Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 27,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Privia, Oak Street Health, and Aledade by subscribing here!

UnitedHealth Group gets into crypto?

A Wired article published on March 4 speculates a recent $22M Bitcoin transaction was a ransom payment for the Change Healthcare cybersecurity incident.

If so, the payment sets a dangerous precedent. It’s one of the largest ransomware payments in history, and we should expect a major ramp-up in cybersecurity events within healthcare given its scale.

From the Wired article:

- “If Change did pay, it’s problematic,” says Callow. “It highlights the profitability of attacks on the health care sector. Ransomware gangs are nothing if not predictable: If they find a particular sector to be lucrative, they’ll attack it over and over again, rinse and repeat.”

Fallout has continued from the attack – like, seriously; crisis level stuff here – as providers grow more and more cash strapped. Optum has come up with a paltry stopgap offering – more or less working capital loans to provider groups. The solution seems to barely scratch the surface for needs from provider organizations according to the AHA, which is having an absolute PR field day with these developments. It’s also low key a way for Optum Financial Services to acquire some new customers?

Advocacy groups like the AMA and AHA are calling on Congress to provide assistance for provider organizations as key healthcare processing functions stay down. There’s no timeline for getting back key functionality. No timeline!! Imagine if Amazon were down. Or Chase Bank.

Implications of UnitedHealth Group’s antitrust review

Per the Wall Street Journal, the DOJ has been investigating UHG since Q4. Many are skeptical anything comes from UnitedHealth’s debacle with Change Healthcare.

A common, perhaps cynical but directionally correct theme I’m hearing is this: “UHG’s lobby is powerful, and they’re in the pocket of lawmakers. Plus, big government prefers to work with larger entities. It’s easier that way.”

On that note, any antitrust investigation faces an uphill battle.

For one, Optum is historically payor agnostic, meaning they work with all health insurers across the industry (despite the obvious advantages of working within its own organization and UnitedHealthcare plans). UHG management has consistently stressed the divisions between Optum services and payor services.

Two, there is no legal precedent for proving harm in vertical mergers. It’s why Change went through in the first place. It’s why Optum can buy Amedisys (still pending, by the way) and LHC Group, Kelsey Seybold, and other services. And harm for who? Plus if you break up UHG, as weird as it sounds, you actually might raise costs in the short term for employers, a huge customer base UnitedHealth works with. And then you’d have to deal with the other payors who are following a similar vertical integration strategy.

Three, it’s an election year, and so it’s possible much of this hubbub is just politicized rhetoric. The Biden Administration is ramping up antitrust scrutiny across the board as we’ve seen with Apple, Amazon, and others. The fact that UHG didn’t even disclose the investigation on an SEC filing signals to me the news is far from material.

It’s still possible we see something happen here. That’s not what I’m saying. My main point is…when you consider the above factors, you can see why folks around the healthcare industry are skeptical.

That being said, here’s more to work with than we’ve ever seen before. The Change Healthcare news is fanning the flame, and the algorithmic denials debacle happened. It doesn’t matter whether UHG deserves the blame or how integrated they were with Change given the deal closed relatively recently. Outward optics against health insurers are bad in general – net promoter scores are notoriously low.

The investigators have in recent weeks been interviewing healthcare industry representatives in sectors where UnitedHealth competes, including doctor groups, according to people with knowledge of the meetings.

During their interviews, investigators have asked about issues including certain relationships between the company’s UnitedHealthcare insurance unit and its Optum health-services-arm, which owns physician groups, among other assets.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Investigators have asked about possible impacts of the company’s doctor-group acquisitions on rivals and consumers, the people said.

