Today we’re diving into HCA’s recent investor day.

Part 1:

- Key takeaways for hospital execs, healthcare professionals, and investors on HCA’s investor day

- What drives HCA’s success – market selection and density

- HCA’s growth strategy

Part 2:

- Optimizing operations – What IT investment and digital transformation looks like for HCA

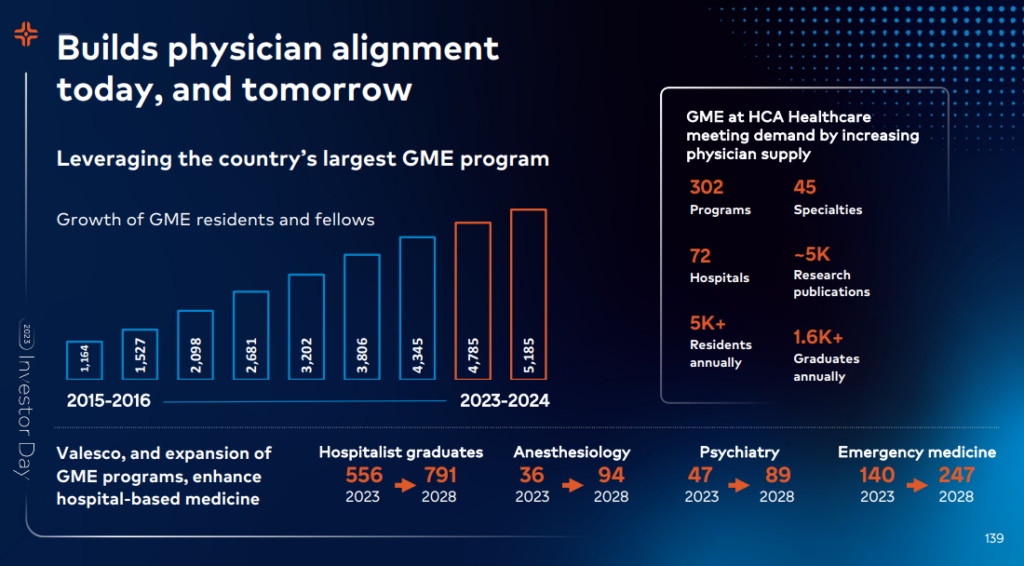

- A hyper focus on nurse and physician pipeline

- Tying HCA’s grand strategy together

- Challenges on the horizon for HCA & Hospitals

This one took me – and is taking me – a while to put together, so if you find it valuable I’d appreciate you subscribing to Hospitalogy here!

Resources:

SPONSORED BY NAVINA

A complete picture of a patient’s health is crucial for accurate diagnosis capture and effective treatment.

But already overburdened clinicians spend way too much time sifting through fragmented and chaotic patient data rather than sitting in front of their patient.

Enter Navina.

The first AI model designed specifically for primary care, Navina’s AI platform transforms complex data from EHRs, HIE, labs, and even scanned PDFs into a concise and timely patient portrait. It also delivers AI-powered diagnosis recommendations at the point of care, helping clinicians accurately capture patients’ health status and improve value-based outcomes.

Navina is on a mission to reduce burnout and transform the primary care experience in a value-based world. Risk-bearing organizations like Privia Health and Tampa General Hospital have already joined in.

HCA’s 2023 Investor Day. What do Operators & Investors need to know?

Note: I have no position in HCA

The main takeaways HCA wanted folks to leave with from this investor day:

- HCA’s business is longstanding and defensible despite ongoing competitive threats

- Despite everyone’s best efforts, the CBO is projecting long-term hospital expenditures to accelerate which benefits HCA

- HCA is well positioned to capitalize on healthcare’s future state given its strong capital structure and existing investments / footprints in its markets.

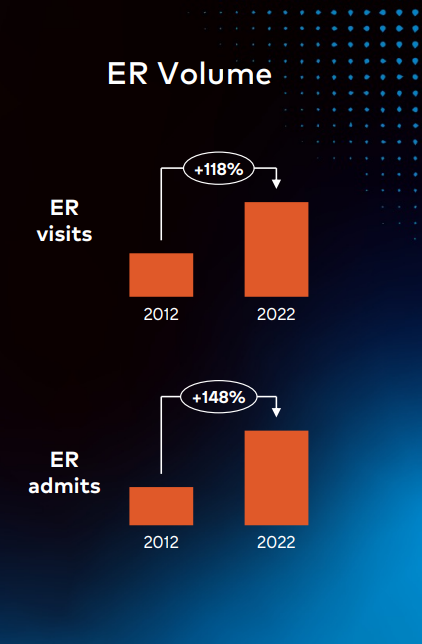

- Strategies include tight physician alignment, doubling down on higher acuity volume, ER expansion & investment, urgent care expansion & investment

- HCA is investing in digital transformation to drive efficiency

- HCA is hyper focused on nursing and physician capacity, offering internal programs and investing in education, career advancement to support hospital capacity and diversity of leaders along with support for future facility growth.

In my mind, the biggest question mark is how believable you think this narrative is. And for me, despite everything going on in the hospital sector, it’s hard not to believe that HCA is a unicorn among health system operators and will continue to respond to ongoing challenges while (hopefully) continuing to drive better patient outcomes.

