Hospitalogists,

For those of you who partake in President’s Day, I hope you had a restful, 3-day weekend. Today’s send should get you stragglers caught up on the latest happenings in healthcare strategy, finance and M&A across the ecosystem.

Thanks so much to NeuroFlow and Adonis for sponsoring today’s send! They have been and are awesome sponsors for Hospitalogy. I’m grateful!

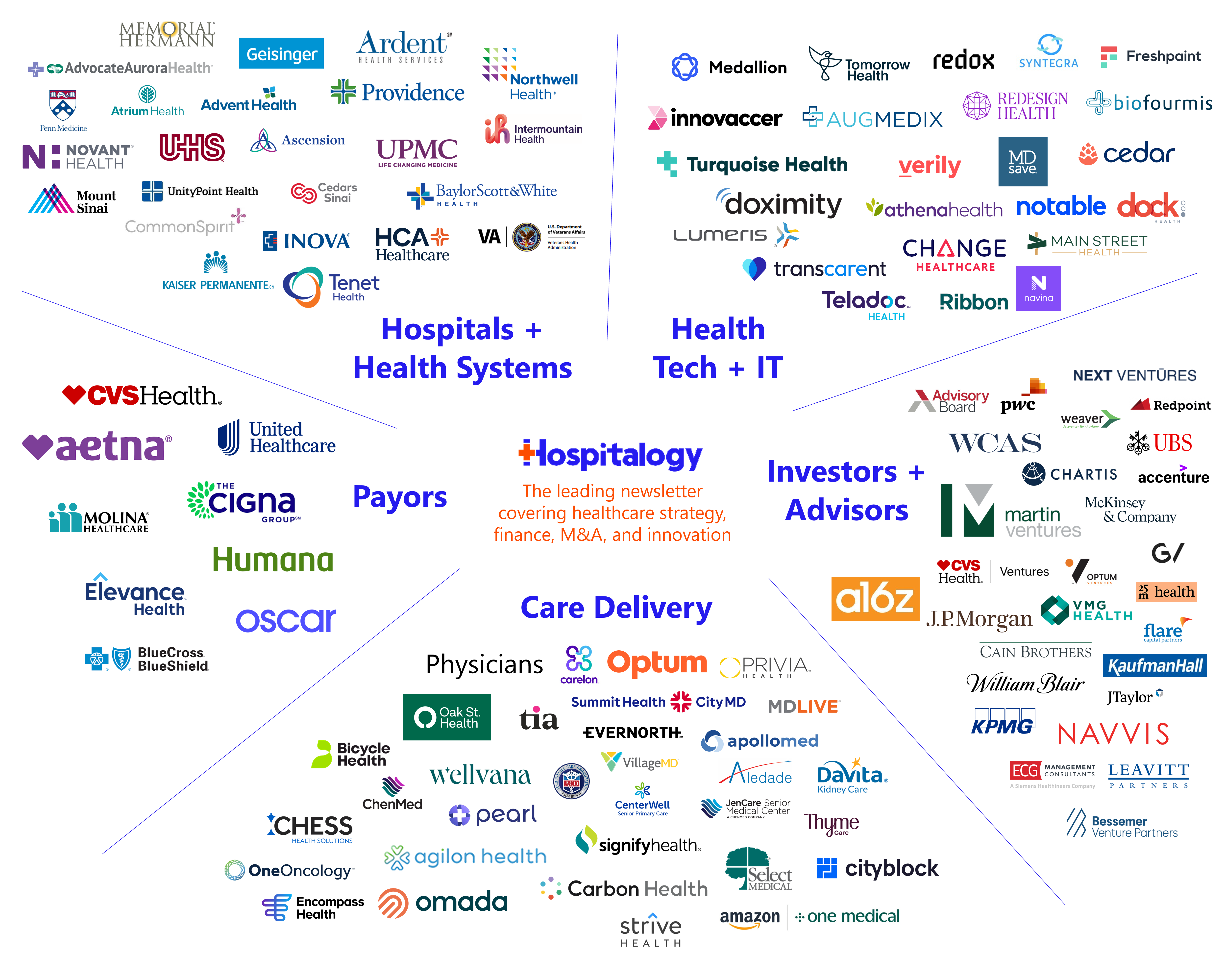

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 27,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Privia, Oak Street Health, and Aledade by subscribing here!

