Good morning,

I hope everyone is having a great time at ViVE! I couldn’t make it this year, but you guys better be Vive’ing in my stead.

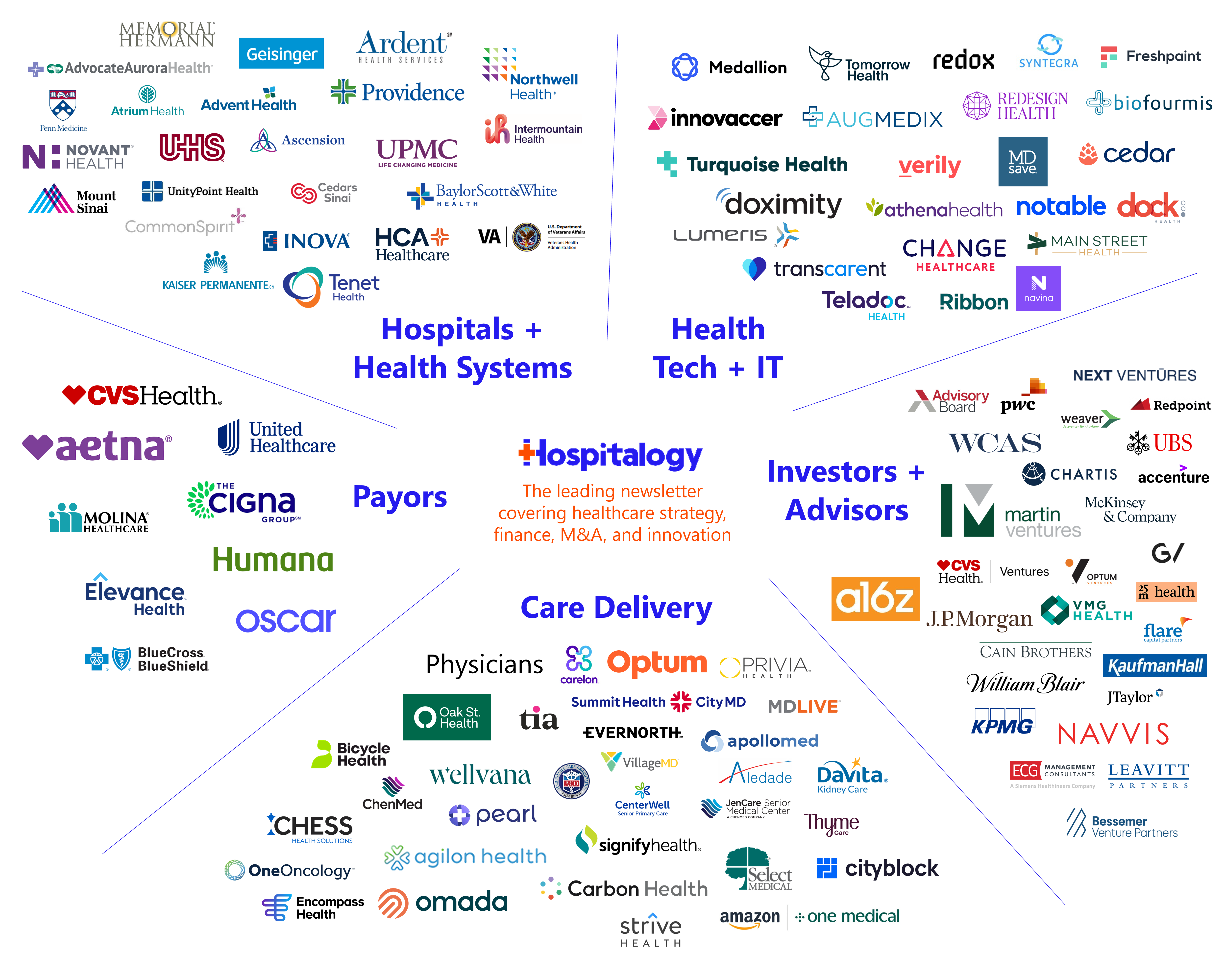

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 27,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Privia, Oak Street Health, and Aledade by subscribing here!