HCA’s Success: It’s all about Markets and Density, Dummy

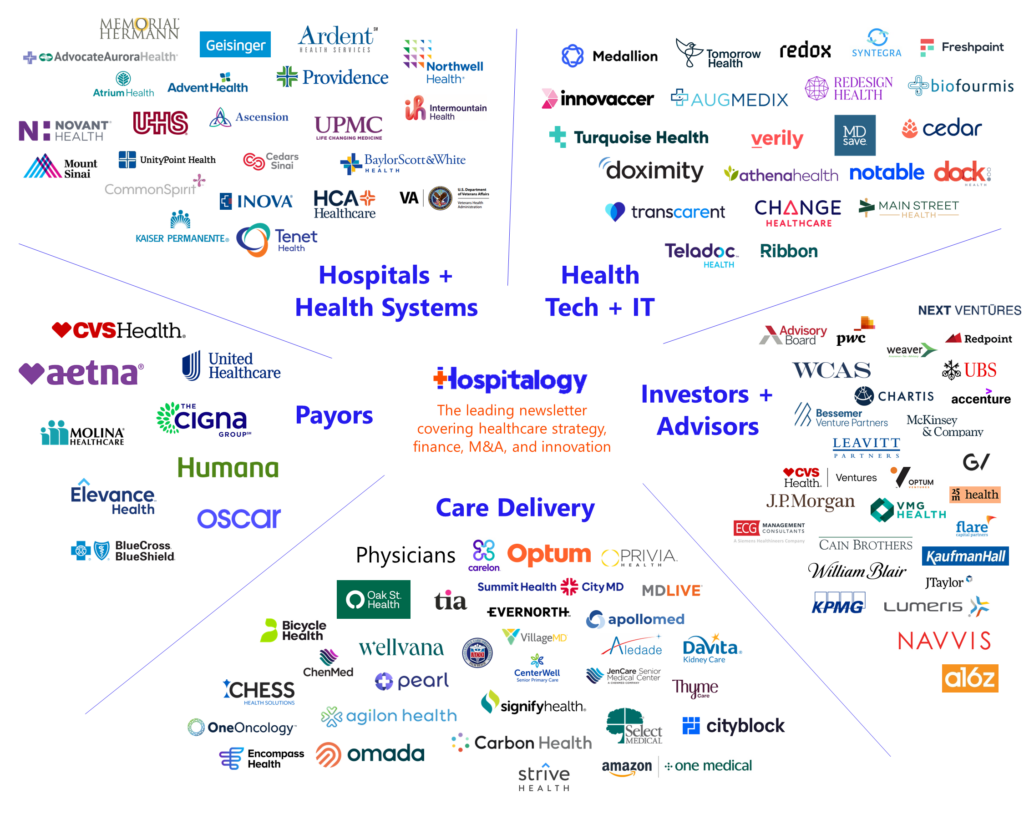

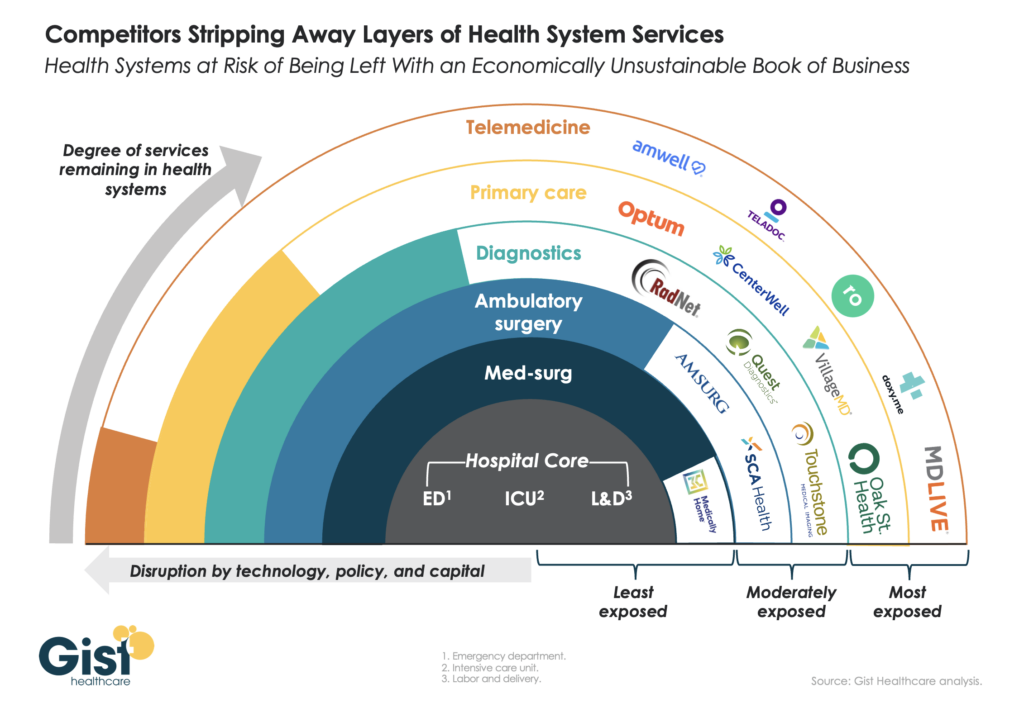

In its opening investor day remarks, HCA felt a need to defend its business – characterizing its longstanding strategy as enduring and defensible – given the ongoing conversation in healthcare related to health system disruption (characterized very well in this Gist Healthcare post, image, and analysis):

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Image credit: Gist Healthcare – The Weekly Gist: The Travis Unwrapped Edition – “Beyond inflation and high labor costs, health systems are struggling because competitors—ranging from vertically integrated payers to PE-backed physician groups—are effectively stripping away profitable services and moving them to lower-cost care sites. The tandem forces of technological advancement, policy changes, and capital investment have unlocked the ability of disruptors to enter market segments once considered safely within health system control.”

Despite the above rhetoric, HCA seems insulated, and there’s a reason for that. HCA is objectively an incredible, cash-flowing business that has survived and thrived through multiple take-privates, significant healthcare reforms.

How?

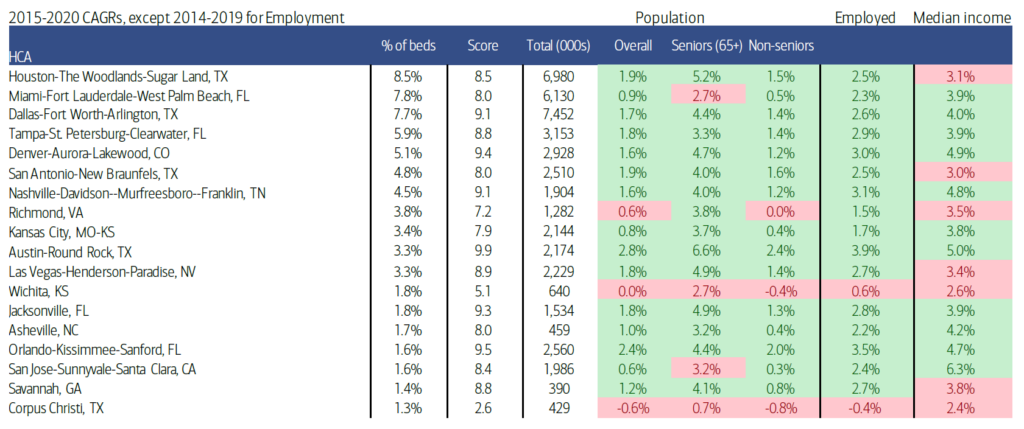

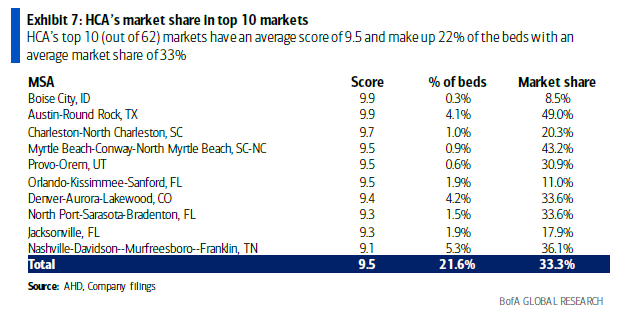

- They are thoughtful about the markets they enter and exit and the population characteristics present in each. Their hospital and ambulatory footprint is massive. HCA market demographics generally are faster growing from a population standpoint, have higher income, and are stronger jobs markets. Some examples from a recent BofA research note:

Source: BofA Global Research, Deep Dive into HCA’s hospital assets – positioned to outgrow the industry

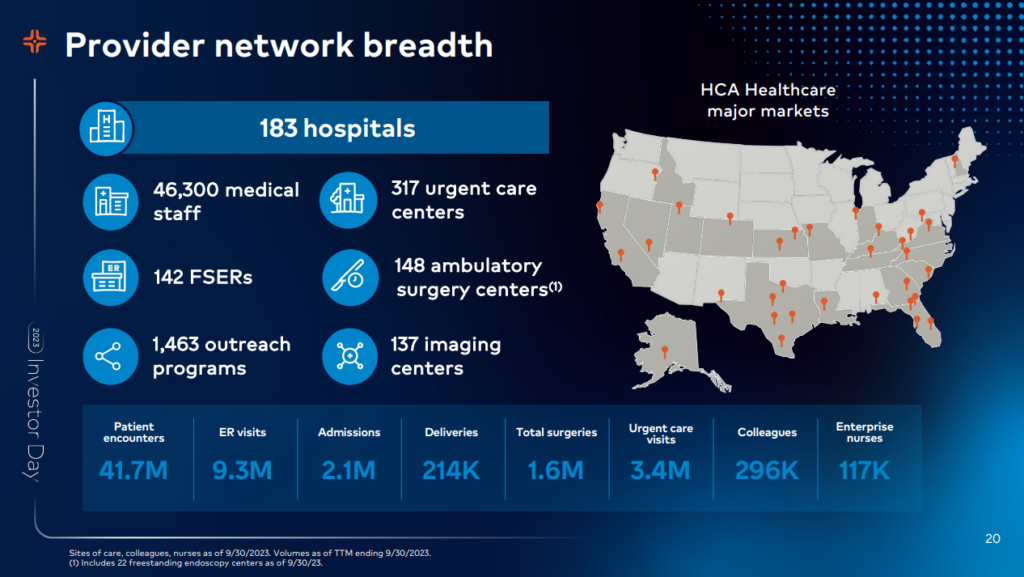

- Side note: has HCA ever disclosed how many doctors it aligns with? Maybe I’ve missed it before, but alignment with 46,000+ doctors is formidable:

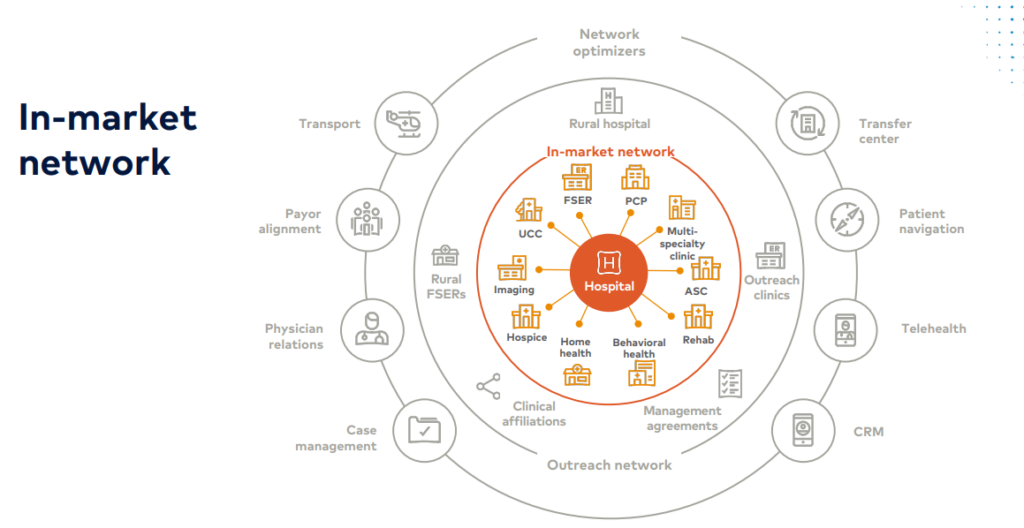

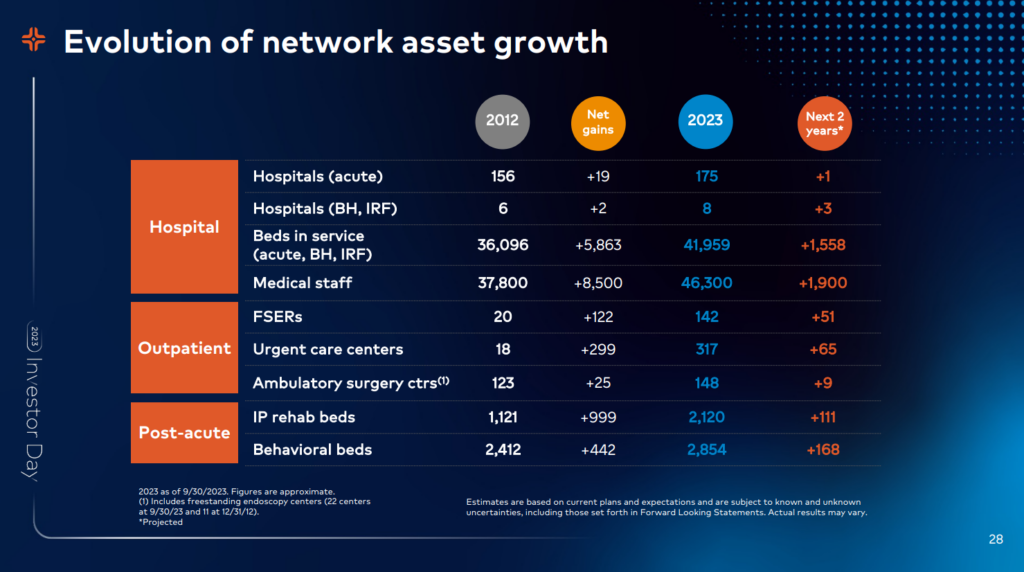

- HCA achieves market density in those markets to command market power and favorable negotiation with payors, making investments in delivery assets to support hospital vitality, including ASCs, urgent care, and freestanding EDs

- “For us to be successful, we have to build networks that have local scale, they have to have a local scope of services and facilities, and we have to integrate them into a cohesive network, which we believe creates value for our patients. It creates value for our physicians and it creates value for the payers.”

- This is our flywheel. This is how we plan, this is how we resource. This is how we drive execution as a company. Inside the flywheel is the local piece of our organization. We have 16 geographic divisions that have responsibility to make the inside of the flywheel turn. They have been structured organizationally around each of our markets in a way that gives us the opportunity to develop networks within the communities that we serve and ultimately execute on the operational agenda that we have.

- HCA tends to do a good job with foreseeing challenges on the horizon – for instance, doubling down on its investments in the Galen College of Nursing to boost its nursing pipeline, or acquiring its hospitalist JV from Envision before cash flow problems got worse.

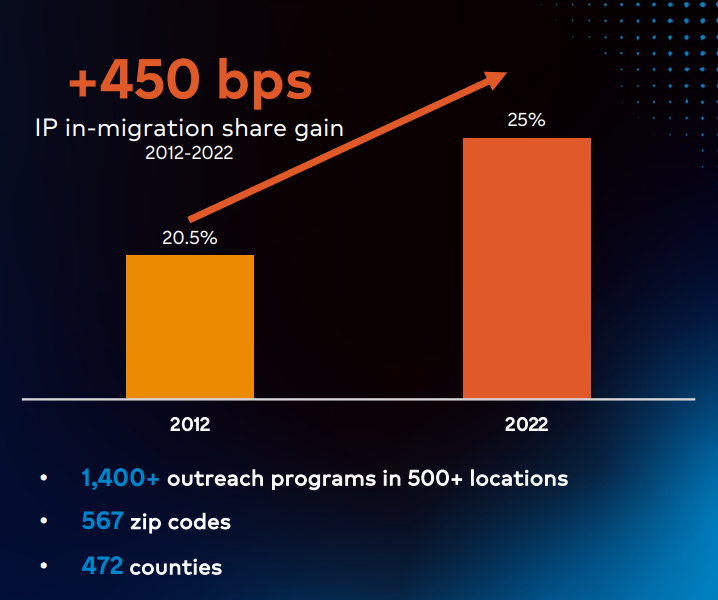

- Because they’re for-profit, despite the tax advantages of nonprofit health systems, HCA can run much more efficiently. HCA isn’t beholden to complex governance structures or operational inefficiencies that plague nonprofit competitors. As nonprofit systems continue to struggle, divest, close service lines, or hemorrhage clinical talent, HCA will naturally accrete inpatient market share and insulate itself further in its markets. Stated differently, HCA is the 800 pound gorilla (though I’d go up even further in mass from there).

