The first annual Fintech Takes Lending Summit, which took place earlier this month, featured a bunch of interesting sessions. Two, in particular, stand out in my memory because they were absolutely chock-full of great data.

The Macro Picture: The Economic Forces Shaping the Lending Environment, presented by Amy Crews Cutts, former Chief Economist at Equifax.

Unpaused: How Will the Resumption of Student Loan Repayments Shake Things Up?, featuring:

- Kevin Moss, former Chief Risk Officer at SoFi

- Michele Raneri, VP Financial Services Research and Consulting, TransUnion

- Tom La Centra, former EVP of Consumer Lending Servicing and Collections at Wells Fargo

- Bobby Matson, Founder and CEO, Payitoff

Given that today was Black Friday – capitalism’s favorite day – I thought it would be useful to share a few of the most interesting insights from these sessions about the current macroeconomic environment and consumer credit conditions in the U.S.

#1: The macroeconomic picture is still murky.

First insight – the economy continues to be really weird.

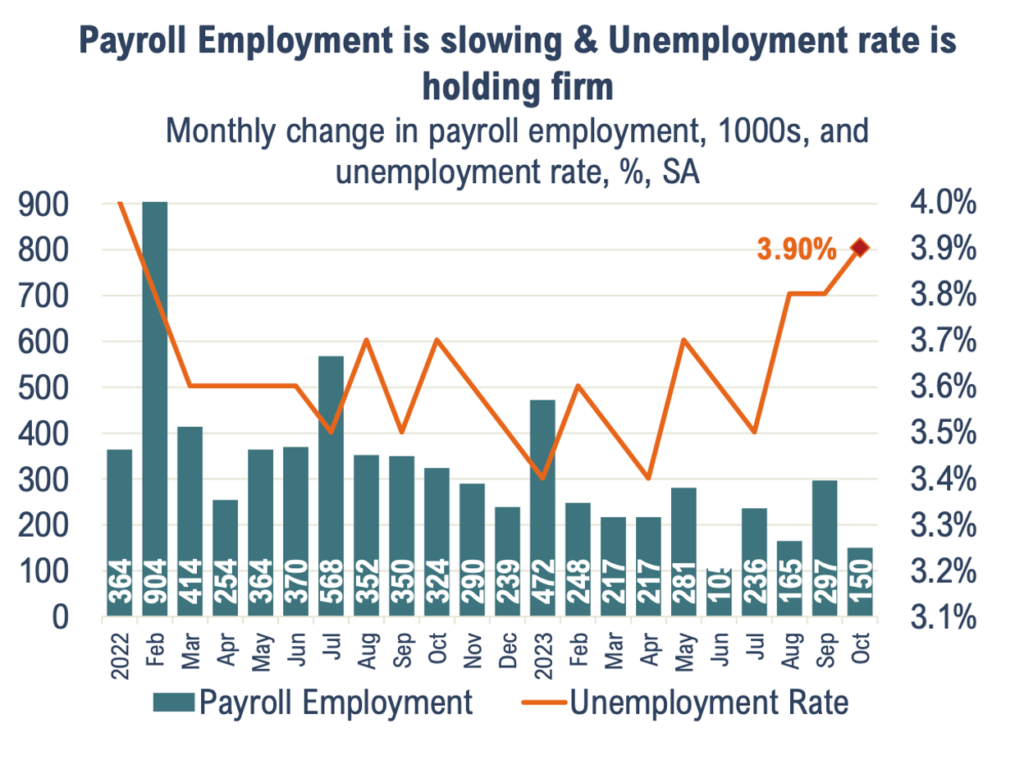

Not the most scientific statement, I realize, but professional economists seem to have no clue what’s going on right now. To Amy’s credit, she was very honest about this in her presentation. The latest jobs data that she shared in her session showed payroll employment growth slowing slightly and the unemployment rate holding steady:

This is how I like to imagine Jerome Powell reacting to the unemployment rate holding steady:

And yet inflation is showing some signs of moderating!

