28 June 2022 | Cannabis

Terpene testing for all, taxes and transparency, and where we’ll be next year.

By Kaitlin Domangue

So, I’ll be honest y’all. I am basically on board the “terpenes are overhyped” train.

And it’s NOT because I don’t think that terpenes are valuable. It’s because I see some people placing way too much emphasis on terpenes and forgetting about cannabinoids, enzymes, and the countless other chemical reactions that happen when cannabis meets our body.

Overhyped. Not unimportant.

Terpenes are wildly important and they do play a part in how certain varieties affect us. This study is just one of many uncovering the anti-inflammatory properties of myrcene, limonene, and caryophyllene.

So while I don’t think consumers should be basing their purchasing decisions on terpene profiles alone, testing for terps is important.

This gives consumers a chance to see a more comprehensive product profile. It also holds brands accountable for how they market their products.

But, it’s not that easy. Here in the United States, our cannabis market is fragmented. It’s a patchwork of laws from state to state, even county to county.

At one point, Arizona’s medical cannabis program didn’t even *have* testing laws. You can imagine how inconsistent terpene testing is across the nation.

That means getting all 50 states to agree on anything will be a challenge.

Testing is expensive. Producers are paying anywhere from $300 to $700+ for one sample. Some states might also end up paying more than other states for additional testing if terpenes are required to be part of the panel.

There’s also the unfortunate fact that some testing labs aren’t reliable. One Praxis, Washington lab was shut down after falsifying THC results on over 1,200 samples. There are similar stories in other states.

What I’m thinking

I wish the whole country tested for terpenes, too. I really do. They are a vital part of the cannabis plant and every variety’s unique characteristics. Terpene profiles also give us key insights into how each variety affects us.

I don’t see all legal states testing for terpenes anytime soon, though. Not until federal reform forces standard regulations across the whole industry. In Canada, terpene testing is not required across the country, but cannabis is federally legal.

There are just too many operational burdens at hand in the United States’ current market, including the cost of testing and ensuring all lab results are accurate.

I think there’s also the challenge of discovering new compounds in the future or wanting to expand cannabis testing in some way. I hope national laws are flexible enough to account for the new science that will emerge after federal restrictions are lifted and more studies are conducted.

Awkward.

