Workweek

PEOPLE

FOLLOW

PEOPLE,

NOT

INSTITUTIONS

Workweek helps business leaders across every industry have a more productive – and fun – work week.

We deliver insights and analysis from our network of industry experts, foster thriving professional communities, and innovate work flows through modern technology – all to help leaders like you make better decisions, expand your network, and be more successful induring your work week.

Learn

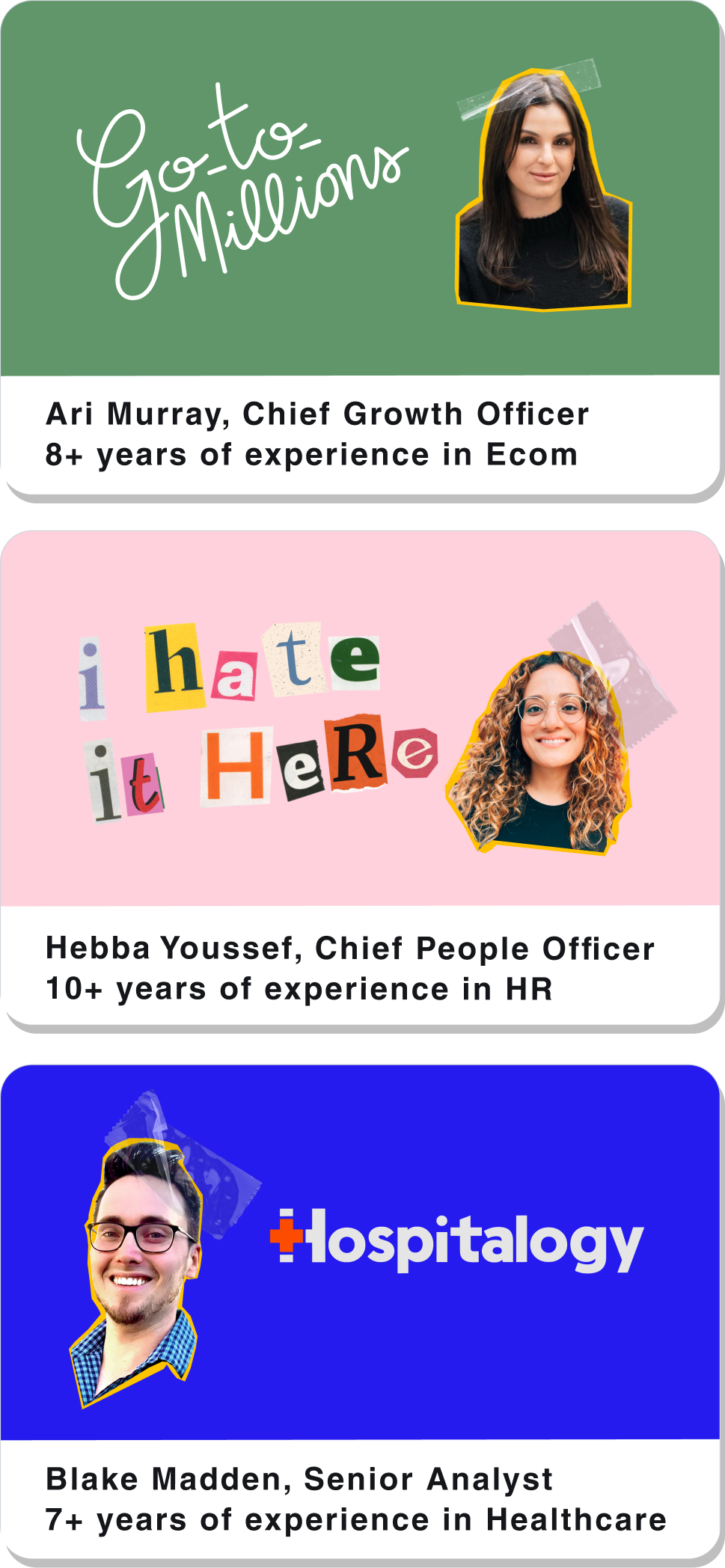

from experts

Who can you trust when the internet is full of AI-generated blog posts and self-proclaimed gurus?

