Hospitalogy Round-up: 5.3.22

Happy Tuesday, fam!

- This week we’re diving into the end of the travel nurse saga, and why I think there isn’t a public digital health bubble, along with this week’s M&A, earnings, and favorite reads.

Let’s get after it!

New here? Subscribe to Hospitalogy today

LABOR

The Travel Nursing Saga Nears its End

Demand for travel nursing has dropped since April, echoing comments from top hospital operators that May and beyond will see the labor market continue to right-size.

Both AMN Healthcare Services and Cross Country Health Care are expecting sequential declines in revenue and earnings during Q2. Their forward guidance signals that contract labor services even among the largest staffing firms is slowly trickling in the downward direction.

Madden’s Musing

As long as Covid doesn’t surge again, there will be lower and lower demand for travel nursing and contract labor. The labor market will stabilize as these nurses return home to local health system jobs. Nurses will still benefit from better base pay which I view as a net positive, but it’ll be a welcome return to normalcy for hospitals nationwide.

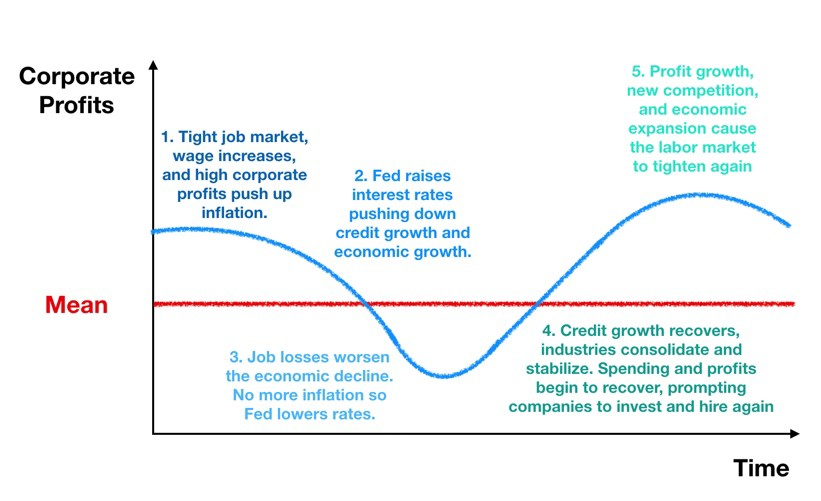

The dynamics involving travel nursing and hospital systems is a telltale sign of the macro economic environment unfolding before our eyes. We’re in a contractionary part of the business cycle. Production is declining (shortages, etc), wages are rising, and therefore inflation is picking up. At the same time, capital is tightening as the Fed increases interest rates.

Here are my biggest questions – have nurses permanantly left the industry? If there’s another Covid surge, how do things play out with contract labor? Will smaller operators be able to support higher nursing salaries, or will they be forced to shut down bed capacity / census? Finally…how does this bode for the future of healthcare as utilization demand increases while workforce shortages wreak havoc?

One fact remains certain: This is the new normal.

Resources

- Hospitalogy Q1 hospital earnings analysis

- Cross Country earnings announcement

- AMN Healthcare earnings announcement

- Travel nursing cuts

- Hospitals look to raise treatment costs as nursing salaries increase

BUBBLES!

