Happy Tuesday, Hospitalogists,

I hope everyone is having a great start to their week. Today’s Hospitalogy returns to an ultra-skimmable format for your viewing pleasure. Also – I know the newsletters while I’m out on paternity leave have been very analysis-light, and I’ve been scant to respond to e-mails . Rest assured we’ll be back to regular scheduled programming in December! I’m grateful for everyone’s support of Hospitalogy and the fact that I’m even able to take a generous paternity leave thanks to Workweek.

Thanks so much to Adonis for sponsoring today’s send.

Onward!

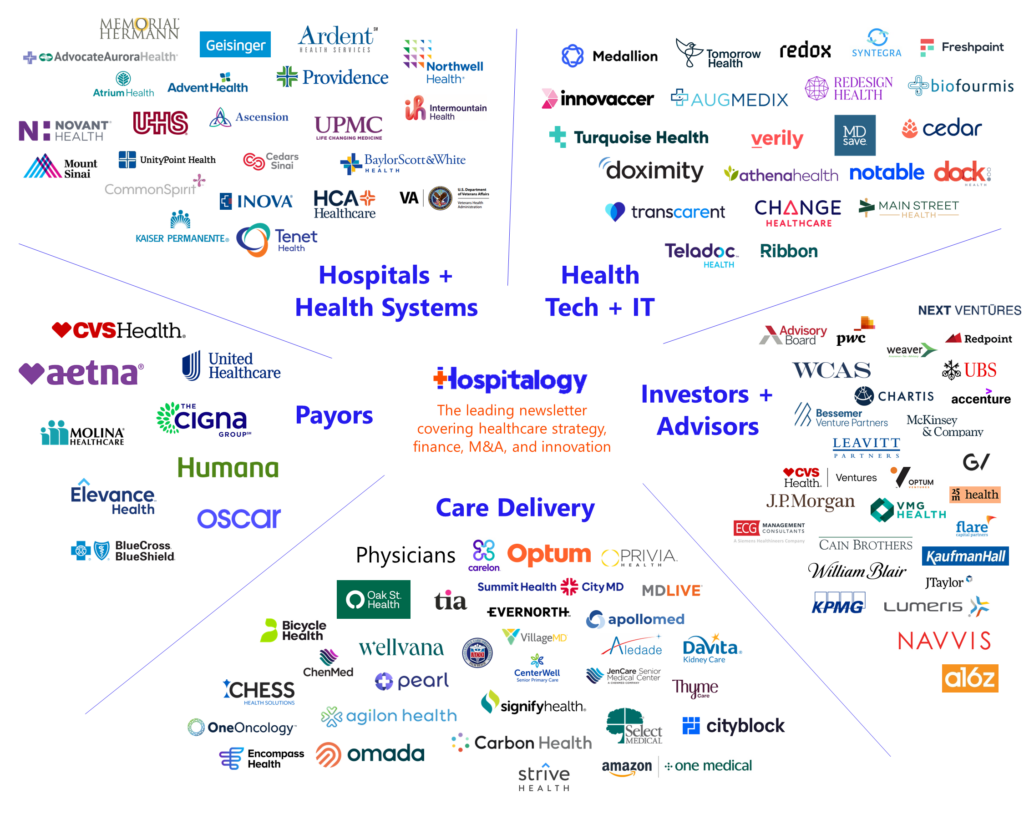

Subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 23,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)

SPONSORED BY ADONIS

Last call to join Adonis as we dive into the evolving healthcare landscape.

We’ll unpack the stark reality for private practices, the complex relationship with Private Equity, and operational headaches like Revenue Cycle Management (RCM).

As physicians eye a breakup with hospitals and corporations for increased autonomy in private practice, the administrative burden of RCM is a battle we shouldn’t fight alone. Luckily, there’s Adonis who streamlines these cumbersome processes so we can focus on what matters most: patient care.

We’ll be chatting November 14th at 2 PM ET, save your spot below.

