I’ve spent the last few days combing through hospital operator transcripts, published articles, equity research, and nonprofit health system EMMA disclosures.

This newsletter contains everything you need to know about what’s affecting hospitals so far in 2022. If you enjoy the read, I’d appreciate you passing along the write-up to friends and colleagues.

Post Outline:

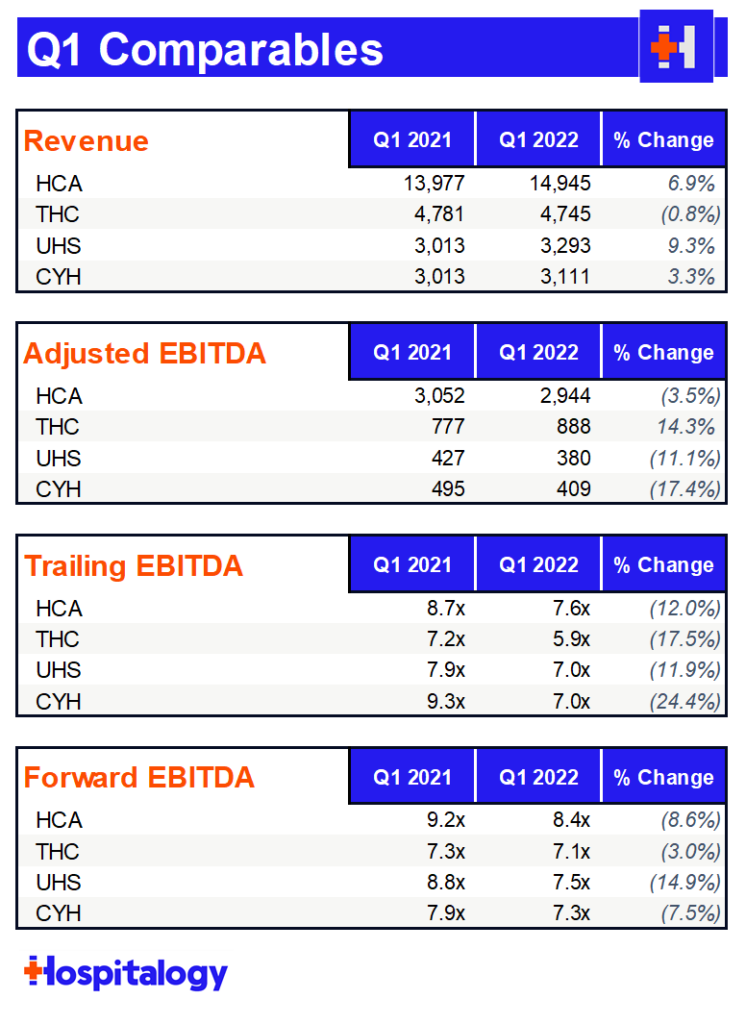

- Key themes across HCA, Tenet, CHS, and UHS

- HCA, Tenet, CHS, and UHS earnings breakdowns

- My expectations for 2022

Let’s dive in!

Common Hospital Themes

- Lower revenue from lower acuity Omicron patients

- Enhanced labor costs

- Texas Medicaid supplemental payments unfrozen by Biden Admin

- Tenet outperforms

- IPPS proposed ruling results in 2ish% bump for most operators

- Finally, pent-up demand from lower complexity outpatient surgical cases is unwinding.

Pretty much every single hospital dealt with the same perfect storm of conditions in January and February. Omicron cases spiked, which resulted in an onslaught of Covid admissions. This time, however, instead of the higher acuity conditions that Delta brought, Omicron led to a decay in net revenue per admission as a result of lower acuity and worse payor mix (moreso Medicaid and self-pay this time around).

At the same time, hospitals were hit with a double whammy on the labor side. EVERYONE got infected by Omicron, leading to normal staff taking sick leave, which affected census and volume numbers. To add insult to injury, hospitals were forced to negotiate for a higher share of travel nursing and contract labor coverage – pretty much on the staffing agency’s terms. Even though Omicron pressures alleviated in March, hospitals were still stuck with the contracts, which typically last 8-13 weeks.