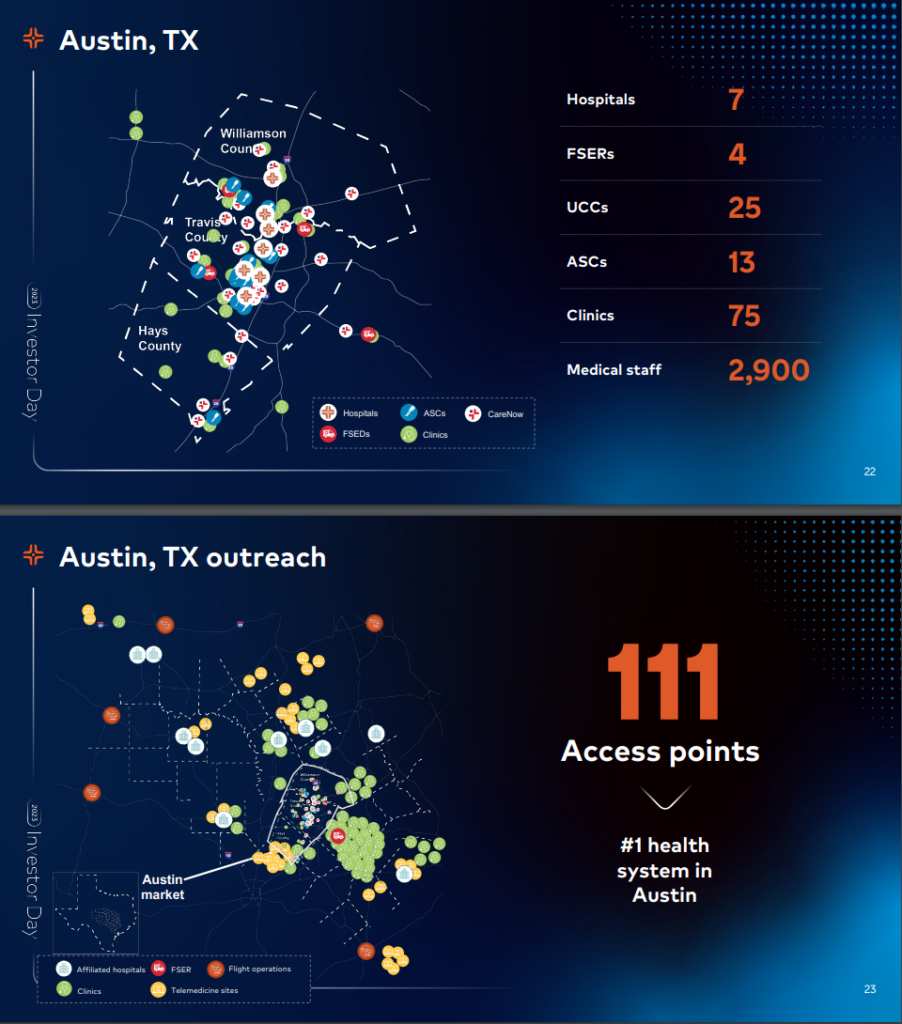

HCA gave us an interesting look inside its market entry and subsequent investment in the Austin market through St. David’s, growing into the #1 health system in a fast-growing urban market:

Now back in 1995, we formed the St. David’s HealthCare partnership. And when we did that, there were 4 hospitals and 1 ambulatory surgery center in the primary service area or what we would call the in-market geography. And over time, in that immediate service area, we’ve added 3 more hospitals, 4 freestanding emergency departments, 25 urgent care centers, 11 ambulatory surgery centers, 75 outpatient clinics, and it’s all supported by a 2,900 member medical staff.

Now in the outreach market, we’ve added affiliated hospitals, we’ve added clinics, freestanding ERs, telemedicine sites and [indiscernible] operations. And in addition, we also have 2 de novo hospitals that are in the planning stages for the Austin market over the coming years. So all told, this has formed the largest, most comprehensive healthcare network throughout Central Texas and frankly, one that is perennially recognized nationally for its quality.

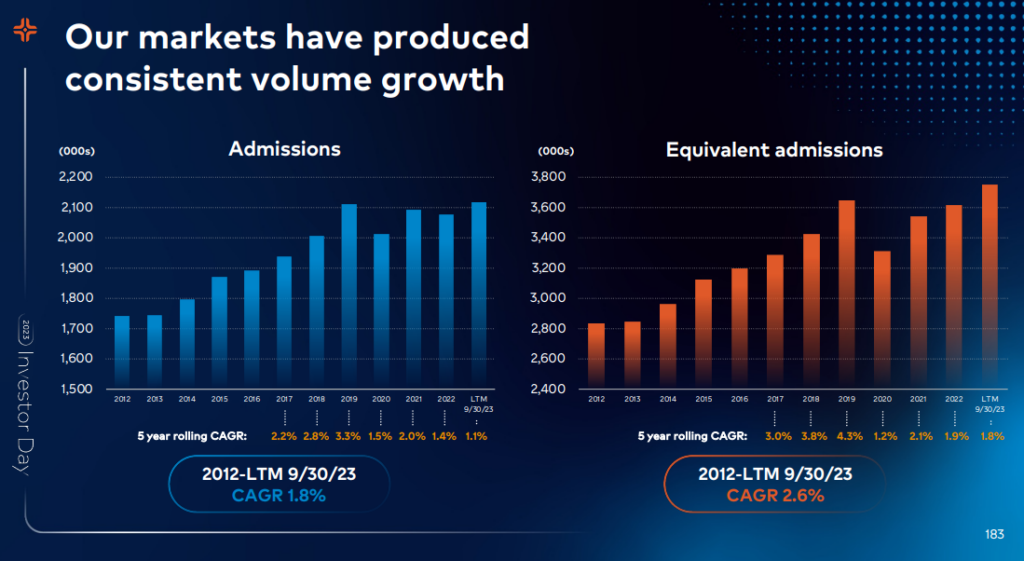

With strong demographic patient tailwinds, HCA expects Inpatient and Outpatient volumes to grow

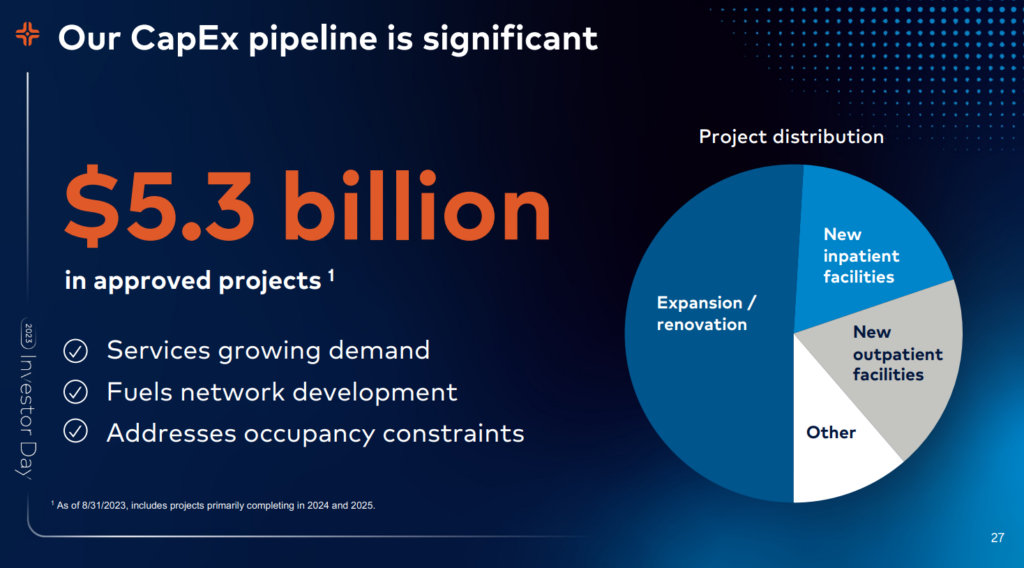

Overall, HCA’s growth strategy holds 3 main pillars:

- Expand networks into markets with growing demand and favorable demographics

- Hospitals act as anchor facilities in HCA markets

- Continued investment in inpatient + outpatient resources ($5.3B annual CAPEX spend!!)