Workweek cuts through the noise to provide the industry-specific insights and analysis you actually need.

We partner with real experts who have walked the walk. They’ve made the mistake you’re about to make. They’ve seen what you’re about to see. They can help you learn what’s around the corner – and, ultimately, become a better operator.

How? Meet our experts, find your industry, and subscribe.

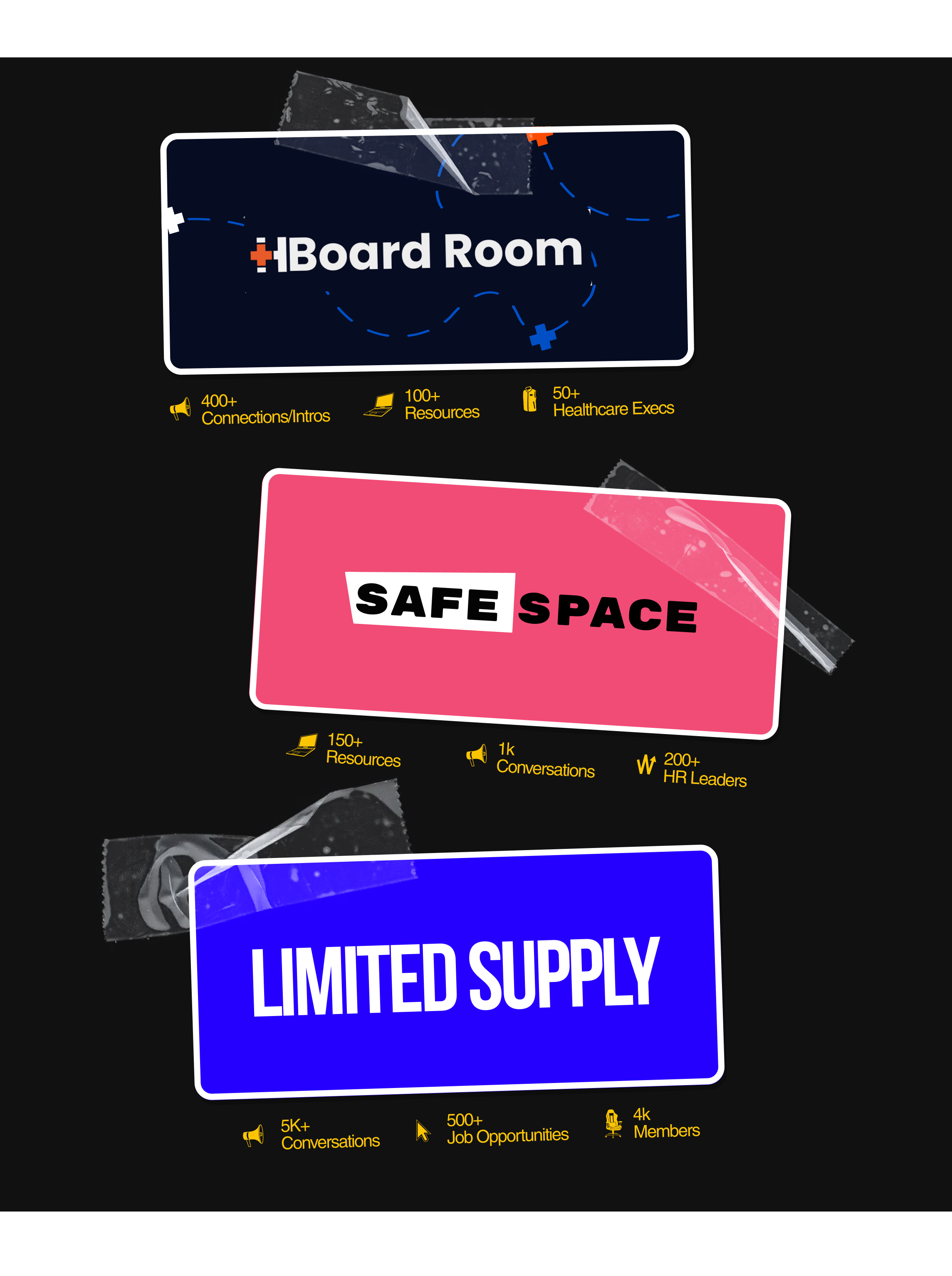

Find your community

Grow your net worth through your network.