In case you couldn’t tell, the biggest theme of Q1 was labor, labor, labor. Contract labor stuck around for longer than expected, eroding even HCA’s margin and causing a rare guidance drop. Notably, HCA and Community dropped EBITDA guidance while Tenet operated efficiently this quarter, reiterating its full-year guidance.

Based on Tenet’s stagnant admissions growth , it looks like Tenet really emphasized a flexible staffing model during the quarter.

Other common themes during the quarter included a return to strong outpatient surgery volumes and other outpatient services as pent-up demand continues to unwind. Since a lot of these volumes are still under pre-pandemic high’s, I would imagine there’s still more growth for these operators – especially Tenet with its sizable USPI footprint.

Finally, hospitals benefited from the end of the Biden Administration’s challenge to the Trump administration’s 10-year extension for Texas’ state Medicaid program, resulting in a chunk of change received from the state related to frozen supplemental dollars.

Related to CMS’ proposed ruling, most operators expect about a 2% bump in Medicare for 2023 and also noted a future change to the wage index in 2023 and beyond related to current base wage rate inflation.

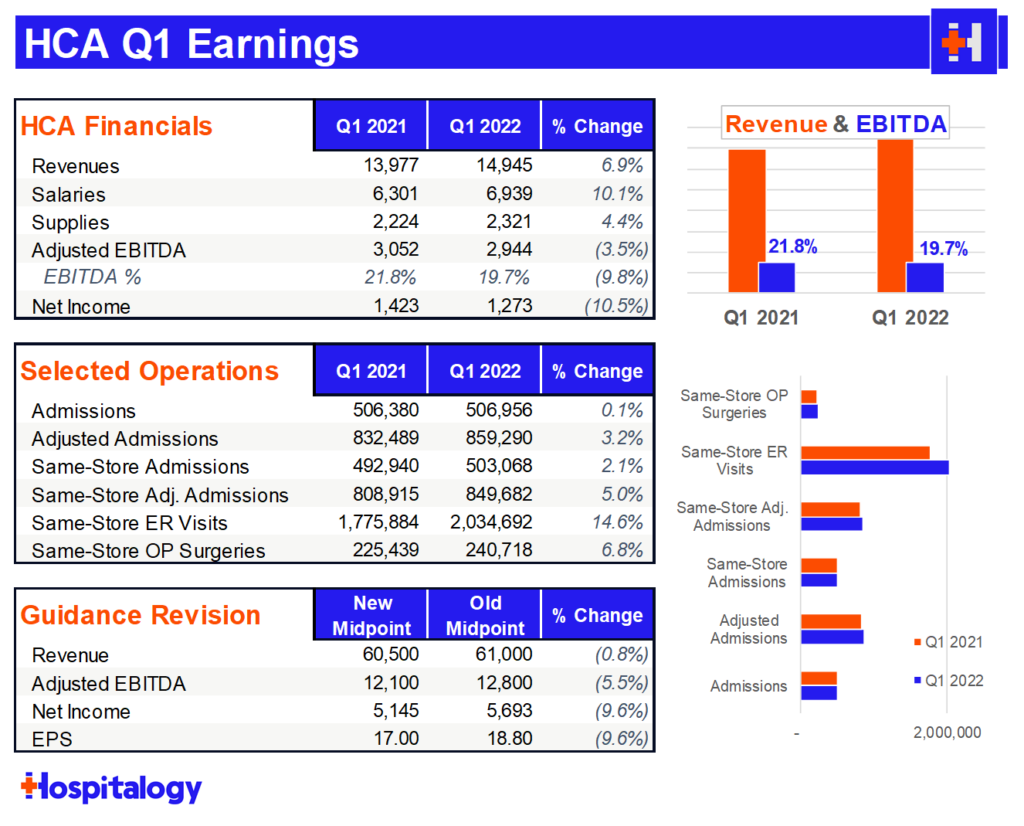

HCA Breakdown

Volume: Great rebound in same-facility admissions and very strong growth QoQ in ER visits and outpatient surgeries. HCA saw 49k COVID patients, about 10% of admissions.