- Patient capture: Keeping patients within the HCA referral network with this investment

- So collectively, today, if you roll it all up across our system, we have roughly 12 outpatient access points for every 1 HCA hospital. And over the next few years, you’ll see that easily growing to a ratio of 20:1. We’re meeting patients where they want to be served. We’re making it convenient for them and offering them a broad range of clinical services so they don’t need to seek care outside of our local networks.In 2022, our urgent care clinic produced 220,000 referrals, primarily to specialists in the emergency room setting. From these urgent care clinics, HCA was able to retain 56% of the patients going to specialists and 61% of the patients going to the ER. While those numbers are best-in-class, you can obviously see there’s more opportunity for us there. Our urgent care platform will continue to be a key source of growth, likely moving from predominantly acquisition to de novo of development and building out our network.

- This quote in context is hilarious, as HCA seems almost exasperated by the constant ‘shift to outpatient’ narrative they’re having to battle: “Sam referenced the diversity of our portfolio. We’re not dependent on any 1 single service line for greater than 14% of our inpatient hospital net revenue. This mitigates risk, risk from having new drugs to market that may prolong a patient getting treatment or that shift from inpatient to outpatient we’ve been talking about for 10 years. This contribution margin, as you might expect, is higher than our average contribution margin for these complex patients. One reason we go for that.”On recruitment away from academic medical centers: In the old days, those physicians would probably have been attracted to an academic medical center. We’re faster, we’re more nimble. We give them voice. We are less bureaucratic and physicians love that. These academic centers without our scale are at a competitive disadvantage. And so this growth in CMI has generated net positive growth on our revenue. The first example I want to give you is our neuro. In 2016, we took a very deliberate approach to building the infrastructure by building out these comprehensive stroke centers. These high acuity patients often require surgery or intervention as that first video you watched. This impacted both our case mix and our market share. We added 10,000 incremental admissions over this time period, 121% growth in our stroke surgeries.

- Patient capture: Keeping patients within the HCA referral network with this investment

Cardiac care is another terrific example. In 2013, we took a deliberate approach in expanding and deepening our CV service lines. The outcome of that was that we grew our 120 programs for ECMO, for ventricular assisted devices, for ablation across our platform. So this is about broadening and deepening. The examples I gave you on the right is just showing you the sheer growth that happened during that time period. Right here in Nashville. In 2008, our Centennial Heart, which is our flagship hospital here in Nashville had 6 cardiologists. Today, there are 41, serving 4x the access sites, they grew the CMI by 50% and expanded our network.

And finally, cancer. In cancer space, we did — and over the last 10 years, HCA experienced 92% growth in our transplant and cellular therapies. This makes HCA the nation’s leader in bone marrow, CAR-T and gene therapy research. We served patients from 36 states to 7 transplant centers as shown by the blue lines on the graph. We perform more transplant from the academic medical centers of Mayo, MD Anderson and Dana Farber. The exciting thing that happened in the last year is that we did a partnership, a joint venture with McKesson. This brought together 2 community care assets and created this care closer to home.

If you are a cancer patient, that’s what you want. You want second to none quality and you want it right in your backyard, and we’ve successfully done that. We put 250 — with McKesson, we got 250 research locations, we embedded the 1,500 medical oncologists under the U.S. oncology brand that this was about not just doing research and doing cutting and medicine, which we all get really excited about, but it’s doing care. It’s doing care for our patients and our families.

HCA is fine with physician independence: In order to attract physicians, we’ve developed a value proposition. As I mentioned, a number of our physicians are independent. So generally, they are selecting where they admit their patients and where they choose to practice. The key elements of a value proposition that we’ve identified are giving physicians voice, creating capacity, both physical capacity, but also efficiency in their practices, helping them grow and then wrapping it around exceptional clinical capabilities. We strive to give physicians voice to ensure that they are heard. Jon talked about the physician relations representatives that are out in the field, interacting with our medical staff, understanding what we do well, so we can do more of it, understanding where the challenges are in our health system so that we can carry that back to our operators, and we can continuously improve.

HCA is also increasing existing physician supply by offering physician pathways to hospitalist programs via internal Graduate Medical Education programs. The pipeline aims to generate an internal funnel for increased physician capacity and target need areas in key specialties including anesthesiology, psychiatry, and emergency medicine.

What does IT Investment and Digital Transformation look like for HCA?

Even an old, longstanding company like HCA recognizes the need for innovation and to continue to offer patients & clinicians better, more optimized experiences. I’ve touched on one such way HCA is exploring this in partnership with Augmedix and an ambient documentation pilot.

HCA wants to optimize its internal operations and existing market footprint through tech investment in various key areas. They’ve identified annual cost savings of $600M – $800M through these initiatives as small efficiencies found over time translate into huge value across an entire $60B portfolio:

- Reducing length of stay; smart capacity and workflow management

- The second is this idea of leveraging process improvement, technology and automation. Think about case management as a decentralized service, right? So we have these 3,000 people. They’re embedded in 183 hospitals. In the past, this was a very not only decentralized but unstandardized process set. And so through process improvement and through the adoption and rolling out of technology and automation, we’re able to take what is a decentralized function and produce support through standards and through investments, that elevates the performance of this across the company in a scalable way without having to centralize resources…Now what is the impact of that? The impact of that is the equivalent of building 500 beds of new capacity.

- Revenue cycle management & back-end optimization

- Supply chain and purchased services optimization (HealthTrust)

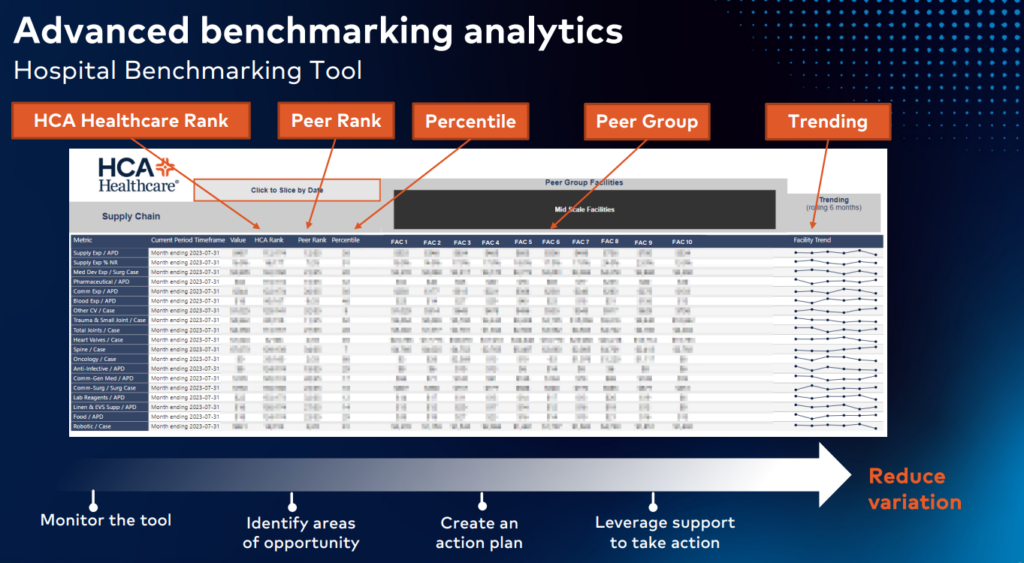

- Advanced internal benchmarking and analytics to reduce performance variability and clinical variation:

I wanted to take a minute and use the hospital benchmark tool as one of the examples of this work. And this tool was rolled out company-wide last year. It’s been very powerful. And what it does is this, it takes 169 key performance indicators across 7 domains of performance. So think labor management, human resources, physician cost, et cetera. Each of these domains have a landing page that looks like this.

And for every one of those metrics, the hospital management team knows how they rank in the company. So think about being a hospital C-suite member: a CEO, a CFO, a COO. And they are able to use this report, and they know where they rank in the company against their key performance indicators. And I mean literally, like they get a rank of I’m #1 of 183 or I’m #183 of 183. And no one really wants to be 183, right? That’s the anchor person. And so there’s a lot of competition that we create in the field for people, and our teams are competitive of making sure they understand their performance gaps and then start taking action against them…This data updates daily, weekly and monthly depending on the metric. And our hospital management teams are using this tool to find their biggest performance gaps.