So what will the Fed do? And what impact will it have on the economy?

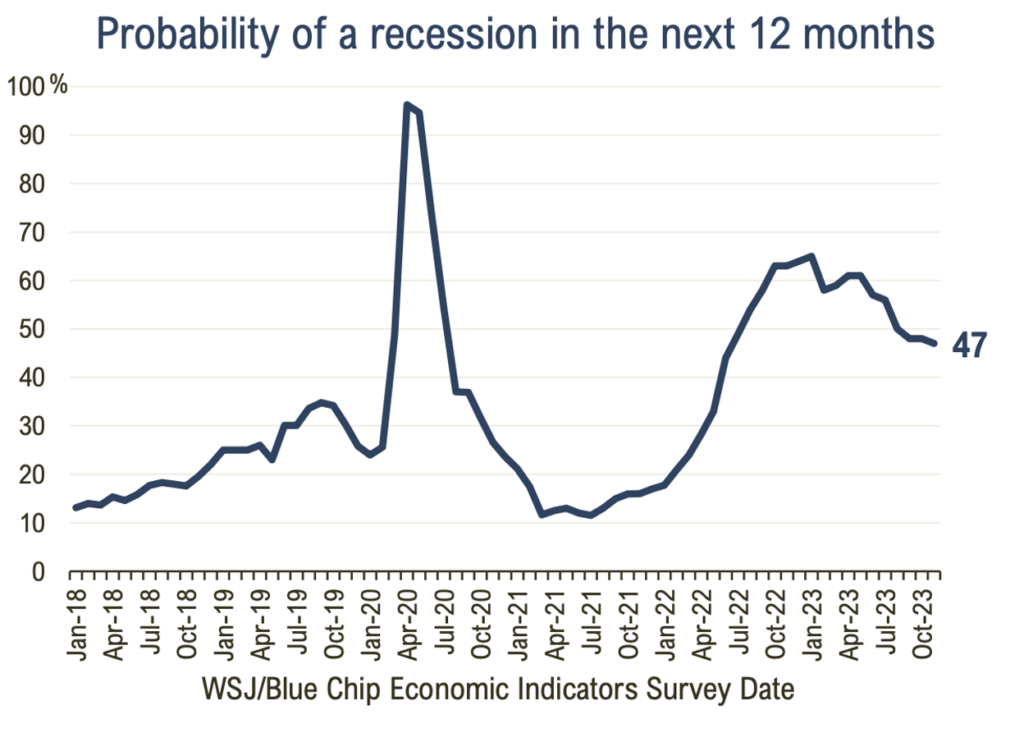

Economists have no idea! The current consensus is that there’s roughly a 50% chance that we will end up in a recession in 2024:

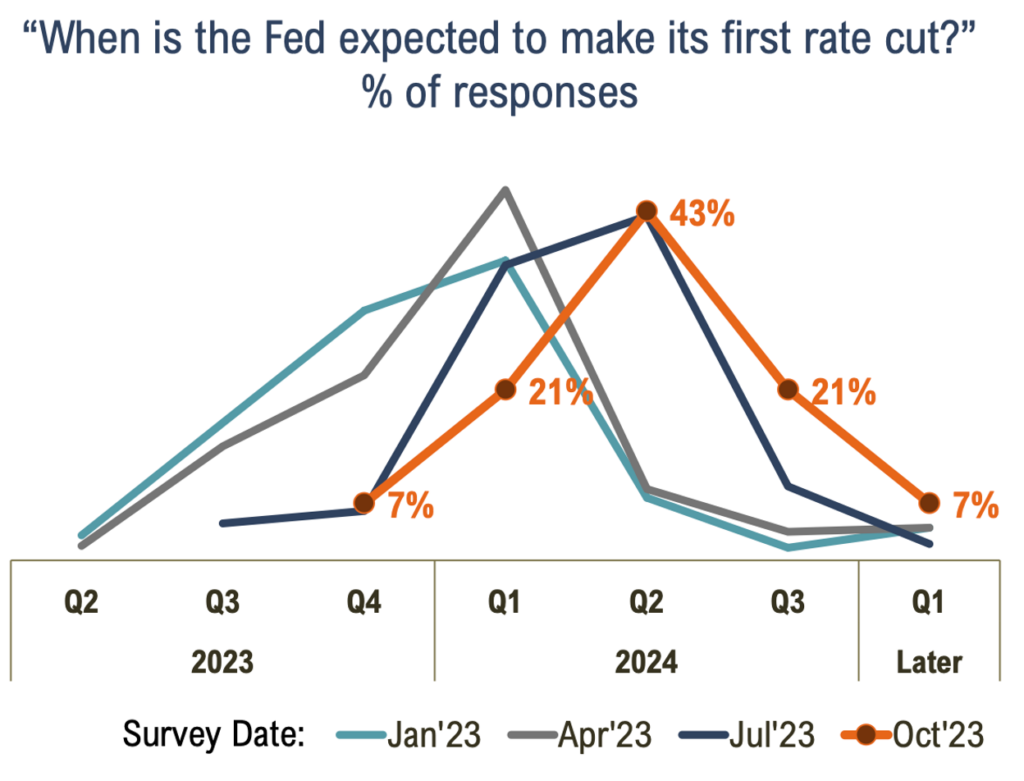

And if that happens, the Fed would likely start cutting interest rates in the first half of 2024:

So, basically, we don’t know.

Great!

#2: Consumer spending looks like it might slow down in 2024.

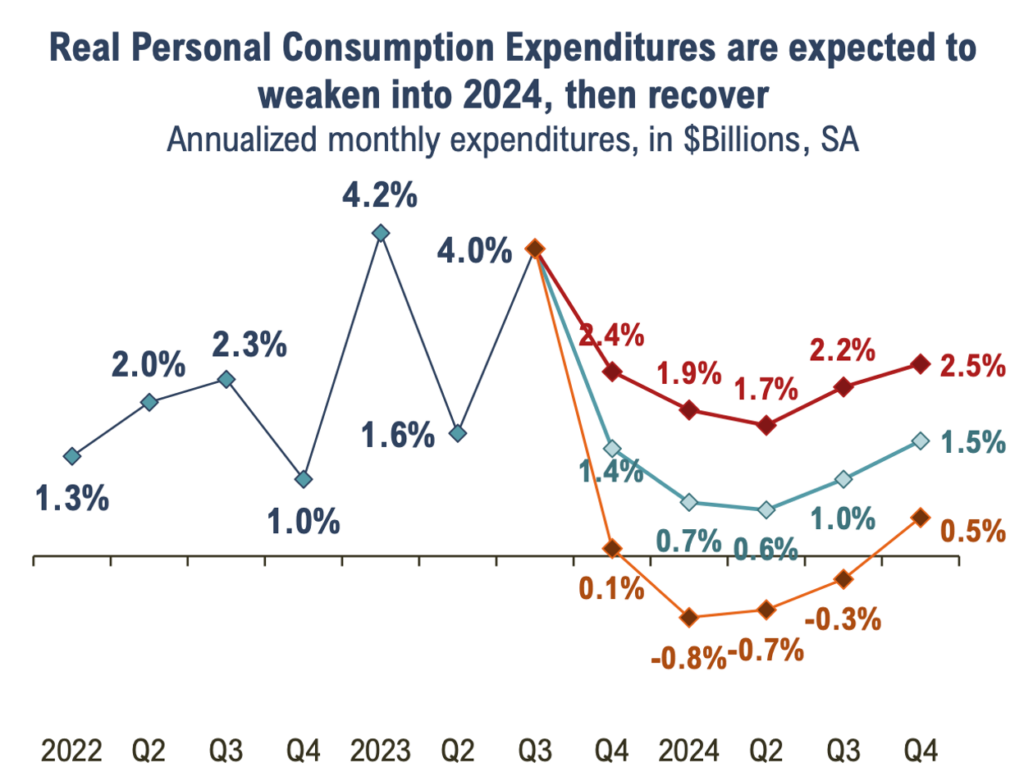

A big deciding factor for whether we slip into a recession in 2024 or manage to stick the so-called ‘soft landing’ is the pace of consumer spending, which, in recent quarters, has helped to stabilize the economy, despite the pressures imposed on consumers by inflation and high interest rates.