Reimbursement: HCA expects a 2% bump from CMS and is actively in discussion with payors in their current contracts to address inflationary pressures. HCA expects to be able to get some leeway in escalators from payors to account for inflation.

Labor & Expenses: HCA (obviously) experienced higher levels of contract labor than expected. HCA expects hourly contract rates to come down and has developed a number of retention and recruiting initiatives for nursing and other clinical staff, including a recent $1.5 million investment in FIU’s nursing program. HCA also experienced inflation in G&A areas and specifically called out professional fees (lawyers stay winning), energy, utilities, and purchased services.

- Contract labor as a percent of nursing hours was about 11%. HCA expects that to be 9-10% by year end

Key Quote: “I think rates will naturally come down as the surges subside and as workforce is aligned with more permanent staff and so forth. And so we’re dealing in the first quarter and the fourth quarter and a little bit in the third quarter as well very high cost per hour for contract labor, and we do not believe that is sustainable. And so we’re anticipating improvements in that.” – Samuel Hazen

Madden’s Musing: As defensive and stable and consistent a company as HCA is should never see a 20% drop in the markets. Markets are slaughtering any company that shows signs of weakness. HCA will be just fine – they’ll just pay a bit more for nurses.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

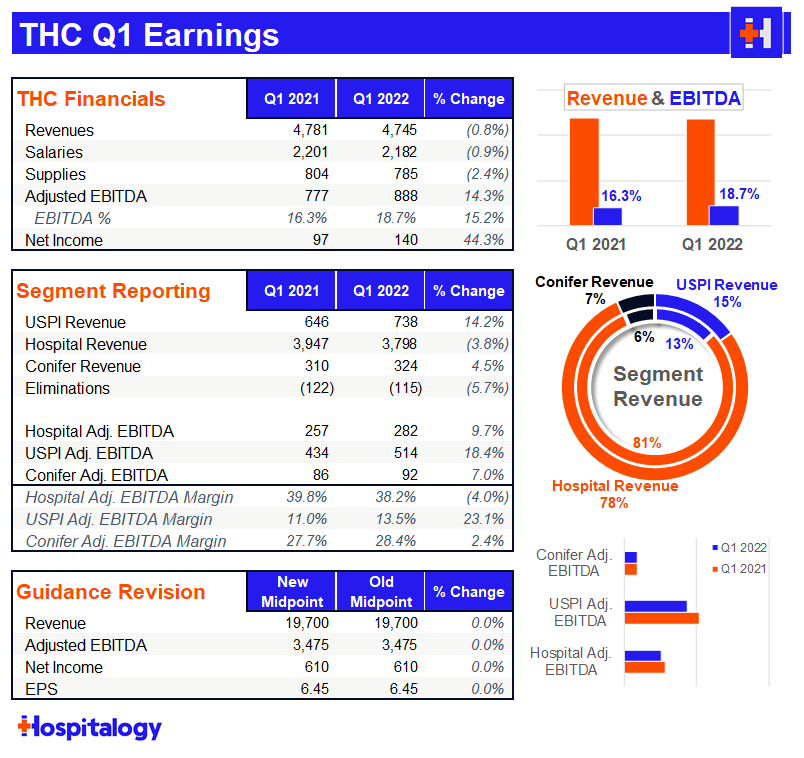

Tenet Breakdown

Volume: Despite a 23% cancellation rate in January (which Tenet was sure to tell us was one of the highest levels ever), Tenet benefited from strong surgical volumes, growing 8% YoY. You can see that pretty easily in the USPI segment – 14% revenue growth and 18.4% growth on adjusted EBITDA proves that Tenet is serious about its outpatient footprint ambitions. In fact, Tenet’s volume levels have returned to 100% of 2019, pre-pandemic baselines. Interestingly, in stark contrast to HCA, Tenet’s emergency department volumes lagged.