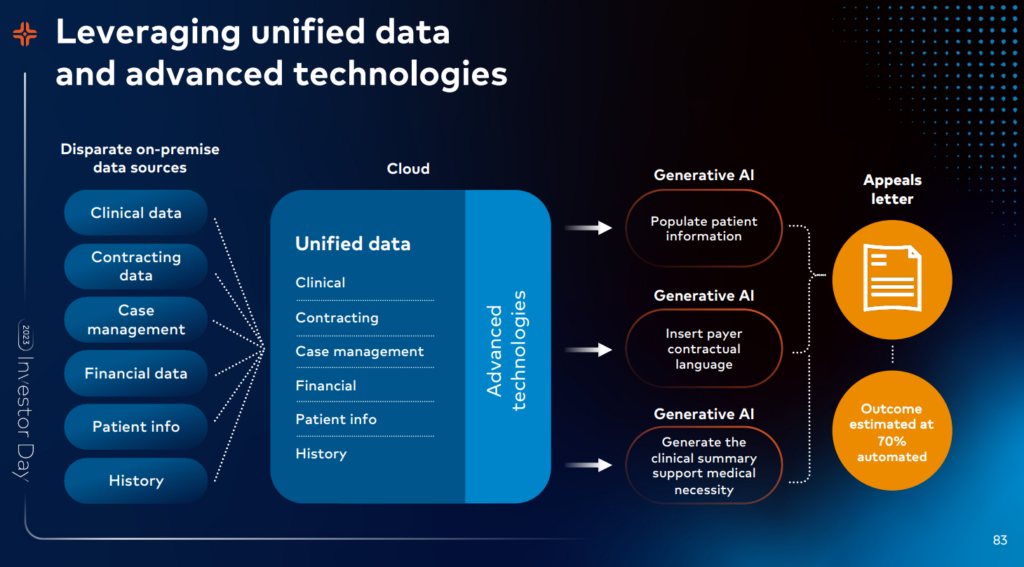

On RCM optimization and use of generative AI:

One of the ways that we’re addressing denials is by unifying our data, layering on advanced technologies like generative AI and using that intelligence to transform our processes. We have immense amounts of data from multiple systems and for seemingly different purposes that we’re bringing together in the cloud. And that’s harder than it sounds because you have to standardize and map all the data together, but it’s so worth it. Imagine the power of having a patient’s clinical information and financial information and payer contract details and language as well as details and time stamps on every activity all in one place.

HCA’s digital transformation strategy revolves around two key partners: Google and Meditech.

- As we envision the future health care delivery environment, two key technology partnerships will serve as our next-generation catalyst. First, we believe our partnership with Google will fundamentally improve our ability to use the cloud’s best attributes, speed and elasticity. We also expect our close partnership will also provide us an accelerated glide path with both generative AI and our next generation of analytics.

- Our second key partnership is with MEDITECH. We believe our enterprise adoption of a new foundational electronic health record will not only serve as our transactional clinical system of record, but will increasingly become the method by which insights identified by the HCA Healthcare Intelligence Net, which we are developing with Google, will be delivered into the clinical workflow real time, providing our care teams access to profoundly differentiating clinical decision support.

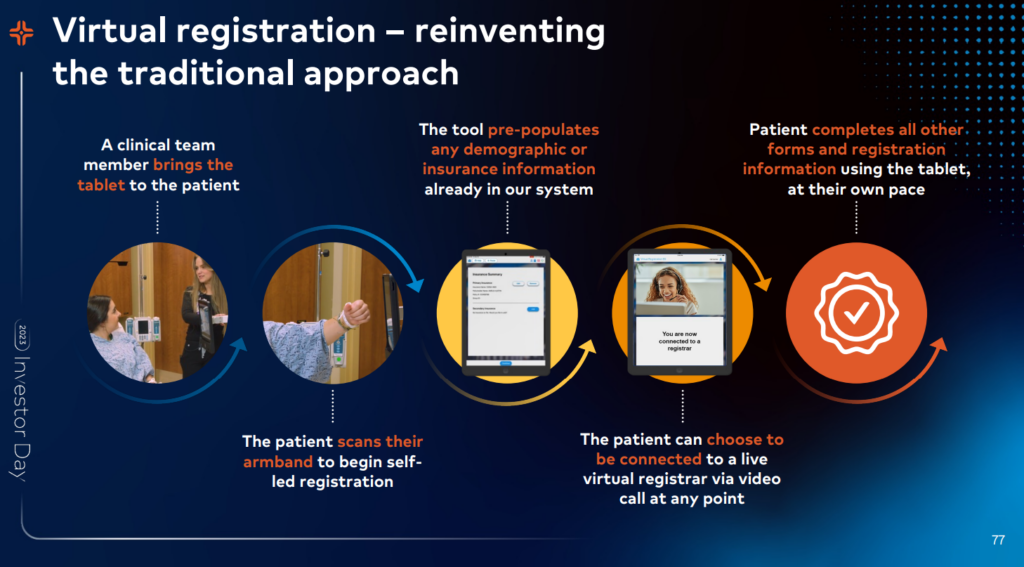

Some ways that HCA is targeting care delivery and administrative transformation through tech:

- Reducing administrative burden for clinicians

- Labor force management – staffing and scheduling automation (a platform called Timpani, live in 9 HCA hospitals)

- Documentation burden

- And so what we’re building with a partner called Augmedix is an ambient speech-driven technology where you can put the phone in between you and the patient, and we’re doing this in our emergency rooms, that’s Dr. Alex Stinard. He’s our Chief of Emergency Medicine at UCF Lake Nona in Orlando. And you can interview the patient and the patient responds and the AI is listening, transcribing that entire event, and then natural language processing and large language models break that transcription down into the structured documentation that we need that can then be fed back into the electronic health record. So this system is live in 4 emergency rooms.

- Right now, we have a human in the loop, so we have a medical scribe that’s in the middle of that process that helps sort of clean up the note because the AI is still learning, but it’s continuously getting better. And large language models have massively accelerated this work. So right now, we have a target of the AI being able to completely independently build this structured note, 60% of the content being completed by the AI by January of 2024. And then the more users we can expand it to, the faster it will get smarter as it learns from all of those encounters.

- We started with the emergency room because it’s basically the hardest place to do this. It’s chaotic. It’s noisy. It’s asynchronous care. And so we know if we can do it there, we can take it to all the other areas of our acute care frame. You’ve probably heard about this in other spaces, right? Maybe part of like Nuance and [ DACs ] and some of these other systems that Microsoft is working on. But one key differentiator for us is that we are focused on structured data. We don’t want to go backwards and just have AI create free text notes that then drops into the record because the structured data is what’s going to power this entire Intelligence Net. So it’s maybe taking us a few minutes more to get this done because we’re focused on that key outcome.

- Redesigning care processes from the ground up with new innovation in mind

- Moving to Meditech’s nextgen EHR – MEDITECH Expanse, an interoperable cloud-based system

- And the last thing, which I mentioned in the beginning, was interoperability. And this does make MEDITECH stand out as a little bit unique in the industry in that they’re building a system that they don’t see as the be all, end all clinical system. They don’t want to be all things to all people. They want to do what they do well, which is that core electronic health record, but then they want to partner with folks like us to be able to bring innovations alongside or even incorporate it into their system. So they built it such that it has APIs and FHIR interfaces, so that if we build a really interesting algorithm inside Google, inside GCP, we can feed that data back into MEDITECH and they can get right into the workflow of our providers. So as Marty mentioned, it’s a really important partnership as we work together to understand what are we going to do inside with MEDITECH and then where are we going to innovate alongside them.