Northwell Health announces plans to merge with Nuvance Health

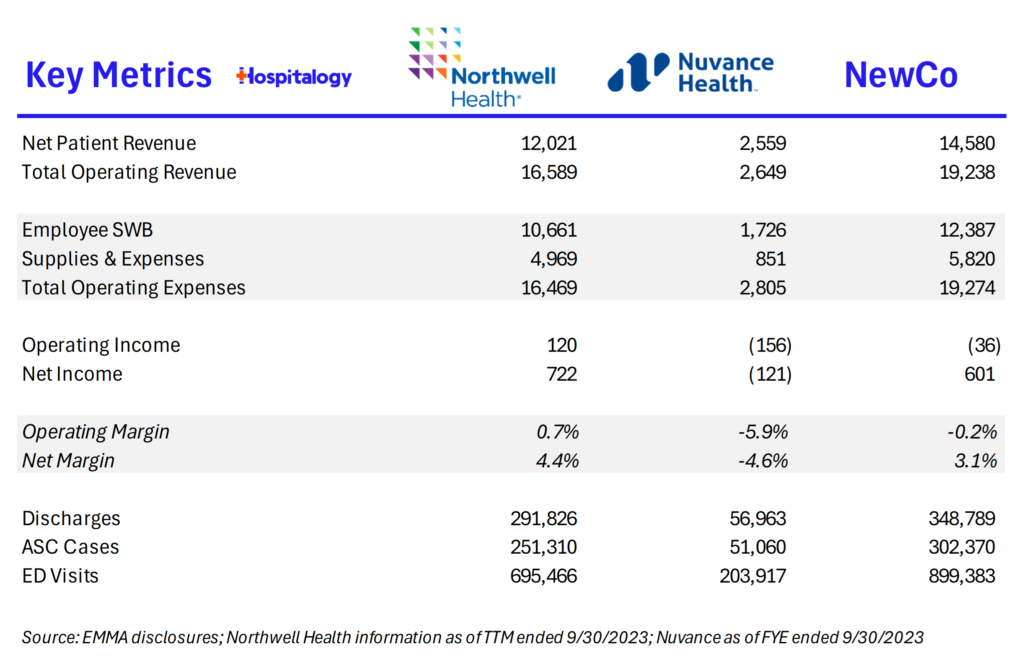

Announced February 28, New York based Northwell Health is merging with Nuvance Health, which would create a 28-hospital, 14,500 clinician,1,000 outpatient sites of care footprint across New York and Connecticut. The two have held longstanding partnerships and also much of their revenue is in outpatient footprints, a potentially key synergy. Some deeper analysis coming on this one soon!

Strategy Updates:

Key considerations for decision makers. Notable moves, policies, and strategies.

Anesthesiology Group Contract Termination: U.S. Anesthesia Partners settled its Colorado state monopoly dispute and ended its contracts with five CommonSpirit Colorado hospitals. More broadly within the state, USAP will reform the structure of its non-compete clauses to completely end non-competes in physician employment contracts within 18 months. This is actually a massive development in the anesthesia space – at least in Colorado – given USAP employs a combined 4,500 anesthesiologists and cRNAs across several states. But it also has big implications for other physician practice management groups and the overarching practice of non-compete agreements assuming cases like these gain similar traction. A development to watch given that Trinity Health just sued an anesthesiology firm for similar reasons. (Link)

Ellison pulls the Ronin plug: Based on some insider reports, Bloomberg reported Larry Ellison shut down Project Ronin on Friday, laying off 150 talented folks and based on some rumors I’ve heard, plans to move the IP over to Cerner. (Link)

Spending Bill Updates: A bipartisan spending bill unveiled Sunday narrows some of this year’s cuts to physician Medicare pay, pushes back scheduled disproportionate share hospital (DSH) payment cuts and increases annual funding for community health centers, among other provisions that would prevent a partial government shutdown on March 8, if signed. More specifically, the bill would halve the cut in professional reimbursement to around -1.7%. (Link)

Micro hospital strategy: ChristianaCare and Emerus Holdings announce their plans to open what looks like a micro hospital type model. They’re opening 3 ‘neighborhood’ hospitals in Delaware County equipped with 10 inpatient beds, full service ED, and advanced imaging/diagnostic capabilities and will plan to add health and wellness centers attached to those campuses. Interesting little play. They’ve also entered into a partnership with WellSpan in central Pennsylvania and plan to open 3 small-format hospitals in South-Central PA with them. (Link)

Walgreens Keeps Shields: After a rumored sale and a $4B+ price tag, Walgreens has decided not to divest Shields from its healthcare delivery assets per commentary from WBA CEO during the TD Cowen Health Conference. (Link)

Top health systems by (bed count), according to Definitive data comprise 185,000+ beds, good enough for 20% of all acute care hospital beds according to the latest data from the AHA:

- HCA (41,694)

- The VA (25,260)

- UHS (21,201)

- CommonSpirit (19,405)