Reimbursement: Tenet expects a 2.3% increase from the IPPS proposed rate from CMS

Labor & Expenses: Similarly to the other hospital operators, Tenet noted that it would have expected the labor market to stabilize by now. Before the pandemic, Tenet’s contract labor sat at 2-3% of revenue. For perspective, in Q1, Tenet’s contract labor swelled to 6-7%!

Key Quote: “…over the past 4 or 5 months, some of the contract labor terms have involved 12 to 13 week contracts and we may just be on a cycle of coming off of those assignments before we start to see even more moderation in contract labor rates. Again I think this is a situation where we sould have hoped that the contract labor rates would have come down faster. The thing abou tit is when the contract labor rates come down, that will reduce the incentive for nurses to travel, which will then help to settle down local market nursing supply relative to demand, which will allow more hiring and more permanent nurse placements into the markets. And so these things are linked together in the way that it seems to be working.” Saumya Sutaria

Key Quote #2: We continue to see strong recovery in cases around MSK, ortho, and spine. I think a particular interest was the recovery in some of the lower complexity cases in Q1. Specifically ENT, for example, increased – the cases increased 34% year over year. And our GI cases increased 14% year over year. And we also saw a pretty significant similar increase in our ophthalmology and retina cases in Q1 as well. So when we think about the 8% growth we saw in Q1, a lot of that was driven by some of those lower complexity cases coming back compared to Q1 of 2021 when we saw – really saw some of the more complex cases come back and the lower acuity cases just took a little bit more time to recover.” – Brett Brodnax

Madden’s Musing: Of all the hospitals, Tenet performed the best and credited to its staffing platform. I find it pretty notable that despite Tenet reiterating guidance and being pretty attractive valuation-wise from a sum-of-the-parts standpoint, the hospital operator stock slid with the rest of the crew.