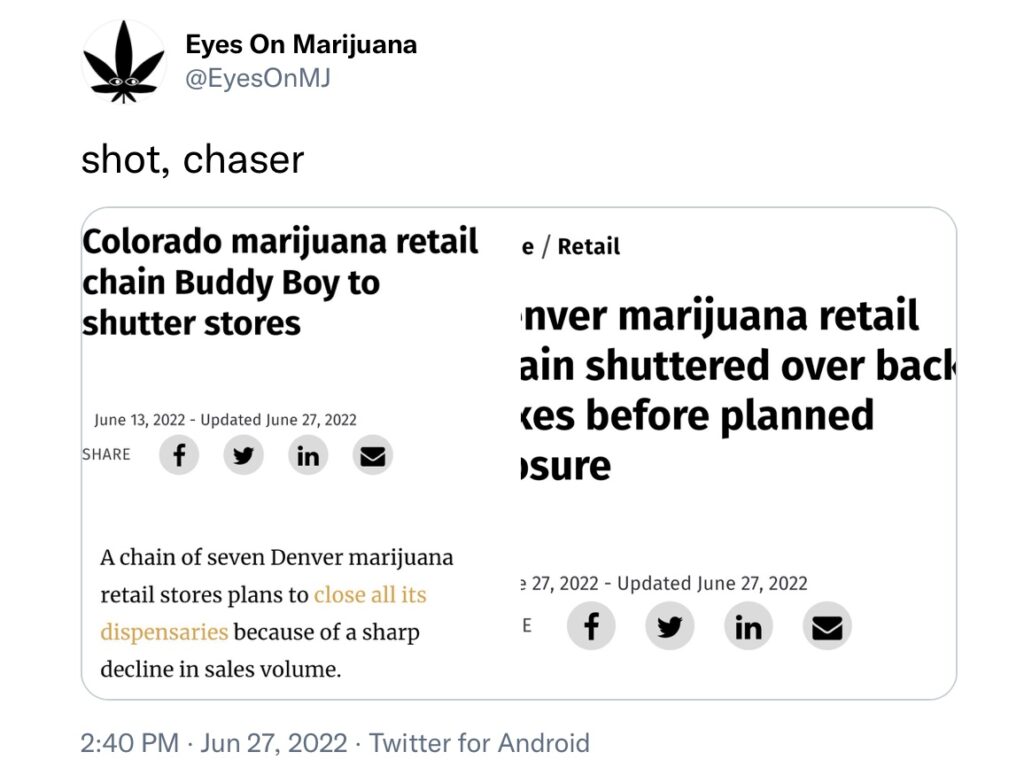

I just touched on this in a recent newsletter. Buddy Boy retailers initially blamed the closure on a sharp decline in sales volume, stating Colorado’s new limits on THC interfered with 90% of Buddy Boy’s revenue.

But it’s now coming out that the Denver Department of Finance closed the retailer down. The Buddy Boy retail chain apparently owed $500,000 in back taxes at the time of closure.

Even worse, this news was discovered by shoppers. Customers visited a retail store hoping to take advantage of going-out-of-business discounts but instead found notices explaining Buddy Boy’s past-due taxes.

Buddy Boy said June 17th was the last day of operations, but the City of Denver had actually shut them down days prior. The owner of the retail chain acknowledged he owed the city money and was working to pay it back.

Like other states, Colorado’s tax structure is burdensome for legal cannabis businesses. Proposition AA allows Colorado to take up to a 15% excise tax on unprocessed cannabis, as well as a 15% tax on retail cannabis – effectively taxing anyone and everyone they can. Medical cannabis is subject to a 2.9% state sales tax.

Mature markets are beginning to see the ramifications of tax structures that don’t favor cannabis businesses, especially in the glaring absence of federal legalization. California’s market is especially volatile, with industry operators warning of its impending collapse without federal interference.

State taxes are steep on their own, but cannabis businesses are also paying federal taxes. And there’s no way to offset the cost of expenses. Tax code 280e prevents legal cannabis operations from claiming ordinary business expenses on their taxes, drastically reducing the company’s net profit.

What I’m thinking

I’m well aware of the challenges facing legal cannabis operators. Paying your light bill can be a challenge some months, much less paying taxes. I don’t fault Buddy Boy for not being able to pay taxes.

I do, however, think the retailer should have been way more transparent than they were. Maybe revenue really was down after THC limits were imposed, but there was no mention of unpaid taxes, which makes this all look a little suspicious.

If I were the Buddy Boy operators, I would have spoken out about this a long time ago. It likely wouldn’t have kept the doors open, but it would have drawn more attention to the crushing restrictions legal operators have to face. It also would have added much-needed transparency to the store’s closures.

I’m using my own opinion today – because this question gets thrown my way a lot (which makes total sense).

“Do you think cannabis will be federally legal this time next year? What do you think the industry will look like?”

I hate to break it to y’all – but I don’t even know what the cannabis industry will look like one hour from now. One of the only surefire predictions I can give you is that the cannabis industry is growing.

I’m also 99% sure we’ll leave 2022 with newly-legalized states in tow after the mid-term elections in November. But it’s hard to make predictions beyond that, especially when you start asking when cannabis will be federally legal.

I do not believe it will be federally legal this time next year. BDSA doesn’t predict cannabis legalization until at least 2026, and I put myself in the same camp.

For many, hopes of federal legalization in the near future were dashed about 6 months after President Biden took office. It became apparent that cannabis reform wasn’t a priority to him or Vice President Harris.

And in a nation ravaged by a pandemic, social justice issues, and more: it would make sense that cannabis legalization isn’t at the top of his to-do list.

The problem is that cannabis legalization was talked about by both Biden and Harris on the campaign trail in 2020, when the effects of the coronavirus pandemic were very much a factor and therefore not a surprise entering office.

What I’m thinking

So I guess I can’t say when federal legalization will happen, but I am almost certain I can’t say it won’t be next year.

Federal legislation just isn’t gaining traction like it should. We haven’t even passed the SAFE Banking Act, much less policies to legalize cannabis at the national level.

This time next year, I hope and pray we at *least* have SAFE Banking. I can’t imagine sitting in the same spot next year, but honestly – this is where we’ve always been.

One more year might not make a difference in the grand scheme of things, but I’m also thinking about those operators who don’t even know how they’ll make it to next month. Even one more year could mean closed doors for them.