28 February 2022 | Healthcare

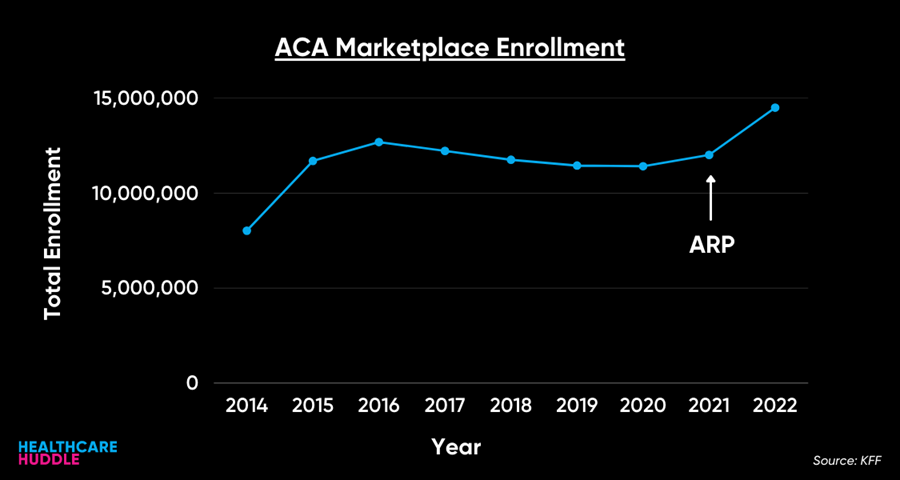

2022 Sees Record-breaking Marketplace Enrollment

By workweek

14.5M Americans signed up for health insurance during open enrollment for the Affordable Care Act Marketplace, a 21% increase from 2021 (link). Additionally, 3M people are newly insured, up 17% from last year. The American Rescue Plan (ARP) is primarily to thank for these positive numbers.

Why the Increase?

The ARP expanded tax credits for Marketplace insurance by eliminating what’s known as the subsidy cliff. Pre-ARP, tax credits for Marketplace insurance were capped at 400% of the federal poverty level (FPL)—if you made more than 400% FPL, you were on your own for insurance. The ARP removed that subsidy limit and capped Marketpalce insurance premiums at 8.5% of household income. So, if you make more than 400% FPL, you won’t pay more than 8.5% of your income in premiums (link). Consequently, premiums for 2022 decreased 23% on average compared to 2021.

What also helped increase enrollment was enhanced focus on areas of friction for learning about and enrolling in the Marketplace. The government added significantly more tools to the Marketplace navigator, used unconventional media to target underinsured communities and hosted in-person outreaches at local libraries, Covid-19 clinics and job fairs (link).

Lessons Learned

How to encourage 3M uninsured Americans to purchase health insurance?

- Make health insurance cheaper → ARP expanded tax credits beyond the 400% FPL cap.

- Reduce friction to education → Meet Americans where they’re already hanging out (libraries, weekly community events) to educate them on the Marketplace.

- Reduce friction to signing up → Add tools to make the enrollment process as easy as possible.

While the increased enrollment is excellent news, the subsidy cliff removed in the ARP is bound to return unless new legislation removes it entirely or delays its return.