This tweet from Sheel Mohnot, co-founder of Better Tomorrow Ventures, has been generating a steady and entertaining volume of replies for the past couple of days:

The replies generally fall into a few buckets:

- Recommendations for specific non-Mint PFM apps (which isn’t really a useful response, but whatever!)

- Arguing that PFM apps just need different business models in order to succeed.

- Arguing that PFM is a feature, not a product, and it needs to be offered by banks and multiline fintech companies.

- Arguing that new technologies or trends (AI, open banking, etc.) will make PFM viable as a venture-scale business.

- Sadly agreeing.

None of these replies quite hit the nail on the head for me, so – as someone who has plenty of thoughts on PFM – I figured I’d write my own!

I’m going to try to frame out my reply by answering three questions, which I think represent the crux of Sheel’s tweet:

- Can a PFM product be the foundation of a venture-scale business?

- How many people want to actively manage their finances (and why do we constantly overestimate that number)?

- Can you build a great business around helping consumers manage their finances?

Can a PFM product be the foundation of a venture-scale business?

I want to get this one out of the way first – I have no idea!

As I have made clear in every episode of Not Fintech Investment Advice with Simon Taylor, I am not an investor! And I truly have no idea what is and isn’t a venture-scale business.

When I gently suggested earlier this year that the niche neobanking model, represented by companies like Daylight and Kinly, might not be compatible with the expectations of venture capital investors, I got quite a bit of aggressive (and fairly compelling) pushback from VCs saying that I was wrong.

So, I don’t know! I’m going to punt on this one and leave this part of the argument for … more interested men.

How many people want to actively manage their finances (and why do we constantly overestimate that number)?

I think Sheel is right here – most consumers don’t want to actively manage their finances using a personal financial management tool, which is why traditional PFM apps, focused on transaction categorization and budgeting, can never seem to capture more than a small share of their theoretical total addressable market (i.e., humans with money).

In fact, all the research I have ever seen suggests that the actual addressable market for budgeting tools is no more than 15-20% of the general consumer population.

In prior newsletters, I’ve referred to this as the 15% problem.

Roughly 15% of the adult population actively enjoys categorizing their transactions, building budgets, and generating detailed charts showing their current and projected future cash flows. A portion of these consumers build their own budgeting and expense-tracking tools in Excel or Google Sheets. A portion of them use a free PFM tool, like Mint. And a portion of them pay for a PFM tool like Quicken (one of my mom’s 3 or 4 favorite pieces of software ever) or Copilot.

There are two reasons why this is a problem in fintech:

- Fintech founders tend to be overrepresented within this 15%. I’m not sure why this is true, but it is true. A lot of the people who are drawn to building in fintech like to build budgets, obsessively track their spending, and categorize their transactions. This is a problem because the false consensus effect – the cognitive bias that causes people to think that their preferences and beliefs are far more common than they are – leads fintech founders to believe that the market for a better PFM app (i.e., the one they wish they had) is much bigger than it is.

- This 15% are very passionate early adopters. So when a fintech founder builds that “better” PFM app, it usually sees a flood of early and very engaged users flock to it. However, this traction, combined with the founder’s misguided belief in the total size of the addressable market, creates a very misleading impression of product-market fit. What the founder doesn’t see is the chasm between their engaged 15% and the other 85% of the market.

This is why, to borrow Sheel’s turn of phrase, the “startup graveyard is littered with PFMs.”

Can you build a great business around helping consumers manage their finances?

Does this mean that PFM isn’t a worthwhile space to build in?

Absolutely not! I think it’s possible to build a great business around helping customers manage their finances.

Join Fintech Takes, Your One-Stop-Shop for Navigating the Fintech Universe.

Over 36,000 professionals get free emails every Monday & Thursday with highly-informed, easy-to-read analysis & insights.

No spam. Unsubscribe any time.

Indeed, I think the fintech ecosystem has already produced quite a few such businesses.

It’s just that they don’t look like your stereotypical PFM companies.

What do they look like?

Well, it depends, but generally, they have two characteristics:

- They are focused on impact, not insight. As Ron Shevlin sagely observed in a recent article, “Budgeting and expense categorization provide insights into how much and where someone spends money, but having bottom line impact on consumers’ financial lives is what consumers really want—and are willing to pay for.”

- They are tailored to life stages. When Sheel tweeted, “There aren’t that many people who want to actively manage their finances,” he was generally correct, but he also missed some important nuance. Where someone is in their life, and their financial journey has a massive influence on their financial priorities and how active they want to be (and are capable of being) in managing them.

That second point is worth drilling down on.

I realized recently that my personal feelings about credit builder products (and, ohh do I have feelings) might be a bit out of step with reality. My take is that we have more than enough of these products in the market already. No need to launch any more!