SPONSORED BY NEUROFLOW

Last week I teamed up with NeuroFlow for a super insightful Pulse Check on how to de-risk your population by addressing behavioral health and suicide prevention.

It was a great chat with execs from the healthcare world sharing tips on spotting and managing behavioral health risks early, all while cutting down on care costs for complex cases.

If you missed out, no problem – you can catch the recording here.

Also, don’t forget to grab NeuroFlow’s latest white paper on Strategies for Healthcare Leaders Addressing the Suicide Epidemic. Worth a read!

Cancelled mergers: SCAN Group, CareOregon; Blue Cross of Louisiana, Elevance call it quits

Two quick updates for you guys on the health insurance side of things.

SCAN-CareOregon: After announcing a new name (HealthRight Group) and an 800,000 member, $6.8B, 5-state merger in late 2022, Nonprofit health plan SCAN Group called off its planned combination with CareOregon this week. The call-off follows some public rhetoric opposing the deal

BCBSLA-Elevance: Talk about a seesaw on this one. Blue Cross Blue Shield of Louisiana initially announced its intended sale to Elevance back in January 2023. Of course, once the public caught wind of the deal, the two parties faced significant backlash and ultimately called off the sale 9 months later. THEN, in December, the two sides tried to resurrect the deal only to, once again, call it off – again – in mid February. BCBS LA can’t get buy in from the state, but they’re still trying to implement some sort of reorganization or merger.

Bottom line*:* Between these cancelled plans, last year’s called off health system deals, the highly politicized HCA-Mission fiasco, Optum’s bubbling public commentary troubles with acquiring the Corvallis Clinic (despite the clinic’s physicians taking a large comp cut and mounting losses to the tune of $1M a month per one public comment), and icy glares at the federal level from the FTC, states are turning on mega-mergers. At this level, we’re entering the Russian winter of healthcare M&A.

Strategy Updates:

Key considerations for decision makers. Notable moves, policies, and strategies.

Kentucky’s CON Program: Kentucky is currently studying the state of its Certificate of Need program and potential changes may be on the horizon in the state given other states have reformed CONs. (Link)

Health Systems Exiting Health Plans: Some health systems including Baystate Health and ProMedica are choosing to divest their health plans amid changing market dynamics. (Link)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Radiology Partners Growth: Radiology Partners provided an update on its 2023, adding 650 physicians and 62 client sites within a year. (Link)

U.S. Oral Surgery Management: The management company announced its 2023 results including partnerships with eight new practices across seven states. (Link)

A couple of nice data analysis pieces from KFF this week:

- State Medicaid Program Trends: KFF explores shifting trends within state Medicaid programs, revealing underlying data insights. (Link)

- Medicare Advantage Enrollment: KFF discusses ten reasons behind the growing enrollment in Medicare Advantage plans. (Link)

Surprise Billing Disputes: CMS data indicates a significant rise in disputes related to surprise billing. (Link)

HCA’s C-Suite Structure: HCA Healthcare updated its corporate structure and reporting. (Link)

Hospital at Home Approvals: Nine more health systems have been approved to implement ‘hospital at home’ programs in recent months per Beckers. (Link)

- AdventHealth

- Virginia Mason Franciscan Health

- Sanford Health

- CareWell Health

- M Health Fairview

- Inspira Health

- BayCare Health System

- North Texas Medical Center

- Boston Medical Center

Optum Contract Terminations: Optum lost 3 notable contracts, two of which occurring in behavioral health (Maryland and Idaho) while SSM Health cancelled its MSA with Optum on revenue cycle and other outsourcing functions. (Link)