Breaking down Q3 2023 Healthcare M&A activity:

Bass, Berry & Sims M&A breakdown: (Full Breakdown) – worth a read for strategy and M&A folks:

- Expect small, strategic acquisitions & deals for the foreseeable future

- Q3 deal volumes dropped amid a tougher regulatory environment

- The FTC / DOJ are ramping up scrutiny of PE roll-ups in healthcare

- Physician practice management: deal volume down 19% as compared to Q3 2022

- Interesting dynamic to take note of here, as called out by BB&S: While macro-economic factors such as inflation, rising interest rates and the increasing cost of labor have influenced investing habits, the market remains replete with sellers looking to off-load the heavy administrative burdens and take advantage of higher reimbursement rates by partnering with PE firms or large health systems.

- Economically, that sounds like a PPM buyer’s market for those willing to take the risk in the higher interest rate environment.

- Health systems: Merger activity comprised almost 100% of deals in Q3

- ASCs: Orthopedics = most popular specialty for ASC growth and investment; Cardiology fastest growing specialty

- Home Health & Hospice: YTD deal volumes down 50+% from 2022 and 2021. Cited lack of supply of lower middle market acquisition targets. Payors and strategics leading the way in home health deals

- Health IT: smaller, fewer deals; digital health is considered to be in a ‘market reset.’

- Behavioral: activity driven by mental health deals (62% of all BH transactions in 1H 2023)

- Managed Care: Payvidor buildout continues; Optum-Amedisys is still being reviewed by DOJ/FTC but they’re not gonna get anywhere.

Final interesting tidbit – MSO regulation on the horizon? Some language from recent proposed regulations in California and New York:

- some experts believe that MSOs could still be brought under the definition of “Health Care Entity”…Considering the clear intent behind the original statute, MSOs still appear to be a target for regulators. Therefore, any MSO arrangements based in California must be carefully vetted and updated to ensure that MSOs are not stepping into the role of a “Health Care Entity.”

BB&S Conclusion: Expect small, strategic acquisitions & deals for the foreseeable future: “Many commentators believe the current slump may continue through 2024—that we should be bracing for a longer than normal winter. The New York Federal Reserve did not allay these concerns when it announced last month that the U.S. is more likely than not (i.e., has a 56% chance) to fall into a recession by September 2024. The next quarter and indeed the next year, then, may continue to be highlighted by small, strategic expansions and creative cross-sector transactions.”

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

Cigna’s MA Plans: Cigna is considering the sale of its Medicare Advantage business, a pretty shocking move if you asked me. Some analysts seem to think Cigna is setting itself up for a sale by divesting its reportedly underperforming MA segment, but with so much consolidation slated to take place on the horizon, you’d think that Cigna would stick it out and reap the rewards from its scale. (Link)

Walmart & Orlando Health: Walmart Health partnered with Orlando Health to improve care coordination in Florida, notable because this is Walmart’s first partnership with a health system. When you think about it, an arrangement like this seems like a win-win. Orlando Health gets the specialist and higher acuity downstream referrals while Walmart and Walmart Health gets the foot traffic and perhaps the Rx scripts. (Link)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Healthcare’s Retail Approach: On that note, health systems are increasingly adopting a retail health environment. (Link)

For-Profit Health Systems: For-profit health systems are incorporating doctors as in-house employees due to rising costs. For more context on the moves, I’d recommend reading HCA and Community Health Systems Q3 earnings call transcripts. Bottom line, the current staffing environment forced these hospital operators’ hands with physician subsidies. (Link)

Amazon & One Medical: Amazon Prime members can now access One Medical health care for $9 a month. Pretty interesting move here. It’s a $100 discount to One Medical’s standard concierge subscription, but that obviously doesn’t include the actual in-person provision of care (insurance is still billed for that portion). From the outside looking in, it seems as if the One Medical acquisition isn’t going great from a volume standpoint. I mean, why else would Amazon bundle the service to 100M Prime members in the U.S.? If there were actual substantial uptake of ONEM services post-acquisition there would be no way Amazon would add this benefit to Prime. ONEM simply wouldn’t be able to handle the capacity otherwise. (Link)