Every day, you grapple with demanding decisions, often with limited information, on unfamiliar terrain. It's undeniably challenging.

One way to make it easier? Leverage the successes – and failures – of your peers (without wasting years of your life in coffee meetings).

Workweek assembles the very best industry leaders into thriving professional communities. These spaces are private, secure, and trustworthy. Here, you can ask the tough questions, get authentic answers – and, ultimately, level up in your career.

Learn from people who are in the arena with you.

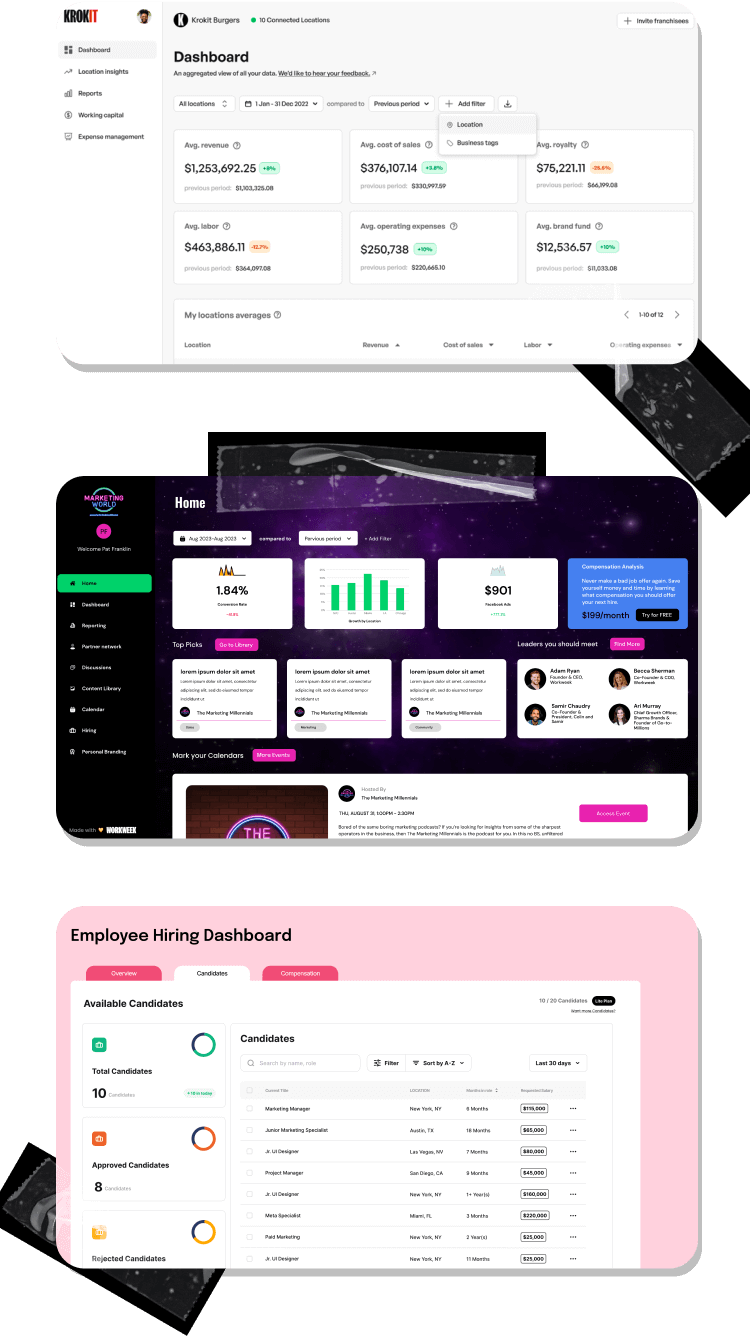