- Standardizing workflows across hospitals

- Other generative AI initiatives:

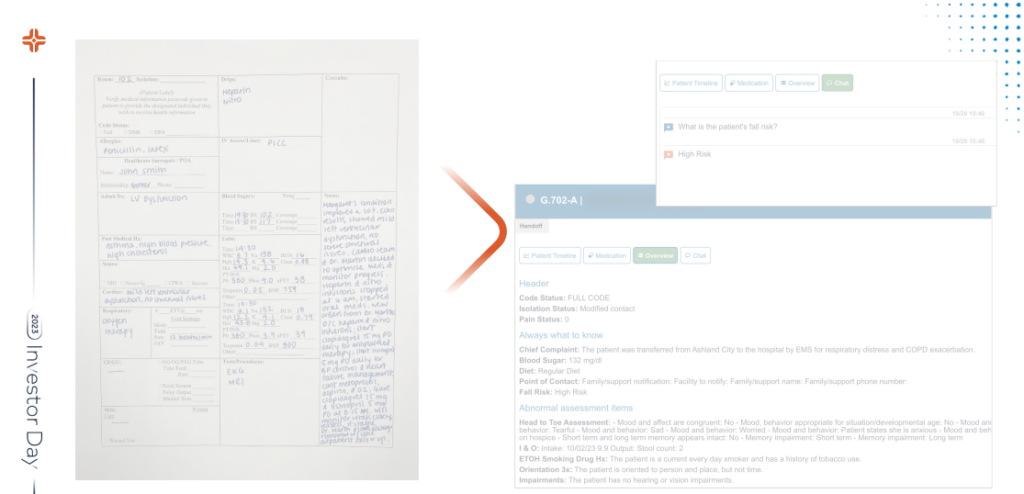

- Shifting patient handoffs for nurses from a manual to an automated process

- Building upon existing prompts to generate more sophisticated use cases (discharge summaries, ER to inpatient handoffs, etc)

On scalability, security of using LLMs like ChatGPT: The key thing about this is the scalability. So you can do this in ChatGPT if you grabbed a bunch of documents and just dropped it in there. We would never do that because they don’t protect our patient information if we do that. We have pipes into these large language models where all the information is protected. But to do it at scale, to do it in a scaled reproducible way where you continuously monitor the output, is actually the challenge. And that’s the innovation that really our teams have created here is the ability to do this in a scaled way.

A Hyper Focus on Nurses

Nurses are the heart of any hospital, and HCA recognizes that – particularly post-pandemic. From a business standpoint, nurses are also key to capacity growth in HCA hospitals. For that reason, HCA is prioritizing its nursing strategy given current labor dynamics for most hospitals:

- From a national supply perspective, 100,000 nurses left the profession in 2021 and 2022. And if you couple that with the 6% projected RN job opening growth over the next 10 years, you can see that supply gap just continues to grow. Additionally, the nursing workforce is aging. Today, the average age of the nurse is 52 years old, and 20% of those nurses are expected to retire in the next 5 years. From a pipeline perspective, there’s currently not enough graduating nurses to backfill the nurses that are leaving.

HCA has (correctly) identified nursing – and nurse happiness – as key to organizational success, and to that end, noted a laundry list of initiatives to support its nurses: Connection with our nurses is critical to our success. Nurses want to learn and grow and in HCA Healthcare, they have that ability. Whether a nurse wants to stay at the bedside as an expert clinician, we need that. Or if they want to take a leadership path, we need that as well.

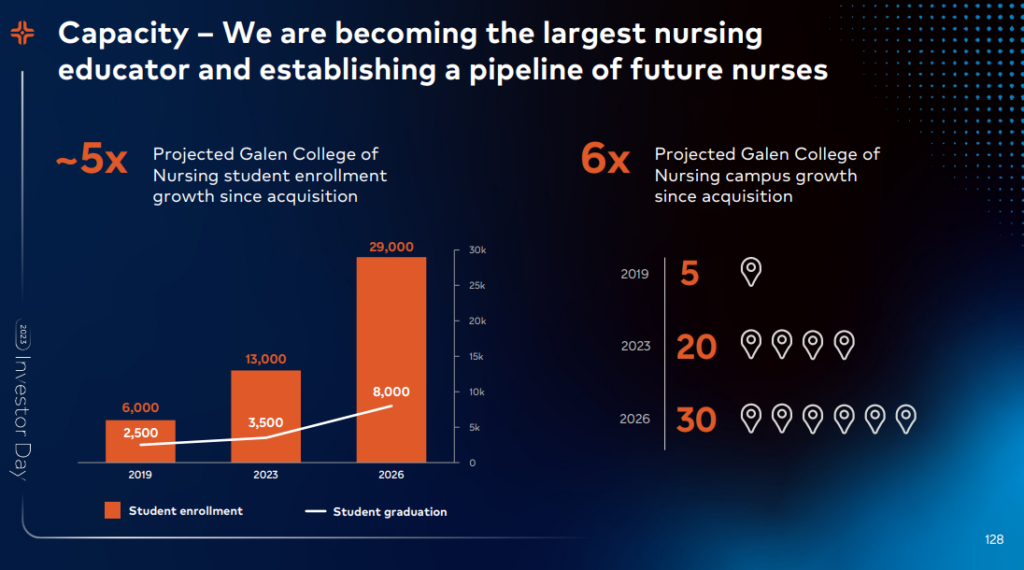

- Investment in its nursing college pipeline (Galen College of Nursing)

- Our majority ownership in Galen College of Nursing will continue to increase our capacity and our supply of future nurses. Our vision is that we have a Galen College of Nursing on the front end of each of our provider systems. Galen is an integral part of our overall system. Our current focus is on nursing, but in the future, we would explore the opportunity to leverage Galen for Allied Health. Since our acquisition of Galen in 2019, we have grown our campus sizes from 5 to 20, with a projection to add 10 additional campuses by 2026. Student enrollment in our markets is strong and is projected to be at 29,000 students in 2026. This will position us as 1 of the largest providers of undergraduate nursing education in the country.

- Emphasizing recruitment and retention – down to 17% turnover from a high of 28%

- Advocating for nurse leadership; formalized leadership training and nurse career advancement

- Our nurses have endless career opportunities. Nurses want to learn and grow. They do not have to leave our company to be able to accomplish that. We’re leveraging our assets to shape the future of nursing.

- Providing nurses with the right tools & support resources to reduce burnout & emphasize communication – assigning unlicensed or other non essential personnel for duties not at the top of the license for that nurse, documentation solutions for charting & handoff, etc.

- Leveraging technology to extend nurses – e.g., virtual nursing programs that complete discharge / admission processes; better equipment management

How HCA’s Grand Strategy comes together

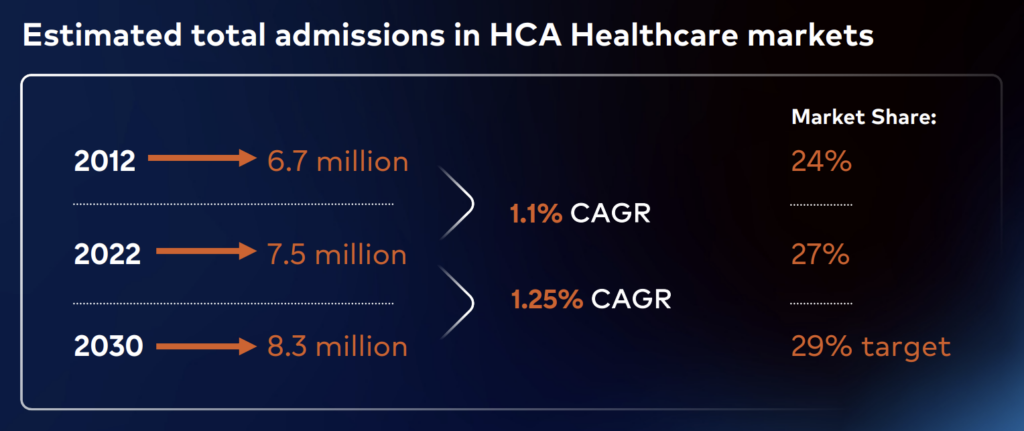

All of these tactical decisions and investments come together into a cohesive hospital-wide strategy for HCA. Given its insights into its local markets, overall healthcare spending trends, and specific growth prospects, HCA plans to expand its enterprise-wide market share to 29%:

Population growth, aging baby boomers, in chronic conditions, yes, such as diabetes, obesity and so forth, put pressure on the demand curve. We estimate that the total inpatient market will grow in excess of 10% over the next 7 years to an estimated 8.3 million inpatient admissions in HCA’s markets. This is a slightly accelerated rate of growth over the past period that we’ve studied.