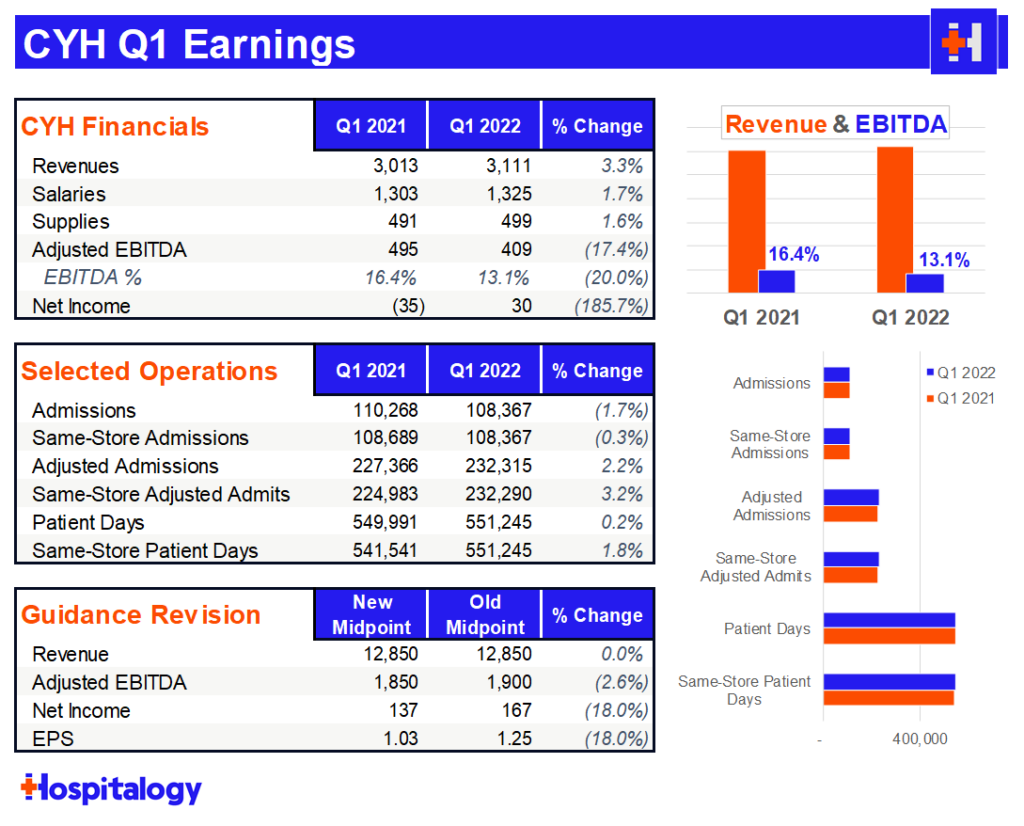

Community Health breakdown

Volume: CHS saw 13k COVID patients in the quarter, good enough for 12% of total admissions for you math wizes out there. CHS pretty much flatlined on growth for the quarter on the inpatient side but similarly saw solid outpatient surgery growth. The hospital operator also did open a couple of ASCs and a freestanding emergency department. A lot of cases are moving to the outpatient setting, providing a boost to outpatient numbers, but creating pressure on admissions growth.

Reimbursement: CHS saw a higher % of Medicaid and self-pay patients related to COVID cases.

Labor & Expenses: Interestingly, CHS noted that its nonlabor expenses were managed really well – probably the result of ongoing expense austerity given the operator’s history, better national purchasing agreements, and lower malpractice insurance. For labor, Community struggled like everyone else, spending $190 million in the quarter on contract labor, up $120 million from a year ago. Labor accounted for a 350 basis point decline in margin.

Key Quote: “Understanding that the labor pressures may take a little bit longer to moderate than we had expected, there are other things in our control, just in the operations. And one of them being the length of stay management, our focus on capacity optimization, being able to drive down the length of stay appropriately back to its historical levels, assuming there’ll be some easing in the post-acute care sector as well as they resolve their staffing challenges. That frees up our beds for inbound traffic. We did have increased declines or patients we weren’t able to accept through our transfer center in the first quarter because we were running at higher capacity even with the contract labor. So we do need to stay focused on reducing that length of stay, something we call capacity optimization.

“In terms of our mid- and long-term prospects for the labor pool — the nursing labor pool, I mentioned the centralized nursing recruitment team that now supports 100% of our hospitals. We have much better insights and resources available to recruit nurses into our health care delivery systems. And as I said, we’re seeing some good progress with hires. On a net hire basis, we’re also seeing improvements and the net hires are based upon a calculation of hires less terminations or resignations. So we’ve seen that moderate as well. So there’s some improvement sequentially and over prior year in terms of the net hires that we’re seeing to help us move through some of the vacancy rates that we’re experiencing right now.” – Tim Hingtgen

Madden’s Musing: CHS had a lot of similarities to HCA regarding comments about contract labor woes and similarly dropped guidance as a result. Unlike HCA, Community is in a tighter position on capital.