- Ascension (17,286)

- Trinity (14,753)

- Tenet (13,806)

- Advocate Health (11,764)

- Providence St. Joe’s (10,199)

- Kaiser (9,819)

CommonSpirit’s MA Clash: On a recent investor call, CommonSpirit’s CFO Dan Morissette noted a tough environment for health systems as payors ramp up utilization management – denials, accurate reimbursement for contracted services, and more – characterizing the recent developments as ‘egregious’ (Link)

IVF Protections in Alabama: Following an abortion ruling, the Alabama House has passed legislation to protect in vitro fertilization (IVF) providers. (Link)

More MD Union Activity: Physicians and APPs at Bicycle Health are planning to unionize, citing a shift in company culture, overworked clinicians, and ignored feedback. (Link)

Oprah sheds WeighWatchers: In a surprising move, Oprah is leaving the WeightWatchers board and donating proceeds from her shares in the company to charity. Pretty interesting time to step away given everything going on in the space. WW stock dropped 20%+ on the news. (Link)

Partnership, Products, and Pilot Announcements:

Collaborations and launches to keep a pulse on.

Accolade added pediatric behavioral health provider Brightside to its Trusted Partner ecosystem. (Link)

RhythmX AI and Sentara Health are collaborating to revolutionize primary care with a predictive and generative AI-driven copilot for clinicians. (Link)

Walgreens becomes the first community pharmacy to accept a wide range of Medicare Advantage supplemental benefits online across 1,700 eligible products. (Link)

Elsevier Health and its partners have introduced a conversational AI decision support tool designed to assist healthcare professionals in making more informed clinical decisions. (Link)

Medallion announces the launch of an accurate one-day credentialing solution, aiming to streamline the credentialing process for healthcare professionals and organizations. (Link)

Finance and M&A Updates:

Healthcare financial summaries and interesting merger activity

Veradigm is set to acquire ScienceIO for $140M in cash, a move aimed at enhancing its healthcare data analytics capabilities while Veradigm itself gets delisted from the stock market. (Link)

St. Luke’s Duluth completed its merger with Aspirus Health, comprising 19 hospitals, 130 OP clinics, 14k FTEs, 1.3k physicians & APPs, and more across Minnesota, Wisconsin, and Michigan. As part of the deal, Aspirus will invest $300M in St. Luke’s over 8 years. (Link)

RadNet announces its entry into the Houston marketing through a platform splash acquisition of Houston Medical Imaging – comprised of 7 imaging centers throughout Houston. It’s the first new market entry for RadNet, a provider of diagnostic imaging services, since 2020. The 7 sites, along with 20 radiologists, perform 135k scans annually across all major modalities and generated $28M in revenue. (Link)

RadNet also reported its fourth-quarter 2023 results, including record revenue and adjusted EBITDA, and introduced a new digital health reporting segment. (Link)

RF-Backed Oral Surgery-Focused Platform, MAX Surgical Specialty Management, announces four acquisitions to support its geographic expansion, enhancing its reach and services. (Link)

Radiology Partners closes a $720 million growth equity investment and completes previously announced debt refinancing transactions, marking a significant financial milestone. (Link)

Tenet Healthcare agrees to sell two California hospitals to Adventist Health for $550M. (Link)

Trinity Health significantly reduces its operating losses by 85% in the first half of 2024. (Link)

Mayo Clinic increases its operating income by 82% in 2023, showcasing a strong financial performance. (Link)

Universal Health Services reports better-than-expected earnings and revenue for the year and projects conservative earnings growth for 2024. (Link)

UPMC faces a $198M operating loss, indicating a challenging financial period with a -0.7% margin. (Link)

Cleveland Clinic posts a $911M net income for 2023, driven by investment and volume growth, highlighting a successful financial year. (Link)

DarioHealth announces the acquisition of Twill, creating one of the most comprehensive digital health platforms across the most prevalent chronic conditions. This move is aimed at broadening Dario’s offerings and enhancing its market position. (Link)

Many disproportionate share hospitals are expected to face lower Medicaid payments due to a new final rule, impacting their financial support for serving low-income communities. (Link)

Elevance won a lawsuit over CMS star ratings for its MA plan and plans to recoup $190M in payments in 2025. (Link) (8-K Link)