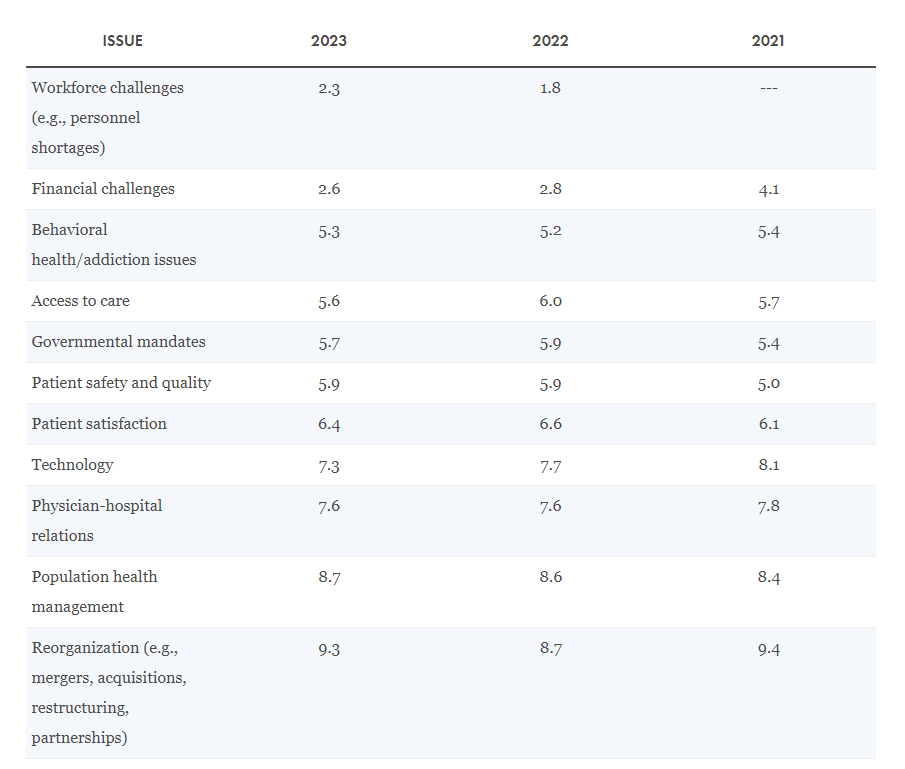

Hospital Industry Challenges: A survey from ACHE outlines the top issues facing hospitals today, from financial pressures to regulatory burdens. (Link)

Retail and Healthcare Collaboration: An exploration of how retailers and health systems can jointly enhance care delivery. (Link)

Advocate Aurora’s Pricing Lawsuit: Advocate Aurora is facing a lawsuit over allegations of its healthcare pricing and negotiation strategy. (Link)

Mississippi Medicaid Expansion: Mississippi’s Lieutenant Governor announces an impending Medicaid expansion bill. (Link)

‘Essential Health System’ Designation: Proposed legislation seeks to classify and fund safety-net hospitals as ‘essential health systems.’ (Link)

Partnership, Products, and Pilot Announcements:

Collaborations and launches to keep a pulse on.

Monogram Health on LinkedIn announced a partnership with Aetna (don’t forget CVS was a new strategic backer in Monogram’s January 2023 $375M funding round) and also announces a collaboration with Millennium Physician Group in Florida back in Jan. to manage thousands of Florida patients dealing with chronic kidney disease. (Link)

Bon Secours Mercy Health and Compassus announce a partnership to provide home care and hospice services, aiming to enhance patient support and care continuity. (Link)

- Note to self – look up how much revenue BSMH’s home health and hospice segment was generating

Florida Blue collaborates with Sanitas to establish a value-based primary care center in Jacksonville. (Link)

RadNet and JVS SoCal create ImagingWorks, an innovative partnership to launch career training programs for medical imaging. (Link)