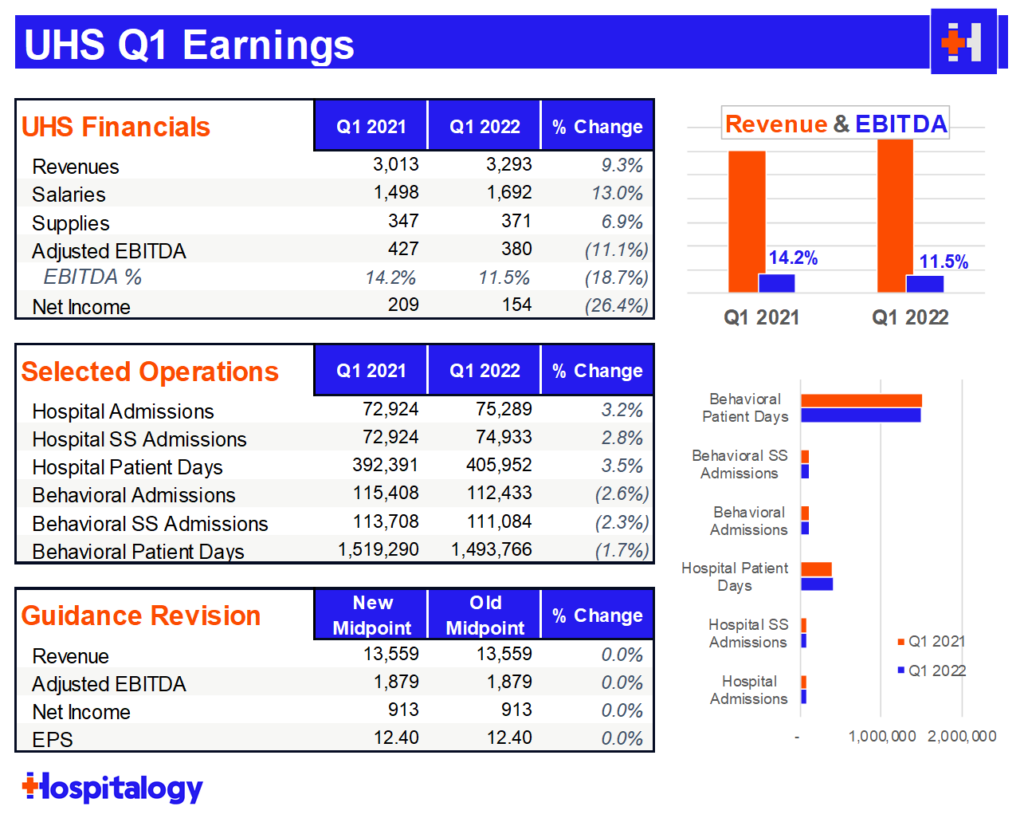

UHS breakdown

If you’re a freak like me and want to read any single hospital earnings call transcript, I would recommend diving into UHS’ transcript this quarter. Steve Filton had a ton of detailed insights into the labor world as one analyst after another touched on labor and what to expect for the rest of 2022.

Volume: UHS was about 6% off internal estimates for volume and earnings. Similarly to other operators, staffing affected census in both UHS’ behavioral AND acute care segments.

Reimbursement: UHS expects the proposed CMS rate to bump up reimbursement by about 2.5% in 2023. They noted disappointment at CMS’ lack of appreciation for inflation. UHS also noted that they’re more than willing to straight up drop payor contracts if they don’t give UHS enough relief from inflationary pressures.

Labor & Expenses: UHS saw a lot of contract labor pressure on the hospital side, but less so on the behavioral side. Steve Filton had a LOT to say about the labor market, but bottom line, he and UHS believes that travel nurses will return to their local markets, albeit at higher base salaries. UHS spent about $150 million in premium pay related to contract labor.

Key Quote: “I mean I think if pre-pandemic our wage inflation was, let’s say, on the acute side 3%, 3.5%; on the behavioral side, it was probably 2%, 2.5%, I think post pandemic, we’re thinking those rates are up 100, 150, maybe even 200 basis points.

“I think we think those rates ease some in 2023 for a number of reasons that we’ve already talked about. But again, I think when we do that math, if we’re replacing nurses who were making $65 or $70 an hour with temporary or traveling nurses who are making $225 an hour, that’s really the drag on our earnings in the current period. If we ultimately replace those nursing hours that we were paying $225 for $75, even though that’s a reasonable increase from what we had been paying pre-pandemic, it’s still an enormous improvement over where we’re sitting right now.” – Steve Filton

Key Quote #2: “I’ll make one more point on this. What we’re trying to do — we’re doing — Steve already mentioned earlier, we do market surveys and we’re doing adjustments like on a quarterly basis in a lot of our markets, trying to understand exactly what the correct base rate is for market. One of the things I want to make sure people recognize is that a lot of traveling nurses don’t actually travel anywhere. So in certain markets, I’ve seen traveling nurses up to 50% of those “travelers” are people that live within 4 or 5 miles of where they’re traveling to. So a lot of them are people that have actually not gone anywhere. They’re taking traveler contracts in their home market. And what is happening now is going to continue to happen is that those opportunities for the traveling contracts are going away.And so hopefully, sooner than later, a lot more of those “traveling nurses,” if they want to stay in their home market, which they clearly do because they haven’t gone anywhere, they’re going to have to go back to the local hospitals at the local wage rates and not the traveling rates that they were getting for those contracts previously, and we’re already starting to see that. And hopefully, that’s going to accelerate in the next couple of months.” – Marc Miller