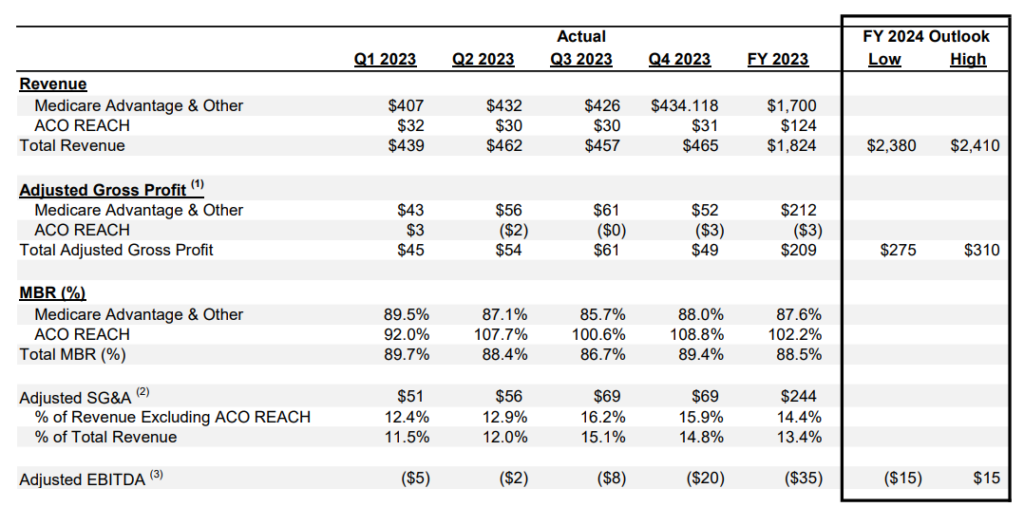

Alignment Healthcare posted some interesting results highlighting its decision to step back from the ACO REACH program – you can see it’s tough to succeed financially quarter over quarter, which makes me wonder about the sustainability of one of the largest alternative payment models. Separately, Alignment is a fascinating company doing things the right way in managed care – it’ll be interesting to watch as the payor goes all-in on Medicare Advantage with its distinct tailwinds headed into 2024 and 2025.

WellSpan Health and Evangelical Community Hospital have reached a definitive agreement to combine their health systems, aiming to expand healthcare services and access. (Link)

Concentra announces the acquisition of I&O Medical Centers in Virginia, broadening its network of occupational health services. (Link)

WebMD acquires Healthwise, aiming to bolster patient engagement and growth within the health information space. (Link)

WindRose Health Investors acquires CardioOne, expanding its portfolio in the cardiovascular health sector. (Link)

The merger of QCCA and NCCA leads to the formation of ONCare Alliance, LLC, a new entity aimed at transforming independent practice oncology and cancer care. (Link)

Innovation Spotlight

Cool initiatives and reasons for optimism

The Coalition for Health AI (CHAI – hilarious acronym) has officially announced its Board of Directors and CEO, marking a significant step forward in its mission to promote the ethical and effective use of AI within the healthcare industry. (Link)

Fundraising Spotlight:

Recent notable funding rounds. AI-generated.

- Reveleer scores $65M to scale AI-enabled data and analytics platform. (Link)

- Moxe Health Raises $30M Series B to Further Advance Interoperability. (Link)

- Carewell Secures $24.7 Million in Series B Funding to Revolutionize Familial Caregiving Experience. (Link)

- Blackbird Health Secures $17M To Expand Youth Mental Health Model. (Link)

- Redi Health secures $14M for healthcare management platform. (Link)

- UnityAI Secures $4 Million in Seed Funding to Revolutionize Hospital Flow. (Link)

- Salvo Health raises $5M to expand GI Provider Enablement for Wraparound Care. (Link)

Hospitalogy Top Reads

My favorite healthcare essays from the week

- VMG Health’s commentary on 2024 physician compensation trends

- Second Opinion’s dive into selling into employers: “…a focus on employers as an initial market has yielded many success stories across a few different categories…These have all followed broadly the same playbook – start by selling to individual self-funded employers…Problem is, for the majority of solutions today, that playbook no longer works…Our answer for the majority of new solutions is to avoid going all in on self-insured employers — with a few notable exceptions that we’ll outline here.”

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 27,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)