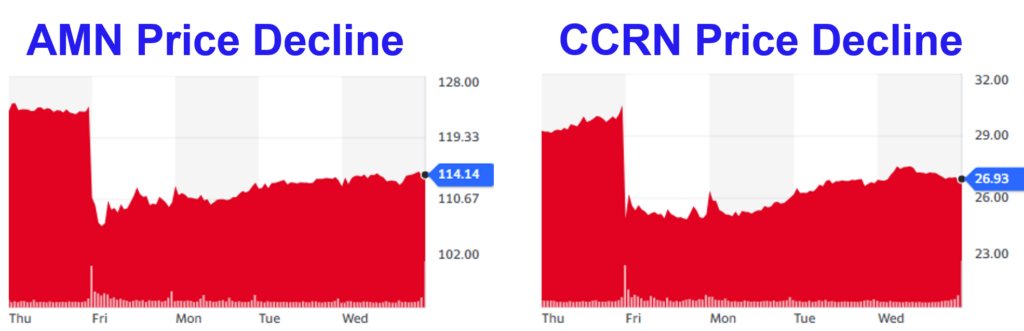

Staffing firms drop on hospital earnings

AMN Healthcare and Cross Country Health Care, two of the main beneficiaries riding the travel nursing wave, saw some pretty heavy declines after comments above from HCA and Tenet mentioned a wind-down of travel nursing contracts.

A smarter investor than I would know how to make money and trade these dynamics! It was an interesting little tidbit and a good reminder that one company’s cost center (staffing) is another company’s margin (agency).

Resources:

- HCA Q2 earnings release and earnings call transcript

- Tenet Q2 earnings release and earnings call transcript (seeking alpha soft paywall)

Cigna Plays Hardball with High-Cost Physicians

A fascinating thread emerged on Tuesday regarding Cigna’s negotiating tactics with traditionally high-cost physician specialties like anesthesiology and emergency services. I should note that these two specialties are more consolidated and historically have had a high prevalence of PE investment activity in the space. These groups have been in contention with payors for a while now with lots of lawsuits abound.

Anyway, according to the thread, Cigna is demanding 15% all the way up to 50% rate cuts for ER and anesthesia groups during contract negotiations, and in this case, Cigna has all of the negotiating leverage.

Why? Because of the arbitration provision in the recently passed No Surprises Act. Under the NSA, payors and providers get sent to arbitration when they can’t agree on payment for healthcare services performed when the physician or medical group is out-of-network.

To figure out final payment for out of network services, an arbiter references each party’s payment offers along with data & resources to support those price points.

Because payors have way more data points and more or less set the median in-network rate, Cigna is playing hardball with these docs during contract negotiation. Cigna (and seemingly other payors as well) is saying “take this rate cut or we’ll force you out of network, which will be way worse for you because we’ll win in arbitration.”

Madden’s Musing: For the record, I’m a fan of letting health insurers negotiate down high-outlier, high cost physician groups if they’re gouging the system. Totally for that. What I’m worried about, though, is how this negotiating tactic and overwhelming payor leverage might translate to other physician groups and specialties.

What incentive do payors have to come to the negotiating table with any physician organization if they can just get a few groups to go in network and leverage that in contract renegotiation / NSA arbitration to destroy reimbursement?

If payors are successful in negotiating commercial reimbursement down by 30% in one or two specialties, I can’t see why they wouldn’t permeate the policy to other specialties, but I could be wrong.

This is something to keep an eye on and could potentially create a troubling dynamic if payors abuse NSA arbitration beyond the current scope.

I’d love others’ comments on this dynamic to see whether there’s more nuance here that I’m missing!

Resources:

- Here’s the link to the original tweet thread

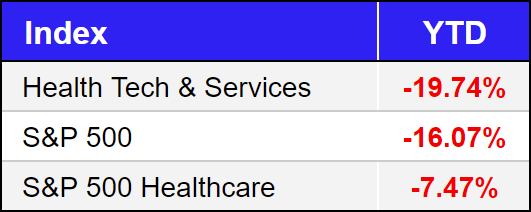

Market Movers

Here’s a handy earnings roundup for you guys (unfortunately I can’t cover everything, I know):

- Elevance earnings. Elevance also gave up its NYC MA contract amid ongoing litigation.