Madden’s Musing: I’ll be watching UHS after Q2, when they’re probably going to revise guidance lower related to contract labor headwinds amid a company that hasn’t had the greatest track record with labor.

Larger Implications for Healthcare

As inflation makes its way through the healthcare system, I’m expecting a few things to happen over the course of 2022:

Based on what I’m seeing, labor currently has the upper hand in the healthcare employer / employee struggle. Health systems are keenly aware of staffing shortages and are investing in a number of retention and recruiting efforts, including signing bonuses, quarterly salary evaluations, nursing school investments, nursing school debt repayment, and plenty of other programs.

- As a result, the bulk of hospital labor pressures – most significantly, contract labor / travel staffing rates – will alleviate. Nurses will slowly find their way home.

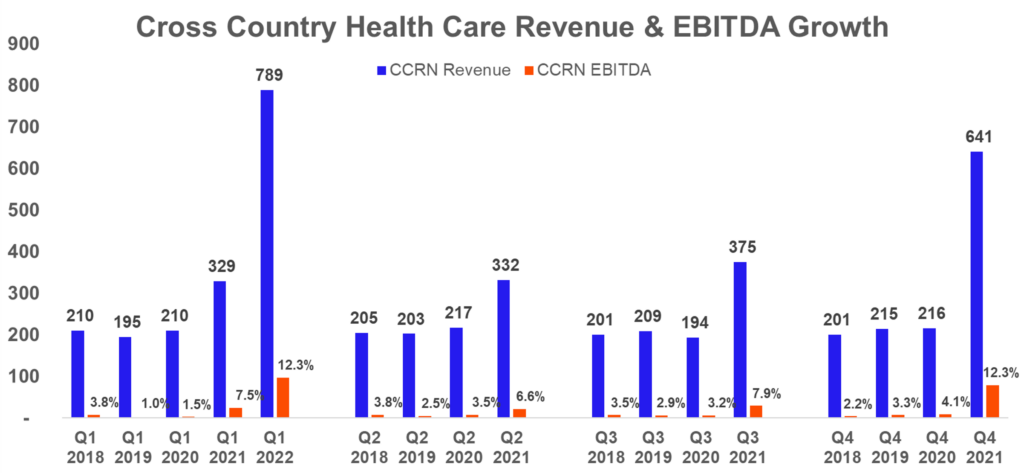

Cross Country Healthcare, the smaller of the publicly traded staffing agencies, reported earnings on the 4th and noted that their “average travel bill rates are anticipated to experience a high single digit to low double-digit decline sequentially.” The firm is guiding to sequential revenue and EBITDA decline for Q2, albeit markedly higher than Q2 2021. Just look at how much growth these staffing firms have experienced since 2021.

In 2020, Cross Country Healthcare made $837 million in total revenue. CCRN just made $789 million in the FIRST quarter of 2022.

This perfectly illustrates how insane the healthcare labor market is right now. Higher input costs for providers will result higher premiums in 2023 if this trend persists.