The current forecast is that we will see a slowdown in the beginning of next year, followed by a recovery in the second half of 2024:

The exact shape of that curve (the three different forecasted scenarios are pictured above) will have a major impact on the overall health of the economy over the next 12-18 months.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

#3: Credit card debt is growing quickly.

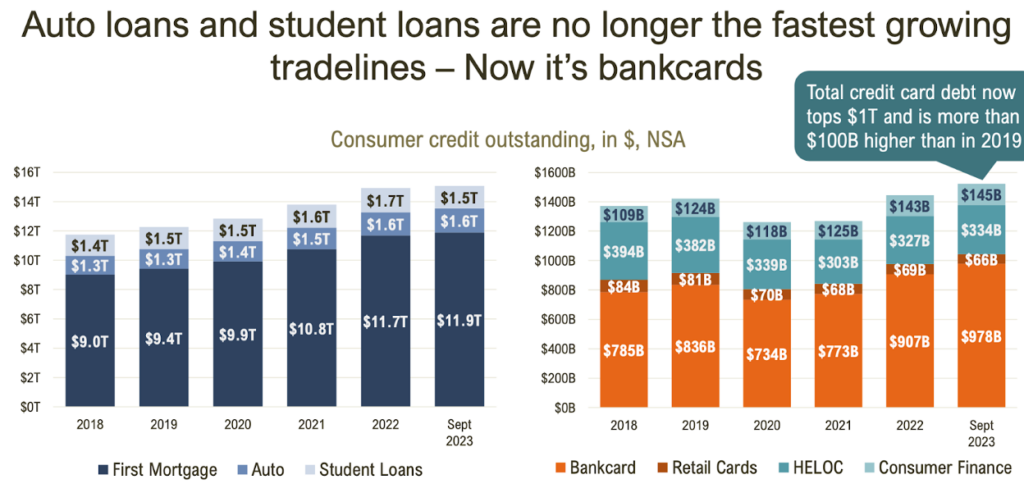

One thing that is unequivocally true – U.S. consumers have taken on significantly more credit card debt in recent years.

In fact, bankcard debt (revolving balances on general-purpose credit cards) is now the fastest-growing category of consumer debt, outpacing auto and student loans:

This has been a major boon to the profits of big banks – JPMorgan Chase, Wells Fargo, and Citi reported a combined $22 billion in profits in Q3 of this year, up by more than a third from Q3 of 2022 – but it is also is cause for concern in a more macro sense.

Are U.S. consumers driving too close to the cliff?

#4: Delinquencies are up, should we be worried?

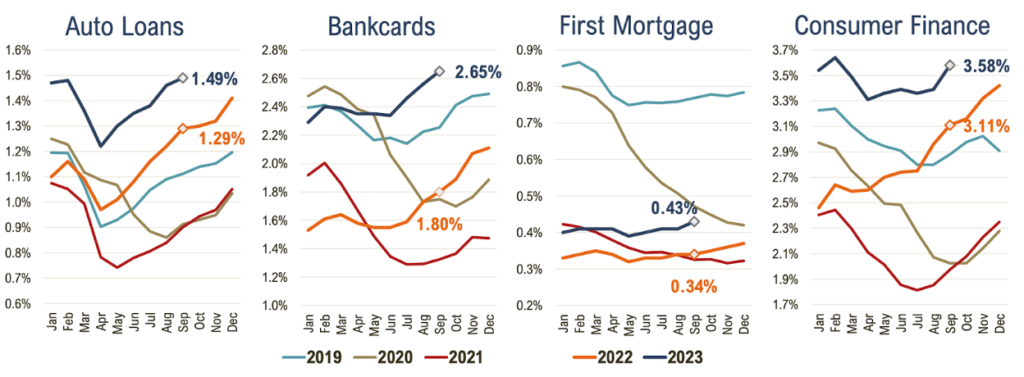

The rate of serious delinquency for auto loans, credit cards, and consumer finance (i.e. personal loans) are all higher than they were before the pandemic (the serious delinquency rate for first mortgage is significantly lower than before the pandemic thanks to the low rates that many consumers locked in):