SPONSORED BY ADONIS

Coming soon: Catch me live on March 6th at 2 PM EST for a cool briefing on major trends and challenges with Adonis.

I’ll be diving into the future of healthcare finance for 2024 and more, with insights from 100+ experts in Finance, Operations, and Revenue.

More specifically, I’ll be covering managing costs, boosting patient happiness, how to grow sustainably, and the big impact of RCM and AI.

Can’t make it? No worries, if you sign up you can get the replay to watch at your convenience.

Can’t wait to see you there!

Don’t click that link!!

The Change Healthcare breach by a nation state is rocking the healthcare world. Optum’s subsidiary has been offline for SEVERAL days after discovering a foreign party had gained access to parts of the system, so Change decided to shut it down for damage control. More specifically, apparently there was a vulnerability in a service called ConnectWise leading to the security exploitation. You should also know that I am far from a cybersecurity expert and I have no idea what any of this means!

Still, the ramifications of the breach are significant – the AHA even went so far as to encourage provider organizations to disconnect from Change’s services (well, they said Optum really, maybe that was on purpose). Side note – can you think of another industry where if a shutdown of this magnitude occurred, the company’s stock price would be entirely unaffected? (That should tell you everything you need to know about UnitedHealth Group’s moat and defensibility).

Folks in the healthcare space were very quick to point out Change Healthcare ‘changed’ hands very recently to UnitedHealth Group’s Optum – a fact that works very harshly against the managed care behemoth, and a point in the favor of the FTC when it comes to anti-megamerger narrative given the DOJ challenged the Change Healthcare acquisition at the time.

Healthcare politics aside, cybersecurity events in general are a huge hazard for healthcare organizations and we should continue to see plenty of investment and crackdown in the arena. We’ve seen several high profile breaches over the last few years.

Tenet, CommonSpirit, Scripps Health, and others have been victims of cybersecurity incidents. For Tenet specifically, the for-profit hospital operator noted a $100M loss stemming from the attack. CommonSpirit’s cost up to $160M for the organization, while Scripps’ was around $110M. Meaning cybersecurity has been and will be a huge point of emphasis for health IT departments across the nation. Finally, for UnitedHealth, what might the ramifications be? Class action lawsuits, government intervention? Guess we’ll see.

R1 RCM gets Take-Private offer

New Mountain Capital, one of the largest shareholders of revenue cycle management firm R1 RCM, offered to take R1 private for $13.75 a share in an all-cash offer announced later in the afternoon on February 26. It’s around a 24% premium from its closing price yesterday.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

R1 is considered one of the ‘gold standard’ large operators when it comes to revenue cycle management services, and clearly the private markets think the firm is undervalued – a dynamic that seems to happen fairly often in healthcare considering the quarterly pressures public companies face.

Another interesting dynamic to consider – Ascension (one of the largest nonprofit health systems) owns a significant stake in R1 RCM and New Mountain would like for them and TowerBrook Capital Partners, another institutional shareholder, to get on board. It also seems as if the takeover proposal was met with frostiness considering R1 shares were trading near $20 as recently as summer 2023.

Bigger picture: this proposed transaction is one of the first take-private offers in healthcare in a minute. Between this news and what appears to be a significant bump in health tech VC fundraising, the capital markets (at least on the PE/VC side of things) appear to be thawing.

VillageMD completely exits Florida

In an unexpected move (and seemingly broken by Brett Jansen on LinkedIn and HTN, wild), VillageMD is fully exiting Florida, one of its largest markets with 52 locations.

Clearly Walgreens is extremely cash strapped, given the initiatives to cut costs at VillageMD but also sell Shields for a purported $4B price tag – if that ends up happening. Adding to this misery is the fact that advanced primary care senior clinics take time and capital to reach maturity and ultimately, profitability. The economics are not in their favor when you consider the massive price tag and cash Walgreens has dumped into VillageMD and Summit Health. Once Walgreens right sizes the VillageMD portfolio and finds the right density in the right markets, we’ll see if things improve for the struggling pharmacy player.

If you’re invested in Walgreens at this point, I don’t know what to tell you. (this is not investment advice)

Partnership, Products, and Pilot Announcements:

Collaborations and launches to keep a pulse on.