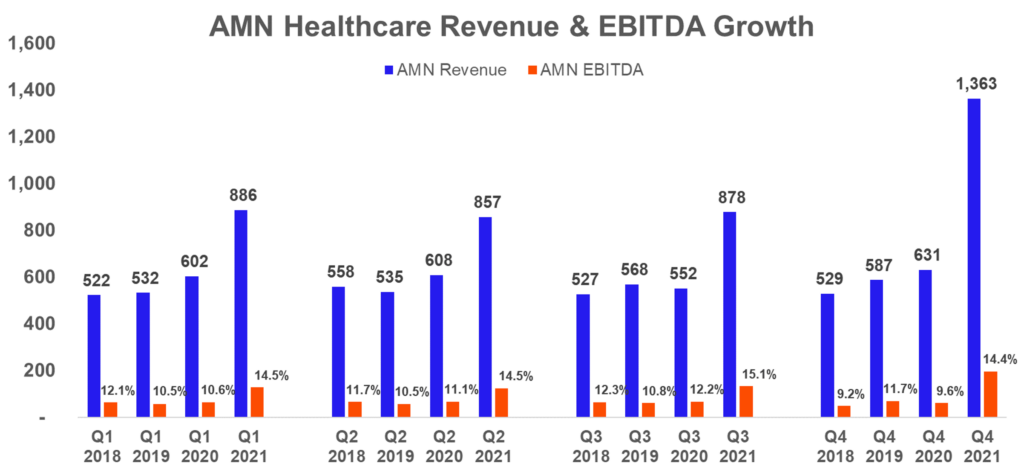

AMN will report very similar metrics during their earnings call after hours on Thursday. They’re almost guaranteed to beat on top and bottom line estimates and report an expected slowdown for Q2.

The travel nursing saga will fizzle out over the course of 2022. Local nurses accepting travel positions in their local cities will have to accept jobs back at their local health systems. The net effect of travel contracts and retention measures, however, means that nursing salaries will rise substantially – something I consider a win-win for the industry and hopefully leads to better retention, happier nurses, and superior care.

Next, provider organizations will demand higher reimbursement from insurers for 2023 to counteract the 8% inflation across all expenses. Insurers will either play hardball and go out of network, meet providers in the middle, or providers will have to eat the inflation and operate more efficiently. My guess is that we’ll see a number of out-of-network spats this year in the media. Spats typically favor providers (you love your PCP; you typically hate your insurer).

On the back end, insurers will be breaking terrible news to employers – I’m expecting to see premiums rise significantly for employer – insurer negotiations. At what point does the employer say “enough” ? At what point is this unsustainable? Qll of these dynamics will hit employers and premiums on the back end, ultimately costing patients.

Finally, the Fed is raising rates and just issued a 50 bps increase, which has an outsized effect on capital-intensive businesses like hospitals. All operators will have to be prudent with their capital spend in a tightening monetary environment on multiple fronts.

Resources

- HCA Q1 earnings announcement

- Tenet Q1 earnings announcement

- UHS Q1 earnings announcement

- CHS Q1 earnings announcement

- AHA report on hospital growth in expenses. You can bet your bottom dollar they’ll be fighting tooth and nail for higher reimbursement from CMS.

- Kaufman Hall Hospital Flash Report – April

- HCA investing $1.5 million into FIU to address nursing shortage

Miscellaneous Maddenings

- I played volleyball for the first time in a while and let me tell you…I’ve never had the yips so badly while serving the ball. I mean, how hard could it be? Yet time and time again…I could not get it over the net. Just brutal to watch the looks of dismay from my teammates.

- I really enjoy Nick Maggiulli’s blog on finance and personal wealth. His latest piece on speculative bets was a good one!

- A man broke the world record for working at the same company for 84 years!! In today’s world, I can’t imagine this record ever gets broken.

Hospitalogy Top Reads

- Lots of reporting on Cerebral and consequential effects this week. I really enjoyed this read from Stat diving into the current issues facing telehealth amid the criticisms from Cerebral.

- Here’s a breakdown of the ramifications of the SCOTUS abortion ruling and associated trigger laws, state by state

- On that note, check out this note from Cerebral’s CEO, Kyle Robertson, – including his rationale behind Cerebral’s decision to stop prescribing controlled substances.

- Finally, Business Insider is reporting that the DEA has launched an investigation (paywall) into Cerebral.

- I’m trying something out on Twitter, but want to get responses here, too. What are your core, fundamental beliefs about U.S. healthcare? Reply to this e-mail if you want to share your thoughts. You can also reply on Twitter here to see other responses as well.