Public healthcare valuations continue to plummet

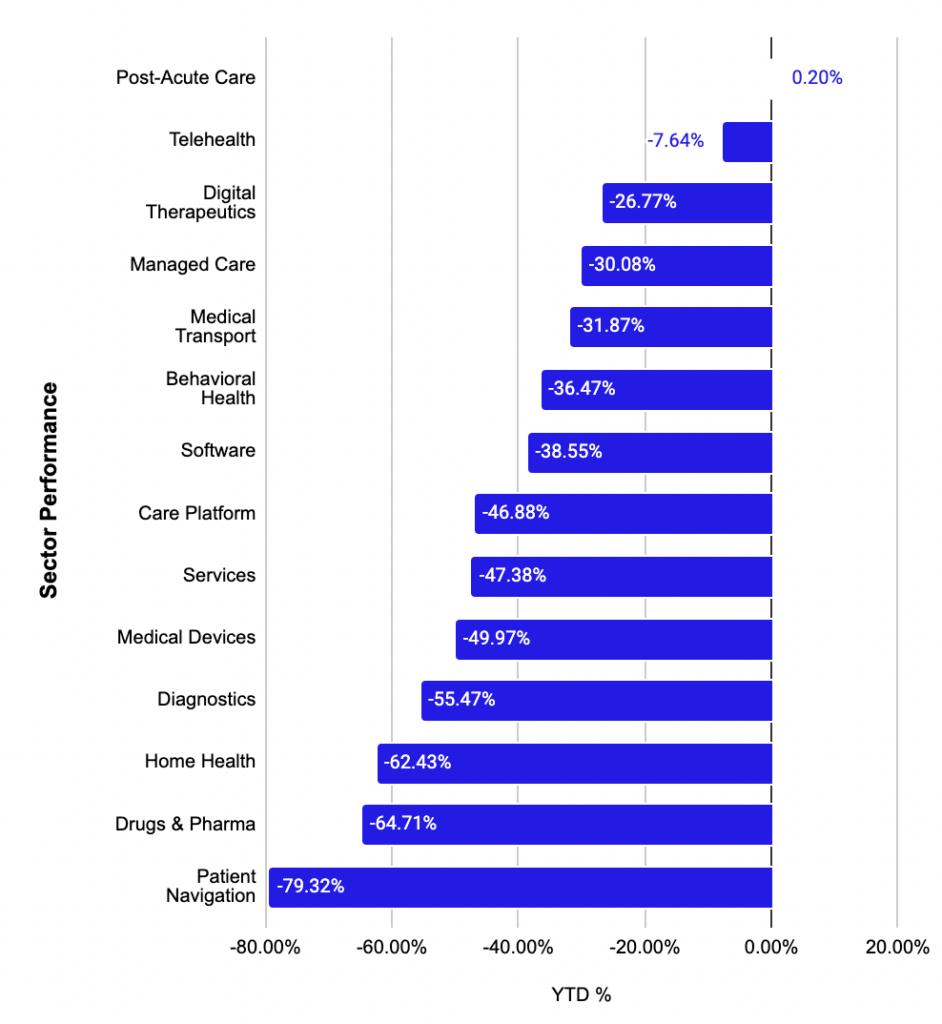

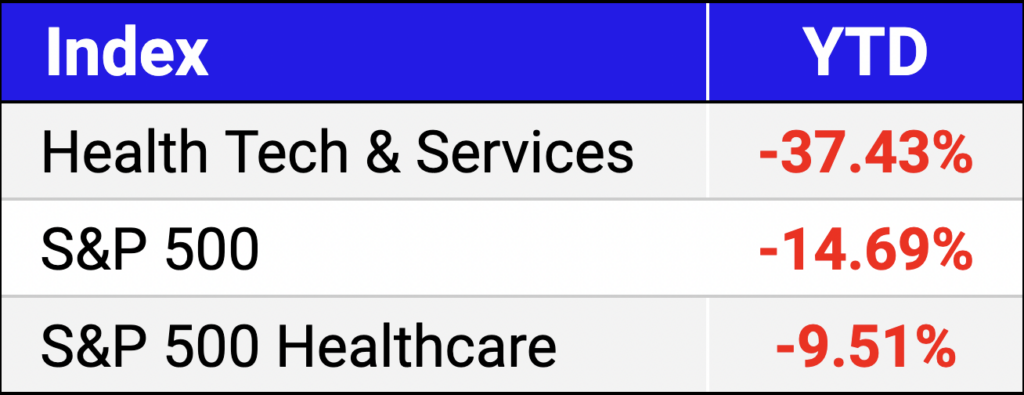

Rock Health posed the question this week – is digital health in a bubble? Their answer, after going through several self-defined qualitative and quantitative factors was…not really, but things are frothy out there. While the question was more-so posed to the private markets, I wanted to touch on the topic for public market valuations and whether there’s still a bubble today.

My brothers and sisters, the digital health bubble has come and gone in the public markets. Not only are we no longer in a bubble, we’re in a damn bear market out here. Speculation and investor excitement for this wave of digital health firms is at an all-time low right now, which mirrors share prices.

Based on what’s been happening in the markets this year, valuations are suffering. Apart from SOC Telemed, whose share price literally decayed 80%, then was purchased less than a year after it went public for a 300% premium, no digital health player is even close to green this year.

All-time, including ApolloMed and Teladoc, some of the more successful players, my digital health index is down 60%. That’s an index, not a single stock.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

For whatever reason, public markets seem to hate healthcare services stocks and relatedly, digital health stocks. My theory is that they don’t grow fast enough for them. A healthcare company is intrinsically hard to scale.

This effect creates attractive valuations in the public markets for strategic buyers. Players like Optum, CVS, Humana, and others will look to capitalize on the Health Tech Bear Market to buy some great strategic assets on the cheap. Plus, private investors will start to swoop in, unlocking value that the retail investor fails to see. We’ve seen public-to-private transactions in the services sector (Envision, LHC Group, HCA, LifePoint) – why not with players like Cano, CareMax, Talkspace and other embattled telehealth players?