On the outpatient side, we expect demand to be even greater than what we see on the inpatient side. And this is especially true for our emergency room services and outpatient surgical services. As I previously mentioned, we’ve had success in growing market share. We set a new target for 2030 of 29%, which is continuing the path of growth.

How does HCA’s strategy culminate into financial outperformance among hospitals?

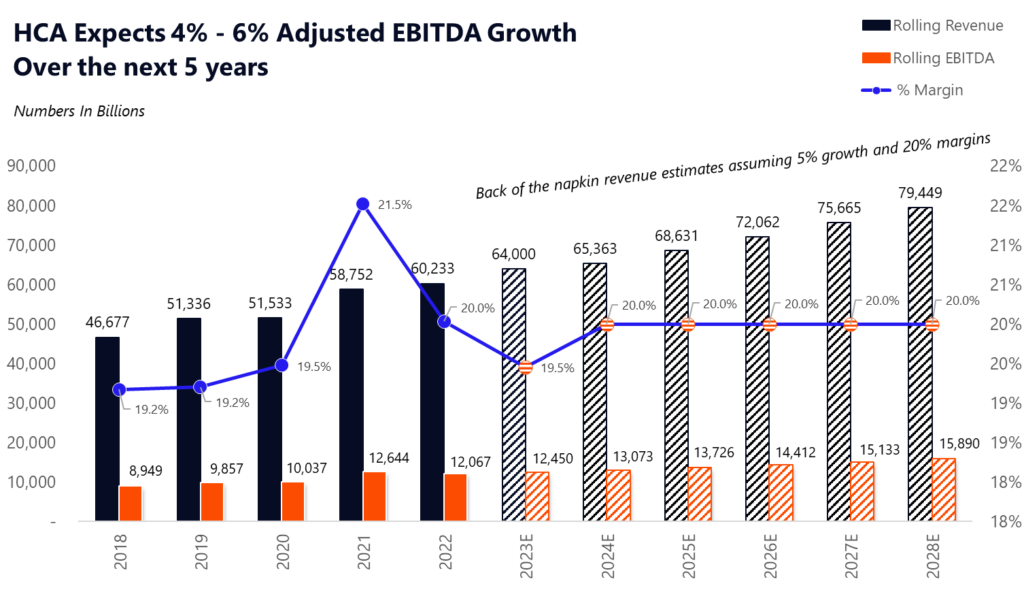

HCA didn’t provide much (yet) in its expectation for 2024, other than to say in its 2024 preview it’ll hit 4-6% Adjusted EBITDA growth and 8-12% diluted EPS growth. Here’s what that might look like over the next 5 years if we assume HCA maintains its 20% adj. EBITDA margin and 5% midpoint growth:

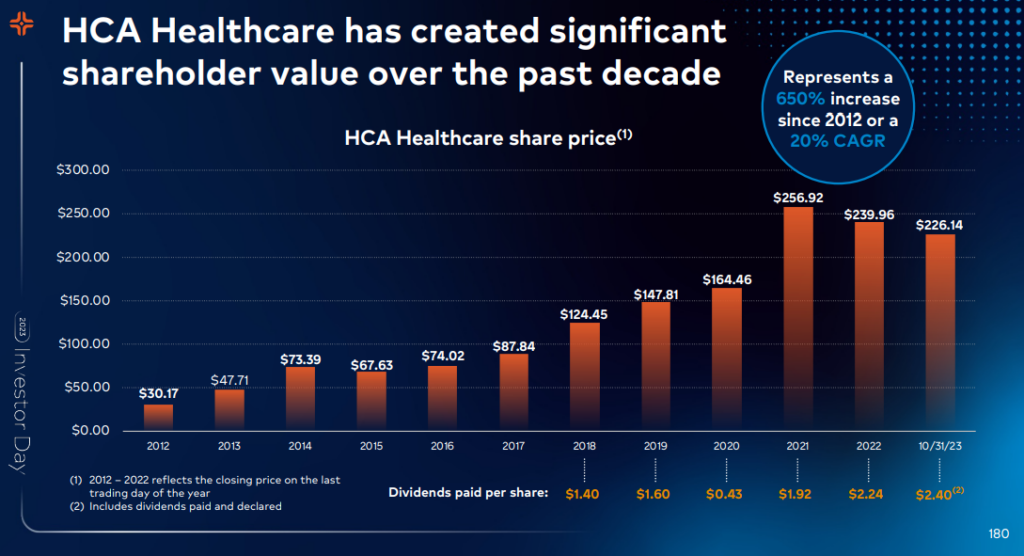

This financial outperformance among hospitals has resulted in impressive shareholder value over the past decade+:

Challenges on the Horizon for HCA & Hospitals.

HCA is not immune to the secular headwinds facing the hospital industry. For instance, the shift to Medicare Advantage and swelling owned care delivery asset bases of the largest insurers is another growing 800-pound gorilla in healthcare. Labor and clinical talent – particularly physician alignment – will always be a problem. Well capitalized startups aim to snatch outpatient market share away from hospitals, threatening the networks of these sprawling systems. But time and time again, HCA has stood fast against ongoing hospital operating challenges.

Finally, despite its business acumen and stellar track record of returns, HCA is not without rebuke. For instance, the publicly traded health system has been accused of questionable ED admissions, aggressive hospice discharges and billing practices, and most recently, anticompetitive practices in its recent takeover of Mission. Many issues affecting healthcare organizations in the future will come from people. Labor shortages. Physicians feeling as if their voice is squashed in the Corporate Machine.

In 2024 and beyond, HCA and others will need to double down on communication efforts, both internally and externally, as hospital costs, hospital CEO pay, hospital billing practices, and other anti-hospital rhetoric remain in policymaker crosshairs. Otherwise, trust in a traditionally steadfast institution will continue to degrade. And as that degradation occurs, strategy and execution will follow suit – M&A gets harder, recruitment of clinical talent gets worse, and growing patient mistrust in an industry that requires relationships will create financial headwinds.

“The U.S. the health industry is composed of good and bad actors in each of its sectors: none owns the moral high ground exclusively though some believe and act as if they do. The health economy has been good to investors and entrepreneurs, especially those who sell products and services to hospitals, medical groups, and long-term care providers and the adjudicators of their transactions. Shareholder values for these increased 5.9% between 2013 and 2018 compared with 3.6% for the S&P 500 as a whole. Accolades, facility names and scholarships memorialize the financial successes of these while those who provide care—hospitals, nursing homes, public health providers—struggle as their operating costs soar and margins erode. But that’s noise to consumers: they see a system that’s big, profitable and self-serving. And, in popular media, they hear it has failed to improve life expectancy, imposed medical debt on 2 in 5 households and addicted a generation to harmful drugs.” – Paul Keckley

If you enjoyed this, consider subscribing to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 24,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)