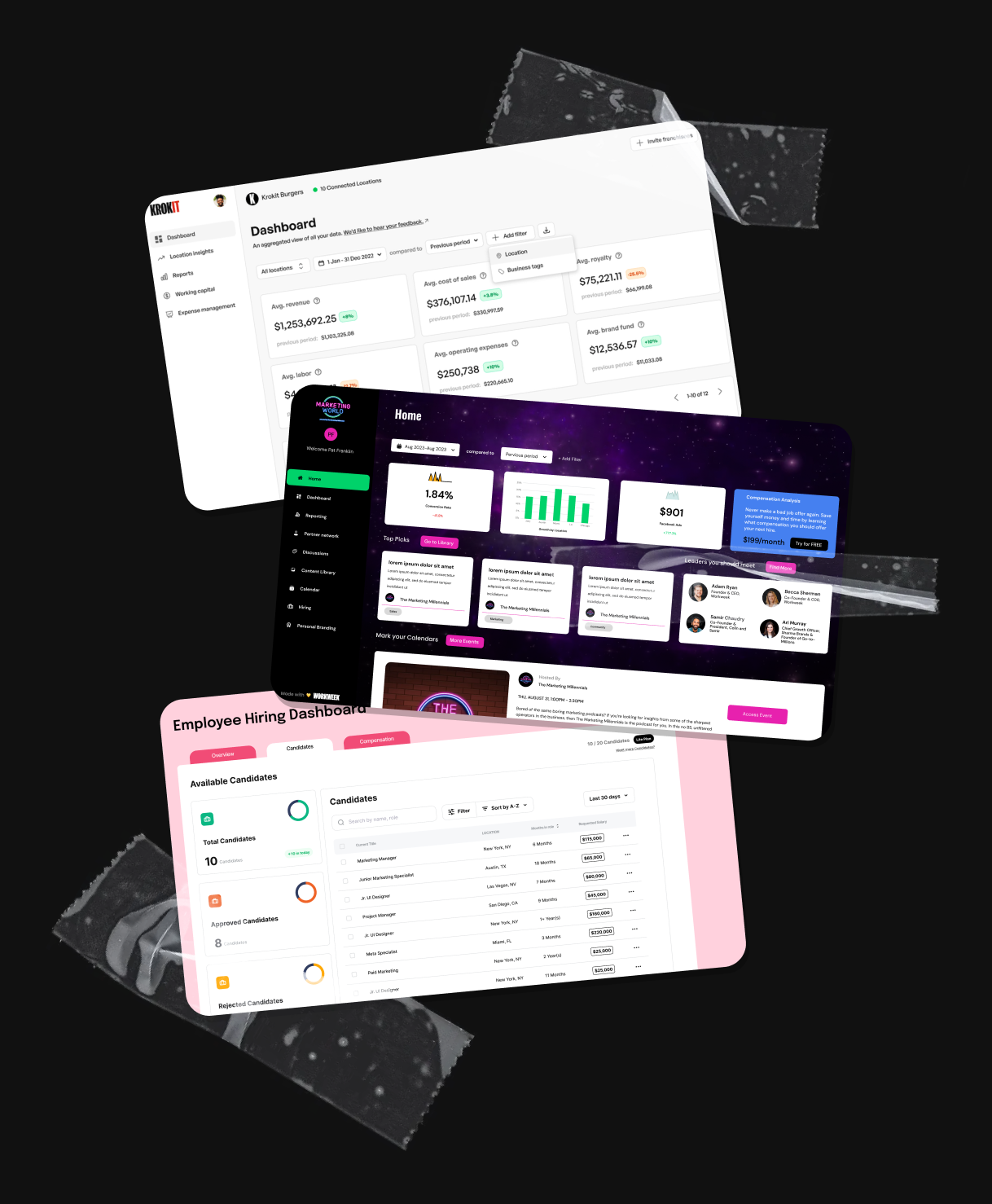

Use Modern Technology

Tech makes our lives easier – at least, it’s supposed to.

The thing is, far too much of the tech we use at work feels like it was built by a bunch of engineers in a basement who have never… well, done your job. It’s hard to use, harder to implement, and becomes more of an expense than an asset.

Workweek collaborates with our expert operators and professional community members to learn what you actually need from a tech solution. Then, we build it into a singular platform so you can manage your day all in one place.