- Centene earnings

- Humana earnings

- Option Health Care earnings

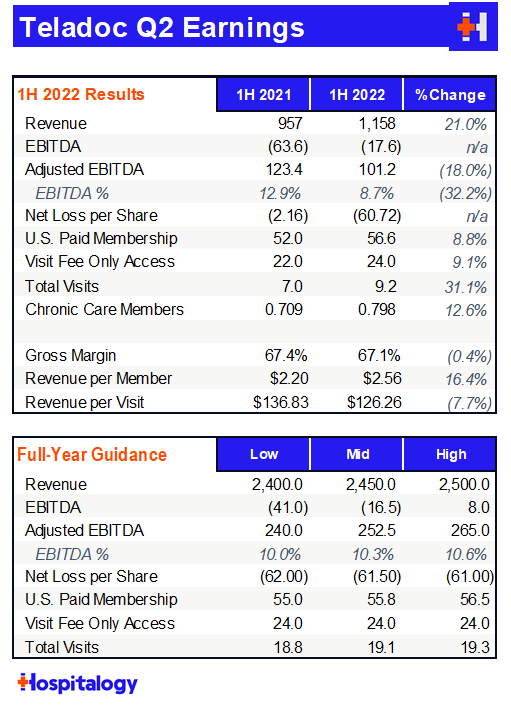

Teladoc released its Q2 earnings and surprisingly had to recognize another $3 billion impairment charge, or $18.78 per share. For those unfortunately keeping tally, Teladoc has had to recognize total impairment charges of $9.63 billion in the first half of the year mainly stemming from the all-stock Livongo acquisition. Teladoc also finally found a new COO – industry veteran Mike Waters will head the operations at the embattled primary care platform.

agilon fell prey to a new short report from notorious shortselling firm Citron Health on Wednesday. After scanning through the 11-page report, the document really reads like a hit piece to me and lacks basic understanding of things common in value-based care and agilon’s business model, including “what is the value of a Medicare life?” and “direct contracting is the privatization of Medicare” and finally, Stark Law’s applicability in value-based care relationships. Laughable. Buy the dip (this is not investment advice)!!

7wireVentures and OMERS Ventures announced the launch of Caraway, a new startup focused on college-aged integrated primary care for women, with $10.5 million in initial funding.

Oui Therapeutics, an incredibly cool startup developing an app aimed at suicide prevention, raised $26 million in its initial launch.

Health Catalyst announced a couple of partnerships this week. The data analytics and patient engagement firm partnered with LifePoint Health, one of the largest for-profit health systems in the country, to offer quite a few of its platform’s services for the goal of reducing clinical variation at LifePoint facilities. Additionally, the firm announced a smaller partnership with MemorialCare to offer its Twistle communication service to pediatric cardiology patients.

Aveanna released preliminary Q2 earnings and revised guidance lower, citing ongoing labor market challenges. Aveanna dropped expected revenues to at-least $1,785 million, down from its expected ~$1,900 million and also dropped expected Adjusted EBITDA by about $50 million.

A group of 6 risk-based players (Aetna, Aledade, BC of California, Health Net, Oscar, and UnitedHealth) signed a memorandum of understanding to increase their investments in an ‘advanced primary care’ program in the state of California. It’s an initiative aimed at helping primary care practices transition to value-based care and standardize data practices.

The next ACA challenge in courts will determine whether part of the law requiring coverage of preventive services is unconstitutional, which continues the string of unconscionable lawsuits against providing people with access to healthcare.

Everyone’s favorite Martin Shkreli just launched a Web3 drug discovery platform called Druglike.

Miscellaneous Maddenings

- I hope everyone’s enjoying Shark Week as much as I am! I know…I’m a freak. Hit me with your favorite species of shark. Mine is, of course, the Great White. Basic.

- Gary in Chicago might be the most hated employee at Facebook after this incident at the latest all-hands meeting.

- With football season upcoming, I just wanted to remind everyone that I’m an avid Texas Longhorns fan, and every time Jennifer Lopez has gotten married in this millennium, Texas has had an 11-win season the same year. Coincidence? I think not.

Hospitalogy Top Reads

- Bain released a wonderful healthcare report on primary care innovation models and what they expect to see by 2030.

- STAT dropped an opinion piece on value-based payments and how the models are producing ‘little value.’ I’m sorry, but I have to vehemently disagree. Halting or killing VBC models right now would nip in the bud what’s about to be a major catalyst for healthcare over the coming decade. You have to financially incentivize change through policy first in order to get operators to transform their business models, and we’re finally seeing that happen in a material way. To me, these first iterations of VBC are less about actual cost savings and more about incentive alignment and a massive shift in the way that traditional players operate, a behemoth of an undertaking. This is actually the worst time to halt risk-based initiatives. While fee for service currently and likely always will have a place in healthcare, the potential to align incentives through VBC is too enticing to give up on. Miss me with this opinion.

- You should read this insane story related to Alzheimer’s research. According to the article, two decades worth of research into Alzheimer’s might be faulty and based on deliberate fraud. It’s incredibly frustrating to read stories like this and wonder what could have been if people could just maintain their integrity.

Join 5,900+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!