If you dig into the data a bit more, though, what you discover is that the state of consumer credit delinquency today isn’t materially different than what it was in April 2020 (the last normal month before COVID). Serious delinquency (60+ days past due) in auto, credit card, and consumer finance are a bit elevated, but less serious delinquency (30+ days past due) is down slightly for those product categories (and way down for mortgage and home equity). Credit card utilization and balances are up compared to April 2020, which tells us that consumers are more reliant on credit, but that increased reliance isn’t necessarily leading them into trouble, at least not yet.

Will it?

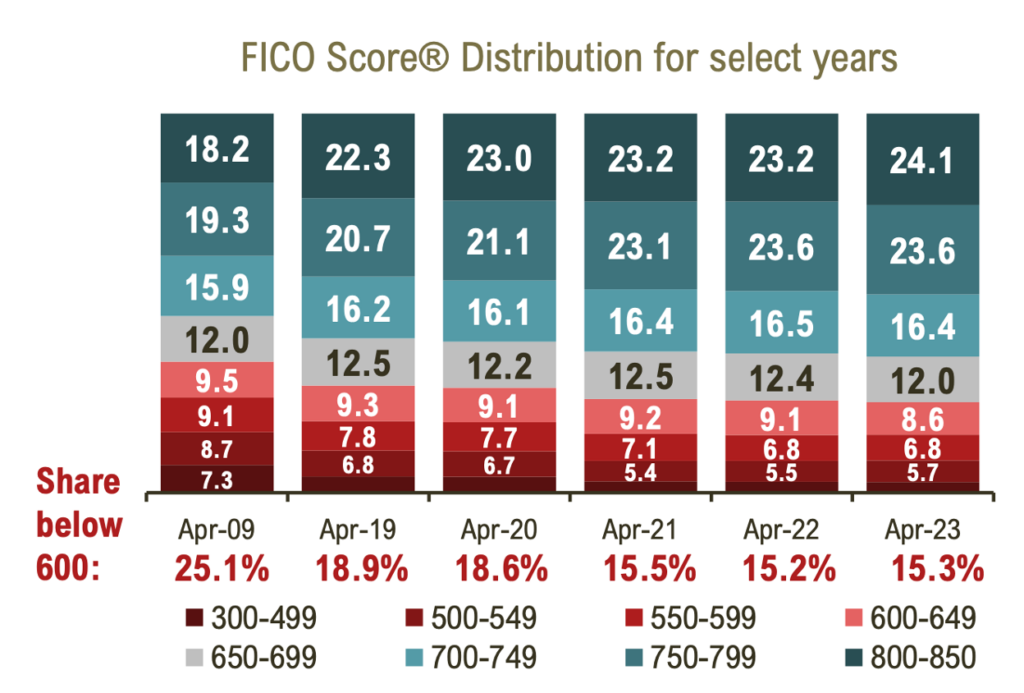

Difficult to say (are you picking up a theme here? No one knows anything!), but one interesting hint that Amy shared in her presentation was the change in the distribution of the FICO Score over the last couple of decades.

Consumers’ scores have been migrating up, and that trend accelerated during the pandemic:

It’s important to note that the FICO Score is a tool for rank-ordering risk. It can’t tell you exactly what the repayment odds are for someone with a 715. Only that the odds are better than someone with a 710.

Still, scores are up. The average FICO Score was 718 in 2022, up from 688 in 2005.

That’s interesting!

Why might that be?

