Good morning Hospitalogists,

I hope everyone is having a great first Tuesday of 2024 catching up on those emails you put off the last week of December. I can relate!

Today I thought it’d be fitting to dive into the company that kicked off 2023 with a bang by acquiring Oak Street Health for $10.6B. Good ‘ole 3-letter. CVS. Here’s what they have in store for 2024.

SPONSORED BY NEUROFLOW

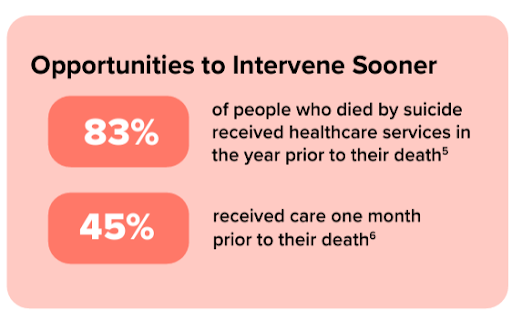

Your organization’s healthcare costs are skyrocketing. The mental health crisis in America is growing as more than 1 in 5 adults live with mental illness, and 49,000 individuals died by suicide in 2022.

In 2024 and beyond, you need a solid strategy to address this population’s growing needs, but most risk-bearing organizations and health systems need help putting one together.

That’s where NeuroFlow steps in.

NeuroFlow works with healthcare organizations to identify and address their population’s behavioral health needs sooner.

Their tech platform proactively identifies and stratifies at-risk populations, meeting those individuals where they are and preventing avoidable downstream utilization – saving both lives and costs.

The NeuroFlow team put together a whitepaper to help healthcare leaders think smarter about building a proactive approach to address the suicide epidemic. I consider it a must-read for anyone looking to better manage their risk and control costs in 2024.

CVS Investor Day: 5 Themes to Know

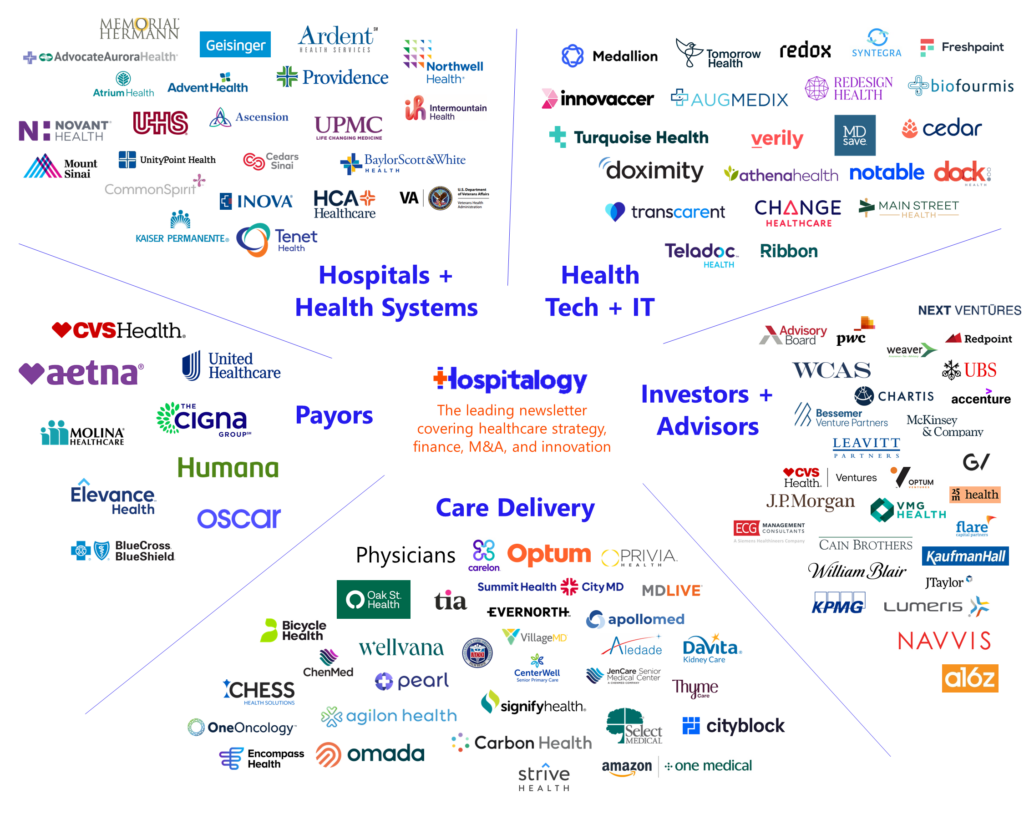

Meet the newly aligned, reinvented, but same old incumbent healthcare behemoth CVS:

CVS wants to optimize its flywheel

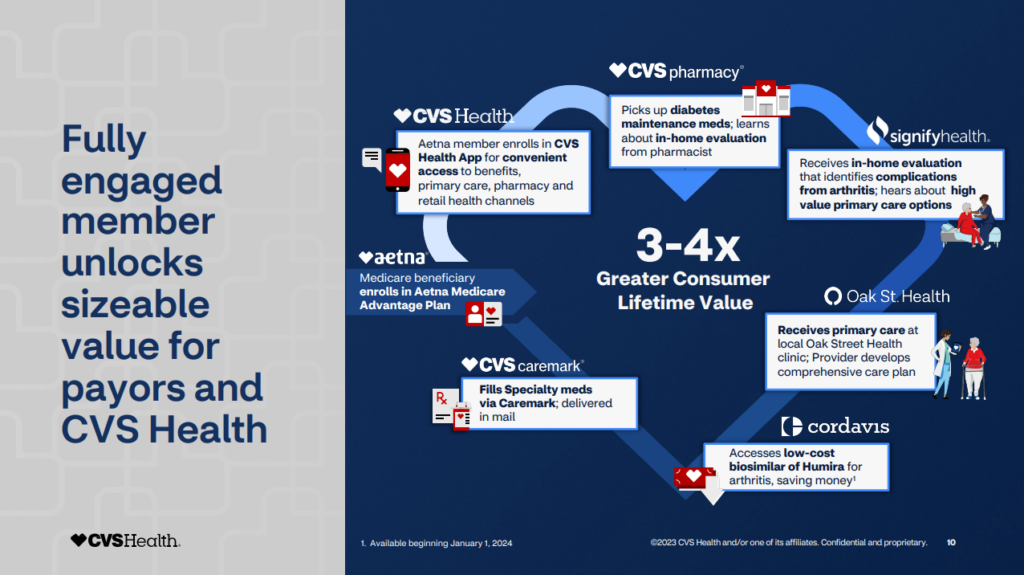

CVS, like most other players with vertically integrated assets, is touting the benefits of its care delivery portfolio on lowering customer acquisition costs and boosting its member lifetime value –

“The Signify and Oak Street acquisitions in particular spent a lot of time talking about the value of the integrated model here and the opportunity to cross-pollinate. One example given of this was that Oak Street is setting up tables inside CVS to convert CVS customers into Oak Street patients. It seems to be working reasonably well as Oak Street is converting 17% of CVS customers they talk with into visits at Oak Street. Signify is spending a lot of time talking to Aetna members in home, and as part of that is attempting to drive those members to Oak Street clinics – of the members Signify talks to, 19% want to be connected to Oak Street, and then 55% of those members actually schedule a visit, for a ~10% conversion rate in total. – Health Tech Nerds