- Waltz Health ventures into Medicare Advantage by forming a partnership with SCAN Health Plan, focusing on pharmacy benefits and patient access to medications. (Link)

- Highmark Health and Epic collaborate to enhance payer-provider collaboration with insights powered by Google Cloud. (Link)

- GE HealthCare partners with Biofourmis to broaden its virtual care and at-home solutions, focusing on patient-centered healthcare delivery. (Link)

- Talkspace and Wheel enter into a strategic partnership to offer a comprehensive virtual care platform that integrates physical and mental health services. (Link)

- Humana announces a strategic partnership with Veda to enhance the accuracy of provider directories. (Link)

- Quantum Health collaborates with Vanderbilt Health Affiliated Network, expanding its healthcare navigation services to Tennessee employers. (Link)

- Uptiv Health and Lyn Health have partnered to integrate infusion therapy with chronic care management. (Link)

- NextGen Healthcare teams up with SCHIO to assist California providers in navigating the state’s new data exchange regulations. (Link)

- Brightside Health expands access to Medicaid and Medicare for greater telemental health coverage. (Link)

Finance and M&A Updates:

Healthcare financial summaries and interesting merger activity

Next up for hospital operators, CHS released Q4 earnings and attributed falling profitability (what’s new) in the quarter to bad payor mix, higher salaries & wages, higher professional fees & insurance costs, while attributing positive tailwinds to those affecting Tenet and HCA as well, namely strong IP/OP volumes, higher acuity, increases in other (DSH) revenues), and falling travel nursing expenses. It also disclosed a DOJ investigation

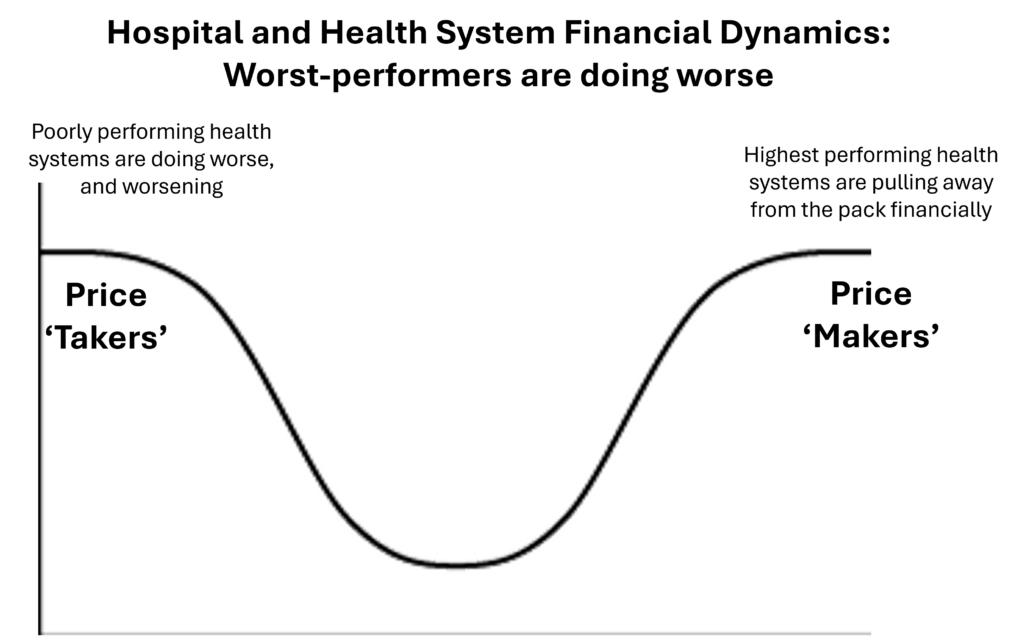

The CHS call really aligns well with the bifurcation we’re seeing among hospitals and health systems. The price ‘makers’ in markets – those commanding market presence and scaled density – are capturing patient volumes and negotiating favorable rates, whereas price ‘takers’ are falling behind. Kaufman Hall noted this dynamic as an ‘inverted bell curve’ which is really quite alarming and should only fuel consolidation. Assuming consolidation is allowed to happen!