Well, certainly, pandemic-era interventions – repayment forbearances and stimulus checks – played a big role in recent years. However, as Amy rightly pointed out in her presentation, that can’t account for this overall trend, which predates the pandemic by many years.

Her theory is simple but compelling – consumers have gotten better at managing their financial obligations. They have gotten more skilled at driving close to the cliff.

#5: Student loan repayments will add stress.

What might push consumers over the edge?

Federal student loans.

Michele Raneri (TransUnion) and Kevin Moss (formerly of SoFi) were two of the panelists on the final session of our Lending Summit – Unpaused: How Will the Resumption of Student Loan Repayments Shake Things Up?

Michele and Kevin helped to author a research paper – How Resuming Student Loan Payments Will Affect Consumer Credit Risk.

The entire paper is fascinating and will be the subject of a more in-depth newsletter essay from me in the future, but the big takeaway was that the unpause of federal student loan payments will significantly impact the consumer credit landscape.

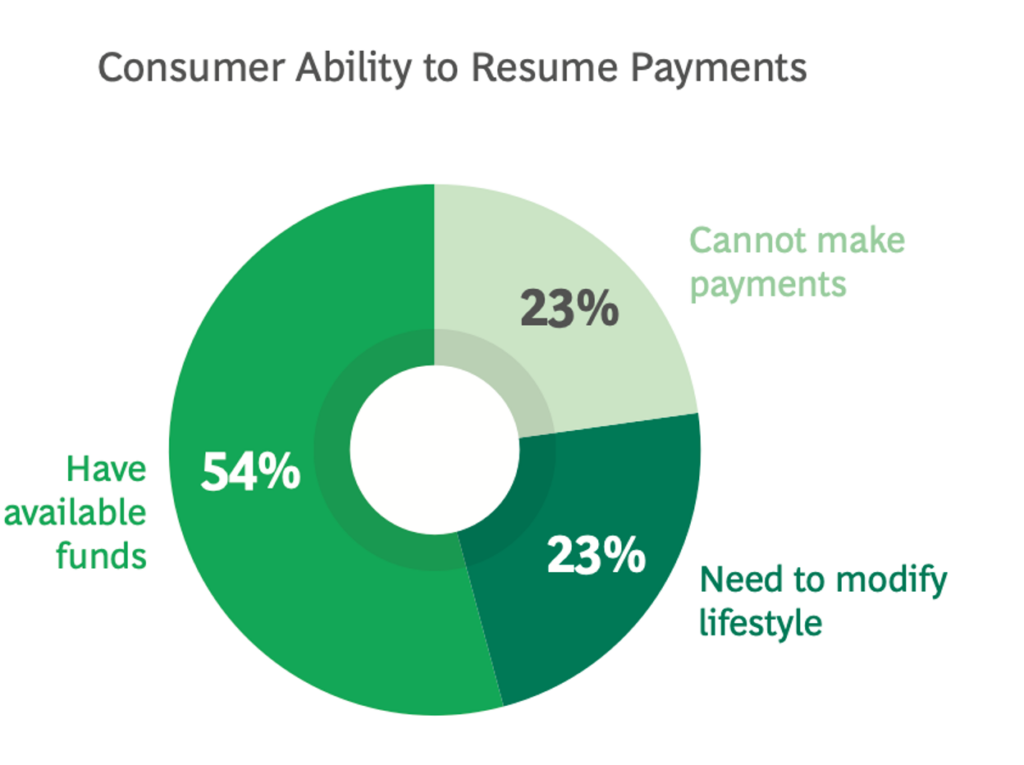

The CARES Act, which was passed in March 2020, placed all federal student loans into forbearance. In October of this year, payments resumed. This means that as many as 40 million U.S. consumers now have an extra bill to pay every month. And according to the survey done by TransUnion and BCG for this research paper, nearly 50% won’t be able to make the payment without making changes to their current lifestyle:

The net-net is that between 500,000 and 1.4 million consumers will become seriously delinquent on one or more of their credit products as a result of the resumption of student loan payments.