Medicare Advantage Concerns: Hospitals reconsidering Medicare Advantage partnerships may face unintended consequences. This dynamic is one of the most pressing to watch over the coming decade as growth in MA continues. The push-pull between providers and payors in MA continues. (Link)

Hospital-at-Home Growth: Medically Home’s CEO Rami Karjian discusses the expansion of hospital-at-home programs. (Link)

Healthcare Pressures: Syntellis Performance Solutions report highlights the struggles healthcare organizations face amid care delivery shifts. (Link)

Medicare Advantage Choices: Medicare beneficiaries will typically have access to 43 Medicare Advantage plans in 2024. (Link)

Humana’s CenterWell Expansion: Humana’s CenterWell is set for aggressive growth in senior-focused primary care. (Link)

CMS Payment Rules 2024: CMS issued four final payment rules for 2024 – Beckers did a nice job of summarizing key points here. (Link)

Eli Lilly’s FDA Approval: FDA approved Eli Lilly’s weight-loss drug, setting it up to compete against Novo Nordisk’s Wegovy. (Link)

340B Program Ruling: A court ruling expanded the definition of “patient” under the 340B program, potentially increasing its use. (Link)

Women’s Health Initiative: The White House launched a new initiative focusing on investing in women’s health research. (Link)

Hospital ASC Development: Hospitals are seeking larger equity stakes in ASC development, according to an Avanza Intelligence survey. (Link)

Medicare Pay Boost Dispute: Medicare’s new primary care pay boost is causing discontent among specialists, yet another boiling point within healthcare. I mean, nobody really wants to talk about this, but specialists sure as hell don’t want to see primary care physicians making more than them – or closing the gap. (Link)

Partnership and Product Announcements:

Sanford Health Plan signs a multi-year agreement to utilize +Oscar’s Campaign Builder Platform. The Hero’s journey continues?? (Link)

NorthShore – Edward-Elmhurst Health partners with Lumeris to transform value-based care. (Link)

CenterWell Senior Primary Care announces an expansion into Indianapolis (Link) and Virginia (Link)

Vivante Health, a GI health platform, signs a national distribution contract with UnitedHealthcare. (Link)

Baylor Medicine joins other health systems in shifting physical therapy to the home in a partnership with in-home PT provider Luna, which holds partnerships with a number of other health systems. (Link)

RadNet inks a new hospital joint venture partnership, planning to add over 10 imaging centers. (Link)

Best Buy Health partners with Mass General Brigham for home care. (Link)

Compass Surgical Partners announces a joint venture with Jersey Shore Ambulatory Surgery Center. (Link)

OneOncology partners with Mid Florida Cancer Centers. (Link)

Blue Shield of California expands its maternal health partnership with Mahmee. (Link)

Particle Health and Hona partner to empower providers with longitudinal data for informed clinical decisions. (Link)

Sempre Health partners with Organon on a pricing program that links patient copays to adherence. (Link)

RWJBarnabas Health and Rutgers Cancer Institute of New Jersey announce a significant investment in cancer research and care. (Link)

Doximity launches DocDefender, expanding services to safeguard physician privacy. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

In perhaps some of the biggest health tech news from the past couple of weeks, Olive, which raised $800M and was once valued at multiple billions of dollars, has sold itself off for parts and is now defunct. (Link)

JLL Partners and SV Health Investors backed Hightop Health, which launched a new outpatient mental health platform and acquired Psych Atlanta. (Link)

Moody’s predicts stabilization in the nonprofit hospital sector in 2024 due to rising reimbursement and volumes. (Link)

Health systems are struggling to regain their financial footing to pre-pandemic levels. (Link)