My final question posed to you guys: Will the massive public washout have an effect on private valuations and investment dollars pouring in to the space? I think any changes to digital health investments will have less to do with digital health business fundamentals, and more to do with the current macro environment.

Market Movers

Big Winners: Bright Health (+22%), InnovAge (+7%), that’s about it folks.

Big Losers: Outset Medical (-37%), Phreesia (31%), Skylight Health Group (27%).

- Like I said, digital health experienced another mass selloff given the current market. I mean, the S&P is down 15%. Any sort of growth asset right now not producing cash flow is getting absolutely smashed. Health tech is the unfortunate recipient of that fact.

Intermountain Healthcare announced a partnership with venture capitalist firm General Catalyst. This move is especially notable because you might recognize some of General Catalyst’s portfolio companies in digital health – including Transcarent and Olive.

agilon and United Physicians announced a partnership – United Physicians is one of the largest independent physician groups in Michigan. Agilon will help the group transition to full-risk, similar to Privia and other groups pursuing value-based initiatives. Agilon has been busy this quarter, announcing its partnership with MaineHealth just in March. It also slightly annoys me that they purposely don’t capitalize their company’s name, but I can get over it since they have a cool business model.

Similar to the agilon news, primary care management platform Skylight Health acquired NeighborMD – a 9-practice primary care group – and is entering into full risk MA contracts.

A couple of notable insurer program roll-outs this week – UnitedHealth dropped a new virtual physical therapy program, partnering with Kaia Health (last valued at $4.8 billion) on the rollout. Meanwhile, Cigna announced the launch of a new provider consult service for oncology care, which seems to allow oncologists to access more nuanced specialists in the aims of improving cancer care coordination. Finally, Anthem closed its Integra deal this week, adding 40k Medicaid beneficiaries to its membership roster.

Prior to the Healthcare Realty Trust merger with Healthcare Trust of America, Welltower reportedly made a $5 billion offer for HRT that was rejected. Dramaaaa.

Centene is selling two of its pharmacy businesses separately – MagellanRx to Prime Therapeutics, and PantherRx to a few private buyers – for a total of $2.8 billion. Keep on your radar here that Politan Capital Management has a couple seats on Centene’s board and is doing quite a bit of active investing at the imbattled insurance giant.

Cedars-Sinai is dealing with a 5-day worker strike on the heels of the end of a Stanford nursing strike that concluded just last week.

GoodRx appointed three C-suite executives in one day today. Has that ever happened before? Oh yeah, their stock plummeted 30% after losing a grocery partner, announced during its Q1 earnings. I’m personally kind of shocked and bummed to see GoodRx fall from grace. It seems like the firm is failing on certain key strategic initiatives including expanding its presence into other areas of healthcare, and now this. Hopefully things can turn around at GoodRx and generate some positive news for the sector.

Q1 Earnings Roundup

Here’s a roundup of all the names that reported earnings this week. Lots of good growth going on despite what the macro environment is saying. I really think the best operators are going to continue to differentiate themselves from the lumped-in digital health trade right now.

- Ascension’s $884 million loss

- Kaiser’s $961 million loss

- Sutter’s $184 million loss

- Insurer Earnings Roundup

- Alignment Earnings

- Agilon Earnings

- ApolloMed Earnings

- Select Medical Earnings

- Surgery Partners Earnings

- Talkspace Earnings

- Bright Health Earnings

- Acadia Healthcare Earnings

- Oak Street Health Earnings

- One Medical Earnings

- Amwell Earnings

- Signify Earnings

- Him & Hers Earnings

- Clover Earnings

- AmWell Earnings

- ATI Physical Therapy Earnings

- Lifestance Earnings

- DocGo Earnings

Madden’s Musings

- This insane video of the Kentucky Derby comeback win – Rich Strike for the win at 80 to 1 odds!!!

- The Fed raised rates by 50bps, its largest interest rate raise in a minute. Q1 worker output fell 7.5% in Q1. Pretty crazy – anyone think we’re headed for a recession / stagflation? The alarm bells are ringing. At least my high interest savings account will get another 5 bucks a month.

- CNBC ran its special ‘Markets in Turmoil’ on Friday night, which is a fantastic contra-indicator for the markets

Hospitalogy Top Picks

- I really enjoyed this write-up from the Health Care Blog contributors on the high-level trends affecting digital health and healthcare. It’s a great overview of the current environment.

- Brendan Keeler and Jan-Felix Schneider co-authored a great piece on direct patient scheduling, challenges facing health systems in implementation, and why they’re excited for the future here.

- These nursing surveys charted by Advisory Board were pretty cool to visualize how nurses value their profession and what might keep them around!