AT&T’s 125,000 employees gain access to fertility and family-building benefits through Maven Clinic. (Link)

Cityblock extends its services to New York Medicaid members through a partnership with Fidelis Care, focusing on comprehensive healthcare for underserved communities. (Link)

Biofourmis and WellSpan Health collaborate to deliver high-quality, hospital-level acute and post-discharge care to patients at home, leveraging advanced technology. (Link)

PACE-focused myPlace Health opens its first care center in Los Angeles, enhancing services for the elderly. (Link)

Frame partners with Privia Women’s Health, focusing on improving healthcare delivery and patient engagement. PWH patients will have access to Frame’s services to support their pre-pregnancy, fertility and infertility needs. (Link)

Nema Health, a virtual clinic for PTSD, partners with Horizon BCBSNJ to expand access to mental health services. (Link)

Cigna and HelloFresh team up to offer a meal kit benefit in employer plans, aiming to support healthy eating habits. (Link)

Key Physicians selects Infina Connect’s Intelligent Care Coordinator to improve healthcare referral management across the Triangle area. (Link)

care.ai and Virtua Health collaborate to expand the hybrid care providers’ virtual care offerings, integrating advanced AI solutions. (Link)

Orlando Health and Acadia Healthcare hold a groundbreaking ceremony for a new behavioral health hospital to serve the greater Orlando area. (Link)

UCI Health and Lifepoint Rehabilitation break ground on a new inpatient rehabilitation hospital in Orange County, CA. (Link)

Finance and M&A Updates:

Healthcare financial summaries and interesting merger activity

Fairview Health Services and the University of Minnesota signed a Letter of Intent for UofM to purchase four key academic health facilities that make up the M Health Fairview University of Minnesota Medical Center — the East and West Bank campuses, M Health Fairview Masonic Children’s Hospital and the M Health Fairview Clinics and Surgery Center. The news comes after Fairview’s collapsed merger plans with Sanford and Fairview noting that continued support of the teaching hospitals was financially unsustainable. (Link)

- Figures provided by Fairview show the company has invested $1 billion into U of M hospitals since 1997, and it has steadily lost money since the M Health Fairview agreement between Fairview, the U of M and M Physicians was formed in 2018. Earlier this month, Fairview announced it was eliminating roughly 250 positions by the end of the year through a combination of layoffs and attrition.

The Q4 2023 Healthcare Services Report by PitchBook provides in-depth insights into the healthcare sector’s performance and trends. (Link)

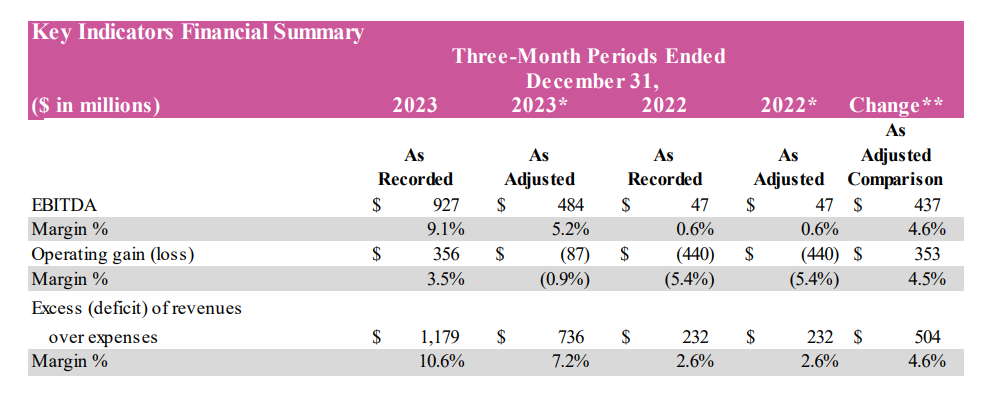

CommonSpirit bounced back majorly in calendar year Q4 noting significantly improved operating & EBITDA margins. (Link)