Ken Kaufman’s post on these dynamics are must-read for any provider organization leader.

Surgery Partners reported its Q4 yesterday to a muted market reaction. The firm is projecting greater than $3B in revenue and $495M in adjusted EBITDA (~16.5%) in 2024.

- …same-facility revenues increased 11.3% in the full-year 2023 versus 2022

- …same-facility revenues increased 8.1% in the fourth quarter 2023 versus 2022

Other notable earnings highlights:

- Evolent Health reported

- ATI Physical Therapy lost less money

- Teladoc earnings disappointed yet again and we’ve seen a marked fall from grace for the once high-flying covid name

- Hims and Hers had a huge Q4 and 2024 outlook. Full year highlights:

- 48% subscriber growth to ~1.53M

- 18% increase in average order value

- $872M in revenue (65% growth)

- 82% gross margins (4% improvement)

- Adjusted EBITDA of $49.5M (~$60M improvement)

- Talkspace earnings were solid

Notable upcoming earnings this week. Looks like R1’s today might be…a bit more interesting huh!

- If you missed my analysis of Tenet and the ASC space, you can find it here: (Link)

Innovation Spotlight

Cool initiatives and reasons for optimism

Ambient documentation player Abridge raised a massive whopper of a round – $150M (!!!) in a Series C announced late last week after raising much of their Series B in May 2023. Abridge also notched a nice partnership with Yale New Haven Health as part of the announcement. As the ambient documentation wars heat up and the space continues to stay crowded, some serious investors have thrown some serious coin behind their jockeys of choice in the horse race going on here. I’ll likely do a deeper dive on the state of the space here soon as I’m having ongoing conversations with folks! This dive from Jacob Effron was a great overview of Abridge.

Fundraising Spotlight:

Recent notable funding rounds. AI-generated.

- Medical Microinstruments secures $110M for surgical robotics advancements. (Link)

- Reveleer scores $65M to scale its AI-enabled data and analytics platform. (Link)

- Fabric announces $60M Series A led by General Catalyst. (Link) (GC Breakdown of investment)

- b.well Connected Health raises $40M to scale its platform unifying patient data. (Link)

- Bioptimus launches with $35M to create an AI foundation model for biology. (Link)

- Oula banks $28M to build out maternity care clinics, backed by Chelsea Clinton. (Link)

- 9amHealth raises $9.5M Series A extension led by The Cigna Group Ventures to expand to employers nationwide. (Link)

- Siftwell Analytics secures $5.8M in funding round for digital health analytics. (Link)

- UnityAI secures $4 Million in seed funding to revolutionize hospital flow. (Link)

- Maia Oncology picks up $4.25M to build out a virtual primary care clinic for cancer patients. (Link)

- Menopause Startup raises $3.3M in funding led by UPMC. (Link)

- RapidClaims launches with $3.1M using AI to automate healthcare claims. (Link)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

So there we were on Friday night, about to play a golf round at a local muni when one of my good buddies from Houston texts me and says he’s driving up to play 36 holes at Pine Dunes, a course right outside of Tyler, Texas – a 2 hour drive from Dallas. So me being the degenerate I am, ask a disgruntled wife for permission to do so, and so I pick up my other good buddy at 4:45am to tee off at 8:00am at the legendary Pine Dunes course. Despite the great company and fantastic weather, my golf game was in shambles. I’m a lefty and hit a draw, and many of the holes are shaped right to left. That’s a pretty bad excuse though. Really my swing wasn’t in sync all day and my touch was absolutely abysmal around the greens. I ended up shooting a 90 and salvaged the round with a single birdie on the par 5 18th hole. We’ll get em next time in April!

Hospitalogy Top Reads

My favorite healthcare essays from the week

- VMG Health (my old firm, and some of my old colleagues!) wrote a really nice breakdown of the oncology space from an investment standpoint including recent private equity and corporate-backed activity. (Link)

- Primary Care: the mother of all APIs

- The wild and magical world of claims

- A good write-up from the Commonwealth Fund on FQHCs and how they can transition to value-based care.

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 27,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)