However, what I have been told by fintech companies that are launching these products is that there is still an overwhelming demand from their customers for them.

And again, my immediate personal reaction is usually pretty skeptical – really? Is credit building *this* urgent of a problem?

But maybe I’m wrong. Maybe the issue is that credit building hasn’t been a problem for me for a very long time, and I’ve forgotten just how fucking frustrating it was to be told, as an 18-year-old, that I couldn’t get a loan until I’d already had a loan.

Similarly, I’ve often wondered why more fintech founders don’t build products for elderly consumers and their families who care for them. It’s a MASSIVE market that has, for decades, been severely underserved by technology.

Perhaps the answer is simple – most fintech founders are young enough that they haven’t personally experienced what it’s like to care for an aging parent or other relative and protect them from scams while ensuring that they are able to manage their financial affairs with dignity and autonomy.

Maybe all of these consumer life stages are much bigger opportunities for impact-focused financial management products than any one of us realizes.

Maybe this is how we should think about PFM moving forward:

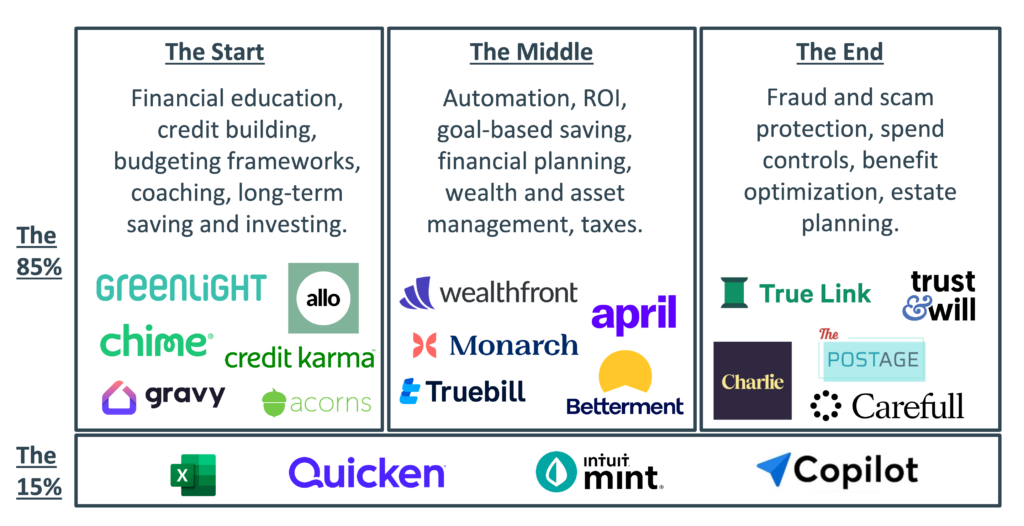

We have our 15%, who are diligently building budgets and categorizing transactions in their app of choice.

And then we have the other 85%, who pick up and put down various financial management tools as they move through the different phases of their lives and financial journeys.

Those phases are, of course, not universal. Nor are they exactly correlated with age, income level, or any other demographic characteristic. However, roughly speaking, they can be split out like this:

The Start

The critical resource for consumers at the start of their financial journey is knowledge. They don’t know how to think about budgeting or the emotional impact that money can have on themselves and their relationships. They don’t understand how to build a positive credit history. They don’t know how long it will take to save for a down payment for a house or how impactful compounding interest can be on their financial future. They want help getting off on the right foot.

The Middle

The critical resource for consumers in the middle of their financial journey is time. They have at least some knowledge of how finance works, and they have likely accumulated some financial assets as well, but they almost assuredly lack the time necessary to manually optimize their short-term and long-term financial outcomes, particularly given the complexity of their financial situations (which are often compounded by having both children and parents to think about). They want help getting the most out of their money without spending too much of their time.

(Editor’s Note – this is the stage of life I am in right now, and it’s truly remarkable how little free time I have and how much I don’t want to spend that free time on financial management tasks.)

The End

The critical resource for consumers at the end of their financial journey is safety. They have more time available to manage their finances, but they also have much more complex financial situations (significant assets + significant costs + limited or fixed incomes). They are also more likely to be dealing with medical challenges that might impair their ability to manage their finances, a fact that fraudsters and unscrupulous companies will constantly seek to capitalize on. They want help keeping themselves and their loved ones’ futures safe.

Rethinking PFM

We make a mistake when we assume that PFM = budgeting and expense categorization.

It’s much broader than that.

PFM is about meeting consumers where they are and delivering them the best possible financial outcomes.

Much of the best stuff that we’ve built in fintech over the last two decades is PFM.

We just didn’t realize it.