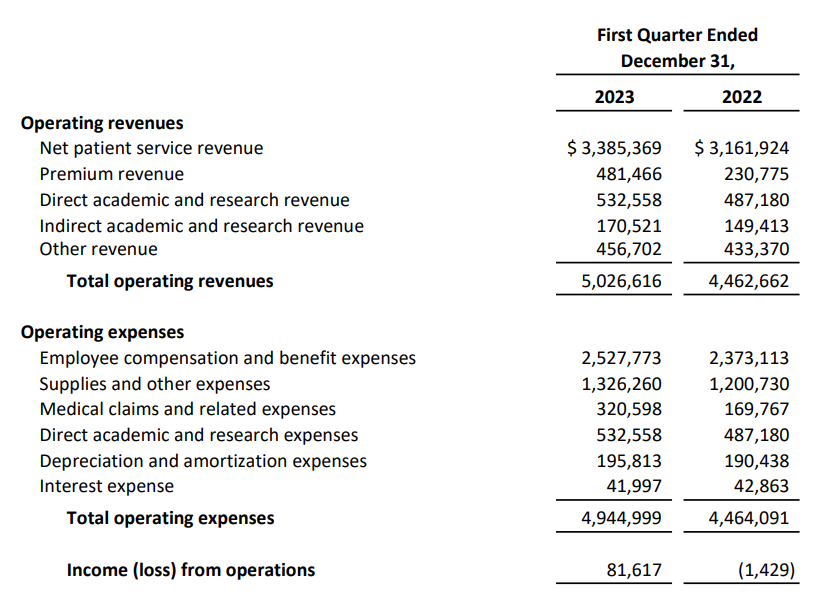

Mass General Brigham also flipped to positive operating margins. Despite a stronger than expected medical loss ratio, 3.2% inpatient discharge growth, 9% procedure growth, and 10% imaging growth boosted its margins for calendar year Q4. (Link)

A New Jersey healthcare system Cooper University Health Care has received a historic ‘A+’ credit rating, reflecting its financial stability and performance. (Link)

Cotiviti announces an $11B recapitalization agreement with KKR and its long-standing owner Veritas, aiming to strengthen its financial structure and expand its services. (Link)

Nava Health MD, Inc. and 99 Acquisition Group, Inc. have entered into a merger agreement, leading to Nava Health becoming a publicly traded entity. (Link)

PatientFi, a leading payments platform, secures a significant growth equity investment from Questa Capital, which is expected to support its expansion and enhance its offerings. (Link)

Amwell reported a $679M loss for the year but anticipates accelerated growth in 2025, bolstered by a significant defense contract. (Link)

Upcoming healthcare earnings reports:

- 2/20: Teladoc, Pediatrix

- 2/21: CHS

- 2/22: Evolent, Talkspace, Health Catalyst

- 2/23: Select Medical

Innovation Spotlight

Reason for optimism

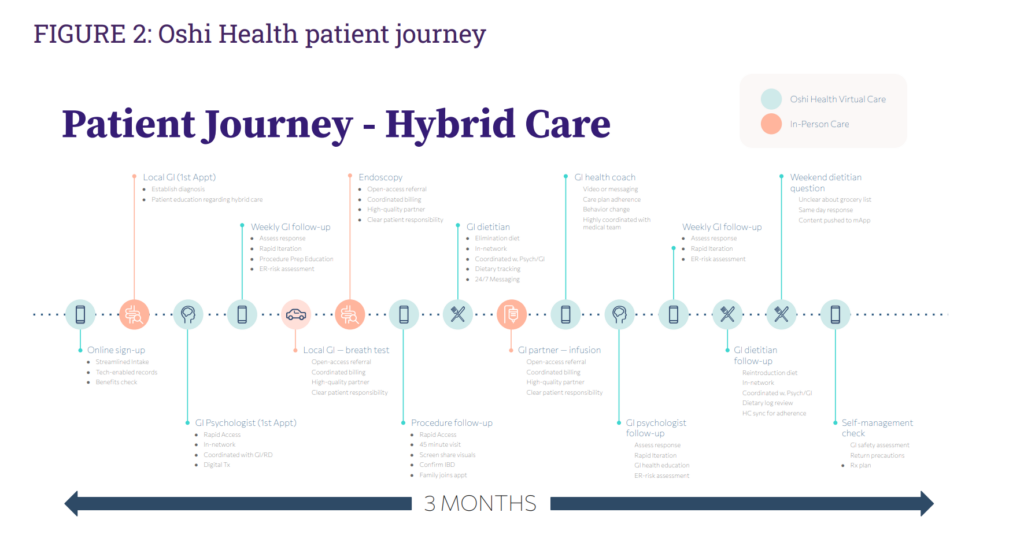

An Oshi Health case study conducted by the AMA’s Future of Health series was an interesting look at a forward thinking company in the GI space. (Link)

Abridge posted a cool video on Twitter of its work with Emory Healthcare and how it has helped shape 3,000+ clinicians’ day to day. (Link)

More Vision Pro stuff! Sharp HealthCare has initiated a spatial computing center with a focus on Apple Vision Pro, aiming to integrate advanced technology into healthcare services. If you’ve come across interesting use cases, send em my way. (Link)

Hippocratic AI launches a Nurse Advisory Council to ensure the safety of Large Language Models (LLMs) in healthcare. (Link)

Fundraising Spotlight:

Recent notable funding rounds. AI-generated.

- Elephas garnered $55M to advance its live tumor imaging technology, aiming to transform cancer treatment with real-time insights. (Link)

- Headlight launched with $18 Million in funding, bringing on board Amazon Pharmacy executives to simplify the mental health journey for patients. (Link)

- Elidah secured Series A funding to further its innovations in women’s health, specifically addressing urinary incontinence. (Link)

- DeepLook Medical raised $1.7M for its AI-driven technology aimed at enhancing cancer detection in dense breast tissue. (Link)

- Firefly Bio unveiled $94M to develop new ADC (Antibody-Drug Conjugates) cancer medications, showcasing a novel approach in the field. (Link)

- Unlearn secured $50M to further develop its digital twin technology, which aims to accelerate clinical trials and personalized medicine. (Link)

- Dina raised $7 Million to expand its digital care-at-home platform and network, aiming to enhance home healthcare services. (Link)

- Ezra raised $21 million to make Full Body MRIs more accessible, democratizing advanced diagnostic imaging for better health outcomes. (Link)

Sponsored by Adonis

Want the lowdown on the future of healthcare finance in 2024?

Join me on March 6th at 2:00 PM EST for an exclusive discussion, hosted by Adonis.

We’ll unveil fresh research from over 100 finance and operations executives, highlighting 2024’s key trends and challenges.

From cost management to patient satisfaction and AI’s role in growth and RCM innovation, get ready for useful insights that will shape your strategy for the year.

Register here to secure your spot. Let this event be your ticket to preparing for the future!

Miscellaneous Maddenings

Fun, random stories & updates from Blake

Great news fam! Baby Madden had his first big sleep through the night. 8pm to 6am. Send good thoughts for continued success in dream land fam.

Separately, I’m smoking my first brisket on Sunday on the Traeger – send me your favorite recipe.

Hospitalogy Top Reads

My favorite healthcare essays from the week

- VMG Health’s Ambulatory Surgery Centers Year in Review is a must-read for anyone in the space.

- Weaver’s Health Care Valuation 2023 Year in Review

- Chartis’ latest report on the dire state of rural hospitals. Can you call it a crisis if it’s been happening for 15 years?

- The Xealth 2024 Trends Report is a good look into the future of digital health and what’s top of mind for health systems in 2024. (Link)

- Modern Healthcare’s 40 Under 40: Meet the influential young leaders in healthcare as recognized by Modern Healthcare. (Link)

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 27,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)