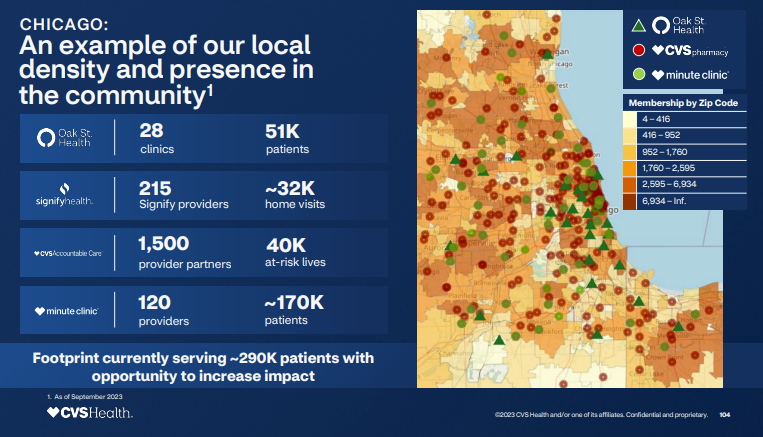

- Adding to this, it’s interesting to note the emphasis on market density for anyone owning care delivery assets. I touched on this in part 1 of the HCA investor day published on Friday, and CVS notes the same need for density in any market: “another advantage, another opportunity is local density. When we put together all these different assets in the health care delivery and create that inoperable data infrastructure, what we can do is we can create a lot of local scale. And that opens up even more opportunities for our care model. For example, by getting more local density, we can do more with home visits for patients following a hospitalization and lower readmissions and we can leverage Signify for providing that service to Oak Street patients or for patients in the CVS ACO.”

- “So what’s the opportunity on increasing penetration? How do I get more of that? We’ve proven that we can do this. 70% of Aetna members today use Caremark. 40% of Aetna members use CVS Pharmacy. But on our individual population, on our co-branded Aetna CVS product, that penetration is closer to 50%. Less than 1% today of Aetna members use Oak Street Health. It’s a lot less than 1%. Caremark members use CVS Pharmacy about 1/3 of the time. That’s better than our market share, but still a great opportunity. If we were to increase all of our penetration rates by 1% across the board, we can generate up to an additional $0.5 billion of net present value across the enterprise. That’s the power of our diversified model.” An important thing to note at these massive healthcare organizations: small movement in percentages matter. A lot. We’re talking 100 basis points equating to millions of dollars for just a little bit better optimization, or patient conversation, or lowered acquisition cost.

New notes around its MSO:

This slide below is a handy representation of everything CVS says it achieved in 2023. Wait – what’s that third bullet under that middle checkmark there? Launched an MSO with $10B in managed spend in 2023?? CVS gave us some commentary on this MSO, saying that it formed from culmination of assets from Signify’s Caravan Health, CVS’ own internally developed ACO, and likely some influence from Oak Street Health. Ultimately the newly formed ACO has allowed CVS to partner with the likes of RUSH Health in Chicago, and Ardent Health Services nationally, reaching 1 million covered lives (presumably 700k of which are under Caravan?):

- So there were 2 main assets that compromise what we now call CVS Accountable Care. First, CVS before Signify had very successfully built out one of the largest scale performance ACO reach businesses. And so they did that with their novel technology stack and internal teams that was a fully CVS build initiative.

- And then Caravan came via Signify, we merged those 2 things together, and that’s the 1 million total lives. When you think about coverage, we’re in rural health centers. So FQHCs, critical access hospitals, PPS hospitals all the way up to multistate academic medical centers. We’ve closed since the acquisition, 8 multistate health systems. So there’s been continued traction there. There’s been good top line growth just with the sales pipeline in that business as well. It’s across 40-plus states, so it’s across the country essentially. And it’s, again, showing positive shared savings rates and it’s been a really big success story of bringing the businesses together.

CVS’ New Segment, and Cost-Plus Launches:

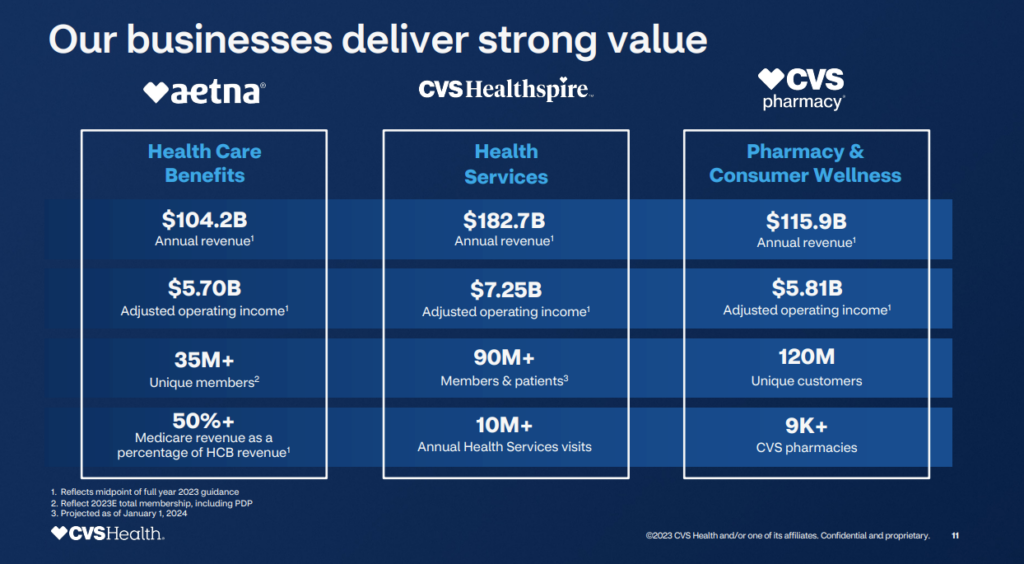

CVS’ care delivery segment is now called…Healthspire. It also launched a new biosimilar subsidiary under Healthspire called Cordavis in August. Finally, CVS is taking a page out of Mark Cuban’s book by launching a cost-plus drug pricing model. Mark Cuban should be flattered – but not fearful.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

An update on how these initiatives affect 2024 Financials

Put all of these segments & narratives together, and CVS is expecting at least the following for its business in 2024:

- $366B in revenues

- $17.24B in adjusted operating income

- $8.50B in adjusted earnings per share

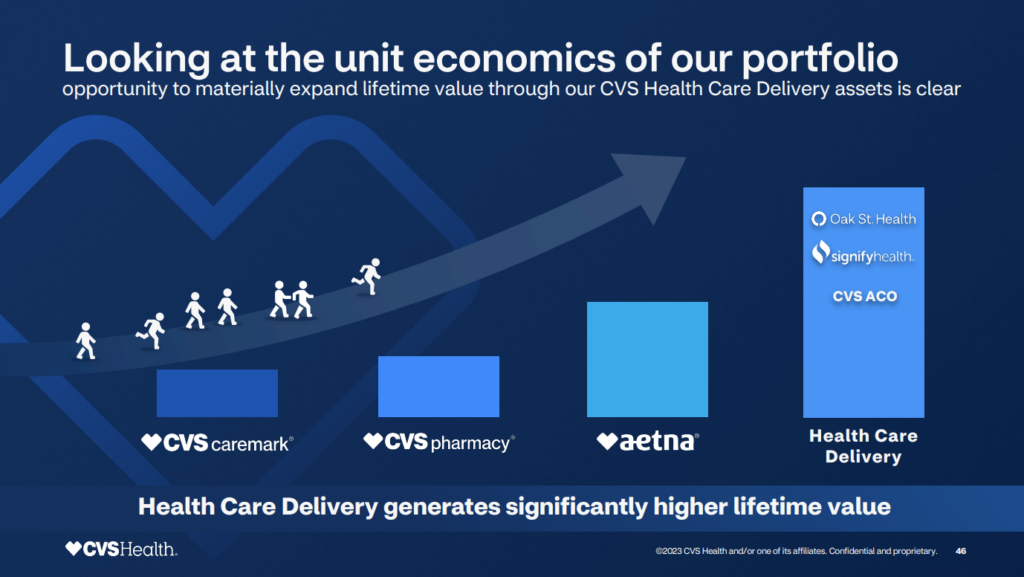

TL;DR: Healthspire will drive long-term CVS growth

Healthspire unlocks cheaper customer acquisition for Aetna and Caremark while bumping up customer lifetime value by 3-4x. Its retail pharmacy segment is in secular decline. Just look at this slide! The synergies!

There’s plenty more to unpack here that I didn’t get to, so I’ll leave you with some resources below.

Useful Links:

- CVS – 2023 investor day resources (Link) 2024 outlook (Link) Introducing Healthspire (Link)

- What CVS Pharmacy’s New Cost-Plus Reimbursement Approach Means for PBMs, Pharmacies, Plan Sponsors, and Prescription Prices (Link)

- CVS Plans to Overhaul How Much Drugs Cost (Link – WSJ paywall)

If you enjoyed this, consider subscribing to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 24,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)