SurgNet Health Partners, Inc. announced its initial acquisitions, including the Executive Ambulatory Surgery Center and Lippy Surgery Center. (Link)

agilon health has announced its exit from Hawaii with the sale of MDX Hawaii. (Link)

Revelation Partners closed a $608 million fund, surpassing its $500 million target. (Link)

Staff shortages in Revenue Cycle Management (RCM) are significantly impacting healthcare providers’ ability to get paid. (Link)

Apollo Medical Holdings, Inc. has announced a definitive agreement to acquire assets of Community Family Care Medical Group IPA, Inc. (Link)

Gentiva completed the acquisition of ProMedica’s Home Health, Palliative, and Hospice Business. (Link)

The Tennessee Attorney General called for an investigation into Ballad Health following concerns about the quality and access to care. (Link)

HCA allegedly violated the terms of its Mission purchase agreement, according to the North Carolina Attorney General. (Link)

Rx.Health has joined Commure to pioneer patient engagement. (Link)

Honor Health Network expanded southward by acquiring Nightingale Services, Infusion, and Pharmacy. (Link)

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Radiology Partners deploys clinical AI across more than 20 million annual patient exams. (Link)

Calm Waters AI announces an agreement with Privia Health. (Link)

Cleveland Clinic plans to launch prescription drug delivery via drone in 2025, starting with specialty and rush medications. (Link)

Pramana and Intermountain Health collaborate to digitize 8 million archival clinical pathology slides using advanced AI technology. (Link)

GE HealthCare and Novo Nordisk are working together to advance a novel non-invasive treatment for Type 2 Diabetes and obesity with ultrasound. (Link)

Agamon Health enters into a know-how agreement with Mayo Clinic to close cardiology care gaps with generative AI. (Link)

CB Insights released its Q3 2023 state of digital health report. (Link)

A Senate subcommittee is considering the implementation of guardrails for healthcare AI. (Link)

Recor Medical announced the U.S. launch and first commercial cases of its Paradise Ultrasound Renal Denervation Therapy. (Link)

The next Apple Watch is reportedly introducing new health sensors for diabetes, blood pressure, and sleep apnea. Gonna be honest, this would be an insta-buy for me if they make it happen. (Link)

Cedar collaborates with Advocatia to introduce full-service Medicaid enrollment, aiming to reduce the coverage gap for millions of Americans. (Link)

Ethicon, a Johnson & Johnson company, debuted an AI-powered laparoscopic skills training platform at the American Association of Gynecological Laparoscopists Global Congress. (Link)

The AI-enabled gut health startup Jona emerged from stealth this week. (Link)

Black Opal Ventures launched a health tech fund, focused on investing in technology to transform healthcare. (Link)

Northwell launched a $500 million initiative to enhance pediatric mental health services and improve care access for children and teens. (Link)

UnitedHealth invested in Enable Ventures, aiming to enhance services for people with disabilities. (Link)

The new digital health venture Harmonic Health was launched by Redesign Health, focusing on a comprehensive dementia care model. (Link)

Health AI startup Cercle made its debut with support from notable backer Sheryl Sandberg. (Link)

Investors identified cost of care attribution and payer landscape as major challenges for value-based care in behavioral health. (Link)

Fundraising Announcements:

- Yuzu Health raised $5M (Link)

- Almouneer raised $3.6M (Link)

- Covera Health secured $50M (Link)

- Heali launched with $3M in funding (Link)

- Eleos Health raised $40M Series B Round (Link)

- Elucid raised $80M (Link)

- Nema Health raised $4.1M (Link)

- Vida Health announced $28.5 Million in funding (Link)

Hospitalogy Top Reads

My favorite healthcare essays from the week

- The Hospital sector is under siege

- Vertical Integration Lessons: The Economics and Strategies of Hospital-Owned Specialty Pharmacies

- 2023 State of the Healthcare Consumer Report: Measuring What Matters

- Digital health startups need more doctor CEOs

- Rethinking market maps in healthcare — a brisk walk through chronic care management

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 23,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)